The Thursday Report – 9.24.15 – The Greatest Thursday Report Ever!

What Estate Planners Need to Know About Minority Owned Business Interests

Travel Insurance: A Practical Safeguard or Money-Making Scheme?

Who Really Lives (or Doesn’t) in Your Household? by Tim Ryles, Ph.D., AAI

Richard Connolly’s World – Recent Federal Tax, Estate, and Partnership Changes

Thoughtful Corner – Dealing with Clients Who Have a Terminal Illness

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

What Estate Planners Need to Know About

Minority Owned Business Interests

by Alyssa Eberle, J.D.

What You Need to Know to Not Inadvertently Lose Small Minority Business Status in Your Planning – One Wrong Transfer Can Spoil a Whole Company

The United States Small Business Administration has developed a program called the SBA 8(a) Business Development Program that helps minority-owned businesses develop through counseling, workshops, and management guidance. Some states, including Florida, have adopted the program into their own statues and legislation in order to address the pattern of past and continuation discrimination against minority business enterprises.[1]

The Florida Department of Management Services outlines the eligibility requirements to become certified as a minority business within the state. The minimum eligibility requirements are as follows:

- The business must be registered in MyFloridaMarketPlace.

- The business must be independently owned and operated, with a net worth not exceeding $5 million. The business must also employ 200 or fewer full-time permanent employees or must be recognized as a certified business by the federal government.

- 51% of the business must be owned, managed, and controlled by: a minority, a woman, or a Florida veteran who is a citizen of the United States and a permanent resident of Florida.

- If a professional license if required for the industry, the minority owner must be the license qualifier.

- The minority owner did not acquire their majority ownership of at least 51% through a transferal of ownership occurring within a minimum of two years, when the previous majority ownership interests in the business was by a non-minority who is or was a relative, former employer, or current employer of the minority persons on whom eligibility is based.

- The business must currently be in operation.

- The business must be legally registered to do business in Florida.[2]

In order for the business to qualify as minority owned, the business must be unconditionally owned and controlled by the minority-owner. The owner will have control if he or she directs both the long-term decision making as well as day-to-day management and administration of the business’s operations. To be “unconditionally owned,” the ownership in the business must be direct.[3] In other words, the business cannot be owned by another business entity, nor can the business be owned by a trust such as an employee stock ownership trust.[4] However, ownership by a living trust is permitted and may be treated as the “functional equivalent of ownership” so long as the minority-owner is the grantor, a trustee, and the sole beneficiary of the trust. Once the ownership and control has been determined, the business can file with the Office of Supplier Diversity to receive their certification.

If the minority business owner determines that owning the business by way of a living trust is the most beneficial, the owner will want to be aware of relevant trust law. It is essential to note that living trusts are revocable trusts, meaning that they are able to be changed throughout the life of the grantor. However, minority business owners will want to be wary that the living trust could potentially become a self-settled trust since the owner is the grantor, the trustee, and the beneficiary. Self-settled trusts are trusts established for one’s own benefit and do not provide asset protection benefits.[5] If the business owner wishes to add a trustee to the trust, they must ensure that this will not affect the ownership or control of the business. Doing so could put the minority-owned status at risk.

Minority owned businesses are a growing participant in many industries in Florida. Women and minorities should be aware of the potential benefits in certifying their business, as well as the potential benefits in owning their business in a trust.

***************************************************

[1] See Fla. Stat. §287.09451.

[2] More on the eligibility requirements for a Florida owned minority business may be found here: http://www.dms.myflorida.com/agency_administration/office_of_supplier_diversity_osd/certification/eligibility_requirements.

[3] 13 C.F.R. § 124.105.

[4] Id.

[5] See Fla. Stat. § 736.0540.

Travel Insurance: A Practical Safeguard or Money-Making Scheme?

by Noah Fischer, J.D. Candidate, Stetson Law School

You are 135 times more likely to match all but one number in the Florida Lottery than you are of suffering death or dismemberment in a plane crash. If you already have adequate life insurance, it would seem that the American Express and other similar Travel Accident Protection Insurance is unnecessary.

Executive Summary:

American Express (AmEx) credit card users are able to obtain Travel Accident Protection Insurance, covering accidental death and dismemberment, before departing on vacation. Users can pay between $11 and $35, depending on the terms of the specific AmEx card and the type of coverage offered. If you have the misfortune of needing the coverage while on vacation, you could earn between $250,000 and $1,500,000.[1] What are the odds of cashing in on this?

Some countries may not honor foreign medical insurance coverage, so it would make sense to purchase a policy that would cover any emergencies. AmEx offers a Global Medical Protection policy that covers emergency medical and dental expenses, as well as the cost of emergency medical transportation, for the first 60 days of a trip. The Travel Accident Protection Insurance, however, is less of a logical investment. If you already have adequate life insurance, you probably don’t need additional protection. You are more likely to die in a car crash on the way to the airport than in a plane crash on the way to or from your destination.

Why would someone purchase this coverage, despite the odds telling them they don’t need it? Orit Tykocinski, a professor at the Interdisciplinary Center Herziliya in Israel, plainly addresses why some people may be skeptical when it comes to passing up this offer:

“Why would I want to pay so much for a life-insurance policy that covers me only on airplane trips, which are the safest of all trips? It doesn’t seem like a good deal to me, but that’s just my brain talking. My gut thinks the insurance will make sure the plane gets me to that beach.”

As illustrated by the quote above, many people are provided with a sense of safety when they know they are insured against a plane crash, even though additional coverage does not raise the probability of keeping that bird in the sky.[2]

Facts:

Odds of Dying in a Plane Crash:

As most people know, the odds of dying in a plane crash are extremely low, especially in the United States. There were a total of only six fatal accidents involving US-registered jets during 2013, resulting in 17 fatalities.[3] According to the International Air Transportation Association (IATA), only 210 people died worldwide in airline crashes in 2013, with approximately 3 billion people boarding 35 million total flights in that same year.

Phil Derner, Jr., founder and president of NYCAviation, insists that the odds of dying in a plane crash in the United States are equivalent to the odds of being struck by lightning seven times.[4] For comparison purposes, the odds of winning the jackpot in the Florida lottery are 1 in 22,957,480, while the odds of matching all but one number are 1 in 81,409.[5] The average probability for dying in a plane crash in the US is 1 in 11,000,000.[6]

To further put these odds into perspective, the odds of dying in a motor vehicle crash are about 1 in 5,000, and the odds of dying in a railroad accident are 1 in 306,000.[7] Even if you do end up aboard a flight that happens to crash, according to the National Transportation Safety Board, 95.7 percent of passengers involved in a plane crash survive. Even in the most devastating of crashes, the passenger survival rate is still 76 percent.[8]

Policy Information:

Despite the odds, many people are risk adverse and would like to have the peace of mind that comes with knowing there is additional coverage protecting themselves and their families.

Should you choose to purchase Travel Accident Protection coverage, the coverage begins at 12:01 AM on the first day of the trip and ends at 12:01 AM on the day immediately following the trip’s conclusion date. If the trip that coverage has been purchased for lasts more than one year, only the first 365 consecutive days will be covered. The benefit for the purchased policy is payable if the covered person suffers accidental death or dismemberment while traveling into or departing out of a scheduled airline or common carrier.

The payout depends upon the extent of injuries sustained in a possible plane crash. For example, if your plane crashes and you lose a hand or lose sight in one eye, then 50 percent of the total policy will be paid out. Death, the loss of both hands, feet, eyes, or a mixture of any two of the three is required to have 100 percent of the total policy paid out. The benefit will be paid within 100 days of the accident that caused the death or dismemberment. If accidental death or dismemberment occurs from exposure to the elements while on the insured trip because of disappearance, sinking, or wrecking of a scheduled airline, the coverage will apply.

Death from riding in or driving a rental vehicle is not covered if you meet any one of the approximately 20 exclusions, such as intentional exposure to exceptional danger or any mental or emotional condition, whether it be diagnosed or undiagnosed.[9] Death from any sickness obtained while on the trip is also not covered under the Travel Accident Protection policy.

Once a claim for a death benefit is made, the accidental death or dismemberment benefits will be paid out in a single lump sum.

Comment:

The odds of needing to collect on AmEx’s Travel Accident Protection Insurance for accidental death and dismemberment are already low, even before taking into account the restrictions and exclusions of the policy.

For AmEx, however, it could be a pretty lucrative deal. Assuming that AmEx sells 200,000 of these policies per year with a premium of $23 (the average cost of the different policies), they would make $4.6 million profit while taking minimal risk. A plane would have to defy the 1 in 11 million odds of crashing, and a passenger on that plane would have to have Travel Accident Protection Insurance coverage through American Express, and that passenger would have to suffer a qualifying death or dismemberment under the policy before AmEx would have to dish out the benefit. Not to mention the price of $11-$35 per person per covered trip[10], if annualized, far exceeds the cost of a normal life insurance policy[11].

If you are planning to travel outside of the United States to a country that does not accept your health insurance or is inherently dangerous, you could look into AmEx’s Global Medical Protection plan, but if your flight is confined to the US, you are better off skipping the American Express travel insurance coverage and spending the cash on Florida lottery tickets instead.

*******************************************************

[1] “American Express Travel Insurance.” American Express Travel Insurance. https://www295.americanexpress.com/travel-insurance/quoteDetail.do?aetiSource=AETI#99

[2] Tierney, John. “The Magic of Flight Insurance.” The New York Times. http://tierneylab.blogs.nytimes.com/2008/05/05/the-magic-of-flight-insurance/?_r=0.

[3] Zimmerman, John. “Have We Won the Safety Battle?” Air Facts Journal (2014). http://airfactsjournal.com/2014/01/won-safety-battle/ .

[4] Golgowski, Nina. “Odds of Dying in Plane Crash in US are Equal to Being Struck by Lightning SEVEN Times: Expert.” New York Daily News. http://www.nydailynews.com/news/national/common-plane-crashes-expert-weighs-deadly-week-article-1.1879212 .

[5] “Odds Calculation Results.” LottoStrategies.com. http://www.lottostrategies.com/script/odds_calculate.

[6] Sherwood, Ben. “Flight Check: What are the Chances I’ll Die on my Next Plane Trip?” The Huffington Post. http://www.huffingtonpost.com/ben-sherwood/the-sky-is-falling-will-i_b_170038.html

Barrabi, Thomas. “After Air Algerie AH5017 Incident, A Statistical Look at the Probability and Chances of Dying in a Plane Crash.” International Business Times. http://www.ibtimes.com/after-air-algerie-ah5017-incident-statistical-look-probably-chances-dying-plane-crash-1638206.

[7] Ropeik, David. “How Risky is Flying?” PBS. http://www.pbs.org/wgbh/nova/space/how-risky-is-flying.html.

[8] “How Do People Survive Plane Crashes?” Curiosity.com. https://curiosity.com/playlists/how-do-people-survive-plane-crashes-o53cN3Xy/?utm_source=dsc&utm_medium=rdr&utm_campaign=rdrwork#intro-playlist

[9] “Platinum.” InsureMyTrip.com. http://www.insuremytrip.com/popup/certificate/AETIP/accidentalDeathCommonCarrier.html?rev=5.[10] “American Express Travel Insurance.” American Express Travel Insurance. https://www295.americanexpress.com/travel-insurance/quoteDetail.do?aetiSource=AETI#99.

[11] “Life Insurance Cost.” TrustedChoice.com. https://www.trustedchoice.com/life-insurance/compare-coverage/cost/.

Who Really Lives (or Doesn’t) in Your Household?

by Tim Ryles, Ph.D., AAI

Thank you to Tim Ryles, David Thompson, and the Florida Association of Insurance Agents for allowing us to bring this fascinating discussion that shows how complicated and non-intuitive defining residency can be to Thursday Report readers.

Tim Ryles, Ph.D. provides consulting services and expert testimony in insurance litigation, regulatory matters, and consumer protection. He is also a frequent author and speaker on those issues. Dr. Ryles served as the Georgia Commissioner of Insurance from 1991 to 1995 and was appointed by Governor George Busbee to serve as Administrator of Georgia’s Governor’s Office of Consumer Affairs from 1975 to 1982. Dr. Ryles received his MA and Ph.D. in political science from the University of Georgia. He can be contacted at Tim Ryles Consulting Services, LLC by emailing timryles@bellsouth.net.

The following article is copyrighted by the Florida Association of Insurance Agents and is used with permission.

Given the broadening range of risks within modern families, the boundary lines between resident and non-resident are of great significance in determining coverage issues, including whether an insurer has a duty to defend. Determining residency in a blended-family society is, in many ways, a moving target for insurers and insureds. This article examines the issues raised by non-definition of “resident” in homeowners insurance policy and how it is sometimes construed.

Justice Roger Trainer once observed that, “Plain words, like plain people, are not always as plain as they seem.” Take the common language about who is an insured in homeowners policies as an example. The language of the Insurance Services Office, Inc. (ISO), Broad Form HO 2 policy provided below is representative.

“Insured” means you and residents of your household who are:

your relatives; or

other persons under the age of 21 and in the care of any person named above.

“You” includes the named insured and spouse if a resident of the same household.

The key terms “residents,” “household,” “relative,” and “in the care of” are undefined and have been the subject of considerable dispute and litigation. If past disagreements over their meanings aren’t enough reason to prompt insurers to define what the terms mean, two additional factors converge to highlight the problem: (1) dynamic sociological changes in family structure, and (2) varying court interpretations of the terminology.

Sociological Changes in American Families

Since many of our conceptions of what insurance terms mean may be grounded in an earlier social paradigm similar to that portrayed in “Leave it to Beaver” television series, insurers that fail to adapt to accelerating changes in the American family structure may be in for trouble in the future. Consider, for example, possible implications for risk of the following statistics and trends.

Census figures show that the ratio of marriages to divorces is about 2:1, that divorces annually affect over a million children (16.8 per 1,000 children); and children of divorce are more likely to suffer from psychological or emotional problems, drop out of school, incur teen pregnancies, and end up in prison for aberrant behavior. Of all weddings, 43 percent are remarriages for at least one parent, thereby giving rise to a continuing increase in the number of blended families in which children, parents, and grandparents may share no blood relationships.

Blended families not only combine offspring and in-laws from previous marriages, but also may create a fertile ground for domestic violence by bringing together inhabitants who hold deep-seated, hostile feelings toward one another. Increased step-parenting and live-in significant others may contribute to sexual abuse and other forms of violence against children. Persons living in strained family circumstances may engage in acts of displaced aggression toward others, thereby incurring greater liability for everyone. In other words, it isn’t just the family-dog threat that insurers need to be concerned about.

Who Lives Here? – What Courts Say

Since disagreements about residency often end up in court, a review of how judges resolve the issue is instructive; indeed, the directions taken by judges show that rather than clarifying matters, courts instead may clutter them. Among the factors courts often examine are issues of domicile versus residence, dual residency, and how a grant of child custody in divorces confers residency on children.

Domicile and Residence

It is customary to consult a dictionary for guidance when insurance terms are undefined, technically for the purpose of giving the words their ordinary meaning. Webster’s Ninth New College Dictionary accords the following definition to “resident”: “Living in a place for some length of time. RESIDING.” To “reside” is “to dwell permanently or continuously.” Although policy language does not mention the term “domicile,” some state statues and common-law principles distinguish domicile from residence.

Consistent with this, “resident” is not necessarily “domicile,” view. A New Jersey court distinguished the two as follows: Domicile is “the place where a person has his true, fixed, permanent home, and principal establishment, and to which, whenever he is absent, he has the intention of returning.” Conversely, a residence lacks “the elements of permanency, continuity, and kinship with the physical, social, and political attributes which inhere in a home.” The court added, “Intention adequately manifested is the catalyst which converts a residence from a mere place in which a person lives to a domicile.” [See Miller v. USF&G, 127 NJ Super 37 (1974).]

This “intention adequately manifested” adds a subjective element to the formula for determining resident status. Knowing where a person resides is insufficient – where that person intends to live is also a vital part of the formula. To allay cases of adjuster jitters, some courts temper this subjective element. For example, a California court asserted that exclusive reliance on this subjective indicator “would mean that coverage expands and contracts on the whimsical plans of a dependent family member.” [See Utley v. Allstate Insurance Company, 19 Cal App 4th 820 (1993).]

Other venues make no distinctions between resident and domicile. In West Virginia, for example, “The word residence, as used in divorce statues, is almost universally construed to be the equivalent of domicile.” [See Taylor v. Taylor, 128 W Va 198, 204 (1945), cited at fn. 5, Farmers Mutual Insurance Company v. Hubert Junior Tucker, 213 W Va 16 (2002).] Since blended families are usually the result of divorce proceedings, a prudent adjuster may need to consult a divorce law specialist in making final determinations of how “resident” is applied in a particular jurisdiction when determining a child’s residency.

Dual Residency

For insurance purposes, many states recognize that a person may have more than one residence, a status called dual residency. [See New York Central Fire Insurance Company v. Lawrence W. Perkey, et. al., 747 NYS 2d 878 (2002.)] Factors that call attention to dual residency include the ownership of second homes, child custody assignments in divorce cases, adult children in the process of establishing independence from parents, and elderly parents moving in with children. However, while the view in some states is that one can reside in more than one place, this is not a universal rule: Montana, by statute, does not allow dual residency.

Custody versus Residency

Generally, it may be assumed that in cases of divorce, residency is established by the custody awarded in the divorce decree. (Census figures show that 72 percent of custody awards are to the wife, 9 percent to the husband, and 16 percent are for joint custody.) That a divorce decree is not the final word, though, is well illustrated by the case of Miller v. USF&G, 316 A2d 51 (NJ 1974). In Miller, the divorce decree granted custody to the mother, but the court determined that in actual practice, both parents had custody; consequently, the child was covered under both homeowners policies (a finding of dual residency). Thus, the determining factor is not what the decree says, but what the people involved actually do that matters most. Insurers, therefore, must look beyond formal custody documents to determine residency.

Qualitative and Quantitative Factors: It’s More than Just Headcount

A Georgia court set forth the following guideline for establishing resident status: “The aggregate details of the family’s living arrangements must be considered…not any one factor.” [See Rainey v. State Farm Mutual Automobile Insurance Company, 257 Ga App 618 (1995).] In this approach, the inquiry is directed largely at measuring quantitative indicators, and much of the focus is determining whether separate households have actually been established. As the court noted in Rainey, “Physically maintaining living accommodations in the insured’s home is one, but not the sole, consideration” in determining residency.

New Jersey courts crafted the concept of a “substantially integrated family relationship” to ascertain resident status. Under this label, courts apparently look not only at the qualitative elements but also quantitative ones as well. Quantitative inquiries encompass questions about how people function together as family members in such activities as sharing meals, expenses, and pursuing common goals based upon common interests.

With the New Jersey and Georgia views in mind, it is easier to understand how courts have determined that people don’t have to live together under the same roof to qualify for resident status [Gibson v. Callahan, 158 NJ 662 (1999)] and that resident of a house does not automatically qualify one as a resident of a household for insurance purposes [Hawkeye Security Insurance Company v. Sanchez, 460 NE2d 873 (Ill App 1984)].

Conclusion

Since failure to define “resident” contributes to significant litigation, one might ask why insurers don’t read the judicial tealeaves and make appropriate amendments. Could it be that under the current language, insurers find it easier to deny coverage? For example, insurers can argue that a child visiting a parent on the weekend who causes property damage or bodily injury to others is not a resident, and that a negligent divorced parent who is held responsible for bodily injury suffered by a child during a visitation period and is sued by the other parent is a resident. Whether true or not, plaintiffs’ attorneys will most likely catch on to any apparent company inconsistency in claim adjudication whether it occurs by design or through lax claim management.

For claims personnel, lack of clarity imposes an added burden in investigations to make sure that their determination of who is a resident demonstrates a diligent effort to pursue quantitative and qualitative indicators of resident status and to show familiarity with the prevailing case law.

Finally, claimants may add ammunition to arguments for coverage by pointing out that “resident of your household” language has been found ambiguous [Gibson v. Callaghan] and contend further that different interpretations from one jurisdiction to another of what the word resident means automatically qualifies the term as ambiguous. Given this possible scenario, perhaps insurers should more seriously heed the words of Justice Traynor and assign plain definitions to plain words so plain people can be deterred from giving insurers a plain whipping in court.

For more great articles, check out the FAIA’s Education Library at https://www.faia.com/Resources.aspx?pid=198.

Richard Connolly’s World

Recent Federal Tax, Estate, and Partnership Changes

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “What Congress Didn’t Do Before Summer Vacation: Several Dozen Tax Benefits Remain in Limbo” by Laura Saunders. This article was featured in The Wall Street Journal on August 7, 2015.

Richard’s description is as follows:

As Congress was heading for recess in late July, lawmakers passed several important tax changes. This article provides information on the changes, with the dates they take effect.

Some of the notable changes include:

Partnerships – Starting in 2017, for the 2016 tax year, partnership tax returns will be due March 15 rather than April 15.

Estates – Some estates now will have to provide both heirs and the IRS with information about the value of certain assets to ensure that tax won’t be underreported if the asset is later sold.

The provision takes effect for estates filing returns after July 31, 2015, so it could affect the estates of some who died last year.

Please click here to read this article in its entirety.

The second article of interest this week is “Navigating Tougher IRS Rules for Family Partnerships” by Paul Sullivan. This article was featured in The New York Times on August 7, 2015.

Richard’s description is as follows:

The Internal Revenue Service is about to toughen the rules on a type of investment vehicle that has been abused by some very wealthy families to avoid millions of dollars in taxes.

The wealthy are allowed to use family limited partnerships, family limited liability companies, and their variants to hold family businesses, real estate, or other illiquid, hard-to-value investments.

But some partnerships have put marketable securities, even cash, into the entities and still claimed a discount, even though the investments have a value that is easy to determine.

Stung by its mixed record in challenging these entities in court, the IRS could soon get help from the United States Treasury. Cathy Hughes, an attorney-adviser at the Treasury’s office of tax policy, said in May that new regulations restricting what would be allowed with family partnerships could be released as soon as mid-September.

This article may be what you need to get a procrastinating client moving.

Please click here to read this article in its entirety.

Thoughtful Corner

Dealing with Clients Who Have a Terminal Illness

Throughout your career, it is likely that you will obtain a few clients who are facing terminal illnesses. Do not expect clients or people with terminal illnesses to be logical, to follow-through, or even to be appreciative of your services.

They are often having very big psychological, not to mention physical, issues, and talking about death and what happens after they die can be extremely painful.

One strategy for effectively serving these clients is to have them sign anything that will improve the situation they are in without much fanfare or expensive review. If they can sign a “quick interim plan” that improves on their situation while you also work on a conventional and more extensive re-vamp of their existing documents, everything will be much better if and when they die without getting back to you or before you can finish.

Time is very much “of the essence” in these situations, as people go through what Elizabeth Kübler-Ross wrote about in her landmark 1969 book, On Death and Dying. She established the Kübler-Ross model, which postulates a series of emotional stages experienced when facing either one’s own death or the death of a loved one.

A great many clients and advisors have found the book to be extremely accurate in describing the following states of psychological change and challenge that someone facing death will go through. The stages are as follows, though they can occur in any order:

- Denial

- Anger

- Bargaining

- Depression

- Acceptance

Also consider that people with terminal illnesses may be on mind-altering drugs and are certainly going through extreme changes with respect to their businesses, loved ones, and hobbies. Death is worse than losing everything because you lose not only your belongings but also your relationships and yourself.

Get the person to do as much as they are willing to do as soon as they are willing to do it while also showing compassion for their situation.

If you personally cannot keep the pace the client requests, delegate some of the work to someone else in the office and get it handled. Be willing to go to their house, their hospital room, their rehab, or whatever it takes.

It might also be a good idea to get the family members who will become your clients upon the person’s death and who will bear the consequences of your work to be as involved in the process as possible, but do not expect them to be as logical or necessarily supportive as they should be.

To read more about the Kübler-Ross model, please click here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***********************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES.

This seminar will focus on how owners can transition their businesses to employees or others who buy over time. Topics include avoiding unnecessary capital gain tax on exit, deferred compensation, profits interests, redemptions, life insurance, and getting assets out of corporate solution to obtain a basis step-up (without self-employment tax.)

There will be two opportunities to attend this presentation. Attendees will be given the opportunity to receive over 850 pages of technical business planning materials at no charge.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counter-intuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY AND RECENT DEVELOPMENTS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: TBD

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

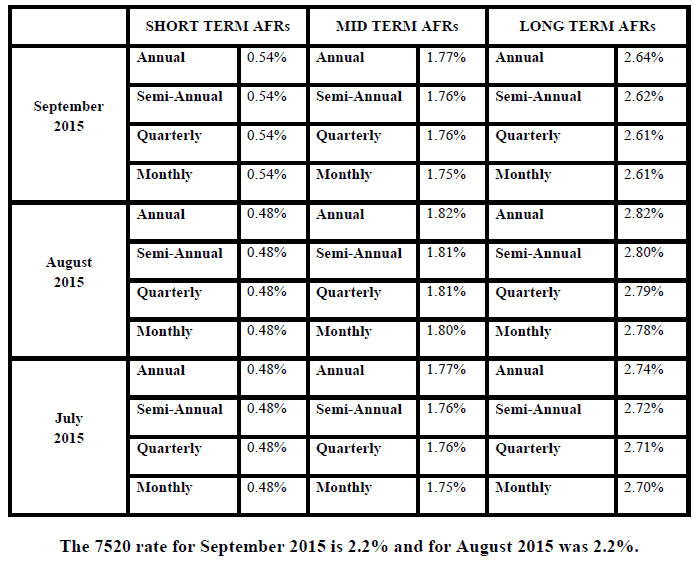

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.