The Thursday Report – 9.1.16

Boost Productivity By Not Opening This Thursday Report

Cutting Corners Can be Catastrophic for a Florida Medical “Clinic” – Non-Physician Ownership Alert – Allstate v. Vizcay

Can You Buy a 529 Plan for Yourself?

1202 Things to Consider When Setting Up a Related Business Servicing Company – Part 4

Richard Connolly’s World: Who Gets the Family Bible and Coca-Cola Stock?

Thoughtful Corner: Trying to Reason with the Hurricane Season – Understanding the National Hurricane Center Website and the Cone of Possibility

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Success is a terrible thing and a wonderful thing. If you can enjoy it, it’s wonderful. If it starts eating away at you, and they’re waiting for more from me, or what can I do to top this, then you’re in trouble. Just do what you love. That’s all I want to do.”

– Gene Wilder

Gene Wilder was born Jerome Silberman in 1933. He adopted the name Gene Wilder, inspired by the Thomas Wolfe character Eugene Gant and Thornton Wilder, at age 26 and went on to be a stage and screen comic actor, screenwriter, film director, and author. Wilder is best known for his roles in Young Frankenstein, which he co-wrote with Mel Brooks, Blazing Saddles, and Willy Wonka & the Chocolate Factory.

Wilder married Saturday Night Live actress Gilda Radner in 1984, and he had this to say about her: “I’m not so funny. Gilda was funny. I’m funny on camera, sometimes. In life, once in a while. But she was funny. She spent more time worrying about being liked than anything else.” Gene and Gilda illustrated the Gus Stavros quote, “If your spouse isn’t your best friend, then something’s wrong.”

Following Gilda’s death from ovarian cancer in 1989, Wilder became active in promoting cancer awareness and treatment, founding the Gilda Radner Ovarian Cancer Detection Center in Los Angeles. Wilder’s last acting credit came in 2003, after which he turned his attention to writing. The world sadly lost Wilder this week at age 83. A collection of his films and books can be viewed by clicking here.

Cutting Corners Can be Catastrophic for a Florida Medical “Clinic” – Non-Physician Ownership Alert – Allstate v. Vizcay

by Jeanne Helton and Lester Perling

Jeanne Helton is a shareholder and an attorney with Smit Hulsey & Busey. Her practice focuses on the representation of health providers, including health systems, physicians, insurance entities, medical suppliers, ambulatory surgery centers, and others. She earned her J.D. from the University of Florida and has been recognized by Best Lawyers in America in the area of Health Care Law. Most importantly, she is a dedicated reader of the Thursday Report and sometimes admits to laughing at its humor.

We thank Jeanne Helton for offering to provide the following important summary that was co-authored by Professor Lester Perling Von Duck.

Clinic with Technical Defaults and its Medical Director Could be Required to Repay Insurance Carriers for Amounts Received During Non-Compliance Period

– 11th Circuit Court of Appeals

Health care clinics that are required to register with the agency for health care administration by having a non-physician owner will need to make careful note of a recent case, Allstate Insurance Company v. Sara C. Vizcay, M.D. (June 23, 2016). Dr. Sara Vizcay was a medical director for three medical clincs licensed under Florida’s Health Care Clinic Act (the “Clinic Act.”) Under the Clinic Act, the medical directory is required to “conduct systematic reviews of clinic billings to ensure that the billings are not fraudulent or unlawful.” Failure to comply with licensure requirements carries significant consequences. The Clinic Act states that all charges or reimbursement claims made by or on behalf of a clinic that is operating in violation of this part are unlawful charges and therefore, are con-compensable and unenforceable. Dr. Vizcay reviewed approximately 5 claims a month per clinic. The clinics had over 100 claims a month. Allstate determined that some of the claims submitted by the clinics were false, inaccurate, misleading, and sometimes, were filed when no services had been rendered.

Allstate sued Dr. Vizcay, and the medical clinics argued, among other things, that because Dr. Vizcay had not systematically reviewed clinic billings, the clinics violated the Clinic Act, and the charges paid by Allstate needed to be fully refunded. The jury agreed with Allstate. The clinics appealed to the 11th Circuit raising two issues for our purposes: whether a judicial remedy for violation of a licensure Clinic Act provision is available, and, if so, whether the clinics could be held responsible for the medical director’s failure to comply with his or her duties.

The 11th Circuit agreed with Allstate’s position that claims made by a clinic are non-compensable and unenforceable because the clinics were operating in violation of the Clinic Act’s licensing requirements. It also held that a clinic and its medical director can be held jointly and severally responsible for the medical director’s failure because the director is “accepting legal responsibility” under the Clinic Act on behalf of the clinic. Significantly, the 11th Circuit found that the jury was within its domain to determine that Dr. Vizcay did not come close to satisfying the statutory mandate to “systematically review the claims,” despite the Clinic Act’s lack of definition as to what that means.

Clinics and their counsel must ensure that medical directors are systematically reviewing claims and that the number of claims reviewed is adequate. Five percent, in this case, was not adequate. Medical directors must know what quantities of claims are being submitted monthly and be familiar with the coding for the services being provided. They need to have an established process for selecting the claims they will review each month and document what that process is and which claims were reviewed. Any irregularities must be addressed immediately. This case, with others, will undoubtedly cause insurers and perhaps qui tam relators to scrutinize all licensure requirements regarding clinics.

Can You Buy a 529 Plan for Yourself?

by Brandon Ketron and Alan Gassman

Oftentimes, clients would like to fully fund a 529 plan with $75,000 to $100,000 at the time of the birth of a child or shortly thereafter.

Transferring more than $14,000 to a 529 plan that names a child or non-spouse of the purchaser could cause gift tax reporting. There is a special 5-year tax exclusion where initial funding can be considered to be gifts over the year of funding and the four succeeding years. For example, a person could make a $70,000 529 plan contribution and consider it to be a $14,000 gift made in the year contributed, as well as a $14,000 gift each year for the subsequent four years.

Alternatively, an individual can create a 529 plan before or after having children and names himself or herself as the designated beneficiary. Then, the plan can be moved to a descendant or other younger party at a later time without adverse income tax consequences.

When the beneficiary is changed to someone other than the purchaser or their spouse, then the 5-year averaging rule can still apply.

Sometimes it is best for clients who know that they will have children and who are single to fund large 529 plan accounts to have the income tax advantage, creditor protection planning, and budgetary and child planning as well. Even if the 529 plan turns out to be an investment (as opposed to being used for college and graduate school expenses), 529 plans are taxed more advantageously than variable annuities are. For an article in progress on this topic, please send three unmarked one-dollar bills and a boxtop from your favorite Kellogg cereal to our street address along with a secret detective whistle and a self-addressed but not stamped envelope and see what happens.

An article on creative planning with 529 plans by Alan Gassman, Christopher Denicolo, and David Koche of the Barnett Bolt law firm in Tampa can be viewed by clicking here.

1202 Things to Consider When Setting Up a

Related Business Servicing Company – Part 4

by Brandon Ketron, J.D., LL.M., CPA, and Alan Gassman, J.D., LL.M.

Part 4 – Calculating the Amount of the Exclusion Under Section 1202

To see our Leimberg LISI article on this topic, which includes the following final example provision, please click here.

This week, we will discuss how to calculate the amount of the exclusion under Section 1202, including several examples and options that can be used to avoid or otherwise minimize capital gains income after having years of lower brackets as a C corporation.

Calculating the Amount of the Exclusion Under Section 1202

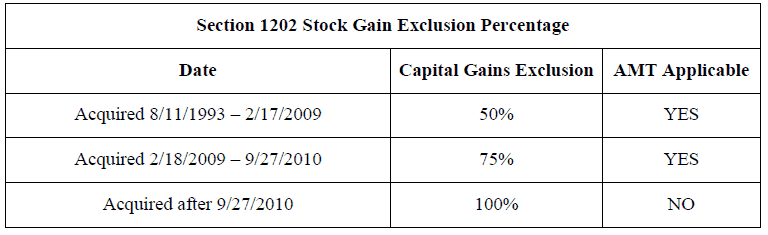

Section 1202 has been amended multiple times so the amount of gain a taxpayer can exclude depends on when the stock was acquired. Originally, 50% of the “eligible gain” could be excluded, and Section 57(a) would treat 7% of the amount excluded as a preference item for alternative minimum tax purposes. The Section 1202 exclusion was then increased to 75%[1] before the Path Act made the exclusion 100% permanently and eliminated the alternative minimum tax preference item.[2] Therefore, the applicable percentages are as follows:

Although potentially 100% of the “eligible gain” can be excluded, Section 1202 provides a ceiling rule that limits the maximum of “eligible gain.” The amount of gain eligible for exclusion cannot exceed the greater of:

- $10,000,000 reduced by the amount of gain taken into account in prior taxable years and attributable to dispositions of stock issued by such corporation,[3] or

- Ten times the aggregate adjusted basis of qualified small business stock issued by the corporation and disposed of by the taxpayer during the taxable year.[4]

It is important to note that the ceiling rule is applied shareholder-to-shareholder on a per-issuer basis; therefore, it is possible for a single taxpayer to exclude amounts greater than the ceiling if the taxpayer has multiple investments in small businesses.[5]

Additionally, for the purposes of determining the amount of eligible gain, Section 1202 (i)(1)(B) provides that when property is contributed in exchange for qualified small business stock, the basis of the stock in the hands of the taxpayer in no event shall be less than the fair market value of the property exchanged. Practically speaking, this means that if built-in-gain property is contributed in exchange for stock, the amount of built-in-gain is not an “eligible gain” and only the subsequent appreciation in the qualified small business stock will be an “eligible gain” excludable under Section 1202.

Below are some examples of how the exclusion is calculated under Section 1202.

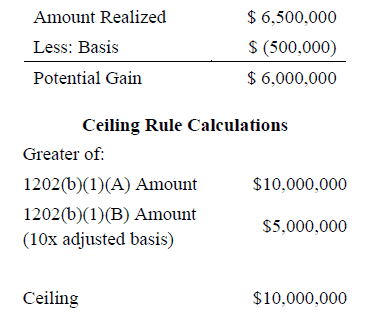

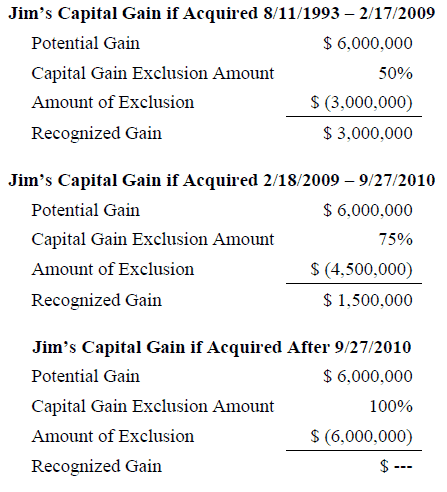

Example One – Cash in Exchange for Qualified Small Business Stock Under Ceiling Rule

Jim contributes $500,000 in exchange for stock in a qualified small business. Over five years later, Jim sells the stock for $6,500,000. Jim would have the following tax ramifications:

With a $10,000 ceiling, the entire $6,000,000 gain is eligible for a Section 1202 exclusion.

Note: For stock acquired prior to 9/27/2010, 7% of the excluded amount will be included as an item of tax preference for the purposes of calculating the alternative minimum tax. Therefore, Jim would have to include $210,000 as a preference item if acquired between 8/11/1993 and 2/17/2009, and $105,000 as a preference item if acquired between 2/17/2009 and 9/27/2010. The excluded amount for stock acquired after 9/27/2010 is not included as an item of tax preference.

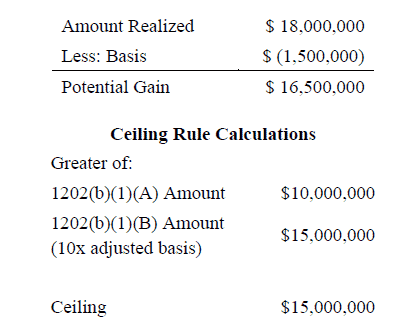

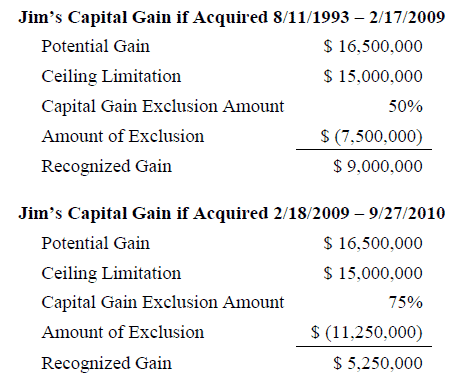

Example Two – Cash in Exchange for Qualified Small Business Stock Over Ceiling Rule

Jim contributes $1,500,000 in exchange for stock of a qualified small business. After five years, Jim sells the stock for $18,000,000. Jim’s tax ramifications would be as follows:

With a $15,000,000 ceiling, $1,500,000 is not eligible for the Section 1202 exclusion.

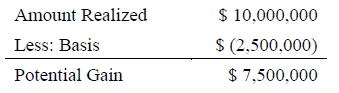

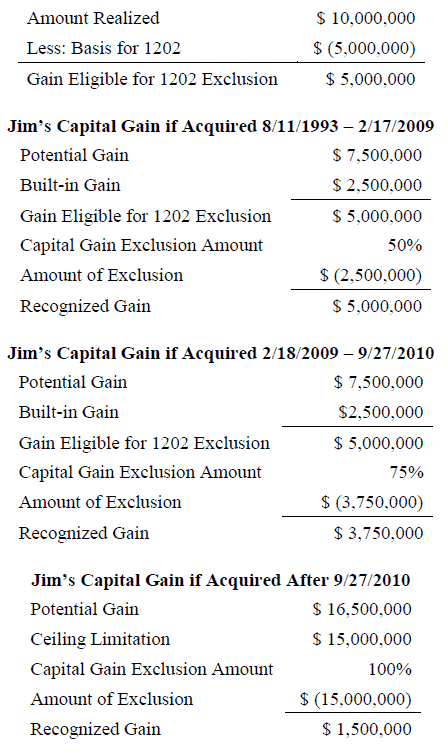

Example Three – Built-In Gain Property in Exchange for Qualified Small Business Stock

Jim contributes property with a fair market value of $5,000,000 and a basis of $2,500,000 in exchange for enough stock of a qualified small business to satisfy the control requirements of

§ 351. Jim sold the stock more than five years later for $10,000,000. Jim’s tax ramifications would be as follows:

Note: Jim’s basis in the stock would be $2,500,000 under § 358; however, for the purposes of Section 1202 calculations, Jim’s basis cannot be less than fair market value of the contributed property. Therefore, the built-in gain is not eligible for Section 1202 exclusion. The remainder of the gain is eligible for exclusion under Section 1202 and is covered under the ceiling rule of Section 1202(b).

Stay tuned for the conclusion of “1202 Things to Consider When Setting Up a Related Business Servicing Company.” Special thanks to Brandon Ketron, JD, CPA, LL.M., who has done a wonderful job with respect to this article.

***************************************

[1] IRC § 1202(a)(3)

[2] IRC § 1202(a)(4)

[3] IRC § 1202(b)(1)(A)

[4] IRC § 1202(b)(1)(B)

[5] See IRC § 1202(b)

Richard Connolly’s World

Who Gets the Family Bible and Coca-Cola Stock?

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Who Gets the Family Bible and Coca-Cola Stock?” by Ashlea Ebeling. This article was featured on Forbes.com on August 11, 2016.

Richard’s description is as follows:

When a widow with incapacity issues and squabbling adult children died, the executor she named in her will rushed to her home and changed the locks just as one son showed up to take things left in her will to his siblings.

“Over and over, tangible personal property is the thing that pushes people over the edge; the beneficiaries are at odds, and the executor is trying to keep the peace,” says Carly Howard, a senior wealth strategist with Atlantic Trust in Atlanta, Georgia.

Howard got her start in probate litigation – representing beneficiaries suing each other after their parents died. Now she’s doing proactive planning with families who don’t want their heirs to fight or end up in court. “There are so many things you can do to avoid this,” she says.

Please click here to read this article in its entirety.

Trying to Reason with the Hurricane Season: Understanding the National Hurricane Center Website and the Cone of Possibility

Those of us who remember watching Get Smart in the 1960s can recall the Cone of Silence that was used to assure confidentiality of discussions. The cone would draw down from the ceiling and surround the speakers to keep what they said completely confidential.

The National Hurricane Center has the cone of probability, and it has been said that the one thing that you can be absolutely sure of is that the hurricane will never actually reach the place where it is considered to be most likely expected to land three days before the fact.

Nevertheless, we all need to be ready for hurricanes, and many of us remember filling our bathtubs with water in case we needed it and buying lots of canned food and sterno that would be used to cook with, should the need arise.

Today, hurricane season has a different meaning, and while retailers do well from selling flashlights, batteries, canned foods, and calamine lotion, we can all be thankful that most of us can afford to get out of town and not have to worry about getting killed by a hurricane.

Please spend ten minutes with your family and think through what you would need and what you would need to do in the event of a hurricane. Please remember that we are living in Florida, and that every few years, tremendous risk arises. In 2004 and almost without warning, Hurricane Charley swept through South Florida, killing 15 people in total and destroying over $15 billion worth of property.

Be ready to get out of town well before the roads close. Do it for your animals if nothing else; they are not permitted at hurricane shelters.

Humor! (Or Lack Thereof!)

Sign Saying of the Week

*************************************

Heard Recently at a Seminar Near You!

Some Random Thoughts from Alan S. Gassman:

“As you can tell, I really like ledger-sized paper. It’s made a big difference in my life.”

*****

“One person asked me on the Puerto Rico thing – how does Puerto Rico know that you were there 183 days? You have to count the days. You have to count the days, and unless you have a row boat and really good arms, you’re going to have to fly, so they’re going to know when you flew there.”

*****

“We were able to make an inter-family sale based upon a lower value than the pro-rata ownership of assets. We call that discounting, and it involves pessimism and some complexity. Does it remind you of your in-laws? ”

*************************************

Protecting Animals from Creditors in Oklahoma – Can This Be Real?

by Dena Daniels and Alan Gassman

We were recently amused when planning for a client who resides in Oklahoma to know that the following assets will be protected from creditors. We’ve added some Ogden Nash poems for good measure.

1.) Five milk cows and their calves under six months old that are held primarily for the personal, family, or household use of such person or a dependent of such person;

The cow is of the bovine ilk;

One end is moo, the other, milk.

2.) Two horses and two bridles and two saddles that are held primarily for the personal, family, or household use of such person or a dependent of such person;

3.) Ten hogs that are held primarily for the personal, family, or household use of such person or a dependent of such person;

The pig, if I am not mistaken,

Supplies us sausage, ham, and bacon,

Let others say his heart is big –

I call it stupid of the pig

4.) Twenty head of sheep that are held primarily for the personal, family, or household use of such person or a dependent of such person;

5.) One hundred chickens that are held primarily for the person, family, or household use of such person or a dependent of such person; and

Let’s think of eggs;

They have no legs.

Chickens come from eggs,

But they have legs.

The plot thickens;

Eggs come from chicken,

But have no legs under’em;

What a conundrum!

6.) All provisions and forage on hand or growing for home consumption and for the use of exempt stock for one year

Porridge is defined as a dish usually served hot and made by boiling ground, crushed, or chopped grain in water or milk. It’s often cooked or served with flavorings such as sugar or honey to make a sweet dish or mixed with spices and vegetables to make a savory dish. The term can also refer to oat porridge, which is better known as oatmeal in the United States.

So whenever you’re ready to fulfill your lifelong dream of being a modern-day Old MacDonald, Oklahoma may be the place for you. Although creditors could potentially reach a lot of assets, in Oklahoma, your animals can be protected.

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY WEBINAR:

Marty Shenkman and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING FAMILY STRIFE FOR ELDERLY CLIENTS BY HAVING A SUPPORT TEAM IN PLACE.

There will be two opportunities to attend this presentation.

Date: Thursday, September 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Al Gomez and Alan Gassman will present a free, 30-minute webinar on the topic of FRAUDULENT TRANSFERS UNDER FLORIDA LAW.

There will be two opportunities to attend this presentation.

Click here to see the article entitled “What Estate Planning Lawyers Should Know About Bankruptcy Law” by Al Gomez and Alan Gassman.

Date: Tuesday, September 27, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Thursday, October 20, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sean Healy and Alan Gassman will present a free, 30-minute webinar on the topic of GUN TRUST UPDATE – NEW RULES AND REGULATIONS YOU NEED TO KNOW ABOUT.

Sean Healy currently operates Healy Law Offices, P.C. in Tyler, Texas, where he has been practicing law for over 20 years. He represents a number of business and nonprofit organizations and focuses on litigation, including jury trials and various types of court cases, including family law cases of divorce, child custody, and others. He is a Life Member of the National Rifle Association and the Texas State Rifle Association and has competed in over 150 pistol competitions.

The second edition of The Legal Guide to NFA Firearms and Gun Trusts by Sean Healy, Jonathan Blattmachr, Alan Gassman, and others will soon be available at the Amazon web store in your neighborhood. We aim to please!

There will be two opportunities to attend this presentation.

Date: Tuesday, October 25, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute. To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, Jerry Hesch, and Curly, Larry, and Moe.

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: Speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

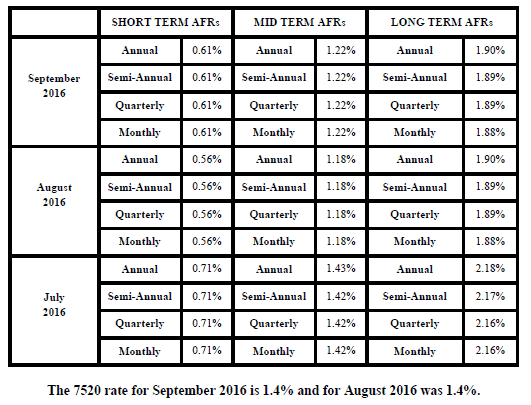

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.