The Thursday Report – Issue 324

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, April 21st, 2022 – Issue #324Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL.

Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1President Biden’s $100 Million Tax: Is It Constitutional?Written By: Samuel Craig, Stetson Law Student And Professional Skydiver Article 2Trust Protectors, Reformation, Decanting, and Other Trust Modification Techniques to Facilitate Flexibility for IRA/Pension Plan Owners Under the Proposed SECURE RegulationWritten By: Alan Gassman, JD, LL.M, Christopher Denicolo, JD, LL.M, and Brandon Ketron, CPA, J.D., LL.M Article 3DON’T BE LIKE BOB – UPDATE YOUR ESTATE PLANNING AFTER DIVORCEWritten By: Jeffrey M. Verdon Article 4School Buses and Emergency Vehicles: Yes, You Must Pull Over And Stop On A Four Lane Highway If There Is No MedianWritten By: McKenzie McAdams, Stetson Law Student Article 5STETSON UNIVERSITY COLLEGE OF LAW SYLLABUS – LAW PRACTICE MANAGEMENT AND PROFESSIONAL MASTERYWritten By: Alan Gassman, JD, LL.M Forbes CornerPresident’s Tax Plan Would Kill Or Suppress Numerous Common Estate Tax Planning TechniquesWritten By: Alan Gassman, JD, LL.M Your Advisor’s Guide To The New IRA Distribution Proposed RegulationsWritten By: Alan Gassman, JD, LL.M Thoughtful CornerStop Struggling and Allow it to HappenWritten By Srikumar Rao, MBA, Ph.D. For Finkel’s FollowersYour Team Is Tired: Here’s How To Prevent Further BurnoutWritten By: David Finkel Saturday WebinarMore Upcoming EventsYouTube LibraryHumorCRYPTO (a children’s story) Someone please find my cryptocurrency, It’s not in my lock safe, where can it be? I jiggle my pocket, there’s no clink or clank, The teller tells me it’s not in my bank. Click this link to read the full poem.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1President Biden’s $100 Million Tax: Is It Constitutional? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2Trust Protectors, Reformation, Decanting, and Other Trust Modification Techniques to Facilitate Flexibility for IRA/Pension Plan Owners Under the Proposed SECURE Regulation |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3DON’T BE LIKE BOB – UPDATE YOUR ESTATE PLANNING AFTER DIVORCE

Written By: Jeffrey M. Verdon | Law Group LLP | Newport Beach & Redwood City CA | www.jmvlaw.com | Dear Clients, Colleagues, and Friends, Bob and Mary got married in 1993. Mary had one daughter, Jane, from a prior marriage. Even though Bob never officially adopted Jane, he treated Jane as if she were his daughter throughout the entire marriage. However, in Bob’s joint trust with Mary, she was referred to as “Bob’s wife.” Moreover, Bob’s Will referred to Jane as his “step-child”. The joint trust referred to Jane as “the only living child of the settlors” and named her as the residuary beneficiary. Bob and Mary divorced in April of 2019, and Bob passed away a couple of months later. As is often the case, when a couple gets divorced, they did not update their estate planning documents to reflect changes in marital status. Following Bob’s death, Mary acknowledged she was no longer a beneficiary of the joint trust under California law as a result of the divorce (see discussion below). Nevertheless, Jane filed a lawsuit, arguing that the divorce did not revoke Bob’s bequest to her. In California, as with many states, once a divorce judgment is entered by the court, certain bequests and nominations relating to the surviving spouse are automatically revoked. For example, CA Probate Code §5040 provides that certain non-probate transfers (e.g. via revocable living trusts, individual retirement accounts (IRAs), other retirement vehicles such as pensions and 401(k) accounts, transfer on death and pay on death designations executed before or during the marriage) are automatically revoked upon the entry of a divorce judgment. Notably, life insurance policy and irrevocable trust beneficiary designations are not automatically revoked. However, the CA Probate Code is silent about whether gifts to stepchildren are voided by a divorce when the document was executed prior to the divorce. California case law offers guidance regarding how gifts to former stepchildren are treated. In Estate of Hermon[1], the Court of Appeals stated that “when a testator provides for his spouse’s children, he normally intends to exclude children of an ex-spouse after dissolution, unless a contrary intention is indicated elsewhere in his will.” And in Estate of Jones[2], the Court of Appeals expanded the foregoing rule, stating that the Court could look beyond the instrument for evidence of the deceased former stepparent’s ongoing relationship with the child following the divorce to determine if the deceased former stepparent would likely have wanted the gift to go to the child. If you are going through a divorce, updating your estate plan is probably the last thing you want to focus on – but it is crucial that you do so. While non-probate transfers to former spouses may be automatically terminated by statute in certain circumstances, keep in mind that these may still be legally challenged by the ex-spouse. Additionally, non-probate transfers to former spouses via an irrevocable trust such as the typical dynasty trust and such as the irrevocable life insurance trust (ILIT) are not automatically revoked in the event of divorce, unless the trust document explicitly states so. And if your current estate plan makes bequests to relatives of your ex-spouse, you should revisit these documents and amend them either to revoke the gift or to specifically state your intention to provide for them after divorce. Otherwise, at death, your assets may be distributed in ways that you did not intend. Note that every state has laws like California’s, and laws are constantly changing. Thus, no matter where you reside, we recommend that you consult with your estate planning attorney to effectively protect yourself and the disposition of your property in the event of divorce. Don’t be like Bob. _____________________________________________ [1] (1995), 39 Cal. App. 4th, 1525, 1531. [2] (2004), 122 Cal. App. 4th, 326.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

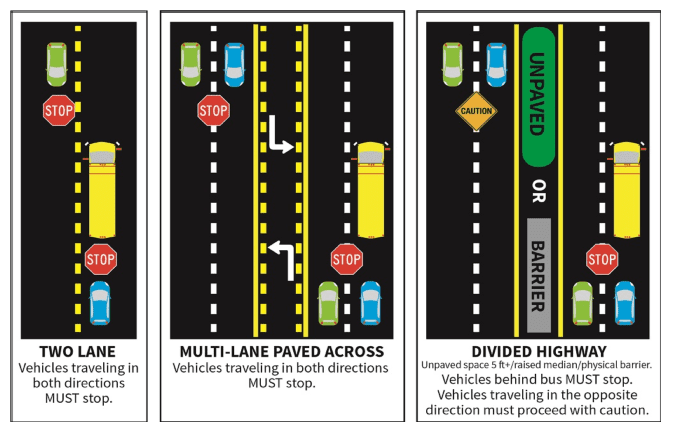

Article 4School Buses and Emergency Vehicles: Yes, You Must Pull Over And Stop On A Four Lane Highway If There Is No Median

Written By: McKenzie McAdams, Law Clerk

https://www.flhsmv.gov/safety-center/child-safety/school-bus-safety/ Introduction Generally, we are all aware that when we hear the sirens or see a stopped school bus we should stop. However, at times we find ourselves questioning whether we must stop if we are driving in the opposite direction. School Buses As of January 1, 2021, the penalty for failure to stop for a school bus rose to a minimum of $200 to $400 for the first offense. To avoid the uncertainty around when you must stop for a school bus, and prevent the receipt of a hefty penalty, we have provided a brief overview of school bus safety requirements. There are three possible scenarios you can encounter with regard to a stopped school bus: 1. You are driving on a two-lane road with vehicles traveling in both directions; 2. You are driving on a multi-lane road that is paved across with vehicles traveling in both directions; or 3. You are driving on a divided highway with a physical barrier between the vehicles traveling in either direction. In the first two instances, you must stop when the school bus displays the stop signal and remain stopped until the children and the school bus stop arm are withdrawn. However, in the third scenario, only the vehicles that are behind the bus are required to stop at the extension of the school bus stop arm. The only requirement of the drivers traveling on side of the road opposite the school bus is to proceed with caution. Emergency Vehicles Akin to school bus requirements, whether you must stop or yield for emergency vehicles is determined by the scenario you are in. Again, the three possible scenarios are listed above. In all three, you are only required to stop if the emergency vehicle is traveling in the same direction behind you. However, you should proceed with caution on the first two, as you never know in what direction the emergency vehicle may be heading. In the final scenario, you do not have to stop as there is no physical way the emergency vehicle could interfere with your driving. Certainty is key in this regard, if you do not know the projected path of the emergency vehicle you should use caution. Conclusion Penalty fines are no fun, and neither are unsafe roads. Knowledge and implementation of road safety ensure that no fines are paid and the roads remain a safe place to drive.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 5STETSON UNIVERSITY COLLEGE OF LAW SYLLABUS – LAW PRACTICE MANAGEMENT AND PROFESSIONAL MASTERY |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Forbes Corner

President’s Tax Plan Would Kill Or Suppress Numerous Common Estate Tax Planning TechniquesWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

On March 28th, the Biden Administration issued a 250-page General Explanation of the administration’s fiscal year 2023 revenue proposals. Click this link the view the “Green Book” PDF. Well-advised taxpayers are already considering actions to take before these new proposals would become effective…Continue reading on Forbes. Your Advisor’s Guide To The New IRA Distribution Proposed RegulationsWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

The IRS issued Proposed Regulations on February 23, 2022 and they are quite extensive. The Proposed Regulations interpret many provisions of the SECURE Act relating to See-Through Trusts…Continue reading on Forbes.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thoughtful CornerStop Struggling and Allow it to Happen

Written By Srikumar Rao, MBA, Ph.D. Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and is the author of Happiness at Work and Are You Ready to Succeed?, which has been published in over 60 languages. You don’t have to work hard and use willpower and rigid discipline to achieve phenomenal results. Here is how most of us live life: We set a goal for ourselves and then take appropriate action to reach that goal. When things do not go our way, we work harder. We put our “nose to the grindstone” and try to remember that “when the going gets tough, the tough get going”. Our lives are full of struggle as we accumulate accomplishments. This is just the nature of life, right? Well, maybe not. The Surrender Experiment by Michael Singer, author of The Untethered Soul, appears in the life-changing books section of the syllabus for the Creativity and Personal Mastery program. Singer describes a phase in his life when he was so tired of his mental chatter that he was spending virtually all of his time in deep meditation. His description of his life then is eerily similar to that of Ramana Maharshi when he first came to the temple at Tiruvannamalai and simply meditated in the cavernous rooms in the many-level temple basement. Singer was in a doctoral program in economics at the University of Florida and had to take three exams. He registered to take the two that he was somewhat prepared for. Somehow, he got registered for all three, and he had not done a stitch of work for his public finance exam. He was tempted to withdraw, but he was experimenting with surrendering to the universe rather than imposing his will on it. He decided to take the exam and that the failure that happened would help in his struggle to vanquish his ego. On the day before the exam, he picked up his main public finance textbook and read three sections at random. He repeated this the next morning and left to take his exam fully expecting to fail and fully at peace with it because he was sure he would drop out of his Ph.D. program to devote full time to his spiritual practice. There were six questions on the exam, and Singer was required to answer three. Three of the six questions dealt with the topics that he had studied. He received an A on the exam and even got a commendation from the Dean on his exemplary performance. Here is a scary thought: Do you really have to impose your will, with all of the pain it involves and the drama it creates, on the universe to make things happen the way you want them to? Or can you learn to set aside your oh-so-strong preferences and let a greater wisdom guide you effortlessly through life? Do not rush to answer this question. This is a deep concept, so think about it, and let your answer emerge. Do not force it. Dr. Srikumar Rao can be contacted at mail@theraoinstitute.com. For more information on his Creativity and Personal Mastery program, please click here.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersYour Team Is Tired: Here’s How To Prevent Further Burnout

Written By: David Finkel; Author, CEO, and Business Coach It’s hiring season, and for many of us, that means that it’s time to look for a few new employees. You have the budget ready, the job descriptions have been carefully crafted and you are ready to start making offers. But before you do that, I want you to take a pause and look at your human resources department as a whole. Are there places where you need to make improvements? Things that you do really well? And things that you might not be doing at all? I always recommend to my business coaching clients that they spend a little time each year reviewing their human resources pillar and their team as a whole before starting the hiring season. Not only will this give you a good plan for the year ahead, but will help prevent any possible issues down the road with your new hires. So here are the areas that I think you should pay attention to before your next hire. Your Current Team Members This seems like a given, but I can’t tell you how many business owners I have worked with that will go on a hiring spree without looking at their current team’s strengths and weaknesses. Ask yourself: Do you have dead weight or low performers who really should be cut? And is everyone in their correct position to utilize their skills and talents? Maybe you have a team member who has recently graduated college or is working towards a degree in another department. Would they be better suited in that department instead of hiring someone new? Is there someone on your team who really enjoys working on projects outside of their department? It might be time to investigate and move individuals that would be better suited elsewhere. After looking at your team, you want to also dedicate some time to talking with everyone to make sure that they are clear on what their roles are within your organization. Not only will this help you identify any gaps that need to be filled, but may also help you get a clearer picture of where you can have your current team members shift their focus to reach your larger company goals. Ask the following: Do each of your employees understand what his or her job is and how that job fits into the bigger picture of the company? Do they know the key results they are responsible for and how the company will measure them on those responsibilities? Do they have a clear understanding of the resources and authority they have in pursuit of these key results? Your Ability to Handle Payroll, Benefits and Legal Compliance. Another area that you want to pay attention to before you bring more team members on is in the area of payroll, benefits and legal issues. How well does your company do at complying with all local, state, and federal labor regulations? How well have you trained your staff on issues like sexual harassment and HR best practices to stay out of legal trouble? And are you able to handle payroll and other issues with ease? If you struggle in any of these areas, it’s imperative that you find the right team members (or third party) to help get your team back on track before hiring additional staff. Hiring the right team members can really help accelerate your growth and allow you to scale your business quickly. With a little bit of planning, you can make sure that you are making the right choices and are set up to retain your staff for years to come. Good luck!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

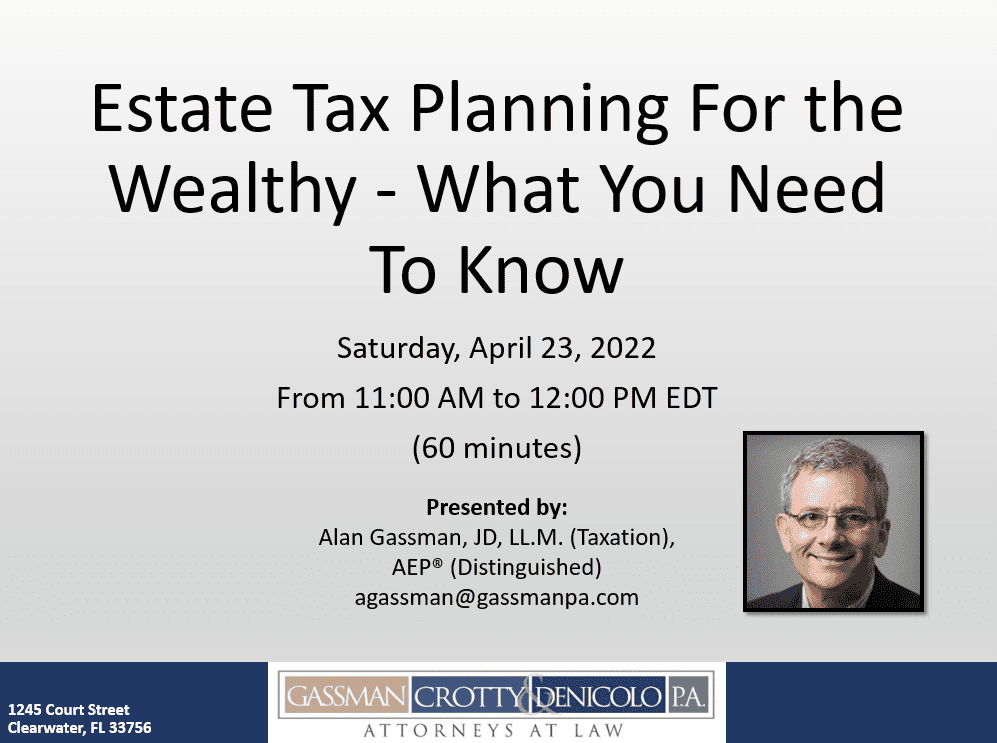

Saturday Webinar“Estate Tax Planning For The Wealthy – What You Need To Know”Plus Part 2 Of The “Human Aspects Of Estate Planning” By Marty Shenkman

Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) and Martin Shenkman, CPA, MBA, PFS, AEP (Distinguished), JD

Date: Saturday, April 23, 2022 Time: 11:00 AM to 12:30 PM EDT REGISTER HERE*These 2 programs will be presented one after another in a single ongoing session, therefore, there is one registration link for both presentations. Please Note: This is a complimentary webinar program. This program does not qualify for CLE/CPE credits. To attend this presentation for free, click the “Register Here” link above. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Click this link to watch the free recording of Part 1 of the “Human Aspects Of Estate Planning”. Please email registration questions to info@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

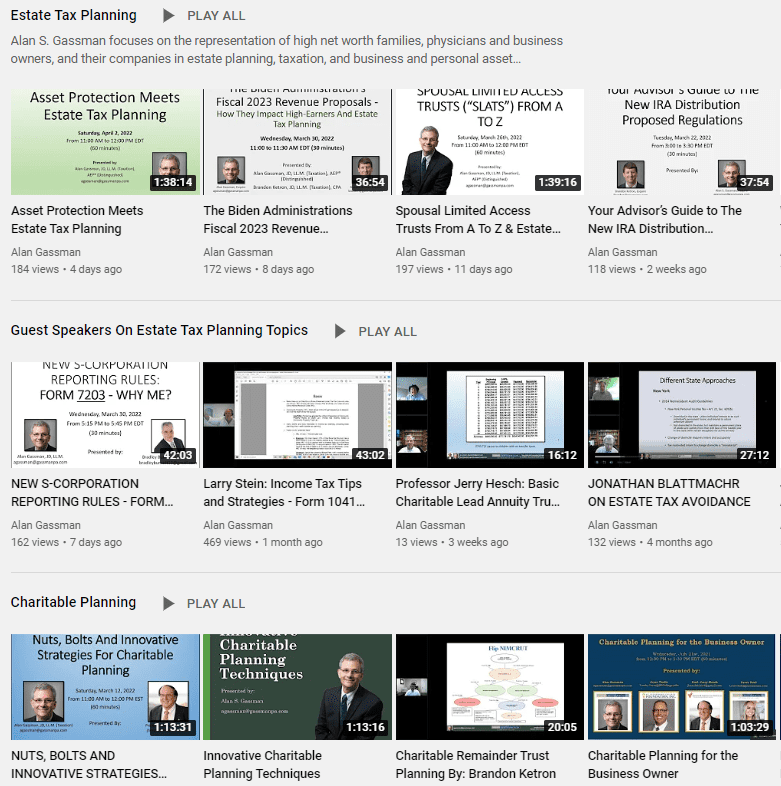

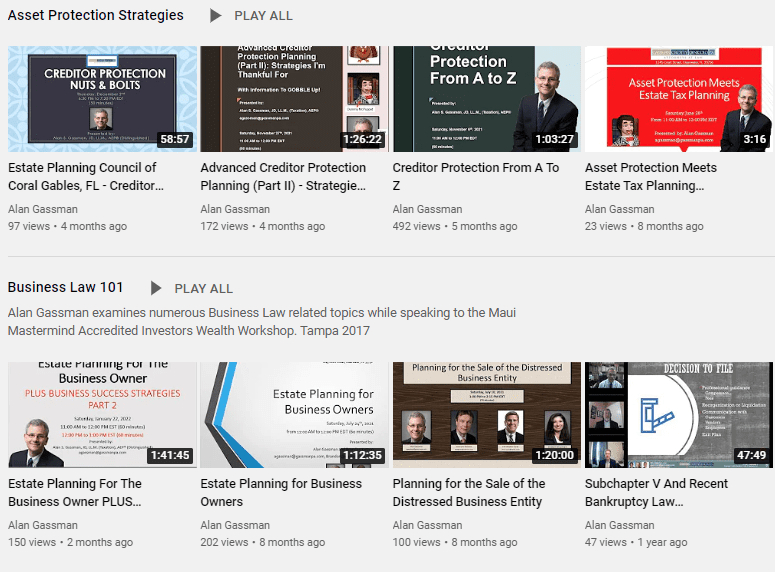

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

HumorCRYPTO (a children’s story)

Written By: Ron Ross

Someone please find my cryptocurrency, It’s not in my lock safe, where can it be? I jiggle my pocket, there’s no clink or clank, The teller tells me it’s not in my bank.

It’s not in my backpack, it’s not in my pouch, It’s not beneath the cushions of the couch. It’s not stolen, I’m not saying someone’s a crook, It’s nowhere and everywhere, except where I look.

I hate paradox, it’s really not fair, To have to buy something that is and isn’t there. If people don’t believe in it, it’s something you can’t sell, It dies, like when kids don’t believe in Tinkerbell.

I don’t want to check, it’s like Shrodinger’s cat, My lack of faith might make it go scat. It rises, it falls, it can go from flood to ebb, Someday it might pull me into the Dark Web.

In that strange void, crypto’s the engine of crime, There’s no right or wrong and it’s tricky all the time. New to that world, it can’t be just my imagination, I just found out I can buy and sell crypto at my local gas station.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||