The Thursday Report – Issue 315

|

HERE LIES THE NEXT THURSDAY REPORT – WE ARE 6 DAYS EARLY

|

||||||||||||||||||||||||||||||||||||

|

Friday, October 29th, 2021Issue 315EDITED BY KENNETH CROTTY Having trouble viewing this? Use this link

|

||||||||||||||||||||||||||||||||||||

A SPECIAL ANNOUNCEMENT ON THE LATEST WHITE HOUSE TAX PROPOSALS

Dear CPAs and Advisors, We’ve recently posted the following articles to Forbes titled: “Hey President Biden – What Are You Doing On Estate Taxes?” and “Hey President Biden – What Taxes Are You Now Imposing On Businesses And High Earners?”. We invite you to join us there by clicking the links below. Hey President Biden – What Taxes Are You Now Imposing On Businesses And High Earners?Written By: Alan S. Gassman and Brandon Ketron Oct 29, 2021 Instead of an estate tax increase, we have an expansion of the Net Investment Income Tax on high earners who use S corporations and partnership entities to shield themselves from this 3.8% tax, a 5% surtax on those individuals who have income exceeding $10,000,000 and an additional 3% surtax on…Continue Reading on Forbes. Hey President Biden – What Are You Doing On Estate Taxes?Written By: Alan S. Gassman, Brandon Ketron and Ian MacLean Oct 28, 2021 Tax advisors and affluent Americans have been working hard to place ownership interests in LLCs and other entities holding their investments under specially designed irrevocable trusts, as gifts or in exchange for promissory notes, in order to have arrangements in place well before the signing of…Continue Reading on Forbes. Best regards, Alan S. Gassman |

||||||||||||||||||||||||||||||||||||

|

Our Annual Halloween Costume Contest at the Gassman, Denicolo & Ketron, P.A. Law Firm |

||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1IRS Publication Errors Are Not Their ProblemWritten by: Alan S. Gassman Article 2A Brief Interview With Alan GassmanInterview between Alan S. Gassman and Paul Caspersen Article 3Reducing Estate and Trust Litigation Through Disclosure, In Terrorem Clauses, Mediation, Arbitration and Pre-Mortem ProbateWritten By: Jonathan Blattmachr, Esq. For Finkel’s FollowersHow to Choose the Right Vendor for Your Next ProjectWritten By: David Finkel Featured Event(s)All Upcoming EventsYouTube LibraryHumor

|

||||||||||||||||||||||||||||||||||||

|

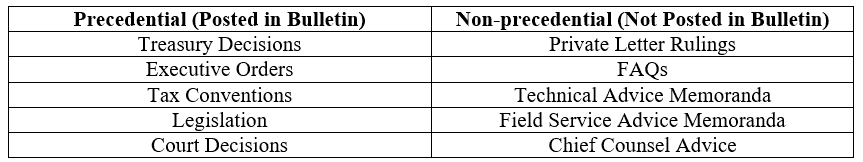

Article 1IRS Publication Errors Are Not Their Problem

By: Alan S. Gassman, Esq. EXECUTIVE SUMMARY Many well-meaning taxpayers and advisors utilize the IRS website and IRS-issued guidance to inform their tax decisions and assume that they may reasonably rely on the information supplied to them. Individuals are often surprised to learn that this is not the case, and users should be aware of what IRS information they can actually utilize to make decisions. The 2014 Tax Court case of Bobrow v. Commissioner caused some uncertainty on a taxpayer’s ability to rely on the guidance published by the IRS. In this case, tax lawyer Alvan Bobrow relied on IRS-issued guidance and made multiple IRA rollovers within a 12 month period. The Tax Court ruled that reliance on IRS guidance was not a defense to any resulting penalty. Bobrow v. Commissioner understandably left many taxpayers wondering what exactly they could rely on from the IRS. Additionally, a long line of cases state that the only authoritative sources of tax law are statutes, regulations, and judicial precedent even though the IRS also issues Publications, tax form instructions, and posts FAQs to its website. It appears that taxpayers cannot cite a large portion of IRS-produced information as authority. Unfortunately, the IRS’s recent news release only partially addresses what types of material may be relied on. Even IRS phone advice cannot be relied on for approximately one-fourth (1/4) of tax-payers. Studies released by the General Accounting Office and the Treasury Inspector General for Tax administration have shown that up to 26% of advice given by the IRS over the phone is either wrong or incomplete.[1] The situation has not improved in recent years according to an agency release in spring of 2021 which said “IRS employees could not keep pace with this massive volume of calls, resulting in the poorest service ever,” referencing the overwhelming backlog of tax returns this year.[2] On October 15, 2021, the IRS issued a news release in an attempt to address concerns regarding transparency and the potential impact of FAQs on taxpayers and concerns regarding the application of penalties to taxpayers who rely on the FAQs. In this new update, the IRS states that FAQs may be relied upon for reasonable cause defenses against negligence or other accuracy-related penalties to the extent that the reliance results in an underpayment of tax, and that guidance published on the Internal Revenue Bulletin may be used as precedent. The release does not address whether taxpayers and advisors may rely on the IRS’s own Publications, tax form instructions, and other material posted on the IRS website. FACTS Bobrow v. Commissioner (T.C. 2014) In Bobrow v. Commissioner, the Tax Court ruled against its own advice regarding IRA rollovers. The Internal Revenue Code allows taxpayers who receive a distribution from an IRA to avoid creating a taxable event by rolling the funds over to an IRA within 60 days. However, IRC Section 408(d)(3)(B) of the tax code only permits taxpayers to complete an IRA rollover once in a 12 month period. In previous Publications, specifically Publication 590, the IRS contemplated situations where Section 408(d)(3)(B) would allow a taxpayer to enjoy multiple tax-free IRA rollovers in a single 12 month period if the taxpayer conducted unrelated transactions using multiple IRAs. The Tax Court held that IRC Section 408(d)(3)(B) applied to all of an individual’s IRAs at once, and stated that reliance on IRS guidance was not an available defense. Following Bobrow, the IRS announced that it would be amending Publication 590 to conform to the decision and erase any contradictory language. IRS News Release In the recent news release, the IRS states that taxpayers who “rely on any FAQ in good faith and [which] reliance is reasonable” will be allowed to have a reasonable cause defense against any negligence penalty or other accuracy-related penalty if the FAQ is later determined incorrect. However, it is important to note that the IRS was careful to add that “if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer’s case, the law will control the taxpayer’s tax liability,” thus limiting the protection to just the negligence penalty. Furthermore, the news update states that “Rulings and Procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents.” This too comes with a slight caveat as the IRS clarifies that “in applying published Rulings and Procedures, the effect of subsequent legislation, regulations, court decisions, Rulings and Procedures must be considered.” ANALYSIS In 2014, Judge Nega declared that “taxpayers rely on IRS guidance at their own peril”[3] after making a Ruling against a tax attorney who had relied on guidance by the IRS in the case Bobrow v. Commissioner. This Ruling by Judge Nega caused many tax professionals to question just how much they could really rely on guidance that has been issued by the IRS. So what information from the IRS can be relied on? Treasury Regulations set the highest standard for advice, as they are officially published in the IRS Bulletin and set precedent. Following Treasury Regulations are Rulings and Procedures reported in the Bulletin. While they may not have the same force and effect as Regulations, they also may be cited as precedent. Only Rulings or Procedures published in the Bulletin may be cited as precedent. Moreover, caution is advised when applying published Rulings, as the facts and circumstances of each case differ and may result in different Rulings. Private Letter Rulings are frequently used to provide guidance for confused taxpayers, but that does not mean they provide reliable advice. Private Letter Rulings are not officially published in the IRS Bulletin, and may not be relied on as precedent by other taxpayers or IRS personnel. Technical Advice Memoranda (TAMs) similarly only apply to certain closed transactions, and therefore do not establish any precedent outside of the specific issue the TAM addresses. Field Service Advice Memoranda (FSAs) are additional taxpayer-specific Rulings that may not be relied on or cited as precedent. The precedential value of IRS written determinations are laid out in 26 U.S. Code § 6110(k)(3). “Written determinations” means any Ruling, Determination Letter, TAM, or Chief Counsel advice. The statute states the following: (3) PRECEDENTIAL STATUS Unless the Secretary otherwise establishes by regulations, a written determination may not be used or cited as precedent… The news release addresses the extent to which the IRS FAQs can be relied on for the purpose of avoiding tax penalties. A portion of the IRS’s announcement is provided below: FAQs that have not been published in the Bulletin will not be relied on, used, or cited as precedents by Service personnel in the disposition of cases. Similarly, if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer’s case, the law will control the taxpayer’s tax liability. Only guidance that is published in the Bulletin has precedential value. Notwithstanding the non-precedential nature of FAQs, a taxpayer’s reasonable reliance on an FAQ (even one that is subsequently updated or modified) is relevant and will be considered in determining whether certain penalties apply. Taxpayers who show that they relied in good faith on an FAQ and that their reliance was reasonable based on all the facts and circumstances will not be subject to a penalty that provides a reasonable cause standard for relief, including a negligence penalty or other accuracy-related penalty, to the extent that reliance results in an underpayment of tax.[4] While this clarification is a welcome one, it is important to keep in mind several things. In order for a taxpayer to properly rely on the FAQ as a defense, the reliance must be both reasonable and done in good faith. Further, as noted above, this defense only applies to the negligence penalty or other accuracy-related penalties. This means that the taxpayer could still be liable for any unpaid tax liabilities, including possible interest, even if they do meet this reasonable cause standard. The FAQ update seems to fall in conformity with Bobrow. Towards the end of the Bobrow opinion, the court states that there is no negligence penalty if there is a finding that the taxpayer could establish reasonable cause derived from a finding of reasonable reliance and good faith. This mirrors the language of the recent update which clarifies that a taxpayer may achieve this reasonable cause by relying on an FAQ, even if the FAQ is later determined to be incorrect. In addition to clarifying how taxpayers should value the FAQs, the IRS reiterated that only information published in the Internal Revenue Bulletin has precedential value. Taxpayers and their advisors should feel comfortable using the various forms of guidance published in the Bulletin. Documents in the Bulletin include regulations, revenue Rulings, revenue Procedures, notices, and announcements.[5] However, it should be noted that applying these Rulings and Procedures must be done in conjunction with the consideration of other legislation, regulations, and court decisions. Therefore, while information published in the Bulletin can be relied on, used, and cited as precedent, taxpayers and their advisors should not entirely rely on these Rulings and Procedures as their sole source of guidance. Rather, they should look at all of the laws on their issue and use the Bulletin as further supplementation. While the press release clarifies that taxpayers may use reasonable reliance on IRS FAQs as a defense, it does not address other sources of tax information that taxpayers regularly use, such as tax form instructions and IRS Publications. The news release states that the FAQs are a “valuable alternative to guidance published in the Bulletin” as the justification for why taxpayers should be able to use the FAQs as a valid reasonable cause defense. The IRS apparently does not consider IRS Publications and tax form instructions as “valuable alternatives” to the Internal Revenue Bulletin. Additionally, the news release itself and the clarifying addition to the FAQ fact sheet are not authoritative guidance and can be revoked at any time. The following chart will hopefully clarify the differences between various forms of IRS guidance.

While the recent news release by the IRS provides a bit of clarity on reliance concerns that taxpayers and tax professionals have struggled with for years, it only addresses how individuals may use the IRS FAQs and does not include other commonly used sources of tax information. Conclusion If anything, the press release solidifies the IRS’s position that there is certain information published by the IRS that cannot be relied on by taxpayers. This is certainly a confusing stance in a world where almost every industry, including the legal profession, requires disclaimers and “fine print” in order to protect against liability, but it seems that the IRS can release instructions and later disavow them. With this is mind, Taxpayers and their advisors should take extra care when researching tax law. [1] https://www.wsj.com/articles/SB1031175736263468595; https://www.latimes.com/archives/la-xpm-1987-04-09-mn-397-story.html [2] https://www.forbes.com/advisor/personal-finance/irs-customer-service-tips/ [3] Bobrow v. C.I.R., 107 T.C.M. (CCH) 1110 (Tax 2014) [4]https://www.irs.gov/newsroom/irs-updates-process-for-frequently-asked-questions-on-new-tax-legislation-and-addresses-reliance-concerns [5] https://www.irs.gov/newsroom/understanding-irs-guidance-a-brief-primer CITED AS: LISI Business Entities Newsletter #241 (September 21, 2021) at http://www.leimbergservices.com. Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

|

||||||||||||||||||||||||||||||||||||

|

Article 2A Brief Interview With Alan GassmanTHE FOLLOWING ARE EXCERPTS OF AN INTERVIEW THAT WILL BE PUBLISHED BY THE UNIVERSITY OF FLORIDA LEGACIES NEWSLETTER, NOTWITHSTANDING POPULAR DEMAND

By: Alan S. Gassman, Esq. Moderated By: Paul Caspersen, CFP®, AEP®, MS When should Florida residents consider using a revocable living trust as their primary distribution tool? The overwhelming majority of households will want a revocable trust. As lawyers, we primarily draft estate planning documents to be revocable trusts, and then we also draft simple wills called a “pour-over will.” If you have a last will and testament, it is going to be fine, but when you die the assets must go through the probate process. That is a lot of paperwork that could be avoided by having those assets in a trust or payable to a trust. Why is a “pour-over” will important? I had a client who died after he signed his revocable trust, but not his last will, and because of that the items in the revocable trust went the way he wanted them to go, but the items in his personal name had to go by Florida law. In his situation, it was half to his spouse and half to his child by a prior marriage, which is not what he wanted. It was a real hardship on the family. So, it is especially important to have the pour-over will. You may want to ask your lawyer to include a section in the trust that says “in the highly unlikely event that I do not have a pour-over will, this will be considered my pour-over will, and an amendment to any old will that is not a pour-over will.” Do you think the probate courts would support that language in the trust as a substitute for a pour-over will? Absolutely. Has the House Ways and Means Committee proposal got you thinking about possible planning, leading up to the end of this calendar year? Every week, clients with large estates are calling me. They did not do the right planning even for the current $11,700,000 exemption, let alone planning for the lower exemption (of possibly going back down to $5,000,000/per person), which is going to occur by 2026, if not sooner. So, every family should run the math on their exact situation and see what planning they need. Whether it is this year or next, after the midterm elections there is a serious risk that your exemption is going to go down. Additionally, you are not going to be able to set up an irrevocable trust that does what we are able to do right now. What you would set up before the president signs a new bill would be grandfathered, at least according to the Ways and Means Committee proposals. Most of our planning each day is setting up irrevocable trusts that benefit a spouse and descendants and are disregarded for income tax purposes. Someone can put assets in that trust, and pay the income tax on behalf of the trust, and that is not considered a gift. That person can sell their assets to that trust for a low-interest rate note. Finally, that person can get a discount on how they transfer assets to the irrevocable trust by using a limited liability company, non-voting stock. Anyone whose estate is greater than $11.7 million should have already been doing this over the last five years. Now, putting on your estate planner’s hat again, are there some general considerations that clients might consider before the end of ‘21, outside of taxes? For Floridians, effective July 1, 2021, there is a new community property trust law that says that if spouses put their assets in a community property trust with a Florida trustee, on the death of one spouse they get a full step-up in basis. So, for people who have high mortality risk, it’s well-advised to go ahead and get into that type of arrangement or a joint exempt step-up trust (JEST), which is a joint trust between spouses that will get that step-up on the first death. Other than that, what we really emphasize is creditor protection. We’re all driving on wet roadways in the Florida weather. People get injured and then they sue my clients and my clients call me and say, “Well, I have a revocable trust. I’m immune from creditors, right?” No, a revocable trust is not immune from creditors. You should have had an irrevocable trust or a tenancy by the entirety type of arrangement. Those are the things that really come to mind at the very top of the list. There are only a handful of states that I am aware of that offer “tenants by the entirety.” Could you explain what “tenants by the entirety” means? When Florida became a state in the 1800s, the first thing they did was adopt the common law of England. In 1776 in England, women were not allowed to own assets. Because men could own assets and wanted to give their daughters a dowry – in fact, they had to give their daughter a dowry – England invented the concept of an artificial person, called a “tenancy by the entireties.” So, for example, I would give my daughter and my new son-in-law the farmland, and the definition of tenancy by the entireties was that you could not transfer the land without joint consent of the husband and wife. It didn’t belong to either of them individually. This way the son-in-law could not lose it in a card game. The creditor law in England became, “Hey if you have a judgment against my no-good son-in-law, you can’t take the dowry. If you have a judgment against my daughter, you can’t take the dowry. You need a judgment against both spouses.” Florida has had that law since the very first day that it became a state. It is an absolute creditor immunity; it is not immune from the IRS, the Federal Trade Commission or the SEC, though, because of how federal law works. For a general creditor situation, though, such as a car accident or if you can’t pay your bank debts, if only one spouse is responsible, the creditors have no shot at their joint assets in the state of Florida if they are properly titled before the problem has occurred. One spouse could bankrupt out all that debt that he or she owes; it goes away, and the creditor does not get any of the joint assets. Many states adopted the Commonwealth law, but overtime must have gotten rid of tenancy by the entirety since there’s only a handful of states that still have it. Do you think that is what happened over the years? Yes, the banking and lending industries have gotten involved with the lobbyists and the legislatures and mowed right over it. The pure tenancy by the entirety states that remain are Florida, Pennsylvania, Delaware, and Wyoming. Tennessee is similar but not as protective as those four states.

|

||||||||||||||||||||||||||||||||||||

|

Article 3Reducing Estate and Trust Litigation Through Disclosure, In Terrorem Clauses, Mediation, Arbitration and Pre-Mortem Probate

Written By: Jonathan Blattmachr, Esq. | Principal, ILS Management, LLC Mr. Blattmachr is a Principal in ILS Management, LLC and a retired member of Milbank Tweed Hadley & McCloy LLP in New York, NY and of the Alaska, California and New York Bars. He is recognized as one of the most creative trusts and estates lawyers in the country and is listed in The Best Lawyers in America. He has written and lectured extensively on estate and trust taxation and charitable giving. Mr. Blattmachr graduated from Columbia University School of Law cum laude, where he was recognized as a Harlan Fiske Stone Scholar, and received his A.B. degree from Bucknell University, majoring in mathematics. He has served as a lecturer-in-law of the Columbia University School of Law and is an Adjunct Professor of Law at New York University Law School in its Masters in Tax Program (LLM). He is a former chairperson of the Trusts & Estates Law Section of the New York State Bar Association and of several committees of the American Bar Association. Mr. Blattmachr is a Fellow and a former Regent of the American College of Trust and Estate Counsel and past chair of its Estate and Gift Tax Committee. He is author or co-author of several books and more than 400 articles on estate planning and tax topics. Among professional activities, which are too numerous to list, Mr. Blattmachr has served as an Advisor on The American Law Institute, Restatement of the Law, Trusts 3rd; and as a Fellow of The New York Bar Foundation and a member of the American Bar Foundation. Introduction This article discusses how litigation relating to the administration of estates and trusts might be reduced through by careful planning prior to the property owner’s transfer of wealth during lifetime or at death. As the article details, litigation involving trust and estate matters often involves an emotional element not present in most other legally disputed matters. That also suggests that methods to reduce the risk of such litigation occurring may be unique to such matters. In Part 1, certain background matters relating to the climate for such litigation are presented. In Part 2, the historic “tool” of a disinheritance clause in an instrument is discussed. In Part 3, seven specific ways in which litigation or the scope and cost of litigation relating to the administration of estates and trusts might be reduced, including the use of mandatory mediation and arbitration, are presented. Part 2 and Part 3 will be featured in subsequent Thursday Report Newsletters. Part 1: Background Law is the tool that our society uses as a method of resolving disputes. It is not an exclusive or perfect solution. Wars still occur, outcomes produced by the law are sometimes wrong in many ways, from an incorrect finding of fact to legal decisions that, in turn, spawn more disputes. Also, the law does not provide a remedy for all perceived wrongs. Pure hurt feelings, for example, generally go uncompensated. In the context of estate and trust administration, these feelings, regardless of whether not consciously realized or openly acknowledged, often are involved because of the familial relationships among the parties who have an interest in the estate or trust. And these “bruised” feelings often are as catalyst in triggering litigation with respect to trust and estate matters. Moreover, the cost of society’s resources in providing a legal forum for dispute resolution sometimes is greater than what the cost to society would be if no such forum were offered. Despite that fact that millions of lawsuits are filed each year in the United States, most disputes are resolved by negotiation or concession. The common element in most legal disputes is money. Even the most fundamental source of crime, even violent crime, usually is money. No one goes to court for truth and justice. Rather, each litigant goes to court to win—and, almost always, it is to win money. However, disputes relating to estates and trusts often involve another element: vindication for a perceived moral wrong such as one child being “wrongly” favored over another. Money sometimes can be restored by other means (such as a lucky investment) but many do not accept that a moral impingement can be righted in an alternative matter. In some cases, the hurt feelings arise not on account of another inheritor being financially favored over another but because the individual was not selected as a fiduciary (e.g., executor of the Will) or because his or her share of the inheritance is placed in trust rather than passing outright and free of trust. The saying goes “You never really know another person until you share an inheritance with him (or her).” That expression has been spawned by experience. Emotions run high with respect to actual or expected inheritances or the management of the property gratuitously transferred. Part of the reason is that the perception of whether an inheritance is “fair” often is related to the inheritor’s view of his or her position in the family. Unlike commercial relationships where perceived productivity is, perhaps, the key element of position of control and economic rewards bestowed (that is, how much has the person “earned” by effort and productivity), position and financial reward within a family are often based upon other factors, such as acceptance and support by a family member without regard to how deserving he or she is in a financial and, often, moral sense. Failure to be treated as one believes he or she should have been with respect to sharing in an inheritance or gift often triggers litigation. And, it seems that the climate for such disputes likely may never have been greater in modern time on account of three factors. One is expectation. The growing wealth of people has allowed them to provide their offspring and spouses with ever increasing financial benefits. Fewer teenagers today acquire summer jobs, more children receive automobiles immediately upon obtaining a driver’s license, more adult children live at home (often with their own spouses and children) supported by their parents. Under such circumstances, it seems natural for the descendants to expect to continue to be supported by their ancestors’ wealth after the ancestors die. There is a sense of entitlement that does not have to be earned. Frustrating that sense may lead to litigation. Second, there are more marriages than ever before where either or both spouses have a descendant from a different union. Although almost everyone knows that a person is most influenced by the one with whom he or she sleeps (such as his or her parent’s spouse who is not his or her parent), descendants from an earlier union continue to have expectations of financial reward especially when the ancestor dies, even though the parent may be married to someone other than their other ancestor. The last spouse also may expect to be rewarded financially even if the deceased spouse has descendants only from another union (or unions). In fact, most states provide to a minimum inheritance for a surviving spouse no matter how short the duration of the marriage (unless the right to it has been effectually waived). But there are virtually no rights to inheritance for descendants. Not infrequently, the surviving spouse will be approximately the same age as the children from a prior union of the spouse dying first, and sometimes considerable younger. In such a case, diversion of wealth, even if only temporarily for the surviving spouse (such as for the balance of his or her lifetime), may result in a perception of denial of the property by descendants. Third, more families today, than in the recent past, have three generations living together. Grandchildren expect continued support from grandparents and some grow to believe that they should share any inheritance equally with their parents who are the children of the grandparent. Usually, however, neither the law nor the instruments that control the disposition of wealth at death provide directly for a grandchild whose parent who is the child of the property owner and which child survives. For example, the intestacy laws, which specify the distribution of the wealth of a decedent who does not dispose of his or her directly owned property by Will, universally provide for a distribution to children who survive and not to any grandchild unless his or her parent who is the child of the property owner has predeceased the latter. In general, the law provides for all children (or descendants of a predeceased child collectively) to receive an equal share of wealth belonging to the property owner when the latter dies, unless an alternative disposition is specified in a Will or other testamentary instrument. Usually, disputes arise among descendants as to the disposition of property directed by the decedent when that disposition among children is not equal. But disputes may occur for other reasons as well. For example, an older child may perceive that he or she is entitled to a larger share of the inheritance. Also, children may feel that the descendants of a predeceased child should not share equally with the surviving children even though such descendants usually take collectively only the part that the predeceased child would have received had he or she survived. On the other hand, some grandchildren believe that they should share equally with other grandchildren even though the number of children each predeceased child leaves behind is different. For example, two of a parent three children predecease her. The first child to die has three children and the next child to die has only one child. The three children of the older predeceased child share equally in the part the oldest child would have received if he or she had not predeceased the parent (that is, each receives one-third of one-third or one-ninth of the parent’s estate); the one child of the other predeceased child takes the entire share his or her parent would have received if he or she had survived (that is, a full one-third). Hence, the grandchildren do not share equally: the only child of one of the two predeceased children receiving three times more than that which his or her cousins receive. It is appropriate to point out that today significant property passing upon death does not pass under the intestacy laws or Wills. Rather, it passes pursuant to “operation of law”, such as a survivorship feature embedded in the legal relationship such as property jointly owned with right of survivorship, a contract or similar designations (such as with respect to life insurance and annuity policies, retirement plans and trusts) or by other means. Disputes also arise with respect to wealth that is disposed of by such alternate means. Yet the development of mechanisms to discourage litigation with respect to such wealth has been limited. In addition to disputes as to the proper disposition of wealth between inheritors, disputes between fiduciaries and inheritors often arise and lead to litigation. The person raising the dispute is sometimes called the “contestant” or “objectant.” Usually, the complaint is made by the contestant about the conduct of the fiduciary although it has arisen in the context of the fiduciary making a complaint. Inheritors may seek damages from a fiduciary for alleged violation of the duties of care and loyalty, or they may seek the removal of a fiduciary for a variety of other reasons. In some ways, the law in some states itself spurs litigation. For example, in certain jurisdictions, such as New York, proving an instrument is the property owner’s Will may be accomplished only by a commencement of a lawsuit against those who would inherit if there were no Will, those whose interests have been reduced or eliminated by a codicil (which is also offered to probate) and those whose interests have been reduced or eliminated under the instrument offered for probate that is later in date than one filed in the court where the probate proceeding is commenced. Hence, a lawsuit must be commenced, causing those against whom the suit is brought often to seek legal advice as to their rights and options. Not all states follow such procedures. It is understood that the reason many jurisdictions do not require the commencement of a lawsuit to get the instrument admitted to probate as the decedent’s Will is that those who would inherit were there no Will likely would be aware that the property owner had died and are aware of the probability that an instrument will be offered for probate. (Usually, notice of the offering of the instrument to probate must be published.) It is understood that a far lower percentage of Will contests occur in such jurisdictions. Another area where the law tends to spur litigation is with respect to the actions of a fiduciary. In New York, for example, it is common for the executor(s) or trustee(s) to prepare a written accounting of the acts, transactions and proceedings undertaken while acting as such fiduciary and to commence a proceeding in court against those who have an interest in the trust or estate with respect to which the accounting relates. Again, being made a party to a lawsuit may well trigger that party into seeking legal advice. Also, the form of the accounting “required” by New York law is essentially not readily comprehensible except by those who have had considerable experience with it. Hence, an interested party who receives such an accounting (sometimes at least as thick as the Manhattan telephone directory) may turn to a lawyer for advice about it and that increases the chances of litigation with respect to matter disclosed in it (or matters which the beneficiary is advised should have been disclosed).

|

||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersHow to Choose the Right Vendor for Your Next Project |

||||||||||||||||||||||||||||||||||||

Featured EventsFREE ESTATE TAX PLANNING WEBINAR |

||||||||||||||||||||||||||||||||||||

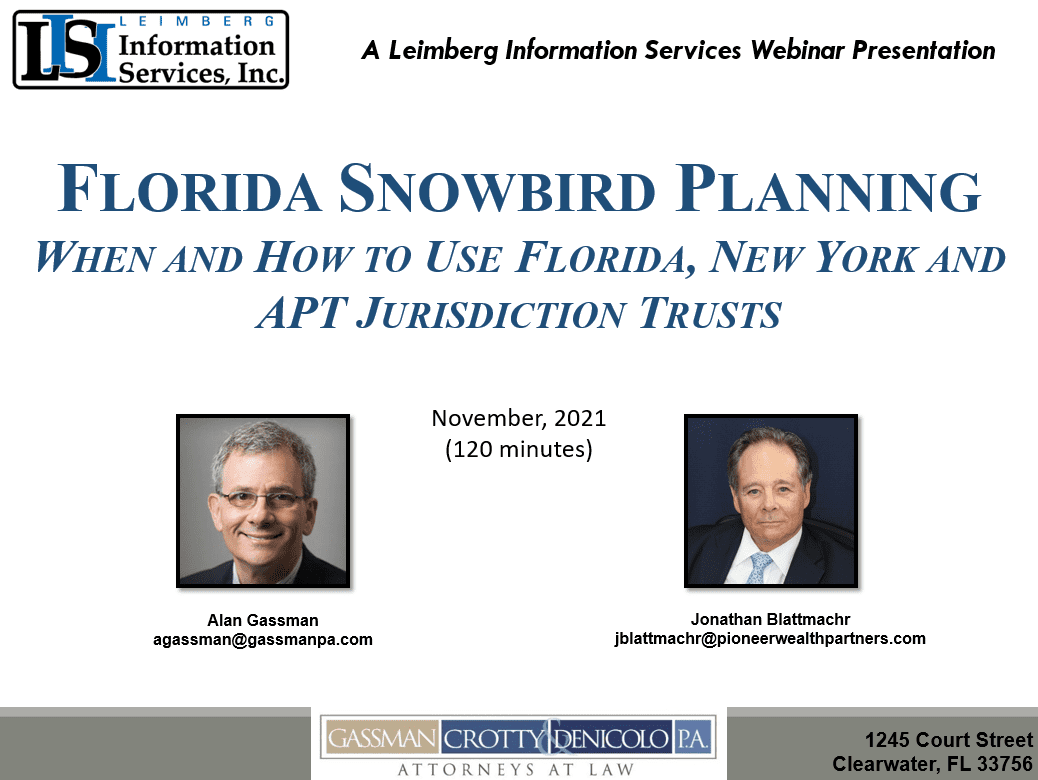

A ‘NOT SO FREE’ LEIMBERG INFORMATION SERVICES WEBINAR PRESENTATION

REGISTERFriday, November 5th, 2021 3:00 PM to 4:30 PM EDT Presented by: Jonathan Blattmachr, Esq. and Alan Gassman, Esq. Tax and estate planning advisors have many options that should be considered when determining how to best advise clients who reside in non-APT jurisdictions, like Florida, and wish to maximize estate tax, creditor protection and the most efficient and effective manner of preserving and allowing assets to be held and managed for family members. This notably includes Spousal Limited Access Trusts and Dynasty Trusts that are used to void estate taxes, Community Property Trusts that can be used to avoid capital gains taxes after the death of a spouse, and the many other alternatives that exist for well-represented clients. Please join Jonathan Blattmachr and Alan Gassman in their exclusive LISI Webinar where they will discuss planning opportunities that apply for Floridians and those who establish trusts jurisdictions like Nevada, Alaska and South Dakota to maximize flexibility while favorable estate tax law opportunities are still available. This 90-minute presentation will cover the following. and more:

There will be no CE for this webinar. For those who have a conflict with the date/time, The session will be recorded. Simply register and you will have unlimited access to the recording. Although they are scheduled for a particular time and date – once purchased – they can be viewed at ANY TIME! For more information on registering for this program, click the “REGISTER” button above.

|

||||||||||||||||||||||||||||||||||||

|

Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

||||||||||||||||||||||||||||||||||||

YouTube LibraryVisit Alan Gassman’s YouTube Channel for complimentary informational webinars and more!

|

||||||||||||||||||||||||||||||||||||

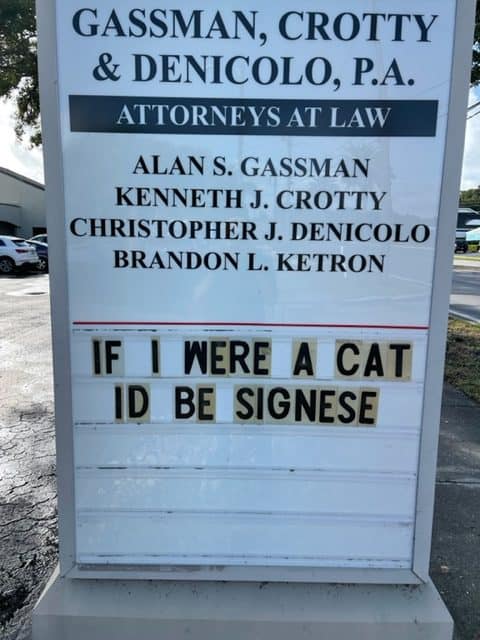

Humor |

||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

||||||||||||||||||||||||||||||||||||