The Thursday Report – 7.17.2014 – Spot The Typos Edition

Sttructuring IRA and Other Retirement Plan Beneficiary Designations to Provide Flexibility for Maried Clients After Death, an article by Christopher J. Denicolo, J.D., LL.M.

What Estate Planing and Other Laywers Need to Know About Bankruptzy, an article by Alberto F. Gomez and Alan S. Gassman, Part 2

Docusign – What Is It and How Dooes It Work?

Thoughtful Corner – Estate Planners – Reaching a Certin Age is Not Enough!

Your Tex Information Is Still Not Protectd From Being Hacked, an article by Denis Kleinfeld

Student of the Yeer Award Givin to Our Own Amy Bhatt!

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Sttructuring IRA and Other Retirement Plan Beneficiary Designations to Provide Flexibility for Maried Clients After Death, an article by Christopher J. Denicolo, J.D., LL.M.

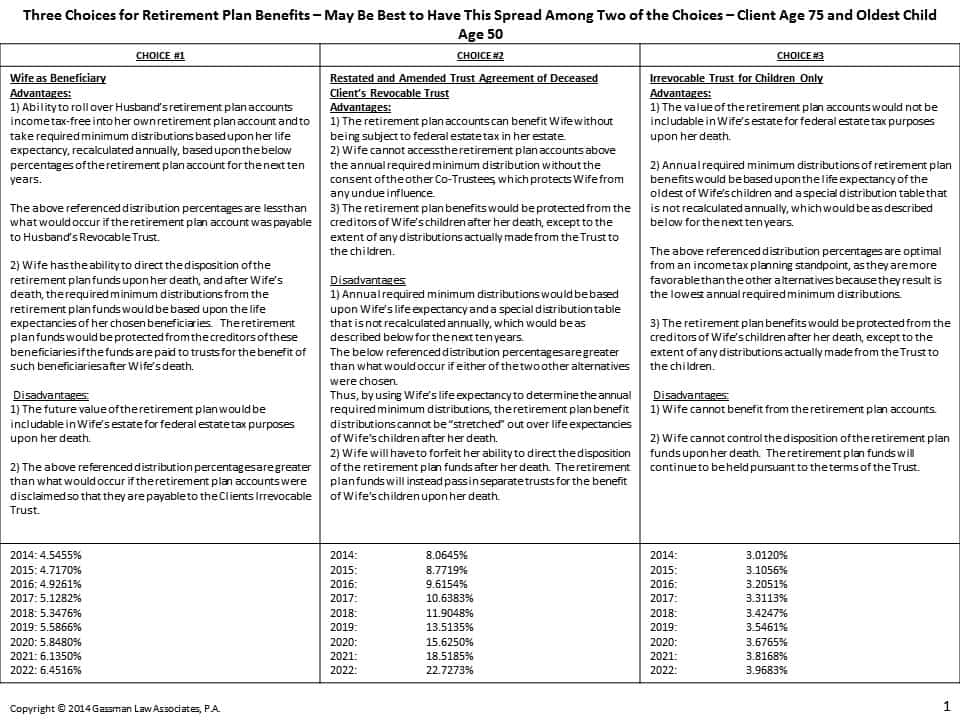

Many clients have IRAs and other qualified retirement plan accounts that will comprise a substantial portion of their estate upon their death. It is therefore important for clients and their advisors to assure that the client’s beneficiary designations are titled appropriately to assure that the IRA and qualified retirement plan benefits will pass in a tax-advantaged manner upon the client’s death.

Married couples usually prefer to leave their retirement plan benefits to the surviving spouse after the first dying spouse’s death for asset security and other non-tax purposes. Structuring beneficiary designations in this manner will allow the surviving spouse to roll over the first dying spouse’s retirement plan benefits into his or her own IRA, and be treated as the owner of the IRA for all purposes under the tax law. This means that the surviving spouse would not be required to take annual required minimum distributions from the IRA until he or she reaches the age 70 ½, and that he or she can name his or her own beneficiary who would receive the IRA funds after his or her later death.

In second marriage situations and where clients wish to have spendthrift protection and other asset preservation considerations apply after the death of the first dying spouse, clients may want to leave their retirement plan benefits to their revocable trust. This will cause the assets in the first dying spouse’s retirement plan to pass in accordance with the client’s desired disposition under his or her revocable trust. Further, the trust can be drafted as an “accumulation trust” that does not mandate the payment of annual or more regular distributions to the surviving spouse and to provide for a co-trusteeship or independent trustee to manage the assets, which can provide for the protection and preservation of the retirement plan benefits and prevent the surviving spouse from unilaterally withdrawing such benefits from the trust.

However, naming the retirement plan owner/participant’s revocable trust as the primary beneficiary of the retirement plan would cause the annual required minimum distributions to be higher than what would occur if the surviving spouse was named as the primary beneficiary. Moreover, the trust must be properly drafted in order to have the trust considered as a “see-through trust,” which the tax law looks through to the ultimate beneficiaries to determine the applicable ages to which the required minimum distribution percentages will apply. If the Trust is not properly drafted and the other requirements of the regulations are not complied with, then the retirement plan benefits would need to be distributed within five (5) years of the decedent’s death, and the benefits would not be able to be “stretched” over the life expectancy of the beneficiaries.

For example, suppose that Husband leaves his IRA to his revocable trust upon his death, and that Wife is the primary beneficiary of the trust for her lifetime, with Husband and Wife’s descendants as the remainder beneficiaries after Wife’s death. Wife would be able to benefit from the IRA benefits, but the annual required minimum distributions would be larger than if she was named as the sole beneficiary of the IRA and she rolled over the IRA into her own IRA. This is illustrated in the chart described below.

The age of the oldest beneficiary of the trust is used to determine the applicable required minimum distribution percentages, so advisors want to be sure that the Trust does not provide benefits for older individuals or allow beneficiaries the power to appoint assets to individuals that are older than them.

If the revocable trust of the decedent provides for benefits for an older beneficiary, then the beneficiary designation should be structured to pay to a separate trust established under the decedent’s revocable trust for the younger beneficiary to avoid accelerating the required minimum distribution payments.

As a variation to the above example, if Husband’s father is also a beneficiary of Husband’s revocable trust after his death, then the father’s age will be used for the purposes of determining the annual required minimum distribution payouts of Husband’s IRA after his death. This would cause the required minimum distributions to be higher each year, which reduces the tax efficiency of “stretching out” the retirement plan benefits of the IRA after Husband’s death. Husband may instead want to have his revocable trust drafted to provide that Wife will be the oldest beneficiary of a separate trust established for her benefit under his revocable trust, and that his father will be the oldest beneficiary of a separate trust established for his benefit under the revocable trust. Husband can then structure his beneficiary designation so that all or a desired portion of his IRA will pass to the trust established for Wife, and that all or a desired portion of his IRA will pass to the trust established for his father.

If Husband and Wife want their children to receive retirement plan benefits on the death of the first dying spouse (or at least have this available as an option after the death of the first dying spouse), and want to take advantage of the lower required minimum distribution payouts based on the children’s longer life expectancy, then they can form an irrevocable trust solely for the benefit of the clients’ children and other descendants and name the trust as a beneficiary of all or a desired portion of their retirement plan assets.

This trust can be established in a manner that will cause the oldest child to be considered to be the “designated beneficiary” for the purposes of determining the annual required minimum distributions. This will usually cause the annual required minimum distributions after the death of the retirement plan owner/participant to be significantly lower than if the surviving spouse or an older individual is also a beneficiary of the trust. As stated above, it is important to assure that the requirements for a “see-through trust” are complied with in order to assure that the required minimum distributions can be stretched over the life expectancies of the beneficiaries of the trust.

Many clients want flexibility after the death of the first dying spouse with respect to the disposition of retirement plan assets. A married couple therefore may want to name the surviving spouse as the first choice beneficiary under their retirement plans to enable the survivor to roll over the retirement plan into his or her own IRA, and name the separate revocable trust of the retirement plan owner/participant or a joint trust that locks up on the first death as the secondary beneficiary. This will enable the surviving spouse to disclaim all of a portion of his or her interest in the retirement plan to cause the benefits to pass to the first dying spouse’s revocable trust or a joint trust that locks up on the first death, if such spouse wishes to do so within nine (9) months of the first dying spouse’s death and if the surviving spouse complies the other requirements for a qualified disclaimer (such as not accepting the benefits that will be disclaimed).

The clients further may want to establish an irrevocable trust for the benefit of their children, and name that trust as the tertiary beneficiary of their retirement plans. This will afford the trustee of the first dying spouse’s revocable trust or the joint trust the ability to disclaim the retirement plan benefits after the death of the first dying spouse to cause them to pass into the irrevocable trust for the clients’ children and other descendants.

We have prepared the following chart to show clients the results and required minimum distribution payout implications of the various beneficiary designation alternatives that are described above:

While there is no “one size fits all” way to structure a beneficiary designation, many married couples will want to structure their retirement plan beneficiary designations with the surviving spouse as the primary beneficiary, the retirement plan owner/participant’s revocable trust (or a joint trust established by both spouses that locks up on the first death) as the secondary beneficiary, and an irrevocable trust established for the benefit of their children and other descendants as the tertiary beneficiary. This can provide for flexibility in a tax-advantaged manner after the death of the first dying spouse, and can allow for the decision with respect to the ultimate disposition of retirement plan assets to be made after the death of first dying spouse when important factors and considerations are known.

What Estate Planing and Other Laywers Need to Know About Bankruptzy, an article by Alberto F. Gomez and Alan S. Gassman, Part 2

Last week’s edition provided an introduction to key bankruptcy principles, including the concept of strategizing to stay out of bankruptcy by having at least 12 creditors so that the rules would require that 3 creditors file to force a debtor into bankruptcy. The question is to what creditors count and the extraordinary judicial powers held by bankruptcy judges are discussed below. There have been many notable decisions, including one by the U.S. Court of Appeals for the Fifth Circuit in Denham v. Shellman Grain Elevator,[1] where the bankruptcy court refused to count small and recurring claims as “countable” under the 12 creditors requirement. One Florida bankruptcy case, In re Smith, cited Denham and excluded creditors holding de minimis claims for $20-$275.[2] Other cases have permitted claims of $65 and $10 to be countable under Section 303 requirement that the aggregate claims must equal or exceed $12,300.

The courts that have chosen not to follow Denham, and to instead allow small and recurring claims to count, have dismissed the de minimis exception as an argument to disqualify one or more creditors, based upon the argument that Congress has not explicitly ruled out small and/or recurring debts and the statute,[3] therefore, should be applied literally.[4] Some courts, however, such as the court in Matter of Runyan have indicated that a $25 debt would not be sufficient, and will evaluate the claims on a case-by-case basis.[5]

Filing an involuntary petition is an aggressive creditor strategy and there are serious and costly consequences if the petition is dismissed. A creditor who files for an involuntary bankruptcy “in bad faith” can be forced to pay the debtor’s fees, costs and actual and punitive damages.[6] In In re Cannon Express Corporation,[7] the U.S. Bankruptcy Court for the Western District of Arkansas awarded compensatory damages and punitive damages where three creditors filed involuntary bankruptcy proceedings against debtor and the court found them to be in bad faith.

The decision was based on a combination of 5 tests identified in In re Landmark Distributors, Inc.[8] The Cannon court combined[9] and restated the tests finding that:

1. the claims were not well grounded in fact because the creditors did not speak with an attorney, talk to other creditors or attempt to collect the money from the debtor directly;

2. the creditors could have advanced their own interests in a different forum by using a collections agency or setting up a payment system with debtor or other forum, instead holding that using bankruptcy courts is an improper use of judicial resources.

3. the creditors used the bankruptcy proceedings to gain a disproportionate advantage over other creditors because the creditors, who were unsecured, testified that they thought filing involuntary bankruptcy proceedings would put them ahead of other unsecured creditors, thus gaining priority; and

4. the creditors were motivated, the court held, by an improper use because the creditor “knew that he was not going to be paid” but thought filing would force the debtor to make payment. Finally, the court held no other reasonable person would have filed the same or similar claim without first investigating whether or not the debtor was paying its debts on time or attempting to collect the debts in some other fashion. For the improper filing the court awarded more than $14,000 compensatory damages and $35,000 in total punitive damages. Had the debtor proven losses in sales by preponderance of the evidence, the court would have awarded these damages as well, which were to be $2,768,288.00 according to the debtor.

In re Adell, 321 B.R. 562 (Bankr. M.D. Fla. 2005) is a good example of an involuntary bankruptcy filing that backfired on the petitioning creditor and resulted in the petitioning creditor becoming a debtor! In Adell, a bankruptcy court in Michigan dismissed an involuntary petition which was filed by Mr. Adell against his former builder. The Court awarded sanctions in the amount of $6,413,230.68 against Adell. Adell then quickly moved to Naples Florida and filed a Chapter 11 bankruptcy petition. Substantial litigation ensued resulting in the conversion of the Chapter 11 case to a Chapter 7 and ultimately the dismissal of the Chapter 7 case for substantial abuse.

The Bankruptcy Code can affect an estate plan if your client is a debtor, a recipient of a transfer from a debtor, or has an interest in a debtor. In general, upon filing a bankruptcy, assets of a debtor become property of the estate 11 U.S.C. Section 541. Some assets are specifically excluded, such as an interest in a spendthrift trust, as defined in 11 U.S.C. Section 541(c)(2) or social security or veterans benefits under 11 U.S.C. Section 522(d)(10)(a) and (b). If your client is a debtor, a recipient of a transfer from a debtor, or has an interest in a debtor, then bankruptcy law can dramatically affect the estate plan.

During pre-bankruptcy planning, advisors need to consider whether to leave assets in an estate that would become accessible to a trustee in bankruptcy. On one hand, there is less likelihood that transfers made before the filing of bankruptcy would be considered “fraudulent,” when remaining assets that would be usable to pay creditors were, arguably, sufficient to pay a substantial portion of expected debt.

Also, courts may be sympathetic to situations in which debtors have lost “sacrificial lambs” as a part of their bankruptcy filings.[10] Judges may be more lenient in looking at fraudulent transfers and other issues with debtors who lose some assets upon filing bankruptcy, as compared to clients who have moved all of their assets to the exempt category and at filing show no assets going into the bankruptcy estate.

On the other hand, if a trustee has funds derived from bankruptcy estate assets to spend on attorneys’ fees and costs to pursue a debtor or recipient of a transfer, it is more likely that the bankruptcy or pre-bankruptcy transfers will be challenged. Often, creditors do not want to “throw good money after bad,” so some planners believe that only enough money to pay a small distribution is appropriate to leave in the debtor’s name in the event of a bankruptcy.

JUDICIAL POWERS

Bankruptcy courts are courts of equity, able to fashion broad and extensive remedies typically not available to state court judges. For instance, under 11 U.S.C. Section 105 of the Bankruptcy Code, bankruptcy judges can enter “any order, process or judgment that is necessary and appropriate to carry out the provisions of this title.” In addition to equitable powers, bankruptcy trustees are empowered with certain “strong arm powers” under the Bankruptcy Code. Presumptions concerning fraudulent transfers and avoidance of transfers are built into the Code, for instance in 11 U.S.C. Section 548 (fraudulent transfer) and in 11 U.S.C. Section 547 (preference), which are described below.

As a matter of bankruptcy law, a trustee is the equivalent of a hypothetical judgment creditor, and the court can step into the shoes of creditors to exercise statutory strong-arm powers to set aside and recover transfers deemed to be fraudulent or preferential. For instance, Section 548 provides for a two year presumption of fraud for transfers of property owned by the debtor.

There are many bankruptcy cases in which courts have disregarded transfers that were ostensibly motivated by estate-planning purposes. In most of these cases, the court’s decisions were fact-specific, involving transactions that occurred when the creditor claim was known or should have been known by the debtor. One of the critical factors considered by courts is the “timing” of the specific transfers.

Lesson learned: Get your client’s estate and income tax plan underway early and document your client’s business, estate, tax, family, and other legitimate motives to ensure that a bankruptcy court will not dismantle legitimate planning that occurs before a bankruptcy petition is filed.[11]

Bankruptcy judges often apply substance over form and rely on equitable principles, in rendering decisions, which often favors the trustee and creditors. For example, in In re Larry Portnoy,[12] the bankruptcy court ignored the law of the applicable offshore jurisdiction and applied the law of the jurisdiction where the bankruptcy court resided, to determine that offshore trusts were not effective creditor protection devices. In FTC v. Affordable Media[13] and in Lawrence v. Goldberg,[14] debtors were held in contempt and jailed for not turning over offshore assets. The U.S. Court of Appeals for the Ninth and Eleventh Circuits, respectively, upheld the bankruptcy court’s decision in both Affordable Media and Lawrence.

TIMING CAN BE EVERYTHING

In too many cases, estate and asset protection plans miss key bankruptcy protections or ignore crucial facts that could jeopardize the plan itself. Again the bottom line is that the timing of an asset protection or estate plan is crucial to how it will fare in bankruptcy court. Case law principles and strategy with respect to timing intent and documentation concerning pre-bankruptcy actions will be discussed next weak.

Check back next week to read the next installment of this article.

Docusign – What Is It and How Dooes It Work?

By Dena Daniels, MBA, and Stetson Law Student

What is Florida Statute 668.004 Force and effect of electronic signature.—Unless otherwise provided by law, an electronic signature may be used to sign a writing and shall have the same force and effect as a written signature.

Docusign is a program that allows you to sign documents electronically. Using DocuSign, an individual or company can send documents all over the world to be signed by using a simple process. First, a user of DocuSign uploads a document in Word, PDF, or other common document formats. The user then adds the name and email of the people that need to sign the document, marks where they need to sign, and sends it out. Once the recipients have signed the document it is returned to the original user and stored electronically for future use. This seems like a great way to be able to get documents signed quickly and efficiently, however the question is are these signatures valid and legally binding?

Legality of DocuSign Signatures

There are two major laws that govern the use of electronic signatures. The first of these two laws is the Electronic Signatures in Global and National Commerce Act (“ESIGN”), a federal statute. The second is the Uniform Electronic Transactions Act (“UETA”), this uniform law has been passed by 47 states, including Florida.[14] The three states that have not implemented the UETA are New York, Washington, and Indiana. Generally, an electronic signature may not be unenforceable simply because it is in electronic form.[16] An electronic signature is defined in both acts as an “electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed by a person with the intent to sign the record.”[17] This can include typing a full name, clicking an “I accept” box, or scanning a signature into the file. As you can see, most of us have likely used an electronic signature before. DocuSign allows you to sign with your mouse, finger, upload a scanned image of your signature, or use a standard signature style provided by DocuSign. This qualifies as an electronic signature under both ESIGN and the UETA, but other requirements must still be met.

Consent

The first requirement is that the signer has consented to sign electronically and has been given the option to sign on paper or in another non-electronic form.[18] Consent can be established either explicitly or implicitly based on the parties interactions. While using DocuSign, the parties accept emails and documents to sign. This would most likely satisfy the requirement that the party consented to sign electronically.

Intent to Sign

The second requirement that must be met is that the signer has the intent to sign.[19]

Signature Associated with the Record

The third requirement is that the electronic signature must be logically associated with the record or thing that is being signed.[20] In order to prove this the process used to sign the document must be documented. DocuSign satisfies this requirement via their digital audit trail. This trail included the signer names, authentication history, digital signatures, email addresses, the IP address of the signer, the chain of custody of the document, etc. This information is provided if need be in a Certificate of Completion that is tampered sealed and court admissible.

Record Retention

The final requirement is that the signed document is able to be effectively retained. In order to satisfy this requirement the electronically signed document must accurately reflect the information set forth in the record, and remain available in a form that is able to be accurately reproduced for all parties entitled to access.[21] DocuSign satisfies this requirement with their record keeping practices. DocuSign securely stores information with encryptions and other methods to ensure that only the designated parties will be able to review the signed documents.

When a DocuSign signature would not work

Both the ESIGN Act and the UETA have explicitly stated exclusions to when an electronic signature will have no legal effect. The exclusions are as follows:[22]

1. The creation or execution of wills, codicils, or testamentary trusts

2. Adoption, divorce, or other matters of family law

3. The Uniform Commercial Code except Section 1-107, 1-206, and Article 2 and 2A

4. Court orders, notices, or official court documents

5. Notice of cancellation of utility services

6. Default, acceleration, repossession, foreclosure, eviction, or a rental agreement for, an individuals primary residence.

7. Notice of cancellation or termination of health insurance or life insurance

8. The recall of a product

9. Any document related to the handling of hazardous materials

Conclusion

In conclusion, the procedures and safeguards of DocuSign will satisfy the legal requirements for an electronic signature. Documents signed using DocuSign will be valid and legally binding, with exception of the above mentioned exclusions. DocuSign provides a safe and efficient way for businesses and individuals to send documents around the world and have them signed in a matter of minutes with a valid and legally binding signature.

Thoughtful Corner

Estate Planners – Reaching a Certin Age is Not Enough!

We rarely draft trusts that release assets at any given age, but instead provide that the primary beneficiary of such a trust may become Co-Trustee or even sole Trustee upon reaching certain ages.

But how can we be sure that such an individual will be qualified to serve as Trustee and not “blow it?”

Please consider the following language to protect your clients’ descendants (from themselves):

6.04 Trusteeship of Separate Trusts. After the death of myself and my spouse and after division of the Trust estate into separate trusts for my children or other descendants, then a Primary Beneficiary of a separate Trust (as defined in Article Four and/or Article Five) shall have the ability to do the following at the ages indicated below if such Primary Beneficiary meets one of the following criteria: (1) the Primary Beneficiary has attained a four-year college degree at an accredited state university or a well respected private university approved by a regional accreditation organization recognized by the United States Department of Education and the Council for Higher Education Accreditation, and is gainfully employed and self-supporting (or is a full-time homemaker raising one or more minor children) for a period of at least five (5) years; or (2) the Primary Beneficiary is determined to be stable, willing and able to support himself or herself, and responsible and thus appropriate to serve as Trustee by the individuals (other than the Primary Beneficiary) named above in Section 6.03 who are able and willing to affirm such status:

(a) Upon having attained the age of twenty-five (25), to serve as Co-Trustee with the Trustee or Co-Trustees then serving, provided that there shall always be one individual named in Section 6.03 or a licensed trust company serving as Co-Trustee with the Primary Beneficiary; and

(b) Upon having attained the age of thirty (30), to replace any Corporate Trustee or Co-Trustee then serving with another Corporate Trustee of the Primary Beneficiary’s choice, provided that there shall always be a Corporate Trustee serving with such Primary Beneficiary if such replacement power is exercised, until such Primary Beneficiary reaches age thirty-five (35);

(c) Upon having attained the age of thirty-five (35), to serve as sole Trustee and to designate the successor Trusteeship to serve in the event of the Primary Beneficiary’s resignation or incapacity.

(d) At any age as an adult, to designate the successor Trusteeship to take effect upon the death of the Primary Beneficiary of such separate trust or any trusts created therefrom, by signed writing delivered to the Trustee then serving or by specific reference to this power in the Primary Beneficiary’s Last Will and Testament.

We encourage stronger language than the above, but many clients have elected to use this looser standard.

The safest standard is to require a trusted individual and/or a licensed trust company to serve as Co-Trustee for the lifetime of the individual.

We tell the clients that if the individual beneficiary is sound they should not mind having a Co-Trustee, but if they are unsound it will be sorely needed.

6.08 Removal of Beneficiary/Trustees. Notwithstanding any provision in this Article Six to the contrary, if a Primary Beneficiary is serving or is to serve as sole Trustee of a separate trust established for such Primary Beneficiary’s benefit, and if such Primary Beneficiary is insolvent or is unable to satisfy any financial or court or arbitration ordered obligation, or is in the process of being divorced, then such Primary Beneficiary shall be automatically removed as Trustee, and replaced with an Independent Trustee chosen by such Primary Beneficiary. The Independent Trustee chosen as a replacement shall be a descendant of mine (other than the applicable Primary Beneficiary) who has attained the age of thirty-five (35), a licensed attorney who has represented me or who specializes in estate and trust law with an “AV” rating in the Martindale-Hubbell directory, a certified public accountant who has done my accounting work or has extensive experience preparing estate and income tax returns for a reputable trust company, or a licensed trust company. A Trustee Beneficiary who has been forced to no longer serve by reason of this provision shall have the right to regain the trusteeship when circumstances have clearly changed such that there is no longer an insolvency and/or the applicable divorce has been resolved or withdrawn and there is no imminent threat of creditor or claims of a family nature that could cause loss of trust assets. Further, if applicable state law where a beneficiary resides, or other applicable law, would make the Trust for such beneficiary creditor accessible if such beneficiary were the sole Trustee, then such beneficiary shall be required to choose an Independent Trustee meeting the requirements as described above with respect to trusteeship of such Trust and shall be required to serve with an independent Co-Trustee so long as the state law where such beneficiary resides requires a Co-Trustee to facilitate creditor protection.

Your Tex Information Is Still Not Protectd From Being Hacked

By: Denis Kleinfeld

“Serious weaknesses remain that could affect the confidentiality, integrity, and availability of financial and sensitive taxpayer data,” said Nancy R. Kingsbury and Gregory Wilsushusen of the Government Accountability Office (the GAO) in the latest GAO report on the IRS.

They ought to know since they are the directors for applied research and methods, and information security respectively.

Although the IRS has suffered from funding problems, an ever increasing work load of new tax laws, manpower limitations, plus Obamacare, compliance regulation impacting all financial institutions in the entire world, and morale depleting political scandals, that does not diminish the fact that your tax information is at risk of being stolen by hackers.

I have the impression that having all your most intimate financial details being in the IRS computers is somewhat analogous to a golf ball being teed up for Tiger Woods. Only these Tiger Woods are the professional computer hackers stealing billions of dollars by getting your financial–and medical–information stored on the government’s computers.

GAO reports going back at least to 2007 have highlighted the flaws and vulnerabilities of the IRS systems.

Basically, the IRS has long standing information technology issues which can expose taxpayer data to cyber-attacks by hackers, criminals, and foreign governments.

The IRS is not alone.

The GAO report states, “Our previous reports, and those by federal inspector general, describe persistent information security weaknesses that place federal agencies, including the IRS, at risk of disruption, fraud, or inappropriate disclosure of sensitive information.”

The GAO labels the government’s computer information security as a “high-risk area since 1997.”

Yes, the IRS has made some progress, but as the GAO report says, “These weaknesses and others in the IRS’s security program increase the risk that taxpayer and other sensitive information could be disclosed or modified without authorization.”

Even when it comes to something as fundamental as passwords and preventing wrongful access, the IRS did not fully implement effective controls in the areas of user identification, authentication, authorization, cryptography, audit and monitoring, and physical security.

Other parts of the information systems are also in peril. This is especially troubling considering that the IRS has the heavy burden of trying to keep their computer systems up-to-date with congress constantly making dramatic changes in the tax law. And now the IRS has oversight over both the entire health care system and getting U.S. tax compliance of every foreign financial account held by every financial institution world-wide.

Planning for continuity in configuring the computer system for new policies, procedures, techniques, software updates are challenges that may well be, and likely are, beyond any governmental agency or private company’s ability to keep pace.

The IRS is in the same boat as many computer owners in private industry in that it has a lot of its computers still using the Windows XP operating system which Microsoft is no longer supporting any security updates. The current IRS Commissioner explained in a recent congressional hearing that the conversion from Windows XP to Windows 7 had not been completed since the IRS didn’t have the money to do it.

No matter whether congress or the IRS is to blame for this mess, the fact is that taxpayers’ sensitive financial information is not being protected by the government from being hacked.

Student of the Yeer Award Givin to Our Own Amy Bhatt!

One great pleasure of our practice is hiring and watching high school students become mavens, and Amy Bhatt is a prime example. Amy started working for our firm when she was 15 years old as a sophomore at Countryside High School. She will be a fantastic lawyer!

In 10th grade, Amy took the highly demanding entrance test for the Early College Program and got accepted as one of the few selected students in Pinellas County. She has simultaneously achieved a 4.72 weighted High School GPA and a 4.0 College GPA. While in the Early College Program, she won the “Student of the Year” award after achieving the highest grade in the rigorous Honors Interdisciplinary Studies program.

With a passion for law and justice, Amy is majoring in Paralegal Studies at St. Petersburg College. Her goal is to earn a Juris Doctor from Stetson University College of Law. She currently works as a Legal Administrative Assistant at Gassman Law Associates, drawing from her education and prior office experience from the Criminal Justice Center to ease the workload of paralegals and attorneys. If only Doogie Howser was here to see her!

Upcoming Seminars and Webinars

FREE LIVE WEBINAR:

STEP-UP YOUR EFFORTS TO STEP-UP CLIENTS’ BASIS – STRATEGIC ESTATE PLANNING AND STEPPED-UP BASIS CONSIDERATIONS

Date: Wednesday, July 23, 2014 |12:30 p.m. (30 Minute Webinar)

Speakers: Edwin P. Morrow, III, Alan S. Gassman

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE LIVE WEBINAR:

GAUGING AND HANDLING ENTITLEMENT TENDENCIES OF BENEFICIARIES, EMPLOYEES AND OTHERS – A FASCINATING AND EXTREMELY PRACTICAL GUIDE ON SOCIETY’S NEWEST ISSUE

Date: Tuesday, July 29, 2014 | 12:30 p.m. (30 Minute Webinar)

Speakers: Stephanie Thomason, Ph.D. and Alan S. Gassman, Esq.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

CLEARWATER WORKSHOP FOR YOUNG LAWYERS:

Alan Gassman will be joined by several experienced attorneys and other well respected industry experts during a full day workshop for young lawyers who wish to enhance their practice and personal lives.

Date: Sunday, August 3, 2014 | 9am – 3pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

FREE LIVE WEBINAR:

HIPOO MEDICAL OFFICE DISASTER AVOIDANCE CHECKLIST

This 20-25 minute webinar includes valuable forms and important strategies that every medical office should know about. Join us for an interactive and innovative discussion of how medical practices can be decimated by HIPOO, including a number of survival techniques, tips, and tools.

Date: Tuesday, August 5, 2014 | 12:00 p.m. and 7:00 p.m.

Speakers: Alan S. Gassman, Lester Perling, and Jeff Howard

Location: Online Webinar

Additional Information: To register for the 12 p.m. webinar, please click here. To register for the 7 p.m. webinar, please click here.

*******************************************************

FREE LIVE WEBINAR:

SOFTWARE UPDATE WEBINAR: NEW FEATURES FOR ATTENDING CREATURES

Alan Gassman will be joined by Ken Crotty and software designer Dave Archer to discuss the new features of our EstateView software. Additionally, there will be a session for new users to become familiar with the program.

Date: Wednesday, August 6, 2014 | 12:30 pm (30 minutes)

Location: Online webinar

Additional Information: To register for the webinar please click here.

*******************************************************

FREE LIVE WEBINAR:

A POWERFUL 40 MINUTE DOUBLE HEADER WITH JONATHAN BLATTMACHR

Topics:

- Foreign vs. Domestic Asset Protection Trusts: More Than Just Creditor Protection Considerations

- Empowering Your Powers of Appointment: Don’t Leave Out Important Tax and Practical Provisions or Ignore Important Considerations. With Sample Provisions

Date: Tuesday, August 12, 2014 | 12:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE ISLE OF MAN PRESENTATION:

Alan S. Gassman will be speaking on US TRUST AND TAX LAWS FOR INTERNATIONAL INVESTORS at Cayman National Bank and Trust Company on the Isle of Man

Sign up now and you will receive a free lunch! Transportation not included.

“Half-way between England

And Ireland in the Irish Sea.”

Is a great place to discuss trusts with glee.”

Date: Wednesday, September 3, 2014

Additional Information: If you would like to receive a copy of the materials that will be presented please email Janine Gunyan at janine@gassmanpa.com and we will send them to you once they are ready.

********************************************************

FREE LIVE WEBINAR:

Ken Crotty will be presenting a free live webinar entitled AVOIDING DISASTER ON HIGHWAY 709. The 50 minute guide to disaster avoidance with respect to gift tax returns. This webinar will qualify for 1 hour of CLE and CPE credit.

Date: Wednesday, September 3, 2014 | 12:30 p.m. (50 minutes)

Location:Onlinewebinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAS.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it’s our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

Additional Information: To attend this seminar please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifing the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Date: January 16, 2015

Location: TBD – Fort Lauderdale, Florida

Additional Information:For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY MOTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

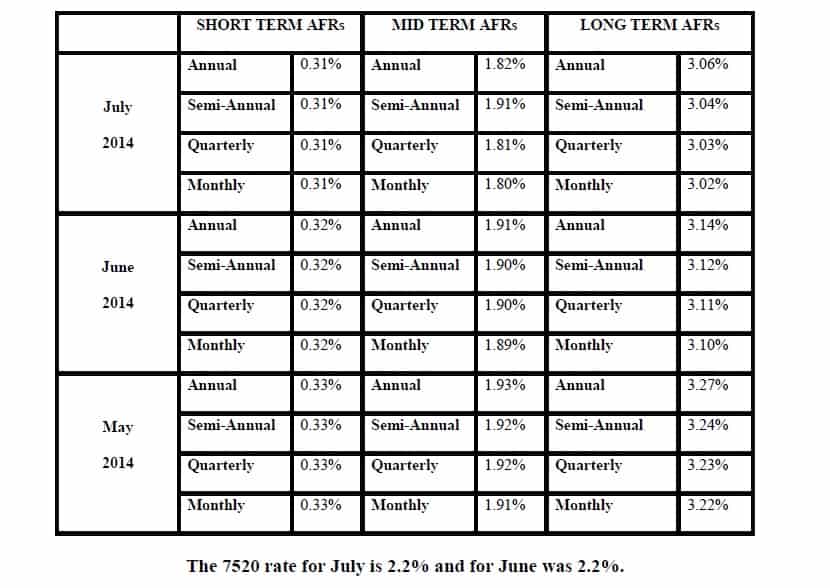

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

[1]Denham v. Shellman Grain Elevator, 444 F.2d 1376 (5th Cir. 1971), the debtor listed 18 creditors with an aggregate indebtedness of only $467.13, all but one of whom were owed less than $100, to defeat an involuntary petition for bankruptcy filed by one of Denham’s very large creditors. The court found that all of the debts were open and unliquidated, as opposed to claims reduced to judgments, and that small recurring debts cannot qualify creditors to be counted toward the necessary amount required to initiate a petition.

[2]See In re Smith, 123 B.R. 423 (M.D. Fla. 1990).

[3]11 U.S.C. Section 303(b)(2) (2007).

[4]See In re Okamoto, 491 F.2d 496 (7th Cir. 1974) which allowed eight debts, all of which were below $65 each, to count toward the 12 creditor threshold and stated that most courts abandon Denham because Denham refused to acknowledge Congressional intent by specifically differentiating betweenlarge and small debts and removing a prior provision excluding debts below $50; See Matter of Rassi, 701 F.2d 627 (7th Cir.1983) which prevented the petitioner from forcing the debtor into an involuntary bankruptcy by allowing two claims, both $10 or less; See also 11 U.S.C. Section 548(e); See also Steve Leimberg’s Estate Planning Newsletter Number 485 by Alan S. Gassman.

[5]Matter of Runyan, 832 F.2d 58 (Tex. Court App. 1987).

[6]11 U.S.C. § 303(I) (2007).

[7]280 B.R. 450 (Bankr. D. W.Ark. 2002).

[8]189 B.R. 290,309-10 (Bankr. D.N.J. 1995).

[9]Those five tests are 1) the improper use test which finds bad faith if a creditor files involuntary bankruptcy to gain a disproportionate advantage for himself over other creditors, 2) the improper purpose test which finds bad faith if creditor’s motivation for filing is ill will, malice or harassment, 3) the objective test which asks if a reasonable person would have also filed involuntary bankruptcy, 4) the subjective test which looks at the subjective motivation of the creditor (almost identical to the improper purpose test), and 5) the two part test which combines the subjective and objective tests. Cannon at 453.

[10]A common refrain from bankruptcy lawyers regarding this topic is that “pigs get fat and hogs get slaughtered.” Leaving a sacrificial lamb may tip the scales more favorably towards a debtor since the perception of treating creditors fairly increases. Also, there is a much better chance that a settlement will result, especially with a Chapter 7 trustee. The Chapter 7 trustee is a court fiduciary who is required to promptly convert assets and disputes to cash, unlike some litigants who pursue litigation out of principle or some ulterior motive.

[11]For bankruptcy cases dealing with estate planning issues, see In Re Kossow, 325 B.R. 478 (S.D. Fla. 2005); In Re Jennings, 332 B.R. 465 (M.D. Fla. 2005); In Re Ludwig, 345 B.R. 310 (Bankr. D. Colo. 2006); Joseph J. Luzinski v. Peabody & Arnold, LLP and Joel Reinstein, P.A. (In Re Gosman), Adv. No. 03-3228-BKC-SHF-A (S.D. Fla. 2007).

[12]In re Larry Portnoy, 201 B.R. 685 (Bankr. S.D.N.Y. 2996).

[13] Federal Trade Commission v. Affordable Media, LLC, Denyse Lindaalyce Anderson and Michael K. Anderson, 179 F.3d 1228 (9th Cir. 1999).

[14]Lawrence v. Goldberg (In re Lawrence), 279 F.3d 129 (11th Cir. 2002).

[15]http://www.ncsl.org/portals/1/oldsite/programs/lis/images/uetamap.gif

[16] 15 U.S.C. § 7006 (a); F.S. 688.50 (7)(a)

[17] 15 U.SC. § 7006 (5); F.S. 688.50 (2)(h)

[18]15 U.S.C. § 7001 (c)(1)

[19] 15 U.SC. § 7006 (5); F.S. 688.50 (2)(h)

[20] Id.

[21]15 U.S.C. § 7001 (d)(1)

[22] 15 U.S.C. § 7003; F.S. 688.50 (3)

You are receiving this email because you are a colleague, friend or client of Gassman, Crotty & Denicolo, P.A.

If you no longer wish to receive the weekly Thursday Report Newsletter, simply click here to be immediately unsubscribed.