The New Year Report – Issue 296

Happy New Years From A Puppet

The slides can be downloaded here.

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, December 31, 2020 – Issue 296

Having trouble viewing this? Use this link

Stimulus Media Corner

Stimulus Checks For Those Earning More Than $75,000/$150,000 – How It Works

PPP And EIDL Loan Advances And Changes Under New Act

Alan Gassman On CBS News 46 Atlanta Discussing Stimulus Checks

Happy Thursday from Kristen Sweeney and The New Year Report

Regulations Take SALT Out of Taxpayer Wounds for State and Local Taxes Paid by S Corporations and C Corporations

Upcoming Events

From A Reader

For Finkel’s Followers

Humor

Stimulus Checks For Those Earning More Than $75,000/$150,000 – How It Works

A note to readers: This article was originally posted on December 28th but was updated on December 31st to reflect a better understanding of how credits for dependent children would be affected by reductions due to AGI limitations.

The Economic Impact Payments, or stimulus checks as they’ve come to be known as, were one of the most hotly debated aspects of the COVID-19 relief package Congress agreed to on the evening of December 20th.

When the CARES Act was passed back in March, qualifying individuals received $1,200 checks. That amount is down to $600 under the new Coronavirus Response and Relief Supplemental Appropriations Act. Numerous public officials have expressed their disappointment with the considerably lower amount of direct relief that will find its way into Americans’ hands…Continue reading on Forbes

PPP And EIDL Loan Advances And Changes Under New Act

Hundreds of thousands of small businesses and millions of people have been waiting for a second round of Paycheck Protection Program (“PPP”) loans to keep businesses and professionals operational. The new law will help many of these individuals and businesses, but not all.

This proposed bill is being enacted to correct a number of problems that PPP borrowers have had, and also opens the door to new opportunities for borrowers who were not treated as well under the previous program…Continue reading on Forbes

Alan Gassman On CBS News 46 Atlanta Discussing Stimulus Checks

Happy Thursday from Kristen Sweeney and The New Year Report

You might never guess from the bright Florida sun,

But 2020’s soon over, finished, and done.

Its sendoff had whistles and confetti rain

And beautiful flutes of bubbly champagne.

We watched the ball drop, way up in Times Square,

And we thought, “It’s so crowded; I’m glad I’m not there!”

Then we all yelled and shouted at 11:59

When they said, “Let’s open one more bottle of wine.”

If you woke up this morning with red bloodshot eyes,

Just have a mimosa, your headache disguise.

You might watch football all day on TV

Or maybe it’s time to take down the tree.

It might be this Thursday you find some solutions

To help follow through on this year’s resolutions.

Take time to be grateful for all that you’ve got.

The sunshine is warm or the fireplace hot.

You might write a goal, a thing or two,

That in this year you would like to do.

You might join the gym or go on a diet.

But today’s a family day – wait for tomorrow to try it.

You might pass the Bar or buy a new car,

Whatever you choose, you’re sure to go far.

Before the new habit you were going to abort,

Don’t forget to share your Thursday Report.

Every day is special and the only day you are in,

But Thursdays are the best when you are Thursday Report’n.

Stay safe and responsible, but make sure to have fun,

Here’s to the first Thursday Report of 2021!

Regulations Take SALT Out of Taxpayer Wounds for State and Local Taxes Paid by S Corporations and C Corporations

Alan Gassman, Brandon Ketron & Alexander Sorley

EXECUTIVE SUMMARY:

The Tax Cuts and Jobs Act (“TCJA”) was passed on December 22, 2017, and within this legislation was the addition of 26 U.S.C. Section 164(b)(6). Section 164(b)(6) implemented the State and Local Tax (“SALT”) limitation that provided, in short, a maximum of $10,000 in deductions for state and local tax credits for taxpayers who choose to itemize their deductions.

The IRS has since issued Revenue Procedure 2019-12 and Notice 2020- 75 to clarify confusion regarding the SALT limitation. Advisors should be cognizant of these rules to ensure that their clients do not turn into SALT, like Lot’s wife, when filing deductions. Further comments and analysis regarding these documents are provided below.

COMMENT:

The State and Local Tax (“SALT”) limitation provides that a taxpayer cannot deduct more than $10,000 ($5,000 for an individual who is married and filing a separate return) of their state and local tax credits if they choose to itemize their deductions. The Tax Cuts and Jobs Act (“TCJA”) added the SALT deduction in 26 U.S.C. Section 164(b)(6).

The SALT deduction in 26 U.S. Code § 164(b)(6) states as follows:

(6)Limitation on individual deductions for taxable years 2018 through 2025

In the case of an individual and a taxable year beginning after December 31, 2017, and before January 1, 2026—

-

Foreign real property taxes shall not be taken into account under subsection (a)(1), and

-

The aggregate amount of taxes taken into account under paragraphs (1), (2), and (3) of subsection (a) and paragraph (5) of this subsection for any taxable year shall not exceed $10,000 ($5,000 in the case of a married individual filing a separate return).

The preceding sentence shall not apply to any foreign taxes described in subsection (a)(3) or to any taxes described in paragraph (1) and (2) of subsection (a) which are paid or accrued in carrying on a trade or business or an activity described in section 212. For purposes of subparagraph (B), an amount paid in a taxable year beginning before January 1, 2018, with respect to a State or local income tax imposed for a taxable year beginning after December 31, 2017, shall be treated as paid on the last day of the taxable year for which such tax is so imposed.

Many taxpayers attempted to work around this rule by donating to a charity in exchange for state and local tax credits. The IRS then stepped in and told taxpayers that this was not allowed on an individual basis.

A number of states attempted to help out taxpayers by allowing corporations, partnerships, and pass through entities to make a donation to a charitable organization and receive a state local tax credit in return for the payment. The IRS’s $10,000 state local tax limitation was never meant to apply to state local taxes imposed on businesses and business income, but they allowed business to do this and receive the state tax credit and deduction as an ordinary necessary business expense under Section 162.

Rev. Proc. 2019-12 was released on December 28, 2018 and discussed the issues noted above. This Revenue Procedure announced safe harbors under Section 162 for C corporations and specified pass through entities.

The safe harbor provided for C corporations is as follows:

If a C corporation makes a payment to or for the use of an organization described in section 170(c) and receives or expects to receive a tax credit that reduces a state or local tax imposed on the C corporation in return for such payment, the C corporation may treat such payment as meeting the requirements of an ordinary and necessary business expense for purposes of section 162(a) to the extent of the credit received or expected to be received.

Rev. Proc. 2019-12 also listed two examples of this safe harbor. Example 1 is stated as follows:

A, a C corporation engaged in a trade or business, makes a payment of $1,000 to an organization described in section 170(c). In return for the payment, A receives or expects to receive a dollar-for-dollar state tax credit to be applied to A’s state corporate income tax liability. Under section 3 of this revenue procedure, A may treat the $1,000 payment as meeting the requirements of an ordinary and necessary business expense under section 162.

Rev. Proc. 2019-12 provides a safe harbor for specified pass through entities. For purposes of this safe harbor, a specified pass through entity must meet each of the following requirements:

-

The entity is a business entity other than a C corporation that is regarded for all federal income tax purposes as separate from its owners under section 301.7701-3;

-

The entity operates a trade or business within the meaning of section 162;

-

The entity is subject to a state or local tax incurred in carrying on its trade or business that is imposed directly on the entity; and

-

In return for a payment to an organization described in section 170(c), the entity receives or expects to receive a state or local tax credit that the entity applies or expects to apply to offset a state or local tax described in section 4.02(3) of this revenue procedure other than a state or local income tax.

If the specified pass through entity meets the requirements listed above, then it is eligible for the safe harbor. The safe harbor for a specified pass through entity is as follows:

If a specified pass through entity described in section 4.02 of this revenue procedure makes a payment to or for the use of an organization described in section 170(c) and receives or expects to receive a tax credit described in section 4.02(4) of this revenue procedure that the entity applies or expects to apply to offset a state or local tax described in section 4.02(3) of this revenue procedure other than a state or local income tax, the specified pass through entity may treat such payment as meeting the requirements of an ordinary and necessary business expense for purposes of section 162(a) to the extent of the credit received or expected to be received.

An example of the safe harbor for a specified pass through entity is provided in Rev. Proc. 2019-12 and is stated as follows:

P is a limited liability company (LLC) classified as a partnership for federal income tax purposes under section 301.7701-3 and is owned by individuals A and B. P is engaged in a trade or business within the meaning of section 162 and makes a payment of $1,000 to an organization described in section 170(c). In return for the payment, P receives or expects to receive a dollar-for-dollar state tax credit to be applied to P’s state excise tax liability incurred by P in carrying on its trade or business. Under applicable state law, the state’s excise tax is imposed at the entity level (not the owner level). Under section 4 of this revenue procedure, P may treat the $1,000 payment as meeting the requirements of an ordinary and necessary business expense under section 162.

Notice 2020-75

States began getting more creative and allowed businesses to pay the state directly for the state and local taxes, and pay those payments at an entity level. The IRS accepted this in Notice 2020-75 which was issued on November 9, 2020.

IRS Notice 2020-75 discusses the result of the implementation of Section 164(b)(6). A number of States and local jurisdictions have enacted tax laws that “impose either a mandatory or elective entity-level income tax on partnerships and S corporations that do business in the jurisdiction or have income derived from or connected with sources within the jurisdiction.”i Some jurisdictions have also included an owner-level tax benefit with full or partial credit, deductions, or exclusions.

IRS Notice 2020-75 defines the term “Specified Income Tax Payment” as, “any amount paid by a partnership or an S corporation to a State, a political subdivision of a State, or the District of Columbia (Domestic Jurisdiction) to satisfy its liability for income taxes imposed by the Domestic Jurisdiction on the partnership or the S corporation.”

For partnership and S corporations that made Specified Income Tax Payments, the partnership or S corporation may deduct the payment. IRS Notice 2020-75 continues by stating as follows:

Any Specified Income Tax Payment made by a partnership or an S corporation during a taxable year does not constitute an item of deduction that a partner or an S corporation shareholder takes into account separately under section 702 or section 1366 in determining the partner’s or S corporation shareholder’s own Federal income tax liability for the taxable year. Instead, Specified Income Tax Payments will be reflected in a partner’s or an S corporation shareholder’s distributive or pro-rata share of non-separately stated income or loss reported on a Schedule K-1 (or similar form).

IRS Notice 2020-75 applies to Specified Income Tax Payments “made on or after November 9, 2020.” IRS Notice 2020-75 applies to Specified Income Tax Payments “made on or after November 9, 2020.” An example of how this works is a partnership or S-Corporation that pays a 6% state income tax on the partnership’s income by making the payment directly from the entity to the state . This payment will not be subject to the SALT limitations.

Conclusion

As advisors provide guidance regarding the SALT limitation, remember to take life with a grain of SALT, plus a slice of lemon, and a shot of tequila. We will continue to keep readers informed as more information is provided in future IRS statements. We were going to end this article with a SALT joke, but Na, people will likely not get it.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

CITE AS:

LISI Income Tax Planning Newsletter #208 (December 23, 2020) at http://www.leimbergservices.com Copyright 2020, Leimberg Information Services, Inc (LISI). All rights reserved. Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

i IRS Notice 2020-75

UPCOMING EVENTS

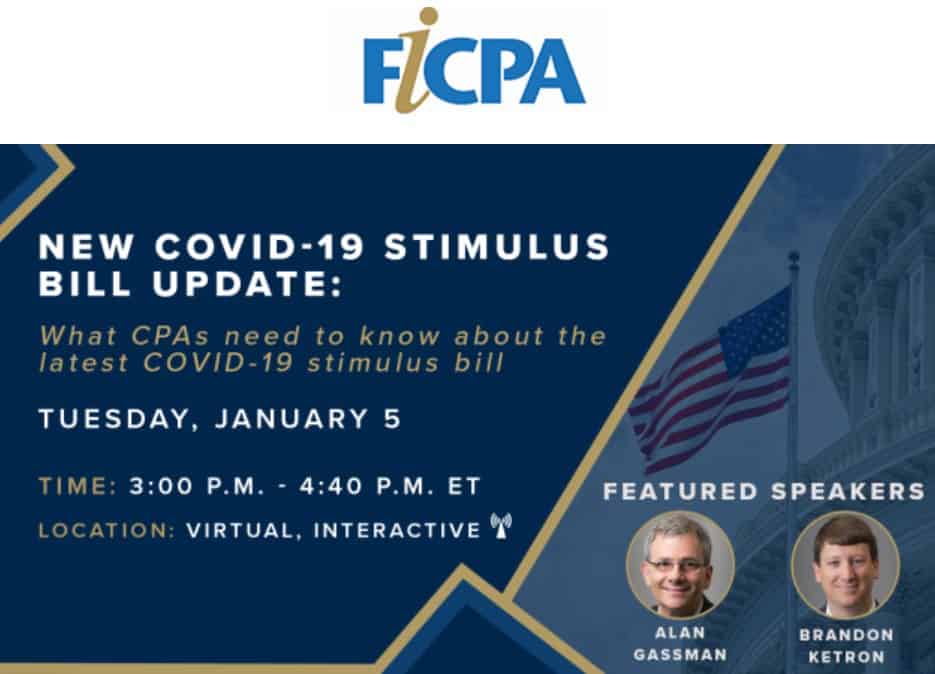

New COVID-19 Stimulus Bill Update: What CPAs Need to Know

With the $900 billion coronavirus economic relief package now signed into law, tax preparers need to know how to navigate this new legislation.

Join us for a virtual Webinar from 3-4:40 p.m. ET on Jan. 5, as Alan Glassman and Brendon Ketron walk you through everything you need to know about the latest round of COVID relief. Main topics include:

- “Second Draw” PPP funding, with new rules and limitations

- PPP expense deductibility

- Simplified PPP loan forgiveness

- $600 stimulus payments

- Extended and expanded tax credits

- And a host of provisions related to emergency rental assistance, health care, transportation, agriculture, nutrition programs, broadband access and more.

The course will prepare you to advise your clients as they deal with the continued financial ramifications of COVID-19.

Head to FICPA.org, learn more and register for this can’t-miss Webinar!

| When | Who | What | How |

|---|---|---|---|

| Thursday, December 31, 2020 | Free webinar from our firm |

Alan Gassman and Brandon Ketron present: New Stimulus Bill Explained from 5:30 to 6:05 PM EST |

Register |

| Tuesday, January 5, 2021 | FICPA |

Alan Gassman and Brandon Ketron present: What CPAs need to know about the Latest COVID-19 Stimulus Bill from 3 to 4:40 PM EST |

Register |

| Tuesday, January 5, 2021 | CPA Academy |

Alan Gassman, Jerry Hesch and Brandon Ketron present: CRUT Planning from 5:30 to 6:30 PM EST |

Register |

| Monday, January 11, 2021 | FICPA |

Alan Gassman and Brandon Ketron present: What CPAs need to know about the Latest COVID-19 Stimulus Bill from 3 to 4:40 PM EST |

Register |

| Tuesday, January 12, 2021 | CPA Academy |

Alan Gassman, Jerry Hesch, Michael Lehmann and Brandon Ketron present: CLAT Planning from 5:30 to 6:30 PM EST |

Register |

| Tuesday, January 19, 2021 | CPA Academy |

Alan Gassman, Jerry Hesch, Michael Lehmann and Brandon Ketron present: Charitable Planning Series Finale – Putting It All Together With Real Life Examples from 5:30 to 6:30 PM EST |

Register |

| Friday, January 22, 2021 | Collier County Bar Association |

Alan Gassman presents: An Estate Tax Planning Tune Up from 11 AM to 12 PM EST |

Register |

| Friday, January 29, 2021 | Florida Bar Health Law Section: Representing the Physician |

Alan Gassman presents: Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications |

Coming soon |

| Wednesday, February 3, 2021 | CPA Academy |

Alan Gassman presents: Establishing 501(c)(3) Organizations and the Form 1023 from 5:30 to 6:30 PM |

Coming soon |

| Wednesday, February 10, 2021 | CPA Academy |

Alan Gassman presents: The Creditor Protection Conversation – What CPAs Can Explain to Their Clients (and Themselves) to Safeguard Wealth and Insulate from Potential Creditor Catastrophe from 5:30 to 6:30 PM |

Coming soon |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman: Introduces speakers and listens carefully |

Register |

| Wednesday, February 17, 2021 | CPA Academy |

Alan Gassman presents: How Asset Protection Trusts Work, and When They Won’t Work – Pros, Cons and Related Going Ons from 5:30 to 6:30 PM |

Coming soon |

| Tuesday, February 23, 2021 | Estate Planning Council of Northern New Jersey |

Alan Gassman presents: WHAT YOUR BEST CLIENTS NEED TO KNOW ABOUT FLORIDA LAW AND PLANNING from 4:30 to 5:30 PM EST |

Register |

| Saturday, February 27, 2021 | MOTE Vascular Surgeon Conference |

Alan Gassman presents: Managing Your Money: How to Save It, Manage It and Protect It from 1:15 to 2 PM EST |

Coming soon |

| Friday, March 26, 2021 | Florida Bar: Tax Section |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming soon |

| Thursday, May 13, 2021 | FICPA-FSU Spring Accounting Conference |

Alan Gassman presents: Topic to be determined |

Coming soon |

| Friday, May 21, 2021 | Michigan ICLE Annual Probate & Estate Planning Institute |

Alan Gassman presents: Prebankruptcy and Bankruptcy Avoidance Strategies for Challenging Situations from 11:15 AM to 12 PM CT |

Coming soon |

| Thursday, June 10, 2021 | AICPA & CIMA ENGAGE 2021 in Las Vegas, NV |

Alan Gassman and Ken DeGraw present: Pre-Bankruptcy and Creditor Planning During the COVID-19 Pandemic from 3 to 3:50 PM PT |

Register |

| Thursday, November 4, 2021 | Estate Planning Council of Birmingham |

Alan Gassman presents: Hot Topics In Estate Tax And Creditor Protection from 8 to 10 AM CT |

Coming soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

From A Reader

Alan –

Thank you for all the information you have provided us “PPP Enthusiasts” as you like to call us. Your emails and webinars were so helpful. Those were really dark days for the first months of the pandemic, and I spent many sleepless nights reading and watching videos about the PPP. The Diocese of Arlington provided us with a spreadsheet tool (very similar to the one Kevin used) but not a lot of additional guidance. Your webinars and emails were invaluable in helping me through the forgiveness process. Getting the loan was easy, but making sure that it was forgiven caused a tremendous amount of stress. As a school, our payroll drops off significantly in the summer and I was desperately trying to find a way to use the 8-week period. With your help, our loan was forgiven in full.

Please know you’ve helped me and countless others during a difficult time. I wish you all a wonderful holiday season. If I could, I’d move you to the front of the queue for the vaccine.

Take care!

Kathy Whetzel

Business Manager

The Top 3 Things You Should Have A Recruiter Help With (and What You Can Do Yourself)

What’s It’s Really Like to Work With A Hiring Recruiter

David Finkel

We have talked a lot about hiring and finding good prospects lately and the topic has resonated with quite a few of you. We are all looking for ways to tap into the talent pool and find good, quality prospects.

Today, I wanted to go into a little more depth about what it’s like to work with a talent recruiter and how you can best leverage their skills along the way. As a business coach for the past 25 years, I have helped thousands of business owners with this process and do it for myself in my own coaching business.

You Can Do It Piecemeal

When you think of hiring a recruiter, many business owners think that a recruiter will handle everything from start to finish and hand you over the perfect candidate within a set period of time. And for some, that is the reality. But for a lot of business owners, myself included, it is a cooperative effort between the recruiter and your own team.

You can have the recruiter:

- Help you gather together a candidate pool

- Screen candidates that you already have in your pipeline

- Schedule interviews

- Etc.

The key is to find what works for you, your budget and your skillset.

Recruiter Strengths and Weaknesses

When planning out your hiring campaign, it’s important to look at the strengths and weaknesses that recruiters bring to the table. They generally possess three things that most business owners lack in varying degrees – time, tools and expertise.

Time: Hiring campaigns are time-sensitive and you want to respond to candidates in a timely manner to prevent them from taking other job opportunities along the way. As a business owner, you may not have ten to twenty hours a week to dedicate to a hiring campaign. But a good recruiter does. The one tip I will share here is that even if you hand over pieces to a recruiter, you will need to make the process a top priority and communicate with your recruiter in a timely manner. The faster you are to respond to their questions, the faster they can get back with your prospective job candidates.

Tools: A recruiter will have access to the highest level of LinkedIn, have access to software for candidate screening and filtering, and have access to sources that you most likely do not. They have the technology and tools to help weed through a large candidate pool to find the ones worth interviewing. The process will go much smoother with a recruiter than having someone on your team weed through thousands of emails in their inbox daily.

Expertise: “David, I just let my HR manager do the hiring.” Most HR professionals do not have the expertise to recruit candidates, and they usually don’t enjoy the process. It’s a completely different skillset and job and you are limiting your chances of finding a good quality hire by leaving this task in the hands of someone who isn’t trained to do this properly. Now, they can certainly be used during the interview process, but for the initial recruitment phase, a recruiter is likely a better fit.

How do you best leverage a recruiter for your own hiring? Have you given it a try yet?

Humor

Gassman, Denicolo & Ketron, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200