The Thursday Report – Issue 311

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, September 9th, 2021– Issue 311 –Having trouble viewing this? Use this link

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Table of ContentsArticle 1BEFORE YOUR BUSINESS GOES BANKRUPT By: Alan Gassman Article 2DIRECT PAYMENT OF TUITION By: Alan Gassman Article 3NEW TEXAS ABORTION LAW By: Alan Gassman Article 4PRACTICAL STRATEGIES FOR AVOIDING ESTATE AND TRUST LITIGATION By: Alan Gassman and Wesley Dickson For Finkel’s FollowersFREE UP YOUR TO-DO LIST BY LETTING YOUR TEAM MANAGE THEMSELVES HERE’S HOW By: David Finkel Forbes’ CornerHOW TO BE PART OF THE $5.8 BILLION OF AUTOMATIC FEDERAL STUDENT LOAN FORGIVENESS FOR THE DISABLED By: Alan Gassman Featured EventsMore Upcoming EventsYouTube ChannelHumor

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Before Your Business Goes Bankrupt

By: Alan Gassman I spoke on The CPAs Guide to Bankruptcy and joined a panel on “Planning Strategies for Distressed Businesses” at the annual AICPA ENGAGE Convention in Las Vegas a few weeks ago. Co-Presenter Kenneth DeGraw, CPA, and I discussed the following ten important strategies for CPAs who have business clients who are or may become insolvent: 1. Understand the basics of bankruptcy. Once you file for bankruptcy, nothing is private anymore. Everything is exposed. There is plenty of infrastructure in the bankruptcy world to investigate every case. Moreover, with every bankruptcy can come terrible publicity, high emotional cost, and significant paperwork. While there are notable advantages to declaring bankruptcy (e.g., if you file a Chapter 11 Bankruptcy, you can get out of a lease), it can often be more advantageous to avoid bankruptcy when possible. There are several different ways to file bankruptcy and each alternative offers certain advantages depending on the circumstances of who is filing.

2. Find your client the right attorney or attorneys. You don’t have to file bankruptcy just because you consult an attorney. In fact, attorneys can often be crucial in avoiding bankruptcy. In addition to attorneys, business advisors can often make the potentially complicated bankruptcy as smooth as possible for the debtor or the business. While the process of hiring various goods, bankruptcy attorneys can become expensive, it is unwise to cut corners and settle for inferior attorneys or CPAs. Even if a client just needs a Chapter 7 Bankruptcy, it is a wise practice to direct clients to a competent, Chapter 11 experienced, bankruptcy attorney, to help design the bankruptcy. 3. Plan for insolvency well before the problem happens, both for tax and bankruptcy purposes. An efficient and thoughtful organization of assets, liabilities, and business entities can make a world of difference if insolvency becomes inevitable. For example, consolidating secured debts as unsecured debts can help safeguard secured collateral. The debtor will have to take extra care to ensure that no transferring of assets prior to filing is deemed by a Bankruptcy Court to be a fraudulent transfer to frustrate creditors, as those transfers can be reversed. Any transactions completed by the creditor prior to filing will be scrutinized by a bankruptcy trustee to determine if there has been a fraudulent transfer. All credit transactions that occurred up to six months before the filing will be reviewed, as well as any other sizable purchases for as far back as four years or sometimes longer prior to filing. 4. Do not sign any compromise or extension with the bank because you could potentially sign away the right to the automatic stay. An automatic injunction halts any actions by creditors trying to collect debts. This stay of the collection begins when the original bankruptcy petition is filed. Certain creditors (most commonly secured creditors – such as home mortgage holders) can petition the court for relief from the stay. Bankruptcy settlements will often include clauses that give up the right to an automatic stay. Most loan agreements will include language that says that they are not subject to the automatic stay. While this language is typically unenforceable, it will become enforceable if the debtor client signs something called a forbearance agreement. 5. Be careful when deciding what attorney will handle the bankruptcy. Get your client a personal attorney, not a corporate attorney, to maintain the attorney-client privilege and decide who you are working for. In Chapter 7 Corporate Bankruptcy, there is no attorney-client privilege. On the other hand, if the lawyer your client hires only represents your client individually and does not assist them in making a transfer to avoid other creditors, then the attorney-client privilege is preserved. Advisors should know that when a corporation files a Chapter 7 bankruptcy, the attorney-client privilege belongs to the Chapter 7 trustee. The Trustee can then depose the lawyer who was advising the company and gain access to all of the lawyer’s files. 6. Consider whether you should work under a Kovel letter. Attorney-client privilege just doesn’t exist for CPAs in bankruptcy. While some states will not admit privileged correspondence with CPAs in their respective state courts, this does not apply in a federal court. A Kovel letter is used to provide client confidentiality for complex accounting situations so that the accountant can relay technical issues to the client’s attorney. Consequently, a forensic accountant may want to wait until an attorney is hired, so that all correspondence can be forwarded through the attorney to protect any information under the attorney-client privilege and work product rule. 7. Before the problem, have plenty of friendly debt in place. Loan money to your company, be the biggest creditor and have a lien against its assets to enforce the debt. Setting up a new parent S-corporation and have the operating company owned by the new parent company which then becomes a QSA that is income tax-free under IRC section 368(a)(1)(f). The QSA is able to continue using the taxpayer identification number, name, and the Medicare number of the original entity. The parent company takes over all the tax characteristics of the private entity and now can have a promissory note secured by a security agreement from the original entity. Often, the ability to reorganize assets among subsidiaries and move long-term accounts receivables out of the insolvent entity is enough to deter plaintiff lawyers from rejecting a settlement. 8. Set up a storefront company or a lifeboat company. So if your company has to file bankruptcy, your customers can go to the other company and you won’t have to advertise that you are a debtor in possession, necessarily. Client perception can be vital to maintain operations through a reorganizational bankruptcy. Having a backup company that can seamlessly continue operations in the event of bankruptcy can make the difference in calming the concerns of clients. 9. Keep cars and drivers separate from the company that has the most value. It is common in practice to see a lot of car accidents, which can often end up being extremely costly. Setting up a subsidiary LLC, which then buys all of the company vehicles can help limit any potential accident liability to the subsidiary which owns the vehicles. 10. Make sure to understand how the Doctrine of Successor Liability works. In most states, if following an assignment for the benefit of creditors, if the resulting business is substantially similar to its predecessor company (i.e., same clients, same employees, same location) then the Court has the discretion to extend the Doctrine of Successor Liability so that the creditors may continue to pursue their judgments against the original business from the successor company. To avoid the possibility of the doctrine of successor liability applying to the debtor’s company, a federal bankruptcy court should approve any sale, because pursuant to federal bankruptcy law, the creditors of the debtor company cannot reach the purchaser of a court-approved sale. 11. Be a psychologist or send your client to one.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2Direct Payment of Tuition

By: Alan Gassman QUESTION: What can direct payment of tuition extend to avoid gift tax treatment? SHORT ANSWER: Tuition is limited to “[E]xpenses . . . paid directly to the qualifying educational As discussed below, this would only apply to institutions with brick-and-mortar locations This has been permitted for a martial arts institution, as decided by Revenue Ruling 78-309, By analogy to martial arts institutions, the following would likely apply as “qualifying 1. Music Schools; ANALYSIS: Treas. Reg. § 25.2503-6(b)(2): For purposes of paragraph (b)(1)(i) of this section, a qualifying educational organization is one that normally maintains a regular faculty and curriculum and normally has a regularly enrolled body of pupils or students in attendance at the place where it’s educational activities are regularlycarried on. See section 170(b)(1)(A)(ii) and the regulations thereunder. The unlimited exclusion is permitted for tuition expenses of full-time or part-time students paid directly to the qualifying educational organization providing the education. No unlimited exclusion is permitted for amounts paid for books, supplies, dormitory fees, board, or other similar expenses which do not constitute direct tuition costs. 1 See Treas. Reg. § 25.2503-6(b)(2)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3New Texas Abortion LawDid The Supremes’ Have a Choice?

By: Alan Gassman This article is not an expression of opinion on the new Texas abortion law, but the public deserves to know how this law works and why the Supreme Court did not issue a stay. Senate Bill 8, which took effect September 1st, established a new subsection of the Texas Health and Safety Code. Section 171.204 of the Code prohibits abortions of an unborn child with a “detectable fetal heartbeat.” Some are calling this the “Heartbeat Act.” Section 171.201 defines “fetal heartbeat” to mean “a cardiac activity or the steady and repetitive rhythmic contraction of the fetal heart within the gestational sac.” As such, the new law effectively prohibits abortions after roughly six weeks, since that is generally the period when a fetal heartbeat starts being detectable. Nearly 85 to 90 percent of abortions happen after this six-week window in Texas, making the law a near-complete ban on abortions. The law uses an interesting legal mechanism, essentially delegating enforcement of the prohibition to the Texas citizens. Section 171.208 of the newly added chapter provides that “Any person, other than an officer or employee of a state or local governmental entity in this state, may bring a civil action against any person who…performs or induces an abortion in violation of this subchapter; knowingly engages in conduct that aids or abets the performance or inducement of an abortion, including paying for or reimbursing the costs of an abortion through insurance or otherwise.” In an unsigned 5-4 decision, just a day after the new law took effect, the Supreme Court denied an application for an injunction to block the Texas law. The majority opinion was only one paragraph, stating that the abortion providers challenging the law had not met their burden of making a “strong showing” that their application for an injunction is “likely to succeed on the merits, that it will be irreparably injured absent a stay, that the balance of the equities favors it, and that a stay is consistent with the public interest.” The majority opinion stressed that it was not ruling on the constitutionality of the Texas law and was only ruling on the procedural elements for granting an application for a stay or injunction. The majority further noted that “it is unclear whether the named defendants in this lawsuit can or will seek to enforce the Texas law against the applicants in a manner that might permit our intervention.” The case was doomed to fail from the start; the plaintiffs only named a single judge to the defendant. The Supreme Court does not have the broad sweeping authority to erase a statute from the books. In this case, the Court could only do as much as enter an order against one judge, a judge who had no role in actually writing or enforcing the law. With no government official having the authority to enforce the prohibition, the majority held that there is no one for challengers of the law to sue until private civil actions start arising in the courts. This legislative loophole of expressly barring the government from enforcing the law is the primary reason why the Court was correct to reject the premature challenge. All four of the dissenting justices filed opinions. Justice Sotomayor wrote, “[t]he court has rewarded the state’s effort to delay federal review of a plainly unconstitutional statute, enacted in disregard of the court’s precedents, through procedural entanglements of the state’s own creation.” Forty-eight years ago, in the seminal case of Roe v. Wade, the Supreme Court legalized abortion across the U.S., holding that women have an unfettered constitutional right to an abortion during the first trimester of pregnancy. Since the Roe v. Wade ruling, the Court has weakened that right through upholding parental and spousal notification laws and by permitting enhanced regulation of abortion clinics. A common misconception is that Roe v. Wade is the current state of the law. However, Planned Parenthood v. Casey did away with the trimester approach set out in Roe, and instead looked to “viability,” when a fetus can survive outside of the womb. Casey held that a woman has a right to choose to have an abortion before viability of the fetus without undue interference from the state because prior to viability, the state’s interests are not strong enough to support the prohibition of abortion or the imposition of a substantial obstacle to a woman’s right to elect for the procedure. In short, regulations in the pre-viability period are unconstitutional if they have an undue burden on the woman’s choice to control her own body. Senate Bill 8 is unlikely to pass constitutional muster, but the Supreme Court must wait to properly hear the case. The Supreme Court’s decision not to grant the stay leaves open the option for abortion providers to challenge the Texas law in other ways in the future. The Texas law will likely make its way back to the Supreme Court. In the meantime, the new law will have a devastating effect on women in Texas. In the 50 years since Roe was decided, there has never been a Court majority as predisposed to ruling against abortion rights as the current one. All three of former President Donald Trump’s appointees voted against blocking the Texas law. One of the court’s six conservatives, Chief Justice John Roberts, joined the three dissenting liberal justices.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 4Practical Strategies for Avoiding Estate and Trust Litigation:Proactive Thinking and Communications Can Make a Big Difference

By Alan Gassman and Wesley Dickson It is no secret that estate and trust litigation is a thriving industry, which takes millions of dollars away from deserving beneficiaries and distorts estate plans. While the estate planning community, and estate planning lawyers in particular, tends to be straightforward, well-organized, and generally uniform in how estates and trusts are planned and administered, the intersection of inheritance vehicles, personalities and family workings, and a common lack of careful advanced planning can cause issues. This coupled with the American court system, results in a good many lawsuits, and also unpleasant disputes that may be resolved short of litigation or by arbitration, which can cause great harm to beneficiaries by reducing what is available, delaying or causing loss of educational opportunities, and causing families to not get along, or even to engage in active financial and interpersonal war as the result of circumstances that are commonly beyond anyone’s control. Along with this comes the increasing frequency of elderly or infirm individuals being taken advantage of financially by family members, friends, nursing and other professionals, notwithstanding laws that make it a jailable felony to take financial advantage of an elderly or infirm person in most states, although it typically requires a “theft” to trigger such statutes. The fact that almost all metropolitan, police departments, and sheriff departments have entire departments, or at least one dedicated investigator, to handle elderly abuse provides all of the evidence needed that this is commonly occurring. WHAT IS AN ESTATE PLANNER TO DO? If you would like to find out what estate planners should do, then check out the full version of this article when it is released in the September issue of Bloomberg’s Estates, Gifts and Trusts Journal TM. For more information, visit bloombergindustry.com. Stay tuned for the next Thursday Report in 2 weeks for the full article!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersFree Up Your To-Do List by Letting Your Team Manage ThemselvesHere’s How |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Forbes’ CornerHow To Be Part Of The $5.8 Billion Of Automatic Federal Student Loan Forgiveness For The DisabledAug 19, 2021

By: Alan Gassman Financial advisors and borrowers will have to get busy if they wish to take advantage of the most recent automatic student loan forgiveness initiative for individuals receiving Social Security disability payments… Continue Reading on Forbes

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

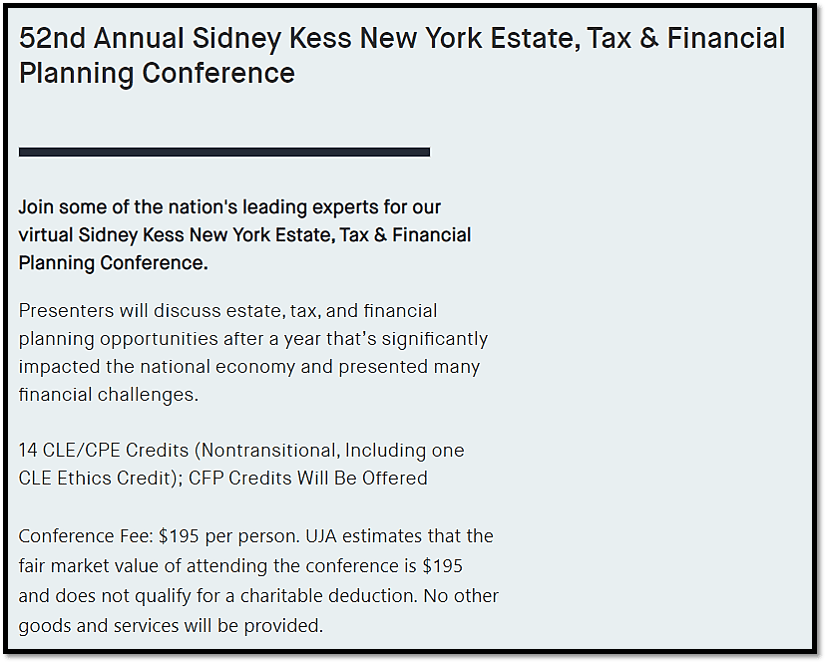

Featured EventsFREE INFORMATIONAL WEBINAR FROM OUR FIRM “Estate Tax Planning – Greatest Hits”A Review (Part 2) And How to Strategize for Possibly Imminent Tax Law ChangesSaturday, September 11th 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, Esq. and Brandon Ketron, Esq. Please register for Greatest Hits – A Review (Part 2) And How to Strategize for Possibly Imminent Tax Law Changes on Sep 11, 2021, 11:00 AM EDT at: https://attendee.gotowebinar.com/register/9185668001128932363 After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 1 hour after the program concludes, the video recording and PowerPoint presentation will be emailed to all who register. This program does not qualify for CLE Credit. Please email your questions and comments to agassman@gassmanpa.com.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

DID YOU MISS ALAN GASSMAN’S“GREATEST HITS (PART 1)”?

Don’t Worry! You can watch the recording of “Greatest Hits – A Review (Part 1)” by clicking this link: https://www.youtube.com/watch?v=J9g7laEDrhA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

LEARN MORE ABOUT ALAN GASSMAN’S SATURDAY MORNING ESTATE PLANNING SERIES Please consider your Saturday mornings booked for the foreseeable future…

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

“Toast, Trusts, and Taxes with Alan Gassman and Friends”Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A!

The video recording will be emailed to all registrants approximately 1 hour after the program concludes. This series does not qualify for CLE Credit. Email topic suggestions to Alan Gassman at agassman@gassmanpa.com: Subject line “Saturday Series Topic”

SATURDAY SERIES EVENT DETAILS ARE LISTED IN THE TABLE BELOW Click the “Play Recording” links to watch all of the past replays. You can access the PowerPoint slides in the YouTube description located below the YouTube video. Click to Register for all Upcoming Saturday Morning Webinars

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

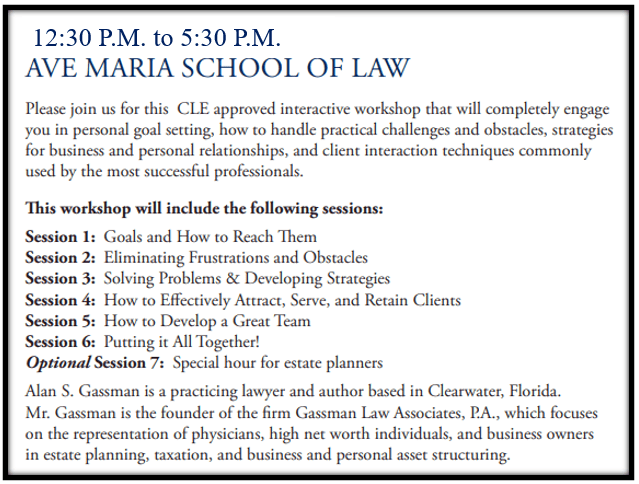

AVE MARIA SCHOOL OF LAWPROFESSIONAL ACCELERATION WORKSHOPCLE ACCREDITATION: 5.0 ETHICS CREDITS

CLICK HERE FOR MORE INFORMATION ABOUT THIS PROFESSIONAL ACCELERATION WORKSHOP SEMINAR

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

UPCOMING NATIONAL EVENT

47th Annual Notre Dame Tax And Estate Planning InstituteOctober 20th – 22nd, 2021 A Virtual Presentation Please join us in ushering in a welcoming announcement of topics and speakers for the 47th Annual Notre Dame Tax & Estate Planning Institute. We are proud to support the Institute, provide speakers this year, and share the attached 1-hour special preview video that can be viewed by clicking HERE. The video features Jerry Hesch, Jonathan Blattmachr, Marty Shenkman, and others discussing planning ideas and topics that are both interesting and useful for tax and estate planning practitioners. In addition, please consider registering for this year’s Notre Dame Tax and Estate Planning Institute by clicking HERE. This year’s topics and speakers are set forth below. Special thanks to Professor Jerry Hesch for all he does as director of the Notre Dame Tax and Estate Planning Institute, and to a great many speakers and exhibitors, and attendees who make this very worthwhile for a very worthy, educational experience.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

47th Annual Notre Dame Tax & Estate Planning Institute Special Preview – A Tasting Menu of Planning IdeasCLICK HERE TO WATCH A FREE SNEAK PREVIEW OF THIS UPCOMING EVENT (60 minutes)

(left to right) Jerome Hesch, Esq., Jonathan Blattmachr, Esq., Alan Gassman, Esq., Christopher Denicolo, Esq., Marty Shenkman, Esq., Sandra Glazier, Esq., and Todd Angkatavanich, Esq. TOPICS INCLUDE

DON’T BE LAME – SIGN UP FOR NOTRE DAME! CLICK HERE FOR REGISTRATION INFORMATION

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

We are writing to share the good news that the 47th Annual Notre Dame Tax & Estate Planning Institute will take place in virtual form on October 21 and 22, 2021. We have lined up an impressive panel of speakers who will as always, address a broad range of topics (including current developments arising from possible legislative developments) that will be of use to you and your clients. Given the ongoing uncertainty regarding COVID-19, we will not be meeting in person in South Bend this year. Instead, we plan to deliver the Institute to you in a virtual format with live, online presentations (including our popular dual-track approach) throughout the day on Thursday, October 21, and Friday, October 22, along with a bonus session on the afternoon of Wednesday, October 20. This virtual format, which proved to be very popular last year, will allow you to participate online in real-time with the speakers, including opportunities for Q&A, and will be structured to qualify for continuing education credit to the extent allowed by the respective accrediting agencies for which there is significant attendee demand. As an added bonus, we plan to record videos of all the sessions and your registration fee will include online access to these recordings for later viewing at your convenience. While we will, again, miss seeing you in person and facilitating the camaraderie that is associated with the Institute, we are pleased to be able to provide you with the information and knowledge that so many of you have come to rely on. We also hope that this virtual format will enable many estate planning professionals, who might not otherwise have had the chance to attend the Institute in person, to engage with and benefit from the Institute this year. Online registration is now available. Please visit the following web address to register: https://law.nd.edu/for-alumni/alumni-resources/tax-and-estate-planning-institute/ We greatly appreciate your past participation in the Notre Dame Tax & Estate Planning Institute, and we look forward to seeing you (virtually) on October 21 and 22, 2021. Jerome M. Hesch Director

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

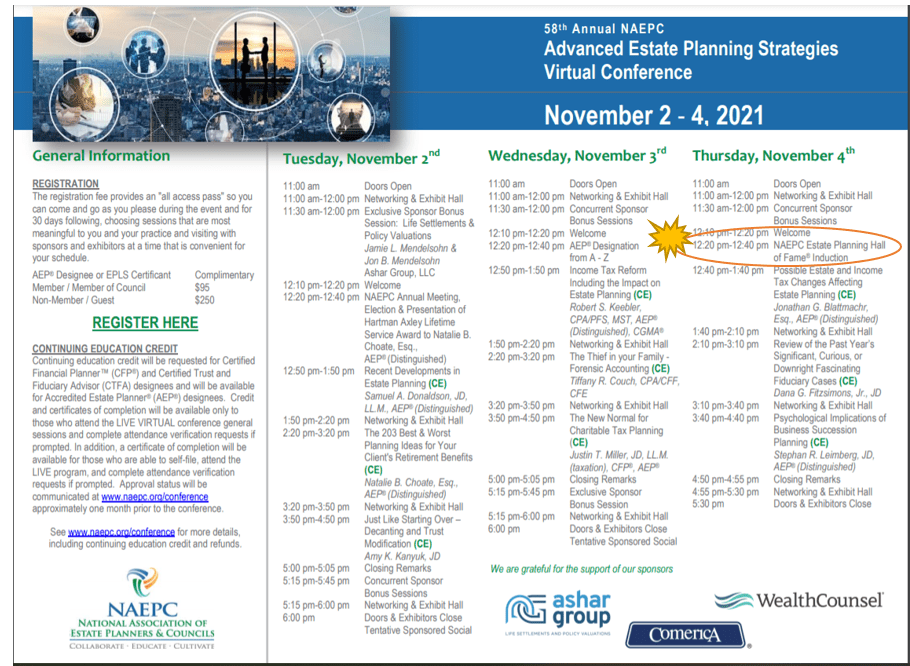

UPCOMING NATIONAL EVENT58th Annual NAEPC Advanced Estate Planning Strategies Virtual ConferenceNovember 2-4, 2021 11:00 AM EDT To attend this event, please click on this link to register:

Continuing education credit will be available only to those who attend the LIVE virtual general sessions.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

More Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Alan Gassman’s YouTube ChannelVisit Alan Gassman’s YouTube Channel for featured webinars and more. Did you miss a past webinar event? Don’t worry! Watch the webinar recordings on Alan Gassman’s YouTube Library for free. One of our most recent popular recordings on YouTube called “PPP and Employee Retention Credit (ERC) Update” has gotten a lot of attention recently. Click this link to access the recording: https://youtu.be/EUK5PhOV_20. FORBES PPP and ERC Articles By: Alan Gassman and Brandon Ketron New ERC Rules Beyond Family Ownership Issues, And What To Do If You Got The Credit And The Owner Has A Relative

Borrower Friendly PPP Loan Forgiveness Regulatory Changes Provided By The New SBA Regulation

Newly Issued Employee Retention Credit Guidance Punishes Owner Employees If They Have Living Family Members

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

EMPLOYEE RETENTION CREDIT GUIDE EBOOK

Already purchased this eBook? You can download the updated copy using the support tab on the LISI Upcoming Webinars Page or download again using the same link you were sent with your initial order. The link address is the same and now delivers the updated eBook PDF. Questions? Please email: webinaradmin@leimbergservices.com

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Humor

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200

|

||||||||||||||||||||||||||||||||||||||||||||||||||||