The Thursday Report 1.16.14 – Heckled at Heckerling

Heckled at Heckerling

Foreign Currencies and Overseas Bank Accounts, an article by Dr. Jack Barrett and Parker Evans

Our article, Imposing Punitive Damages was published last night on Leimberg Information Systems

Seminar Announcement – Innovative Charitable Giving Techniques for the Well-Tuned Estate Planner with Jerry Hesch

Stump the Panel: Consanguinity or Affinity or Affluenza?

Why Wyoming?

The Story of Yellowstone and Teton National Parks

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

HECKLED AT HECKERLING

We brought our JEST (Joint Exempt Stepped-up Basis Trust) to Heckerling,

At booth four-three -oh,(430)

With our peer reviewed articles,

To explain and show,

That a stepped-up basis on the first death is doable,

Based on PLR’s, a TAM, and unique trusts that are movable,

(and no downside because if it doesn’t work

–you are back where you started–but more alert)

A lot of people like the JEST,

Because the only alternative is much less best,

And how proud we were that Professor Jeffrey Pennell,

Commented on our technique, which he found less than swell,

He alluded to TAM’s and PLR’s,

Which support our system, like tires work for cars,

He said that these authorities make the JEST a gift by the survivor,

But did not mention that they also allowed the marital

Deduction, (and that our incomplete gift design is even wiser)

He did say there was less than certainty on the 1014e Rule,

But did not read our article explaining that the suriving

Spouse would not be a surviving 1014e fool,

Professor Pinnell be nimble,

Professor Pennell be quick,

Professor Pinnell torched the JEST like a candle stick,

But we heard him exclaim as he rode out of sight,

“I also think that none of the Alaska, Delaware or

Nevada trusts will work right!”

When evaluating techniques for successful clients who took

Risks in businesses and professions after taking a look,

Make sure you warn them if you decide to be bashful,

Lest their heirs may complain and pursue you for a cashfull,

Especially if the reward is high and the risk is small,

If you don’t try for a higher basis you may take a fall

We thank the other speakers

Whose outlines mention the JEST

And happy Thursday to you and all of the rest.

Foreign Currencies and Overseas Bank Accounts, an article by Dr. Jack Barrett and Parker Evans

Dr. John P. Barrett, a retired by very active Tampa Bay orthopedic surgeon, is an internationally known innovator, investor, philanthropist and serial entrepreneur. Dr. Barrett’s passion for investment management and research inspired him to create Successful Portfolios. Dr. Barrett can be reached via email at jpbmd@aol.com.

With thirty years professional experience as an investment advisor, Parker co-founded Successful Portfolios in February 2010. Parker holds the Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Chartered Market Technician (CMT) designations. Parker’s commentary and papers have appeared in the Journal of Financial Planning, CFA Magazine and the Journal of Technical Analysis. He is the former President of First Discount Securities Corp., a pioneering discount brokerage firm acquired by First Union (now Wells Fargo). Parker is a former Vice President of First Union, Smith Barney, and Fifth Third Private Bank. He earned a B.A., with a major in Economics from Eckerd College where he won the Wall Street Journal Award for outstanding academic achievement. Parker received an MBA with Honors from Nova Southeastern University. Parker can be reached at 727-744-3614.

Many clients have asked us recently about buying foreign currency or opening bank accounts offshore to hold foreign currencies, so we asked Dr. Jack Barrett, MD and Parker Evans, CFA, CFP, CMT of Successful Portfolios LLC, a Clearwater based Registered Investment Advisor, for their thoughts on this. They have extensive experience with offshore accounts and foreign currencies and sent us the following memo.

Their memo mentions Interactive Brokers as a low cost broker – we are not endorsing Interactive Brokers here, but like the memo and are therefore making it available below. Doubtlessly there are many possible firms and platforms that offer what they are referring to, and we invite other investment advisors and professionals to chime in on the discussion below. While Switzerland has been the gold standard for bank safety and professionalism for many decades, it is essentially closed to direct accounts for Americans, and therefore intermediary organizations, Lichtenstein banks and other structures are evolving. Some clients may feel that it is best to have a portion of their money or wealth held in foreign currencies or in overseas accounts. Most clients do not have oversees currency or accounts and feel perfectly fine with that, as do we. Now, take it away Jack and Parker………………………

It is easy to see that the US dollar isn’t worth what it used to be. The US Treasury and Federal Reserve continue issuing debt and printing money at an unprecedented rate. High taxes, accelerating inflation and low interest rates could ultimately decimate the value of your cash reserves if held in only US Dollars. Rather than holding all your cash reserves in U. S. Dollars, it might make sense to diversify into currencies that could better protect your purchasing power. For example, historically the value of the Swiss Franc has appreciated versus the US Dollar. Consider too that Australian and Canadian Dollars deposits typically yield more than US Dollar deposits.

Next, let’s carefully examine the how and where of investing in foreign currencies. Consider these alternatives;

1. Go to your local commercial bank and buy the currency of choice. This is a very expensive way to acquire currency for investment purposes.

2. Purchase at the airport currency booth. Don’t do it! This is even more expensive than buying currency at your local commercial bank.

3. Open an account with Interactive Brokers (IB), a public company, where you can purchase up to US $1,000,000 of most any major world currency at low, transparent wholesale prices for a commission of just $2.50.

Once you acquire your foreign currency where do you keep it?

Option one, physical possession:

1. Stuff the paper money in or under your mattress and forget it.

2. A home safe is a better choice as long as no one knows about it.

3. A safe deposit box at your bank is the best choice for physical possession.

For reasons we won’t go into here, we strongly recommend you avoid in- or under-the-mattress currency storage. Also remember currency in a safe deposit box doesn’t earn interest. Not good. If you like the idea of holding some safe harbor assets in your safe deposit box consider holding gold and silver coin numismatics in addition to paper currency.

Option two, an Overseas Bank Account:

There is no requirement to have an overseas bank account to invest in foreign currencies. However, an overseas bank can be a good option for holding foreign currency deposits, especially if you plan on spending some time in the county and if you are ok with reporting your overseas accounts to the IRS as required by U.S. law.

Be aware that these days it is very difficult if not impossible for a US Citizen to open a Swiss Bank account offshore. There are foreign banks that will accept your deposit account if you jump through the required hoops. Caution is in order. Consider for example what might happen if a major hurricane submerges your favorite island tax haven. You should avoid banks paying higher than market interest rates on deposits. If you are adamant about opening an overseas bank account, remember that an affiliate of a systemically important, too big to fail, multinational bank holding company is a safer bet than small locally based banks. Subsidiary banks of any of the Canadian big five banks would likely be a safe choice.

For many investors the best option for buying and holding foreign currencies is……here it comes………. an online IB Brokerage Account. Consider:

1. You can quickly and easily buy a currency ETF (exchange traded fund) from most online on line stockbrokers like Schwab. Currency ETFs are safe but remember ETF prices will fluctuate.

2. At some brokers, like IB, you can buy currency in the cash FX (foreign exchange) market. This usually is the most cost effective approach. Executing a cash market FX trade requires a bit of a learning curve and is more complicated than simply buying an ETF.

3. You can buy FX futures contracts. There are some big advantages with this but don’t leave home without professional advice.

4. Another advantage of a brokerage account at IB is you have the option of investing your foreign currency balance in attractive stock or bonds directly in their home market. Many of these securities are not readily available for trading in US markets.

5. If you have a foreign bank account and an IB brokerage account, you can easily and economically convert your US Dollars to a foreign currency and then wire it overseas.

……and a bucket of Kentucky fried chicken for every IB account you open

Our Article on Punitive Damages

Our article on Punitive Damages was published last night by Leimberg Information Systems. We thank Steve Leimberg, Steve Adkisson, Dave Slenn and Charlie Lawrence for making the article on LISI possible.

Jay’s 12:35 a.m. email today made our day and reads as follows:

Alan,

Just wanted to drop you a line and tell you what a tremendous and helpful article this is — I am frankly awed by the excellent state-by-state research that you have done.

As I don’t have Charlie’s e-mail, please forward my comments to her with my best.

BTW, you guys gave me sole credit for the Cutuli/Elie article, but in truth Dave Slenn contributed tremendously to that article and was the co-author, but was not mentioned.

I do very much appreciate the credit, but Dave is also very deserving of sharing it.

Best,

— Jay

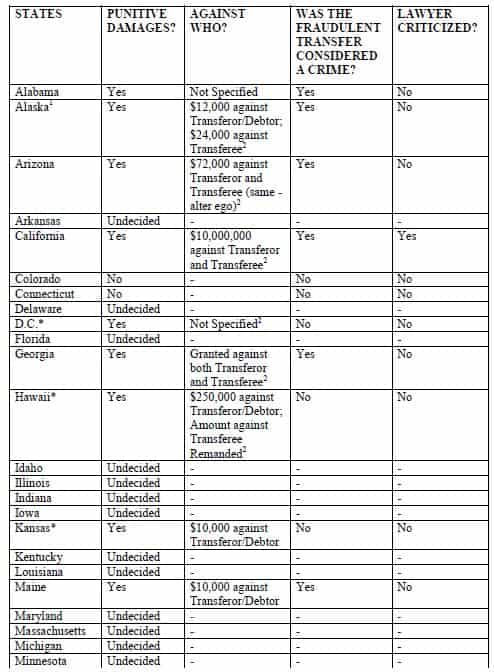

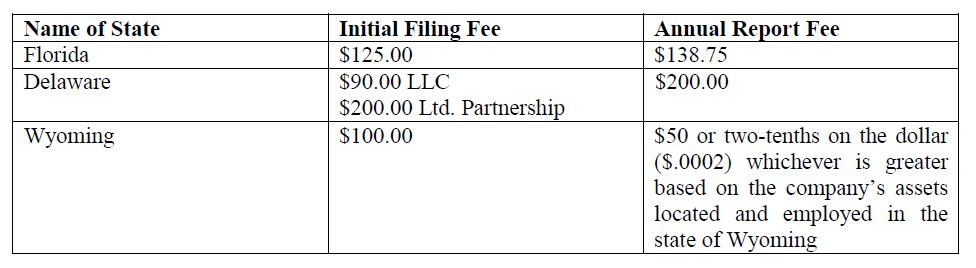

The introduction and the chart from the article are as follows:

“Some states are allowing punitive damages for fraudulent transfers in bankruptcy cases, some states are not allowing punitive damages, and some haven’t decided yet. The majority of states that have considered the issue have jumped on the bandwagon to allow punitive damages for fraudulent transfers, regardless of whether the transfer is considered a crime. Only time will tell how the remaining states will fall.”

After reviewing Jay Adkisson’s Asset Protection Planning Newsletter #229, Alan Gassman couldn’t help but investigate what was going on with punitive damages. He enrolled the help of Charlie Lawrence to investigate the situation, and their commentary captures what they found.

Alan S. Gassman, J.D., LL.M. practices law in Clearwater, Florida. Each year he publishes numerous articles in publications such as BNA Tax & Accounting, Estate Planning, Trusts and Estates, The Journal of Asset Protection, and Steve Leimberg’s Asset Protection Planning Newsletters. Mr. Gassman is a fellow of the American Bar Foundation, a member of the Executive Council of the Tax Section of the Florida Bar, and has been quoted on many occasions in publications such as The Wall Street Journal, Forbes Magazine, Medical Economics, Modern Healthcare, and Florida Trend magazine. He is an author, along with Kenneth Crotty and Christopher Denicolo, of the BNA Tax & Accounting book Estate Tax Planning in 2011 and 2012. He is the senior partner at Gassman, Crotty & Denicolo, P.A. in Clearwater, Florida, which he founded in 1987. His email address is agassman@gassmanpa.com

Charlie Lawrence is a 2013 Stetson Law School graduate and is a member of the Florida bar; she co-wrote this commentary while performing legal research for Gassman, Crotty & Denicolo, P.A.

*Awarded punitive damages when conduct was not a crime

1Does not follow the Uniform Fraudulent Transfer Act.

2Transferee was found to have acted with intent to defraud.

Seminar Announcements

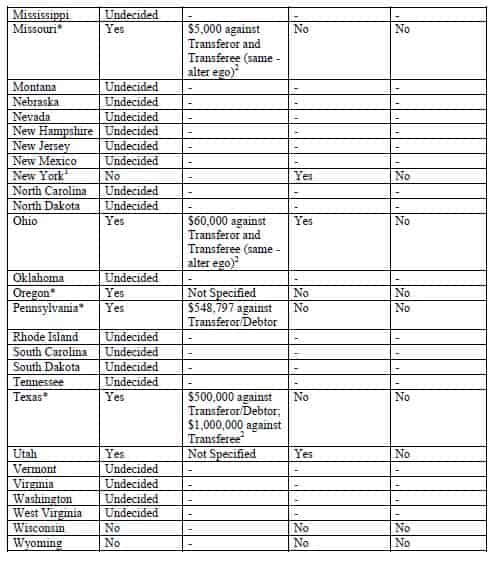

Innovative Charitable Giving Techniques for the Well-Tuned Estate Planner with Jerry Hesch

On Tuesday, April 22, 2014 from 4:00 – 4:50 pm, Professor Jerry Hesch will be speaking at the Ruth Eckerd Hall Planned Giving Council meeting in Clearwater, Florida on the topic of Innovative Charitable Giving Techniques for the Well-Tuned Estate Planner. This session will qualify for 1 hour of continuing education credit for lawyers and CPA’s.

Following Professor Hesch’s talk there will be a social program and networking along with a brief information session.

Ruth Eckerd Hall is also scheduling a donor luncheon so that Professor Hesch can explain how the government will contribute to charity when proper techniques are used.

Please plan to attend this great event.

Stump the Panel: Consanguinity or Affinity or Affluenza?

We see these words all the time in regards to inheritance, but what do they mean? Where did they come from?

Consanguinity means “related by blood.” The word is derived from the Latin word “consanguinitas,” meaning “blood relation.”

Affinity means “related by marriage.” The word is believed to be Latin, derived from “affinitas.”

Affluenza means the guilt or lack of motivation experienced by people who have made or inherited large amounts of money. The word comes from aff(luent) + (in) fluenza. Wikipedia has a good entry on Affluenza that can be reviewed by clicking here. Also the book Affluenza: The All-Consuming Epidemic by John de Graaf is presently being reviewed by your Thursday Report editors to see how much of it we have. Click here to order your copy now.

Why Wyoming?

Bigger and better than Disney World?

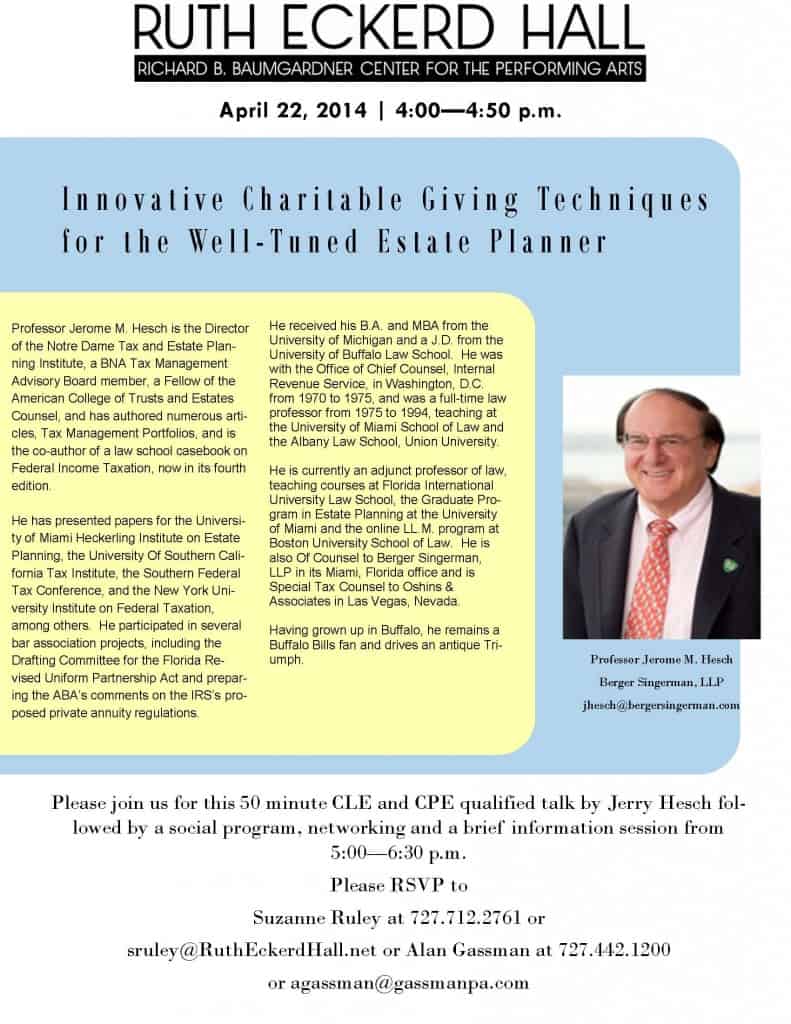

The benefits of limiting liability of owners and shareholders exist under the law of many states and many clients are best served by using a state other than Florida for confidentiality, creditor protection and cost reduction purposes.

While Florida’s limited partnership and LLC laws are among the best in the country, the Florida Supreme Court decision in Olmstead, annual changes in the statutes thereafter, confusion resulting from the above, and the question as to whether there will be further changes leads some planning lawyers to the conclusion that Wyoming secrecy rules and stability help make it the appropriate jurisdiction for many entities.

Many clients are married and want their ownership of an entity to qualify as tenancy by the entireties, which cannot be assured unless the state where the entity is formed or recognition of tenancy by the entireties exists. Delaware and Wyoming are considered to be incorporation havens because they do not impose any income tax and have pro-business laws. In addition, both Delaware and Wyoming recognize tenancy by the entireties, and have good secrecy practices as well, but we have found Delaware to be much more expensive and cumbersome to use than Wyoming, except that Wyoming does not have electronic filing like Delaware does. Colorado and Nevada are also popular, but do not recognize tenancy by the entireties. Wyoming is the only state in the union that is a perfect rectangle with its lines being north and south and east and west. It is more square than Colonel Sanders.

The filing fees and annual report fees for limited partnerships and LLCs in Florida, Delaware, and Wyoming are as follows:

Please note that a Registered Agent will need to be retained in the state of formation.

WHILE IN WYOMING – ON YOUR TAX DEDUCTIBLE TRIP – MAKE SURE TO VISIT JACKSON HOLE AND YELLOWSTONE NATIONAL PARK WHICH ARE AMAZING U.S. GOVERNMENT TERRITORY GIFTS THAT WERE PROVIDED BY JOHN D. ROCKEFELLAR, AS DESCRIBED BELOW.

The Story of Yellowstone and Teton National Parks

Wyoming and small parts of Idaho were well known to have incredible scenery, volcanic mountain, and incredible rivers, spring fed lakes, and natural beauty since originally surveyed by Ferdinand Vandeveer Hayden as part of the Hayden Geological Survey of 1871.

In 1924, John D. Rockefeller, then the wealthiest man in the world, visited part of the 2,221,766 acres that is now known as Yellowstone National Park. This trip turned into an annual family visit to the Yellowstone and Teton Mountain Range areas, including Jackson Hole.

In 1927, Mr. Rockefeller established the Snake River Land Company, which was administered by a Salt Lake City, Utah lawyer named Harold Pegram Fabian.

Much like Walt Disney did in Central Florida in the mid-1960s, Mr. Rockefeller remained completely anonymous as an affiliate of the Snake River Land Company, and the company had confidentiality agreements in place so that land owners were not aware that large portions of their area were being purchased.

The economic travails of the 1920s caused a significant number of land owners to sell their property to the Trust for less than what they felt it was worth, but more than they could get anywhere else.

The Snake River Land Company initially bought some of the 114,170 acres of land that had recently open for purchase on both sides of the Snake River. At that time, land to the west of the river cost $28/acre, and land to the east of the river merely $10/acre.

Most of the property would probably be described as being too mountainous to develop, but at approximately 2.5 million acres, these two parks cover roughly 4% of the real estate within the State of Wyoming. The federal government owns 48% of all land in Wyoming, and the state government owns an additional 6% of the land.

A great many of the citizens of the State of Wyoming were unhappy to learn that John D. Rockefeller had acquired approximately 35,000 acres of land for an overall average of $39.66/acre. Although the property had been freely sold for a fair price, as soon as it was revealed that Rockefeller was behind the Snake River Land Company, there was indignation that the richest man in America did not have to pay more for the land he purchased. The lands were purchased under willing buyer/willing seller arrangements, but Rockefeller was rich and most of the sellers were suffering in the Great Depression, which drove the cost of land down. Furthermore, the western culture was not keen on being told what to do by a family from the northeast.

John D. Rockefeller held onto the property for 15 years, and finally wrote to President Franklin Delano Roosevelt stating that if the President did not accept the donation of this land immediately and create a national park, that he would dispose of the land privately. President Roosevelt used federal power to bypass local issues and declared the creation of the Jackson Hole National Monument on March 5, 1943.

This caused a major political upheaval in Jackson Hole and throughout Wyoming as people came to realize that they would not be able to live in developing communities, and that the federal government would be telling them what to do on Mr. Rockefeller’s property. The President’s actions were referred to as the death of democratic rights and even compared to the Nazi seizure of Austria, in the midst of World War II no less!

In 1944, President Roosevelt struck down a bill that had passed both houses of Congress, calling for the dissolution of Grand Teton National Park altogether. In 1950, the lands held under the Jackson Hole National Monument finally merged into the 310,000 acres of land that today make up Grand Teton National Park.

Also, a great many families had property within what would become the National Park System, and would not have road access to the outside or would have many miles to travel in order to get to non-public park property.

These negotiations with the federal government resulted in a number of compromises, including permission for big game hunting within specific hunting seasons, grazing rights, and even dude ranching on park property under certain circumstances.

The descendants of many of these families still reside on park lands today.

Once the idea of protecting national lands was extremely unpopular, but today Yellowstone and Grand Teton National Parks are huge tourist attractions. The Jackson Hole Airport accommodates approximately 285,000 visitors per year and is located entirely on the Yellowstone National Park. It is the only airport to be contained within national park property. It is currently undergoing expansion that will be completed in the spring of 2014.

Teton Village in the Jackson Hole area consists of approximately 3,200 acres of hotel, timeshare, condominium, ski resort and ski slope, and upscale housing. It is located at the base of Rendezvous Peak, and is a major tourist spot, particularly for avid skiers (Rendezvous Peak, at 10,536 feet, has the largest vertical rise in America- 4,139 feet).

The interplay between the federal park system and the outside private sector has been an integral part of the park system’s history since its inception.

There is an interesting parallel between the creation of Yellowstone and Grand Teton National Parks and the creation of the Walt Disney World Resort in Orlando, Florida. Like Rockefeller, Walt Disney quietly purchased over 30,000 acres of land in the heart of the state; in the 1970s, the average price was $180/acre. Rockefeller’s aim in purchasing the land was to preserve and protect it from development; Disney’s aim was to create a resort complex with theme parks and hotels for commercial gain. However, Yellowstone and Grand Teton generate a significant amount of commercial revenue from tourism each year, and Disney has a 12,000 acre nature preserve right on its property.

The Disney property today encompasses approximately 25,000 acres, roughly 0.62% of Florida’s 42,083,200 acres. The Magic Kingdom has the most visitors of any theme park in the world (17,536,000), and the Walt Disney World properties together drew 126,479,000 visitors in 2012.

Compared to that, Yellowstone and Grand Teton cover roughly 2.5 million acres, and draw 6,153,000 visitors per year. That is roughly 2.46 visitors per acre of national park. Disney attracts 5,059.2 visitors per acre annually.

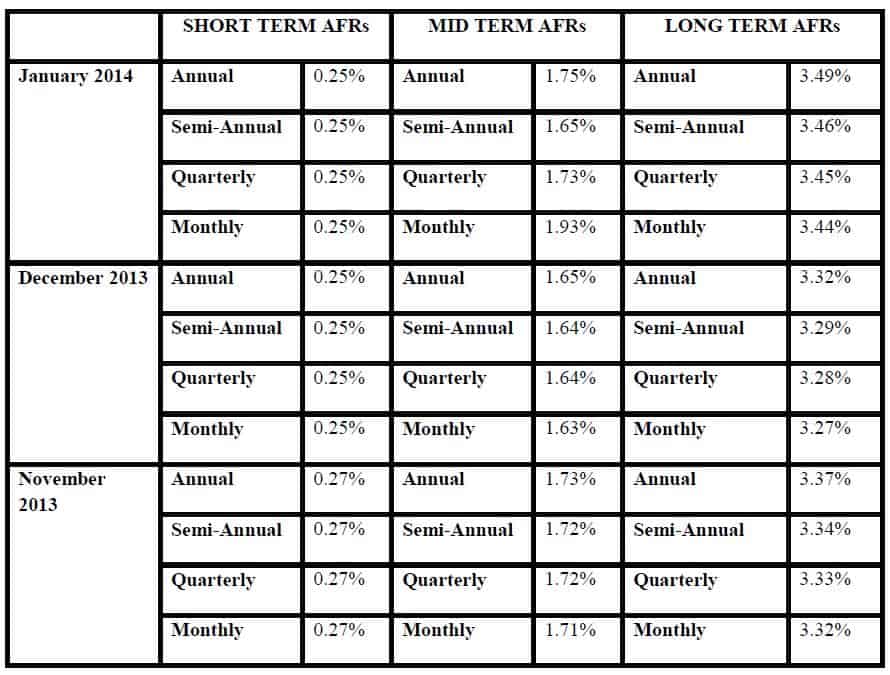

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

Seminars and Webinars

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2014

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2014, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

PINELLAS COUNTY CHAPTER OF THE FLORIDA ASSOCIATION OF WOMEN LAWYERS SEMINAR

Alan Gassman will be speaking on Same Sex Marriage and Associated Laws We Should All Know About Anyway.

Date: January 30, 2014 | 5:30 p.m.

Location: Stetson Law School, Gulfport, Florida

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

INDIVIDUAL AND GROUP MEDICAL PRACTICES BLOOMBERG BNA WEBINAR

Health care attorney Lester Perling, Pension Actuary Jim Feutz and Alan Gassman will be presenting a 90 minute webinar for Bloomberg BNA Tax and Accounting on Individual and Group Medical Practices.

Date: February 13, 2014 | 12:00 – 1:30 p.m. (90 Minutes)

Location: Online webinar

Additional Information: Please contact agassman@gassmanpa.com for more information.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

HILLSBOROUGH COUNTY BAR ASSOCIATION HEALTH LAW SECTION LUNCHEON

Alan Gassman and Christopher Denicolo will be speaking at the Hillsborough County Bar Association’s Health Law Section Luncheon on the topic of Tax and Asset Protection Basics for Those Who Represent Physicians and Medical Practices

Date: March 12, 2014

Location: Chester H. Ferguson Law Center in Tampa, FL

Additional Information: For additional information please contact Co-Chairs Sara Younger (sara.younger@baycare.org) or Thomas Ferrante (tferrante@carltonfields.com).

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2014

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

NOTABLE SEMINARS PRESENTED BY OTHERS:

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: For more information and to register for the program please visit www.floridataxinstitute.org. There will be cocktail parties at the Grand Hyatt as part of the programs on Wednesday, February 19 at 5:00 p.m. and then again on Thursday, February 20 at 5:00 p.m. Please plan to attend these receptions. See how your classmates are doing and say hello to your favorite professors. (If they didn’t teach at Florida then you can call them on your cell phone during the cocktail hour). Help us strengthen and improve a UF LLM community, the school, and the synergism that results from these types of activities. Students will be in attendance and will greatly value conversations with an advice from alumni. Do you remember how you felt when you were in the LL.M. program and were able to interact with successful lawyers who gave you valuable feedback? There is also a reception for all attendees and the guests on February 10, 2014 at 5:00 p.m. for attendees and their spouses along with a reception on February 11, 2014 at 5:00 p.m. to thank the supports of the University of Florida, the law school and the LL.M. program.