The Sid Kess Report – Issue 340

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, October 12, 2023Issue #340Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Alan Gassman

“Sid Kess was a brilliant and dedicated pillar of our profession. As an author, mentor, dedicated teacher, and CCH personality, he touched the lives of thousands of professionals and was also dedicated to charitable causes. I first spoke to Sid in 1984 about writing an article for him and last communicated just weeks ago, 39 years later. Dozens of times he would call me and make suggestions, while also asking for symposium ideas and commitments to make sure that I contributed to the profession and charitable causes, sometimes beyond my comfort zone. He always encouraged me to budget time to develop my materials and presentations which was and continues to be great advice for anyone in our profession. He also let me know what I did wrong and what I could do better with candor which is very rare in this day and age. Sid’s fearless leadership and directness was a voice and a spirit that will be forever missed and never forgotten.” – Alan Gassman “Syd took charge of the Federation’s program not only to educate the profession about estate planning to save estate taxes, but to address the other concerns that are often overlooked, such as: – Accomplish non-tax objectives such as creditor protection for the beneficiaries, have the trusts be flexible to take into account the specific needs of each beneficiary, and the need for a trust to be flexible in its investments. – Encourage individuals who may not be charitably inclined to consider charitable planning as part of their plan. – Consideration of financial planning and income tax planning. – Syd mentored young lawyers.” – Jerry Hesch “Sidney Kess was possibly the greatest contributor to the tax profession in my lifetime. He was both a great writer and a great teacher. All CPAs are greatly indebted to Sidney for his generous contribution of time to the AICPA’s tax and estate planning education programs. I’m so grateful that I was able to attend some of his sessions during his career. He will be greatly missed.” – Kevin Bassett, CPA

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Sidney Kess: A Distinguished Career in Taxation and Financial PlanningWritten By:Josh Hawkins Article 2The Grass is Greener on the Other Side of the BeltWritten By: Anthony Del Rosario & Alan S. Gassman Article 3A Guide to Guided ToursWritten By: Anthony Del Rosario Article 4Employee Retention Credit after the Infastructure ActWritten By: Anthony Del Rosario Forbes CornerSunshine State Becomes The Firearm State: Florida’s New Permitless Concealed Carry LawWritten By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) For Finkel’s FollowersThe 3 Biggest Fears Business Owners Have About Hiring An AssistantWritten By: David Finkel Free Upcoming WebinarsPatient Care and the Business of MedicinePresented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) & Lynda Benson & Pariksith Singh More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Sidney Kess: A Distinguished Career in Taxation and Financial Planning

Written By: Josh Hawkins

In the realm of taxation and financial planning, few individuals have left as profound an impact as Sidney Kess. His illustrious career spanning over six decades is marked by a relentless pursuit of excellence, an unwavering commitment to educating others, and a legacy that continues to shape the field. Sidney Kess is not merely a name; he is a revered figure whose contributions have enriched the lives of countless professionals and individuals alike.

Early Life and Education Sidney Kess was born in Brooklyn, New York, in 1930. His early life was shaped by the challenging economic circumstances of the Great Depression, which instilled in him a strong work ethic and a deep appreciation for financial security. These formative experiences likely played a significant role in his later career choice and commitment to helping others navigate the complexities of financial planning and taxation. Kess earned his Bachelor of Laws (LL.B.) degree from St. John’s University School of Law and later obtained a Master of Laws (LL.M.) degree in Taxation from New York University School of Law. This academic foundation would serve as the bedrock for his distinguished career in taxation.

An Exemplary Career Sidney Kess’s professional journey began in the early 1950s when he joined the law firm of Davis Polk & Wardwell. During his tenure at the firm, he worked on a wide range of tax matters, gaining invaluable experience and honing his expertise in taxation and estate planning. However, it was his transition to a career in education that truly set him apart. Kess joined the Tax Division of the Internal Revenue Service (IRS), where he served in various roles, including as an attorney-adviser and as the Director of the Office of Professional Responsibility. His time at the IRS allowed him to gain a unique perspective on tax regulations, compliance, and ethics, insights he would later impart to countless professionals.

A Respected Educator Sidney Kess’s passion for education became evident during his tenure at the IRS, and it continued to flourish throughout his career. He authored numerous books and articles on taxation and financial planning, becoming a prolific writer and sought-after speaker. His ability to simplify complex tax concepts and regulations made him a beloved figure among tax professionals, attorneys, accountants, and financial planners. Kess’s contributions to education extended far beyond the written word. He was a dedicated lecturer and educator, conducting seminars and workshops on tax planning across the United States. His ability to communicate with clarity and engage his audience made him an effective teacher, empowering countless individuals to navigate the intricate world of taxation with confidence.

A Legacy of Excellence Sidney Kess’s legacy extends beyond his professional accomplishments. His commitment to ethical conduct in the financial and tax planning industry led to his role in establishing and upholding high standards of professionalism. Kess was instrumental in shaping the ethics standards for tax professionals and advocating for the importance of integrity in financial practices. Throughout his career, Kess received numerous awards and accolades, including the prestigious Sidney Kess Award for Excellence in Continuing Education, which was established in his honor by the American Institute of CPAs (AICPA). This award serves as a testament to his enduring impact on the field.

Conclusion Sidney Kess’s remarkable career in taxation and financial planning stands as a testament to his passion, dedication, and enduring commitment to the betterment of the industry and the lives of those he served. His contributions as a writer, educator, and advocate for ethical professionalism have left an indelible mark on the financial world. As we reflect on the life and career of Sidney Kess, we are reminded of the profound impact that one individual can have on an entire industry. His legacy continues to inspire generations of tax professionals and financial planners to strive for excellence, uphold ethical standards, and educate others with the same passion and dedication that defined his extraordinary career. Sidney Kess was not only a pioneer in taxation and financial planning; he was a beacon of integrity and excellence for all to emulate.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

The Grass is Greener on the Other Side of the Belt

Written By: Alan S. Gassman, JD, LL.M. (Taxation), AEP (Distinguished) & Anthony Del Rosario, Stetson Law Student

PROPERTY TAX ASSESSMENTS AND GREENBELT EXEMPTIONS Given the complexity surrounding Florida property tax assessments and exemptions under Florida law, the authors thought it’d be helpful to start this article by asking Chat GPT how it would explain property taxes and greenbelt exemptions to a 5-year-old, Okay, imagine you have a big box of crayons and want to know how much your crayons are worth. That’s like what grown-ups do with their houses and land. They want to know how much their houses and land are worth, and they have to pay something called ‘property taxes’ every year. Now, let’s talk about ‘Greenbelt exemptions.’ Imagine some people have really nice gardens or farms with lots of plants and animals, and they want to take care of them. Greenbelt exemptions are like a special prize for these people. It means they don’t have to pay as much in property taxes because they’re doing a good job looking after their gardens and farms. So, just like when you share your crayons with your friends, some grown-ups share their land with nature, and they get a special reward called a ‘Greenbelt exemption’ that makes their taxes a bit smaller. It’s like a way to say ‘thank you’ for being nice to the earth. For the adults reading this article, farmland owners, like all real property owners, pay property taxes, and the amount of taxes those owners must pay is generally based on the assessed fair market value of the land. In fact, under Florida Statute Section §193.011(2), all property is assessed at fair market value based on the highest and best use of that property.[i] This article explains how greenbelt exemptions can help farmland and other agricultural landowners pay less in property taxes based on rules known as “Greenbelt Exemptions.”[ii] GREENBELT EXEMPTIONS Section §193.461, also known as Florida’s Greenbelt Exemption, “facilitates the financially viable operation of agricultural businesses by shielding the agricultural property from potential property tax increases attributable to encroaching development.”[iii] Essentially, having a greenbelt means a farm owner/operator would pay less taxes on that land.[iv] However, that land must be classified as “agricultural land” pursuant to Section §193.461.[v] A Floridian landowner could have their property classified as agricultural land under the Greenbelt Exemption 1) if the land was primarily used for “bona fide agricultural purposes” after 2) filing an AG application to the relevant county’s property appraiser on or before March 1st of each year.[vi] This article will use Citrus County as an example.[vii]

Under Section 193.461(b), the term “bona fide agricultural purposes” means good faith commercial use of the land.[viii] Lands for residential use are not eligible for greenbelt exemption. While there is no specific definition of good faith commercial agricultural use of land, Florida law provides factors for authorities to consider,[ix]

First, these factors must be present by the statutory assessment date of January 1st. Property appraisers assess eligibility for agricultural status by looking at the actual use of the land,[x] rather than speculative or future use.[xi] Next, based on previous Florida cases, good faith commercial agricultural use does not mean the land has to provide a profit for the landowner.[xii] Lastly, as subsection Section 193.461(b)(1)(g) suggests, the above factors are non-exhaustive. Fortunately, in addition to these factors, counties like Citrus County provided guidelines for landowners seeking to apply for agricultural status for certain kinds of lands. Citrus County provides guidelines on some of the most common types of agricultural lands, including pasturelands, croplands, and timberlands.[xiii] Pastureland[xiv] In Citrus County, pastureland would likely be approved for agricultural status if it was a fenced property of at least 10 acres, had been maintained, and cared for in a manner appropriate for this type of land, i.e., fertilizing, mowing, etc. Further, pastureland owners are required to show receipt from the purchase or sale of livestock, expenses incurred from the operation, proof of a lease by January 1st, an Agriculture Business Plan, copies of licenses/permits, and should have sufficient livestock to constitute a commercial operation.[xv] Cropland[xvi] Similarly, an owner of cropland should demonstrate proof of leases, business plans, licenses, permits, and all other relevant documentation. Suppose the crop is hay, 10 acres is sufficient, or the land should at least be 5 acres or used in conjunction with other parcels. Understandably, the production of crops for home use (gardens) does not qualify for the greenbelt exemptions. Timberlands[xvii] Timberland or forestry operations have more rigorous requirements. The following requirements must be complete by January 1st: a Forest Management Plan or Forest Stewardship in place; a contract for the purchase of the trees; a contract with a planter, this can include the purchase of the trees; the property must be cleared of competing vegetation and prepped for planting; and any other activity recommended by the Management Plan should be readily apparent to the agricultural appraiser. Additionally, Timberland land should be at least 10 acres or, if a larger operation, have a minimum of 400 trees per acre, have an approved forestry-management plan prepared by a “professional forester,” and the land must have been prepared for planting/had planted trees by January 1st. Most importantly, simply following the statutory factors and county-specific guidelines is not enough. A farmland owner would not benefit from the Greenbelt Exemption without actively filing for agricultural status.

A person filing for Agricultural Classification for the greenbelt exemption must complete the “AG Application.” Since the AG applications are a statutory requirement, most counties have a similar process for filing for agricultural status. Each county provides instructions on how to complete the application. For example, the Citrus County Property Appraiser has helpful tips for completing an AG Application

A property appraiser must provide notice to the owner of the land whether the land was classified as agricultural land by January 31st.[xviii

CONCLUSION In conclusion, farmland owners looking to pay less in taxes for their agricultural land should ensure their land meets the statutory factors and file their AG application with their respective county’s property appraisers by January 1st.

[i] Raychel Thomas, Jana Caracciolo, and Catherine Campbell, How to Apply for a Greenbelt Agricultural Tax Assessment, UF IFAS EXTENSION (August, 17, 2021), https://edis.ifas.ufl.edu/publication/FY1497. citing Fla. Stat. §193.011(2). [ii] Straughn v. Tuck, 354 So.2d 368 (1977) (“The statute under which agricultural use is required for preferential tax treatment of lands as agricultural lands is constitutional”). [iii] Shutts & Bowen LLP, Florida Greenbelt Law: The Agricultural Classification of Land in Florida, JDSUPRA (February 10, 2021), https://www.jdsupra.com/legalnews/florida-s-greenbelt-law-the-8882009/#:~:text=This%20statute%20is%20frequently%20referred,property%20classified%20for%20other%20purposes; Straughn v. K&K. Land Management, Inc., 347 So.2d 724 (2nd Dist. Ct. App. 1977) (“Primary purpose of the ‘green belt’ law was to encourage continued agricultural use by assisting a former owner to make a reasonable profit from such use, vis-à-vis a like profit should be put to a nonagricultural use; additionally, it was laudable legislative purpose to encourage continued bona fide commercial agricultural use in general, commercial agrarian use in society’s best interest”). [iv] Supra note 1. [v] Fla. Stat. §193.461(3)(a). [vi] Id; Under Fla. Stat. §193.461(1), the Property Appraiser has the authority to decide whether a parcel of land is entitled to an agricultural classification. Under Fla. Stat. §193.461(2), any landowner whose land is denied may appeal to the value adjustment Board. [vii] Guidelines for Agriculture Classification for Lands, https://www.citruspa.org/_dnn/Portals/0/pdfs/Citrus%20County%20Guidelines%20for%20Ag%20Classification.pdf (last reviewed September 16, 2023). (According to the Citrus County’s website, reach out to the Citrus County Property Appraiser’s Office at 352-341-6651 or 352-341-6600 for any Citrus County-specific questions) [viii] Fla. Stat. §193.461(b) [ix] Fla. Stat. §193.461(b)(1)(a)-(g). [x] Tilton v. Gardner, 52 So.3d 771 (5th. Dist. Ct. App. 2010) (“Favorable property tax treatment provided by statute with respect to agricultural land is predicated on land use, that is physical activity conducted on land”). [xi] RH Resorts, Ltd. V. Donegan, 881 So.2d 1152 (5th Dist. Ct. App. 2004) (“In applying statutory factors to determine whether parcel of real property is entitled to receive agricultural classification for property tax purposes, property appraiser cannot consider property own’s future intended use of property but instead must focus on use of property as of January 1st of subject year”). [xii] See Wilkinson v. Kirby, 654 So.2d 194 (2nd Dist. Ct. App. 1990); Department of Revenue v. Goembel, 382 So.2d 783 (5th Dist. Ct. App. 1980); Fisher v. Schooley, 371 So.2d 496 (2nd Dist. Ct. App. 1979). [xiii] Supra note 7. [xiv] Supra note 7. [xv] According to the Citrus County guidelines, “one cow on one acre cannot be construed as commercial agricultural operation while 70 cows on 100 aces could be.” [xvi] Supra note 7. [xvii] Supra. [xviii] Fla. Stat. §193.461(3)(e).

|

|||||||||||||||||||||||||||||||||||||||||||||||||

Article 3A Guide to Guided Tours

Written By: Anthony Del Rosario, Stetson Law Student

The holiday season, running from late November to early January, is fast approaching. Traveling on vacations is how people get away and unwind to come back refreshed ready to take on life and do their best work, especially in 2023. According to other Forbes contributors, like Becky Pakora, 49% of consumers plan to travel more in 2023[1] by taking road trips, beach vacations, romantic getaways, etc., rather than just seeing family and loved ones. A big appeal of traveling is to explore new places and engage with new cultures around the world. Unsurprisingly, planning a vacation in a new place can be daunting. How do busy people, without the time to spend hours researching Mexico, Italy, or Sweden make the most of their experience? Vacation packages and guided tours! Those packages and tours seem like a great idea because everything is taken care of. It’s convenient to have tour guides pick the prospective traveler up at the airport, have the hotel or vacation homes arranged for them, and guide travelers through each step of their journey so they don’t even have to think about it. The author, however, cautions readers to be careful when booking these guides. Many tour guides and luxury vacation providers have their own websites that provide positive testimonials, reviews, and proposals describing what customers can expect to experience on those tours. Most of these websites provide excerpts of what other customers have said about the experience with beautiful pictures of amazing destinations. Others have websites that flaunt awards like “winner of the best tour company X number of years in a row.” Readers should take these claims with a grain of salt. While the authors are not claiming these websites are intentionally misleading people, any website planning luxury vacations is going to “make the pitch” to try and sell customers on those vacations. A well-designed website with the above may appear, at first, very luxurious and reputable, especially if the website promotes themselves as a luxury vacation or tour guide provider, but that does not automatically mean the luxury tour guides are good, reputable businesses. This article has three tips on how to find reputable guides and plan enjoyable vacations:

Call or Email Tour Company First, instead of reading about the experience from the tour guide company or vacation package company, potential travelers should speak to the company about the experience. These companies generally have a vested interest in selling to potential customers. Actually speaking to the representatives helps potential vacation-goers to understand how truthful or reputable these agents may be over the phone. If these conversations take place in advance, it gives the potential customer much more time before the vacation to ask questions about potential concerns that may arise.

Research Third Party Travel Websites Next, these businesses have an interest in their guides selling, potential travelers should look to third-party websites, such as Yelp, TripAdvisor, Trust Pilot, etc. These third-party websites are not perfect but provide testimonials and reviews from individuals who do not have a vested interest in the tour guide website doing well. These websites also have a rating system that can help potential travelers quickly point out whether a tour guide business is reputable or not.

Ask Trusted Friends/Family Finally, trusted family and friends also do not have a vested interest in the tour guide doing well. Loved ones, especially those whose opinions can be trusted, are generally willing to discuss their experiences on these tours. The advantage to asking those individuals is that they will likely be open, and honest, and inquiries will go into much more detail than a 5-star rating system or 500-character excerpt from a stranger. In conclusion, even if a prospective traveler is too busy to research potential destinations, readers should do some extra reading on these tour guide companies to make sure they make the most of their vacations.

[1] Becky Pokora, Travel Trends 2023: 49% of Consumers Plan to Travel More in 2023, Survey: Inflation Has Not Deflated America’s Travel Plans In 2023 – Forbes Advisor (last updated Aug. 16, 2023) |

|||||||||||||||||||||||||||||||||||||||||||||||||

Article 4Employee Retention Credit after the Infrastructure Act

Written By: Anthony Del Rosario, Stetson Law Student

EXECUTIVE SUMMARY: Employers and employees alike suffered one of the most traumatic periods in human history after Covid-19 swept the world in 2020. According to the Bureau of Labor statistics, around 49 million Americans were unable to work in May 2020 because employers closed down or lost their business in the pandemic.[1] To help combat the labor shortage, the Employee Retention Credit (ERC) was first introduced in March 2020, to help employers keep employees working through the pandemic. How does it do this? Well, the ERC is a refundable tax credit for an eligible business that continued to pay employees 1) while the employers’ business was fully or partially suspended or 2) had significant declines in gross receipts between the dates of March 13, 2020 to Dec. 31, 2021.[2] Initially, the credit created an incentive for employers to retain employees despite those employers not making the profits they did pre-pandemic. While the ERC was originally set to expire January 2021, the Relief Act of 2021 and American Rescue Plan (ARP) extended that deadline, expanded eligibility rules, and added additional quarters that eligible employers could receive the credit. FACTS: All of the above-mentioned changes and expansions made the already complicated rules even more complicated. In fact, they are so complicated that the IRS has issued four warnings for employers between 2022 and 2023 about third parties who take advantage of the confusion by promising employers, after charging large, upfront fees, money through the credit. The third parties activities had been so rampant that, due to rising concerns of “improper Employee Retention claims,” the IRS imposed a moratorium beginning September 14, 2023 through at least the end of December 2023 on processing new claims to “protect honest small business owners from scams.”[3] The IRS would continue to work previously filed ERC claims received prior to September 14, 2023 but made clear that “hundreds of criminal cases… and thousands of ERC claims have been referred to audit.”[4] The IRS recommends employers review guidelines before believing these third-party promoters. In anticipation of when the moratorium will be lifted, this article provides information on the newest update to the ERC rules to review from the Infrastructure Investment and Job Acts (“Infrastructure Act”). United States Laws affecting ERC

The Infrastructure Act is a 1.2 trillion dollar spending bill, signed into law on November 15, 2021, with the intention of providing clean water, high-speed internet, reliable public transit, and overall improvement to America’s infrastructure. In addition to infrastructure changes, Section 80604 of the Infrastructure Act retroactively stops most employers from claiming the ERC for the 4th quarter of 2021. Fortunately, the IRS provided guidance on section 80604 in the form of Notice 2021-65. This article will highlight the three major changes according to the Notice: 1) ERC is only available for recovery startups in the 4th quarter; 2) non-recovery startups need to return advance payments received that were attributable to the 4th quarter of 2021, and 3) the IRS will not waive failure to deposit penalties for employers other than recovery startups. COMMENTARY: Infrastructure Act Changes to the 4th Quarter

First, as mentioned above, under the CARES Act an employer could qualify for ERC under two circumstances: 1) the trade or business was fully or partially suspended due to orders from the government or 2) there was a reduction in gross receipts for any calendar quarter.

Calendar quarters

Recovery startups are a new category of businesses that are eligible to claim ERC in the third and fourth quarters of 2021, which originally came about under the ARP.

A recovery startup is defined under the ARP to mean: “a recovery startup business means any employers A) which began carrying on any trade or business after February 15, 2020, B) for which the average annual gross receipts of such employers for the 3-taxable year-period ending with the taxable year which precedes the quarter for which the credit is determined under subsection (a) does not exceed $1,000,000.”[5] After the ARP, if the employer demonstrated their annualized gross receipts did not exceed $1,000,000 and started after February 15, 2020, then that business could automatically qualify for ERC for the third and fourth quarters of 2021 regardless of whether their revenue decreased or if the business was considered to be partially suspended. In addition to recovery startup businesses, the ARP created a second new category of employer, a “severely financially distressed employer.” A severely financially distressed employer is an eligible employer that suffered more than a 90% loss in gross receipts in any quarter for 2021 when compared to the same quarter in 2019. Under Section 80604 of the Infrastructure Act, the fourth quarter is treated very differently, “Section 80604: Termination of Employee Retention Credit for Employers Subject to Closure Due to Covid-19. A) In General Section 3134 of the [I. R. C.] is amended – (2) in subsection (n), by striking “January 1, 2022” and inserting “October 1, 2021 (or in the case of wages paid by an eligible employer which a recovery startup business, January 1, 2022). B) [Amendments] shall apply to calendar quarters beginning after September 30, 2021.”[6] Now, after the Infrastructure Act, only recovery startup businesses are eligible to claim the credit. Therefore, the rules for determining if an employer is eligible under the first two tests[7] and other related eligibility rules are inapplicable for the fourth quarter of 2021.[8] Accordingly, “severely financially distressed employers” are no longer eligible to receive credits in the 4th quarter.

Next, employers previously could claim an advance payment on their ERC by filing a form 7200. According to Notice 2021-65, after the Infrastructure Act, employers who already requested advance payments of the ERC for the 4th quarter of 2021 who are not recovery startup businesses must repay any advance ERC payments. Repayments are due by the due date of the applicable employment tax return (generally January 31, 2022). The Notice further states that “[f]ailure to repay the advance payment by the due date… may result in the imposition of failure to pay penalties under section 6651.” Section 6651 simply states a taxpayer who fails to return or pay their taxes on time will be subject to a five percent of the tax due.[9]

Finally, employers previously could have reduced deposits of Employment Taxes by the amount of the ERC the employer anticipated for the fourth quarter based on the two tests.[10] IRS Notice 2021-20 gives the following example for how this reduced deposits waiver works: Example: Employer A paid $10,000 in qualified wages (including allocable qualified health plan expenses), among other wages. After deferral of the employer’s share of social security tax under section 2302 of the CARES Act, Employer A is otherwise required to deposit $8,000 in federal employment taxes for all of its employees for all wage payments made during the same quarter as the $10,000 in qualified wages. Employer A did not choose to use the relief under Notice 2020-65 to defer the employee’s share of social security tax. Employer A has no credits under sections 7001 and 7003 of the FFCRA. Employer A is not a tax-exempt organization eligible for the credit under section 303(d) of the Relief Act. In anticipation of the employee retention credit, Employer A may keep up to $5,000 of the $8,000 of taxes Employer A was otherwise required to deposit and it will not owe a failure to deposit penalty for the $5,000. Employer A will later account for the $5,000 it retained when it files Form 941 for the quarter. Notice 2021-65[11] provides that non-recovery startups are no longer eligible for this waiver in the 4th quarter unless:

If an employer does seek relief in the manner described above, the employer may reply to a notice about a penalty with “an explanation and the IRS will consider reasonable cause pursuant to section 6656(a).”

CONCLUSION The IRS warned employers to review ERC guidelines in lieu of changes to the credit rules and for the employers to be cautious of third parties promoting the credit. To protect those employers, the IRS had imposed a moratorium beginning September 14, 2023 until at least the end of the year. When the moratorium is lifted, those concerned about the Infrastructure Act should know it did not affect most of the eligibility for the first, second, or third quarters of 2021. In fact, the most consequential changes from the Infrastructure Act relate solely to the 4th quarter of 2021. After the Infrastructure Act, non-recovery startup businesses 1) cannot claim the credit, 2) have to repay any advance payments received for the 4th quarter and 3) can no longer reduce their deposits of employment taxes without seeking relief under notice 2021-65, and only those businesses that qualify as a recovery startup business may seek the ERC for the 4th quarter of 2021.

[1] 6.2 million unable to work because employer closed or lost business due to pandemic, June 2021, BLS (Mar. 31, 2023), https://www.bls.gov/opub/ted/2021/6-2-million-unable-to-work-because-employer-closed-or-lost-business-due-to-the-pandemic-june-2021.htm (released Jul. 8 2021) [2] Employee Retention Credit, IRS (Mar. 29, 2023), https://www.irs.gov/coronavirus/employee-retention-credit#:~:text=The%20Employee%20Retention%20Credit%20(ERC,to%20Dec.%2031%2C%202021 (last updated Mar. 16, 2023). [3] IR- 2023, 169, To protect taxpayers from scams, IRS orders immediate stop to new Employee Retention Credit processing amid surge of questionable claims; concerns from tax pros, IRS (Sept. 14, 2023), https://www.irs.gov/newsroom/to-protect-taxpayers-from-scams-irs-orders-immediate-stop-to-new-employee-retention-credit-processing-amid-surge-of-questionable-claims-concerns-from-tax-pros. [4] Supra. [5] I. R. C. §3134. [6] H.R. 3684 – Infrastructure Investment Jobs Act §80604(b)(2021). [7] Two tests: 1) full/partial suspension and 2) gross receipts test. [8] I. R. S. Notice 2021-65. [9] 26 U.S.C. §6651 Failure to file tax return or to pay tax. [10] Supra, note 5. [11] Supra, note 6. |

|||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

Sunshine State Becomes The Firearm State: Florida’s New Permitless Concealed Carry LawWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

There is continuous debate surrounding the rights to gun ownership and what regulations should or should not be implemented… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersThe 3 Biggest Fears Business Owners Have About Hiring An Assistant |

|||||||||||||||||||||||||||||||||||||||||||||||||

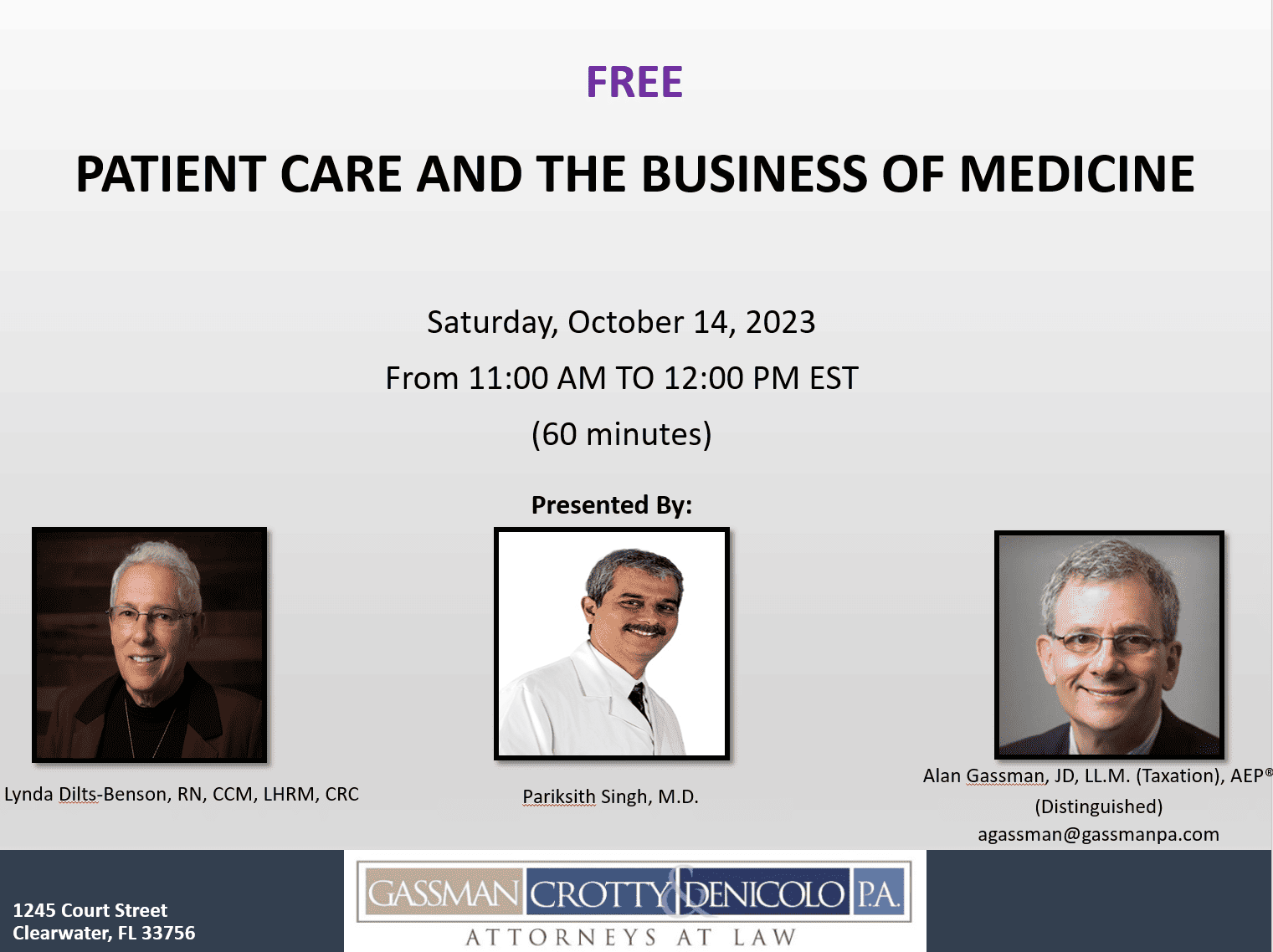

Free Saturday WebinarPatient Care and the Business of MedicineDate: Saturday, October 14, 2023 Time: 11:00 AM to 12:00 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished), Lynda Benson, RN, CCM, LHRM, CRC & Dr. Pariksith Singh, M.D.

REGISTER HERE FOR 1.0 CPE CREDIT REGISTER HERE FOR NON-CPE CREDIT REGISTER HERE FOR FLORIDA CLE CREDIT

Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please register above through CPA Academy. If you would like Florida CLE Credit, please register through the provided link above. Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

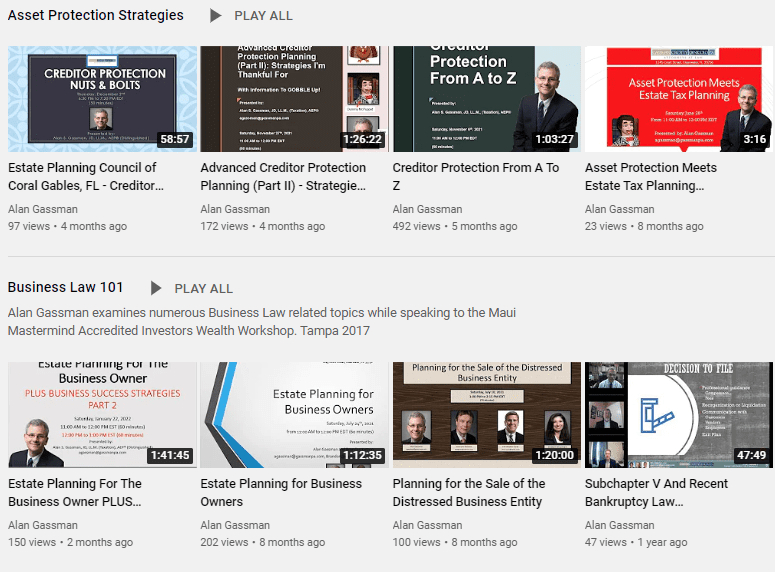

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||

HUMORClassic Jokes Your Dad Will Love

Why don’t scientists trust atoms? Because they make up everything!

Why did the scarecrow win an award? Because he was outstanding in his field!

Why don’t oysters donate to charity? Because they are shellfish!

Abbott & Costello in “Estate Tax Confusion” Written by AI

Abbott: (Reading a newspaper) Hey, Costello, have you heard about the estate tax? Costello: Estate tax? What’s that? Abbott: Well, it’s a tax on the estate of a deceased person. Costello: So, they tax your house? Abbott: No, not your house, Costello. They tax your entire estate. Costello: What’s an estate? Abbott: Your estate is everything you own when you die. Your money, property, investments… Costello: So, they tax everything you own? Abbott: Right, everything you own. Costello: But what if you don’t own anything? Abbott: Then you don’t pay the estate tax. Costello: So, if you don’t own anything, you’re off the hook? Abbott: That’s correct. Costello: Well, that’s easy. I’ll just give away all my stuff before I die. Abbott: Ah, but there’s a catch, Costello. Costello: What’s the catch? Abbott: If you give away too much, there’s a gift tax. Costello: A gift tax? So, if I give my stuff to my kids, I have to pay a tax? Abbott: That’s right, Costello. You can’t avoid the tax man. Costello: Wait a minute, Abbott. So, if I don’t give anything away and I don’t own anything when I die, then there’s no tax? Abbott: Well, not exactly, Costello. There’s still a tax on the estate. Costello: But you said if I don’t own anything, I don’t pay the tax! Abbott: I did, but there’s an exemption. Costello: An exemption? What’s that? Abbott: It’s an amount of money you can pass on to your heirs without paying the estate tax. Costello: So, if I don’t own anything and I pass on my stuff without giving it away, I don’t pay the tax, except for the exemption? Abbott: That’s right, Costello. You got it! Costello: (Pauses) So, who’s on first? Abbott: No, no, Costello, we’re talking about estate tax, not baseball! Costello: I know, I know, but I’m just trying to figure out who’s on first when it comes to this tax stuff! Abbott: (Sighs) Costello, estate tax is a bit like a comedy routine itself. Just remember, it’s the tax on what you leave behind when you’re gone. Costello: Got it, Abbott. But who’s going to pay it? Abbott: (Smiles) Well, that’s a question for your heirs to figure out! (They both laugh as the confusion over estate tax continues.) |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||