The Thursday Report – 6.23.16 – New Florida Medical Laws

Two New Florida Medical Laws by Lester Perling and Alan Gassman

1202 Things to Consider When Setting Up a Related Business Servicing Company – Part 2

Florida Bar Board of Governors Approves Florida Bar Advertising Rule Amendment Regarding Lawyer’s Use of “Expert” and “Specialist” – But is it Constitutional? by Joseph A. Corsmeier, Esquire

Event Spotlight: Jay Adkisson and Srikumar Rao Webinars – June 28th and 29th

Clause of the Week: Sponsored by the Alan Gassman Channel at InterActive Legal

Thoughtful Corner – Orlando: In Memorium

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“If you are going to achieve excellence in big things, you develop the habit in little matters.

Excellence is not an exception, it is a prevailing attitude.”

– Colin Powell

Colin Luther Powell is an American statesman and a retired four-star general in the United States Army. During his thirty-five year military career, Powell served as the National Security Advisor and a Commander of the US Army Forces Command. He also served as the United States Secretary of State under President George W. Bush during his first presidential term, from 2001 to 2005. Powell was the first African American to serve as the US Secretary of State. He was also the first (and, so far, only) African American to serve as the Chairman of the Joint Chiefs of Staff, the highest-ranking military officer in the US Armed Forces. He is also a distant relative of author Malcolm Gladwell.

Thanks to Jeff Howard of Ray Howard & Associates for this great quote!

Two New Florida Medical Laws

by Lester Perling and Alan Gassman

Recently, the Florida Legislature and Governor Rick Scott enacted and signed into law several new regulations and amendments, which bring new exceptions to Florida’s many medical laws.

One significant change was to expand the scope of what physician assistants and nurse practitioners can do. These “mid-level practitioners” are becoming more prevalent due, in part, to the enactment of the Affordable Care Act, which has led more individuals to seek care providers.

Florida Statute Section 458.347 specifically authorizes physician assistants to perform services delegated to them by supervising physician,[1] so long as the task is consistent with his or her education and training. This includes prescribing authority, both for paper and electronic prescriptions. Prior to this change, it was unclear whether or not physician assistants could prescribe in electronic form. This distinction is important because most prescriptions are now sent electronically to the pharmacy, as this method is more efficient and consumer friendly.

Florida Statute Section 627.638 was primarily intended to address instances in which patients go to a facility contracted with their health plan network but inadvertently receive services from an out-of-network provider.

This new statute prohibits an out-of-network provider, such as a radiologist, pathologist, or emergency provider, from billing members of a preferred provider organization (PPO) or an exclusive provider organization (EPO) for covered emergency or non-emergency services other than applicable co-payments, coinsurance, and/or deductibles. In essence, the insurer must not provide reimbursement for services rendered, even though those hospital-based providers were out-of-network.

*******************************************

[1] However, a PA may not perform services expressly prohibited by ch. 458, ch. 459, F.S. or rules adopted under the allopathic and osteopathic medical practice acts.

1202 Things to Consider When Setting Up a

Related Business Servicing Company – Part 2

by Brandon Ketron, J.D., LL.M., CPA, and Alan S. Gassman, J.D., LL.M.

Some advisors are using or considering C corporation management companies, which are separate and apart from a medical, legal, CPA, or other practice, and can receive tax-deductible management fees that are then taxed at the level of the management company, which may be in a lower bracket. Under Internal Revenue Code Section 1202, such a company may be taxed as a C corporation and may liquidate later on a tax-advantaged basis.

What rules have to be followed in order to achieve this result or similar results that can apply anytime that a client or family’s business and investment arrangement can entail arm’s-length payments per services, leasing furniture, equipment, and otherwise?

This is not a widely addressed issue, and our newest lawyer, Brandon Ketron, J.D., LL.M., CPA, has worked extensively on the following explanation.

We hope you enjoy it!

Part 2 – Requirements Under Section 1202, Continued

Last time, we began looking at the requirements to qualify for Section 1202 Gain Exclusion, including general requirements, stock of a C-Corporation requirements, and original issuance requirements. To see Part 1 of the 1202 series, please click here.

This week, we will discuss more Section 1202 requirements, including the Qualified Small Business Requirement and the Active Business Requirement.

C. Qualified Small Business Requirement

In order to be considered a qualified small business, the C-Corporation must meet the following requirements:

- The aggregate gross assets of such corporation (or any predecessor thereof) at all times on or after the date of the enactment of the Revenue Reconciliation Act of 1993 and before the issuance did not exceed $50,000,000.[1]

- The aggregate gross assets of such corporation immediately after the issuance (determined by taking into account amounts received in the issuance) do not exceed $50,000,000,[2] and

- Such corporation agrees to submit such reports to the Secretary and to shareholders as the Secretary may require to carry out the purposes of this section.[3]

Aggregate gross assets means the amount of cash and the aggregate adjusted basis of other property held by the corporation.[4] In computing the aggregate adjusted basis of other property, a special rule applies to property contributed with a built-in gain. The basis of property contributed with a built-in gain, for the purposes of determining the aggregate adjusted basis of other property under Section 1202, is equal to its fair market value at the time of the contribution.[5]

Additionally, for the purpose of determining the aggregate gross assets of a Corporation, all corporations connected with a common parent through more than 50% ownership will be aggregating and considered as one corporation.[6]

D. Active Business Requirement

A major hurdle in qualifying for the exclusion of gain under Section 1202 is the active business requirement of §1202(e). A corporation will satisfy this requirement if at least 80% of the assets of the corporation are used by the corporation in the active conduct of one or more “qualified trades or businesses.”[7] A qualified trade or business is defined by exclusion and means any business other than the following:

- Any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees.[8]

- Any banking, insurance, financing, leasing, investing, or similar business.[9]

- Any farming business (including the business of raising and harvesting trees.)[10]

- Any business involving the production or extraction of products of a character with respect to which a deduction is allowable under section 613 or 613A.[11]

- Any business of operating a hotel, motel, restaurant, or similar business.[12]

In determining whether the requirements of an active trade or business is met, any subsidiary corporation shall be disregarded and the parent corporation is deemed to own a ratable share of the subsidiary’s assets and to conduct a ratable share of the subsidiary’s activities.[13]

In determining whether 80% of the assets are used in the active conduct of a qualified trade or business, any assets (including cash) held as part of the reasonably required working capital needs of the business are treated as used in the active conduct of such business.[14] Once a corporation has been in existence for more than two years, no more than 50% of the total assets of the corporation can qualify as used in the active conduct of a qualified trade or business by reason of being held as working capital.[15]

A corporation will not satisfy the active trade or business requirement if more than 10% of the corporation’s total assets (in excess of its liabilities) are stock or securities in other corporations which are not subsidiaries of such corporation, or held as part of the reasonably required working capital of the corporation.[16]

A corporation will also fail the active trade or business requirement if it holds more than 10% of the total value of its assets in real property which is not used in the active conduct of a qualified trade or business.[17] For the purpose of satisfying the active trade or business requirement, the ownership of, dealing in, or renting of real property is not treated as the active conduct of a qualified trade or business.[18] One might conclude that since the statute only mentions the rental of real property, the rental of other business assets such as equipment and furniture to a related entity may not cause the corporation to fail the active trade or business requirement. This is discussed in more detail at a later point in this series.

A corporation receiving royalties associated with the production of computer software will satisfy the active trade or business requirement, so long as the royalties are active business computer software royalties, which are defined in Section 543(d)(1).[19]

The IRS recently issued PLR 201436001, which is the only guidance on the definition of a qualified trade or business specifically related to § 1202. In this ruling, the IRS stated that a company providing products and services primarily within the pharmaceutical industry was a qualified trade or business. Even though the company has a close connection to the field of health, the company’s use of its specific manufacturing assets and intellectual property assets to create value for customers is similar to a car manufacturer. Therefore, the activities of this company did not fall within the meaning of § 1202(e)(3) as the performance of services in the health industry.

The ruling does not provide much guidance, but it does go to show that just because a company is in a field similar to the ones enumerated in § 1202(e)(3), it does not mean that the company cannot be a qualified trade or business. The policy behind § 1202(e)(3) seems to be to exclude companies that offer value to customers primarily in the form of services.[20]

Stay tuned next time for a discussion of the Tax Court Memorandum decision of Owens v. Commissioner and how it affects the Active Business Requirements of Section 1202 as well as a look at the Five Year Holding Period Requirement under Section 1202.

********************************************

[1] IRC § 1202 (d)(1)(A). [2] IRC § 1202(d)(1)(B). [3] IRC § 1202(d)(1)(C). [4] IRC § 1202(d)(2)(A). [5] IRC § 1202(d)(2)(B). [6] See IRC § 1202 (d)(3). [7] IRC § 1202(e)(1)(A). [8] IRC § 1202(e)(3)(A). [9] IRC § 1202(e)(3)(B). [10] IRC § 1202(e)(3)(C). [11] IRC § 1202(e)(3)(D). [12] IRC § 1202(e)(3)(E). [13] IRC § 1202 (e)(5)(A). [14] IRC § 1202(e)(6). [15] IRC § 1202(e)(6)(B). [16] IRC § 1202(e)(5)(B). [17] IRC § 1202(e)(7). [18] Id. [19] IRC § 1202(e)(8). [20] See PLR 201436001.

Florida Bar Board of Governors Approves Florida Bar

Advertising Rule Amendment Regarding Lawyer’s Use of

“Expert” and “Specialist” – But is it Constitutional?

by Joseph A. Corsmeier, Esquire

Joseph A. Corsmeier, an “AV” rated attorney practicing in Clearwater, Florida, concentrates his practice primarily in the areas of defense of attorney disciplinary matters before The Florida Bar, attorney admission matters before The Florida Board of Bar Examiners, and professional license and disciplinary matters before the Boards of the State of Florida. He provides expert analysis and opinion on conflict of interest and other attorney disqualification and legal malpractice issues. He received his J.D. from Mercer University and can be contacted at jcorsmeier@jac-law.com.

The Florida law firm of Searcy Denney Scarola Barnhart & Shipley, P.A. filed a federal lawsuit against The Florida Bar in December 2013 after the Bar found that language on the law firm’s website was in violation of Bar Rule 3-7.14, which prohibits claims of expertise unless a lawyer is Florida Bar Board certified in that area of practice, whether truthful or not.

The Florida Bar Rule currently states, as follows, in relevant part:

RULE 4-7.14 POTENTIALLY MISLEADING ADVERTISEMENTS

A lawyer may not engage in potentially misleading advertising.

(a) Potentially Misleading Advertisements. Potentially misleading advertisements include, but are not limited to:

(4) A statement that a lawyer is board certified, a specialist, an expert, or other variations of those terms, unless:

(A) The lawyer has been certified under the Florida Certification Plan as set forth in Chapter 6, Rules Regulating the Florida Bar and the advertisement includes the area of certification and that The Florida Bar is the certifying organization;

(B) The lawyer has been certified by an organization whose specialty certification program has been accredited by the American Bar Association or The Florida Bar as provided elsewhere in these rules. A lawyer certified by a specialty certification program accredited by the American Bar Association but not The Florida Bar must include the statement “Not Certified as a Specialist by The Florida Bar” in reference to the specialization or certification. All such advertisements must include the area of certification and the name of the certifying organization; or

(C) The lawyer has been certified by another state bar if the state bar program grants certification on the basis of standards reasonably comparable to the standards of the Florida Certification Plan set forth in Chapter 6 of these rules and the advertisement includes the area of certification and the name of the certifying organization.

In the absence of such certification, a lawyer may communicate the fact that the lawyer limits his or her practice to one or more fields of law.

The injunction order found that the rule was unconstitutional as applied and prohibited the Bar from enforcing it against lawyers who make truthful statements regarding their expertise. The order states as follows:

“The Bar prohibits every lawyer in the state from claiming expertise in mass tort or unsafe product cases because there is no board certification in these narrow fields. And the Bar prohibits every law firm in the state from claiming expertise in personal injury cases, because law firms, as distinguished from individual lawyers, cannot be board certified….The state cannot prevent a person from advertising a lawful specialty, even if the state’s own definition of the specialty is different.”

The law firm also had the following statements on its website:

- “The days when we could trust big corporations…are over.”

- “Government regulation of corporate America’s disregard of consumer safety has been lackadaisical at best.”

- “When it comes to ‘tort reform,’ there is a single winner: the insurance industry.”

The Florida Bar found that these statements were not “objectively verifiable” and were therefore, prohibited. The order stated that the Bar’s position on political statements was “obviously unconstitutional.” However, since the Bar withdrew from its initial position, and the law firm failed to appeal the standing committee’s decision to the Board of Governors, the issue was not ripe for consideration. “Until the Board of Governors interprets the rule in an unconstitutional manner, the challenge is premature.”

The injunction order was not appealed by The Florida Bar, and there is currently a Bar moratorium on enforcing the rule. The Bar’s Ethics and Advertising Department, which review lawyer ads, indicated that it would not find noncompliance for claims of specialization or expertise from non-certified lawyers. “Instead, the Bar will point out to the filer that the advertisement makes claims of specialization or expertise, and the filer may use them only if the filer can objectively verify those claims.” The Board of Governors also ordered a review of the current rule and potential amendments to comply with the judge’s Order and Injunction.

A proposed amendment was drafted, and the Board of Governors approved the rule amendment as drafted at its meeting on May 20, 2016 in Palm Beach. The approved amendment is below, with the new language in italics:

RULE 4-7.14 POTENTIALLY MISLEADING ADVERTISEMENTS

A lawyer may not engage in potentially misleading advertising.

(a) Potentially Misleading Advertisements. Potentially misleading advertisements include, but are not limited to:

(4) A statement that a lawyer is board certified, a specialist, an expert, or other variations of those terms, unless:

(D) The lawyer’s experience and training demonstrate specialized competence in the advertised area of practice that is reasonably comparable to that demonstrated by the standards of the Florida Certification Plan set forth in Chapter 6 of these rules and if the area of claimed specialization or expertise is or falls within an area of practice under the Florida Certification Plan, the advertisement includes a reasonably prominent disclaimer that the lawyer is not board certified in that area of practice by The Florida Bar or another certification program if the lawyer is not board certified in that area of practice.

The proposed amendment will be filed with the Florida Supreme Court in November 2016, and the Court will decide whether the revised rule will be implemented.

Bottom Line: It remains to be seen whether the rule amendment is in compliance with the federal court’s order and the United States Constitution on its face and as applied. If the Bar reasonably interprets the language that the lawyer’s experience must be “reasonably comparable to that demonstrated by the standards of the Florida Certification Plan set forth in Chapter 6 of these rules,” it may be found to be constitutional if challenged. Another potential constitutional challenge would be that the rule is vague and ambiguous on its face.

Event Spotlight

Jay Adkisson and Srikumar Rao Webinars

June 28th and 29th, 2016

Learn how Florida may harm many debtors if this act is passed.

Please click here to register for the 12:30 PM presentation of

Jay Adkisson’s Musings on the UVTA.

Please click here to register for the 5:00 PM presentation of

Jay Adkisson’s Musings on the UVTA.

Thousands have benefitted dramatically from Professor Rao’s university-originated and widely published techniques and principles.

Please click here to register for the 12:30 PM presentation

with Dr. Srikumar Rao.

Please click here to register for the 5:00 PM presentation

with Dr. Srikumar Rao.

Clause of the Week:

Sponsored by The Alan Gassman Channel at InterActive Legal

Is it Fair to Leave Assets to Children Equally When Some are

Further Along in Their Education Than Others?

The following is an explanation and language recently furnished to a married couple. They have one child in college and younger children of differing ages in high school and middle school.

Is it fair to leave everything equally between the children when they will have significantly varying future educational expenses? Do equal shares economically penalize the younger children for spending on their educations?

It came to mind after the meeting that clients may want to set aside a certain amount of money for the education of their children. Then, the children who spend more money on their education are not penalized. Also, the children who are done with their education earlier do not have an undue advantage by inheriting equal amounts when the younger children will have to spend significant portion of their share on educational expenses.

I can therefore add the following provision, or something similar thereto, to the trust documents:

4.01(e) Educational Trust for Children. I recognize that some of our children may have finished or be almost finished with their college education, while others may have a significant way to go as of the date of the death of the survivor of myself and my spouse. Therefore, between this Trust and my spouse’s Trust, the amount of Five Hundred Thousand Dollars ($500,000) shall be set aside as a “FAMILY NAME” EDUCATIONAL TRUST and will be used to provide college and graduate school tuition, books, room and board allowances deemed conservative and reasonable, and other expenses deemed appropriate by the Trustee so that our younger children are not disadvantaged by the need to be educated solely from their own separate Trusts.

Another purpose of this separate Trust will be to encourage our children to pursue higher education. The Trustee shall establish ground rules as to what portion of educational expenses will be paid from this Trust.

For example, a beneficiary who chooses to attend an “expensive college” may have tuition and some expenses paid from this Trust, and some portion of such expenses paid from the separate Trust established for the primary benefit of such child. Amounts remaining under this Trust when the Trustee determines it appropriate will be divided equally among the Trusts for our children and distributed thereto. We anticipate that this will occur once our youngest children have finished college and graduate school education, but if a beneficiary delays his or her education or is appearing to become a “professional student” then the Trustee may cause the division to occur upon such date as the Trustee deems appropriate.

We also acknowledge that we have 529 plans established for our children that will likely not be equal in value or correspond to what has been spent on a specific child as of the date of death of the survivor of us. The Trustee is requested to alter the shares of our children and the funding of the above devise as the Trustee deems appropriate in order to take such 529 plans into account, and to have them used for the education of our descendants.

For more information about The Alan Gassman Channel at InterActive Legal or to register, please visit https://legalexpertchannels.com/.

Thoughtful Corner

Orlando: In Memorium

by Ron Ross and Alan S. Gassman

Brace yourself.

Our sisters and brothers

Have been taken

From our fathers and mothers.

You’d better sit down.

Our daughters and sons

Are forty-nine fewer,

And there are 300 million guns

LGBT, Latino,

Christian, Muslims, and Jews,

Black, White, and Asians

All afraid to watch the news

Are there friends you have forgotten?

Calls you need to make?

“The branch bends toward the Earth,”

But how much more weight can it take?

Orlando’s hurt but building,

With strong support and warmth.

Getting through this challenge,

Can unify our course.

We hope you’ve done your part,

Hugged those close to you,

Encourage ways to end the threats,

Let’s dampen every fuse.

OneOrlando is a fund established after the horrific tragedy at Pulse nightclub earlier this month. To donate to the OneOrlando Fund or to learn more about how you can help in the aftermath of this attack, please click here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***********************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, 30-minute webinar on the topic of JAY ADKISSON’S MUSINGS ON THE UVTA (Uniform Voidable Transactions Act – this is not a tanning lotion!) Learn how Florida may harm many debtors if this act is passed.

There will be two opportunities to attend this presentation.

Date: Tuesday, June 28, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Dr. Srikumar Rao and Alan Gassman will present a free, 30-minute webinar on the topic of ETHICAL FRAMEWORK FOR DEALING WITH CHALLENGING SITUATIONS.

There will be two opportunities to attend this presentation. Thousands have benefitted dramatically from Professor Rao’s university-originated and widely published techniques and principles.

Date: Wednesday, June 29, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, one-hour webinar on the topic of FRAUD AND ABUSE LAWS AS APPLIED TO DRUG TREATMENT CENTERS.

There will be two opportunities to attend this presentation.

Date: Wednesday, July 13, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

John Porter will present a one-hour webinar on the topic of BASIC BUT EFFECTIVE ESTATE TAX PLANNING TECHNIQUES AND HOW THE IRS MAY LOOK AT THESE.

This webinar is part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

Date: Thursday, July 14th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

DAVID FINKEL CONFERENCE FOR PHYSICIANS – SCALE YOUR MEDICAL PRACTICE

This free event for physician clients and friends of Gassman, Crotty & Denicolo, P.A. features nationally-recognized business advisor and author David Finkel’s unique presentation on growth and lifestyle improvement opportunities for physicians and medical practices. The conference will be entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM.

Spouses, office managers, and other practice advisors will also be welcome to attend this interesting and useful one-day conference.

Date: Saturday, July 23, 2016

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

FLORIDA’S PREMIER BEHAVIORAL HEALTH ANNUAL CONFERENCE

Alan Gassman and Lester Perling will be speaking at Florida’s Premier Behavioral Health Annual Conference, sponsored by The Florida Alcohol and Drug Abuse Association and The Florida Council for Community Mental Health. The 2016 conference theme is Providing Value in Challenging Times and examines the latest advances in the fields of substance use disorders and mental health.

Alan and Lester will be speaking on the topic of ETHICAL AND LEGAL MARKETING FOR TREATMENT CENTERS.

Date: August 10th – 12th, 2016 | Alan and Lester will speak on August 10th at 11:00 AM – 12:30 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information or to register for this conference, please visit http://www.bhcon.org/. You may also email Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

Edwin Morrow and Christopher Denicolo will present a one-hour webinar on the topic of ESTATE & TRUST PLANNING FOR IRA & PENSION ACCOUNT ASSETS.

This webinar is part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

Date: Thursday, August 11th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

The Ameriprise Clearwater branch office, in conjunction with The Tampa Bay Gay and Lesbian Chamber of Commerce, will be hosting an event centered on LGBT estate planning, featuring Alan Gassman’s presentation on PRACTICAL PLANNING FOR MARRIED AND UNMARRIED COUPLES.

Purchase The Florida Advisor’s Guide to Counseling Same Sex Couples on Amazon for only $39.17. It can be viewed by clicking here. The last revision of this book occurred before the US Supreme Court decision of Obergefell v. Hodges, but the book still has extensive, useful information.

Date: August 18th, 2016 | Time To Be Determined

Location: Safety Harbor Resort & Spa | 105 N Bayshore Drive, Safety Harbor, FL, 34695

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Philip Nelson at philip.nelson@ampf.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates for 2017!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar. Watch this space for more details to be announced!

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The ENGAGE conferences include Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

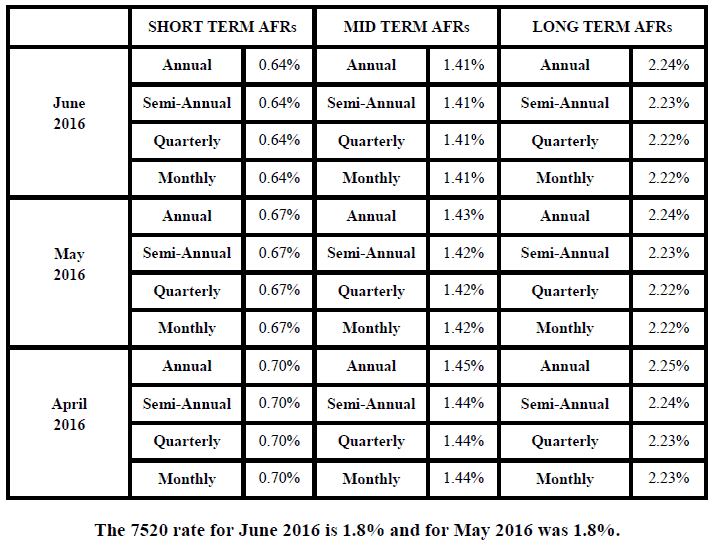

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.