The Thursday Report – 12.17.15 – Better Late Than Thursday

New Online Procedure for Obtaining Estate Closing Letters

Summary of the New Congressional Spending and Tax Compromise

Classifying Independent Contractors and Employees Under the Fair Labor Standards Act, Part II

Barrett Family Foundation Awards Exceptional Math and Science Teachers

Richard Connolly’s World – IRAs and Taxes

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“All motivation is self-motivation. The best way to induce that is to make people feel good

about themselves. Appreciation power trumps all.”

– Tom Peters

Tom Peters is the author of several books on business management practices. He is best known for the books Thriving on Chaos and In Search of Excellence, which he co-authored with Robert H. Waterman, Jr. In Search of Excellence was released in 1982 and quickly became a national best-seller. It can be viewed by clicking here. Today, Tom Peters continues to write and speak about personal and business empowerment and problem-solving methodologies.

New Online Procedure for Obtaining Estate Closing Letters

The following was sent to us by Paul T. Horgan, CPA extraordinaire:

New Online Procedure for Obtaining Estate Closing Letters: The IRS announced earlier this year that for all estate tax returns Form 706 filed on or after 6/1/15, closing letters will be issued only when requested by the taxpayer. Instead, the IRS said it would provide taxpayers with an alternative to receiving estate closing letters that would provide the same level of assurance that the Form 706 had been accepted as filed or that the required adjustments were completed. The IRS has now said that it will include a special code on account transcripts as an acceptable substitute for the estate tax closing letter. Transaction Code 421 indicates that Form 706 has been accepted as filed or that the examination is complete. If Code 421 isn’t shown, the tax return is still under review. For more on this new procedure and how to access account transcripts for estate tax returns, see www.irs.gov/irspup/Businesses/Small-Businesses-%26-Self-Employed/Transcripts-in-Lieu-of-Estate-Tax-Closing-Letters#tds.

Thanks, Paul, for sharing this information with us!

Summary of the New Congressional Spending and Tax Compromise

On December 15, Congress released a spending and tax compromise. Specifically, the legislation contains provisions called “tax extenders,” a series of tax provisions that have been repeatedly reinstated over the last ten years. The new legislation is entitled the “Protecting Americans from Tax Hikes (PATH) Act,” and will allow for popular tax breaks to become permanent provisions. Other tax breaks would be extended into the New Year. PATH would combine an omnibus spending bill with the tax provisions. The bill will make research credit, increases on Section 179 expensing limitations, and the exclusion of 100% gain on qualified small business stock all permanent provisions. The bill will also extend bonus depreciation and the discharge of qualified principal residence indebtedness excluded from income extended through 2016.[1]

The legislation is currently in the rule-making process but is expected to pass in the agreed-upon form in a matter of days.

Improvements to Section 529 Accounts

Congress wishes to extend 529 plans to allow for more qualified expenses for higher education purposes. The improvements to section 529 accounts are as follows:

Section 269. Improvements to section 529 accounts. The provision expands the definition of qualified higher education expenses for which tax-preferred distributions from 529 accounts are eligible to include computer equipment and technology. The provision modifies 529 account rules to treat any distribution from a 529 account as coming only from that account, even if the individual making the distribution operates more than one account. The provision treats a refund of tuition paid with amounts distributed from a 529 account as a qualified expense if such amounts are re-contributed to a 529 account within 60 days. The provision is effective for distributions made or refunds after 2014, or in the case of refunds after 2014, and before the date of enactment, for refunds re-contributed not later than 60 days after the date of enactment.[2] Through this proposed legislation, qualified expenses, such as tuition, fees, books, and supplies, will not include any computers and related technology necessary for education. Section 529 plans also provide a special tax break if five years’ worth of annual gift tax exclusions are front-loaded. Section 529 plans allow contributions of up to $70,000, or as much as $140,000 if the gift is split with a spouse.[3]

Modifications to Alternative Tax for Certain Small “Captive” Insurance Companies

Under present law, the taxable income of a property and casualty insurance company totals the amount earned from underwriting and investment income, and certain companies may elect to be taxed on the investment income under section 831(b) of the Internal Revenue Code.[4] The election is available to the companies with net written premiums or direct written premiums, whichever is greater, that do not exceed $1,200,000.

The proposed provision changes are as follows:

Section 262. Modifications to alternative tax for certain small insurance companies. The provision increases the maximum amount of annual premiums that certain small property and casualty insurance companies can receive and still elect to be exempt from tax on their underwriting income, and instead be taxed only on taxable investment income. The provision increases the maximum amount from $1.2 million to $2.2 million for calendar years beginning after 2015, and indexes it to inflation thereafter. To ensure that this special rule is not abused, the provision also requires that no more than 20 percent of net written premiums (or if greater, direct written premiums) for a tax year is attributable to any one policyholder. Alternatively, a company would be eligible for the exception if each owner of the insured business or assets has no greater an interest in the insurer than he or she has in the business or assets, and each owner holds no smaller an interest in the business than his or her interest in the insurer. The provision would be effective for tax years beginning after 2016.[5]

The change will modify section 831(b) in a multitude of ways. First, the proposal increases the amount of $1,200,000 to an amount of $2,200,000 and indexes the amount for inflation.[6] Second, in order to prevent abuse of this section, for a casualty insurance company to be eligible for an 831(b) election, no more than twenty percent (20%) of its net written premiums or direct written premiums, whichever is greater, can be attributable to any one policyholder.[7] The entire proposed provision will become effective following the 2016 tax year.

Enhanced Child Tax Credit

The child tax credit is $1,000. Further, to the extent that the child tax credit exceeds the taxpayer’s tax liability, the taxpayer is eligible for a refundable 15% credit of earned income in excess of a threshold dollar amount. The provision has been changed to permanently setting the threshold amount at an unindexed $3,000.

Enhanced American Opportunity Tax Credit

In the past, post-secondary students were eligible for a scholarship credit covering tuition and related expenses for the first two years of post-secondary education in the amount of $1,800, which is indexed for inflation. The scholarship credit phased out at an adjusted gross income of $48,000 for individuals and $96,000 for married couples. Now, however, the American Opportunity Tax Credit permanently increases the scholarship credit to $2,500 for four years of post-secondary education, and the credit is phased out at an adjusted gross income beginning at $80,000 for individuals and $160,000 for married couples.

Enhanced Earned Income Tax Credit

Low and moderate income workers and their families could be eligible for earned income tax credit. The earned income tax credit was increased for those with three or more children, and the marriage penalty has been reduced.

Schoolteacher Expense Deduction

The above-the-line deduction for eligible expenses of elementary and secondary school teachers has been modified to index the previous $250 cap to inflation. The deduction will also include any related professional development expenses.

With the conclusion of this tax legislation, it is unlikely that there will be any more tax laws until the next election. There is therefore still potentially significant future tax reform legislation that may occur in the coming years.

**************************************************

[1] The full text of the PATH bill can be found at http://docs.house.gov/billsthisweek/20151214/121515.250_xml.pdf.

[2] Id.

[3] Comm. On Ways & Means, Section-by-Section Summary of the Proposed House Amendment to the Senate Amendment to H.R. 34: The “Tax Increase Prevention and Real Estate Investment Act of 2015,” § 269 (Dec. 7, 2015), http://waysandmeans.house.gov/wp-content/uploads/2015/12/WM-extenders-2015-2016-summary-12-7-2015-FINAL.pdf

[4] Joint Committee on Taxation, Description of the Chairman’s Mark Relating to Modifications to Alternative Tax for Certain Small Insurance Companies (JCX-21-15), February 9, 2015. This document can also be found on the Joint Committee on Taxation website at www.jct.gov.

[5] Id.

[6] Id.

[7] Id.

Classifying Independent Contractors and Employees

Under the Fair Labor Standards Act, Part II

by Alan Gassman and Alyssa Eberle

The Fair Labor Standards Act (FLSA) of 1938 introduced the forty-hour work week, established minimum wage, guaranteed overtime for certain jobs, and prohibited child labor.[1] More recently, however, the FLSA has been the pinnacle of new lawsuits settling in the millions. Last week, we looked at the factors that were considered when classifying independent contractors and employees under the FLSA and what the legal definition of each type of worker is. To review Part I of this article, please click here https://gassmanlaw.com/the-thursday-report-12-10-15/. This week, in the conclusion of this article, we will look at tipped employees, including tip pools and requirements for tipped employees, as well as problems with the minimum wage.

II. Tipped Employees

Tipped employees are employees who customarily and regularly receive more than 30 dollar per month in tips. A tipped employee designation is the middle-ground between independent contractors and employees. Commonly, tipped employees are those involved in the restaurant industry, though they exist in other industries as well.

Tips are the property of the employee. The employer may not use an employee’s tips for any reason other than as credit against its minimum wage obligation to the employee, also called a “tip credit,” or in furtherance of a valid tip pool.

Tip Credit

Section 3(m) of the FLSA allows an employer to use a tip credit toward its minimum wage obligation for tipped employees. This is permitted so long as the credit is equal to the difference between the required cash wage and the federal minimum wage. The required cash wage for tipped employees must be at least $2.13. The federal minimum wage is currently $7.25. Therefore, the maximum tip credit that an employer may claim under FLSA is $5.12 per hour.[2]

Note: The new minimum wage for tipped employees is now $5.03/hr in Florida. The rate is calculated as equal to the tip credit ($3.02) subtracted from the state minimum wage ($8.05).

Tip Pool

Even though it is a requirement under FLSA that the employee must retain all tips, it does not preclude a valid tip pool or sharing arrangement among employees who do not customarily and regularly receive tips.[3] If the employer wishes to establish tip pooling in their business, the employer must notify tipped employees of any required tip pool contribution amount, may only take a tip credit for the amount of tips each tipped employee ultimately receives, and may not retain any of the employees’ tips for any other purpose.[4] The FLSA does not impose a maximum contribution amount or percentage on valid mandatory tip pools.

Tipped Employee Requirements

An employer must provide the following information to the tipped employees prior to the employer using a tip credit:

- The amount of cash wage that the employer is paying the tipped employee must be at least $2.13.

- The amount claimed by the employer as tip credit cannot exceed $5.12 (the difference between the minimum required cash wage of $2.13 and the current minimum wage of $7.25).

- The tip credit claimed by the employer cannot exceed the amount of tips received by the tipped employee.

- All tips that are received by the tipped employee are to be retained by the employee except for the purpose of a valid tip pooling arrangement limited to employees who customarily and regularly receive tips.

- The tip credit will not apply to any tipped employee unless the employee has been informed of these tip credit provisions.[5]

The employer may provide oral or written notice to its tipped employees regarding numbers 1 through 5 above. If an employer fails to provide the above information, the employer cannot use the tip credit provisions and must therefore pay the tipped employees at least $7.25 per hour in wages and allow the employee to keep all of the tips received.

If the employer elects to use a tip credit provision, the employer must be able to show that the tipped employees receive at least the minimum wage when cash wages and the tip credit are combined. If the numbers do not equal minimum wage, then the employer must make up the difference.

Retention of Tips

A tip is the sole property of the tipped employee, regardless of whether or not an employer takes a tip credit.[6] It is prohibited to establish an arrangement between the employer and the tipped employee where any part of the tip received automatically becomes the property of the employer. Therefore, even in instances when the tipped employee receives the minimum wage amount directly from the employer, the employee may not be required to turn over his or her tips.[7]

Service Charges

A compulsory service charge is not a tip. They are part of the employer’s gross receipts.[8] While the amount distributed to the employees from service charges cannot be counted as tips, they may be used to satisfy the employer’s minimum wage and overtime obligations.

Minimum Wage Problems

If an employee does not receive sufficient tips to make up for the difference between their cash wage payment and minimum wage, the employer must make up for the difference.

Further, if a tipped employee is required to contribute to a tipping pool that includes employees who do not necessarily regularly and customarily receive tips (i.e. busboys, etc.), the employee is owed all the tips he or she contributed to the pool and the full amount of minimum wage.[9]

********************************************

[1] 29 U.S.C. §201-219.

[2] U.S. Dept. of Labor, Wage and Hour Division, Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act

[3] Id.

[4] Id.

[5] Id.

[6] Oregon Restaurant and Lodging Ass’n et al. V. Solis, 2013 WL 2468298 (D. Or. 2013).

[7] Fact Sheet #15.

[8] For example, an automatic “service charge” of 15% may be added to the bill, and it will not count as a tip under the FLSA.

[9] Id.

Barrett Family Foundation Awards Exceptional

Math and Science Teachers

The Barrett Family Foundation awarded six $10,000 awards to exceptional Math and Science teachers from select private high schools in Pinellas and Hillsborough counties for the 2015-2016 school year. The awards ceremony was held at Admiral Farragut Academy in St. Petersburg.

This year, the six recipients of the award were Nicole Costa from Keswick Christian School, Jenna Cummings from Canterbury School, Sari Deitche from Admiral Farragut, Amy Hoag from Lakeside Christian School, Anthony Napodano from Shorecrest Preparatory School, and Martha DeWeese from Berkeley Prep.

Mr. Jeff Brandeis, State Senator, handed out the checks to the six winners, while on-air personality Jenn Holloway from Channel 8 TV introduced the key note speaker, St. Petersburg College President Dr. William Law. Dr. Law had previously arranged for the four-person judging panel for the awards and commented that this was the best thing he has seen in education in a very long time.

Mr. Thomas Ma, a math teacher at Admiral Farragut and one of last year’s award recipients, spoke about how and why the award improved his teaching since 2014, while Dr. Jack Barrett, co-trustee of the foundation, commented that it was his hope to replicate this in other Florida metropolitan areas.

The Barrett Family Foundation is a non-profit based in Clearwater, Florida. Founded in 2013, the mission of the organization is to recognize outstanding math and science high school teachers from private schools in Pinellas and Hillsborough counties. The Excellence in Science/Mathematics Teacher Award was created as a vehicle to award the chosen educations. With this award, the Barrett Family Foundation hopes to honor outstanding high school teachers who share their energy and enthusiasm for science or mathematics through creative and innovative methods to cultivate student interest and ability in these fields.

To find out more about this great organization, please click here to visit the Barrett Family Foundation website.

Richard Connolly’s World

IRAs and Taxes

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Thousands Hit with Surprise Tax Bill on Income in IRAs” by Laura Saunders. This article was featured in The Wall Street Journal on November 13, 2015.

Richard’s description is as follows:

Under the tax code, IRAs and Roth IRAs have significant benefits, such as tax-free growth, but they come with limits. When owners use IRA funds to invest in partnerships as opposed to stocks, bonds, and funds, they owe tax on certain annual income from the partnership exceeding $1,000 because of an anti-abuse provision. This levy is known as Unrelated Business Income Tax, or UBIT, and its top rate of 39.6% can take effect at about $12,000 of taxable income.

A further, unique twist is that when this tax is due, the IRA custodian or trustee, such as Pershing or Charles Schwab, is responsible for obtaining a special tax ID number and then filing and signing an IRS Form 990-T reporting the income. The IRA owner is typically responsible for paying the tax.

Because of this complexity, experts often caution investors to avoid putting publicly traded partnerships into IRAs.

Please click here to read this article in its entirety.

The second article of interest this week is “A Tax Deduction That’s Often Overlooked” by Anne Tergesen. This article was also featured in The Wall Street Journal on November 1, 2015.

Richard’s description is as follows:

If you are withdrawing funds from an inherited retirement account, you might be overlooking a sizable income-tax deduction.

Officially called the estate tax deduction, but better known as the IRD deduction (which stands for Income in Respect of a Decedent), it is available to those who have inherited certain financial assets, including a traditional individual retirement account or a 401(k) account, from someone with an estate large enough to have paid a federal estate tax.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Sayings of the Week

***************************************************

Upcoming Seminars and Webinars

NEW EVENTS

LIVE ORLANDO PRESENTATION:

HECKERLING INSTITUTE – INTERACTIVE LEGAL TALK

Alan Gassman will present a 15 minute speech at the InterActive Legal booth at the Heckerling Institute for Estate Planning on HAVE GUN TRUST, WILL TRAVEL. His bullet points will be very useful and give you ammunition to help make your gun trusts more explosive than ever! We expect this talk to be right on target, so take off your silencers and come to see this important, thorough, and detailed 15 minute talk.

While at the InterActive Legal booth, see the new Alan Gassman Channel and get a free book of your choice by being one of the first to sign up for this new, monthly, interactive, computer-based library featuring several of Alan’s books, many forms, charts, and even exclusive video webinar presentations. $129.40 per year gets you this and a bucket of Kentucky Fried Chicken if you sign up before January! (Mashed potatoes are extra.)

Special thanks to Michael Graham and George Brittingham of InterActive Legal for risking their entire operation on the success of this channel.

Date: Wednesday, January 13, 2016 | 10:40 AM

Location: InterActive Legal Booth | Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS AND PLANNING FOR THE INCOME TAXATION OF ESTATES AND TRUSTS.

This is a free webinar series being presented by Bloomberg BNA. We will have the full schedule available in a future Thursday Report. Save up so you can afford it!

Date: January 21, 2016 | Replay on January 26, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Practical & Creative Planning webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS, FINE POINTS, AND INNOVATIVE STRATEGIES FOR LIFE INSURANCE AND USE THEREOF.

Bloomberg BNA will charge for this webinar and this series of webinars, but we believe it is well worth it! We will have the full schedule available in a future Thursday Report.

Date: February 25, 2016 | Replay on March 1, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

Calendar of Events

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Annual Florida Bar Health Law and Tax Section Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World

(with Lester Perling) - Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ESTATE PLANNING BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, February 17, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, March 16, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, May 11, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

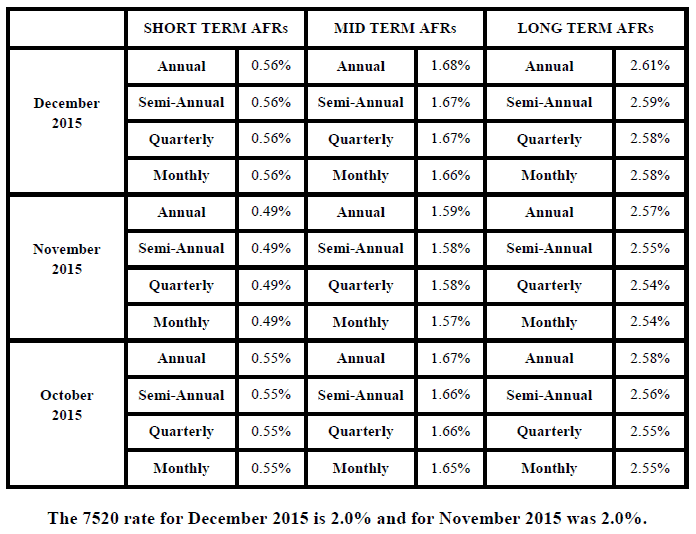

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.