The Thursday Report – 8.13.15 – It’s 5 o’clock Somewhere

Aggressive Income Tax Planning Becomes a Felony Conviction with Jail Time

Underwriting, Physical Exams, and Ratings

Back Seat Drivers Can Be Held Liable by Jeffrey M. Verdon, Esquire

Richard Connolly’s World

Thoughtful Corner – Stop Struggling and Allow it to Happen by Dr. Srikumar Rao

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“You are two people who have great talent, who have been very successful in life, who I am going to send to prison.” – Manhattan Federal Court Judge Denise Cote

To find out how this quote came to be and who it was directed to, see our Richard Connolly’s World section below!

Aggressive Income Tax Planning Becomes a

Felony Conviction with Jail Time

Jay Adkisson is a partner of Riser Adkisson LLP and licensed to practice law in Arizona, California, Nevada, Oklahoma, and Texas. He practices in the area of creditor-debtor law and has authored books on asset protection and captive insurance. Adkisson has been an expert witness to the US Senate Finance Committee and is currently the Chair of the Committee on Captive Insurance.

For decades, legitimate businesses have been able to deduct insurance premiums paid to offshore related party insurance carriers, where there is a legitimate shifting of risk, resulting in income tax deductions for premiums paid and eventual capital gains income if and when the carrier does well and can be liquidated in later years.

Offshore insurance carriers may be able to invest their surplus monies on a tax-deferred basis.

Take these concepts and an aggressive platform, where there was apparently no real shifting of risk, and significant compensation paid to the middle men who set this up, and you have the perfect storm for abuse and treachery.

A good many professionals will remember the advertising and sales calls from Foster & Dunhill, an “exclusive agency” that specialized in offshore tax planning.

Creditor protection lawyer and author Jay Adkisson has done a fantastic job of summarizing the US District Court for the Middle District of Florida court decision in his Forbes article dated July 23, 2013, which can be viewed by clicking here.

In the article, Mr. Adkisson points out:

The rather obvious flaw with this arrangement is that the BPPs [business protection policies] were nothing like an insurance policy, since there was no “risk distribution,” i.e. no sharing of risks with others. Apparently, to get suckers like Thomas and Kidd to invest in these arrangements, the Foster & Dunhill scheme promised that “the profitability of each life policy’s reinsurance business is tied to that client’s company’s non-life policies and to none other.”

Kidd didn’t care that Attorney #2 had withdrawn his opinion letters, since Kidd “believed that he could always find another lawyer.” And he was right, since Jenkens & Gilchrist were in town – a law firm that was basically a drive-up window for opinion letters on transactions that were hopelessly flawed. In fact, by 2007, Jenkens & Gilchrist had folded, after paying a $76 million fine to the IRS and agreeing to cease practicing law – and facing a bunch of civil lawsuits by clients whose shelters had been blown up by the IRS.

On July 25, 2013, the indictment of Foster & Dunhill executives, Duane Crithfield and Stephen Donaldson, in Tampa was announced. They will face a maximum penalty of five years in federal prison and a $250,000 fine. In the first week of August 2015, the two executives signed a plea agreement admitting to one of the counts that is punishable by up to three years in prison. The prosecutors will drop two other counts in exchange for the plea agreement. One of the charges dropped was conspiracy to defraud the government.

This shows that the government will not be taking offshore captive life insurance and offshore life insurance policies lightly when they come across them. There are certainly legitimate and tax-advantaged purposes and uses for these vehicles, but they always actively rely upon impartial advisors who are independent of the “promoters.”

Jay’s article does a very good job of showing how law firms can become known as “opinion mills,” and thereafter, may be nowhere to be found when the dozens or even hundreds of opinions that they have issued turn out to be without foundation.

Anything too good to be true is quite likely too good to be true. Sometimes, it is best to pay our taxes and sleep safely at night knowing that what is left over after taxes is not going to be subject to question.

Underwriting, Physical Exams, and Ratings

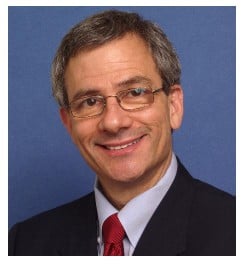

by Barry Flagg, CFP, CLU, ChFC and Alan Gassman, Esquire

Underwriting is the carrier-based process of reviewing the application and medical information of a proposed insured in order to determine whether the carrier will be willing to offer coverage and upon what terms.

In this article, we explain what an informal application is and why it is important, as well as review some important information that policy owners may ask about this process. We will summarize typical ratings systems used by carriers.

The underwriters work closely with the issuing carrier to determine whether or not the carrier should provide insurance to the applicant and what rating will be assigned to the insured. The rating system ranges from preferred to standard and could have a modifier attached – such as “standard – smoker.”

If an applicant is a higher risk, they will be “rated” and categorized into a higher price table. The majority of companies have between 12 to 16 substandard rating classifications that range from 125% to 500% of the charge of standard rating.[1] The “average” rating will typically be standard smoker or standard non-smoker, though premiums will be much higher if that person is categorized as a smoker. Most cigar smokers will be characterized as smokers, even if they only occasionally smoke cigars.[2] Many carriers offer permanent life policies that will adjust to lower premiums if and when the insured can confirm that they have quit smoking for a minimum period of twelve (12) months. Nevertheless, such coverage will still be more expensive than if the person was classified as a non-smoker when the policy is issued.

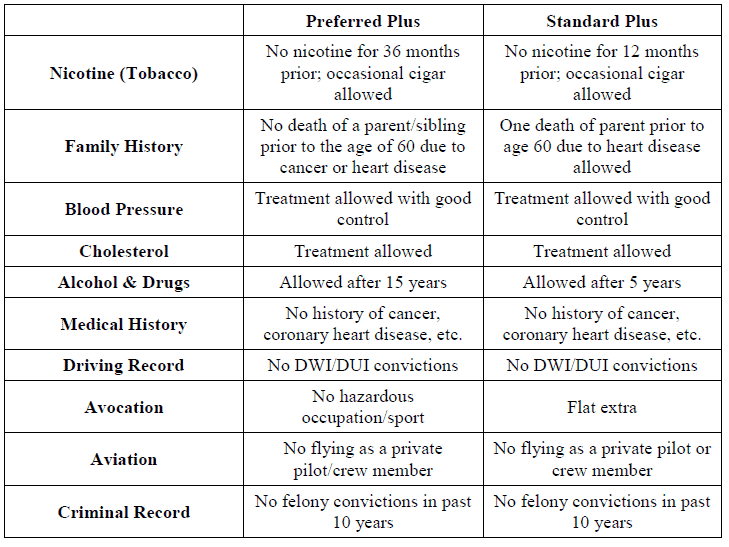

The below charts show a typical ratings system employed by a well-respected carrier:[3]

Sometimes an underwriter will also attach an additional charge to the policy known as a flat extra. A flat extra is a charge per $1,000 of face amount that is added to any rating schedule changes. Usually, the flat extra is assessed for a limited time period.

Ask the carrier for a better rating.

It is not unusual for agents to call carriers and ask them to reconsider the health-risk rate offers that they have given, based upon nuances or complexities associated with health situations, and urge them to match superior health-risk ratings that may have been offered by competing carriers. The agencies that seem to report the most success with this strategy are those most capable of making a compelling argument for the better health-risk rate class and those that have a reputation for full and forthright field underwriting and communication with underwriters. This is most likely to occur in instances where those agencies have underwriters and medical directors on their staff. Underwriters are unlikely to match a competing rate or offer if they cannot or do not understand and assess the risk. Oftentimes, carriers will be more flexible to provide a more favorable rating at the end of a calendar month or quarter if business is slow, depending on the person in charge.

To begin the underwriting process, a policy application will be completed, and a medical examination will be scheduled. The vast majority of carriers will want to have all of the insured’s medical records and information for the preceding five (5) years, as well as conduct a one-on-one interview with a nurse or a physician assistant, who will visit the insured at a place of their choosing. Sometimes, an EKG will also be performed, depending on the amount of coverage and the age of the proposed insured.[4] The insured will not be charged for the examination and gathering of medical materials, notwithstanding whether a policy is purchased.

Most of the time, the exam will include taking blood and urine samples to check cholesterol, blood sugar, nicotine, traces of various controlled substances, and to detect urine protein to determine kidney function. In addition, an EKG (electrocardiogram) may be required.[5] If the policy face amounts are higher, policy amounts and older ages will typically dictate more extensive testing.

Marijuana users can expect to pay higher rates for coverage. Some carriers treat marijuana like tobacco, while others are more lenient. While nicotine will typically stay in the body for 7 to 10 days after smoking a cigarette, marijuana will typically stay in the body for about 10 days after being used.[6]

Applicants outside of Colorado and Washington State (and perhaps also in those states, because of federal laws) who use marijuana can expect to pay higher premiums or can be denied coverage altogether. An applicant who is dishonest on his or her insurance applications stands the risk of having the policy owner only receive a refund of premium in lieu of a death benefit in the event of death within two years.[7] Some carriers simply apply tobacco-smoker status to users who admit to marijuana use. Further, in many cases, disclosure of recreational drug use will lead to a more favorable underwriting classification than denying such use and having it show up on a blood test.[8]

Typically, this process will take between six to nine weeks because it involves receiving independent copies of medical records from all physicians for the past five years.[9] Well-organized agents will check after two to three weeks to see what records are still needed and may call doctor’s offices or other facilities to encourage them to comply with requests to provide medical records.

An insured is eligible for re-examination if there is a disagreement with a medical underwriting determination. Once the underwriter working for the carrier has reviewed the medical information, a rating will be issued, and premium costs can be established.

If a formal application is made, then the completed medical exam and application information will be provided to the Medical Information Bureau (MIB), which keeps the information on file for seven years, and will compare back to previous data to help assure that the medical information is accurate and that the participating carriers have access to this. The MIB obtains information through a release form from the applicant and keeps the data on file, making it available to all of its members, for a period of seven years.[10]

Many advisors urge policy owners and agencies to only file “informal applications,” whereby the medical information is not shared with the Medical Information Bureau, and the carrier or carriers receiving the information and an “informal application” will not formally rate or turn down the proposed insured, but will instead communicate what rating and terms for a policy will be offered, if the proposed insured wants to make a formal application. The results of these exams and proposed ratings are not shared with the Medical Information Bureau during or after the application process, so the privacy of the policy owner is preserved.

All 50 states have a two-year contestability period whereby a carrier cannot deny paying a death benefit if the application is more than two years old, even if it is inaccurate by not disclosing a substantial medical condition or circumstance that would have caused the carrier to not offer to provide coverage on the applicable terms that were accepted.[11] For this reason, many advisors recommend that old insurance policies be maintained for up to two (2) years as opposed to being dropped immediately when being replaced by new coverage.

Involved professionals should never aid, abet, encourage, or have any involvement in any application fraud. Those that do abet or aid in application fraud can lose their professional licenses and may owe liability to the carrier that has had to pay a claim based upon a dishonest application more than two years old, so extreme caution should be exercised.

Typically, the offer made by the carrier to write the policy is only open for six months from the date of the physical. Often, the insurance agent will strongly encourage that the insured accept an offer based on the premise that the carrier has offered a better rating than the insured would expect to qualify for later.

********************************************

[1] Gary Lee and Craig Wilkey, 807-2nd T.M., Personal Life Insurance Trusts.

[2] Id.

[3] These are hypothetical rating charts for illustrative purposes only and should not be interpreted as an indication for a purchaser’s ability to obtain life insurance.

[4] Gary Lee and Craig Wilkey, at A-26.

[5] Id.

[6] See Elijah Wolfson, What Happens When You Quit Smoking? Medically reviewed by George Krucik, M.D. on January 28, 2013. Available at: http://www.healthline.com/health-slideshow/quit-smoking-timeline.

[7] See Mark Barnum, Underwriting – Going to Pot, The Messenger, available at: http://www.scor.com/images/stories/pdf/library/messengers/Underwriting%E2%80%93Going_to_Pot.pdf.

[8] Id. Some carriers may also want to consider other circumstantial information when underwriting. More questions may be asked, and the insured’s age will become a bigger factor. Indeed, Mr. Barnum suggests that those who admit to using before age 18 should be declined insurance coverage.

[9] Id.

[10] Id. The MIB will not only record the height/weight, blood pressure, etc. of an applicant, they may also keep a record of the applicant’s driving record, participation in hazardous activities, or aviation.

[11] See definition of Incontestability clause at: http://www.investopedia.com/terms/i/incontestability-clause.asp.

Back Seat Drivers Can Be Held Liable

by Jeffrey M. Verdon, Esquire

Jeffrey Verdon is Managing Partner of Jeffrey M. Verdon Law Group, LLP. He has an LL.M. in Taxation from Boston University and practices law in the areas of taxation and comprehensive estate planning. He specializes in estate, trust and income tax planning, and asset and lifestyle protection planning for high net-worth clients across the US. He is also a highly sought-after speaker in the areas of taxation and estate planning, lecturing aboard cruise ships and at top Investment Conferences internationally.

To see this article in its original form, please click here. Thanks, Jeff, for sharing this Client Alert with Thursday Report readers!

Dear Clients, Colleagues, and Friends,

Josh and Jessica planned a Friday night movie date at home. They rented Fast and Furious, as they were both avid NASCAR fans. They were ready to see some exhilarating action scenes, but then they discovered they didn’t have any popcorn, so they jumped in the car for a quick trip to the store.

Jessica knew a short cut through the residential neighborhood. She also knew the road contained dips that would cause a vehicle traveling at a high speed to become airborne – they could create their own fast and furious adventure! She encouraged Josh by saying, “It’s fun to drive fast on them! You should do it!” She continued encouraging him to increase his speed. Josh finally put the pedal to the metal!

Then it happened.

Josh lost control of the vehicle and collided at 71 miles per hour with a parked vehicle. A neighbor was putting one of his children in a car seat when Josh’s vehicle slammed into theirs, killing the father upon impact.

The father’s widow sued Josh and Jessica for violating Vehicle Code Section 21701, willful interference with the driver of a vehicle so as to affect the driver’s control of the vehicle, as well as for civil conspiracy. For the section 21701 violation, the widow claimed that the passenger, Jessica, egged on Josh to drive at an unsafe speed over a road which Jessica should have known would cause his vehicle to become airborne. As to the alleged conspiracy, the widow claimed Jessica and Josh formed an oral or implied agreement to commit a wrongful act by driving on the residential street at an unsafe speed, which caused injuries to the plaintiff and decedent.

In her defense, Jessica moved for summary judgment, arguing that undisputed facts demonstrated she never interfered with Josh’s control of the vehicle for liability under Section 21701. She further argued there was no evidence of an agreement between her and Josh to support a tort conspiracy. In opposition, the widow argued that verbal encouragement and solicitation to commit a wrongful act can constitute a civil conspiracy.

The trial court sided with the defendant, Jessica. The plaintiff appealed, and the Court of Appeal reversed the trial court. The appeals court found sufficient basis for the case to go to a jury. The question was whether to impose joint liability on Jessica under theories of concert of action and conspiracy, and whether she unreasonably interfered with the safe operation of a vehicle. Would you want to be in the position of Jessica or her parents?

This case demonstrates there is now potential liability for someone other than the guilty party to have joint and severe liability if their conduct contributes to harm. See [Navarrete v. Meyer 2015 DJDAR 7012].

Parents: This is a serious situation. Your children can unwittingly expose you and your wealth to extreme risk of loss in a civil lawsuit, for which your insurance carrier is likely to decline coverage. We often witness tragic situations for the victim and his or her family, as well as for the parents of the often youthful defendant. When a young person makes a mistake, the parents get stuck with the tab and often with catastrophic results.

To what other areas of commerce might this theory of liability be extended? The prospects can be alarming. Please be extra vigilant, whether it’s your teenager behind the wheel or in the passenger seat, or whether you are engaged in a business or activity where someone else’s acts could result in your liability. Be prepared for any eventuality. Regardless of how a potential problem may arise, protect yourself with effective “firewall” estate and asset protection planning.

To see this case in its entirety, please click here.

Richard Connolly’s World

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Wealthy Couple Sentenced to Jail for Obstructing IRS at Audit” by Kelly Phillips Erb. This article was featured on Forbes.com on August 2, 2015.

Richard’s description is as follows:

“You are two people who have great talent, who have been very successful in life, who I am going to send to prison,” Manhattan Federal Court Judge Denise Cote advised Dr. Jeffrey Stein and his wife, Marla Stein, shortly before handing down their sentence.

Both will spend time in federal prison for their respective roles in cheating the Internal Revenue Service (IRS). Dr. Jeffrey Stein, a vascular surgeon, was sentenced to 18 months, while Marla Stein, a personal injury lawyer, was sentenced to one year plus one day.

The sentencing followed charges and a guilty plea filed earlier this year. The couple pleaded guilty to a scheme to lower their tax burden by providing “false and fictitious information” to their accountant. That information involved generating fake deductions to offset actual business income from their respective practices. When their returns were flagged by the IRS for audit, the two became even more creative: they made up documentation to support their lies.

Please click here to read this article in its entirety. For more information about this case, please click here.

The second article of interest this week is entitled “Estate Tax Tips for Wealthy Clients” by Ingrid Case. This article was featured on Financial Planning.com on February 2, 2015.

Richard’s description is as follows:

For the 2012 tax year, the following statistics are true:

For estates worth between $5 million and $10 million, the IRS audited 58.6% of returns and determined that heirs still owed an average of $105,388 per return, in addition to taxes already paid.

And while there were just 937 returns that year for estates worth more than $10 million, the IRS actually conducted 1,087 audits, going over returns repeatedly, and, on average, asked heirs for an additional $819,243 per return.

The lesson: the higher a client’s net worth, the more important it is to create an estate plan that can withstand careful scrutiny. For wealthy clients, a solid estate plan can offer tax benefits via strategies that work to reduce estate value, shelter estate value, and shift future appreciation between now and the second spouse’s death out of the estate.

Please click here to read this article in its entirety.

Thoughtful Corner

Stop Struggling and Allow it to Happen

by Srikumar Rao, MBA, Ph.D.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and is the author of Happiness at Work and Are You Ready to Succeed?, which has been published in over 60 languages.

You don’t have to work hard and use willpower and rigid discipline to achieve phenomenal results.

Here is how most of us live life:

We set a goal for ourselves and then take appropriate action to reach that goal. When things do not go our way, we work harder. We put our “nose to the grindstone” and try to remember that “when the going gets tough, the tough gets going.”

Our lives are full of struggle as we accumulate accomplishments. This is just the nature of life, right?

Well, maybe not.

The Surrender Experiment by Michael Singer, author of The Untethered Soul, appears in the life-changing books section of the syllabus for the Creativity and Personal Mastery program. Singer describes a phase in his life when he was so tired of his mental chatter that he was spending virtually all of his time in deep meditation. His description of his life then is eerily similar to that of Ramana Maharshi when he first came to the temple at Tiruvannamalai and simply meditated in the cavernous rooms in the many-level temple basement.

Singer was in a doctoral program in economics at the University of Florida and had to take three exams. He registered to take the two that he was somewhat prepared for.

Somehow, he got registered for all three, and he had not done a stitch of work for his public finance exam. He was tempted to withdraw, but he was experimenting with surrendering to the universe rather than imposing his will on it.

He decided to take the exam and that the failure that happened would help in his struggle to vanquish his ego. On the day before the exam, he picked up his main public finance textbook and read three sections at random. He repeated this the next morning and left to take his exam fully expecting to fail and fully at peace with it because he was sure he would drop out of his Ph.D. program to devote full time to his spiritual practice.

There were six questions on the exam, and Singer was required to answer three. Three of the six questions dealt with the topics that he had studied.

He received an A on the exam and even got a commendation from the Dean on his exemplary performance.

Here is a scary thought:

Do you really have to impose your will, with all of the pain it involves and the drama it creates, on the universe to make things happen the way you want them to? Or can you learn to set aside your oh-so-strong preferences and let a greater wisdom guide you effortlessly through life?

Don’t rush to answer this question. This is a deep concept, so think about it, and let your answer emerge. Don’t force it.

Dr. Srikumar Rao can be contacted at mail@theraoinstitute.com. For more information on his Creativity and Personal Mastery program, please click here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking with Barry Flagg at the North Suncoast Chapter FICPA meeting on a topic to be determined.

Date: Wednesday, August 19, 2015 | 4:30 PM – 6:15 PM

Location: Chili’s | 9600 US 19 North, Port Richey, FL, 34668

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law one week from this Saturday. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

**LIMITED SPACES AVAILABLE**

CLICK HERE TO REGISTER

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES. There will be two opportunities to attend this presentation.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Please watch this space as details for these two great events are finalized in the upcoming months!

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE CLEARWATER EVENT:

40th ANNIVERSARY SCREENING OF JAWS WITH RICHARD DREYFUSS

The Capitol Theatre ’70s Movies Series will present a special feature 40th anniversary screening of Jaws with a live appearance by Academy Award winter Richard Dreyfuss.

The 1975 thriller, directed by Steven Spielberg, will be followed by a rare, candid, interactive discussion and Q&A with the film’s star Richard Dreyfuss. The event will be hosted by Tampa Bay Times film critic Steve Persall.

A portion of the proceeds from this event will benefit the Clearwater Marine Aquarium.

Date: Thursday, September 10, 2015 | 7:00 PM

Location: The Capitol Theatre, 405 Cleveland Street, Clearwater, FL

Additional Information: For more information, or to purchase tickets for this event, please click here.

**********************************************************

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and have a killer time with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

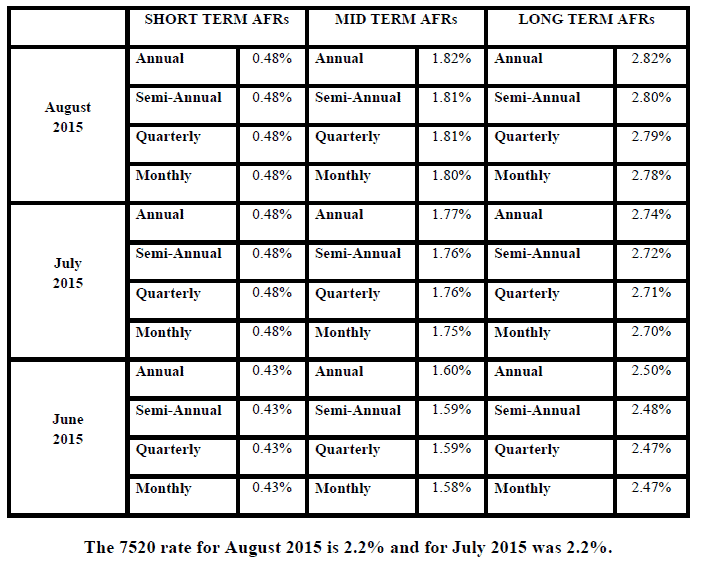

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.