The Thursday Report – 11.27.14 – Don’t Read This if You’re a Turkey!

Happy Thanksgiving from Gassman, Crotty & Denicolo, P.A.

Being Thankful for Mistakes Avoided: The Most Common Errors in Physician Planning

Applicable Federal Rates Down By Between 5.8% and 12.82% for December!

Avoiding Disaster on Highway 709: Gift Tax Return Basics

Richard Connolly’s World – An Estate Plan for Your Treasures

Thoughtful Corner – The Power of Saying Thank You

A Special Offer for Thursday Report Readers!

A Note from One of Our Readers

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Happy Thanksgiving from Gassman, Crotty & Denicolo, P.A.

by Alan Gassman and Kristen Sweeney

The very best thing about Thanksgiving,

(if you are not a turkey) is that you’ll still be living.

If by some chance you happen to be a turkey,

My condolences friend; prepare to become jerky.

Today we feast to celebrate our good luck,

So I hope you’re not a turkey; I hope you are a duck.

If you’re not holiday fowl, have some gratitude and sing.

If you’re going gobble gobble, better hurry up, take wing!

I know one turkey who was born in New York.

Each year he masquerades as a pelican or a stork.

When I asked him how he did it, the turkey laughed, low in his belly,

“Once they start eating all that food, their minds turn right to jelly!”

So this year when you make your Thanksgiving wish,

Be darn grateful it’s not you on that dish.

And rather than think on your sorrow and loss,

Savor every last bite of your cranberry sauce.

And chewing each morsel of those salty green onions,

Take a moment to ponder the plight of John Bunyan.

Old John wrote his treatise, Pilgrims Progress, in jail;

For his religious freedom, he fought tooth and nail.

Though perhaps, instead, he should have fought tooth and toe;

For Bunyan’s bunions were really the main event of the show.

So when you think on this day that something’s afoot,

Make a place in your heart for gratitude to be put.

Take time to enjoy this time off with your family.

(We hope that part is not a total calamity.)

And if your family is an issue,

Then be grateful they only spend holidays with you.

Don’t be concerned, have no fear,

The Pilgrims thought turkey went well with beer.

If the family is good, and the time is well spent,

That’s just one more gift, be glad, don’t relent.

Thank you for all you do for others,

Thanks to your fathers and your mothers.

We hope you have a great Thanksgiving.

It is truly wonderful to be living.

Thanksgiving is our most favorite holiday and provides us with time off for thinking about what we have to be grateful for.

At the same time, we think about our families and loved ones. Job Number One is to protect them and ourselves, both now and in the future.

What better way for the Thursday Report to help in this regard than to provide a list of common mistakes made by professionals and their clients?

We wish you, your family, your colleagues, your friends, and every surviving turkey a wonderful Thanksgiving as we enter into the official fast and furious holiday season.

May your wishbone wish come true, and now, let us roll the drumsticks and head into our first featured article.

Being Thankful for Mistakes Avoided: The Most Common Errors in Physician Planning

The following list of common physician planning errors can be read as an entire article by clicking here, or you may prefer to read only 1 or 2 of the sections by clicking each title above its brief introduction.

This commentary reviews eleven avoidable mistakes that can be the cause of fatal errors for medical practices and physician well-being.

While different physicians and groups of physicians tend to make more mistakes in one area than another, each common mistake area should be reviewed and understood with appropriate advisors. These common errors, which can be viewed in more detail by clicking on each mistake, are as follows:

1.) Failure to Maintain and Appropriately Use Independent Professional Advisors

Many of the calamities described in this section will be avoided if a medical practice has experienced advisors on board. The practice should consult with its advisors when making major practice decisions and periodically confirm that appropriate procedures and safeguards are in place.

2.) Failure to Maintain Medical Law Compliance

A great many physicians are annihilated financially when Medicare and/or private insurance carriers request hundreds of thousands of dollars in refunds because the physician has used inappropriate billing practices or financial arrangements with third parties. In many cases, these problems are reported to the government by employees who can earn a 15% “whistle-blower fee.”

Many physician clients simply do not realize that they use improper coding, do not maintain sufficient patient file back-up, or bill for items that are inappropriately unbundled or altogether un-billable.

3.) Failure to Maintain Proper Malpractice Insurance

While malpractice insurance is not inexpensive, it is necessary in order to protect physicians from the significant legal fees, expert witness costs, and liability exposure associated with defending lawsuits. The proliferation of the personal injury lawyer industry shows no sign of slowing down, and a sympathetic jury system, coupled with experts willing to testify that a doctor committed malpractice under complicated circumstances that a jury can never understand provides good cause for maintaining appropriate malpractice insurance coverage.

Many successful medical practices are run on a handshake or a long-forgotten and now archaic agreement, but when problems or changes in circumstances arise, the results can be catastrophic and quite lucrative for the legal profession.

5.) Failure to Procure and Maintain Proper Insurances

There are a myriad of insurances required to appropriately safeguard a medical practice from the normal risks of doing business, particularly in view of the American trial system. Fortunately, most of these risks can be reasonably handled on an affordable basis, assuming that proper coverage is in place.

6.) Failure to Make the Medical Malpractice and Doctor Judgment-Proof

There are many ways that a medical practice and a doctor can work to make themselves a less-attractive target for a plaintiff’s lawyer.

7.) Failure to Theft-Proof the Practice’s Monies and Accounts Receivable

We regularly receive at least one phone call per year from a very upset physician who has had tens of thousands of practice dollars stolen by an employee. This employee has often been with the practice many years and, most of the time, is the most-trusted person in the practice other than the physicians themselves. As such, the employee is able to obtain physical possession of checks made payable to the practice by one or more payer sources and/or has written checks on the practice accounts for bogus expenses.

8.) Using Greedy Investment Advisors

There are a number of different investments and life insurance and annuity arrangements that can be sold to doctors and their practices in the financial world. The quality of each particular investment vehicle can vary dramatically in terms of actual financial safety, conservative versus aggressive orientation, likelihood of being acceptable to the IRS in the event of an audit, and the amount of commissions paid to advisors who may suggest such arrangements.

9.) Unbalanced Investment Portfolios

Statistical studies show that a diversified portfolio of investments will generally out-perform a non-diversified portfolio with significantly less risk. Many successful clients own investment real estate, mutual funds allocated among the various classes of stock investments, and bond funds or CDs. It almost never makes sense for anyone to put all of their eggs in one basket.

10.) Doing Business with the Wrong People

Unfortunately, crime and deceitful or misleading behavior can be lucrative for the “bad or careless actor,” and these individuals are often found courting doctors to do business and investment transactions or to provide consulting services.

Since the overwhelming majority of doctors are very honest and do not have formal business training, it is not difficult to market “unique propositions” to doctors and to eventually find a handful of doctors who may succumb to participate in a recommended arrangement.

11.) Failure to Have Anyone in the Practice Pay Attention to Contracts with Third Parties

Quite often, medical practices get into disputes or find themselves stuck in agreements as a result of a trusting nature or lack of attention to details associated with contracts they enter into with third parties.

We hope that this list helps you to help yourself and others, whether you are a lawyer, a physician, or the owner and operator of a Kentucky Fried Chicken franchise!

Applicable Federal Rates Down By Between 5.8% and 12.82% for December!

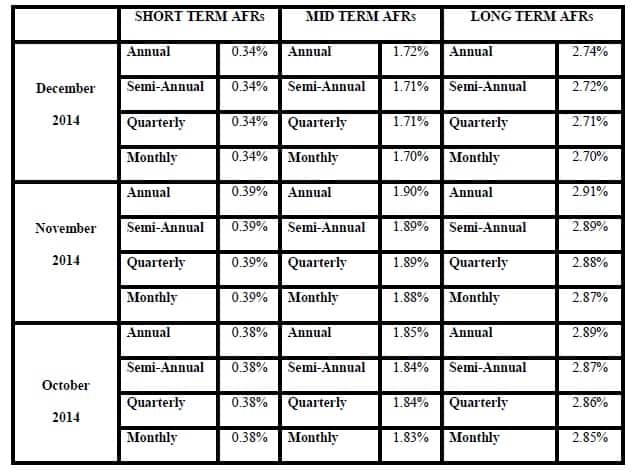

The December Applicable Federal Rates, which provide the lowest interest rates that can be used between related parties, installment sales, and similar transactions, have come down considerably for December.

The rates are 12.82% lower (3.4% instead of 3.9%) for short term rates, 9.47% lower (1.72% instead of 1.9%) for mid-term loans, which are loans of longer than 3 years but not more than 9 years, and 5.8% lower (2.74% instead of 2.91%) for long-term loans, loans of more than 9 years.

The Section 7520 rate went down for December from 2.2% to 2.0%, a 9.09% reduction.

This is the time of year when clients with large estates should consider installment sale trusts for spouses and descendants.

For information on these types of techniques, you can email agassman@gassmanpa.com.

Below we have the Applicable Federal Rates for December, November, and October. For a sale, you can use the lowest of the 3.

Avoiding Disaster on Highway 709: Gift Tax Return Basics

by Kenneth J. Crotty

Gift Tax Return Basics – Including Why a Gift Tax Return Needs to be Filed Correctly and Who Needs to File a Return.

This is the first of a five part series reviewing the IRS Gift Tax Return Form 709 answering some of the questions you have secretly been wanting to ask. This series will cover the basics of who should file a gift tax return, the importance of filing the gift tax return correctly, the common mistakes made on gift tax returns, mistakes related to splitting gifts with spouses, the annual gift tax exclusion and the GST exclusion, and a completed sample Form 709.

Gift Tax Return Basics

During 2011, the applicable exclusion amount for lifetime gifts was increased from $1,000,000 to $5,000,000. This amount has increased with inflation and is currently $5,340,000 for 2014.

Because the applicable exclusion amount for lifetime gifts has been increased, many clients are making gifts which require a gift tax return to be filed. Preparers need to be certain that the gift tax returns are prepared correctly so that the client does not suffer any adverse consequences

American Tax Relief Act of 2012, and a Word About Portability

The passage of the American Tax Relief Act of 2012 (“ATRA”), which was signed on January 2, 2013, made the concept of portability permanent. Portability provides that a surviving spouse has the ability to add his or her deceased spouse’s unused exemption amount (“DSUE Amount”) to his or her basic exclusion amount. This DSUE Amount is determined at the date of death of the decedent, but unlike the applicable exclusion amount for lifetime gifts of the surviving spouse, the DSUE Amount of the first dying spouse is not indexed with inflation and will not grow larger.

For example, if a spouse dies in 2014 with $3,340,000 worth of assets in his or her name, then $2,000,000 of the first dying spouse’s estate tax exemption would be unused ($5,340,000 – $3,340,000 = $2,000,000), assuming that the deceased spouse did not make any taxable gifts during his or her lifetime which would have reduced his or her exemption.

With the DSUE Amount, the surviving spouse now can gift $7,340,000 during his or her lifetime.

To be able to use the DSUE Amount, the deceased spouse’s personal representative must make the appropriate election on the deceased spouse’s timely filed estate tax return. The DSUE Amount can then be used by the surviving spouse during the surviving spouse’s lifetime or on the surviving spouse’s death.

It is important to note that the DSUE Amount applies to the estate tax and the gift tax, but does not apply to generation skipping transfer tax. Therefore, any unused generation skipping transfer tax exemption will be lost on the death of the first dying spouse.

It is also important to note that the DSUE Amount applies to the last spouse to which an individual was married. Assume Husband 1 dies with a $4,000,000 DSUE Amount, and Wife remarries to Husband 2. If Husband 2 has a $1,000,000 DSUE Amount and dies before Wife, then Wife will only have the $1,000,000 DSUE Amount from Husband 2.

There are two main reasons for ensuring a Gift Tax Return is completed correctly when it is initially filed:

- To avoid wasting the client’s applicable credit amount by not taking advantage of the available exclusions; and

- An accurately filed return will start the statute of limitations, which limits the ability and time the IRS has to challenge the value of the reported gift

IRS Challenge of Reported Value

If the value of a gift is adequately disclosed on a Gift Tax Return in a manner sufficient for the IRS to determine the nature of the gift, the IRS only has three years to challenge the value of the gift from the date that the return was filed. I.R.C § 2504(c); I.R.C. § 6501(a).

Treas. Reg. § 301.6501(c)-1(f)(2) provides that adequate disclosure occurs when a Gift Tax Return provides the following information:

1) A description of the transferred property and any consideration received by the transferor;

2) The identity of each transferee and the relationship between the transferor and the transferee;

3) If the gift is made to a Trust, the Gift Tax Return must include the Trust’s tax identification number and a brief description of the terms of the Trust or a copy of the Trust Instrument;

4) The Gift Tax Return must include a statement describing any position taken on the return that is contrary to any proposed, temporary, or final Treasury Regulation or Revenue Ruling published at the time of the gift; and

5) Unless the value of the gift is supported by an appraisal meeting the standards of Treas. Reg. § 301.6501(c)-1(f)(3), the Gift Tax Return must include a detailed description of the method used to determine the fair market value of the property transferred and the underlying data must be submitted. Additional requirements are contained in Treas. Reg. § 301.6501(c)-1(f)(2)(iv).

Documenting the Value of a Gift

Appraisals should be submitted for items that do not have readily determined values, such as interests in closely held corporations, tangible personal property, or real estate. A Form 712 should be included for transfers of life insurance policies. For transfers of closely held corporations, the balance sheet, earnings statements, and dividends received for the five years prior to the gift should be attached. Instructions for the Gift Tax Return provide additional information that should be submitted for some specific items.

When Must a Gift Tax Return Be Filed?

Generally the Gift Tax Return is due by April 15th of the year after the gift was made. If the taxpayer files for an extension of time to file his or her personal Income Tax Return, the taxpayer will also receive a 6 month extension to file the Gift Tax Return. See Treas. Reg. § 25.6081-1(a).

The taxpayer may also request an extension specific only to the filing of the Gift Tax Return by filing a Form 8892, and will receive a 6 month extension to file the Gift Tax Return.

If a donor dies during the year that the gift was made, the Gift Tax Return is due when the Estate Tax Return for the decedent is due.

If gift tax is owed, the gift tax must still be paid no later than April 15th (or when the Gift Tax Return is due for a deceased donor if earlier), regardless of whether the time for filing the Gift Tax Return is extended.

Who Must File a Gift Tax Return?

A donor does not need to file a Gift Tax Return if one of the following six exceptions applies:

1) If the donor transfers amounts to donees that do not exceed the “annual exclusion;”

- If the donor transfers an amount in excess of the annual exclusion to a donee and splits the gift with his or her spouse, a gift tax return will need to be filed even if the amount is less than twice the annual exclusion. In such cases, only the donor spouse needs to file a gift tax return.

- For example, if (1) Husband’s only gift is a $25,000 gift to Son, (2) Wife makes no gifts during the year, and (3) Husband splits the gift with Wife, a gift tax return will need to be filed by Husband even though the gift is less than $28,000 which is two times the $14,000 annual exclusion. In this example, Wife will not need to file a separate gift tax return, but will need to sign Husband’s gift tax return indicating her consent to split the gift.

2) If the donor and the donor’s spouse are U.S. citizens, and the donor transfers assets to his or her spouse that qualify for the gift tax marital deduction;

3) If the donor transfers assets to his or her spouse and

(1) the spouse is not a U.S. citizen and

(2) the amount does not exceed $143,000 for 2013 or $145,000 for 2014

4) If the transfers are payments that qualify for the educational exclusion or the medical exclusion stated in I.R.C § 2503(e);

- To qualify for the educational exclusion, the payment must be made directly to the qualifying educational organization and must be for tuition. Payments for books, supplies, room and board, and other expenses do not constitute direct tuition costs. Reg. § 25.2503-6(b)(2).

- To qualify for the medical exclusion, the payment must be made directly to the care provider. In the event that the amount is later reimbursed by insurance, the reimbursed portion will constitute a gift. Reg. § 25.2503-6(b)(3).

5) If the donor transfers assets to a political organization

If a donor makes transfers described in Sections 4 or 5 above, the donor does not need to file a Form 709 to report these transfers and should not list them on Schedule A if the donor does file a Form 709. Form 709 Instructions, page 2 (I.R.S. 2012); and

6) If the gift qualifies for the Charitable Deduction and either

(1) The transfer is a qualified conservation contribution, or

(2) The transfer is a transfer of the donor’s entire interest in the property and the donor is and has never made a transfer of any interest in the property for less than full FMV to a person or for a use that is not described in I.R.C § 2522(a) or (b).

Many clients make donations to charities. If a client makes a gift which requires that a Form 709 be filed, then Part 1 of Schedule A of the Form 709 must list the donations that were made to the charities during the year. The client receives a deduction on Part 4 of Schedule A of the Form 709 for these donations.

7) In order to qualify for the Gift Tax Marital Deduction:

- The spouses must have been married to each other at the time the gift was made;

- The donee spouse must have been a U.S. citizen; and

- The asset transferred by the donor must NOT have been a nondeductible terminable interest as defined by I.R.C § 2523(b). If a donor transferred assets to his or her spouse that would qualify as QTIP property, the donor MUST file a Form 709 to make such election. Treas. Reg. § 25.6019-1(a). There is no relief available for late filing to make the QTIP election.

Reporting Gifts to 529 Plans

Gifts to 529 Plans do not qualify for the I.R.C § 2503(e) tuition exclusion. Therefore, to avoid having these contributions treated as taxable gifts, the contributions need to utilize the donor’s annual exclusion. Per I.R.C § 529(c)(2)(B), if the aggregate amount of the contribution made by a donor to a 529 Plan for a donee exceeds the annual exclusion, then the donor may elect to have the contribution spread out over 5 years, beginning with the calendar year that the amounts are contributed.

If the donor makes the election to spread the contribution ratably over five years, then for each of the five years the donor reports 1/5th of the value on the annual Gift Tax Return. It is not permissible to take the maximum annual exclusion amount out of the split gift each year; instead, the gift to the 529 plan needs to split equally among the five year period. However, if the donor does not make any other gifts that would require the donor to file a Gift Tax Return in any of the four years after the original contribution to the 529 Plan is made, then the donor is not required to file a Gift Tax Return to report the year’s portion of the 529 plan contribution.

Stay tuned for Part Two, where we will examine the Ten Biggest Mistakes Made on Gift Tax Returns and How to Avoid Them.

Richard Connolly’s World

An Estate Plan for Your Treasures

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “An Estate Plan for Your Treasures” by Veronica Dagher. It was featured in The Wall Street Journal on October 30, 2014.

Richard’s description is as follows:

Collectors can spend a lifetime amassing things like baseball cards, comic books, or even casino chips, as well as art. But they often pay too little attention to what will happen to their prized possessions after they die.

Collectors may hope their children will suddenly find a passion for all the stuff that cluttered their house when they were growing up. They may figure another collector will pay their heirs big bucks for it, or dream of donating it to a museum that will display it for posterity.

Without proper planning, though, their treasured possessions could wind up being dumped in a yard sale.

This article contains some steps collectors can take whether they decide to pass along, sell, or donate their collections.

Click here to view the full article.

Thoughtful Corner

The Power of Saying Thank You

by Janine Gunyan

How often have you said thank you to a colleague for a referral or for consulting you on a difficult matter? Do you thank your clients for choosing you to represent them? Do you thank your office staff for a job well done?

The season of Thanksgiving is a great time to reach out to those individuals and let them know that you are thankful for their business relationship; it is a great time to let your clients know that you appreciate them; and it is a great time to let your employees know that you recognize their hard work and dedication.

We find that in our practice the power of saying thank you leads to more referrals and happier clients and employees.

Saying thank you is also a great marketing tool as it provides you with another point of contact with your referral source.

However, keep in mind that payment for referrals is strictly forbidden under the Florida Bar’s Handbook on Lawyer Advertising and Solicitation. Section 4-7.17(b) says:

Payment for Referrals – Rule 4-7.17(b)

A lawyer is not permitted to give anything of value to another person for recommending the lawyer or for referrals. However, a lawyer may pay reasonable costs of advertising, fees charged by a lawyer directory that do not constitute an improper division of legal fees, and may buy a law practice in conformance with Rule 4-7.17. A lawyer may not participate in networking or tips clubs where members are required to make referrals to each other as part of membership. Massachusetts Ethics Opinion 08-01; Montana Ethics Opinion 960227; New York City Bar Opinion 2000-1; New York State Ethics Opinion 791 (2006); and Virginia Legal Ethics Opinion 1846 (2009).

A simple hand-written thank you note or a brief letter goes a long way in keeping the lines of communication open between your referral sources and clients and does not take much time at all to complete.

A letter that we use to thank our clients is as follows:

Dear Client:

I just wanted to let you know how honored I am to have been selected to help with your planning.

You are obviously a remarkable person and have your choice of virtually any professional or professionals in the country for this task.

If there is anything I can do to improve our service or to make this a better experience for you, please let me know.

Best personal regards,

Attorney

Here at the Thursday Report we thank you, our faithful readers, for laughing with us, learning with us, and sticking with us over the last two and a half years. We look forward to many years to come. We are thankful for each and every email and letter you send us commenting on Thursday Report content and for contributing to it in so many ways.

A Special Offer for Thursday Report Readers!

Our book Eight Steps to a Proper Trust and Estate Plan will be available on Amazon Kindle for just $0.99 through Monday, December 1, 2014. That is only $0.12 per step!

Please click here to order and download your copy, and please share this with your friends, families, and fellow KFC patrons when you go in to order your Thanksgiving meal of fried chicken and mashed potatoes with gravy! The turkeys will thank you!

A Note from One of Our Readers

Our friend and Board Certified Health Law Attorney Sandra Greenblatt had the following to say about Stetson Law Student Dena Daniels’s write-up last week on “The Women’s Guide to Dressing for Success for First Year Lawyers and Others.” You can view this article by clicking here.

“Alan, shame on you! “The Women’s Guide to Dressing for Success for First Year Lawyers and Others” should have been under your humor category!! It was “de rigueur” in 1984 through the 1990s when I was a young Associate, but fortunately now, women lawyers have much greater latitude for style, color and creativity than in those days. I do agree no shorts, miniskirts, bustiers, or low cut blouses, but “closed toe shoes and pearls”?? Really!

Unfortunately, it still seems that no matter what women lawyers wear, many male attorneys and judges will still try to treat us differently. Bad Judge certainly didn’t help the cause!

Just one woman’s opinion.”

-Sandra Greenblatt, Esquire

We thank Sandy for her comment, voracity, and pearls of wisdom, and we invite others to chime in on what young lawyers and professionals need to know about dressing in the second decade of the 21st century. Please send your comments to agassman@gassmanpa.com.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING. Sign up today! People are dying to see this webinar!

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar please click here. To register for the 5:00 p.m. webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES. Much of the materials presented at this seminar will apply to all couples as well.

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE CLEARWATER PRESENTATION:

Alan Gassman will be hosting a workshop for lawyers and other professionals who are interested in improving their futures both personally and professionally. Topics to be explored include goal setting, overcoming frustrations, problem solving, and strategies to help attract and retain the type of clients that will help grow your practice.

This workshop will be followed by a tour of the Gassman Law Associates office.

Date: December 14, 2014 | 9:00 a.m. – 3:00 p.m.

Location: 1245 Court Street, Ste 102, Clearwater, FL

Additional Information: For more information, or to register for this free workshop, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015. Topic is To Be Announced.

Date: March 6, 2015

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on Eleven Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.