The Thursday Report – Issue 313

|

|

||||||||||||||||||||||||||||||||||||

|

Friday, October 1, 2021– Issue 313 –Having trouble viewing this? Use this link

|

||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1What Part of Disregarded Did You Inadvertently Disregard?Written By: Alan Gassman, Brandon Ketron & Grace Paul Article 2The 10% Cap TrapWritten By: Brock Exline Article 3How Your Estate Plan May Be Affected by Potential Changes to Income and Transfer Taxes under the House Ways and Means Committee Tax ProposalWritten By: Barry Nelson, Jennifer Okcular & Cassandra Nelson For Finkel’s FollowersYour Anxiety Is Real: How To Make Peace With Your BusinessWritten By: David Finkel Upcoming Events

|

||||||||||||||||||||||||||||||||||||

|

Article 1What Part of Disregarded Did You Inadvertently Disregard?

Written By: Alan Gassman, Brandon Ketron & Grace Paul EXECUTIVE SUMMARY: Most tax advisors are well aware that the September 13th House Ways and Means Bill provides that the estate tax exemption amount would go to one-half of what it would otherwise be January 1st, 2022, discounting for non-business assets and entities would be unavailable after enactment, and that contributions made to irrevocable trusts that would otherwise be disregarded for income tax purposes would cause problematic results to the extent made after the date of enactment. As a result of the above, taxpayers all over the country are considering what they should add to existing “defective grantor trusts”, or whether they should establish new ones. In addition, those who have or are establishing irrevocable life insurance trusts are considering whether to pre-fund these trusts with cash or to pre-fund life insurance policies before the possible date of enactment in case Congress does not find a way to provide safe passage for the life insurance industry, which has historically been a sacred cow that has been milked regularly for campaign contributions. FACTS: On September 26th, the House Budget Committee released House Report No. 117-130 which is 501 pages of pleasurable reading on the intention behind the 881 pages of proposed legislation. All of the above items are described in the House Report in the manner expected, with one unpleasant surprise – transactions between a grandfathered defective grantor trust and the person or persons considered to be the owners of that trust for income tax purposes will trigger capital gains tax when the “grantor” who is considered to be the owner transfers an appreciated asset or assets to the trust after the date of enactment. The proposed law itself can be read to have this result, although it is somewhat confusing because of the use of the word “disregarded” in a way that is inconsistent with how the word is normally used in tax literature: SEC. 1062. CERTAIN SALES BETWEEN GRANTOR TRUST AND DEEMED OWNER. (a) IN GENERAL.—In the case of any transfer of property between a trust and the person who is the deemed owner of the trust (or portion thereof), such treatment of the person as the owner of the trust shall be disregarded in determining whether the transfer is a sale or exchange for purposes of this chapter. (b) EXCEPTION.—Subsection (a) shall not apply to any trust that is fully revocable by the deemed owner. (c) DEEMED OWNER.—For purposes of this section, the term ‘deemed owner’ means any person who is treated as the owner of a portion of a trust under subpart E of part 1 of subchapter J. EFFECTIVE DATE —The amendments made by this section shall apply— (1) to trusts created on or after the date of the enactment of this Act, and (2) to any portion of a trust established before the date of the enactment of this Act which is attributable to a contribution made on or after such date. Experts who read this sentence when the bill was released assumed that this meant that disregarded trusts created before the enactment of this Act would continue to be disregarded so that assets could be sold or exchanged with the trust so long as there was no “contribution” (aka a gift) made to the trust on or after the enactment of the Act, but this was apparently not the case.1 The House Report clarified that the effective date was intended to cover transactions between a grantor and any grantor trust after the date of enactment, even if the trust was created before the date of enactment, specifically stating: The provision is generally effective for ( 1) trusts created on or after the date of enactment and (2) any portion of a trust established before the date of enactment that is attributable to a contribution made on or after such date. The portion of the provision relating to sales and exchanges between a deemed owner and a grantor trust is intended to be effective for sales and other dispositions after the date of enactment. The House Report noted in a footnote that “A technical correction may be necessary to reflect this intent.” COMMENT: The immediate thought with respect to this provision is that after the date of enactment assets having a fair market value exceeding their tax basis will not be good candidates for being sold to a defective grantor trust in exchange for a note or other assets. The other thing that becomes apparent is that the opposite may apply – If a grantor trust transfers an asset that it owns that is worth more than the tax basis of the asset, then income tax may be triggered as if the asset was sold to a third party. In many situations, this will not be a problem. For example, if a taxpayer has an active business corporation and the stock has a basis of $1 million and is worth $1,500,000, then a 99% non-voting member interest in the company may be worth $1 million, after discounts, and discounts will be permitted after enactment for “all business” assets. Therefore, a sale of the 99% non-voting member interest for $1 million will trigger no income tax in the above example, and there is nothing in the legislation that appears to cause the basis of the stock to be reduced. But issues may arise with respect to other kinds of trusts that are disregarded for income tax purposes. WHAT ABOUT GRATs AND CLATs? For example, under present law Grantor Retained Annuity Trusts (“GRATs”) can receive appreciated assets on an income tax-free basis and will be required to make payments in cash, or in kind, back to the grantor based upon a formula which usually provides that what the grantor will receive will have a value that is approximately equal to what has been placed into the GRAT, plus a rate of return equal to the Section 7520 rate, which is presently 1%, in a series of annual payments that range from being equal to increasing by up to 20% per year. As a result of this many existing GRATs do not have sufficient cash to meet the payment requirements, and therefore make payments in kind of investment or other assets that are valued as of the date of distribution. Will the transfer of an appreciated asset from a GRAT to its grantor be considered to be a sale of the asset for income tax purposes, thus triggering capital gains or ordinary income due to depreciation recapture based upon its character? This appears to be what Congress is intending and what the IRS would enforce if the Act is passed as proposed. And what about Charitable Lead Trusts which receive gifts and make annual payments to charity which may be in cash or in kind? Many Charitable Lead Annuity Trusts are “Grantor CLATs” considered to be owned by the contributor, so the same issues can apply – the distribution of an appreciated asset to charity may be considered to be a taxable event if the IRS considers the payment to charity to be in discharge of a financial obligation of the grantor. This issue is discussed in a number of articles, including Charitable Giving With a Charitable Lead Annuity Trust by Dino Giannobile from Plante Moran.2 And then what about capital losses that might occur if a defective grantor trust transfers an asset that has gone down in value to a grantor in exchange for a note or cash? The legislation specifically provides that IRC Section 267(b), which disallows losses on sales between related parties, will be amended to now include transactions between a grantor trust and its deemed owner. PLANNING POINT: As a result of the above, taxpayers who have irrevocable trusts that are disregarded for income tax purposes, including Section 678 trusts that are considered as owned by a person or persons other than the grantor should review what assets are presently in the trusts and what assets are outside of the trusts to decide whether there should be “swapping” or sales in the immediate future, before the date of enactment, to optimize tax planning and minimize potential taxable income. For example, if a taxpayer has appreciated stock that he or she would like to have held under the trust and would like to receive back a low-interest promissory note or cash in exchange for the stock, or if the trust has appreciated stock that planners would like to have in the taxpayer’s name in order to ensure a new fair market value date-of-death income tax basis if the taxpayer dies and the stepped-up basis rules remain the same, then the swapping of assets should occur before the date of enactment. Likewise, if the taxpayer is owed payments by a GRAT which has appreciated assets, he or she can receive the appreciated assets now in exchange for cash or non-appreciated assets that can be paid to the grantor to avoid the possible income tax described above. Some taxpayers will have their grantor trusts borrow monies at arm’s length from third parties or related parties to repay promissory notes owed to the grantor and be able to retain appreciated assets so as not to trigger gain. A tax advisor’s work is never done! CONCLUSION: The one thing that we can probably be sure of is that tax legislation resulting from a compromise between the House and Senate and refinement between now and passage will probably not be the same as what now have on the table. Nevertheless, a new law can be substantially similar to what is being formally proposed, and Congressmen should be reluctant to make things worse than what is being proposed, or to move timetables forward as opposed to backwards from an effective date standpoint. Stay tuned, keep your seatbelts on, and remember to exit the ride to the left when it is over, keeping all hands, arms, hats, and sunglasses inside the ride until coming to a complete stop.3 1 While the word case commonly refers to a court decision, it may also refer to four six-packs of beer, which many of us need after reading this kind of legislation. 2https://www.plantemoran.com/explore-our-thinking/insight/2020/10/charitable-giving-with-a-charitable-lead-annuity-trust 3 Until the 1980s, those purchasing admission to Disney World received tickets that admitted the Disney visitor onto rides. The very best rides required E-tickets, which could be purchased for additional monies if an attendee wanted to go on any E-ticket ride such as Space Mountain and the Country Bear Jamboree more than once. Great experiences in the 1970s were therefore described as “E tickets”. This is not relevant to the article but possibly of interest to theme park enthusiasts who consider tax law to be more fun than Disney World.

|

||||||||||||||||||||||||||||||||||||

|

Article 2The 10% Cap Trap PoemNowhere on earth since the Cat in the Hat has anyone experienced the 10% cap trap. If you have Florida non-homestead property that has gone up in value this year much. Don’t transfer it to anyone or anything before you’ve been in touch. With someone to advise you of consequences that may be dire. Because forfeiting the 10% assessment limitation might cause a financial fire. Under Florida’s Constitution, the assessed value cannot exceed more than 10% of the prior year’s assessed value, except as to School taxes (which may be about 36% of the 2% or less property tax), But a transfer in title to an LLC or otherwise creates a loss of the Cap, that’s a fact, And if the property is commercial you can’t even transfer it to your spouse so don’t be lax. The 10% Cap Trap Article

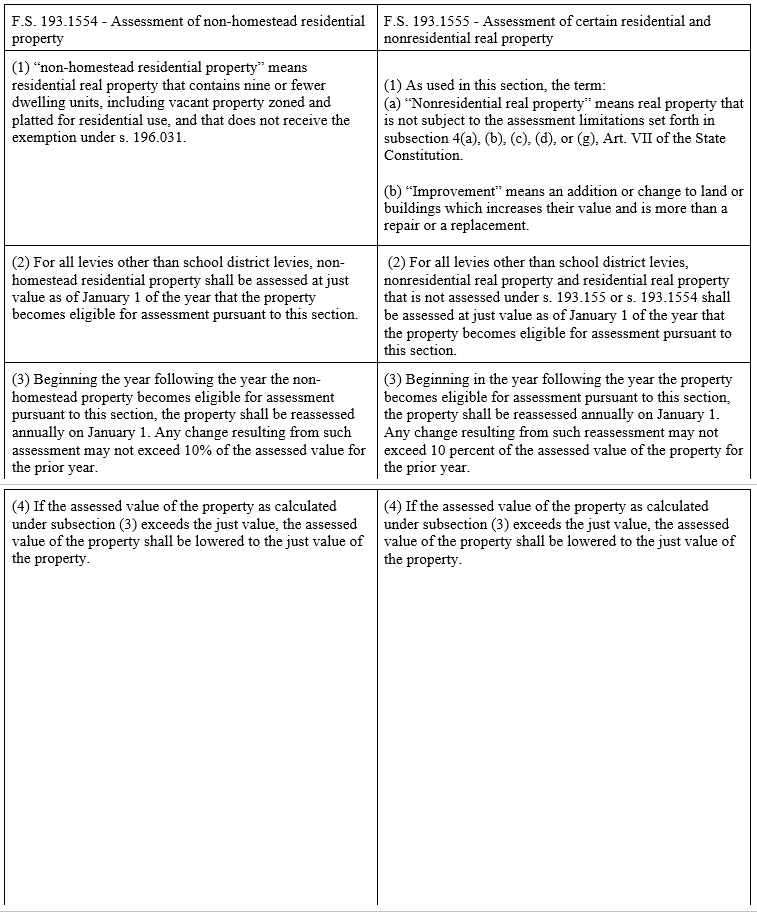

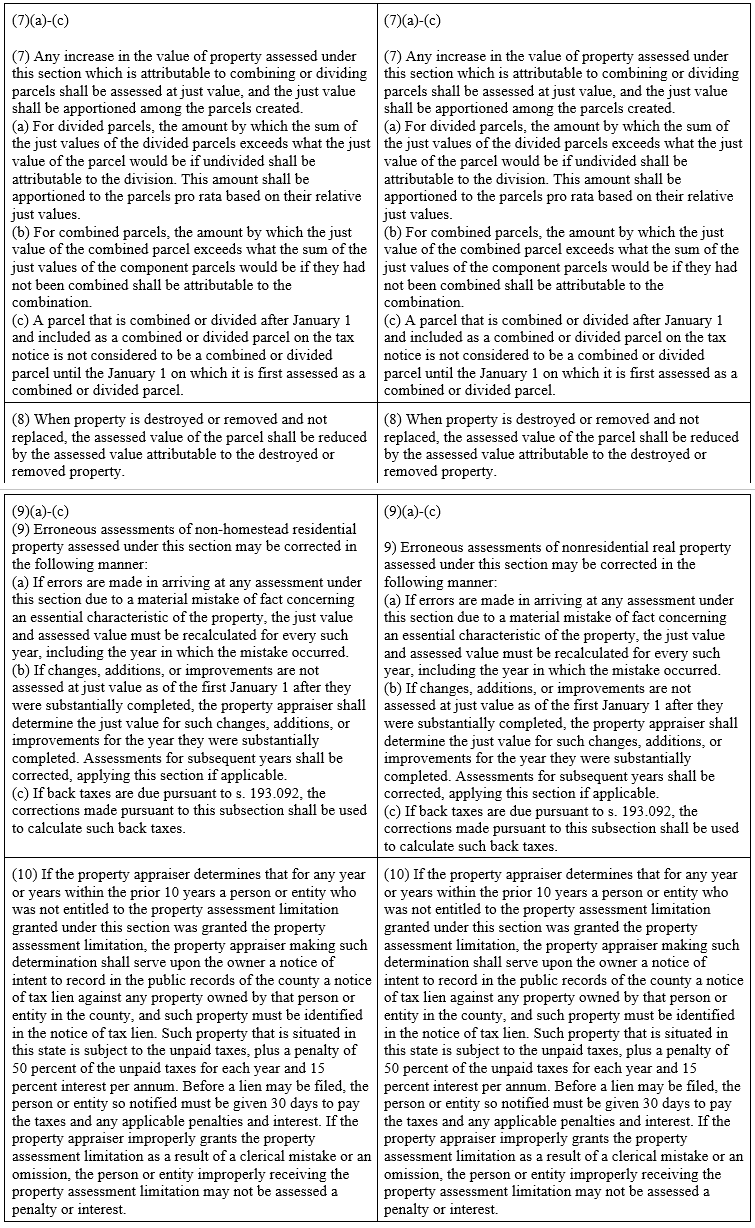

Written By: Brock Exline Stetson Law Student In 2008, The Florida Constitution was amended to provide non-homestead property owners with protection against substantial increases in their annual property tax assessments. The Florida Constitution, as amended, now prohibits the assessment of certain non-homestead property from increasing by more than 10% per year, except for School Board expenses. Originally, the 10% cap was approved for a temporary 10-year period and was scheduled to sunset on January 1, 2019. However, Florida voters in 2018 approved another amendment to make the 10% cap permanent. The amendment is implemented through Florida Statutes 193.1554 (non-homestead residential property) and 193.1555 (certain residential and nonresidential real property). The 10% cap applies to most types of commercial property, including non-homestead residential property (i.e. apartments and other rental properties) and nonresidential property (i.e. commercial property and vacant land). This 10% cap applies automatically, without the need to apply for the 10% cap status. The 10% cap does not apply to school district levies, agricultural or conservation property, or to certain other real estates that already qualifies for favorable ad valorem tax treatment. The cap will remain year over year provided that certain actions by the landowner are not taken. Generally, an ownership change, application for the homestead exemption, splitting or combining property during the previous year, or the occurrence of construction or improvement will trigger the loss of the 10% cap, this is what we affectionately refer to as the “10% cap trap.” The big two “cap traps” are changes of ownership or control and qualifying improvements. The protection of the 10% cap is forfeited when there is a change of ownership or control. A change of ownership or control means “any sale, foreclosure, transfer of legal title or beneficial title in equity to any person, or the cumulative transfer of control of more than 50 percent of the ownership of the legal entity that owned the property when it was most recently assessed at just value.” Therefore, property owners contemplating the transfer of their non-homestead residential or commercial properties to anyone or anything should first get in touch with their estate planner before finalizing such transfers. Florida Statute 193.1554, relating to non-homestead residential property, excludes from the definition of change of ownership any transfer of title to correct an error, transfers between legal and equitable title, transfers between husband and wife (including a transfer to a surviving spouse or a transfer due to a dissolution of marriage), and for publicly traded companies, the cumulative transfer of more than 50 percent of the ownership if the transfer of the shares occurs through the buying and selling of shares on a public exchange. Florida Statute 193.1555, relating to other certain residential and nonresidential real property, excludes from the definition of change of ownership the same list of transfers excluded for non-homestead residential property under 193.1554, except it does not exclude transfers between husband and wife from the definition of change of ownership or control. Therefore, a transfer of commercial property between husband and wife will trigger a loss of the 10% cap, whereas a transfer of non-homestead residential property between husband and wife will not trigger a loss of the 10% cap. Additionally, if there is a change of ownership or control not recorded on a deed, any person or entity owning property subject to the 10% cap must notify the property appraiser promptly of any change of ownership or control. Failure to do so may subject the property owner to a lien of back taxes plus interest of 15% per annum and a penalty of 50% of the taxes avoided. When the change of ownership is recorded by deed or another instrument in the public records, that recorded instrument serves as notice to the property appraiser. Beyond a change of ownership or control, another action that will trigger the loss of the 10% cap is when improvements are added to commercial property that increases the value by at least 25%. These are referred to under 193.1555 as “qualifying improvements.” 193.1555 defines “improvement” as an addition or change to land or buildings which increases their value and is more than a repair or a replacement. By contrast, 193.1554, relating to non-homestead residential property, does not include the same provision regarding qualifying improvements. Although 193.1554 does provide that changes, additions, or improvements to non-homestead residential property shall be assessed at just value as of the first January 1 after the changes or improvements are substantially completed, it does not provide that the entire property must be assessed at just value as of January 1 of the year following a qualifying improvement. Therefore, improvements to commercial property that increase the value by at least 25% will trigger a loss of the 10% cap for commercial property, but improvements that increase the value of non-homestead residential property by 25% will not trigger a loss of the 10% cap. Nonhomestead residential property is afforded greater protection from a potential forfeiture of the 10% cap than is commercial property. As mentioned above, transfers between husband and wife and qualifying improvements will trigger a loss of the 10% cap for commercial property only. These actions will not trigger a loss of the 10% cap for non-homestead residential property. However, owners of both non-homestead residential property and commercial property alike should be mindful of the loss of the 10% cap following the change of ownership or control, including through sale, foreclosure, transfer of legal title or beneficial title in equity to any person, or the cumulative transfer of control or of more than 50 percent of the ownership of the legal entity that owned the property when it was most recently assessed at just value. With no sign of the increases in Florida property values slowing down, now is not the time to lose this valuable property assessment limitation. According to data compiled by Florida Realtors, Tampa, St. Petersburg, Clearwater, Lakeland, Winter Haven, North Port, Sarasota, and Bradenton all saw at least a 20% increase in median sales prices for homes in the last year. Additionally, Zillow notes that Tampa Bay’s home value index has increased by 24.9% since August of last year. Be sure to speak with your advisor in order to avoid falling into these “10% cap traps.” Section by Section Comparison of 193.1554 & 193.1555

|

||||||||||||||||||||||||||||||||||||

Article 3How Your Estate Plan May Be Affected by Potential Changes to Income and Transfer Taxes under the House Ways and Means Committee Tax Proposal

Written By: Barry Nelson, Jennifer Okcular & Cassandra Nelson COMMENT: We are publishing this letter a bit later than some excellent summaries that were issued over the last week or so by other publications and/or professionals after the House Ways and Means Committee released its tax law proposal to be incorporated in the budget reconciliation bill on Monday, September 13, 2021 (referred to hereinafter as the House Proposal). The House Proposal now has a number HR 5376 (which can be found at: H.R.5376), and a Report (which can be found at: H.R.5376 Report). We wanted to absorb the House Proposal and determine if there would be any clarification as to areas that have caused confusion, as described below. Based upon our review of the House Proposal, helpful analyses by other professionals, and commentary from peers, we are providing this letter that is up to date as of September 22, 2021. The legislative review process will be multi-step and it is likely that many substantive changes will be made before any legislation becomes law. It is possible that some (if not all) of the tax law changes described herein will never be enacted. We are certain many more changes will be forthcoming, so seek legal or CPA advice before taking any action. Very Truly Yours, Barry Nelson Jennifer E. Okcular Cassandra S. Nelson Summary of Potential Changes as a Result of the House Proposal Based upon the House Proposal, the current $11.7 million gift and estate tax exemption could be reduced to approximately $6.03 million after December 31, 2021. As we prepare this letter, I grow increasingly concerned that trusts to be created to take advantage of the current gift and estate tax exemption must be executed before the enactment of the House Proposal in its final form, which could possibly be much earlier than December 31, 2021 (as soon as the House and Senate agree on the House Proposal and the President signs it). Of course, the process could drag on, but nobody knows. As a result, a prudent approach is to have any new grantor trusts, such as SLATs or QTIPs (as described below) be created and funded as soon as possible. Estate planning attorneys may not have the capacity to prepare all of the documents their clients may need before the enactment of the House Proposal. We are aware that the House Proposal is only proposed legislation and that this could be a fire drill if Congress is unable to agree on a final bill. We are also aware that if Congress does agree on a final bill, it may differ significantly from the House Proposal. However, all we, as advisors, can do at this time is explain the House Proposal in its current form so that those that may be affected by it can consider their immediate options. The good news is that the House Proposal does not: (i) address the elimination of the step-up in income tax basis from cost to fair market value at death; (ii) tax unrealized appreciation at death; or (iii) raise the current 40% estate, gift, and generation-skipping transfer tax rate. This summary only covers portions of the House Proposal that are most relevant to our clients. For example, any foreign tax issues will not be covered in this letter. The effective dates in the House Proposal differ. For example: (i) the reduction of the current $11.7 million gift and estate tax exemption to about $6.03 million will be effective January 1, 2022, (ii) capital gains increases will be effective for tax years ending after September 13, 2021 (when the House Proposal was introduced) and (iii) the grantor trust limitations described below will be effective upon the date of enactment. The Report provides the following effective date provisions with respect to grantor trusts (page 1282-1283 (top page numbers) and page 324-325 (bottom page numbers) of the Report – refer to the instructions above for links to the Report): The provision is generally effective for (1) trusts created on or after the date of enactment and (2) any portion of a trust established before the date of enactment that is attributable to a contribution made on or after such date. The portion of the provision relating to sales and exchanges between a deemed owner and a grantor trust is intended to be effective for sales and other dispositions after the date of enactment. Although the effective date provision of the Report provides that any portion of a trust established before the date of enactment that is attributable to a contribution made on or after such date it is unclear whether such provision applies to sales and exchanges for a grantor trust created before enactment. A summary of the parts of the House Proposal that we believe are most relevant to our clients is below: Individual Taxes Tax rates: The top marginal individual income tax rate would increase from 37% to 39.6%. This marginal rate would apply to married individuals filing jointly with taxable income over $450,000; to heads of household with taxable income over $425,000; to unmarried individuals with taxable income over $400,000; to married individuals filing separate returns with taxable income over $225,000; and to estates and trusts with taxable income over $12,500. High-income surcharge: The House Proposal would impose a surcharge tax equal to 3% of a taxpayer’s modified adjusted gross income (MAGI) in excess of $5 million (or in excess of $2.5 million for a married individual filing separately). For this purpose, modified adjusted gross income means adjusted gross income reduced by any deduction allowed for investment interest (as defined in section 163(d)). Capital gains: The House Proposal would increase the 20% tax rate on capital gains to 25%, effective for tax years ending after September 13, 2021 (note that President Biden had considered a 40% capital gains tax). However, a transition rule would provide that the current statutory rate of 20% would continue to apply to gains and losses for the portion of the tax year prior to September 13, 2021 and gains recognized after September 13, 2021 that arise from transactions entered into before September 13, 2021 pursuant to a written binding contract (and which is not modified thereafter in any material respect). Note: Most capital gains are also subject to an additional 3.8% tax. Estate and Gift Tax Provisions Gift, Estate, and Generation-Skipping Transfer Tax Exemptions (effective for decedents dying and gifts made after December 31, 2021): The House Proposal would reduce the current $11.7 million exemption from gift, estate, and generation-skipping transfer taxes (which is currently scheduled to sunset on December 31, 2025) to approximately $5 million per taxpayer, adjusted for inflation since 2011. In 2022, the exemption will be $6,030,000. This produces a $5,670,000 exemption drop from 2021 to 2022. While this is a substantial drop, future indexation effectively restores part of this $5,670,000 of bonus exemption for a taxpayer who did not fully utilize the current $11.7 million unified credit and lives beyond 2022. Taxpayers who feel comfortable making outright gifts of their remaining gift, estate, and generation-skipping transfer tax exclusions should do so before January 1, 2022. However, gifts in trust, especially to grantor trusts (as described below) need careful analysis. Note: For reasons beyond the scope of this letter, taxpayers will only fully benefit from current exemptions by using their entire $11.7 million exemption (reduced by prior taxable gifts) as compared to making a gift of, for example, $5,670,000, which will not result in the effective use of the current $11.7 million exemption. This computation should be reviewed with the taxpayer’s tax advisor or with our firm if you are our client. New Grantor Trust Rules Could Eliminate Benefits General Explanation: While some of the House Proposal provisions are simple to comprehend and planning options are relatively clear, the House Proposal creates some confusion by eliminating the benefits of grantor trusts created and/or funded after enactment. Grantor trusts have been a significant planning technique for many of our clients for over 20 years. Grantor trusts allow the creator (also commonly referred to as the settlor or grantor) to make a gift to a trust that, with proper planning, will be excluded from the creator’s estate, and also allows the creator to pay income tax on all trust income without such payments being considered a gift to the trust or its beneficiaries. The rationale is that the trust creator is considered the owner of the trust income for income tax purposes, but not for gift or estate tax purposes because the trust provides the creator with one or more retained power, such as the power to substitute the creator’s other assets for trust assets of equivalent value. As a result, the creator of the trust is obligated to pay income tax on trust income (both ordinary and capital gains) and because of such obligation, payment of income tax by the creator is not a gift to the trust or its beneficiaries. An important benefit of grantor trust status is the ability of the creator during his or her lifetime to take the creator’s high-income tax basis assets and substitute such high basis assets for low or even negative basis assets of equivalent value that are owned by the grantor trust. Assets held in such a grantor trust do not benefit from a step up in income tax basis to fair market value upon the death of the creator whereas the law currently in effect allows a step up in basis to fair market value for assets owned by a person upon death. The House Proposal does not currently eliminate step up in income tax at death. Accordingly, as of the date of this letter, grantor trusts are a great estate planning technique as they allow taxpayers who create grantor trusts to: (i) pay the trust’s income tax and (ii) maximize income tax basis planning for assets owned by the grantor trust at the creator’s death by allowing the creator to substitute the creator’s high-income tax basis assets for low or even negative basis assets of equivalent value before the creator’s death and thereby the creator’s beneficiaries benefit from a step up in income tax basis at death as to the low-income tax basis assets owned by the creator as of his or her date of death. As stated above, the House Proposal eliminates the ability to take advantage of grantor trust planning for any trust created or funded after enactment. However, trusts created before enactment should maintain full grantor trust benefits so long as the trust is not modified after enactment and there are no contributions to such trust. Grantor trust status will be eliminated, at least to some degree, based upon the value of post-enactment contributions in the event contributions are made to the trust after enactment. As indicated above, the House Proposal is unclear as to whether a grandfathered trust will lose its grantor trust status if assets are substituted by the creator or sold by the creator to the trust subsequent to enactment. We expect the rules to be clarified in the future as to sales and substitutions of assets as to grantor trusts created and funded before enactment. However, we anticipate a race to create and fund new grantor trusts before enactment to take advantage of the grantor’s ability to pay income tax on grantor trust income and based upon the possibility that the law may be clarified to allow sales and substitutions for grandfathered trusts. Based upon the House Proposal, it is also unclear whether modification of an existing grantor trust will result in loss of grantor trust status. Thus, for clients that have existing grantor trusts that may have outdated provisions including dispositive provisions, the best option may be to decant such trusts (based upon applicable state law and with care to maintain generation-skipping transfer benefits after consulting with their attorney) into a newly updated grantor trust and fully fund the new trust before the enactment of the House Proposal. This may not be easy especially since it is unclear when enactment will occur. Note: The grantor trust provision will eliminate the benefits of techniques such as GRATs and inter vivos QTIP trusts as well as most life insurance trusts created or funded after enactment, and to a more limited extent, even pre-enactment life insurance trusts funded after enactment. Grantor Trust Provisions in House Proposal – Estate Tax Inclusion (effective date: trusts created on or after the date of enactment (or to any portion of a trust that was created before the date of enactment which is attributable to a contribution made on or after the date of enactment)): The House Proposal would essentially eliminate grantor trusts as a planning vehicle for any trusts created after enactment. Specifically, the House Proposal would add new Section 2901 to the Code, which:

Grantor Trust Provisions in House Proposal – Income Taxation on Sales to Grantor Trusts (effective date: trusts created on or after the date of enactment (or to any portion of a trust that was created before the date of enactment which is attributable to a contribution made on or after the date of enactment)): Under existing law, when a grantor sells appreciated assets to a grantor trust, no capital gain is triggered. In addition, under existing law, the swap or substitution of assets of equal value for assets in a grantor trust does not trigger a capital gain. The House Proposal would add new Section 1062 to the Code, which would require gain to be recognized on sales of appreciated assets to a grantor trust, but deny the recognition of a loss. Under new Section 1062, if enacted, swap or substitution transactions would no longer be free of capital gains tax consequences as to post-enactment created grantor trusts. Furthermore, if a post-enactment contribution is made to a grandfathered trust a portion of that trust would be subject to these new rules. The term contribution is not defined and has caused much confusion, especially as to existing life insurance trusts where the trust creator typically makes annual trust contributions to pay the current year’s life insurance premium. It is unclear whether sales or swaps to grantor trusts created before enactment will be subject to the new rules subjecting post-enactment sales or swaps to tax and until further guidance is provided, such post-enactment transactions should be avoided. Family Limited Partnership and Other Valuation Discount Limits as Non-Business Assets The House Proposal seeks to limit the estate and gift tax valuation discounts applied to transfers of closely-held non-business assets. This provision is designed to limit the strategy of creating family limited partnerships to hold passive assets (i.e., a portfolio of stocks, bonds, mutual funds, any like type assets), and have the partnership valued for gift and estate tax purposes at a lesser value due to discounts for lack of marketability and minority interests. The Proposal defines non-business assets as passive-type assets, which are held for the production or collection of income and are not used in the active conduct of a trade or business. In other words, forming a family limited partnership or limited liability company and funding it with marketable securities would no longer be a viable technique for transferring marketable securities at a discounted value. This provision, if enacted, would apply to transfers after the date of enactment. Included in the valuation discount prohibition rule is passive real estate held in partnerships and LLCs. Currently, it appears that fractional gifts of interests in real estate (not owned in a business entity) could still qualify for valuation discounts, but such transfers could create catastrophic title issues such as where one owner of a small fractional interest does not agree to a sale or if such an interest is conveyed upon divorce to an ex-spouse. Retirement Plans IRA and Retirement Plan Provisions: The House Proposal creates significant tax increases, accelerates taxable withdrawals, and prohibits additions to IRAs of high-income taxpayers who already have retirement assets in excess of $10 million and other modifications described below. If the House Proposal is enacted, taxpayers must consult with their retirement plan advisors to make sure they are in compliance. Contributions to IRAs: The House Proposal would prohibit further contributions to a Roth or traditional IRA for a tax year if the total value of an individual’s IRA and defined contribution retirement accounts generally exceeds $10 million as of the end of the prior tax year. The limit on contributions would only apply to single taxpayers (or taxpayers married filing separately) with taxable income over $400,000, married taxpayers filing jointly with taxable income over $450,000, and heads of household with taxable income over $425,000 (all indexed for inflation) (high-income taxpayers). Required Minimum Distributions: For high-income taxpayers, as defined in the preceding item, whose combined traditional IRA, Roth IRA, and defined contribution retirement account balances generally exceed $10 million at the end of a tax year, a minimum distribution would be required for the following year as follows:

Roth conversions: The House Proposal would eliminate Roth conversions for both IRAs and employer-sponsored plans for single taxpayers (or taxpayers married filing separately) with taxable income over $400,000, married taxpayers filing jointly with taxable income over $450,000, and heads of household with taxable income over $425,000 (all indexed for inflation). This provision would apply to distributions, transfers, and contributions made in taxable years beginning after December 31, 2021. This provision would also prohibit all employee after-tax contributions in qualified plans and after-tax IRA contributions from being converted to Roth regardless of income level effective for distributions, transfers, and contributions made after December 31, 2021. Moving Forward Before a Bill Passes There are numerous planning techniques that can be initiated now before the House Proposal (or any negotiated revised proposal) is enacted. Specifically, clients who were considering Spousal Limited Access Trusts (SLATs), Grantor Retained Annuity Trusts (GRATs), or sales of discounted partnership or LLC interests using their remaining gift, estate, and generation-skipping transfer tax exclusions, selling assets to a grantor trust, or substituting assets into a grantor trust for other assets of equivalent value (if authorized in such grantor trust), should act now before enactment. For those concerned about asset protection planning, inter vivos QTIP trusts can provide excellent results. However, creating inter vivos QTIP trusts before enactment is necessary to avoid the possibility of double estate tax inclusion should the creator die before his or her spouse. Clients with family limited partnerships and/or limited liability companies that hold passive assets should consider whether gifts or sales of partnership or LLC interests should be made before enactment. Clients who have used their entire gift tax exemption but have GST tax exemption remaining may make a gift equal to their remaining GST tax exemption and pay the gift tax on such gift and, provided the donor lives three years from the date of the gift, the gift tax paid will be removed from the donor’s estate. If you wish to initiate planning before the House Proposal is enacted, call your attorney, CPA, and/or financial advisor soon as there is only limited time to act before enactment. HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE! Barry Nelson Jennifer Okcular Cassandra Nelson CITED AS: LISI Estate Planning Newsletter #2911 (September 29, 2021) at http://www.leimbergservices.com. Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

|

||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersYour Anxiety Is Real:How To Make Peace With Your Business |

||||||||||||||||||||||||||||||||||||

|

CASE STUDIES IN ESTATE TAX PLANNING: Learning By ExampleIn this 60-minute program, Alan will review a number of sample client estate plans, share useful charts, client explanation letters, and Estate View illustrations. He will also answer questions on possible tax law changes and may have members of the audience unmiked to ask questions and engage in useful discussion. Presented by: Alan S. Gassman Saturday, October 2, 2021 11:00 AM EDT Register for CASE STUDIES IN ESTATE TAX PLANNING: Learning By Example on Oct 2, 2021 11:00 AM to 12:00 PM EDT (60 minutes) at: REGISTER HEREAfter registering, you will receive a confirmation email containing information about joining the webinar.

|

||||||||||||||||||||||||||||||||||||

|

Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

||||||||||||||||||||||||||||||||||||