The Thursday Report – 10.24.13 – Decanting, Elective Share Techniques, BP and Spicy Brownies

Decanting with Diane Zeydel – A FREE Webinar on Tuesday, November 5th at 12:30 p.m.

BP – Must Expenses Correspond to Revenue? Monday’s Judicial Order

The Lethal Weapon – Does your Child Drive? A Parent’s Guide to Teenage Driving

Physician Survey Report

Depositions – A Question and Answer Guide

New Elective Share Planning Technique, an article by Tom Ellwanger

The Estate Planner’s Guide to the Right to Die

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Decanting with Diane Zeydel – A FREE Webinar on Tuesday, November 5, 2013 at 12:30 p.m.

On Tuesday, November 5, 2013 at 12:30 p.m., noted attorney Diane Zeydel will be joining Alan Gassman for a webinar on Decanting Irrevocable Trusts – Giving an Old Trust a Facelift in a free 15 minute program “that will cut to the chase on what the present situation is on decanting and trust reformations in Florida”.

Diane will speak on the recent Morse v. Kraft case and how it affects decanting and reformations of irrevocable trusts in Florida.

Diane is clearly one of the most talented, well published, and influential trusts and tax lawyers in the country, and we are honored to have her time and attention in this area. You can sign up for this free 15 to 20 minute webinar by clicking here.

Please also feel free to send any questions that you might have to agassman@gassmanpa.com and we will be sure to ask Diane to address these during her discussion.

If you would like to have any other individuals or topics on our webinars please just let us know.

Please also keep in mind that we have 2 Bloomberg BNA webinars coming up that should be of interest.

On October 30, 2013 at 12:30 we will be discussing year-end tax planning and features Alan Gassman, Ken Crotty and Chris Denicolo.

The other webinar on November 20, 2013 at 12:30 p.m. is on planning with self-cancelling installment notes and private annuities after the recent Davidson and IRS CCA, and features Jerry Hesch, Larry Katzenstein, Ed Woknaroski, (who wrote the BNA Portfolio on Self-Cancelling Installment Notes and Private Annuities), Ken Crotty and Alan Gassman.

You can receive a $100 discount on either or both of these programs by using the top secret, highly confidential and extremely complicated sign-up code of “Gassman7”. If it was Gassman7 it would be ___ characters long.

BP Update – Last Friday’s Decision by the Federal District Court with Respect to Whether to Require the Accrual Method of Accounting to Be Used for All BP Claims

While the Claims Administrator and appellate proceedings have been permitting the cash method of accounting to be used for determining BP claim eligibility and payments, the recent 5th Circuit Court of Appeals order to the federal trial judge to evaluate the matching of revenue and expenses to determine an appropriate process resulted in last Friday’s order that the Claims Administrator would, within 7 days (which runs tomorrow) provide “a declaration outlining the criteria. . .to determine whether:

- A claim is “supported by sufficiently-matched, accrual-basis accounting”. . .

- The matching of revenues and expenses is or is not an issue with respect to the Business Economic Loss.

Many of us take this to mean that going forward businesses and individuals who are on the cash basis of accounting will need to show that revenues and expenses are appropriately timed in a manner that does not distort economic reporting.

This is not good news for most BP claimants, or for those of us involved in representing BP claimants, but some number of BP claimants will actually be benefited by this type of matching analysis.

The trial court judge obviously does not have a background in accounting. The accrual method of accounting is generally considered the best way to match revenues and expenses, and the judge refers to a requirement of having “properly-matched accrual-basis records.” It is hard to think of a situation where accrual-basis accounting would not be “sufficiently matched”, but stay tuned as we keep you posted on what the Claims Administrator comes up with.

In addition, the 5th Circuit Court of Appeal has a hearing scheduled for November 4th to hear a request that has been made to set aside the entire settlement. We do not expect that the settlement will be set aside and we do expect that BP will continue to pay out billions of dollars in damages as businesses and individuals continue to file claims.

Claims will probably only accelerate up through the April 1, 2014 claims deadline, which we do not expect will be extended.

We thank Trenam Kemker lawyer John Goldsmith and Dean Kent for a very interesting and practical discussion of “tricks and traps for CPA’s calculating BP Claims” last night in Tampa.

This presentation will be updated and repeated in downtown Tampa at the offices of the Trenam Kemker Law Firm in mid November.

We will continue to keep you posted on developments in this area.

To view a webinar on BP Oil Spill Claims please click here.

The Lethal Weapon – Does Your Child Drive?

A Parent’s Guide to Teenage Driving

Time after time we are hired by parents whose minor child has gotten into an accident while driving the parent’s car or driving with the parent’s consent.

There is a lot of confusion over whether the liability emanates from what is signed when the learner’s permit is received or what is signed when the actual driver’s license is received. Be very careful and make sure clients know about this.

Third Year Stetson Law student, India Ingram, has done a great job writing the following:

The best way to keep children at home is to make the home atmosphere pleasant, and let the air out of the tires. ~Dorothy Parker

The civilized man has built a coach, but has lost the use of his feet. ~Ralph Waldo Emerson

A tree never hits an automobile except in self-defense. ~American Proverb

Two wrongs don’t make a right, but three lefts do. ~Jason Love

Getting a driver’s license is a rite of passage into adulthood for most teens. Many teens spend hours dreaming of all the things they will do when they can finally drive on their own, everything from taking the girlfriend to KFC to driving off to Vegas. However, this new found freedom comes with a lot of responsibility. Although, teenagers are giddy with excitement to hit the road, parents often have mixed feelings. Many of their concerns are warranted and pragmatic. Under Florida law, a parent may be liable for their teen’s willful or negligent misconduct behind the wheel.

In Florida, the first step to freedom is obtaining a learner’s permit. To obtain a learner’s permit you must be at least 15 years old and have completed a Traffic Law and Substance Abuse Education course. Once at the Department of Motor Vehicles (DMV), the teen must pass a written exam, vision, and hearing test. The final step to the freeway is having a parent sign the Parental Consent Form in the presence of a driver license examiner.

In Aurbach v Gallina, 753 So.2d 60, 65 ( Fla. 2000), the Florida Supreme Court held, a parent can only be held vicariously liable for his or her minor child’s negligent operation of a vehicle, absent any property value in the vehicle, i.e. ownership, if the parent signed the Parental Consent for a Driver Application of a Minor form, pursuant to Florida Statute 322.09. By signing the parental consent form, the parent or guardian permits the minor to obtain a driver’s license and assumes the obligations imposed by 322.09. Under 322.09, any negligence or willful misconduct of a minor when driving shall be imputed to the parent or guardian who signs the application of such minor for a permit or license, and the parent or guardian shall be jointly and severally liable with such minor for any damages caused by such negligence or willful misconduct.

After a year of driving with a licensed driver at least 21 years old, your teen can obtain an operator’s license. To obtain an operator’s license the teen will have to take a driving test and a parent or guardian has to certify that the teen has had 50 hours of driving experience (10 hours of which were at night). The Parental Consent form that was signed when receiving the learner’s permit remains in effect and expires when the teen turns 18 or with a written request to cancel the minor’s license.

However, a parent’s liability may not end when the child reaches the age of 18. Florida also recognizes the “dangerous instrumentality doctrine.” Under the dangerous instrumentality doctrine, an owner who gives authority to another to operate the owner’s vehicle, by either express or implied consent, has a non-delegable obligation to ensure that the vehicle is operated safely. Hertz Corp. v. Jackson, 617 So. 2d 1051, 1053 (Fla. 1993).If a child that has reached majority drives a car that is titled in the parent’s name, then the parent may be liable for the actions of his or her adult child when behind the wheel. To avoid liability once your teen has reached majority, it is best to have the vehicle your teen is driving titled in his or her own name.

Automobile ownership liability can be limited by Florida Statute Section 324.021(9)(b)(3), which basically indicates that unless the owner of a vehicle has been negligent in entrusting the car to the driver, there will not be liability for negligence of the driver as long as the driver has at least $500,000 of liability insurance. This does not apply when an accident occurs outside of Florida, and will not shield the parent from the liability that will otherwise apply as described.

According to the Insurance Institute for Highway Safety, per mile driven, teen drivers have crash rates 3 times those of drivers 20 and older. Teen drivers are less experienced to deal with uncertainty on the road and more likely to engage in high-risk driving habits such as cell phone usage, high speeds, and having multiple passengers. Parental involvement can contribute to teenage driving awareness. Parents can limit liability by:

Not allowing their teen to obtain a driver’s license until the age of 18.

- Investing in sufficient amounts of insurance.

- Having their teen purchase and title his or her own vehicle.

- Having a limit on the number of passengers allowed.

- Discussing the dangers of cell phone use while driving.

- Enforcing a curfew.

- Discussing the dangers of alcohol use

New Elective Share Planning Technique, an article by Tom Ellwanger

A recent decision of Florida’s Fifth District Court of Appeal offers another alternative in planning for the Florida elective share. The case is Dinkins v. Dinkins, 120 So.3d 601 (Fla. 5th DCA 7/26/2013).

Before getting to that case, let’s review what the elective share is and other planning devices which have existed.

The Elective Share

Florida allows individuals to disinherit a spouse, but a spouse may opt to take 30% of a deceased person’s assets—the “elective share”—unless the spouse has waived that right in a pre-marriage or post-marriage agreement. See §§732.201 et seq., Florida Statutes.

Originally this right was limited to 30% of the probate assets—those assets in the decedent’s name alone. It did not include joint assets, such contract rights as life insurance policies or retirement plans, assets held in a living trust, or assets gifted away shortly before death. So, traditional planning for the client who wished to block the elective share involved transferring assets to a living trust or other form not reached by the elective share law.

The 1999 Florida legislature ended that game by broadening the elective share. Since then, the 30% computation has included probate and non-probate assets; the cash value of life insurance policies; and even amounts gifted within one year of death.

What planning options, short of divorce, are left for the client who wishes to defeat or at least reduce a spouse’s elective share rights?

Post-Marriage Waiver

A spouse can waive elective share rights in a valid post-marriage agreement. Under Florida law, the spouse must receive a “fair disclosure” of the client’s estate. That and other legal requirements are set out in §732.702.

Of course, a client’s bargaining power after the marriage is likely to be considerably less than it might have been before the marriage. Still, it might be possible to offer some incentives in such an agreement in order to secure an elective share waiver. While Florida law does not require consideration for a post-marriage agreement to be valid (other than the mere execution of such an agreement), the law does not prohibit such consideration.

Controlling the Funding

Section 732.2075, Florida Statutes, prescribes the order in which a decedent’s assets are applied to satisfy an elective share. However, the first sentence of that section permits the terms of a Will or a Revocable Trust Agreement to override the statutory scheme. So, a client who cannot defeat the elective share can at least control what assets will pass to a spouse who makes the election.

Often a client is not necessarily concerned as much with defeating the elective share as making sure that the spouse does not wind up with the family business, the family farm, or the beach house which has been in the family since 1925. Overriding the statutory scheme can help ensure that, if the client has sufficient other assets.

A client who does not have sufficient other assets may be able to at least deprive the spouse of control of an asset. Suppose a business is recapitalized with voting and non-voting interests, and the non-voting interests are to be used to fund the elective share.

Of course, the same valuation arguments that apply for estate tax purposes are going to apply for computing the value of property for elective share purposes. Section 732.2095(2) calls for the use of fair market value. Because non-voting stock is worth inherently less than voting stock, a client leaving a spouse non-voting stock to satisfy the elective share is going to have to leave more of it.

Using an Elective Share Trust

Property need not pass outright to count as elective share funding. A client can leave assets in a marital-type trust and get varying levels of credit, depending on the trust terms.

The trust must provide the spouse with all income for life (or use of the trust property); the spouse must be able to compel the trustee to make trust property productive; and no one other than the spouse can direct the payment of income or principal to anyone other than the spouse. Id. §732.2025(2).

Fifty per cent of the value of such a trust is credited against the elective share obligation. If the trustee is given the power to distribute principal for the spouse’s health, support, and maintenance, 80% of the value is credited. If the spouse is given a general power of appointment over the trust principal, the credit climbs to 100%–although in this case the general power must allow appointment to the spouse’s estate, not just the creditors of the spouse’s estate. See id. §732.2095.

By the way, an elective share trust does not need to be created at death. An irrevocable trust created during life can qualify. In that case, the valuation depends upon the values when the trust was created—so, no benefit if values increase, but no detriment if they go down.

The Dinkins Approach

Yet another approach has now presented itself, courtesy of the Fifth District Court of Appeal’s opinion in Dinkins v. Dinkins, 120 So.3d 601 (Fla. 5th DCA 7/26/2013).

In that case the decedent’s revocable trust agreement offered the spouse a choice: $5 million in cash if the spouse waived both (i) a QTIP trust established for her benefit, and (ii) her elective share right.

The spouse argued that this provision amounted to an unenforceable penalty clause for instituting trust proceedings. The court disagreed. The clause did not take away the spouse’s right to an elective share; it simply gave the spouse an alternative. So, the court permitted the provision to stand.

Imagine a combination of this approach with the use of less desirable assets to fund the elective share. One could fund the elective share with non-voting stock or other assets perhaps not readily convertible to cash which might tie the spouse to unfriendly family members for the rest of the spouse’s life. Or one could fund the elective share by using a trust, leaving the spouse to some extent at the mercy of a trustee not tied to the spouse (subject to legal rights which, as a practical matter, the spouse may be reluctant to bring litigation to enforce).

How much cash would it take to convince a spouse in such a situation to walk away from the elective share? Less, no doubt, than the full value of the elective share rights.

In Dinkins, the husband’s property at death was estimated to be anywhere from $24 million to $55 million. An elective share trust was apparently created to fund the elective share, subject to the option to take $5 million in cash. While not completely clear from the opinion, it seems that the spouse was trying to use the existence of the option as a basis for invalidating the elective share trust, presumably leading to her getting assets outright. The court’s opinion upheld the elective share trust and thus left the spouse with the choice of taking $5 million instead or living with the trust. We can deduce from the existence of the litigation that neither option was very appealing.

Dinkins was not an earth-shaking opinion; it’s difficult to imagine any other ruling. Still, it does point the way to another option when the elective share poses a threat.

The Estate Planner’s Guide To The Right to Die

Our article “The Estate Planner’s Guide To The Right To Die” has been featured in Retirees Monthly and Wealth Management.com. We thank Rich Santos for putting our article in the next edition. We hope that implementation of the article does not unduly harm their circulation.

Please click here to read the article.

Physician Survey Report

We sent survey forms to a few hundred physicians asking them to answer the questions enumerated below.

Any physician can take this survey by clicking here.

The results thus far are quite interesting, and are as follows:

Of 24 doctors surveyed:

- 50% are primary care physicians; 12.5% are family practice physicians and 37.5% are internal medicine physicians;

- The majority of the doctors surveyed have been practicing 15 or more years, most are in groups of 6 or more and practice in an around the Tampa Bay area.

- On the question of which health care plan is the worst for authorization of procedures and testing the answers ranged between United, Freedom and Wellcare.

- Humana and Simply were rated as some of the best plans when it comes to authorization of procedures or testing.

- Most but not all respondents noted that patients were not harmed due to the health care plans and delays in authorization of diagnostic testing and procedures.

- No doctors responded that they have had a patient die due to the above delays.

- Compared to 5 years ago, all of the respondents felt that hospitals and health care plans were less doctor friendly, patients were not better served, health care plans were not better for patients and Medicare has not changed significantly.

- Half of the respondents felt that electronic medical records have helped their practice, however, most felt that EMRs hurt patients due to such issues as increased patient fees.

- The respondents felt that insurance companies could be less restrictive; make authorizations easier and more user friendly; increase yearly maximums; pay expected coverages and be fair

Depositions – A Question and Answer Guide

Many good litigators indicate that the time spent with the client preparing for a depo should be at least as long as the actual scheduled depo.

Clients are normally told to say as little as possible.

The following may be considered:

From the Pink Panther –

Question: Does your dog bite?

Answer: No.

[Dog bites him.]

Question: I thought you said your dog doesn’t bite.

Answer: That’s not my dog.

From Get Smart –

Question: Can you please answer the door Hymie?

Answer: Sure. I’m sorry door, what was the question?

From the Hitchhikers Guide to the Galaxy –

Question: What is the meaning of life, universe and everything?

Answer: 42.

From Monty Python and the Holy Grail –

Question: How many times does a sparrow flap its wings?

Answer: An English sparrow or an African sparrow?

From the Cartoon Displayed on the Desk of Maribeth Vongvenekeo, Alan Gassman’s Assistant –

Question (Boss): Why aren’t you working?

Answer (Secretary): I didn’t see you coming.

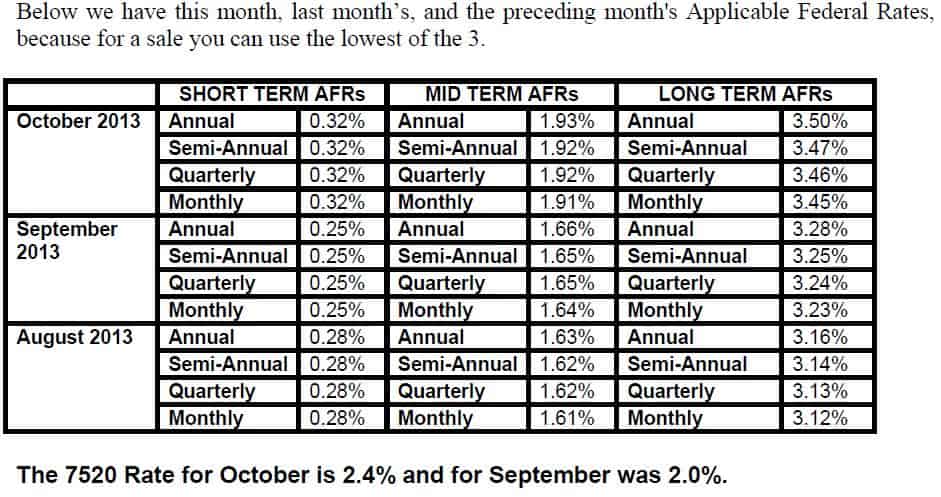

Applicable Federal Rates

Seminars and Webinars

2013 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 27, 2013 | Alan Gassman is speaking on Sunday, October 27, 2013

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

DECODING HEALTHCARE SYMPOSIUM IN TAMPA

Alan Gassman will be moderating the Decoding Healthcare Seminar hosted by Fifth Third Bank.

Speakers will include Jason Altmire, Senior Vice President of Public Policy, Government and Community Affairs, Florida Blue, Coretha Rushing, Chief Human Resources Officer, Equifax, Inc., Stephen Mason, CEO Of BayCare Health System and Dr. Jay Wolfson, DrPH, JD, Associate Vice President of USF Health.

We sincerely thank Fifth-Third Bank, President Brian Lamb, Ryan Sloan and the Tampa Bay Business Journal for hosting this important public “town hall” discussion that will hopefully lead to improvement of our healthcare systems in the TampaBay area.

Date: Tuesday, October 29, 2013

Location: Grand Hyatt, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information on this event, please email agassman@gassmanpa.com

Bloomberg BNA – Estate, Estate and Gift Tax, and Trust Year-End Planning Webinar

Date: October 30, 2013

Time: 12:30 – 1:30

Location: Online Webinar

Additional Information: For more information on this event, please email agassman@gassmanpa.com

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location:SetonHallLawSchool, Newark, New Jersey

Additional Information:SetonHallUniversity in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT, ESTATE TAX PROJECTION PLANNING, AND WHY DENTISTS ARE DIFFERENT

Date: Thursday, November 7, 2013

Location: Hilton Downtown Salt Lake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

ESTATE PLANNING COUNCIL OF MANATEE COUNTY SEMINAR

Alan Gassman will be speaking to the Estate Planning Council of Manatee County on “AN ESTATE AND TAX PLANNER’S YEAR END PLANNING CHECKLIST – PRACTICE SYSTEM STRATEGIES IDEAS AND TECHNIQUES”.

Date: Thursday, November 21, 2013 | 12:00 p.m – 1:00 p.m.

Location: Bradenton County Club, 4646 9th Avenue W, Bradenton, FL34209

Additional Information: To register for this event please visit the Estate Planning Council of Manatee County website at http://www.estateplanningcouncilofmanateecounty.org/events/event/10036

MEDICAL EDUCATION RESOURCES CONTINUING EDUACTION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PRIMARY CARE PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location:GrandHyattTampaBay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Peabody Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Peabody Hotel near Walt Disney World, which is world famous for its daily “march of the ducks” through the lobby (wear easy to clean shoes) and maybe we will have peking duck for dinner.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland can include a room at the fantastic Peabody Hotel for a discounted rate per night, single occupancy.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors:AveMariaSchool of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: OrlandoWorldCenter Marriott, Orlando, Florida

Sponsor:University of MiamiSchool of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and ConferenceCenter, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”