The Thursday Report – 12.12.13 Dr. Law, Tax, Son-in-Laws and Wax

No Estate Tax Changes for 2014? – A Christmas Gift for Advisors

The Vancouver Clinic Case and Taxation of Hospital Loans, an article by Alan Gassman and Charlie Lawrence

IRS Final Regulations on §1411 Investment Tax and Add-On Medicare Tax

New Seminar Announcements and More Spotlights from the UF Tax Institute

Phil Rarick’s Informative Blog: The “Son-in-Law Problem”: Keeping Your Wealth Safe – And Out of Reach From Your Daughter’s Husband

Our Chapter on Creditor Protection for the Health Law Section’s Upcoming Health Law Manual

Medical Practice Business Realities

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

No Estate Tax Changes for 2014? – A Christmas Gift for Advisors

House Ways and Means Committee Chair Dave Camp, R-Mich., told reporters November 20 that he is not planning to make changes to the estate and gift tax law in the comprehensive tax reform bill he is drafting. Congress made major estate and gift tax provisions permanent as part of the American Taxpayer Relief Act of 2012 (P.L. 112-240) enacted January 2. Camp’s decision not to touch estate tax law will likely anger many Republicans. Several House Republicans have introduced bills that would repeal or otherwise alter the estate tax. Keeping up with the case law and developments on the approach to estate tax planning after the monumental changes that have occurred since 2010 are keeping us plenty busy!

The Vancouver Clinic Case and Taxation of Hospital Loans Under Physician Recruiting Agreements

By Alan Gassman and Charlie Lawrence

Many physicians receive hospital support payments when they begin practicing in a new geographical area, and are typically in the lowest tax bracket they will experience during their career. Therefore, it makes sense for the physician to pay income tax on the advances and support payments as they are received, as opposed to being taxed in future years on both current income plus past support payments when forgiven in subsequent years.

Unfortunately, there is not very much authority for if and when a support payment in advance of this nature will be considered as income. Standard HCA documents provide that the Hospital will report the income on a Form 1099 only as forgiven. Other hospital systems take the opposite approach.

The April 9, 2013 U.S. District Court of Washington opinion in Vancouver Clinic held that advances paid by a medical clinic to newly hired doctors were compensation, because the parties did not intend repayment.[1] The Court found that the advances were an inducement for the doctors to remain with the clinic for a set period of time, and the repayment provision functioned as a liquidated damages clause.[2]

In this case, the clinic entered into “Associate Physician Loan Agreements” with over 100 new physicians in 2007, 2008, and 2009 with the intention of assisting the clinic in recruiting and retaining new physicians[3]. Each physician was loaned funds over the first 2 years, and after completing at least 5 years the loans were forgiven. Interest accrued at the prime rate over the 5 years, but the physicians were not required to pay it as it accrued.[4] There was no fixed repayment schedule when the agreement was executed. The clinic did not record income taxes or otherwise treat the advances as compensation for W-2 or other purposes. The clinic did not withhold income as compensation. Instead, the clinic issued a Form 1099 as the debt was forgiven. The clinic advanced over $1.5 million during the three-year period, and expected more than 80% of it to be forgiven.[5]

Contrary to the above, the 2002 Tax Court Memorandum decision of Rosario v. Commissioner of Internal Revenue concluded that advances under the Hospital Recruitment Agreement were considered to be a loan as opposed to current compensation for the following reasons: 1) the agreement provided for repayment to the extent the doctor’s monthly income exceeded the monthly loan amount and provided; 2) the doctor’s intent to repay was supported by an amendment, a signed promissory note, and his correspondence to the hospital after he ended his practice; and 3) the hospital’s intent to enforce the agreement was shown in other documents and by court action after he ended his practice.[6]

In a 2000 Technical Advice Memorandum (“TAM”), the IRS held that advances were compensation, even though they were secured by a promissory note and bonus agreement.[7] The TAM found that there was no unconditional and personal obligation to repay the advances, because repayment was with guaranteed bonus payments that matched the repayment amounts. Further, the agreement didn’t require periodic cash payments.[8]

Several articles offer suggestions on how to structure advancement arrangements if the parties intend having advances be treated as loans until they are actually forgiven. These include: 1) providing a specific repayment schedule; 2) properly executing a promissory note; 3) performing a financial background check and credit check on each physician; 4) instead of the clinic forgiving the loan, the physician could use future compensation to make scheduled interest and principal payments to the clinic; and 5) use a separate employment agreement to specify the physician’s compensation and employment terms.[9] Please click here for a copy of the Memorandums.

Those of us who counsel medical groups and physicians with respect to hospital support agreements need to be aware of these issues and the possible alternatives that hospitals and medical groups have with respect to structuring loan arrangements. All advisors must, however, keep in mind that structuring for hospital advances needs to comply with the STARK regulations and other applicable law.

Our Thursday Report of March 21, 2013 discusses the STARK regulations and hospital support arrangements with respect to non-competition covenant planning. You can access that report by clicking here.

IRS Final Regulations on §1411 Investment Tax and Add-On Medicare

On November 26, the IRS issued the final regulations on the §1411 (Medicare Tax) and the add on .9% Medicare Wage Tax which applies to high earners (the threshold is $200,000 of income for a single individual and $250,000 for married couples filing jointly). The Regulations are long and complicated, and may be categorized as follows:

- The sale of S Corporation stock in an active business that the taxpayer materially participates in should not be subject to the 3.8% Medicare tax

- Net losses are allowed against the Net Investment Income Tax (NII)

- Self-charged interest and self-charged rental income will not be subject to NII

- A safe harbor provision is available to real estate professionals who can satisfy the 500 hour test

- Options are available for computing investment income passed out to CRT beneficiaries

- More expenses are identified as allowed investment expenses

- The method for determining the amount of various itemized deductions that are allowed to offset NII has been simplified

- Regrouping is not allowed at the entity level

- Regrouping is allowed at the 1040 level, with the condition of being subject to the NII

- The foreign tax credit may not be used to offset the NII tax

Often it is best to first read the preamble to new regulations, which indicate what the IRS personnel were thinking when they wrote the regulations. The preamble to the regulations are 107 pages double spaced and can be viewed by clicking here.

We will provide further coverage of these new regulations as we refine our thinking, strategies, and drafting with respect thereto.

We welcome questions, comments and suggestions, or even articles on subtopics for this project.

New Seminar Announcements

Same Sex Marriage and Associated Laws We Should All Know Anyway

On January 30, 2014 at 5:30 p.m. the Pinellas County Chapter of the Florida Association of Women Lawyers will present a seminar at Stetson Law School in beautiful Gulfport, Florida from 5:30pm, followed by a social mixer. After that you can have dinner at Six Tables which has a bed and breakfast and wonderful table service and atmosphere.

Speakers will include Charlie Robinson, Alan Gassman and others to be announced.

Our continuing white paper on Same Sex Marriage Law and Considerations continues to improve and evolve. For a copy please email agassman@gassmanpa.com or Janine@gassmanpa.com.

Annual Florida Bar Wealth Protection Conference

The annual Florida Bar Tax Section sponsored Wealth Protection Conference will be held on Thursday, May 8, 2014 at the Hyatt Regency Downtown in Miami. Please make your reservations now.

Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection” and Denis Kleinfeld on The Roadmap to Wealth Protection Planning.

Our talk will be on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

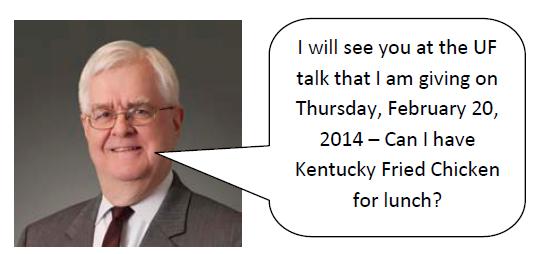

Two Top Notch Home Run Hitters in the Estate and Estate Tax Planning World to Speak at the 1st Annual UF Tax Institute, February 19-21, 2014

We would like to thank Ronald Aucutt and Steve Leimberg for their participation in the first annual University of Florida Tax Institute being held February 19-21, 2014.

Ronald Aucutt is a partner at McGuire Woods in Tysons Corner, Virginia where he is the leader of the private wealth services group. Mr. Aucutt has been named Trusts and Estate Lawyer of the Year for 2012 by Best Lawyers and has been recognized by The Washingtonian as one of Washington’s 31 “Best Lawyers.”

Mr. Aucutt is past president of The American College of Trust and Estate Counsel and is a fellow of the American College of Tax Counsel and the American Bar Association as well as a member of The International Academy of Estate and Trust Law; and the Advisory Committee of the University of Miami Philip E. Heckerling Institute on Estate Planning. He has been a lecturer at the University of Virginia School of Law and has lectured on estate planning at more than 100 tax institutes and conferences nationwide. He is the co-author of Structuring Estate Freezes and has published more than 100 articles on estate planning and related tax subjects.

Ron will be giving a capital report at the Tax Institute during the luncheon session on Thursday, February 20, 2014.

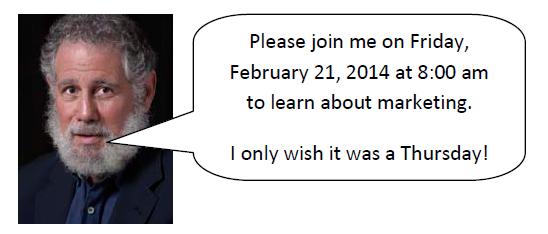

Steve Leimberg is the CEO of Leimberg and LeClair, Inc., and estate and financial planning software company, as well as President of Leimberg Associates, Inc. a publishing and software company in Bryn Mawr, Pennslyvania. Mr. Leimberg publishes Leimberg Information Services, Inc. which provides email based news, opinions and information for tax professionals.

Steve is a nationally known speaker and has been awarded the Excellence in Writing Award of the American Bar Association’s Probate and Property Section. He has also been named 1998 Edward N. Polisher Lecturer of the Dickinson School of Law and was a featured speaker at the American Bar Association’s Tax Sections Annual Meeting.

Steve will be speaking on Marketing an Estate Planning Practice on Friday, February 21, 2014.

You can view his Wikipedia page by clicking here.

We also thank Bruce Bokor and the other founding members of the Steering Committee for their work on making this great tax conference a success:

● Leslie J. Barnett, Esq. ● Samuel C. Ullman, Esq.

● John C. Bovay, Esq. ● Dennis Calfee, Esq.

● Richard B. Comiter, Esq. ● Lauren Y. Detzel, Esq.

● Michael Friel, Esq. ● Michael L. Kohner

● Martin McMahon, Esq. ● Louis Nostro, Esq.

● A. Brian Phillips, Esq. ● David Pratt, Esq.

● John Scroggin, Esq. ● Donald Tescher, Esq.

To quote Monty Python “If you enjoy this conference half as much as they do, then they will have enjoyed it twice as much as you do.”

Phil Rarick’s Informative Blog: The “Son-in-Law Problem”: Keeping Your Wealth Safe – And Out of Reach From Your Daughter’s Husband

Let’s face it. If you have adult children, now married or considering marriage, you are a little concerned that your daughter’s husband could someday inherit your hard earned wealth. (Or maybe it’s your son’s wife.)

So, how do you protect your property, and make sure it only goes to your adult children and not their spouse?

Our Chapter on Creditor Protection for the Health Law Section’s Upcoming Health Law Manual

We recently completed a chapter on creditor protection for the health law section’s upcoming health law manual.

The health law section would like to have our chapter peer reviewed by one or more individuals who would be given editing credit in the book.

If you are interested in taking a look at our proposed chapter and giving us input and becoming an editor please let us know by emailing agassman@gassmanpa.com or janine@gassmanpa.com

Medical Practice Business Realities

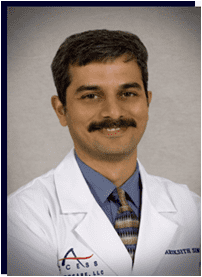

We have co-authored a chapter of an upcoming book by Pariksith Singh, M.D. called 2014 Health Care Primer.

Dr. Singh became dedicated to the task of organizing a primary care concentrated specialty care connected system that services fee-for-service, HMO’s, Medicare and now includes an ACO and clinically integrated systems and tracking.

He has this up and running because he started it in 2004.

Pariksith Singh, M.D. is board certified in Internal Medicine. Dr. Singh received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001. He has been our fearless leader ever since!

Dr. Singh determined to study medicine at age 15, out of a desire to help others. Although this sounds idealistic, Dr. Singh helps his patients and the Access family every day – his genuine care for others’ well-being is evident in his interactions with patient – he remembers something personal (not health related) about every one of his patients! Dr. Singh finds it gratifying to be able to help save a life or a limb – he is committed to educating patients on healthy lifestyles and successful management of chronic conditions. He has admitting privileges at Brooksville and Spring Hill Regional hospitals, Oak Hill Hospital, and Regional Medical Center Bayonet Point.

Dr. Singh and Dr. Scunziano have four active children (between the ages of 14 and 2), who certainly keep them on their toes! In addition to family activities, Dr. Singh’s hobbies include writing poetry, literature, religion and philosophy. Dr. Singh also dedicates much of his time to philanthropic endeavors, and is passionate about supporting the Wounded Warrior Project in Hernando County.

The chapter we wrote together on patient-centered medical practice philosophy is as follows:

Customer Service: The Single Biggest Shift in Health Care, by Dr. Pariksith Singh and Alan S. Gassman

Gone are the days when physicians told patients what they were going to do. Gone also are the days when a physician’s bedside manners and ability to communicate were not some of the most important criteria in evaluating a physician. The days when the physician was the real “Oz” are behind us, for the internet now allows patients to research medical conditions and physician ratings on their own.

To me, it seems that the single most important change with STAR ratings is not HEDIS or outcomes, since, in principle, they were always important, but the enormous weight given to customer satisfaction. When I started practicing medicine, it was common for physicians to discharge patients if they so much as raised a question about their medical care. We all know how health care was denied egregiously in the early days of managed care. Healthy patients were cherry-picked or unhealthy ones lemon-dropped, and providers would crassly let patients know how much their care cost the provider’s bottom-line. Those days, I believe, are gone or, at least, are on their way out.

Patients have been given much more say as to their health care with the advent of Consumer Assessment of Healthcare Providers and Systems (“CAHPS”) and Health Outcomes Survey (“HOS”). Suddenly, we find that health insurances are bending over backwards to accommodate patients, sometimes overriding provider input or even medical necessity. Patient satisfaction and perception have begun to be an important component of the profitability of insurance plans.

We find much more plan involvement in patient care and patient engagement. IPAs, if they are to be of value to the plans and providers, must do the same. The biggest change in health care is the unmistaken emphasis on provider-patient engagement and relationships, communication, and patient satisfaction. It is very clear that providers who realize this turn in priorities will do better in the coming years.

Thus, we no longer have patients. Rather, they are seen as customers, or perhaps, I should say patrons. The medical office, including the front and the back operations, has to essentially be run more like the Ritz, Disney, or Starbucks where the customer comes first, and their experience is paramount.

Starbucks has always aspired to be the second home of its customers, as its motto clearly states. In times of the Patient Centered Medical Homes, why should the health care motto be any different? The PCMH is not just about creating a model that emphasizes team work, patient communication and involvement and patient-centered health care, but also convenience, ambience, and great customer service. Thus, patients would do well to learn from the corporate leaders in how to provide excellent customer service.

As markets become saturated with managed care, the returns on marketing dollars are reduced. It is far easier and less expensive to retain membership than to get new members. It also makes sense to retain members since MRA-improvement initiatives take 12-18 months to show an increase in premium, stable patients have less utilization and better HEDIS scores, and managed care profits improve with greater retention. For this to happen, it is critical that physicians realize that their smile is worthwhile, not only to communicate genuine happiness and engagement, but that it also affects their panel’s expense ratios.

However, customer service does not stay restricted to offices. In hospitals, we see an even greater need for communication with patient and family, coordination of care, proper planning, and a service-oriented philosophy. A higher patient satisfaction will result in less re-admissions, visits to the emergency rooms, and malpractice lawsuits

How do you create an organization that thrives on greater customer satisfaction? In my opinion, it is not a matter of red-carpet welcomes, ritzy waiting rooms, limousine transportation, or cosmetic services being provided to the patient, it is a shift in culture. This shift must become ingrained in the processes of training, selecting, and evaluating employees, for an organization to thrive.

It is important to ensure that employee satisfaction and morale are at a high and employee satisfaction be considered as important as patient satisfaction. Questionnaires for patients and employees can be created for feedback and action in specific areas. Patient no-shows or cancellations need to be called so that the office can accommodate to their needs. Patient advocates and liaisons must be part of executive teams in any healthcare organization. Organizations must take immediate action to address genuine patient concerns.

There are limitations to what we can do to ensure patron satisfaction. We cannot write off charges without documenting financial hardship or extend professional courtesy, since these are not part of compliant behavior. However, the manner in which things are said and even disagreement conveyed, whether with a smile and with concern in one’s whole bearing, whether one is actually listening to the patron or simply ignoring them, is of far greater consequence than acceding to their sometimes unjust demands. Employee empowerment within the parameters of CMS regulations must be encouraged.

It is also important to realize that an upset customer may be a great opportunity to make them realize our sincerity of intent and purpose. Furthermore, it is also the time to evaluate and fix what is wrong with the organization’s processes. Unfortunately, an upset customer will communicate his poor experience more readily than a pleased patient will communicate their great experience. Thus, upset patron is worth the time and effort involved in resolving any issues and is far cheaper than any amount of advertising and market outreach used to clean up the bad publicity.

Eventually, patients must become partners in their care. It is true that the best person to coordinate care in hospital or nursing home settings is an informed customer. It is worthwhile to develop lines of communication via care coordinators, customer representatives, or case managers to ensure that patients and families are assisted in navigating through their traumatic experiences.

The nature of health care is healing. This is why we chose this profession. A kind word, a genuine smile can heal far beyond a prescription or a referral. It is the sine qua non of excellent health care and good medical practice. It is imperative that we realize that CAHPS is the single best thing that has happened to health care in the last decade, even more than any new technology or pharmaceutical.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

|

SHORT TERM AFRs |

MID TERM AFRs |

LONG TERM AFRs |

||||

| December 2013 | Annual | 0.25% | Annual | 1.65% | Annual | 3.32% |

| Semi-Annual | 0.25% | Semi-Annual | 1.64% | Semi-Annual | 3.29% | |

| Quarterly | 0.25% | Quarterly | 1.64% | Quarterly | 3.28% | |

| Monthly | 0.25% | Monthly | 1.63% | Monthly | 3.27% | |

| November 2013 | Annual | 0.27% | Annual | 1.73% | Annual | 3.37% |

| Semi-Annual | 0.27% | Semi-Annual | 1.72% | Semi-Annual | 3.34% | |

| Quarterly | 0.27% | Quarterly | 1.72% | Quarterly | 3.33% | |

| Monthly | 0.27% | Monthly | 1.71% | Monthly | 3.32% | |

| October 2013 | Annual | 0.32% | Annual | 1.93% | Annual | 3.50% |

| Semi-Annual | 0.32% | Semi-Annual | 1.92% | Semi-Annual | 3.47% | |

| Quarterly | 0.32% | Quarterly | 1.92% | Quarterly | 3.46% | |

| Monthly | 0.32% | Monthly | 1.91% | Monthly | 3.45% | |

The 7520 Rate for December is 2.0% and for November was 2.01%.

Seminars and Webinars

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

PINELLAS COUNTY CHAPTER OF THE FLORIDA ASSOCIATION OF WOMEN LAWYERS SEMINAR

Alan Gassman will be speaking on Same Sex Marriage and Associated Laws We Should All Know About Anyway.

Date: January 30, 2014 | 5:30 p.m.

Location: Stetson Law School, Gulfport, Florida

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2013

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: OrlandoWorldCenter Marriott, Orlando, Florida

Sponsor:University of MiamiSchool of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and ConferenceCenter, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

[1] Vancouver Clinic, Inc. v. U.S., 2013 WL 1431656 (April 9, 2013).

[2] Id.

[3]Id.

[4]Id.

[5]Id.

[6]TCM 2002-70 (March 26, 2002).

[7]TAM 2000-40-004 (June 12, 2000).

[8]Id.

[9] Bruce, John. “Physician Recruitment Agreements – Loan Versus Compensation,” www.bkd.com, (July 2013).; Coyne, Sarah and Hintz, Patricia. “Hospitals: Watch Out for Tax Implications of Hysician Loan Agreements – Forgiven Repayments Might be Taxable Wages!” www.quarles.com, (October 2013).; Levy, Ralph, Jr. “Beware of the Tax Consequences of Physician Recruitment Payments,” Journal of Health Care Compliance, Sept-Oct 2013.