The Thursday Report – Issue 312

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, September 23rd, 2021– Issue 312 –REVIEWED BY: ADRIANA OCHSNER Having trouble viewing this? Use this link

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

HAPPY BIRTHDAY BRUCE SPRINGSTEEN!This Springsteen Report is dedicated to Bruce Springsteen who is age 72 today and needs to call Natalie Choate to discuss his minimum distribution planning. He may also need to get divorced and give his wife Patti Scialfa 10 million dollars of IRA in order to avoid having to make significant distributions next year. He should also call Marty Shenkman to update his estate plan because of recent New Jersey law changes.

This image was originally posted to Flickr by Becker1999 at https://flickr.com/photos/21426642@N07/2916453115 (archive). It was reviewed on 21 March 2019 by FlickreviewR 2 and was confirmed to be licensed under the terms of the cc-by-2.0. Wikimedia Commons: a collection of 77,082,956 freely usable media files to which anyone can contribute.

HOW WELL DO YOU KNOW “THE BOSS”? BRUCE SPRINGSTEEN TRIVIA: 46 FASCINATING FACTS ABOUT THE SINGER Bruce Frederick Joseph Springsteen (born September 23, 1949) is an American singer, songwriter, and musician. He has released twenty studio albums, many of which feature his backing band, the E Street Band. From Wikipedia, the free encyclopedia.

POEM Had a wife and kids in Baltimore, Jack, Offered her a 10 million dollar IRA and she never came back. Like a river that don’t know where it’s flowing, I teamed up with my lead singer and it’s still ongoing.

HAVE YOU EVER WANTED TO PLAY GUITAR WITH BRUCE SPRINGSTEEN? Here’s what it’s like: CLICK HERE to watch this sweet moment where “Bruce Springsteen brings young fan up on stage to perform ‘Growin’ Up’ with him”.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1Possible Estate Tax Law Changes – What To Do Now By Alan S. Gassman and Brandon Ketron Article 2Income Tax Changes Under the September 13th House Ways and Means Proposed Legislation By Alan S. Gassman and Brandon Ketron Article 3Practical Strategies for Avoiding Estate and Trust Litigation By: Alan Gassman and Wesley Dickson Article 4Using the Florida Irrevocable Community Property Trust to Protect an Elderly Couple from Abuse By: Brock Exline For Finkel’s FollowersThe 1 Question Every Business Owner Should Ask When Faced With a Tough Decision By: David Finkel Forbes’ CornerIncome Tax Law Changes – What Advisors Need To Know By: Alan Gassman Featured EventsMore Upcoming EventsYouTube ChannelHumor

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Possible Estate Tax Law Changes – What To Do Now

Written By: Alan S. Gassman and Brandon Ketron EXECUTIVE SUMMARY A great many wealthy taxpayers were given a not so welcome jolt of energy and fear last week when the Democrats on the House of Representative Ways and Means Committee released their 881-page proposal on how to raise over $3,000,000,000.00 in taxes from wealthy families and high earners, causing many phone calls and e-mails from taxpayers who have put off making proper use of the $11,700,000 exemption and the opportunity to fund and sell to Grantor Trusts, form and fund Grantor Retained Annuity Trusts, fund Qualified Personal Residence Trusts and use other planning techniques that may be gone in just a few days. For many planners, the issue of the hour is how to fund LLCs, Limited Partnerships and other entities with assets that will be indirectly gifted while qualifying for lack of marketability and lack of control discounts without getting stymied by the Step Transaction Doctrine that the IRS may Senda (pronounced “Send Ya ” and named for the Senda case) if the newly-added assets are not held for a sufficient time before the entity interests are transferred. Nominee Agreements will be more popular than ever this week and next week where retitling may provide difficult and cumbersome. While providing a comprehensive and extensive summary or analysis of the full 881 pages of proposed new laws would prove to be cumbersome, especially since the terms of any bill can be expected to be materially different than the House Bill, we are able to cover many of the primary changes, points of confusion, and effective dates provided in the proposed legislation as relates to estate tax planning, along with some key planning ideas. Those affected will be pleased to hear that only a few of the new rules would impact transactions or transfers made before the new Act would be enacted. Further, many of the provisions would not become effective until January 1, 2022, but those who are being advised to transfer significant values to irrevocable “Grantor Trusts” that are disregarded for income tax purposes before their exemption amounts are cut in half must act by the day that the law is enacted. Alternatively, based on the plain language of the bill, potentially affected individuals may plan to gift such amounts to individuals or entities other than grantor trusts, if they do this after the date of enactment and before year-end. The law of survival of the fittest will apply to cause many wealthy families to lose a great portion of their net worth to estate tax, while smarter and properly situated families may have little to no estate tax. The train may be leaving the station very soon, leaving much wealth exposed for lack of follow-through on the part of many clients. Planners may want to concentrate on getting simple trusts that can be better defined by the use of Trust Protectors or powers of appointment into place without delay to help the last survivors of any estate tax Titanic into whatever lifeboats can be set up in time. FACTS Below is a section-by-section analysis of the major proposed changes and effective dates, and thoughts relating to actions to take and not to take while we wait to see what changes are made to the Bill and if any substantial bill will be passed this year. While all of this is subject to change as the Senate gets involved, but we do not expect to see anything more severe or taxpayer unfriendly than the House bill, and it could be a lot worse. COMMENT Use It or Lose It – Estate/Gift Tax Exemption Cut in Half Effective January 1, 2022 The good news on this front is that the reduction of the estate and gift tax exemption from $10,000,000 as adjusted for chained inflation (presently $11,700,000 per person) will be intact through the end of 2021, but will be reduced to one half of the applicable amount effective January 1st, 2022. This means that the “use it or lose it” gifting decisions for wealthy individuals can be made up through the end of this year, but most well-advised wealthy families will be better off making such gifts before such legislation is passed, because of the Grantor Trust and discount rules that would be changed as of the date of enactment. The $2,800,000 Mistake As an example, Grandma has used $700,000 of her estate and gift tax exemption from prior gifting, and therefore has an $11,000,000 exemption remaining that she may wish to use prior to the end of the year. If she has a $21,000,000 estate and makes an $11,000,000 gift, then her estate will be $10,000,000. If Grandma then dies in 2022, or thereafter, she would have no exemption remaining, and the estate tax will be $4,000,000 ($10,000,000 x 40% = $4,000,000). Fortunately, the proposed law would not increase the estate tax rate the way that the Bernie Sanders bill would have. Alternatively, if Grandma does no gifting in 2021 and dies in 2022, or thereafter, when the exemption would be based upon one half of $11,700,000 ($5,850,000) adjusted for inflation to perhaps $6,000,000, then her estate will be $21,000,000 reduced by her remaining exemption amount of $5,300,000 ($6,000,000 less prior gifts of $700,000), and estate taxes of $6,280,000 ($15,700,000 x 40% = $6,280,000) will be owed to Uncle Sam 9 months after her death. It will not feel good to stroke that checks for $6,280,000 when it could have been $4,000,000, and the $2,280,000 difference does not take into account that growth on assets would be expected to make the difference greater. Suppose however that Grandma does not make the gift but is on her death bed on December 31, 2021, thinking about using the Living Will, while hoping for a miraculous recovery and a few more years in the very nice retirement home where she lives. Would you want her children or best friend to make her health care decisions at that time? One day of life could cost $2,280,000. We would bet on the best friend is less likely to pull the plugin in this situation! It is important to note is the fact that there will be no “clawback” for use of the increased exclusion amount, meaning that Grandma will not be penalized for gifting $11,000,000 of assets if she passes away in a year when the applicable exclusion amount is $6,000,000. Use Less Than Half and Uncle Sam Gets A Laugh Another factor that warrants consideration is that in order to use the temporarily increased exemption, gifts must exceed what the exemption will be reduced to. For example, if Grandma were to gift $5,000,000 in 2021 when the applicable exclusion amount is $11,700,000 and then pass away in 2022, or thereafter when the applicable exclusion amount is only $6,000,000, Grandma’s applicable exclusion amount would only be $1,000,000. Therefore, in order to take full advantage of the increased exemption, Grandma will need to gift all $11,000,000 of her remaining exclusion. That being said, those who decide that they cannot afford to gift the full $11,700,000 may still be well advised to gift what they are comfortable with to get future growth in value out of the estate and to gift limited liability company or partnership interests when possible in order to lock in discounts that may not apply once the new Act is passed and to make the gifts to Grantor Trusts while there is time to do so. The good news is that families will have until the end of this year to make large gifts if the law passes. The bad news is the loss of very important vehicles that we commonly use for gifting and estate tax planning that may occur below then. Is A Grantor Trust Really A Must? Grantor Trusts can be separate and apart from the Grantor and contributor of the trust for estate tax purposes while still considered as owned by the Grantor for income tax purposes. Because the Grantor is considered to be the owner of the trust for income tax purposes, transactions between the trusts and the grantor are “disregarded,” meaning that assets can be sold or exchanged with the trusts and the trusts can pay interest on low-interest notes owed to the Grantor without triggering any income tax consequences. Our hypothetical Grandma from the examples above could place $14,000,000 of investments into an LLC and after waiting a proper amount of time gift the 99% nonvoting membership interest in the LLC to a Grantor Trust for her descendants. Due to the discounts mentioned above, this might result in an $11,200,000 gift (assuming a 20% discount applies). Grandma can pay the income tax on the income from the investments for her remaining lifetime, which will further reduce estate taxes for her family upon death, but only if she acts before the date of enactment of the new bill if it passes. A favorable provision of the new proposal allows Grantor Trusts established and funded before the enactment of the new law to be grandfathered, as would promissory notes in place at the time of enactment, so a great many estate tax planners expect to be very busy completing trusts and sale arrangements that are in progress now, and remain uncertain of how many more they have the capacity to handle given the short time frame Congress is providing us with here. Potential Impacts on Discounts and Other Estate Planning Tools In addition to preventing the use of post-enactment contributions to Grantor Trusts for estate tax purposes, the new bill would also eliminate discounts after the date of enactment unless the asset gifted or sold is an “active trade or business.” The language and effect of the new bill may also cause us to lose other very powerful tools in our toolbox, such as Grantor Retained Annuity Trusts (GRATs), Qualified Personal Residence Trusts (QPRTs), and lifetime Grantor Charitable Lead Annuity Trusts (CLATs) depending upon how the bill is applied and interpreted. The bill may also change how life insurance trusts will be funded and structured in the future, but we expect that the life insurance lobby will do what it takes to preserve its status as a favored child of Congress. The following discussion of what is available now that may not be available after a law is enacted is as follows. A Qualified Personal Residence Trust (“QPRT”) allows a homeowner to transfer his or her primary residence or a vacation property into a Trust that enables the Grantor to make use of the property at no rent charge for a term of years and to report the gift of the ownership interest in the home to be less than the full value of the home because of the discount attributable to the present value of the free use possessory term. Nevertheless, after the death of the Grantor, the entire value of the property held under the Trust escapes estate tax, and the Grantor will pay rent after the possessory term of years lapses, which further reduces the Grantor’s estate and enables the Grantor to continue to use the property. The QPRT can be drafted to be disregarded for income tax purposes, both during and after the possessory term, so that rent paid for use is not taxable to the Trust, and the property is treated as owned by the taxpayer in the event of a sale, to qualify for the $250,000 or $500,000 exclusion for the sale of a primary residence. Reading the newly proposed act literally, QPRTs that are entered into and funded by deed before the date of enactment will be grandfathered to receive the above benefits, but those that are executed and funded by deed after the date of enactment will lead to gain being recognized as if the property was considered to have been sold to the trust upon contribution, and then considered to be a gift by the Grantor following the possessory term when the property is transferred to the beneficiaries, although credit may be received for gift taxes paid on the initial transfer when the second transfer occurs. So Long and Farwell to GRATs Similar to a QPRT, a Grantor Retained Annuity Trust (“GRAT”) is an arrangement whereby an individual can transfer property to a trust which provides for payments back to the individual over a term of years in fixed dollar amounts that are sufficient to cause there to be no gift for gift tax purposes. Nonetheless, if the assets in the GRAT appreciate in value by more than approximately 1.0% a year, based upon the present rate for GRATs entered into this year, the excess value remaining after the term of years can pass estate and gift tax-free. A GRAT is treated as a Grantor Trust while the Grantor is receiving annual payments, and can be considered to be a Grantor Trust thereafter if drafted to facilitate that result. Under the proposed new rules, the funding of a GRAT after the date that the law would be enacted could cause income tax to be imposed on the excess of the fair market value of the assets placed into the GRAT over the tax basis of such assets. Further, the excess value remaining after the GRAT term may be considered a gift when distributed, notwithstanding that Internal Revenue Code Section 2702 maintains under present law that no gift results when the actuarial value of the annual payments made to the Grantor equals the value of assets placed into the Trust. While 2 and 3 and 4 year GRATs have been most common, longer-term GRATs will lock in values for a longer period of time and should be more popular before the new law passes. Most planners will prefer to use long-term installment sales to Grantor Trusts, for this reason, but GRAT’s will normally be used when the risk of gift tax is high, or the value of assets is above what would typically fit under an installment sale. I Must Form My Income Tax Deductible CLAT In Nothing Flat A Charitable Lead Annuity Trust (“CLAT”) functions in a manner similar to a GRAT, except that the fixed annual payments will go to a charity, and assets remaining in the CLAT after the term of years can be held for to family members without being considered to be a gift. A Grantor CLAT is a variation of a CLAT that is drafted to be disregarded for income tax purposes to allow for an income tax deduction on funding, which causes the Grantor to be subject to income tax on the CLAT’s income during the charitable payment term. Unfortunately, Grantor CLATs that are funded after the date of enactment may trigger income tax on the excess of the fair market value of the assets placed in the GRAT over the income tax basis, with the remainder interest passing to descendants being subject to federal gift tax when the payments to charity end. The above analysis of the impact of the newly proposed rules on QPRTs, GRATs, and CLATs may not be accurate or what the Ways and Means Committee is intending, and guidance with respect to this will likely be forthcoming in any legislation that would pass, or before or immediately after passage. Nevertheless, individuals and families who are considering the use of QPRTs, GRATs, or Grantor CLATs should proceed without delay. Although the loss of the vehicles and planning techniques reviewed above seems more than formidable, other techniques will continue to exist. Regardless, estate tax planners will feel like carpenters who have lost their hammers, nails, and pliers, and have significant construction to do somehow without those tools. The result for wealthy families will be increased exposure to pay much more in estate taxes. How About Some Good News? We were pleased to find the absence of a number of items on the bill that had been tossed around by lawmakers, including the following: 1. No “capital gains tax on death” was included, or any rule that would detrimentally affect the present tax laws that permit the assets of a deceased individual to be considered to have been purchased for the fair market value thereof on the person’s date of death to eliminate capital gains taxes attributable to appreciation and depreciation taken up through the date of death. 2. Proposals that would have imposed a tax on placing appreciated assets into separately taxed trusts, or transferring appreciated assets out of separately taxed trusts are also thankfully not mentioned. 3. Proposals that would have reduced the number of annual gifts using Crummey withdrawal powers that an individual or married couple could have made to irrevocable trusts or otherwise were not included. 4. Proposals that would have made the estate tax rates progressive potentially applying a 65% tax rate on estates in excess of $1 billion. Thankfully under the current proposal, the estate tax remains at a flat rate of 40%. 5. Proposals to decrease lifetime gifting allowance to as low as $1,000,000. Under the current proposal, the estate and gift tax exemption remains the same, although reduced to one-half of what would have otherwise applied. 6. Specific provisions that would eliminate a step up in basis for assets held by a Grantor Trust. While it is unclear under present law if a step-up in basis applies to assets held by Grantor Trusts, many practitioners take the position that a step up in basis does apply since the grantor is considered to be the owner of the assets for income tax purposes, and the inclusion of the elimination of step-up in basis for Grantor Trusts in prior proposal further supports this proposition. 7. Proposals to apply generation-skipping taxes via a deemed termination of Generation-Skipping dynasty trusts every 50 years. The good news for estate tax advisors is that there are very few proposed new rules in this arena under the new bill, so the changes will be relatively easy to learn and implement, and grandfathering will allow us to be proud of and continue the structures that have been put into place and properly maintained. The bad news is that if our spouses were upset because we have been working late up until now, then they have not seen anything yet! CONCLUSION Times like these call for courage, calmness, and smart thinking by planners who have much more work than they can do to help clients finish building their arcs before the hard rain begins. We must first make sure that we have the resources and client cooperation to complete projects that have been started, and notify clients that it will be too late if they do not act immediately. General non-estate tax planning can be pushed off or not taken in over the next few days as we size up our workload, and how to simplify and implement what we can while we can, while still hoping that none of these changes will come to fruition. Clients will remember that we were there for them and did our best, and in many cases, those who would not have done the proper planning will do so, and be helped regardless of whether the laws change or not. Let’s take a deep breath and enjoy the experience of what it is worthwhile working in the intensive care style environment that we find ourselves in. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2Income Tax Changes Under the September 13th House Ways and Means Proposed Legislation

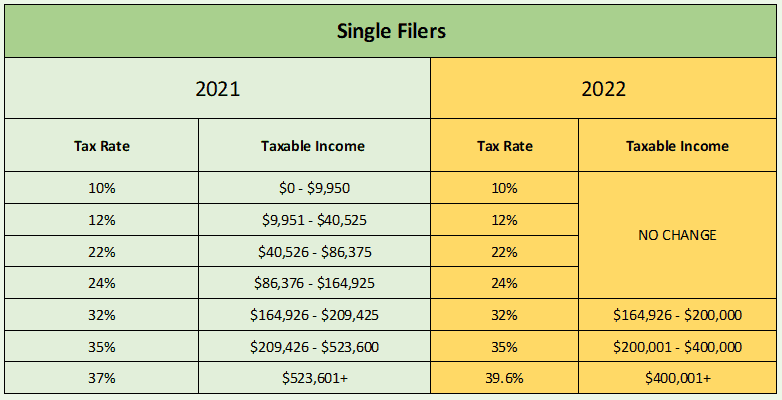

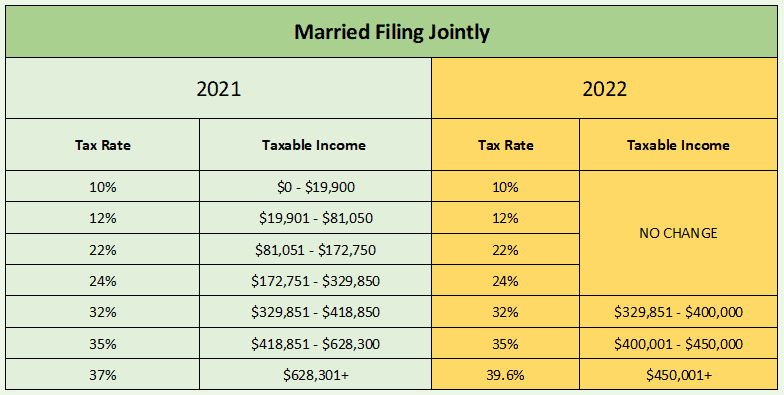

Written By: Alan S. Gassman and Brandon Ketron Alan S. Gassman, J.D., LL.M., is a partner in the law firm of Gassman, Denicolo & Ketron, P.A., and practices in Clearwater, Florida. Brandon L. Ketron, CPA, JD, LL.M. is a partner at the law firm of Gassman, Denicolo & Ketron, P.A., in Clearwater, Florida and practices in the areas of Estate Planning, Tax and Corporate and Business Law. The authors would like to thank Stetson University College of Law student, Grace Paul, for her patience and perseverance with regards to this article. EXECUTIVE SUMMARY The House Ways and Means Committee released 881 pages of proposed legislation on September 13th to give a nation full of underworked tax professionals something new to do in their ample spare time. Even some who work on the first floor of buildings thought about jumping out the window, but it could have been worse–there are very few complex changes. The new law would create many changes to income, estate, and gift taxes, and anyone who is about to send a Form 2553 in to file for S-election status should think twice and discuss this with the client before the deadline, as discussed below. The authors covered changes to the Estate and Gift Tax system in LISI Estate Planning Newsletter #2906 (September 20, 2021). Now, we are back, contrary to popular demand, to cover proposed income tax changes. While we wait to see what alterations will have to be made to the bill before it would have sufficient support from 50 senators and Vice President Harris, if this is possible, we are providing this summary of some of the most significant proposed income tax changes, proposed effective dates, and our thoughts on what actions to take and not to take. As the Senate becomes involved, all of the following proposals are subject to change, although we do not expect to see anything more detrimental to taxpayers than the current proposals. COMMENT: I got my PhD in PPP I survived the odyssey of ERC Now during tax season For taxpayers to learn about the potential income tax rate increase So if you’re serious about planning to plan Potential Income Tax Rate Increases and Rate Bracket Adjustments Among the most heavily discussed proposals is the increase in income tax rates, raising tax rates on ordinary income to 39.6% for individuals. This new rate would apply to married individuals who file jointly with taxable income over $450,000, to heads of households with taxable income over $425,000, to unmarried individuals with taxable income over $400,000, to married individuals filing separate returns with taxable income over $225,000, and to trusts and estates with taxable income over $12,500, as adjusted for inflation in future tax years. Beyond the increase in tax rate, the rate brackets will also be modified with individuals on the upper end of the 32% and 35% rate brackets at risk of a potential tax rate increase as a result. A year by year comparison of the rate brackets is as follows:

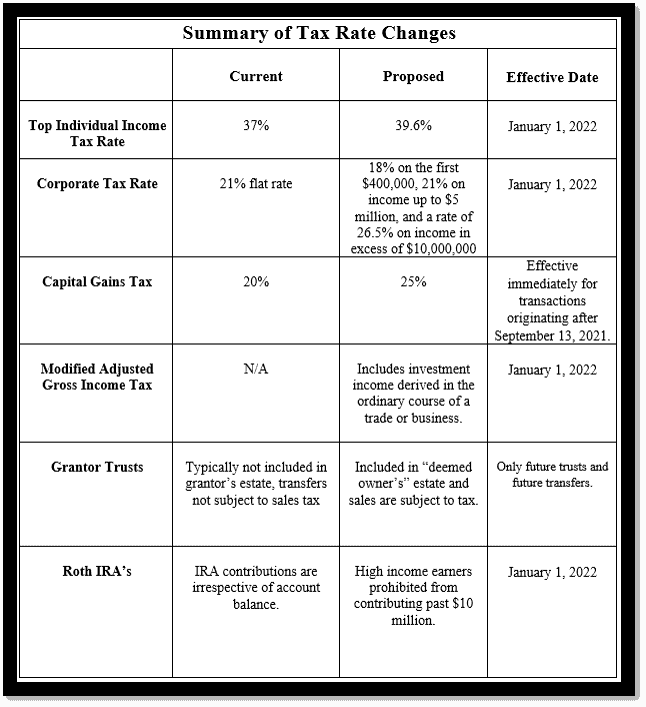

One strategy is to earn as much as you can while you can at our current historically low tax rates and our thankfully vibrant economy, as the rate hikes will only apply to taxable years following December 31, 2021, and your spouse is probably tired of seeing you anyway. Individuals should also consider that they will have to pay much more in income taxes due to the limitations on the 20% Section 199A Qualified Business deduction, a 3% surcharge on ultra-high earners, and the 3.8% Net Investment Income Tax that will now apply to active business income for high earners, as described below. There is a lot of math to run through before we can give a client a straight answer as to what their real effective income tax rate will be. The answer is, really high, but it could be worse. The federal income tax rates were at 70% in the 1970s, and have previously been as high as 90%. The following chart should be helpful with respect to the proposed tax law changes that are further described below.

Proposed 25% Capital Gain Rate and Back to The Future Expanding the Definition of “Net Investment Income” for the 3.8% Net Investment Income Tax As previously noted, the 3.8% Net Investment Income Tax under Internal Revenue Code Section 1411 would be broadened to include any income derived in the ordinary course of business for single filers with more than $400,000 in taxable income ($500,000 for joint filers) effective January 1, 2022. Under current law, the 3.8% tax generally only applies to passive investment income (interest, dividends, gain on the sale of stock, etc.). As mentioned above, advisors may consider delaying the filing of Form 2553 S-Elections for newly formed entities until discussions can be had with clients on the impact of the expansion of the 3.8% Net Investment Income Tax, which would apply on all S-Corp income for high earners if the bill is passed. Clients may be better served in entities taxed as partnerships or C-Corporations if S-Corporations can no longer provide the added benefit of sheltering income from the 3.8% Net Investment Income Tax. Please remember, however, that the late filing of a Form 2553 is only permitted if it is inadvertent, so clients need to be communicated with well before the deadline unless the entity can safely be taxed as a partnership or disregarded until a decision is made about whether to make an S election. The Net Investment Income Tax will also apply to trust and estate income beginning at $13,050 of net taxable income in 2021, and the threshold will increase slightly each year. Therefore, most trusts and estates that have ownership of profitable businesses or ownership interests in profitable entities that are taxed as partnerships will be subject to the 3.8% tax except to the extent that the income received is paid out to beneficiaries. If the income received is paid out to the beneficiaries, the beneficiaries will be subject to tax as if they received it. S-Corporation income received by a complex trust is taxed at the highest bracket on Schedule K-1 from the S-Corporation regardless of whether it is distributed, and will also be subject to the 3.8% Net Investment Income Tax if it has made an ESBT (“Electing Small Business Trust”) election. However, many trusts have the ability to sell S-Corporation ownership interests to beneficiaries who are in lower brackets, so this may become a common strategy implemented shortly after the death of a client in order to not incur capital gains tax on such sale. Then the trust owns a note from the beneficiary and the beneficiary owns the S corporation stock. Beginning January 1, 2022, if the proposed rules become law, a 3% tax will apply to individual taxpayers to the extent that they have Adjusted Gross Income (“AGI”) in excess of $5,000,000 ($2,500,000 if married but filing separately), and on trust and estate income exceeding $100,000 per trust or estate. Because this surcharge applies to AGI in excess of the applicable threshold, AGI includes ordinary and capital gains and is not decreased by charitable deductions (or any other itemized deduction). This tax would be imposed for most taxpayers when a business, or another large asset, is sold for a large gain. Experienced planners may consider selling to a related party under the installment method to spread out the gain over multiple tax years, keeping in mind that this would need to be completed more than two years prior to the liquidation event in order to avoid acceleration of the gain upon the sale to a third party under the anti-Rushing rule, which has nothing to do with tax fraternities. Planners might also consider transferring interests that could be sold to a charitable remainder trust which can be used to spread income out over a number of years in order to avoid AGI in excess of the threshold. Running the numbers on these structures can reveal significant tax savings if rates become lower in the future, in addition to the advantages of tax deferral and helping charities. The Above $100,000 Trust and Estate Income Problem Trusts face a bigger issue under the proposed rules because the tax would apply to all trust income exceeding $100,000, making distributions of Distributable Net Income (DNI) to reduce a trust’s remaining taxable income an even more critical tool for planners. As stated in overly simplified terms, when a trust makes a distribution of income to a beneficiary, the beneficiary will pay the tax on such income, and the trust will receive a deduction to reduce its taxable income. Fortunately, the 3% surcharge will only apply to the extent that income in excess of $100,000 remains in the trust after taking into account distributions made to the beneficiaries. Drafters of trust documents should be familiar with the applicable Principal and Income Act of the situs of the trust to confirm whether capital gains are treated as principal (and thus not distributable) or income. The majority of states allow trust documents to specify that a fiduciary will have the power to treat capital gains as income that can be distributed to beneficiaries and escape the additional 3% tax. Profitable C Corporations Should Prepare for More Taxes in 2022 The bill would also change the 21% flat corporate income tax on ‘C-Corporations” to a progressive tax, providing for 18% tax on the company’s net income of up to $400,000, a 21% tax on net income up to $5,000,000, and a 26% tax on net income in excess of $5,000,000. These rates are still significantly lower than what the corporate tax rates were before the 2017 tax cuts. A great many S-Corporations will likely be converted to C-Corporations if the bill passes and these rates go into effect, especially when viewed in light of the 3.8% Medicare tax that would be imposed on S-Corporations and flow-through income for high bracket individuals. A Haircut for High Earner 199A Qualified Organization Owners Wealthy taxpayers claiming the 20% 199A deduction for qualified business income deductions will be disappointed to learn of the proposed maximum deduction of $500,000 for joint returns, $400,000 for individual returns, $250,000 for a married individual filing a separate return, and $10,000 for a trust or estate. Beyond this, non-corporate taxpayers still have to deal with the permanent removal of excess business losses. The IRS vs. Over $10,000,000 IRA/Pension Holders In an effort to prevent the stockpiling of assets in massive IRA accounts, those who hold Roth and traditional IRA and retirement plan account with a combined balance that exceeds $10 million as of the end of a taxable year are not permitted to make further contributions if the account holder has taxable income over $400,000 or if the account is jointly held by a married couple with taxable income exceeding $450,000. These large account holders will be prescribed to make a minimum distribution equal to “50% of the amount by which the individual’s prior year aggregate tradition IRA, Roth IRA, and defined contribution account balance exceeds the $10 million limit.” Even more severe tax treatment will apply to those who have over $20 million in combined accounts. Further, a loophole that allowed indirect funding of Roth IRAs by the “backdoor Roth” technique could be removed for high earners. A $10,000,000 IRA owner may be better off taking money out of the IRA this year at the lower tax brackets. Taxpayers looking for a reason to get divorced can move the $10,000,000 out of the IRA to their spouse’s IRA under a Qualified Domestic Relations Order (QDRO). Clients looking for a reason to separate from their spouse may find this to be a viable option. The good news is that Natalie Choate has written about these proposed changes in the September 2021 edition of Choate’s Notes, which can be found at https://ataxplan.com/choates-notes. Please don’t tell Natalie Choate we mentioned her because we did not have time to get Natalie’s permission. What About Charity? Charitable gifting does not appear to be impacted, except for Grantor Charitable Lead Annuity Trusts. With higher income tax brackets potentially being introduced, charities may receive more in donations, which would benefit charitable causes and those who work for charities. If you will be a high earner next year, now may be the time to set up and fund that family foundation you have been considering. The use of Charitable Remainder Trusts will become a more attractive option to spread large gains over multiple tax years in order to avoid crossing applicable income thresholds. With that in mind, some of the new provisions are applied based on Adjusted Gross Income (“AGI”) thresholds. This means that large charitable donations will not prevent taxpayers from being subject to some of the new taxes on high earners since AGI is determined before deductions for charitable contributions or any other itemized deduction. Let’s not forget that this may be the last year that taxpayers can deduct up to 100% of AGI. Individuals who are over age 59 ½ may want to take large IRA contributions and donate the amounts withdrawn to charity as opposed to waiting until death, or only being able to donate $100,000 a year from an IRA after waiting to get into their 70’s. Miscellaneous Changes Other proposed changes in the bill that are noteworthy include the following: 2. Cryptocurrencies (Bitcoin, Ethereum, DOGEcoin, etc.) will be subject to the constructive and wash sale rules as of January 1, 2022, so if your cryptocurrency went “to the moon” and you want to lock in an offsetting position without triggering gain, we advise that you do so before the end of the year. If you were less fortunate and have a loss position in cryptocurrency, you have until the end of the year to sell your coins to harvest the loss and immediately buy back in without being subject to the wash sale rules. You would be in the same position economically, but with the added benefit of being able to recognize the loss and offset other passive income. This type of planning is prevented for most, if not for all, other marketable securities, but somehow cryptocurrencies have managed to stay under the radar, until now. 3. IRAs can no longer invest in entities in which the IRA owner has a 10% or greater ownership interest (this is presently 50%), or if the IRA owner is an officer. This will also be considered an IRA requirement rather than a prohibited transaction, which means that if the IRA invests even a small part of its holdings in such a business the entire IRA will be disqualified resulting in loss of creditor protection status and having taxes apply as if the IRA was liquidated. There is a proposed two-year transition period of IRA’s currently invested in these types of investments. 4. The IRS will receive approximately $80 Billion to enforce the tax law and presumably audit many more taxpayers and bring in much more tax revenues. This will make tax professionals busier, and taxpayers more conservative. We are not sure where the IRS will find qualified people to add to their workforce given present market demands, so it may take many years before this has much of an impact out here in the real world. 5. The employer tax credit for wages paid to employees during family and medical leave will expire in 2023 (2025 under present law). 6. S-Corporations, that elected S-Corp status prior to May 13, 1996, will be permitted to convert tax-free to a partnership any time in the two years following the passage of the act. Under present law, this would result in the deemed taxable sale of all of the assets of the S-Corporation at the time of conversion, so this will be a very good opportunity for many taxpayers. While S-Corporations can generally convert tax-free into a C-Corporation, C-Corporations are not as flexible in regards to the distribution and allocation of income as an entity that is taxed as a partnership. For S-Corporation owners who wish to have greater flexibility and do not expect the ability to have significant income excluded from the Net Investment Income Tax to come back soon, this will be attractive, and it will be fun to see what Steve Gorin advises if this passes. 8. Those who deal with tax-related stress by smoking tobacco products will be sad to hear of the proposed doubling of the excise taxes on cigarettes, small cigars, and roll-your-own tobacco, in addition to several other new imposed nicotine taxes not covered by this article. Many may switch to medical marijuana. Planning to Plan Once we have all of the aforementioned in mind, we can begin to plan, while also recognizing that what actually occurs is likely to change. Here are some examples of planning moves that may be considered at this time: 1. If you have an estate plan in progress get the estate tax planning part completed as soon as possible to grandfather what we expect to be grandfathered. 2. Charitable individuals who are over age 59-1/2 with large IRAs may wish to consider withdrawing monies from their IRAs and giving those monies to charity, as IRA distribution rules are changed for the worse. In addition, the ability to receive a dollar-for-dollar charitable deduction is permitted this year, but may not be allowed in the future. Until 2020, only taxpayers over age 70-1/2 can transfer IRA monies to charity on a tax-free basis, and were limited to $100,000 per year. 3. Accelerating income into 2021 – Quite likely, 2021 tax rates will be much lower than 2022, and this will hopefully apply to the entire tax year. CONCLUSION: It is important to remember that there are advisors and others who stand to gain economically by making recommendations and implementing changes that may backfire on their clients, so caution is advised. For many individuals and families, the best thing to do is to get all of the information and documentation organized and to see a reputable tax advisor in order to be farther up in line to get properly positioned once changes are (if they are) ratified. Please don’t forget to enjoy the experience of having the opportunity to help so many in so many ways. Without a doubt, the coming months will see plenty of people concerned about protecting their income and assets from taxation. This will drive taxpayers across the country to reacquaint themselves with their estate planners and CPAs and motivate people to schedule their annual financial check-ups. We may have to change how we do things to maximize what we can do for others while also getting some sleep here and there.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3Practical Strategies for Avoiding Estate and Trust LitigationPROACTIVE THINKING AND COMMUNICATION CAN MAKE A BIG DIFFERENCE This article is from Bloomberg BNA Tax Management Estates, Gifts and Trusts Journal and may be used only for educational purposes. Please do not use it for any other purposes. Please do not drive while reading this article or while driving a motor vehicle or using heavy machinery. This article is void where prohibited by law. This article may cause acne or alcoholism. Read this article at your own risk. 09/09/2021 www.bloombergindustry.com Reproduced with permission from Copyright 2021 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloombergindustry.com. Originally published by Bloomberg INDG.

Written By: Alan Gassman and Wesley Dickson It is no secret that estate and trust litigation is a thriving industry, which takes millions of dollars away from deserving beneficiaries and distorts estate plans. While the estate planning community, and estate planning lawyers, in particular, tend to be straightforward, well-organized, and generally uniform in how estates and trusts are planned and administered, the intersection of inheritance vehicles, personalities and family workings, and a common lack of careful advanced planning can cause issues. This coupled with the American court system, results in a good many lawsuits, and also unpleasant disputes that may be resolved short of litigation or by arbitration, which can cause great harm to beneficiaries by reducing what is available, delaying or causing loss of educational opportunities, and causing families to not get along, or even to engage in active financial and interpersonal war as the result of circumstances that are commonly beyond anyone’s control. Along with this comes the increasing frequency of elderly or infirm individuals being taken advantage of financially by family members, friends, nursing and other professionals, notwithstanding laws that make it a jailable felony to take financial advantage of an elderly or infirm person in most states, although it typically requires a ‘‘theft’’ to trigger such statutes. The fact that almost all metropolitan, police departments, and sheriff departments have entire departments, or at least one dedicated investigator, to handle elderly abuse, provides all of the evidence needed that this is commonly occurring. WHAT IS AN ESTATE PLANNER TO DO? While estate planners usually do a good job of documenting client intent, asset and liability information, and how assets should be held and passed in the event of incapacity or death, there are some actions that can be taken to reduce the risk of clients and family members being improperly treated and inheritances being lost or significantly reduced. This potentially leaves the end result of an estate or trust administration to not even be remotely what the decedent had envisioned. Estate planners may wish to evaluate what significant risks of trust and estate problems exist by looking for ‘‘red flags’’ that are commonly apparent, or which can become readily apparent in discussions with clients, family members, and other advisors. When these red flags become apparent the planner can explain each prominent risk, and what can be done about it, and then take steps to avoid problems. The primary circumstances that the authors have seen which should provide a reason for the possible proactive actions described below are as follows: 1. The infirm client; Examples of what can be done with each of these categories of problems, as well as strategies for how the estate planner can protect him or herself and other involved professionals, including the following discussed below. The Infirm Client The infirm client may be an individual who is suffering from the beginnings of dementia, or who has mental health problems or physical afflictions that cause the person to be dependent upon caretakers or one or more relatives who may exercise undue influence to receive gifts and change inheritance plans to their favor. Form an Irrevocable Trust for the Benefit of the Individual and Family The infirm client may be well-advised to place their assets into an irrevocable trust with a trustworthy and independent trustee who is required to use the assets for the sole benefit of the infirm individual, to provide transparency and accountings to involved family members if appropriate, and to divide the assets according to the wishes of the infirm individual as expressed at a time when the infirm individual is able to make intelligent and balanced decisions. Use a Safety Latch Provision in the Client’s Revocable Trust Alternatively, or in addition to an irrevocable trust arrangement, a revocable trust may be amended to include a ‘‘safety latch’’ that prevents amendment or large withdrawals without consent of an advisory committee that acts in a fiduciary capacity, or medical/mental health professionals such as psychiatrists, neurologists, or licensed mental health counselors to assure that it is not easy to exert undue influence to change a living trust agreement. Require Children and Others to Execute Agreements Oftentimes the children of an infirm individual will enter into a ‘‘Care and Inheritance’’ agreement at the request of the infirm individual and his or her advisors which may require the following: 1. Full disclosure and transparency with respect to any financial dealings or changes in estate planning documents; 2. The right for a child who advances or spends money on behalf of the individual to be re-paid from his or her estate before the division of remaining assets among my siblings; 3. An inheritance agreement to provide that each sibling agrees to share any inheritance equally, notwithstanding whether the parent may change their estate plan; This can be particularly important in families where one child tends to be imbalanced, and unable to support themselves. What commonly occurs is that the imbalanced child arrives at the infirm parent’s home and begins to help take care of them by helping him or herself to the assets in every way possible. Caretaker Agreements Many unskilled home nurses become multi-millionaires by helping elderly or infirm individuals. A Personal Caretaking Agreement can provide incentive compensation for individuals who provide services for an infirm individual, by also providing contractual obligations on the part of the individual to not receive any significant gifts or inheritances. Typically the children or other individuals who are expected to benefit from the estate or trust of the infirm individual are made to be third-party beneficiaries of the agreement and are given the explicit light to disclosure and accountings as to the assets of the infirm individual and the management thereof. Skeptical professionals may note that the above-referenced agreements and techniques are not foolproof, but the authors have found that individuals who sign such agreements or see that they are in effect are less likely to take advantage, or more likely to find someone else to take advantage of. Communications and Transparency or Secrecy When dealing with an infirm client that may have forceful or ne’er-do-well intended or unintended beneficiaries, the planner must make, or allow the client and their family to make, a number of decisions that can have a significant influence on whether there will be litigation or dispute, and how it might occur and end up. One strategy is to be completely transparent, both with the questionable beneficiary or beneficiaries and those who may have involvement therewith. Given that the client’s mental state may not be expected to get stronger, and may not ever be better than what it is at a particular moment, the planner should not waste time or resources in deciding whether the client should be having mental health checkups, videotaped conversations about the situation, and direct communications with the potential ne’er-do-well or questionable beneficiary, so they do not have false expectations, and can complain, and possibly even file litigation or arbitration while the client is still living and able to express their position. On the other hand, such steps can have a significant negative impact on the client or clients, if they find this to be upsetting, and do not wish to risk confrontation at the present time, or even at any future time during their lifetimes. All in all, the estate planner will be safest from professional conduct and potential liability standpoint, if he or she consults with reputable probate and trust law litigation counsel, and the client and family members, and it is determined that the arrangement can be handled with full videotaping and audio recording of communications and transparency with all involved. This can spare the lawyer from being accused of saying things or doing things that simply do not occur, and can save significant deposition time and expense, as well as the inconsistency that will always occur when different individuals are deposed about a common event. On the other hand, if the mental status of the individual is weak, or they prefer to have privacy, a video or audio taping may not be feasible. The rules of evidence also need to be consulted to determine what would be admissible. FLORIDA COMMUNITY PROPERTY AND OTHER CONFIDENTIAL AND EXCLUSIVE BENEFIT TRUSTS One common new form of trust is now available that enables a married couple to place assets under a trust where state law requires that they be the sole lifetime beneficiaries, and does not require any notice to any remainder beneficiaries, unlike most other Florida irrevocable trusts. This applies under the new Florida Community Trust Act, which became law on July 1, 2021, and was designed to facilitate allowing the surviving spouse to receive a full stepped-up basis for all assets in the trust. In addition, Florida provides that notice that would otherwise go to descendants or other beneficiaries under an irrevocable trust can instead go to a designated representative, who can be appointed in the trust agreement pursuant to Fla. Stat. §736.0306. A designated representative can also waive any right to notice or accounting of the trust. SECOND AND SUBSEQUENT MARRIAGES If there is a Prenuptial or Postnuptial Agreement, the estate planner should, of course, be very careful to assure that the agreement is being complied with and to see whether an amendment should be entered into in order to enhance the probability of enforceability, if this is desired. For example, in many states, there is a requirement that both spouses make exhaustive disclosure of assets and income, and this is not always complied with. An amendment to a Prenuptial or Postnuptial Agreement can both fine-tune rights and responsibilities, and will often enhance what the less wealthy spouse is entitled to receive while increasing the probability that the agreement will be enforceable. Many times, the wealthier spouse is required to leave a lifetime benefit trust for the surviving spouse’s lifetime that can pass to or for the benefit of the descendants of the wealthier spouse after the surviving spouse’s death. A wealthy spouse making gifts to irrevocable trusts for estate tax planning purposes may want to have an income or annuity interest held under the trust, in order to be able to satisfy the Prenuptial or Postnuptial Agreement, even if the personally retained assets of the wealthier spouse are lost in some sort of catastrophe or by reason of unintended large expenditures or lifetime gifts. Planners should be aware that a high percentage of wealthy spouses in a subsequent marriage will commonly change their estate plan for the benefit of the new spouse so that the new spouse will receive more than what is contracted for under the Prenuptial or Postnuptial Agreement. Descendants of the wealthy spouse may later complain that the changes resulted from undue influence, and may blame the estate planner for allowing this to occur. In those situations, it can be beneficial if the estate planner did not represent the less wealthy spouse, and to provide the less wealthy spouse with independent legal counsel, so that the estate planner is not accused of manipulating or assisting in the manipulation of the wealthy spouse by reason of fiduciary duty to the non-wealthy spouse. In most non-community property states, a nonwealthy spouse has an entitlement to inheritance under elective share, courtesy, or dower statutes. Another common question is whether the wealthier spouse is willing to benefit descendants of the less For example, a wealthier spouse having a $20,000,000 net worth and two children and three grandchildren may wish to gift $150,000 a year in trust or outright to the children and grandchildren by having the less wealthy spouse sign a split gift tax return and may be willing to gift $10,000 a year to each of the less wealthy spouse’s children in exchange for such cooperation. THE NOT SO PERFECT FIDUCIARY Commonly, individuals will name a relative, friend, or professional to serve as personal representative and trustee, not realizing the risk that such individual may not do a good job, or might even be untrustworthy and greedy with respect to actions taken. Sometimes, the trustee appointed has relatively little business experience, or not-so-good judgment, or will be misled by a ne’er-do-well friend or advisor. While clients will commonly want to appoint family, friends, or professional advisors who may turn out not to be trustworthy, wise, or even coherent, a planner may provide language under a will or trust which permits one or more of the beneficiaries or a third party to require a change in fiduciary, or the addition of a co-fiduciary, using language such as the following: After my death or incapacity, any one of John Smith, Mary Smith, or Jane Doe may request that a Licensed Trust Company be appointed by the individual trustee or trustees to serve as cotrustee, and any such trust company shall be the ‘‘tie-breaker’’ in the event of a disagreement between one or more of the co-trustees. If the individual trustee or co-trustees do not choose a Licensed Trust Company meeting the definitions of Section 1.09 hereof within 20 days of receipt of a written demand to do so, then the majority of John Smith, Mary Smith, and Jane Doe who are able and willing to participate shall name a Licensed Trust Company or may request that the law firm of ____________________________ name a Licensed Trust Company or a board-certified trust and estates lawyer to serve as such co and tie-breaker trustee. The very fact that an individual trustee may have to select or serve with a Licensed Trust Company or board-certified trust and estate lawyer may be sufficient to convince that individual to do their job properly and to comply with the advice of competent legal counsel. The following language can also be provided: My trustee or trustees shall confer at least annually with the law firm of ___________________ or such board certified trust and estate lawyer or lawyers as they may select, and shall have such law firm or lawyers confirm in writing that they have and continue to be retained to represent the trustee and that to their knowledge the trustee is compliant with applicable law and advice provided in fulfilling all trustee duties. A provision such as the above may be completely ignored unless or until a beneficiary or legal counsel for a beneficiary gives the trustee or trustees’ counsel a ‘‘heads up’’ that reasonable conduct is expected. Many clients are also not aware that trustees in many states can charge a percentage of the value of trust assets, notwithstanding that they actually do very little. Trust language may attempt to reduce or even eliminate the right of a trustee to charge trustee fees, although the enforceability of such a provision will vary from state to state. The following provision may be used to limit the compensation of trustees, or to at least attempt to do so: No individual named as a trustee under this Trust Agreement shall receive more than the greater of $10,000 per year or an hourly rate commensurate with what the individual earns as net compensation for services rendered multiplied by the number of hours reasonably spent by such individual. For example, if the trustee is a business executive who earns $200,000 per year, $200,000 divided by 48 weeks in a year divided by 40 hours per week is $104.17 per hour that the grantor would expect would be a reasonable maximum trustee fee. It is further requested that any and all lawyers, CPAs, or other professionals will charge no more than their normal hourly rate for services rendered so that they do not increase or decrease their personal income as the result of serving as trustee or co-trustee under this Trust Agreement. AMBIGUOUS OR INCONSISTENT WILL OR TRUST PROVISIONS Oftentimes there will be provisions under a will or trust that are inconsistent or ambiguous. This is simply a fact of life. Even the most conscientious and safe estate planning draft-person can make errors, and the English language itself along with the legal aspects thereof can cause issues to arise. It can be advisable to appoint trust protectors who have the power to amend trust provisions or even a scrivener protector who will have the power to make changes to correct clerical errors and to ameliorate ambiguities. The language that is part of the ‘‘Scrivener Protector’’ provision of the author’s normal Revocable Trust Agreement reads as follows: The law firm of ________________________________ has drafted this Trust Agreement and it is expected that the law firm will be available in the event of the grantor’s death or incapacity in order to help to assure that the intentions of the grantor are followed, and shall serve as a trust protector in the event that there is no trust protector currently serving, based upon the terms of Section 6.16 hereof, which will require the appointment of an additional trust protector and having the limitations and powers provided under Section 6.16 hereof apply. It is recognized that in the course of drafting and administering trust agreements there can be ambiguities, inconsistencies, and changes in circumstances that can cause inconvenience, disputes, and hardships for trustees and one or more beneficiaries. The grantor hereby empowers the law firm of ________________________________, or its successor, to make changes to this Trust Agreement by providing written notice confirming such change in order to comport with the grantor’s intentions and to avoid potential uncertainty, litigation, or arbitration. Any such changes will be consistent with a fiduciary duty to follow the grantor’s intentions. Such power granted to the law firm of ________________________________ shall only apply so long as a member of the firm is a Martindale-Hubbell AV-rated and Florida board-certified trust and estate lawyer who approves such action, and the exercise of such power shall be limited as to not cause loss of the federal estate tax marital deduction or the federal estate tax charitable deduction with respect to any transfer to such trust or any trust herein established. Further, no such action may be taken without having written notice of the proposed action provided to each adult beneficiary of the trust, or to the designated representative of any adult beneficiary or beneficiaries who are empowered to waive and receive notifications for them. Further, such power may be overridden by an act of the trust protectors acting under this Trust Agreement, if trust protectors are appointed under this instrument and empowered to make changes, and shall further be subject to the following limitations: Beneficiaries who may want to use any sort of confusion as to verbiage, inconsistency, or otherwise may be appropriately disarmed by reasonable corrections that are consistent with the intention of the grantor and may avoid the need to go to court or give a judge an easy solution to confirm the actions of a responsible scrivener protector or trust protector. CONCLUSION There are many other aspects of trust and estate planning that merit discussion and ameliorative or informative communications and safeguards that an estate planner can suggest and implement. Perhaps the most important aspect of this is to remain vigilant and to have a good checklist and consultative relationships with lawyers who have knowledge in trust and estate litigation and other associated areas. Tax Management Estates, Gifts and Trusts Journal

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 4Using the Florida Irrevocable Community Property Trust to Protect an Elderly Couple from AbuseWritten By: Brock Exline Effective July 1st, married couples can establish trusts having one or more Florida trustees that can qualify to be considered to be “community property” for purposes of receiving a full new step-up in income tax basis to fair market value on the death of either spouse. This will be the primary reason that many married couples living in Florida and elsewhere will establish Florida Community Property Trusts, but there is another good reason for elderly couples who wish to protect their assets from potential predators, including their own children. Lawyers are challenged when representing elderly individuals who may have one or more aggressive or imbalanced children. A big challenge occurs when one or both parents get sick and the aggressive or imbalanced child shows up and moves in with them. When that happens, estate planning documents and intentions can change and the unruly, aggressive, or imbalanced child can end up inheriting all of the assets or spending them contrary to the parent’s wishes, which may leave the parents penniless and/or take assets away from other desired beneficiaries. Florida’s new Community Property Trust Act allows married couples to set up irrevocable community property trusts that must be for their sole benefit, without the requirement to provide notice of the trust, trust accountings, or other information to secondary beneficiaries, which may include their children or other relatives. As used in the Florida Trust Code, the term “beneficiary” under the Florida Law refers to the universe of individuals who have a beneficial interest in a trust, as well as to any person who has a power of appointment over trust property in a capacity other than as trustee. For purposes of determining the beneficiaries of a trust, it is immaterial whether the interest is present or future, vested or contingent, or whether the beneficiary is ascertainable or even living. By contrast, Section 736.0103(19) defines the term “qualified beneficiary” to refer to only a limited subset of all trust beneficiaries. Essentially, the class is narrowed to the living persons who are current beneficiaries, intermediate beneficiaries, and first-line remainder beneficiaries, whether the interest is vested or contingent. The statutory language applicable under Florida Statute Section 736.0103(19) is as follows: “‘Qualified Beneficiary’ means a living beneficiary who, on the date, the beneficiary’s qualification is determined: (a) is a distributee or permissible distributee of trust income or principal; Florida Statute Section 736.0103 further defines the term “Distributee” as a beneficiary who is currently entitled to receive a distribution (emphasis added), and the term “permissible distributee” as a beneficiary who is currently eligible to receive a distribution (emphasis added). The concept of a “Qualified Beneficiary” is important with respect to trust administration because the Florida Trust Code requires that a trustee has a duty to “inform and account” to a trust’s qualified beneficiaries. Beneficiaries who are not qualified beneficiaries are not entitled to the same privileges. For example, assume that Ma and Pa Kettle establish an irrevocable trust to benefit them for their lifetime and to provide future benefits for their children and grandchildren after the death of the survivor of Ma and Pa Kettle. In such a case, Ma and Pa are the current beneficiaries, their children are the intermediate beneficiaries, and their grandchildren are the first-line remainder beneficiaries. As qualified beneficiaries, both Ma and Pa’s living children and living grandchildren are entitled to be reasonably informed of the trust and its administration. Reasonably informing the qualified beneficiaries entails providing accountings, which can be expensive and cumbersome, complete copies of the trust instrument, relevant information about the assets and liabilities of the trust, and providing due notice in the event of a trust modification, among other things. An alternative to providing qualified beneficiaries directly with notice is to appoint a “Designated Representative” in the trust document under Florida Statute Section 736.0306. The Designated Representative can be any individual named in the trust document, other than the trustee. The Designated Representative can be authorized to waive the right to receive accountings, copies of the trust, and other information on behalf of one or more beneficiaries and can represent and bind one or more of the beneficiaries with respect thereto. The Designated Representative has to be willing to assume these responsibilities and understand that beneficiaries may be upset and may sue the Designated Beneficiary. Nevertheless, the Designated Representative is insulated from liability in certain situations under Florida Statute Section 736.0306(4) from a beneficiary whose interest is represented or to anyone claiming through that beneficiary for any actions or omissions to act that are made in good faith by the Designated Representative. The new Florida Community Property Trust Act, which is intended to allow assets to get a step-up in basis on the death of the first dying spouse provides a new opportunity for planners to help elderly or infirm couples protect their assets without being required to give notice to descendants or other qualified beneficiaries. Even though such a trust can be irrevocable the trust language can allow amendments to the trust when approval is received from one or both of the spouses if they are confident in one or more trusted individuals to verify that there is no undue influence or circumstances that would cause an amendment to be problematic. For example, assume Ma and Pa Kettle establish an irrevocable community property trust to benefit them for their lifetime, and to benefit their children and grandchildren after the death of the survivor. Although Ma and Pa’s children and grandchildren would normally be considered qualified beneficiaries, because under a Florida community property trust, Florida Statute Section 736.1504 dictates that only the married couple are considered qualified beneficiaries, the trustee of Ma and Pa Kettle’s irrevocable community property trust owes no duty to reasonably inform the children and grandchildren of the trust administration. As a result, Ma and Pa’s aggressive, unruly, or imbalanced child is left “out of the loop” and may be unable to manipulate his or her way into a larger inheritance. Florida trust experts are aware of another way to have someone eliminated from being a “Qualified Beneficiary” during the lifetime of an individual trust beneficiary. If a beneficiary holds a power to divest an individual who would otherwise be a “qualified beneficiary,” then notice and waiver provided to the holder of the power will be sufficient to satisfy the notice and the accounting requirements. This is provided by Florida Statute Section 736.0302, which specifically states that the holder of a power of appointment may represent and bind persons whose interests, as permissible appointees, takers in default, or otherwise, are subject to the power. Nevertheless, giving Ma or Pa Kettle the right to divest one or more of their descendants from an irrevocable trust can cause a significant danger because one or more unruly descendants may influence one or both spouses to exercise the power of appointment to exclude siblings and other descendants that are not favored by the person exercising the undue influence. Critics of this type of irrevocable trust planning will point out that Ma and Pa Kettle should have the right to change their trust, and their dispositive intentions for as long as they live. This may be accomplished by having the trust agreement name Trust Protectors who may be trusted advisors or close and trustworthy friends of the family who would be able to make changes upon the request of Ma and Pa Kettle, subject to such ground rules as the trust may provide. Another variation of this concept involves giving Ma and Pa Kettle powers of appointment with respect to the trust, but these may be excludable only with the consent of one or more Trust Protectors, who must approve any such exercise of the power of appointment. While the step-up in basis on the first death is the primary reason that most married couples will use Community Property Trusts, the incidental benefit of not having to inform children or other descendants, not having to account to them, and not even being able to make distributions to or for their benefit from the Trust are other advantages that may be very attractive to planners who are worried about difficult situations that often face elderly clients that have forceful or abusive descendants. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersThe 1 Question Every Business Owner Should Ask When Faced With a Tough Decision |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Forbes’ CornerHouse Estate Tax Proposal Requires Immediate ActionSep 16, 2021

Written By: Martin Shenkman The House tax proposal is wide reaching and will have a dramatic impact on estate and related tax planning for high income and wealthy taxpayers …Continue Reading on Forbes

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

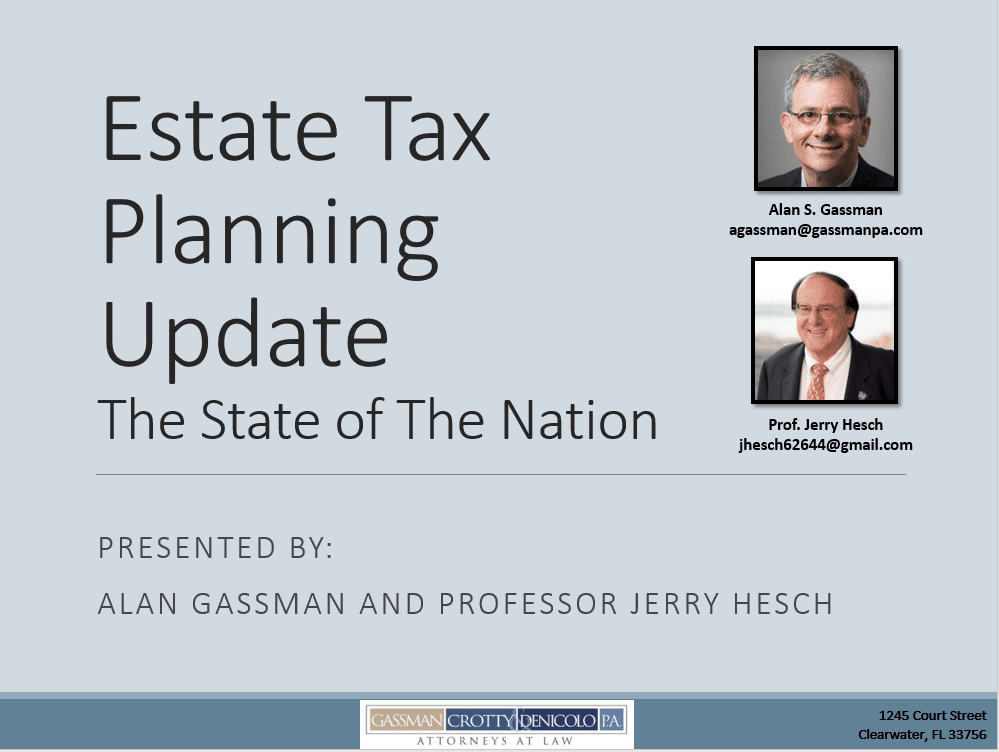

Featured EventsEstate Tax Planning Update – The State of The NationAttendees will receive:

Jerry M. Hesch’s Biography Jerome (“Jerry”) M. Hesch is a tax and estate planning consultant for lawyers throughout the country and is a Special Senior Tax Counsel for Jeffrey M. Verdon Law Group, LLP and Special Senior Tax Counsel for Oshins and Associates, LLC. He is a member of the America College of Trust and Estate Counsel (ACTEC) and an Adjunct Professor at the University of Miami School Law and Florida International University School of Law. An accomplished author, Professor Hesch has published numerous articles, several Tax Management Portfolios, and co-authored a law school casebook on Federal Income Taxation. Please register for Estate Tax Planning Update – The State of The Nation on Sep 25, 2021 11:00 AM EDT by clicking the link below. After registering, you will receive a confirmation email containing information about joining the webinar. This webinar does not qualify for CLE Credit.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Saturday Webinar Series“Toast, Trusts, and Taxes with Alan Gassman and Friends”Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A.

The video recording will be emailed to all registrants approximately 1 hour after the program concludes. This series does not qualify for CLE Credit. Email topic suggestions to Alan Gassman at agassman@gassmanpa.com: Subject line “Saturday Series Topic” SATURDAY SERIES EVENT DETAILS ARE LISTED IN THE TABLE BELOW Click the “Play Recording” links to watch all of the past replays. You can access the PowerPoint slides in the YouTube description located below the YouTube video. Click to Register for all Upcoming Saturday Morning Webinars

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

UPCOMING NATIONAL EVENT |

||||||||||||||||||||||||||||||||||||||||||||||||||||

47th Annual Notre Dame Tax & Estate Planning InstituteSpecial Preview – A Tasting Menu of Planning IdeasCLICK HERE TO WATCH A FREE SNEAK PREVIEW OF THIS UPCOMING EVENT (60 minutes)

(left to right) Jerome Hesch, Esq., Jonathan Blattmachr, Esq., Alan Gassman, Esq., Christopher Denicolo, Esq., Marty Shenkman, Esq., Sandra Glazier, Esq., and Todd Angkatavanich, Esq. TOPICS INCLUDE

DON’T BE LAME – SIGN UP FOR NOTRE DAME! CLICK HERE FOR REGISTRATION INFORMATION

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

UPCOMING NATIONAL EVENT

47th Annual Notre Dame Tax And Estate Planning InstituteOctober 20th – 22nd, 2021 A Virtual Presentation Please join us in ushering in a welcoming announcement of topics and speakers for the 47th Annual Notre Dame Tax & Estate Planning Institute. We are proud to support the Institute, provide speakers this year, and share the attached 1-hour special preview video that can be viewed by clicking HERE. The video features Jerry Hesch, Jonathan Blattmachr, Marty Shenkman, and others discussing planning ideas and topics that are both interesting and useful for tax and estate planning practitioners. In addition, please consider registering for this year’s Notre Dame Tax and Estate Planning Institute by clicking HERE. This year’s topics and speakers are set forth below. Special thanks to Professor Jerry Hesch for all he does as director of the Notre Dame Tax and Estate Planning Institute, and to a great many speakers and exhibitors, and attendees who make this very worthwhile for a very worthy, educational experience. REGISTRATION INFORMATION BELOWWe are writing to share the good news that the 47th Annual Notre Dame Tax & Estate Planning Institute will take place in virtual form on October 21 and 22, 2021. We have lined up an impressive panel of speakers who will as always, address a broad range of topics (including current developments arising from possible legislative developments) that will be of use to you and your clients. Given the ongoing uncertainty regarding COVID-19, we will not be meeting in person in South Bend this year. Instead, we plan to deliver the Institute to you in a virtual format with live, online presentations (including our popular dual-track approach) throughout the day on Thursday, October 21, and Friday, October 22, along with a bonus session on the afternoon of Wednesday, October 20. This virtual format, which proved to be very popular last year, will allow you to participate online in real-time with the speakers, including opportunities for Q&A, and will be structured to qualify for continuing education credit to the extent allowed by the respective accrediting agencies for which there is significant attendee demand. As an added bonus, we plan to record videos of all the sessions and your registration fee will include online access to these recordings for later viewing at your convenience. While we will, again, miss seeing you in person and facilitating the camaraderie that is associated with the Institute, we are pleased to be able to provide you with the information and knowledge that so many of you have come to rely on. We also hope that this virtual format will enable many estate planning professionals, who might not otherwise have had the chance to attend the Institute in person, to engage with and benefit from the Institute this year. Online registration is now available. Please visit the following web address to register: https://law.nd.edu/for-alumni/alumni-resources/tax-and-estate-planning-institute/ We greatly appreciate your past participation in the Notre Dame Tax & Estate Planning Institute, and we look forward to seeing you (virtually) on October 21 and 22, 2021. Jerome M. Hesch Director

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

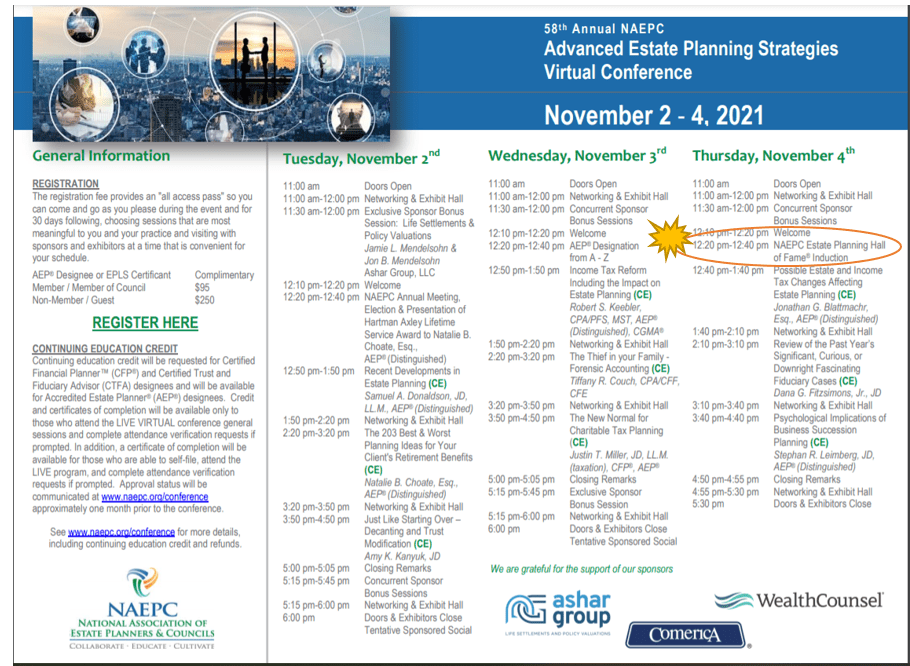

UPCOMING NATIONAL EVENT58th Annual NAEPC Advanced Estate Planning Strategies Virtual ConferenceNovember 2-4, 2021 11:00 AM EDT To attend this event, please click on this link to register:

Continuing education credit will be available only to those who attend the LIVE virtual general sessions.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

More Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Alan Gassman’s YouTube Channel

Visit Alan Gassman’s YouTube Channel for featured webinars and more. https://www.youtube.com/channel/UCTtN3lCa9XzgGeNAHAzWHxQ

This image was originally posted to Flickr by kyonokyonokyono at https://flickr.com/photos/75972766@N02/7479332988. It was reviewed on 19 April 2017 by FlickreviewR and was confirmed to be licensed under the terms of the cc-by-2.0.

Watch this featured YouTube webinar “The SCGRAT, the JEST, and the E Street Shuffle” by clicking HERE.

Watch this featured YouTube webinar “What to Do in View of the Sept. 13th Estate Tax Proposals” by clicking HERE.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Humor

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A |

||||||||||||||||||||||||||||||||||||||||||||||||||||