The Thursday Report – 10.16.14 – The Mouse and the Thursday Cycle

Charitable Contributions Lost if Charity Does Not Provide a Written Statement with Donations Exceeding $250 on or Before the Due Date of the Donor’s Income Tax Return

District Court of Appeals Finds That Spouse With Judgment Against Her Can Keep Annuities Awarded in a Divorce that Took Place After the Creditor’s Claim Arose

In the News – USA Weekend Basis Piece and NY Times Annuity Article

The Reverse Side of Reverse Mortgages – A Great Article by Michael Kitces

Reverse Mortgages Webinar

Don’t Miss the May 7-8 Florida Bar Wealth Preservation Expanded Two Day Program – For the Serious and/or Novice Planner

Thoughtful Corner: Denis Kleinfeld: Books of Interest for Individuals Who Want to Think Themselves Successful

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Charitable Contributions Lost if Charity Does Not Provide a Written Statement with Donations Exceeding $250

by Kenneth J. Crotty

The IRS has recently become stricter in its enforcement of the various requirements related to charitable contributions. Some of these requirements affect the donor and the donor’s ability to take the charitable deduction associated with a donation. Some of these requirements affect the charity, and are reporting requirements to the donor that the charity must comply with to avoid penalties from the IRS.

If a donor makes a donation worth $250 or more to a charity, the donor will need to receive a contemporaneous receipt from the charity to be able to take the deduction on the donor’s income tax return. The receipt will need to state the name of the charitable organization and the amount of cash donated. If something other than cash is contributed to the charity and has a value greater than $250, the receipt needs to describe the non-cash contribution, but does not need to state its value.

The receipt also needs to describe whether any goods or services were received by the donor. If no goods or services were provided by the charity, then the receipt should state this. If goods or services were provided, then the receipt must provide a description of such goods and/or services and an estimate of the value of the goods and/or services that were provided in return for the donation.

Religious organizations have a unique reporting requirement. If the donations were provided in exchange for entirely intangible religious benefits, then the statement from the charity should describe this.

It is best practice that the receipt be provided contemporaneously with the donation. It may be acceptable if the receipt is provided to the donor after the donation is made, but prior to the donor’s income tax return for the year being filed. In the event that there is an audit, it is likely that a receipt provided by the charity after the income tax return has been filed will be deemed to have not have been provided contemporaneously. Therefore, this could prevent the donor from being allowed to take a charitable deduction associated with any donation worth $250 or more.

Charities also have an obligation to provide statements to the donor related to certain donations that are received. If a donor makes a “quid pro quo” donation in excess of $75, the charitable organization must provide a written disclosure statement to the donor. The IRS defines a “quid pro quo” contribution as occurring when the donor makes a payment to a charity, partly as a contribution and partly for goods and/or services provided by the charity to the donor.

Some confusion could occur regarding the $75 value. The $75 threshold is determined based on the total payment made to the charity by the donor, and is not based solely on the value portion of the payment which is the charitable contribution. For example, if a donor pays a charity $200 and receives a concert ticket worth $150, the donor has made a “quid pro quo” contribution. The charitable contribution is only $50 in this example. Even though this $50 charitable contribution does not exceed $75, a disclosure statement must be filed because the total payment made by the donor exceeds the $75 threshold.

The written disclosure statement must inform the donor that the amount of the contribution for income tax purposes is only equal to the excess of the value of the property contributed by the donor over the value of the goods and/or services received by the donor from the charity. The statement must also provide the donor with a good faith estimate of the value of the goods and/or services that the charity provided the donor. The charity must provide this statement when it either solicits the contribution or receives the contribution. If the charity provides the statement when it solicits the contribution, a second statement does not need to be provided when the contribution is actually received by the charity.

There are three exceptions which apply where the charity does not need to provide the disclosure statement. The first is if the goods and/or services given to the donor are considered to be insubstantial in value. The determination of whether the goods and/or services are insubstantial is set out in Rev. Proc. § 90-12. Generally, goods and services received will be insubstantial if the value is not more than the lesser of 2% of the total payment or $50. Goods received will also be insubstantial if the total payment was $52 or more, and the only items received by the donor are token items such as bookmarks, calendars, or key chains, provided that the total value of such items received must be less than $10.40. Both the $52 payment and $10.40 limitation are increased annually by a cost-of-living adjustment.

A second exception applies if there is no donative intent involved in the particular transaction. An example provided by the IRS relates to a museum gift shop. If a donor purchases an item from the museum gift shop, the donor generally has no denotative intent. Therefore, the charity does not need to provide a disclosure statement.

The third exception applies if there is only an intangible religious benefit provided by the charity to the donor. This exception only applies if the charity is recognized as being organized exclusively for religious purposes. Further, the intangible religious benefit must be a benefit that is generally not sold in commercial transactions outside of the particular donative context.

If the charity is required to provide a written disclosure statement to the donor and fails to do so, then the charity may be subject to fines. The IRS may impose penalties on the charity equal to $10 per contribution, provided that the total penalty for any fund-raising event or mailing cannot exceed $5,000. The charity may avoid the penalty if the charity is able to establish that the failure to provide the necessary disclosure statement was due to reasonable cause.

District Court of Appeals Finds That Spouse With Judgment Against Her Can Keep Annuities Awarded in a Divorce that Took Place After the Creditor’s Claim Arose

by Alan S. Gassman and Travis Arango

On March 28, 2014, the Fifth District Court of Appeals held that an annuity contact awarded to a debtor spouse in a divorce proceeding is ruled to be exempt from creditor claims as if the spouse had already been the owner.

In the case of Connor v. Seaside National Bank, Mrs. Connor had a judgment entered against her. The issue was whether the annuities were exempt from garnishment under Florida Statute 222.14. The annuities had been purchased by her former husband, but she gained a “substantial part” of them in the dissolution of their marriage. She was in the process of changing the interest in the annuities to her name when a judgment was entered against her. The creditor argued that it could seize the annuity contract because she was not the beneficiary of the contract pursuant to Florida Statute Section 222.14, which reads as follows:

Exemption of cash surrender value of life insurance policies and annuity contracts from legal process.—The cash surrender values of life insurance policies issued upon the lives of citizens or residents of the state and the proceeds of annuity contracts issued to citizens or residents of the state, upon whatever form, shall not in any case be liable to attachment, garnishment or legal process in favor of any creditor of the person whose life is so insured or of any creditor of the person who is the beneficiary of such annuity contract, unless the insurance policy or annuity contract was effected for the benefit of such creditor.

The trial court found that the annuity was not protected, and specifically indicated that Mrs. Connor was not the “beneficiary” because she was not named on the contract. The Fifth DCA, in a three to two opinion (a dissent was not authored), found that Mrs. Connor was essentially equivalent to being the beneficiary of the annuity as contemplated under the above referenced Florida Statute, and indicated as follows:

The exemption should be liberally construed in favor of the debtor. Black’s Law Dictionary defines beneficiary as “[a] party who will benefit from a transfer of property or other arrangement.” Black’s Law Dictionary 157 (6th ed. 1990). Under this definition, Appellant is clearly a beneficiary of the annuity contracts because she is entitled to payment of the proceeds in accordance with the divorce decree.

The DCA opinion also noted that this is a different situation than the case of In re Pizzi, where a lottery winner was entitled to receive annual payments from the State of Connecticut. The state purchased an annuity contract from which it used the income to make the payouts to the debtor. Under the contract, the State was the owner and the beneficiary. The debtor later filed bankruptcy in Florida and the court held that the proceeds were not exempt because the debtor was not a beneficiary, even though she was a nominee. The court in Pizzi stated the debtor had not right to assert a claim against the annuity company. The Fifth DCA distinguished this case by holding:

Here, by contrast, although Appellant was not the named annuitant, she did have a right to assert a direct claim against the annuity companies because Michael’s contractual rights had been transferred to her through the dissolution judgment. Very simply put, Appellant was the owner of her percentage interest in the annuities.

Therefore, annuity contracts received in divorce proceedings should be protected from the claims of general creditors as long as the divorce proceeding itself is not a fraudulent transfer. Annuities are not protected from the IRS or the Federal Trade Commission, however. This decision applies in Florida only. The law of other states will vary depending upon statutory provisions and judicial interpretation, and how many Kentucky Fried Chickens they have per person in major metropolitan areas.

In the News – USA Weekend Basis Piece and NY Times Annuity Article

Alan Gassman was quoted in USA Weekend on the question of gifting partnership interests and how capital gains tax will work for the recipients of the gift. USA Today reporter Robert Powell did a good job of mentioning two special rules that apply for this type of planning:

- If the donor is estate-taxable, he or she can choose date of death or six months after date of death for the step-up value, depending on which one yields less estate tax.

- If a person receives property by gift and dies within a year and leaves it to the person who gifted it, then there is no step-up.

This short article can be viewed in its entirety by clicking here.

Robert Powell is a journalist and personal finance expert who serves as the president of Unison, LLC, a communications and consulting firm based in Salem, Massachusetts. He also executive produces More Than Money, PBS’ television series about personal finance. His writing has appeared in the Wall Street Journal, the Financial Times, MarketWatch, Your Money, the Boston Herald and the Boston Business Journal.

David Byrne is the lead vocalist and guitarist for the Talking Heads whose amazing film Stop Making Sense should not be missed!

———————————————————————————————————————

The front page of the New York Times Business Section last Sunday profiled a couple who invested $650,000 on a variable annuity through their U.S. Bank advisor. The article notes a 4% per year expense ratio and a 7% surrender charge feature.

The article by New York Times reporter Tara Siegel Bernard also discusses the difference between advisors who work as fiduciaries and advisors who work on a non-fiduciary basis.

A copy of the article can be reviewed by clicking here.

A copy of our Notre Dame outline on this topic that will be presented on Friday, November 14th in South Bend, Indiana at 9:00 a.m. can be obtained upon request by Thursday Report readers.

The Reverse Side of Reverse Mortgages – A Great Article by Michael Kitces

A few weeks ago we discussed new legislation, as well as protection and oversight regarding reverse mortgages. This week our discussion of reverse mortgages continues with commentary from Michael Kitces, a well-respected financial planner and speaker.

Michael Kitces on Reverse Mortgages:

Michael Kitces is an extremely well-respected financial planner and speaker on financial planning. Mr. Kitces has a laundry list of professional degrees and designations.[1] His passion is “to help advance the financial planning body of knowledge and distill complexity into practical applications that advisors can use to create better solutions for their clients.” Mr. Kitces supports the appropriate use of reverse mortgages and had the following to say:

While such loans [reverse mortgages] have been relatively unpopular – due in part to their high costs, and because they are often viewed as a borrowing option of last resort – the reality is that the lack of any cash flow obligations for a reverse mortgage actually allows it to eliminate the sequence risk from the mortgage-in-retirement strategy. In fact, over a long period of time, using a reverse mortgage in retirement can result in materially greater wealth when equities do perform as desired, as the reverse mortgage maintains a greater amount of household leverage, even while reducing the exposure to the impact of an unfavorable sequence of returns.

While reverse mortgages are often criticized for accruing loan interest (potentially resulting in huge compounding loan balances that erode net worth), the reality is that for clients who wish to keep leverage on their balance sheet to achieve their goals, the reverse mortgage is actually more effective than the traditional mortgage! The ongoing principal + interest payments of the latter can result in a deleveraging of the client’s balance sheet, which is actually counterproductive if the portfolio truly is outperforming the borrowing costs!

The reverse mortgage not only removes sequence risk, but for the retiree who wants to effectively buy stocks “on mortgage” with leverage, the reverse mortgage maximizes the leverage potential, as the principal payments of a traditional amortizing mortgage wind down the exact leverage that the mortgage-in-retirement strategy was intended to maintain. Notably, due to the sustained leverage, the reverse mortgage scenario ends up out producing a significantly larger mortgage balance at the end, but a significantly higher net worth as well, as the full amount of the portfolio stays invested throughout. And it does so without the cash-flow sequence risk of the traditional portfolio. For more information about buying stocks “on mortgage,” please click here.

In scenarios where there are little other assets available, the reverse mortgage choice is not so much about the benefits of leverage, but simply represents a lifestyle decision to erode the equity in the residence in exchange for being able to live out one’s life in the manner – and in the location – of his/her choosing. Nonetheless, it may still be preferable to utilize a reverse mortgage before reaching the point where no other assets are available, as the borrowing cost limitations of the reverse mortgage may provide insufficient income from the strategy at a late juncture.

The framing of a reverse mortgage as a lifestyle decision is especially true when the client truly has reached the scenario where virtually all other assets are depleted, and the equity in the residence is the last resort. At such a point, trying to downsize and free up equity to invest may be of very limited value, as the client may need to spend down the assets quickly enough that the time horizon is too short to invest for growth anyway. In such a scenario, the reverse mortgage truly represents a lifestyle cost decision, where the access and use costs of the reverse mortgage upfront and over time may even spend down the equity in the home at an accelerated rate, but doing so will nonetheless allow the client to make the lifestyle choice to stay in the home while spending down assets (and even if the client outlives the equity, can still remain in the home).

Mr. Kitces closes the article herein cited as follows:

In the end, the reverse mortgage is probably an underutilized tool in the financial planner’s quiver, especially given the already common use of keeping traditional mortgages in retirement anyway. Although the costs of reverse mortgages are not trivial, the upfront costs have declined recently, making the strategy somewhat more appealing at the outset, while low interest rates may make the strategy an appealing option on an ongoing basis (even with recently raised ongoing mortgage insurance premiums). Ultimately, the true appropriateness of a reverse mortgage will depend on specific client circumstances. Nonetheless, reverse mortgages definitely deserve a look for many clients – and far earlier than the traditional “income source of last resort” by which they have been traditionally viewed.

Next week, we will feature Congressman Mark Takano’s report on reverse mortgages as well as a discussion of Fred Thompson’s commercial.

************************************************************************

[1] MSFS- Master of Science in Financial Services; MTAX- Master’s in Taxation; CFP- Certified Financial Planner; CLU- Chartered Life Underwriter; ChFC- Chartered Financial Consultant; RHU- Registered Health Underwriter; REBC- Registered Employee Benefits Consultant; CASL- Chartered Advisor of Senior Living.

Reverse Mortgages Webinar

We had good feedback on our 20-minute reverse mortgage webinar last week, including the following from one prominent Florida trust lawyer:

“Alan, what a great service! I really enjoyed listening in. I will read the materials. I laugh my [behind] off every time I see the Fonz hawking this stuff – and not in the way that he would like to make people laugh. How low have his finances sunk?”

We were blessed to have Tarpon Springs based reverse mortgage advisor Elena Katsolus join us. Elena takes a balanced view of when reverse mortgaged may be appropriate, such as where a client only has a large home and a large IRA and would prefer not to draw upon the IRA beyond taking minimum annual distributions and cannot qualify for conventional financing.

Elena will join us on November 5, 2014 at 12:30 p.m. for another free webinar entitled Reverse Mortgages, a Deeper Dive. If you would like to register for this webinar, please click here.

The Thursday Report and our law firm do not receive any direct or indirect compensation from any contributor to The Thursday Report, and we do not pay any compensation except for occasional buckets of Kentucky Fried Chicken, Fresca gift certificates, and free electronic copies of The Thursday Report.

Please join our long list of somewhat satisfied contributors, and thanks for reading The Thursday Report!

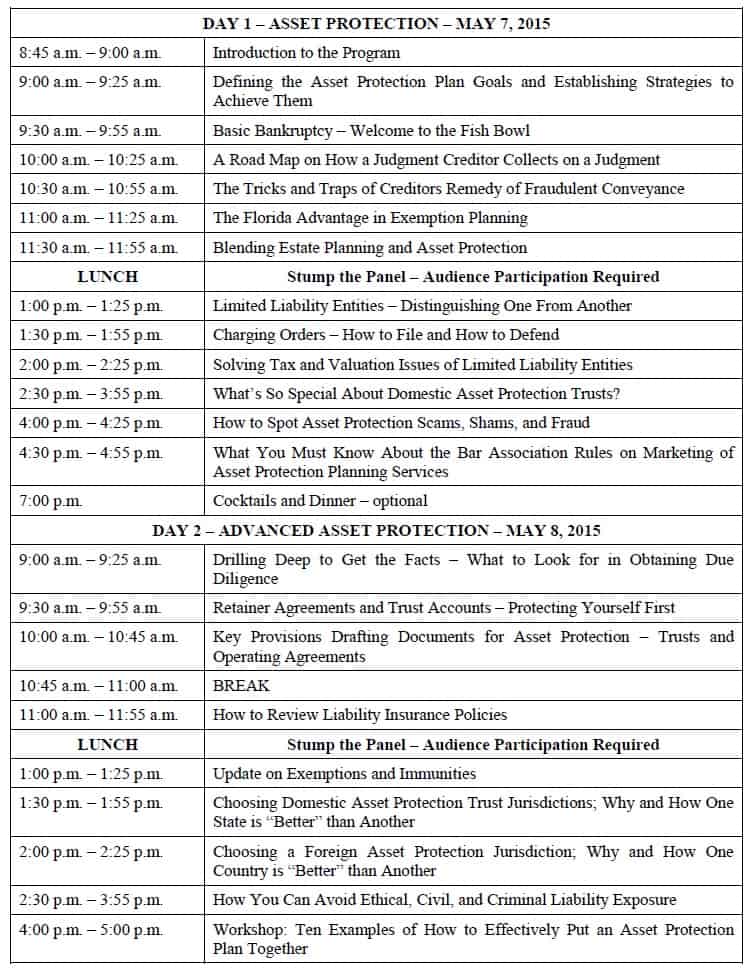

Don’t Miss the May 7-8 Florida Bar Wealth Preservation Expanded Two Day Program – For the Serious and/or Novice Planner

The Florida Bar Wealth Preservation Program

The Florida Bar Wealth Preservation Program has expanded to two days – Thursday, May 7th and Friday, May 8th. Please set your calendars and provide us with input for speakers, panel questions, and what we can do to make this a better program for everyone who attends!

Please come to Miami, and plan to participate in the optional dinner at 7:00 p.m. on Thursday evening – interact with speakers, industry leaders, and possibly Colonel Sanders.

The incredible schedule is provided below.

Please start sending us your questions now!

We will make sure to cover anything requested and much more!

Thoughtful Corner: Denis Kleinfeld: Books of Interest for Individuals Who Want to Think Themselves Successful

This is a continuation of Denis Kleinfeld’s reading list discussion for the wordly professional. Last week, Denis covered How to Speak, How to Listen by Mortimer J. Adler and Happiness is a Serious Problem – A Human Nature Repair Manual by Dennis Krager.

Click here for a copy of last week’s discussion.

This week Denis reviews two more very important books, A Time for Truth by William E. Simon and Rules for Radicals: A Pragmatic Primer for Realistic Radicals by Saul Alinksky.

A Time for Truth by William E. Simon

A Time for Truth offers fascinating insight into the political, economic, and social climate of the 1970s—his description is remarkably similar to Washington, D.C. as it exists today. The author was Secretary of the Treasury under both Nixon and Ford, and the piece is wonderfully written, straightforward, and full of factual information. Simon felt that he was watching Washington politics go astray amid a time of great fear and a “don’t rock the boat” mentality in the government. There was economic uncertainty, high unemployment, and a number of social and cultural movements emerging during this time. Americans were frustrated and disillusioned with Capitol Hill, and bureaucracy was king.

Why it’s important: This book is a must read for anybody who is a businessperson, investor, or professional affected by the law-making in Washington (and that’s basically everybody).

In order to think your way to success, you must have context. We do not operate in a vacuum, nor do we operate exempt from laws, rules, and societal attitudes and responses. To be successful, you need a diverse understanding of the environment in which you live. Success does not come in a linear fashion, and understanding where you live and work is critical to understanding some part of what you are able to achieve. This is an incredibly enlightening book which will provide you with the insight to understand why we are experiencing the crushing political problems we all face today.

Rules for Radicals: A Pragmatic Primer for Realistic Radicals by Saul Alinsky

Legal, financial, and business professionals alike will all benefit from a read of Saul Alinsky’s 1972 guidebook for how to achieve nonviolent revolution by undermining the institutions on which society is based. This book has influenced President Obama and many others. The author and President Obama were both community organizers in Chicago. An understanding of the philosophy and methods revealed by Alinsky are critical in making sense of the actions, taken by President Obama and others in the progressive movement, for the past 6 ½ years to radically transform the United States.

This book is explicit in detailing both the strategy and tactics necessary to make over the political, religious, educational, and community aspects of our culture, and replace them with underlying principles of the radical progressive agenda. The title of the book says it quite succinctly.

Why it’s important: Our government influences everything we do, from how we use the internet to how we drive a car to how we define our relationships. This book helps us to clearly understand that what is happening is neither an accident nor a matter of naiveté, but very much a goal-driven effort to remake America by radicals.

Regardless of your political affiliation or agenda, the principles of this book can be applied to any situation you wish to fundamentally transform. It is a brilliant work. The author has a clear goal, but his system will work successfully for a goal of your own by thinking through the strategy and tactics necessary to reach your objective. Remember, this is a pragmatic set of no nonsense rules (much like Machiavelli in advising his Prince) and is not written based on considerations of morals, ethics, or integrity.

Next week’s Thursday Report will have more treasures provided by Denis Kleinfeld.

Upcoming Seminars and Webinars

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

Cost: $35 per person

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 7:30 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” IRA and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

INTERNATIONAL TAX LAW DOUBLE HEADER WEBINARS:

Alan Gassman and Leslie A Share will be presenting a double header webinar on two topics:

- US Tax and Compliance Issues Affecting Americans Abroad – You Can Run, But You Can’t Hide (5:00 p.m.)

- Door #7 – Planning Techniques for Non-Resident Aliens Who Invest in Florida Real Estate – The Irrevocable Trust Structure Explained (5:30 p.m.)

Date: Monday, October 27, 2015 | 5:00 p.m. and 5:30 p.m.

Additional Information: To register for the 5pm webinar please click here. To register for the 5:30 pm webinar please click here.

*********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by reverse mortgage specialist Elena Katsulos for a webinar on REVERSE MORTGAGES, A DEEPER DIVE

Date: Wednesday, November 5, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar please click here.

*************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: To see the complete schedule, please click here. For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan S. Gassman will be presenting Dick and Jane’s Legal Adventure at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting. This program will cover the basics of Wills, trusts, LLCs and coordination thereof for paralegals. The presentation includes a 4 color slide show called “THE LEGAL STORY OF DICK AND JANE”, and all attendees will receive one copy of the Thursday Report, whether they want it or not. Dinner is included, but mashed potatoes are extra.

Date: November 11, 2014 | 6:00 p.m. – 8:00 p.m. (Alan Gassman speaks at 7pm)

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATIONS:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

*************************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Topics and Times are as follows:

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

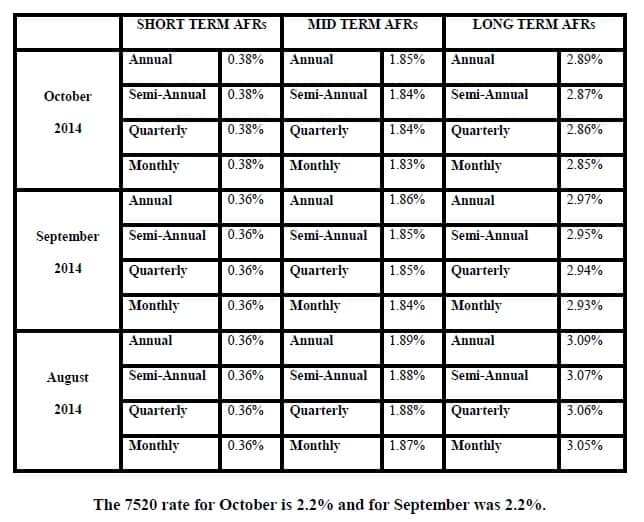

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.