The Thursday Report – Issue 314

|

|

||||||||||||||||||||||||||||||||||||

|

Happy Tax Return Extension Deadline-Eve!Thanks to tax preparers everywhere.Thursday, October 14, 2021– Issue 314 –EDITED BY CHRISTOPHER DENICOLO Having trouble viewing this? Use this link A great many taxpayers have extended the deadline to file their income tax returns, which makes this week a bit hectic for their tax preparers. The Thursday Report sends its support to tax preparers across the country who are getting their clients’ tax returns finalized and filed this week, all while learning potentially significant changes to the tax laws. If there is any solace, is that there is just one more day until this “extension tax season” is over and then the year-end rush begins (or continues!).

|

||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1Charitable Planning for Real Estate Investors and Developers[An Excerpt Of Alan Gassman’s Outline From The Upcoming 52nd Annual UJA-Federation Estate, Tax, & Financial Planning Conference Virtual Presentation on October 20th] Written By: Alan S. Gassman, John Beck and Ian MacLean Article 2House Ways and Means Committee Proposes to Allow Tax-Free Conversion of Certain S Corporations to LLCsWritten By: Bruce D. Steiner For Finkel’s FollowersFeeling Uninspired? Blame Your Lack of a Commute.Written By: David Finkel Forbes’ CornerOne More Scary Estate Tax Change And New Action Items For Many Affluent TaxpayersWritten By: Alan S. Gassman Pandora Trust Disclosures – Less Fraud Than You ExpectWritten By: Alan S. Gassman Featured EventAll Upcoming EventsYouTube LibraryHumor

|

||||||||||||||||||||||||||||||||||||

|

Article 1Charitable Planning for Real Estate Investors and Developers[An Excerpt Of Alan Gassman’s Outline From The Upcoming 52nd Annual UJA-Federation Estate, Tax, & Financial Planning Conference Virtual Presentation on October 20th]

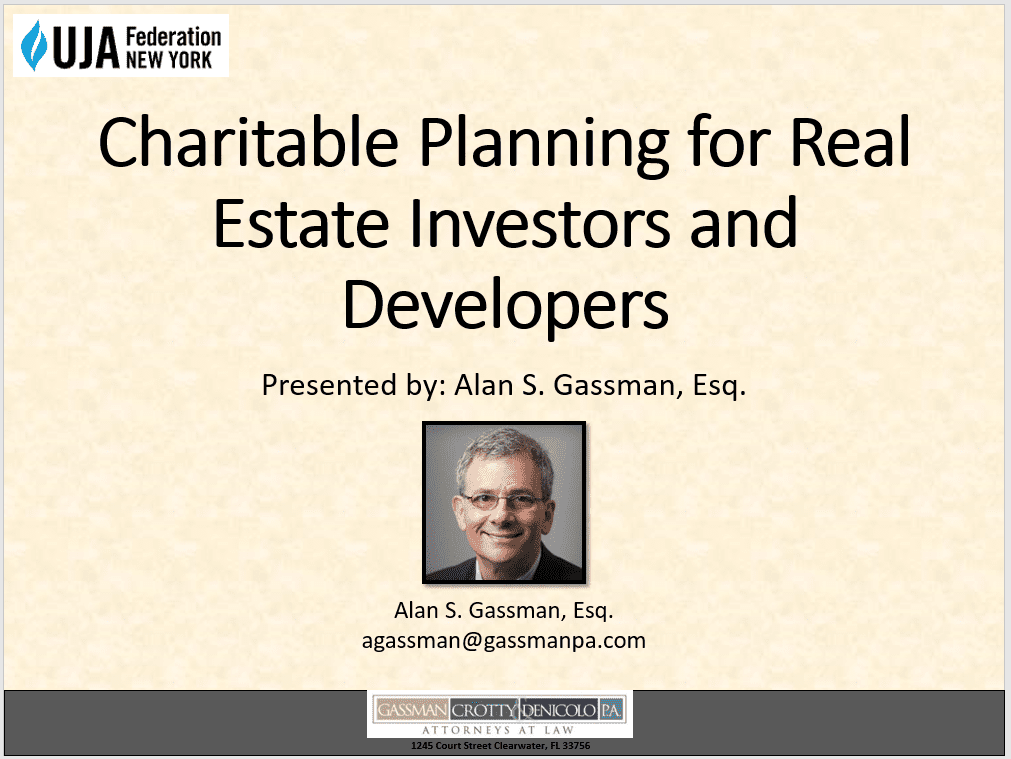

Written By: Alan S. Gassman, John Beck and Ian MacLean John Beck, Esq., LL.M. is a partner with the law firm of Colen & Wagoner, P.A., in Clearwater, Florida and practices in the areas of Estate Planning, Tax Law, and Corporate and Business Law. John has extensive experience in planning for high net worth individuals and complex charitable planning, and routinely publishes articles and presents webinars on various legal topics for both clients and practitioners. John attended the Charlotte School of Law where he graduated cum laude, and he obtained an LL.M. in Taxation from the University of Florida. He also received his MBA with a focus in accounting from Sacred Heart University and a bachelor’s degree in finance from Western Connecticut State University, where he graduated Cum Laude. John is a licensed attorney in the states of Florida and North Carolina. His email address is john@colenwagoner.com. Ian MacLean, Esq., [Not Pictured] is a recent graduate of Stetson University of College of Law, where he received his Certificate of Concentration in Elder Law. Prior to attending Stetson University College of Law, Ian received his BA in Political Science from Stetson University. Ian is a licensed attorney in the state of Florida. His email address is ianwilliammaclean@gmail.com. The authors thank Karl Mill, Michael Lehmann, and Eric Dryburgh of the law firms of Mill Law Center, Dechert, LLP, and Adler & Colvin respectively for significant assistance provided both before and during the preparation of this outline. It is the author’s goal to make what was difficult to find and understand accessible to tax professionals, advisors, and charitable individuals, A. INTRODUCTION Individuals, businesses, and affiliated entities engaged in real estate investment and development can dramatically reduce income and estate taxes, and enhance creditor protection planning by supporting charitable organizations and causes while retaining control and flexibility under such arrangements. Tax and estate planners often face challenges in understanding and explaining to their clients what arrangements are possible and how they will work. The rules relating to charitable organizations are complex, and there is a lack of clear and extensive literature that concentrates on these rules as they apply to real estate investors and developers. The purpose of this paper is to highlight some of the primary strategies and planning arrangements that can be implemented and to explain how various rules can restrict or regulate each potential opportunity. An interesting dynamic often exists when a senior generation has funded significant charitable amounts to 501(c)(3) entities, charitable remainder trusts (“CRTs”), or charitable lead annuity trust entities (“CLATs”), and the next generation or subsequent generations takes control of the entities and wishes to redeploy the financial resources in ways that may be more consistent with the goals held by such subsequent generations. There are ways to indirectly benefit and operate businesses and investment endeavors with charitable resources, while also creating synergies that benefit both charities and existing businesses. In this regard, there are four goals that real estate investors and developers normally have in mind at all times: A. Retain control, These goals are from the perspective of a tax advisor. The opposite order may apply from the point-of-view of a development officer or employees and supporters of a 501(c)(3) entity. There are also charitable endeavors that can indirectly benefit or supplement a real estate developer or investor’s non-charitable objectives and purposes. These can include the following activities, which may enhance entities or properties owned or controlled by donors, as will be more extensively described later in this outline: A. In Revenue Ruling 70-585, the IRS stated that a non-profit was allowed to undertake the construction and renovation of housing for sale to low-income families on favorable financing terms by providing that “where an organization is formed for charitable purposes and accomplishes its charitable purposes through a program of providing housing for low and, in certain circumstances, moderate-income families, it is entitled to exemption under section 501(c)(3) of the Code.” C. In PLR004444030 the IRS allowed for a non-profit to engage in the activity of operating a comprehensive health center, including rehabilitation and fitness functions. D. In PLR200148057 the IRS allowed a non-profit to engage in the funding and operation of a golf course, marina, and common facilities as part of a state park system. E. The authors recently assisted with a Form 1023 approval of an athletic and aquatic center to be built immediately adjacent to the boundaries of a developer’s property, which will provide significant benefits to be derived by the general community from the presence and operations of that center. Basic Principles of Transferring Real Estate to Charities While most charitable contributions consist of cash and marketable securities, many donors have and will prefer to give direct ownership of real estate or ownership of entities that own real estate. Many buildings have been subject to component depreciation upon acquisition, which will Some interesting dynamics apply with respect to variations to the above rules, which can A. Appreciated assets, including real estate, donated to a Private Non-Operating Foundation will only be deductible based upon the income tax basis of the asset (which is normally cost minus depreciation is taken) up to 20% of the adjusted gross income for the taxpayer in the year of donation, forward annually for up to five additional tax years. B. When the donation of appreciated property is to a Private Operating Foundation or a Public Charity, then the limitation for the deduction of the fair market value of the property cannot exceed 30% of the donor’s adjusted gross income for the year of the gift, and then will carry forward for up to five consecutive years thereafter. C. The donation of non-appreciated assets to a Private Operating Foundation or Public Charity D. A taxpayer donating appreciated property may elect to have a tax deduction equal to the basis of the property, in lieu of the fair market value, in order to use the 50% of adjusted E. A taxpayer may also donate percentage ownership in real estate in lieu of a 100% interest. The tax deduction received by the C corporation will be the lesser of: (1) Two times the tax basis of the property, or For example, if a C corporation owns property held for sale that is worth $1,000,000 and has a tax basis of $400,000, the amount deductible will be $700,000, because $700,000 is less than $800,000. Please note that a C corporation cannot deduct more than ten percent of its otherwise applicable taxable income without regard to whether the property donated is long-term capital gains property or has been subject to accelerated depreciation, is inventory, or is short-term capital gains property. The Five-year Carryforward Rule applies to allow a contribution by a C corporation to be deducted in the year of the contribution and the succeeding five tax years thereafter, as needed when the ten percent amount has been exceeded. A charitable organization receiving a gift of $250 or more must provide a contemporaneous written acknowledgment of the gift in order for it to be deductible by the donor. 1. A description of the property donated, 2. A statement of whether the charity provided any goods or services in consideration for the gift, 3. A description in good faith of the value of any goods or services given to the donor by the charity. There is no requirement that the receipt indicates or estimates the value of what was donated. The IRS has been relentless in denying multimillion-dollar charitable donations for taxpayers who did not receive such receipts from their own Private Operating Foundations or other charitable organizations. Unlike cash and marketable securities, the donor of real property or other non-marketable assets who claim a value of more than $5,000 must provide an appraisal that is issued by a qualified state-licensed appraiser who regularly appraises property of the nature being valued. The amounts paid for appraisal are not considered to be a charitable deduction but are instead The qualified appraisal for real estate or other assets means an appraisal prepared by an individual or individuals meeting the definition of a “qualified appraiser” who has earned an appraisal designation from a recognized professional appraisal organization, or has otherwise met minimum education and experience requirements set forth under IRS Regulations, and regularly performs appraisals for compensation, while also meeting other requirements. Specifically, for real estate, the appraiser must be licensed or certified for the type of property appraised in the state in which the property is located pursuant to Treasury Regulation Section 170A-13(c)(5). Real estate is considered to be transferred to a charity when it is owned by the charity under state law. Under the law of most states, the transfer occurs when a deed is duly signed, witnessed, notarized, and physically delivered to the donee. The recording of a deed certainly proves that it existed and was delivered on or before the date of recording, but is generally not determinative. The Tax Court has approved a Contract for Deed arrangement, where the taxpayer sold real estate to a charity in a bargain sale where the charity was required to pay over time. The Court found that the transaction was closed for income tax purposes when the Contract for Deed was signed and that there was an unconditional obligation on the part of the taxpayer to deliver the deed when full payment was made. When real estate donated to a charity is subject to the mortgage a number of rules will apply, as further explained elsewhere in this outline. In short, the deduction for the transfer of property that is encumbered by a mortgage will be limited to the net value of the property after reduction for the debt of the mortgage, even if the taxpayer pledges to pay the mortgage off. Subsequent payments on the mortgage may be considered to be deductible as charitable contributions. If the charity receives property that is subject to debt and uses the property for its charitable purposes, then the unrelated business income rules should not be a concern. On the other hand, if the charity receives encumbered property and rents it for commercial purposes to generate income that is used for charitable purposes, the unrelated business income tax rules apply, even though rent received on a building by a charity is otherwise not subject to the unrelated business income tax. Fortunately, there are exceptions to the debt-financed unrelated business income taxable rules that are further described in this outline which can cause the rules not to apply for the first ten years after acquisition by the charity if the donor owned the property for more than five years and the mortgage was placed on the property more than five years before it was donated to the charity. The transfer of a house or other building separate and apart from the land that it is on may qualify for a charitable deduction if the value of the house exceeds the value of the benefit that the taxpayers may receive from having the charitable organization demolish or move it. See Rolfs 135 T.C. 471-2010 – Affirmed 668 Fed.3d 888 (7th Cir. 2012) and Mann v. U.S. (4th Cir. 2021) – Affirming 364 Fed. 3d. 558 where the partial interest rule under 170(f)(3) was used to deny a charitable income tax deduction when an intended donation of a house separate and apart from the land that it was on did not occur because the taxpayer did not legally separate the house from the land and was therefore not considered to have transferred her entire interest in real property to the charity. See also Patel 138 T.C. 23 (2012). Disregarded LLCs In 2012, the IRS issued Notice 2012-52, which provides that the IRS will treat a contribution of a disregarded single-member LLC as being a tax-deductible contribution of the assets of the LLC for federal income tax purposes. In Private Letter Ruling 200150027, a donor proposed to contribute real estate to a single-member LLC that would be transferred to community property to insulate the foundation from environmental and other liability issues. The foundation would not be the manager of the LLC but would appoint an unrelated individual to serve as the manager. The IRS ruled that the LLC would be disregarded and would not have to file an Application for Exemption from Tax. Instead, it would be encompassed within the foundation’s income tax return. Unfortunately, the IRS did not rule on the deductibility of the contribution of the real estate, so many experts advise that caution should be exercised when a donation would be made in the form of a disregarded LLC. Donations to Charitable Remainder Trusts Unencumbered real estate can be donated to charitable remainder trusts, although the rent income from a donated property may not be sufficient to enable the trust to make its required annual payments. Often real estate will be donated to a “flip” net income makeup charitable remainder unitrust (a FLIP NIMCRUT) with payments to be deferred until the property is sold, as further described below in this outline. Real estate is one of the assets that can be identified under a FLIP NIMCRUT so that the sale thereof causes the trust to “flip” the switch to begin paying the annual unitrust amount. Transferring encumbered property to a charitable remainder trust implicates the self-dealing rules, which may be avoided if the mortgage has been on the property for more than ten years before the gift is made or the mortgaged property was the sole initial asset transferred to the trust pursuant to Treasury Regulation Section 53.4941(d)-1(a). These rules need to be navigated very carefully. Please note that a charitable remainder trust is subject to a 100% excise tax on debt-financed income, unless an exception applies. Real estate can also be donated to facilitate participation in Pooled Income Funds, and for Charitable Gift Annuities. Real estate can also work well with a charitable lead trust when it generates sufficient rent income to allow the lead trust to make its annual required charitable payments. IRS No Longer Issues Favorable PLR’s On Notes Contributed to LLCs That Are Partly In Revenue Procedure 2021-40, 2021-38, IRB that was published in September of 2021, the IRS announced that it will no longer issue letter rulings on whether self-dealing occurs when a private foundation (or other entity subject to section 4941) owns or receives an interest in a limited liability company that holds a promissory note owed by a disqualified person. This was a popular method of estate tax avoidance whereby a donor would sell assets to a dynasty trust and then contribute the note to an LLC, and then donate the 99% non-voting interest in the LLC to a zeroed-out CLAT that would make annual payments to one or more charities, with remaining assets after a term of years to pass to individuals without being subject to federal estate tax. Donate Before an Arm’s-Length Sale – Not After When a building is going to be sold and before a binding contract is entered into, is it better to donate one-tenth of the building to charity before the Sale Contract is entered into than to give one-tenth of the net sales proceeds after the sale to charity? The first alternative is much better because the contributor will not only save income tax by reason of receiving a charitable income tax deduction equal to the fair market value of the ten percent donation but will also avoid paying income tax on the appreciation attributable to the ten percent. For example, Jerry owns a building worth $1,000,000 with a $100,000 income tax basis and has taken straight-line depreciation so that there will be no depreciation recapture upon sale. When Jerry sells the building, he will have a $900,000 capital gain and will pay $225,000 in capital gains taxes, assuming a 25% combined capital gains and Net Investment Income Tax rate. If he donates $100,000 after the sale to a charity, then he will have a $40,000 income tax savings, assuming that he is in the 40% income tax bracket. The net tax attributable to the sale and gift will therefore be $185,000. If he instead donates ten percent of the building to the charity and receives a $100,000 tax deduction, his sale of ninety percent of the building to an arm’s-length purchaser will result in a net capital gain of $810,000 ($900,000 sale price minus basis of $90,000), and will pay $202,500 in capital gains taxes, assuming a 25% combined capital gains and Net Investment Income rate. Jerry still receives an additional $40,000 of income tax savings by reason of the $100,000 donation, making the net tax attributable to the sale and gift $162,500. This is a $22,500 difference than if the donation to charity was made after the sale. In addition, to avoid a possible discount for partial ownership interest circumstances, Jerry can agree that the charity will have the right to put (demand that he purchase) the one-tenth ownership within ninety days of receiving written notice and demand therefore for the full value Is Form 1023 the Poor Person’s Private Letter Ruling? Rev. Proc. 2021-1 recently increased the user fee for certain Private Letter Rulings from $30,000 to $38,000, although taxpayers with gross income below $250,000 may be charged the amount of $3,000 for certain items.3 Clients should know that it will typically take more professional time to apply for a Private Letter Ruling and interact with the Internal Revenue Service then will be the case in providing the same information in a Form 1023 Application for Tax-Exempt Status. A charitable organization must file a Form 1023 within fifteen (15) months of formation (or longer with extension . . .) which will describe the activities of the organization. While the approval of a Form 1023 that provides extensive disclosure of related party situations and issues is not necessarily binding upon the Internal Revenue Service, it can be received at very low cost, as opposed to a private letter ruling, and may be considered to at least be indicative of what the Exempt Organization Division of the IRS will allow. Also, a Private Letter Ruling can take many months longer than obtaining approval under Form 1023 and will receive significantly more scrutiny. It is important to note that Private Letter Rulings are only binding upon the IRS with respect Additionally, the IRS’ published instructions, guidance, and website information are not binding precedent upon the IRS, as stated in the decision of the U.S. Tax Court case Bobrow v. Donating Real Estate Subject to Restricted Uses Restricted uses imposed upon real estate contributed to a charitable organization can be made by the donor, as long as the restriction does not prevent the charity from effectively using the transferred real estate or rental income derived therefrom in furtherance of its exempt purposes. Examples of this are in situations where a contributed real estate is required to be used as a park. See Regulation Section 1.170A-1(e). A problem will arise where the donor restricts the use of the contributed property to benefit a limited class of individuals. In Private Letter Ruling 200150027, a donor wanted to contribute real estate to a Community Foundation, which proposed that he create a single-member LLC that would own the real estate, so that the Foundation would be the sole member thereof, and be insulated from possible environmental liability. The IRS declined to rule on the deductibility of the contribution and has not provided subsequent guidance for the donation of disregarded LLC interests. While there does not appear to be any rationale for denying deductibility of the transfer of an LLC interest, some authors urge caution and the consideration of using a “supporting organization,” which is specifically authorized under Code Section 509(a)(3). Exploring Non-charitable Options for Land Not Yet Being Developed Developers holding land in a separate entity that has not yet been physically adapted for development may choose to sell the property to a related-party S corporation in order to derive capital gains income to the extent of the fair market value thereof before putting a “shovel in the ground” to prevent such appreciation from being subject to ordinary income tax at the time of sale. The S corporation can agree to pay most of the consideration for the sale overtime under an installment note so that the developer can defer the capital gains income tax until the note is paid. In the year that payments of principal are received, the developer may elect to donate other assets to one or more charitable organizations in order to offset the capital gain. Alternatively, a donor who wishes to receive a fair market value income tax basis for appreciated development property may elect to trigger the income tax on the property at the same time that a large charitable donation is made that will offset the income. One way to trigger the income tax and receive a fair market value income tax basis will be to transfer the property or an LLC owning the property to an S corporation and to then transfer the property or the LLC owning the property from the S corporation back to its owner, or by dissolving the S corporation or having it elect to be treated as a partnership for income tax purposes if the entity is an LLC or limited liability partnership that can elect to be treated as an S corporation and then elect to be treated as if it constructively liquidated and converted back to partnership status. The capital gains tax can be deferred and partly eliminated if there is a transfer made into a Qualified Opportunity Fund so that the capital gains tax remaining will not have to be included in income until 2026, and the eventual sale of the business established in a Qualified Opportunity Zone more than ten years later will not be subject to capital gains taxes if all of the requirements are met. An active business can include ownership and rental of apartments, condominiums, or single-family homes where the landlord is actively involved in providing a number of services to the tenants. The other alternative that the developer has will be to facilitate an I.R.C. Section 1031 Exchange from the proceeds of the sale of the property into another investment property that cannot be classified as inventory held for sale by a dealer. Running the numbers on all of these alternatives can help a client understand what they involve, and what the end result of each alternative might be. When the developer owns land not considered to be inventory that can be donated to a 501(c)(3) organization to provide a park, a school, or other accommodations that may generally enhance the value of the development without being considered to be private inurement the results can be very positive. Another alternative would be to place the property that is not yet being developed into a Charitable Remainder Trust, and to defer the capital gains income from the sale of the property by using a FLIP NIMCRUT, but a Charitable Remainder Trust cannot sell the property to a party related to the donor unless no income tax or gift tax deduction is allowable from the arrangement pursuant to Private Letter Ruling 202053007 and Private Letter Ruling 200810016. Unfortunately, the IRS will no longer rule on if and when the self-dealing rules will apply to a Charitable Remainder Trust. This is further discussed in the Charitable Remainder Trust section of this outline. Self-Directed IRAs Many real estate investors and developers have self-directed IRAs which own rental properties and will be subject to both income tax and estate tax after the death of the IRA holder. Such IRAs can be made payable upon death to 501(c)(3) organizations that can facilitate selling the property under the IRA and receiving the sales proceeds tax-free, so as not to be subject to income tax or estate tax thereon. Alternatively, a 501(c)(3) organization can receive a distribution of property owned by an IRA in kind. In order for the IRA owner to be able to claim the distribution as a charitable contribution, the fair market value for such distribution must be determined. Under IRC Section 170(a)(1), the amount of the deduction is usually the fair market value of the property at the time of the contribution. It is the donor’s responsibility to determine a fair market value for the property. Maintaining Confidentiality When Giving to Charity Clients who wish to remain confidential in their giving can consider the following strategies: 1. Form a limited liability company owned by the client but having its own separate name That LLC can be the donor instead of the client, and will therefore be listed on charitable IRS rules preclude disclosure of the owner of an entity, and if the LLC is formed and maintained in a state that does not require or disclose ownership then confidentiality can be maintained. For example, Wyoming does not even require disclosure to the State of Wyoming of the manager or managers of a Wyoming LLC, or its owners. Only the IRS and the client’s hairdresser may know for sure. 2. To make it less likely that anyone will obtain information with respect to details or operations of a 501(c)(3) organization, put as much information as possible in exhibits to Presently, the IRS discloses the Form 990, but not the exhibits to the Form 990. The authors have noticed many Form 990s where almost all the information about the entity has been provided in the exhibits because it is difficult and time-consuming to request and receive the exhibits. To view this presentation please sign up as soon as you can for the 52nd Annual UJA-Federation Estate, Tax, & Financial Planning Conference by clicking HERE.

Sidney Kess, CPA, J.D., LL.M. In 2010, Sidney Kess, CPA, J.D., LL.M., was named Counsel to Kostelanetz & Fink, LLP. Mr. Kess was recently selected “Most Influential Practitioner” by CPA Magazine and is a nationally renowned tax expert and author/coauthor of hundreds of tax books on financial and estate planning. Having lectured to more than 1,000,000 practitioners on tax, financial, and estate planning, Mr. Kess is one of the nation’s most prominent lecturers on continuing professional education. To learn more about Sidney Kess click HERE.

|

||||||||||||||||||||||||||||||||||||

|

Article 2House Ways and Means Committee Proposes to Allow Tax-Free Conversion of Certain S Corporations to LLCs

Written By: Bruce D. Steiner Bruce D. Steiner, of the New York City law firm of Kleinberg, Kaplan, Wolff & Cohen, P.C., and a member of the New York, New Jersey, and Florida Bars, is a long time LISI commentator team member and frequent contributor to Estate Planning, Trusts & Estates, and other major tax and estate planning publications. He is on the editorial advisory board of Trusts & Estates, a co-author of CCH’s Roth IRA Answer Book, and a contributing author of Thomson Reuters’ Irrevocable Trusts. He is a popular seminar presenter at continuing education seminars and for Estate Planning Councils throughout the country. He has served on the professional advisory boards of several major charitable organizations, and was named a New York Super Lawyer each year since 2010, and was selected for Best Lawyers of New York each year since 2018. From Steve Leimberg’s Business Entities Email Newsletter – Archive Message #241 EXECUTIVE SUMMARY: The House Ways and Means Committee proposes to allow certain S corporations to convert to partnership status on a tax-free basis. FACTS: On September 13, 2021, the House Ways and Means Committee released proposed tax legislation to be included in a proposed reconciliation bill. One proposal would permit an S corporation that was an S corporation on May 13, 1996, and at all times thereafter to convert to partnership status on a tax-free basis during the 2-year period beginning December 31, 2021. COMMENT: The House Ways and Means Committee’s proposals are not law. Given that the Senate is equally divided between the parties, and the House is nearly equally divided between the parties, attempting to predict tax legislation is difficult. However, these proposals are worth watching. Some of them may be enacted this year as part of the reconciliation bill, if there is one. For many years, individual tax rates were much higher than corporate tax rates. The top individual tax rate was 91% from 1946 through 1963, between 70% and 77% in 1964 through 1981, and 50% from 1982 through 1986. The top corporate rate was lower during this period. There were also ways to remove appreciated property from corporations without incurring corporate tax. As a result, most businesses were C corporations, though some corporations elected S status when the top individual rate was reduced to 50% effective in 1982 The Tax Reform Act of 1986 reduced the top individual tax rate to 28% beginning in 1988. Since then, the top individual rate has ranged from 28% to 39.6%, and is presently 37%. As a result, many existing corporations became S corporations. Other corporations, mainly real estate corporations, were liquidated into partnerships. If they did so by December 31, 1986 (or in some cases December 31, 1988), they could avoid corporate tax on the appreciation in their assets. A business may also achieve pass-through status as a partnership or as an LLC taxable as a disregarded entity (if it has only one member) or a partnership (if it has two or more members). For many years, there were obstacles to doing business as a partnership. In the case of a general partnership, each partner is personally liable for the partnership’s debts. A limited partnership needs to have a general partner who is liable for the partnership’s debts. In some cases, it was possible to form a general partner with a corporate general partnership to achieve pass-through status without personal liability. However, it was often not practical to do this. Therefore, until the mid-1990s, most businesses were S corporations. In 1977, Wyoming enacted a limited liability statute. In 1978, the Internal Revenue Service issued Revenue Ruling 88-76 which allowed Wyoming LLCs to be taxable as partnerships. In the early 1990s, the other states enacted LLC statutes. As a result, the Internal Revenue Service issued Notice 95-14, saying that they intended to simplify the entity classification process. In 1996, the Internal Revenue Service promulgated the “check the box” regulations. These regulations generally allow a partnership or LLC to choose whether to be treated as a partnership or a corporation for tax purposes. If it chooses to be treated as a corporation, it may elect S status. Some businesses were formed as LLCs and elected to be taxed as S corporations to save self-employment and Medicare taxes. Other businesses were formed as LLCs and were taxed as partnerships. However, if an S corporation converts to a partnership, it is treated as a liquidation of the corporation. The S corporation would be deemed to have sold its assets at fair market value, and the shareholders would be taxed on the gain. In addition, in some cases there would be a corporate level tax on the appreciation in the assets. The Ways and Means Committee proposal would allow an existing S corporation (including an LLC taxable as a corporation) that was an S corporation on May 13, 1996, and at all times thereafter, to convert to partnership status on a tax-free basis during the 2-year period beginning December 31, 2021. There are several advantages to partnership status as compared to S corporation status:

Concluding Observation If this change is enacted, corporations that were S corporations on May 13, 1996, and at all times thereafter, should consider taking advantage of this window to convert to partnership status. HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE! Bruce Steiner CITE AS: LISI Business Entities Newsletter #241 (September 21, 2021) at http://www.leimbergservices.com. Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI. LINKS: House Ways and Means Committee Summary; House Ways and Means Committee Proposal.

|

||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersFeeling Uninspired? Blame You Lack of a Commute. |

||||||||||||||||||||||||||||||||||||

Forbes’ Corner

One More Scary Estate Tax Change And New Action Items For Many Affluent Taxpayers

Written By: Alan S. Gassman Oct 6, 2021 The estate tax revisions released by the Ways and Means Committee of the House of Representatives on September 13th have our full attention for very good reason, given that the effective date of significant changes would be the date that President Biden signs the bill, assuming that it is passed …Continue Reading on Forbes

|

||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

Featured EventESTATE TAX PLANNING WEBINARA Special Broadcast Saturday, October 16, 202111:00 AM to 12:00 PM EDTPresented by: Alan S. Gassman A description of common charitable structures used in tax and estate planning, a review of tax laws relating to charitable planning, and examples of application. REGISTERAfter registering, you will receive a confirmation email containing information about joining the webinar. This event will be broadcasted as a pre-recorded video.

|

||||||||||||||||||||||||||||||||||||

|

Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

||||||||||||||||||||||||||||||||||||

YouTube LibraryVisit Alan Gassman’s YouTube Channel for complimentary informational webinars and more!

|

||||||||||||||||||||||||||||||||||||

Humor |

||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

||||||||||||||||||||||||||||||||||||