The Thursday Report – 2.19.15 – Foreign LLCs may be Subject to US Court Jurisdiction

The Barber of Seville Replaces No Time for Sargeant

Charles Rubin Reads The Thursday Report and The Thursday Report reads Charles Rubin’s Blog

Gregory Gay’s Corner – The Baker Act

Seminar Spotlight – Structuring Joint Exempt Step-Up Trusts

Richard Connolly’s World – When You Die, Who Can Read Your Email?

Thoughtful Corner – Business Etiquette Concerning Email Communication

Humor from Heckerling!

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Barber of Seville Replaces No Time for Sargeant

by Travis Arango and Alan Gassman

It is shocking that the difference between a Limited Liability Company’s membership interest and stock in a corporation could cause such a different result. In Sargeant v. Al-Saleh, the stock in a foreign corporation could not be reached by the court while Well Fargo Bank v. Barber sent the creditor offshore to get a foreign court to allow seizure. In Barber, sole ownership of a Nevis LLC was considered to be like any other intangible personal property that a Florida judgment could be applied against.

In Well Fargo Bank v. Barber[1], the plaintiffs, Wells Fargo, had a deficiency judgment against Barber for $62,491,162.98. Before this judgment, the defendant had made a number of transfers. Here is a timeline of the transfers made:

Before April 13, 2009: Barber gets $1 million for sale of marital home – deposited into “homestead” account at American Momentum Bank (AMB)

September 21, 2009: Barber closed AMB account (balance: $1,066,776.85) and purchased a CD with AMB as “homestead” proceeds

February 17, 2010: Barber transferred CD to AIG Bank

April 15, 2010: Barber withdrew $227,026.20 to buy home

January 10, 2011: Barber formed Blaker Enterprises, LLC

February 28, 2011: Barber withdrew $870,000.49 from AIG and opened account at TD Ameritrade under Blaker Enterprises, LLC

September 9, 2011: Transferred $275,000 from TD Ameritrade back to AIG

February 9, 2012: Transferred $220,000 from AIG to an unknown location

April 2, 2012: Transferred $110,000 from TD Ameritrade into a new TD Ameritrade account

October 2, 2013: Deficiency judgment entered against Barber and another non-party for $62,491,162.98 to Wells Fargo and Regions

Plaintiffs seek injunctive relief, to foreclose on Barber’s membership interest in Blaker Enterprises, LLC, or seek a charging order against it and to avoid the fraudulent transfers made by Barber based on actual and constructive fraud. The court dismissed the injunctive relief claim stating that it is “a remedy that is [only] available upon a finding of liability on a claim.”[2]

The second claim was an attempt to foreclose on the membership interest or to obtain a charging order. The court stated that the Florida Limited Liability Company Act states:

A judgment creditor to any member of a limited liability company may obtain a charging order against the member’s interest in the company or foreclose that interest in the company under certain circumstances.[3]

The charging order will be similar to a lien on the membership interest and allows the creditor to receive distributions from the LLC that the member would have received. [4] This is generally the only remedy available, however, when the LLC only has one member, the Florida LLC Act allows a foreclosure on the company. [5] This foreclosure remedy is available when there is only one member and when “a charging order will not satisfy the judgment within a reasonable time.”[6]

The defendants claimed that the court lacked jurisdiction to foreclose or to enter a charging order on the LLC because Blaker Enterprises, LLC was created under the laws of Nevis. The defendants rely on a recent case Sargeant v. Al-Saleh.[7] In Sargeant, the trial court ordered the defendants to turn over stock they had in a foreign corporation to satisfy a judgment. [8] On appeal, the court of appeals reversed the trial court and held that the court “may only exercise jurisdiction over property of a debtor located within the court’s jurisdictional territory.”[9]

The plaintiffs contend that Sargeant had to do with interests in a corporation which is different than interests in an LLC; the court agreed. The court stated that “a membership interest in an LLC is intangible personal property, which accompanies the person of the owner.”[10] Thus, since Barber lives in Florida, her membership interest is located in Florida. The court goes on to say “Although Defendants repeatedly refer to Blaker Enterprises, LLC as a “foreign corporation,” (see Doc. 32, pp. 6, 7), Blaker Enterprises, LLC is not a corporate entity but a limited liability company. (Doc. 1-1, Ex. J). Unlike stock certificates in a corporation, a membership interest in a limited liability company is intangible personal property, which ‘accompanies the person of the owner.’”[11]

The court was then faced with a conflict of laws issue between the Florida LLC Act and Nevis law, which has the Nevis Limited Liability Company Ordinance of 1995. The court found that there was an actual conflict because the Florida act allows a charging order and a foreclosure action while the Nevis ordinance only allows a charging order. When there is a conflict of laws question, “a federal court sitting in diversity must apply the forum state’s choice of law rules.”[12] Since the issue in this case involves property, the law in Florida dictates that the situs of the property controls. Since Barber lives in Florida, so does her membership interest and thus, Florida law applies.[13] The court held that the plaintiffs are entitled to foreclosing the interest or charging the interest.

The next issue was avoiding the fraudulent transfers based on actual and constructive fraud. The Florida Uniform Fraudulent Transfer Act (FUFTA) states “a creditor may avoid a debtor’s transfer where the creditor shows that the transfer was made ‘with actual intent to hinder, delay, or defraud.’”[14] The statute provides a list of “badges of fraud” for the court to consider. The court finding a badge of fraud creates a prima facie case and a rebuttable presumption that the transfers are void if created.[15] The court held that the complaint showed six badges of fraud:

- Barber’s transfers to Blaker Enterprises, LLC were transfers to an insider, as Barber is the sole member of Blaker Enterprises, LLC.

- Barber retained possession or control of the funds transferred to Blaker Enterprises, LLC because Barber is the sole member of Blaker Enterprises, LLC.

- Barber transferred the funds shortly after the state court entered summary judgment against her and shortly before Plaintiffs sued Barber for a deficiency judgment.

- Barber’s transfers to Blaker Enterprises, LLC appear to constitute substantially all of Barber’s assets.

- Barber did not receive any consideration from Blaker Enterprises, LLC for the funds transferred.

- Barber was insolvent at the time she made the transfers to Blaker Enterprises, LLC, as the summary judgment against her was in excess of $66 million.[16]

This established a prima facie case for avoiding the transfers.

It is shocking that the difference between a Limited Liability Company’s membership interest and stock in a corporation could cause such a different result. In Sargeant v. Al-Saleh, the stock in a foreign corporation could not be reached by the court while Well Fargo Bank v. Barber sent the creditor offshore to get a foreign court to allow seizure. In Barber, sole ownership of a Nevis LLC was considered to be like any other intangible personal property that a Florida judgment could be applied against.

The question remains: did the court get this right? The court stated, “Unlike stock certificates in a corporation, a membership interest in a limited liability company is intangible personal property, which ‘accompanies the person of the owner.’” This would imply that stock certificates in a corporation are not intangible personal property but instead tangible. Is this because the stock is physically in a location? Would an LLC with certificates be classified in this way? The court did not go into much detail about the distinction, the court just stated that they are indeed different.

This goes to show that a foreign LLC may not be the best asset protection tool when the owner of the interest is still going to reside in Florida or in the US. This is especially true when the LLC only has one member which gives the judgment creditor the opportunity to ask for foreclosure under the Florida LLC act. They, of course, would need to show that a charging order would not satisfy their claim in a reasonable time, but that does not seem to be a large hurdle to jump, especially when you are dealing with multi-million dollar judgments like the one in Barber.

Fans of Gomer Pyle, U.S.M.C. might remember Andy Griffith’s movie No Time for Sergeants, where Andy Griffith starred as Private Will Stockdale. The Sargeant case caught the attention of a great many planners last year when the Fourth District Court of Appeal determined that stock held in a foreign country could only be seized by a creditor when permitted by a court sitting in that foreign country.

One would think that ownership in a limited liability company would be equivalent to owning stock in a foreign corporation, and that may be the case (not to be confused with a case of beer, which is what many planners are going to drink this weekend as they think about this case) because Judge Paul G. Byron, who sits at the United States District Court for the Middle District of Florida, determined that because an LLC membership interest is not “certificated,” it is “intangible personal property” that attaches to the debtor.

In No Time for Sergeants, the character played by Andy Griffith could never get his arms around the situation. Wells Fargo (which has been around since 1852, long before anyone had heard of Andy Griffith,) thought they were going to get their arms around stock but failed. The Barber of Seville was an opera that was written by Gioachino Rossini and Cesare Sterbini and first performed in 1861 at the Teatro Argentina in Rome, Italy. When someone gets a cut out of Will Stockdale, it is a heir-cut as opposed to a judicial haircut, which is what Ms. Barber got from Wells Fargo, when she expected that her Nevis LLC interest would not be seizeable[17] without getting a judgment in Nevis. Nevis does not recognize foreign judgments, let alone question the judgment of foreign countries.

The issue of this case will definitely be appealed by Ms. Barber or some subsequent debtor or creditor as this issue is litigated in the future.

Lawyers who have encouraged clients to use out-of-state and/or offshore limited partnerships, LLCs, or other entities need to realize that judges have the ability to apply Florida law in these situations under the Conflict of Law Rules, and that charging order protection will not be available for many Florida based situations where the debtor is the 100% owner of a foreign LLC, thus calling into question whether planners need to get back to clients and suggest additional members.

Another question is whether LLCs should be certificated (required to have stock certificates issued) and whether that would have changed the result for Ms. Barber, who will now have to trade her Rolls Royce in for a Cadillac Seville.

*****************************************************

[1] 2015 WL 470589

[2] Id.

[3] Barber, 2015 WL 470589.

[4] Id.

[5] Id.

[6] Id.

[7] 137 So.3d432 (Fla. Dist. Ct. App.2014).

[8] Id. At 433.

[9] Barber, 2015 WL 470589.

[10] Id.

[11] Barber, 2015 WL 470589.

[12] Barber, 2015 WL 470589.

[13] Id.

[14] Id.

[15] Id.

[16] Id.

[17] “Seizeable” is not a word, but what the heck?

Charles Rubin Reads The Thursday Report and

The Thursday Report reads Charles Rubin’s Blog

Charles Rubin is a Managing Partner with Gutter Chaves Josepher Rubin Forman Fleisher Miller, P.A. Chuck earned both his J.D. degree and his LL.M. in Taxation from the University of Florida. He is Florida Bar Board Certified in Taxation and was named the 2015 Lawyer of the Year by Best Lawyers in Taxation in the Miami metropolitan area. He has been running Rubin on Tax, a tax blog on developments relating to Federal and Florida tax, estate planning, probate, and business law, since 2005. The blog currently features over one thousand posts.

Charles Rubin has a long history of contributing to the tax and estate planning community as a lawyer, intellectual, and writer.

Chuck blogs at least twice a week, and his most recent blog is set forth below. To access Chuck’s website, please click here.

Getting to Appeals in an Estate or Gift Tax Audit with Pending Information Requests

Ain’t gonna happen! So says the IRS in guidance released by the IRS, at least in most circumstances.

In a memo to IRS estate and gift tax examination employees, the IRS advises:

1.) If information requested by the IRS in an IDR (Form 4564, Information Document Request) or other correspondence is not provided, the auditor’s group manager will discuss the case with the taxpayer to facilitate the receipt of the information. Generally, the case should not be sent to Appeals until the information has been provided.

2.) If the requested information is provided, or the taxpayer advises there is no additional information, then the auditor should issue a 30-day letter and provide the taxpayer with the opportunity to request an Appeals conference.

3.) If the requested information is not provided and the taxpayer has not advised there is no additional information, then the initial examination report should be issued, along with Letter 5262-D, Additional Information Due – Estate and Gift, along with the original IDR or a new IDR incorporating the undelivered items. The taxpayer will then have 15 days to provide or confirm they do not have the requested information. After certain prescribed contacts with the taxpayer, if the taxpayer refuses to provide the requested information, then the examiner should close the case to Technical Services for issuance of a statutory notice of deficiency.

The policy is that the examiners are to be the first finders of fact and are responsible for taking relevant testimony and examining books, papers, records, memoranda, and returns. As such, factual items should not first be introduced at the appellate level, at least as to items requested by the IRS. The penalty for not providing the requested items is the loss of access to Appeals review.

As noted, if the taxpayer advises that there is no additional information available to respond to the request, this serves the same function as actually providing the information.

Memorandum for all SB/SE Estate and Gift Tax Employees regarding Interim Guidance on Letter 5262-D, Additional Information Due – Estate and Gift, dated January 30, 2015 (Control #: SBSE – 04-0115-0015).

We thank Chuck for reading The Thursday Report and for contributing to tax literature.

Gregory Gay’s Corner

The Baker Act

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. Mr. Gay is also the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. Our deepest thanks to Mr. Gay for making some of this content available to Thursday Report readers!

This week Gregory Gay’s series continues with a discussion of the purposes and specifications of the Baker Act statute in Florida, as well as a look at Guardian Advocate Provisions under the Baker Act.

Baker Act

The purpose of Florida’s mental health statute known as the Baker Act is to provide examination and short-term treatment for a person suffering from a mental illness. This statute also authorizes the court to order continued placement in certain circumstances if the person, because of his or her mental illness, suffers from self-neglect or is dangerous to self or others.

The intent of this statute is for a person in need of mental health treatment to be admitted as a patient to a facility on a voluntary basis, if competent to give express and informed consent to treatment. However, the statute also provides for involuntary placement, but only after authorized mental health professionals and a circuit judge confirm that it is necessary. The primary goal of the statute is to ensure that individual dignity and human rights are guaranteed to any person admitted as a patient to a mental health facility.

An involuntary psychiatric examination may be initiated by a law enforcement officer who has reason to believe a person appears to meet the criteria for an involuntary examination. It may also be initiated by an order of a circuit judge, if the application filed by one or more persons with the clerk of the court provides sufficient reason to believe another person is in need of a psychiatric examination. In addition, a request for an involuntary psychiatric examination can be initiated by a physician, clinical psychologist, psychiatric nurse, or licensed clinical social worker who has observed that person within the preceding 48 hours and finds (as a result of the observation) that the person meets the criteria for an involuntary examination.

The basis for the involuntary examination is if the person to be examined is mentally ill and without care or treatment, the person is likely to suffer from neglect or refuse to care for his or her self, or is likely to cause bodily harm to his or her self or others. This neglect or refusal of care must pose a real and present threat of substantial harm to the person’s well-being. The mentally ill person must be refusing voluntary examination or be unable to determine whether examination is necessary. It must also be apparent that harm to the person cannot be avoided through the help of willing family members or friends.

If the judge issues what is called an ex-parte order of if the professional signs a certificate stating that a person needs to be examined, the law enforcement officer must deliver the person to the nearest facility designated to receive patients under emergency conditions for a psychiatric evaluation. The person is then examined without unnecessary delay by a physician or clinical psychologist and may be given emergency treatment for the safety of the person or others. The person may not be detained at the facility for more than 72 hours. Within the examination period, the patient must be released or may give expressed and informed consent to continued voluntary placement, or a petition for involuntary placement must be signed by the facility administrator and filed with the clerk of the court. If a petition for involuntary placement is filed, a circuit judge or a hearing master appointed by the circuit judge must hold a hearing within five days to determine whether there is clear and convincing evidence to believe that the patient meets the criteria for involuntary placement. The maximum period for an involuntary commitment is six months.

At any time, a person held in a mental health facility or a relative, friend, guardian, guardian advocate, representative or attorney, or the Department of Children and Families, on behalf of such a person, may petition for a writ of habeas corpus to question the cause and legality of such detention. The petitioner can allege that the patient is being unjustly denied a right or privilege granted by law. The petitioner can request that the circuit court issue an order directing the hospital to respond to the writ.

Significant mental health laws relate to the voluntary admission to a mental health facility of a person 60 years of age or older who is presently residing at a nursing home, assisted living facility, adult day care center, or adult family care home and has previously been diagnosed as suffering from dementia. The statutes provide that an initial assessment of the patient’s ability to give informed consent to treatment is necessary before the person can be transferred from the care facility and admitted on a voluntary basis to a mental health facility.

This initial assessment must be performed by a state designated crisis service at the facility where the patient is residing. This requirement also applies to the voluntary admission of a person to a facility from a nursing home, assisted living facility, adult day care center, or adult family care home when all decisions concerning medical treatment are currently being made by a health care surrogate or proxy. If the designated crisis service cannot respond, the assessment may be performed by an authorized licensed professional who is not employed or under contract and does not have a financial interest in either the facility initiating the transfer nor the receiving facility to which the transfer may be made.

The statutes further state that within 24 hours after the voluntary admission of any patient to a treatment facility, the admitting physician must document in the patient’s clinical record that the patient is able to give informed consent for admission. If the patient is not able to give consent, the facility must discharge the patient or transfer him or her to involuntary status. Transferring the patient to involuntary status will assure that the patient receives a court hearing regarding his or her need for continued treatment.

The statues governing nursing homes, assisted living facilities, adult day care centers, and adult family care homes state that action may be taken by the Agency for Health Care Administration against such a facility for failure to follow the criteria and procedures provided in these mental health statutes. This action includes the right to deny, revoke, or suspend a license or to impose an administrative fine.

Guardian Advocate Provisions

The Baker Act statute provides that when a mentally ill person is involuntarily committed to a facility, a person known as a guardian advocate must be appointed by the court to make decisions regarding mental health treatment on behalf of a patient, if the patient is found incompetent to consent to treatment. The Baker Act statute provides that the court should give preference in the appointment of a guardian advocate to the person designated to make health care decisions in a health care surrogate designation. If the patient has not previously designated a health care surrogate, preference is then given to the patient’s spouse. If there is no spouse, then the following priority should be applied in appointing a guardian advocate:

- An adult child of the patient

- A parent of the patient

- The adult next-of-kin of the patient

- An adult friend of the patient

- An adult trained and willing to serve as the guardian advocate

The Baker Act statute also states that, unless the requirement is waived by the court, a guardian advocate must, prior to exercising his or her authority, attend a training course approved by the court. The training course must be a minimum of four hours and must include information about psychotropic medications that affect a person’s mental state, diagnosis of mental illness, the ethics of medical decision making, and duties of guardian advocates.

It is important to know that the Florida statutes state that a person may designate a separate surrogate to consent to mental health treatment if he or she is later determined by a court to be incompetent to consent to mental health treatment and a guardian advocate is appointed. However, unless the document designating the health care surrogate specifically states otherwise, the court assumes that the surrogate authorized to make health care decisions may also make decisions regarding mental health treatment.

Next time, Gregory Gay’s series will continue with a discussion on Medicaid nursing home financial assistance, including a look at eligibility and non-countable assets. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Seminar Spotlight

Structuring Joint Exempt Step-Up Trusts: Evolving Tools to Maximize Step-Up in Basis

In an environment where the focus is shifting toward maximizing income tax basis step-up, counsel must be knowledgeable of all tools necessary to reach this goal. One tool that is beneficial for preserving both the inheritance tax exemption and basis step-up is the joint exempt step-up trust (JEST).

The JEST has the capacity to not only cause a step-up in income tax basis of all of the couple’s assets on the death of the first spouse, but also an additional step-up in income tax basis upon the death of the surviving spouse.

In order to achieve the entirety of the JEST benefits, counsel must be well-versed in the complex drafting techniques in light of IRS Technical Advice Memorandums and Private Letter Rulings. Additionally, the JEST structure preserves the assets of both spouses by protecting against undue influence, creditor claims, and possible future inheritance tax liability.

Christopher J. Denicolo, Partner at Gassman Law Associates; Alan S. Gassman, Partner at Gassman Law Associates, and Edwin P. Morrow, III, Esquire, Senior Wealth Specialist at Key Private Bank Wealth Advisory Services, will prepare estate planning counsel to use an estate planning tool specifically for inheritance tax exemption and income tax basis step-up preservation. Our experienced panelists will outline practical drafting techniques and explain ambiguities and risks in taking advantage of stepped-up basis.

The outline for the presentation is as follows:

- Basis step-up preservation techniques

- Exemption preservation techniques

- Applicability of IRS Technical Advice Memorandum

- Applicability of IRS Private Letter Rulings

The panel will review these and other key questions:

- What are the best practices for structuring a JEST?

- What drafting techniques must be implemented to maximize basis step-up at both the first-to-die and surviving spouse’s deaths?

- What is the IRS guidance on this tool offered through the Technical Advice Memorandum and Private Letter Rulings?

- Under what circumstances is the JEST most appropriate?

This CLE/CPE webinar will prepare estate planning counsel to use an estate planning tool specifically for estate tax exemption and income tax basis step-up preservation.

Please click here to register for this webinar produced by Stafford Publications, Inc. Register before February 27, 2015 and receive an Early Discount savings of $50.00.

Richard Connolly’s World

When You Die, Who Can Read Your Email?

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “When You Die, Who Can Read Your Email?” by Rachel Emma Silverman. This article was featured in The Wall Street Journal on February 1, 2015.

Richard’s description is as follows:

Many Internet companies strictly limit access to their customers’ accounts to the account holder, in accordance, they say, with federal privacy law. When an account holder dies, estate executors typically have to seek a court order to access the account, which can be expensive and time consuming – sometimes taking half a year or more – and isn’t always successful.

But under a Delaware law passed last summer, executors can now access online accounts without a court order, unless the deceased has instructed otherwise. Similar legislation is under consideration in several other states.

The new Delaware law also gives access to those serving as agents for the deceased under a power of attorney, as well as court-appointed guardians for those who are incapacitated, and to others serving in a fiduciary role.

Please click here to read this article in its entirety.

Thoughtful Corner

Business Etiquette Concerning Email Communication

When to Use the “Reply All” Function in Email Communication

Do not “reply all” in an email when another lawyer’s clients are copied unless you have explicit written consent from the other lawyer to copy his or her clients.

This is not implied by the fact that the lawyer sent you a letter or email and copied his or her clients. This violates a disciplinary rule and does not make the other lawyer happy, whether they tell you about this or not.

Conversely, when you are aware that everyone copied on an email should also be copied on the response, please “reply all.”

Quite often, our job when receiving an email is to make sure that the other people who should be copied have the information. Many people on smart phones and/or iPads hit “reply” but not “reply all.”

The world will be a better place when more people learn how to use the “reply all” button.

Sending Documents with an Email Message

Send documents in Word, not PDF, format so that the other side can verify that what you sent, when compared back to what they last saw, includes all changes.

When sending a document or attachment to somebody by email, consider not only attaching the attachment but also cutting and pasting it into the text of your email so that the person reviewing it does not have to open it separately. You never know when someone may be checking their email on a device that cannot open large attachments.

This is especially the case if you want to get a quick response from somebody who is having to work off of their phone or is older and perhaps not as adept with documents as you might be.

If you are sending an important document by email, ask an assistant to be sure to call the client if you don not get a response within a few hours, especially if this is a client who tends to trip over their emails.

Calls vs. Emails

Do not require someone to call you with a detail that can easily be handled by email or through secretary communication.

You may like to socialize, and you might not think about it all the time, but not expect to be called back by people who believe that the only purpose of the call is to handle something that could have been done without the need for a phone call.

If you need a phone call, offer times that you are available and let the person know by email how long the call needs to be and what it is about so they do not have to play telephone tag with you.

We will appreciate any questions, comments, or suggestions offered for the above article. It has been excerpted from a PowerPoint that we will present to third year law students and alumni (and you, too, if you would like to attend!) at the Ave Maria School of Law on a date to be determined. The presentation will be on professional acceleration. For more information, you can email Alan Gassman at agassman@gassmanpa.com or Janine Gunyan at janine@gassmanpa.com.

Humor from Heckerling!

One of our favorite writers and lecturers is Steve Akers of Bessemer Trust, and one of the best things Steve writes is his Heckerling Musings, which is a 145 page masterpiece describing what he has gleaned from the Heckerling Institute and other noteworthy themes. Steve just released his 2015 musings which cover the January 2015 proceedings very well.1

One feature that we noticed and really liked was his humor summary, which included the following:

On practice advice:

“First, it’s the client’s problem until it’s yours. Second, never make it yours.” – Howard Zaritsky

On representing family members in business succession planning:

“If any of the in-laws are attorneys, my fees go up 25%” – Lou Mezzullo

On the Code as entertainment:

“Section 1014 is a far more entertaining section than you had any right to expect.” – Howard Zaritsky

On dress code:

Upon Dennis Belcher’s expressing some surprise that Sam Donaldson was not wearing a suit coat at the Current Developments panel, Sam replied: “Someday, you might be cool, too, Dennis.”

On miscellaneous itemized deductions:

Miscellaneous itemized deductions are, at least, deductions, but they are subject to the §67 limit, meaning they are not deductible except to the extent they exceed 2% of adjusted gross income. “It’s like going to the prom with your sister. You’re at the prom, and that’s cool, but it’s with your sister. Those first seven or eight kisses are kind of awkward.” – Sam Donaldson

On academic affiliation:

“If you liked that joke, I’m at Georgia State University. If you didn’t, I’m from the University of Georgia.” – Sam Donaldson, a law professor at Georgia State University

On Texas:

“Texas has no income tax. By the way, we don’t have any services, but we’re content with that. We are never disappointed about what we didn’t pay for.” – Stacy Eastland

On perpetual trusts:

“In 28 states and the District of Columbia, by statute, you can have either a perpetual trust or a near perpetual trust. Some states have a gimmick where you can only have a trust for 360 years – which is older than the United States of America – or you can only have a trust for 1000 years – which ought to be long enough for any relatives that you’re going to care about.” – Sam Donaldson

On the definition of “perpetual”:

“For some reason, 1,000 years seems longer than perpetual.” – David Handler

On open-minded attorneys:

“Show me an attorney with an open mind, and I’ll show you an attorney with a head wound.” – Lou Mezzullo

To review Steve’s Heckerling Musings, please click here.

We thank Steve for all that he has done and continues to do for the estate planning industry and especially for his appearance at the February All Children’s Hospital program last week where he spoke on Estate Planning Current Developments and Hot Topics.

*****************************************

1 Including coverage of the JEST Trust and how it cured a client’s arthritis, enabled her to thread a needle, and gave her a reason to send her husband offshore to Nevis to hold a stock certificate.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: March 5, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

****************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan S. Gassman, Christopher J. Denicolo, and Edwin P. Marrow, III will present a 90-minute Strafford Publications, Inc. webinar entitled STRUCTING JOINT EXEMPT STEP-UP TRUSTS: EVOLVING TOOL TO MAXIMIZE STEP-UP IN BASIS.

In an environment wherein the focus is shifting toward maximizing income tax basis step-up, counsel must be knowledgeable of all tools necessary to reach this goal. One tool that is beneficial for preserving both the inheritance tax exemption and basis step-up is the joint exempt step-up trust (JEST).

This panel will review questions such as:

- What are the best practices for structuring a JEST?

- What drafting techniques must be implemented to maximize basis step-up at both the first-to-die and surviving spouse’s deaths?

- What is the IRS guidance on this tool offered through the Technical Advice Memorandum and Private Letter Rulings?

- Under what circumstances is the JEST most appropriate?

Date: Tuesday, March 24, 2015 | 1:00 PM – 2:30 PM

Location: Online Webinar

Additional Information: For more information or to register, please click here. You may also email Alan Gassman at agassman@gassmanpa.com.

***************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be speaking at the Martin County Estate Planning Council Annual Seminar on the topic of JESTs, TRUST PLANNING FROM A TO Z, AND WHAT YOU THOUGHT YOU KNEW ABOUT ESTATE PLANNING.

Date: May 15, 2015 | 8:15 AM – 4:30 PM | Alan Gassman speaks at 9:00 AM

Location: Stuart Corinthian Yacht Club, 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

***************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

**************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please click here.

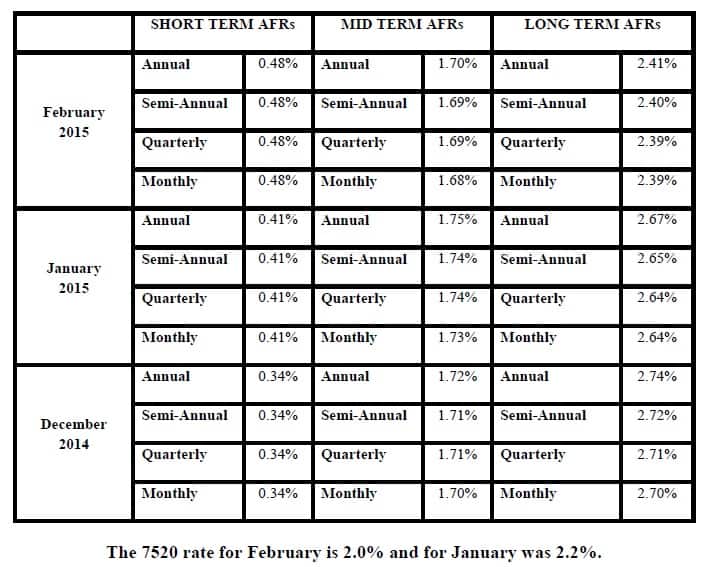

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.