The Thursday Report – 8.27.15 – I Have Become Comfortably Thursday

Market Jitters by Gregg A. Biro

Medical Law Update with Lester Perling

An Introduction to Succession Planning and Possibly All You Need to Know, Part II

Richard Connolly’s World – Changes for Law Firms to Consider

Humor! (or Lack Thereof!)

Upcoming Seminars & Webinars

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

I Have Become Comfortably Thursday

The 1979 double album The Wall by Pink Floyd was written entirely by Roger Waters, both in music and in lyrics, and was a watershed moment for music in a number of ways.

While many view Pink Floyd as just another rock band or as a band that is fairly far out on the “far away from conventional music” scale, Mozart was quoted to the effect that “Pink Floyd is my favorite band. The beat is unsurpassable, and The Wall is, by far, my favorite album.” Even George Gershwin recognized the importance of The Wall when he wrote An American in Paris, recognizing that The Wall, in some ways, reflected the Berlin Wall, which was only 652 miles from Paris and built only 33 years after An American in Paris was composed.

Roger Waters was born in 1943 and joined Pink Floyd in 1967. He parted ways with them in 1985. Not to be confused with Muddy Waters, Roger Waters has been said by many to be one of the most talented writers and performers in the history of Rock and Roll, according to his press agent, his present girlfriend, and the 11.5 million people who have purchased The Wall, not to mention his later works, which included The Pros & Cons of Hitchhiking and Amused to Death.

Quote of the Week

“At first, I felt that it was confined to my liver and that the operation had completely removed it, so I was quite relieved. Then, that same afternoon, we had an MRI of my head and neck, and it showed up that it was already in four places in my brain, so I would say that night and the next day until I came back up to Emory, I just thought I had a few weeks left, but I was surprisingly at ease. I’ve had a wonderful life. I’ve had thousands of friends, and I’ve had an exciting, adventurous, gratifying existence, so I was surprisingly at ease – much more so than my wife was – but now I feel, you know, it’s in the hands of god and my doctors, and I’ll be prepared for anything that comes.”

– President Jimmy Carter, when asked how he felt when he found out he had cancer

James “Jimmy” Carter, Jr. is an American politician and author who served as the 39th President of the United States from 1977 to 1981. He was awarded the 2002 Nobel Peace Prize for his work with The Carter Center, a nonprofit organization that works to advance human rights and alleviate human suffering. In August of 2015, Carter announced that he was undergoing treatment for cancer in his liver and brain.

Market Jitters

by Gregg A. Biro

Gregg is the Director of Business Development and a shareholder with Resource Consulting Group. He joined the firm in 2010. Prior to joining Resource Consulting Group, he was a Vice President for Bernstein Global Wealth Management where he provided comprehensive wealth management solutions to clients in Florida. He also served in a similar role with Wells Fargo Private Bank in Orlando. He holds his Series 65 financial security license and held his Series 7, 31, and 66 financial securities licenses. He is a graduate of The Ohio State University with a Bachelor of Science in both Marketing and Computer Information Systems. A resident of Orlando since 1987, Gregg enjoys swimming, playing golf, and spending time with his three children. He supports several local nonprofits which provide support and guidance to children.

Thanks to Gregg, Michael H. Davis, and Resource Consulting Group for allowing us to share this report with Thursday Report readers! This article has been reprinted with permission.

Market Jitters…

We’ve all seen the headlines declaring that “markets are in a free-fall.” We don’t dismiss the anxiety that market corrections may cause investors, and we want to provide a few points to remember in times like these.

First, market corrections are completely normal. In fact, over the last 35 years, the average intra-year drop from a market high to a market low is approximately 14%. The current volatility is well within this normal range.

To see a chart of intra-year declines versus calendar year returns, please click here.

Second, maintaining your discipline during times of volatility is critical to investment success. Your investment strategy must be driven by your investing goals – not by short-term movements in the markets. It is important to remember that the capital markets have consistently rewarded the disciplined investor who endures these normal periods of market volatility.

Lastly, please remember why the media is in business: to generate ratings that sell more advertising. The old adage that “bad news sells” is very true. As you have no doubt already seen, and will continue to see, the media will use “breaking news” alerts and special coverage to wring the ratings out of this market downturn. You should also expect the media to feature various “experts” offering all sorts of predictions. But we all know those predictions have nothing to do with maintaining a long-term prudent strategy for investment success.

Medical Law Update with Lester Perling

by Travis Arango

There have been some new developments in the state of Florida’s health care laws. This article will go over the specific bills and summarize the webinar presented by Lester Perling, J.D., MHA, and Alan Gassman, J.D., LLM. You can watch the webinar by clicking here.

HB 269 – Experimental Treatments

This is known as the “Right to Try Act.” This allows patients with a terminal condition to try a drug, biological product, or device that has successfully completed Phase 1 of a clinical trial but is not yet approved by the FDA. The licensing board may not take action against a physician’s license for recommending an experimental drug, product, or device. There is also an immunity for the manufacturer of the drug as well. Another interesting nuance is that the patient’s heirs are not liable for the patient’s debt related to the treatment. Keep in mind that most insurances are not obligated to cover experimental treatments.

HB 32 – HIV Testing

Definitions for “health care setting” and “non-health care setting” are added with this bill. Health care setting is defined as a setting devoted to the diagnosis and provision of medical care (hospitals, urgent care centers, health departments, etc.). Non-health care setting is defined as a site that conducts HIV testing only for diagnosis and does not provide any treatments (community based organizations, outreach settings, mobile health vehicles, etc.). The bill reiterates that informed consent is required for both settings. The bill also changed the notification requirements before an HIV test can be performed in both settings. One notification requirement is that the patient must be told that their results will be submitted to the Department of Health, and if they do not want to have the results reported, then they will be given the locations to anonymous testing sites.

HB 633 – Abortions and Informed Patient Consent

This bill requires physicians to inform pregnant women of the risks of having an abortion. The bill also requires that the physician performing the abortion or the referring physician be present in the same room when obtaining informed consent. There is now a 24-hour waiting period for pregnant women who wish to have an abortion. This is not a direct 24-hour wait period, but instead, the informed consent must be given no sooner than 24 hours of the procedure, thus creating a 24-hour wait period. There are exceptions for the 24-hour waiting period for women who are victims of rape, incest, domestic violence, or human trafficking, with documentation evidencing that she is the victim of one or more of these crimes.

HB 655 – Clinical Laboratories

This bill revises the definition of “licensed practitioner” to include consultant pharmacists and doctors of pharmacy. The bill requires clinical laboratories to make its services available to consultant pharmacists or doctors of pharmacies in addition to other licensed practitioners (currently, a clinical laboratory cannot accept human specimens from pharmacists because they are not included in the statutory definition of licensed practitioner.) Clinical laboratories may not charge different prices for its services based upon the practitioner’s licensing.

HB 697 – Public Health Emergencies

This bill amends Florida Statutes to include provisions on communicable diseases. It allows law enforcement to enforce isolation and quarantine orders. Before this bill, law enforcement did not have the power to do this. This bill provides definitions for “isolation” and “quarantine.” “Isolation” means the separation of an individual reasonably believed to be infected with a communicable disease. “Quarantine” means the separation of an individual reasonably believed to have been exposed to a communicable disease but is not yet ill. The goal for this bill is to “fulfill an important state interest.” This is likely a response to the Ebola situation we faced at the beginning of this year.

HB 751 – Emergency Treatment for Opioid Overdose

This bill creates the “Emergency Treatment and Recovery Act,” which allows health care practitioners to prescribe and dispense emergency opioid antagonists to patients for emergency purposes. It provides “good Samaritan” protection from civil liability to practitioners that prescribe and dispense emergency opioid antagonists and does not create a duty or standard of care for a practitioner who prescribes or dispenses or a person who administers an emergency opioid antagonist.

HB 889 – Health Care Representatives

Allows a person to designate a health care surrogate to act any time, including while the person is still competent and able to make his or her own decisions. If the individual is competent to make decisions, then his or her decision controls. This bill ensures that redetermination of incapacity is not necessary for a designated surrogate to make health care decisions. It also provides for the designation of health care surrogates for minors when the minor’s legal guardian cannot be timely contacted or is unable to provide consent for treatment. It specifies that a principal’s wishes are controlling while he or she has decision-making capacity.

HB 1127 – Insurance Fraud

The law expressly provides that charges and claims for reimbursement made by unlicensed health care clinics that are operating in violation of the health care clinic statute are unlawful and could constitute theft even if the claims were not paid to the unlicensed health care clinic. This bill revises the criminal penalties for such unlawful health care charges and classifies unlicensed clinic activities as a felony. This bill requires that when health care providers have knowledge of an unlicensed clinic, they must report the clinic. Failure to report an unlicensed clinic can result in licensing sanctions.

HB 309 – Patient Admission Status Notification

This law adds a provision that if a patient is on “observation status” rather than inpatient status in a hospital, services that are performed during the observation status (such as x-rays, lab tests, etc.) must be documented in the patient’s discharge papers. The bill requires hospitals to inform patients if they are on “observation status.” Medicare coverage varies depending on whether a patient is inpatient or observation, so the point of this law is to make it clear to the patient what his or her co-payment obligation will be; it is often higher if a patient is in observation status.

An Introduction to Succession Planning and

Possibly All You Need to Know, Part II

by Alan Gassman

Last week, we covered terminology and important concepts relating to succession planning. You can review this by clicking here.

This week, we are covering approximately one-half of our substantive succession planning materials, which were written for intelligent laymen, and are as follows:

PART II – A MULTIPLE CHOICE QUESTION

The majority of businesses in the United States are family-owned. Of those family-owned businesses, it is estimated that only 30% survive to the second generation, and merely 12% survive to the third generation.[1] Arguably, the most common reason that family-owned businesses fail to survive beyond the first generation is friction from within the surviving family. A close second may be irrational decision-making to “cash in” and do other things (like spend it all.) A third reason is failure of the business due to naïve or simply incorrect decision-making.

Family-owned business succession is rife with possibilities for discord. For example, consider a business that was founded and operated by a single owner in the first generation. In many cases, that business will be passed on to multiple siblings in the business’s second generation of ownership. These siblings, each with their own individual interests, visions, and rivalries, will now need to depend on each other for their financial security and the survival of the inherited business.

There are endless factors that may bring about or exacerbate contention among siblings. Oftentimes, family members of the second generation who were inactive in the family business would rather sell the business and reinvest the proceeds elsewhere. Similarly, second generation owners who do not have children will have different attitudes about retaining the family business than siblings who do.[2]

Each of these difficulties that are inherent to family-owned business succession are compounded if the business survives to the third generation, where both siblings and cousins may share control.

Clients with successful businesses and professional practices have limited choices when it comes to how they should pass their business on to the next generation or generations of family members. In practice, this tends to be a good thing because recognizing the choices and then the sub-choices that come with each possible direction can help assure that the senior family members have a good understanding of what is possible in the future.

Where Estate Tax is a Consideration

The present estate and gift tax exemption of $5,430,000 per person allows many clients to pass businesses without any concern for federal estate tax at the level of the present owners. This simplifies planning and also enables the next generation to receive inherited stock or businesses at a fair market value income tax basis.

Families facing federal estate tax challenges need to consider the integration of estate tax avoidance techniques into succession planning. However, in most situations, the available options can be kept open while estate tax planning takes place.

For example, stock in a closely held company can be transferred annually to an irrevocable trust that will not be subject to federal estate tax at the level of the parents using the $14,000 per year per person gift tax exclusion (a mother and father can gift $28,000 per year to each of their children, in-laws, grandchildren, etc.). The irrevocable trust can hold S-Corporation or other types of ownership interests and then have them pass without being subject to the federal estate tax at the level of the donating parent.

Other techniques include the use of special trust arrangements such as (i) Grantor Retained Annuity Trusts and (ii) installment sales to Grantor Trusts to move ownership and/or the eventual proceeds from sale and profit (not to mention dividends and other distributions) outside of the federal estate tax system.

Family members or trusted advisors can be named as Trust Protectors so that various family members can benefit from inheritance, continued trusteeship, or the purchase of stock as and when circumstances change.

Often these types of trusts and techniques are used shortly before a company goes public. The rule of thumb in most industries is that a company’s stock will be worth three times as much after a successful initial public offering (IPO) as compared to pre-IPO activities.

One key point that the estate and trust planner must understand is that family members often want maximum flexibility and any one or more of the techniques above can be used.

Life Insurance Arrangements

Life insurance policies that are funded under buy-sell or redemption arrangements are, by no means, the only or even the most common way to have ownership pass to subsequent generations, but they are often considered to be a good fit for many situations.

Inexpensive term life insurance is often used to help assure families that a premature death will not bring a company down or provide serious challenges to its survival because of a loss in cash flows, capitalization, or other tax issues.

It is quite common for many buy-sell arrangements to factor in the amount of money available to pay taxes and expenses as they come due, as well as whether those beneficiaries that may not inherit or benefit from the family business can receive a reasonable inheritance. For this reason, permanent life insurance may be used in certain situations, including second-to-die life insurance policies that will pay a death benefit only on the death of a surviving spouse or business owner. This can ensure that the family has plenty of liquidity to pay taxes, handle bank debt, or provide inheritance monies for those who may not participate in the family business.

We find that, in most instances, insurance is not owned or made payable by beneficiary designation in the most optimal manner. For example, the choice between a cross purchase agreement and a redemption agreement will often be made based upon custom, or simply from a misunderstanding of what choices are available. Our article on this topic, entitled A Logical Guide to Selecting a Buy-Sell Agreement Arrangement: Traditional Choices are not Always Best, is available here.

Another simplified way of using life insurance would be to establish a trust for the primary benefit of junior family members and for that trust to own life insurance on the senior family members so that it can then be used to facilitate a purchase of ownership upon the death of the senior family members.

We rarely recommend that life insurance be owned by an operating company because it is possible for creditors of the company to attach life insurance values or death benefits if the company has a catastrophic situation or the banks are inclined to call in loans upon the death of a shareholder.

Transferring the Business To or For the Benefit of Employees

On occasion, a client will not have family as the intended recipients of a business but will instead prefer to have the key employees take over ownership and possibly pay for the value from the profits of the business.

One method to accomplish this is called the Employee Stock Option Plan (“ESOP”), under which a small contribution is made to a new qualified retirement plan for employees, which then borrows money from a bank or other financial institution and pays the money to the business owner in exchange for the stock of the business.

The business owner will pay a capital gains tax on the payments received, and the business profits payable to the ESOP will not be subject to tax until, eventually, ESOP monies are payable to employees many years down the road.

For example, a business owner receiving $1,000,000 a year in profits and a $250,000 salary might sell his stock to the ESOP for $7,000,000 that would be taxed at the 20% plus state tax bracket instead of at the normal 43.8% plus state tax bracket.

For the next 7 years, the profits of the business would be payable tax-free to the ESOP, and the ESOP would use those profits to repay the $7,000,000 note to the bank.

The seller would remain as president of the company and continue to control it to assure that the $7,000,000 is paid. The seller would be well advised to put some or all of the net after tax monies received from the sale into bond or other safe funds or investments in case the company cannot pay the loan and the selling owner had guaranteed it.

Assuming a 20% capital gains tax and a 43.4% income tax, the tax savings from this arrangement over the seven years would be approximately $1,638,000 (23.4% of $7,000,000), and the owner may be a participant in the ESOP, and thus, retain a relatively high percentage of indirect ownership.

There are also a number of rigid tax law and pension law requirements that must be met to facilitate a successful ESOP transaction.

Join us next week when we conclude our succession planning series with a discussion of shareholder agreements and business allocation planning.

*************************************************

[1] Cain v. Abel: Dealing with Sibling and Cousin Rivalries by Louis A. Mezzullo at 8-3.

[2] Id.

Richard Connolly’s World

Changes for Law Firms to Consider

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Will Law Firms Flock to .Law Domain?” by Jacob Gershman. This article was featured on The Wall Street Journal Law Blog on August 13, 2015.

Richard’s description is as follows:

Starting in mid-October, law firms and credentialed lawyers will be able to purchase web addresses ending in .law, a new domain reserved for their industry.

Law firms are going to have to pay to get a .law domain. The price to register .law starts at $200. Minds + Machines [a major registrar for many new top-level domains] says domains for practice areas, like divorce.law or antitrust.law, will cost more, with prices subject to negotiation.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Baker & Hostetler Weighs Giving All Partners Stake in the Firm” by Sara Randazzo. This article was also featured on The Wall Street Journal Law Blog on August 10, 2015.

Richard’s description is as follows:

What does it mean to be a law firm partner?

At some large firms, being a partner means having an actual voice in how the firm operates and a salary that rises and falls with each year’s profits. At others, the title comes with little influence and a salary barely higher than that of a senior associate.

Baker & Hostetler, LLP is proposing a change to put all of its partners on more equal ground by eliminating its so-called two-tier partnership in favor of one that gives every partner an equity stake in the 930 lawyer firm.

As Above the Law first reported, Baker & Hostetler leadership told its partners last month that it would like to switch systems to “strengthen” its culture “by having all partners invested in the success of the firm.” The partnership is expected to vote on the change in September, according to a memo obtained by the blog.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*******************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES.

This seminar will focus on how owners can transition their businesses to employees or others who buy over time. Topics include avoiding unnecessary capital gain tax on exit, deferred compensation, profits interests, redemptions, life insurance, and getting assets out of corporate solution to obtain a basis step-up (without self-employment tax.)

There will be two opportunities to attend this presentation. Attendees will be given the opportunity to receive over 850 pages of technical business planning materials at no charge.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY AND RECENT DEVELOPMENTS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: TBD

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Please watch this space as details for these two great events are finalized in the upcoming months!

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE CLEARWATER EVENT:

40th ANNIVERSARY SCREENING OF JAWS WITH RICHARD DREYFUSS

The Capitol Theatre ’70s Movies Series will present a special feature 40th anniversary screening of Jaws with a live appearance by Academy Award winter Richard Dreyfuss.

The 1975 thriller, directed by Steven Spielberg, will be followed by a rare, candid, interactive discussion and Q&A with the film’s star Richard Dreyfuss. The event will be hosted by Tampa Bay Times film critic Steve Persall.

A portion of the proceeds from this event will benefit the Clearwater Marine Aquarium.

Date: Thursday, September 10, 2015 | 7:00 PM

Location: The Capitol Theatre, 405 Cleveland Street, Clearwater, FL

Additional Information: For more information, or to purchase tickets for this event, please click here.

**********************************************************

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and have a killer time with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

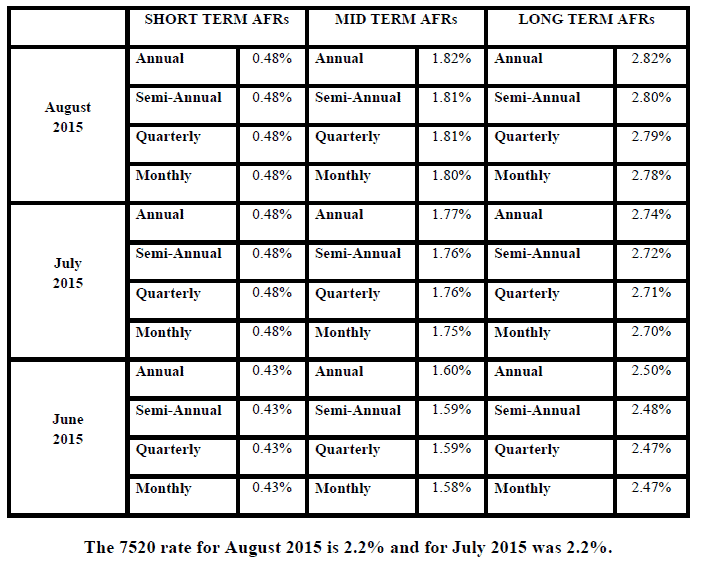

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.