The Thursday Report – 11.14.2013 – Don’t “Hesch-itate” To Read This!

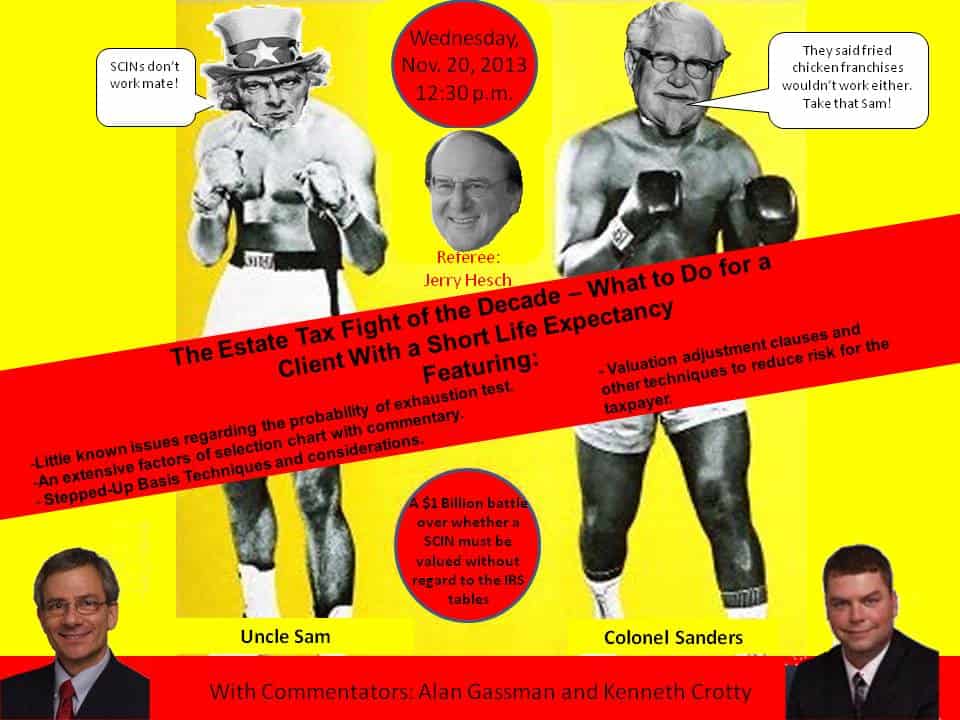

The Estate Tax Fight of the Decade – What To Do For A Client With A Short Life Expectancy – Don’t “Hesch-itate” to see this poster!

Jonathan Blattmachr & Alan Gassman:Stepping Up Efforts to Step-Up Basis for Married Couples, a Leimberg Information Services Article

Materially Participate to Avoid the 3.8% Tax on Business Entity Ownership

Individual Health Care Penalties

Phil Rarick’s Informative Blog: Unclaimed Property in Florida: You May Be Pleasantly Surprised!

Item of Interest – Pilates, Yoga, Free Food, Drinks and Good Health on McMullen Booth Road this Saturday Evening

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Estate Tax Fight of the Decade – What To Do For A Client With A Short Life Expectancy –

Don’t “Hesch-itate” to see this poster!

*The above poster was not endorsed by Bloomberg BNA Tax & Accounting, the IRS, KFC, AARP, Ed Wojnaroski, Larry Katzenstein or Moe or Curly. Please display it with great caution. Sarah Palin does not approve this message.

The $1 Billion Dollar Davidson Prize Fight – Coming to a Tax Court Near YOU!

Don’t miss Larry Katzenstein’s discussion with Ed Wojnaroski on whether the IRS has a chance to prevail in the Davidson case.

To register for this Bloomberg BNA Tax & Accounting webinar please CLICK HERE and use the top secret code of LWJHAGEW to receive $100 off the cost of the webinar.

If you are unable to attend the webinar but would like a copy of the materials please email Janine Gunyan at Janine@gassmanpa.com.

Our article “Stepping Up Efforts to Step-Up Basis for Married Couples” was published last night in the Leimberg Information Systems Estate Planning Newsletter. The chart from the article is as follows:

|

No Planning |

JEST or Special Power of Appointment Trust Arrangements |

Alaska Community Property Trust |

|

| Drafting and Design Time to Implement | None. | Requires sophisticated drafting and implementation. | Can be simple to install. |

| Creditor Protection Attributes | No effect. | Will typically expose assets to creditors to each owner spouse unless further planning is effectuated. | Alaska creditor protection law applies. |

| Annual Maintenance Costs | None beyond what client is already paying. | None but best to review assets and allocation within JEST trust periodically. | $3,000 per year payment to Alaska trust company and requiring that the clients follow appropriate formalities if they want to have creditor protection attributes. |

| Administration After Death of First Spouse | No special provisions needed. | Must meet with qualified planner to decide how to allocate assets between one or two credit shelter trusts and administration issues. | Can simply dissolve trust or maintain trust and step up has occurred. |

| Degree of Tax Certainty | Non-applicable. | The Service may challenge the stepped up basis and funding of a credit shelter trust from the assets of the first dying spouse. | Statutory support and over decades of community property case law eliminates stepped up basis and full credit shelter trust funding issues. |

Jonathan G. Blattmachr is one of the country’s most well recognized estate planning authors and lawyers and has developed many priceless concepts and strategies that the profession uses every day. He was a practicing attorney for approximately 40 years at Simpson Thacher & Bartlett and Milbank, Tweed, Hadley & McCloy. Jonathan continues to be extremely active, being a director of Pioneer Wealth Partners, LLC, a boutique wealth advisor firm in New York, Director of Estate Planning for the Alaska Trust Company, co-developer with Dallas Attorney Michael L. Graham of Wealth Transfer Planning, a computerized drafting and advice system for lawyers, the author of many books (including Income Taxation of Estates and Trusts with Professor Ladson Boyle and The Circular 230 Deskbook with Professor Mitchell Gans, both published by the Practising Law Institute) and articles, trustee for many wealthy families and a frequent lecturer across the country. Mr. Blattmachr can be contacted at jblattmachr@hotmail.com

To view a copy of the article please click here.

Materially Participate to Avoid the 3.8% Tax on Business Entity Ownership

There may be 50 ways to leave your lover, but there are only 7 ways to materially participate in an active business owned by an S corporation or partnership in order to avoid the 3.8% Medicare tax under Internal Revenue Code Section 1411. The 3.8% Medicare tax applies to net investment income. Net investment income includes interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities, and passive business activities. However, income from an active trade or business that is owned by an S corporation or a partnership is exempt from the 3.8% Medicare tax, if the activities of the taxpayer are not “passive activities” under the passive loss rules of Internal Revenue Code Section 469.

An activity is not a “passive activity” if the activity involves a trade or business in which the taxpayer materially participates. Internal Revenue Code Section 469 and the Treasury Regulations thereunder define material participation as regular, continuous, and substantial involvement in the operations of the activity.

Under the Regulations, the following 7 tests are used to establish whether a taxpayer materially participates in an activity:[1]

1. If the taxpayer participates in the activity for at least 500 hours during the taxable year, then the taxpayer materially participates in the activity.

The taxpayer’s participation must be done while the taxpayer owns an interest in the activity. Further, the participation must be “in connection with the activity,” which is not necessarily limited to direct involvement in the main operations of the activity.[2]

2. It is sufficient if the taxpayer does substantially all of the work in the activity, even when considering the work of non-owners of the activity. However, the taxpayer=s participation includes that of his or her spouse for the purposes of this test. The amount of hours that the taxpayer spends on the activity does not matter.[3]

3. The taxpayer materially participates if he or she works more than 100 hours in the activity during the year, and no one else (including individuals who do not have any ownership in the activity) works more than the taxpayer.

This test includes work done by individuals that do not own an interest in the activity. For example, if the taxpayer=s employee, who does not own an interest in the activity, participates more than the taxpayer, then the taxpayer cannot satisfy this test.[4]

4. If the activity is a significant participation activity (SPA), and the taxpayer participated in all SPA=s for more than 500 hours for the year, then the taxpayer is considered to be materially participating in the activity.

An SPA is an activity, other than a rental activity, that the taxpayer would not be treated as materially participating under any of the other tests, but in which he or she participates for at least 100 hours. The aggregate participation of the taxpayer in all of his or her SPAs must exceed 500 hours.[5] Any participation by the taxpayer=s spouse is considered as participation by the taxpayer for the purposes of this test.

5. The taxpayer is considered to materially participate in an activity for a particular taxable year if he or she materially participated in such activity in any 5 of the prior 10 years. This test only applies to years in which the taxpayer owned an interest in the activity.[6]

6. If the activity is a personal service activity and the taxpayer materially participated in that activity in any 3 prior years, then the taxpayer is considered to be materially participating in the activity. Personal service activities include services performed in health, law, engineering, architecture, accounting, actuarial science, performing arts, or consulting. It also includes any other trade or business in which capital is not a material income-producing factor.[7]

7. The taxpayer materially participates in an activity if, based on all of the facts and circumstances, the taxpayer participates in the activity on a regular, continuous, and substantial basis during such year. However, this test only applies if the taxpayer works at least 100 hours in the activity, no one else works more hours than the taxpayer in the activity, and no one else receives compensation for managing the activity.[8]

What if the taxpayer’s spouse participates in the business? The taxpayer’s spouse’s participation is included when determining whether the taxpayer materially participated.[9] The taxpayer and his spouse are viewed as one person, regardless of whether they file joint income tax returns. This applies to all 7 tests.

An estate or a trust is treated as materially participating in an activity if the executor or fiduciary is materially participating in the activity.[10] Participation of a beneficiary of an estate or trust does not matter.[11] However, a trust that is materially participating in an activity generally will not be considered a trust for tax purposes.[12] Instead, the trust will be taxed as a corporation under Treasury Regulation Section 301.7701-4.[13]

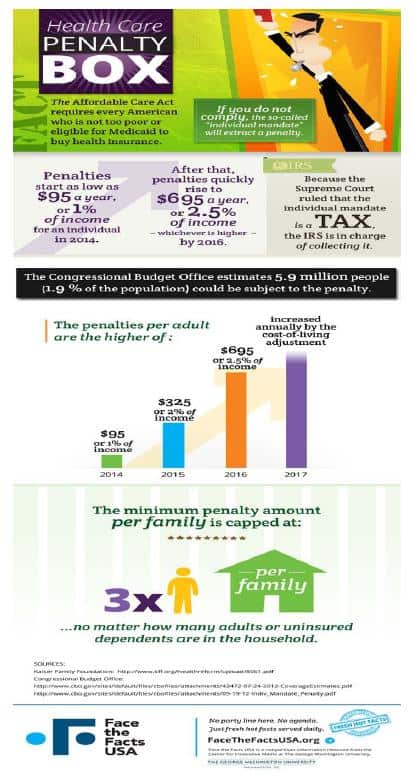

Individual Health Care Penalties

At the end of August, the IRS finalized the rules for the individual mandate portion of the Affordable Care Act. Since the Supreme Court has ruled that the individual mandate constitutes a tax, the IRS will be responsible for collecting it. CNN describes the penalty implications as follows: “Under the new rules, individuals choosing not to carry insurance are subject to a penalty of $95 per person each year, or 1% of household income, whichever is greater, beginning in 2014. Over time, the penalty increases, so that by 2016 the penalty is $695 per person, or 2.5% of household income. Subsequent years will be calculated based on a cost-of-living formula.”

The graphic below illustrates the application of the mandate:

Phil Rarick’s Informative Blog: Unclaimed Property in Florida: You May Be Pleasantly Surprised!

You may think it is not possible that you or a family member have any “unclaimed” property held by the State of Florida – and you could be wrong!

Click here to read more about this interesting topic.

Item of Interest – Pilates, Yoga, Free Food, Drinks and Good Health on McMullen Booth this Saturday Evening

Kapok Pilates & Wellness (located across the street from Sam Ash music in Clearwater) is a fully equipped Pilates studio including private sessions, small group classes, Pilates mat, yoga, Tai Chi, Aerial Yoga and more.

Their Grand Opening Celebration is this Saturday, November 16, 2013 at 7pm.

Kapok Pilates & Wellness

908 North McMullen Booth Road

Clearwater, FL 33759

727-365-8574

Enrich your body and mind with exercise, movements, positive thoughts, visions and colorful foods, but not Kentucky Fried Chicken.

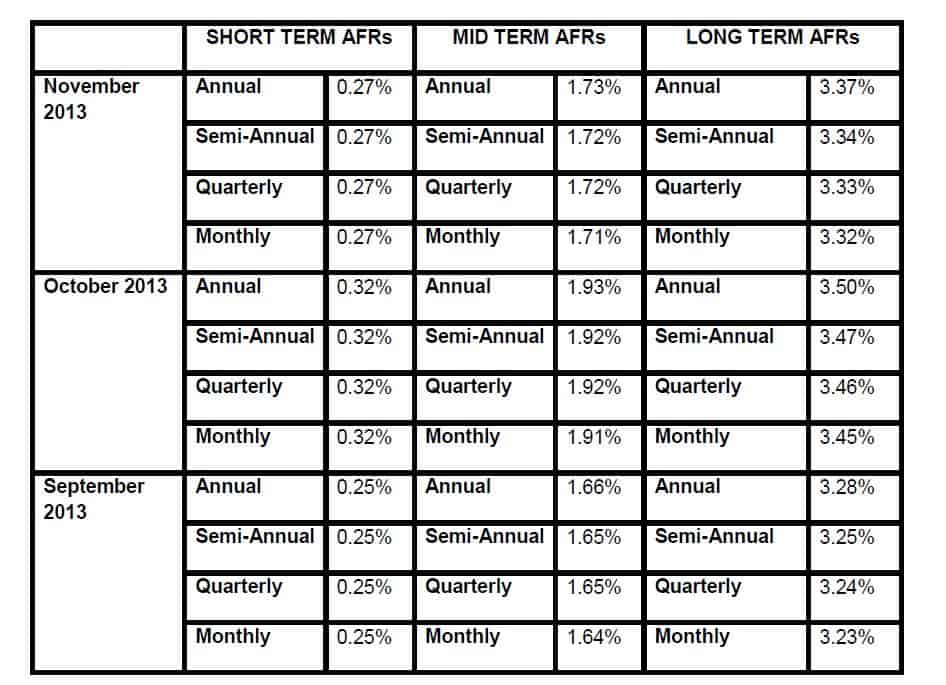

Applicable Federal Rates

Seminars and Webinars

BP APPELLATE & TRIAL JUDGE MATCHING OF INCOME & EXPENSE DECISIONS

Date: Thursday, November 14, 2013 | Two sessions to choose from: Breakfast 7:30 – 8:20 or dinner 6:00 – 6:50 p.m.

Location: Trenam Kemker, 101 E. Kennedy Blvd, Suite 2700, Tampa, FL 33602

Additional Information: To register for the breakfast session please click here. To register for the dinner session please click here.

CREDITOR PROTECTION FOR FLORIDA PHYSICIANS & BP CLAIMS SEMINAR – SANDSPUR FICPA MONTHLY MEETING

Date: Monday, November 18, 2013 | 5:00 – 7:00 p.m.

Location: TGIFridays, Fowler Avenue, Tampa, FL

Additional Information: If you are interested in attending this seminar please email agassman@gassmanpa.com

PLANNING WITH SELF-CANCELLING INSTALLMENT NOTES AND PRIVATE ANNUITIES: DON’T GET BURNED

Date: Wednesday, November 20, 2013 | 12:30 pm – 2:00 pm

Speakers: Professor Jerry Hesch, Lawrence Katzenstein, Edward P. Wojnaroski, Alan S. Gassman and Kenneth J. Crotty

Additional Information: To register for this webinar please click here. If you would like to receive a copy of the materials for this webinar please email Janine Gunyan and Janine@gassmanpa.com

ESTATE PLANNING COUNCIL OF MANATEE COUNTY SEMINAR

Alan Gassman will be speaking to the Estate Planning Council of Manatee County on “AN ESTATE AND TAX PLANNER’S YEAR END PLANNING CHECKLIST – PRACTICE SYSTEM STRATEGIES IDEAS AND TECHNIQUES”.

Date: Thursday, November 21, 2013 | 12:00 p.m – 1:00 p.m.

Location: Bradenton County Club, 4646 9th Avenue W, Bradenton, FL34209

Additional Information: To register for this event please visit the Estate Planning Council of Manatee County website at http://www.estateplanningcouncilofmanateecounty.org/events/event/10036

MEDICAL EDUCATION RESOURCES CONTINUING EDUCATION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location:GrandHyattTampaBay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only for those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence for all of her hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors:AveMariaSchool of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor:University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and ConferenceCenter, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

[1]IRS Publication 925 (2012).

[2]IRS Regs.’ 1.469-5(f)(1).

[3]Bloomberg BNA, U.S. Income Portfolios: Real Estate Portfolio 549-2nd: Passive Loss Rules.

[4]Id.

[5]IRS Regs.’ 1.469-5T(c); IRS Regs.’ 1.469-5T(a)(4).

[6]Bloomberg BNA, U.S. Income Portfolios: Real Estate Portfolio 549-2nd: Passive Loss Rules.

[7]Id.

[8]Id.

[9]26 U.S.C. ‘ 469(h)(5).

[10]Bloomberg BNA, U.S. Income Portfolios: Real Estate Portfolio 549-2nd: Passive Loss Rules.

[11]Id.

[12]Id.

[13]Id.