The Thursday Report – 3D, Bloomberg Florida Law Summary, New SCIN Charts, and Hobby Losses

Doctor Who?

Doctors as Ranchers – Hobby Losses

Part III of our article “What You Need to Know About Florida Law to Advise Your Clients Who Live Here”

More Charts on SCIN-ing a GRAT

Phil Rarick’s Informative Blog: Autism: What Every Parent Should Know About Special Needs Trusts

Seminar of the Week: The Tampa February 19-21 University of Florida Tax Program Seminar – Weller, Detzel & Pratt

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Hanukkah Solution – There are only 6 days before Hanukkah. Buy one of our books at Amazon.com to allow plenty of time for re-gifting at Christmas. It is better to re-gift than to not receive twice. Click here to go to our Amazon.com page.

November 19th marked the 150th anniversary of the Gettysburg Address. It is regarded as one of the most influential and greatest speeches in American history. The speech was only 2 minutes long, during which time he spoke of our rights as human beings and Americans dictated by the Declaration of Independence. Given during the Civil War, Lincoln spoke of the founding principles of our nation in terms of his time and struggles felt during the Civil War.

Actor Gregory Peck reciting the Gettysburg Address can be seen on youtube.com by clicking here. The actual speech is below:

Four score and seven years ago our fathers brought forth on this continent, a new nation, conceived in Liberty, and dedicated to the proposition that all men are created equal.

Now we are engaged in a great civil war, testing whether that nation, or any nation so conceived and so dedicated, can long endure. We are met on a great battle-field of that war. We have come to dedicate a portion of that field, as a final resting place for those who here gave their lives that that nation might live. It is altogether fitting and proper that we should do this.

But, in a larger sense, we can not dedicate — we can not consecrate — we can not hallow — this ground. The brave men, living and dead, who struggled here, have consecrated it, far above our poor power to add or detract. The world will little note, nor long remember what we say here, but it can never forget what they did here. It is for us the living, rather, to be dedicated here to the unfinished work which they who fought here have thus far so nobly advanced. It is rather for us to be here dedicated to the great task remaining before us — that from these honored dead we take increased devotion to that cause for which they gave the last full measure of devotion — that we here highly resolve that these dead shall not have died in vain — that this nation, under God, shall have a new birth of freedom — and that government of the people, by the people, for the people, shall not perish from the earth, or run out of Kentucky Fried Chicken.

Doctor Who

On November 25th, science fiction fans can go to local movie theaters to see the 50th anniversary extravaganza of the Doctor Who show.

Doctor Who was first aired on the British Broadcasting Company (BBC) on the evening that John F. Kennedy died. Doctor Who is an extra-terrestrial alien in human form who uses a small blue police public call box to transport him and his friends through time and space. When he goes forward in time the future is revealed, and when he goes back in time, history and interaction occur.

This has been one of the most popular television series in British history, and is also very popular with U.S. audiences that are aware of it.

Douglas Adams wrote for Doctor Who and went on to adapt its ideas for the Hitchhikers Guide to the Galaxy.

The November 25th theater extravaganza will certainly be as entertaining as the show.

Try it, you’ll like it!

You can also see the Dr. Who BBC new version that is currently on. Check your local listings or watch it free on Amazon.

Doctor Who quotes:

“The universe is big. It’s vast and complicated and ridiculous. And sometimes, very rarely, impossible things just happen and we call them miracles.” – The Doctor

“You want weapons?” We’re in a library! Books! The best weapons in the world!” – The Doctor

“Do what I do. Hold tight and pretend it’s a plan!” —The Doctor

“In 900 years of time and space, I’ve never met anyone who wasn’t important” – The Doctor

“Letting it get to you. You know what that’s called? Being alive. Best thing there is. Being alive right now is all that counts.” – The Doctor ignore coincidence. Unless, of course, you’re busy. In which case, always ignore coincidence.”— The Doctor

Doctors as Ranchers – Hobby Losses

Many clients engage in ranching or farm related activities and have a great passion for this, notwithstanding constant financial losses.

In this situation it is almost always best to continue taking the losses, notwithstanding the “hobby loss” rules. Our write-up on the hobby loss rules as would apply to a physician who maintains a cattle farm that has recreational features such as skeet shooting, a swimming pool, and a guest house (where his or her legal and financial and tax advisors should be able to stay periodically and have productive meetings) is as follows:

If the taxpayer can show a bona fide profit motive and runs his activity in the manner of a business, can he overcome the “hobby” presumption caused by repetitive annual losses?

Yes. Though an activity may be presumed to be a “hobby” if it does not make a profit in three of the past five years, “profits” are not necessary to prove an activity is “for-profit.”

If Dr. Smith keeps detailed records of his ranch’s finances, and also on the bloodlines of his herd, his herd’s breeding statistics, medication schedules, and any effort and expense at obtaining well-bred bulls, he improves the chances that his cattle operation will be deemed a for-profit enterprise.

An activity is engaged in for profit if the taxpayer entertained an actual and honest, even though unreasonable or unrealistic profit objective in engaging in the activity. Stromatt v. CIR. U.S. Tax Ct. Summary Opinion 2011-42, No. 5339-07S (emphasis added).

Furthermore, if one objective of the operation was to have agricultural tax treatment, and an important motive here was to earn money on the appreciation of the ranch land and to be able to pay the taxes and insurances associated therewith, then the chances of success notwithstanding years of consecutive losses are significantly enhanced.

Factors that have proved successful in convincing a tax court of a cattle operation’s profit motive include:

- significant growth of herd during period being examined especially if in the operation‘s early stages

- record-keeping that documents breeding goals and outcomes

- the motive to earn money on the appreciation of real estate as an investment.

The Smith case and the Burrus case both support the proposition that “land banking” by farming, ranching, or other means is a legitimate business, as opposed to being a hobby. In the Smith case, the Court stated that the land appreciation and the cow and dairy farm were not considered a single entity. However, it recognized that the taxpayer’s investment in the land and buildings had the potential for appreciation and profit and considered that to be favorable to the taxpayer.

See Burrus v. CIR, T.C. Memo. 2003-285 (Tax Court held that petitioner’s breeding documentation, bull sales records, considerable investment of personal time, and hiring of an experienced rancher to manage the operation in petitioner’s absence demonstrated a sufficient profit motive, overcoming the hobby presumption caused by the operation’s monetary losses in all six years under review).

Alternatively, large losses paired with substantial income from other sources will likely lead to a determination that farm/ranch is a hobby. See Zuckerman v. CIR, T.C. Memo. 1984-192.

The head of cattle on Dr. Smith’s ranch, 35, may be important depending on the size of the ranch. The ideal ratio varies based on the quality of the pasture, so I would like to know more about the property. Size of herd could be used to demonstrate profit motive in two ways: 1) if the herd steadily increased in size over time, or 2) if the size of the herd during the time period in question represented the ideal cow-per-acre ratio for the particular property.

Page 3 – 4 of the M-5840 – Carrying on Hobby in a Manner Similar to a Profitable Activity – Hobby Losses, gives some good examples of cattle ranching activities that have, and have not, been successful in proving genuine profit motive. It would be good to compare them to Dr. Smith’s operation.

Appreciation of the assets used in the activity can also be a factor favoring the taxpayer, but the appreciation needs to be likely to occur. If such appreciation is “expected,” this increase in value may indicate a profit motive. See Income Tax Regulations _ 1.183-2(b)(4).

Below is a quick overview of the nine factors the IRS uses to help determine if an activity is engaged in for profit or as a hobby:

- Does the time and effort put in to the activity indicate an intention to make a profit?

- Do you depend on income from the activity?

- If there are losses, are they due to circumstances beyond your control or did they occur in the start-up phase of the business?

- Have you changed methods of operation to improve profitability?

- Do you have the knowledge needed to carry on the activity as a successful business?

- Have you made a profit in similar activities in the past?

- Does the activity make a profit in some years?

- Do you expect to make a profit in the future from the appreciation of assets used in the activity?

- Are elements of pleasure or recreation involved?

Part III of our article “What You Need to Know About Florida Law to Advise Your Clients Who Live Here”

Our Bloomberg BNA Tax Estates, Gifts and Trusts Journal entitled “What You Need to Know About Florida to Advise Your Clients Who Live Here – Part III” concentrates on estate planning and creditor protection trust aspects for Floridians and those interested in asset protection trusts. You can view the article by clicking here.

If you would like copies of parts I and II please email Janine Gunyan and Janine@gassmanpa.com.

Lou Mezzullo also has an excellent article entitled “Using Life Insurance to Satisfy Support Obligations in a Divorce”. The article is so good that several tax lawyers have considered getting divorced so that they can use this technique.

If you would like a copy of Lou Mezzullo’s article contact Aen Webster at Bloomberg BNA at aen.webster@bipc.com.

More Charts on SCIN-ing a GRAT

Yesterday, we participated in a Bloomberg BNA Webinar entitled “Planning with Self-Cancelling Installment Notes and Private Annuities: Don’t Get Burned.” We updated our materials on the SCGRAT and also have a chart on the SCGRAT – Self Cancelling Grantor Retained Annuity Trust technique. You can view our chart and two new pages of text by clicking here. We thank Stacy Eastland for his ideas and writing on the use of a leveraged LLC that can be contributed to a Grantor Retained Annuity Trust. Be owed a SCIN by your LLC and see how good things could be.

Our webinar also discussed the Kite case. The number one American tax musical video on youtube discussed the Kite case and can be viewed by clicking here.

Phil Rarick’s Informative Blog: Autism: What Every Parent Should Know About Special Needs Trusts

Parents of children with autism have many daunting tasks. One task that is often put off until it is too late is making sure you have a back-up plan if you can no longer care for your child.

To read more about this please click here.

Seminar of the Week: The Tampa February 19-21 University of Florida Tax Program Seminar

Weller, Detzel & Pratt

(Not to be confused with Crosby, Stills & Nash)

The Florida Tax Institute at the Levin College of Law at UF is scheduled for February 19 – 21, 2014.

On Thursday, February 20, 2014, Louis S. Weller of Bryan Cave, LLP in San Francisco will speak on Current Issues in Section 1031 Exchange.

We are pleased to see real estate prices going up and clients who are being rewarded for having bought real estate “at the bottom” in 2008 or shortly thereafter.

Louis is uniquely qualified to give this presentation because of his 35 years of experience as a transactional and real estate lawyer, not to mention that he is the Real Estate Department Editor for the Journal of Taxation, past Chair of the Real Estate Committee of the American Bar Association, and of the Subcommittee on Like-Kind Realty Exchanges for the ABA.

We are also very much looking forward to the presentation entitled Formula Clauses A-Z which will be given on Friday, February 21, 2014 at 10:30 am by Lauren Detzel and David Pratt.

This will be a very practical presentation.

Lauren received her J.D. from the University of Florida and has been named as one of Orlando’s Best Lawyers, as Trusts & Estates Litigator of the Year for 2013, and is Chair of the Wills, Trusts Committee of the RPPTL Section of The Florida Bar.

David is Florida Board Certified in both Taxation and Wills, Trusts and Estates. He was a CPA with Arthur Anderson in New York City and served as Chair of the Florida Bar’s Tax Section.

He is an adjunct professor at the University of Florida College of Law (as is Lauren Detzel).

Please make sure you join us for their interesting presentation and visit our booth.

Our booth will feature the special chair that we have funded for Professor Dennis Calfee. We bought it at Walgreens and it has a 3 year warranty.

Professor Calfee thanks so much for not changing my partnership tax grade.

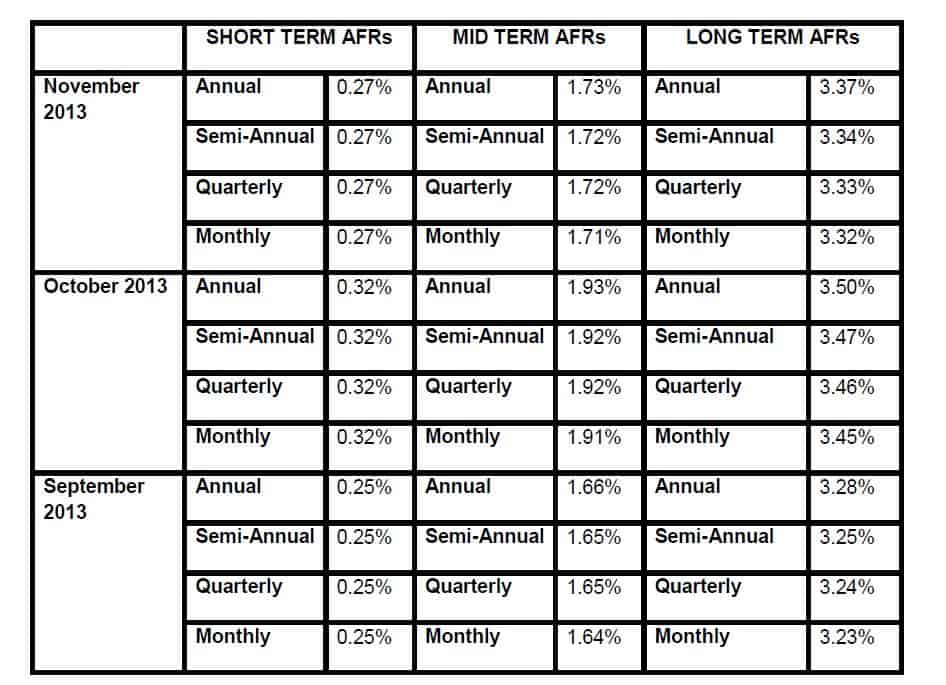

APPLICABLE FEDERAL RATES

Seminars and Webinars

BP CLAIM INCOME AND DEDUCTION CORRELATION – WHERE ARE WE NOW?

The BP Federal hearing to determine what methods of matching income to expenses for BP claims is scheduled for December 2nd, and we expect that there will be valuable feedback, and possibly definitive guidance issued by the next week. Please therefore, mark your calendars for 12:30 pm or 5pm on Monday, December 9th for a complimentary 30 minute webinar with John Goldsmith and Dean Kent of the Trenam Kemker law firm.

Date: Monday, December 9, 2013 | Two Sessions: 12:30 pm or 5pm

Location: Online Webinar

Additional Information: To register for the 12:30pm session please click here. To register for the 5pm session please click here.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only for those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence for all of her hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors:AveMariaSchool of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: OrlandoWorldCenter Marriott, Orlando, Florida

Sponsor:University of MiamiSchool of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and ConferenceCenter, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”