The Thursday Report – Issue 335

|

|

||

|

|

||

|

|

||

|

Thursday, March 2, 2023Issue #335From the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Alan Gassman Having trouble viewing this? Use this link |

||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Can New Discriminatory Notice On The Earned Retention Credit (ERC) Be Thrown Out? (Probably Not)Written By: Blasia Baker Article 2Surving Spouse Must Elect To Be Considered Same Age As The Deceased Plan Participant Of IRA If DesiredWritten By: Peter Farrell Article 3FTC Ban On Non-Compete AgreementsWritten By: P. Jill Ashley, CPA Forbes Corner8 Lessons For George Harrison’s 80th BirthdayWritten By: Alan Gassman, Esquire For Finkel’s Followers5 Destructive Managment Behaviors That You May Be DoingWritten By: David Finkel Free Saturday WebinarNurturing Success & Achievement: The Pattie Boyd StoryPresented By: Pattie Boyd, Alan Gassman & Jim Hartley More Upcoming EventsYouTube LibraryHumor |

||

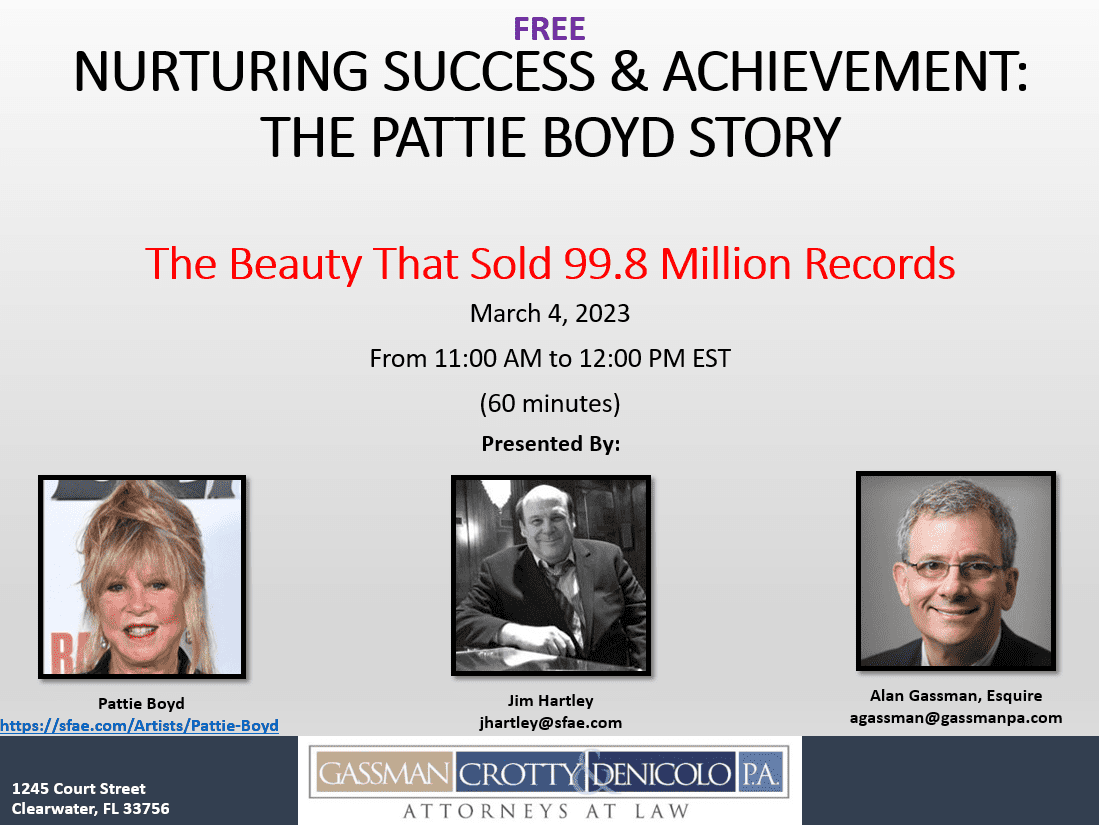

Free Saturday WebinarNURTURING SUCCESS & ACHIEVEMENT: THE PATTIE BOYD STORYDate: Saturday, March 4, 2023 Time: 11:00 AM to 12:00 PM EST (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished), Jim Hartley & Pattie Boyd

REGISTER HERE FOR NON-CPE CREDIT REGISTER HERE FOR 1.0 CPA CPE CREDIT REGISTER HERE FOR FLORIDA LAWYER CLE CREDIT (ELIGIBLE FOR FLORIDA ATTORNEYS ONLY)

Course Description Join Alan Gassman and Jim Hartley for a special presentation with the talented author, photographer, and former model Pattie Boyd. Pattie will lead a discussion on professional and personal achievement, and how we can learn by history and example from some of the most creative and successful creators and performers of the 20th and 21st Centuries. Pattie Boyd, who was one of the most talented and beautiful young models of the 1960s, met George Harrison on the set of The Beatles movie, Hard Days Night. They married in 1966. She become an accomplished photographer, and her pictures and participation and influence on rock and modern culture continued during and after her second marriage to Eric Clapton. Her candid shots and interactive history include many important figures in Rock ’n’ Roll and general history. She is also an author, a founder of the SHARP Self Help Addiction Recovery Program, and a member with distinction of the Royal Photographic Society. Songs written for and about her include Something, If I Needed Someone, For You Blue (George Harrison), Layla and Wonderful Tonight (Eric Clapton), and Breathe on Me and Mystifies Me (Ronnie Wood) Frank Sinatra called Something “the greatest love song of the last 50 years.” San Francisco Art Exchange hosted Pattie’s first-ever exhibition in 2005. “Pattie Boyd is one of the most beautiful and spellbinding people I have ever met, and her beauty is both inside and out”. Jim Hartley, Founding Member, San Francisco Art Exchange Learning Objectives:

Please Note: After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit and non-CLE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPA Academy. If you would like Florida CLE Credit, please register above through the provided link above. Please email registration questions to info@gassmanpa.com. Article 1Can New Discriminatory Notice On The Earned Retention Credit (ERC) Be Thrown Out? (Probably Not)Written By: Blasia Baker

On August 5, 2021, the IRS issued Notice 2021-49 which was meant to provide guidance on the employee retention credit. The employee retention credit, passed as a part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in 2020, was enacted to encourage businesses to keep employees on their payroll amidst the pandemic. Consequently, this collectively costs small business owners who employee their relatives billions of dollars across the United States. However, if there is a way to make this Notice legislative, rather than interpretive, the Notice would be ineffective, as it would fail to meet the notice-and-comment requirements of the Administrative Procedure Act (APA). The APA authorizes federal agencies to promulgate rules. The APA defines a “rule” as “an agency statement of general or particular applicability and future effect designed to implement, interpret, or prescribe law or policy.” There are two kinds of rule rules: legislative and interpretive, neither of which is expressly defined by the APA. A legislative rule is adopted by a government agency in accordance with the notice and comment requirements of the APA that has the force of law, and imposes new duties on all regulated parties. An interpretive rule is a document produced by the agency to explain regulations it has promulgated or to explain the meaning of a statute that it administers. They can include many agency pronouncements, such as guidance documents and interpretive bulletins, and memos.

So the question becomes: Is Notice 2021-49 a legislative rule rather than a guidance document? We look to recent case law. In Green Valley Invs., LLC v. Comm’r of Internal Revenue, No. 17379-19, 2022 WL 16834499 (Nov. 9, 2022), the taxpayer petitioned for readjustment of partnership items after the IRS issued notice of final partnership administrative adjustment disallowing charitable deductions related to syndicated conservation easement transactions listed in the IRS notice. When both sides moved for summary judgment, the court held: (1) The IRS notice was a “legislative rule” subject to APA’s notice-and-comment procedures, and (2) the IRS failed to establish that Congress expressly allowed it to bypass APA notice-and-comment procedures with respect to the notice. In holding the notice was a legislative rule, the case heavily emphasized that a legislative rule imposes new rights or duties, or changes the legal status of regulated parties. Green Valley Invs., (Nov. 9, 2022); Chen Zhou Chai v. Carroll, 48 F.3d 1331, 1340 (4th Cir. 1995) Notice 2021-49 states that ‘when a taxpayer claims the employee retention credit because of the retroactive amendment section of the CARES act, or otherwise files an amended federal income tax return or administrative adjustment request (AAR), if applicable, for the taxable year in which the qualified wages were paid or incurred to correct any overstated deduction taken with respect to those same wages on the original federal tax return.’ The notice continues on to say that ‘section 280C(a) requires tracing to the specific wages generating the applicable credit. See, generally, Treas. Reg. § 1.280C-1. To satisfy this tracing requirement, the taxpayer must file an amended return or AAR, as applicable. ‘ This suggests that by instructing taxpayers to file an amended federal income tax return or administrative adjustment request, the notice imposes a new duty that was not otherwise there before the amendment to the CARES Act. Similarly, demanding the taxpayer they must file an amended return or AAR to satisfy a tracing requirement imposes a new duty as well. Unlike filing an amendment to a federal income tax return which might be intuitive to most of us, and recommended by the IRS often, filing to trace specific wages generating the credit is not. Nowhere in §280(a) (which is listed as controlling law in the CARES Act) does it require a taxpayer to file an amended return with this information. This is a completely new command the IRS makes in the notice.

How the law was originally presented vs. what is presented in the notice It is important to take note that there was no change from the law presented in the original legislation to what is presented in notice 2021-49. There is nothing added, changed, or left out from the legal provisions (§ 2301 of the CARES Act, Internal Revenue Code (IRC) § 3134(e), IRC § 51(i)(1), and IRC § 152(d)(2)) referenced in notice 2021-49 when it explains how it applies to the ERC going forward. So unfortunately, regarding how the original legislation designated an exclusion of the credit based on the taxpayer’s relationships, there is nothing we can do on that front. If the IRS was feeling generous at some point in the future, it could conclude the credit is available on the wages of majority shareholders would be to focus on the theory that there are to be rules “similar to” those found at IRC §51(i)(1). That phrase might be just ambiguous enough to allow the agency to write rules allowing for such wages to qualify without necessarily ruling that owners could also qualify for the work opportunity credit. While the IRS might be pushing their limits of authority on that point, there’s also the fact that it would be hard to imagine a situation where someone could take the IRS to court to challenge that holding, despite the fact many would never wish to do so. In conclusion, a case can be brought to argue that requiring the taxpayer to file an amended adjustment, federal income tax, or other requested return to satisfy the tracing requirement, imposes a new duty on the taxpayer. There is a chance a court could find notice 2021-49 to be legislative, and by failing Congress’ exceptions to the notice-and-comment procedures, it would be void. While this feat itself would not put relatives back on the payroll in terms of the earned retention credit, it could open the door to further examining the “rules similar” language in the original CARES Act, and ultimately rewriting who qualifies.

|

||

Article 2Surving Spouse Must Elect To Be Considered Same Age As The Deceased Plan Participant Of IRA If Desired

Written By: Peter Farrell One advantage provided for surviving spouses who are older than their deceased spouse Plan Participant is the ability to use the Plan Participant’s date of birth as the date of birth for the Surviving Spouse with respect to minimum distribution calculations if the Surviving Spouse (a) has not rolled over the Plan Participant’s IRA under an inherited IRA where the Surviving Spouse takes minimum distributions annually without recalculating life expectancy (recalculating life expectancy is more advantageous and available for a rollover) or (b) under a Conduit Trust. Effective for calendar years beginning after December 31, 2023, the SECURE 2.0 Act added a requirement that the Surviving Spouse must elect to be treated as the deceased employee for purposes of the Required Minimum Distribution rules in order to have the advantage of this opportunity. The election must “be made at such time and in such manner as prescribed by the Secretary, [must] include a timely notice to the plan administrator, and once made may not be revoked except with the consent of the Secretary.”[1] As of March 2023, the Treasury Department has not yet released guidance relating to the deadline to make the election or the consequences of a late election. For example, if a Surviving Spouse is age 75 when the Deceased Spouse Plan Participant dies in 2023 at age 66 and the Surviving Spouse does not roll over the IRA, the Surviving Spouse does not need to begin taking Required Minimum Distributions for 7 years, the date that the deceased spouse Plan Participant would have reached his or her Required Beginning Date at age 73, if a proper election is made. No election was necessary prior to SECURE 2.0 for a Surviving Spouse to be treated as the deceased employee and benefit from a delayed Required Beginning Date. SECURE 2.0 amended IRC § 401(a)(9)(B)(iv) to make an election necessary to benefit from this provision. Even if the beneficiary is a conduit trust, the Surviving Spouse—not the trustee—must make the election. However, if the Surviving Spouse makes the election, SECURE 2.0 modifies the rules to permit either the Surviving Spouse or a conduit trust for the benefit of the Surviving Spouse to use the Uniform Lifetime Table. Prior to SECURE 2.0, they would have had to use the Single Life Table. Ed Morrow published a LISI Estate Planning Email Newsletter on January 24, 2023, that goes into great detail about this section of SECURE 2.0. You can find his article here: https://www.leimbergservices.com/openfile.cfm?filename=d:inetpubwwwrootalllis_notw_3010.html. [1] I.R.C. § 401(a)(9)(B)(iv). [1] I.R.C. § 401(a)(9)(B)(iv).

|

||

Article 3FTC Ban On Non-Compete Agreements

Written By: P. Jill Ashley, CPA

President Biden issued a 2021 Executive Order, seeking to ban or limit employers’ no-poach agreements and non-compete agreements, subsequently appointing Lina Khan as chairwoman of the Federal Trade Commission (FTC).[1] Khan gained notoriety when the Yale Law Journal published her 2017 article, Amazon’s Antitrust Paradox, asserting that despite the popularity of Amazon.com Inc., among consumers, its e-commerce dominance was founded on predatory pricing and aggressive expansion into multiple lines of business, thereby harming competitive markets. Khan draws correlations between commercial antitrust violations and non-compete clauses within employment contracts, inferring that both constitute unfair trade practices. Earlier this month, the FTC published a Notice of Proposed Rulemaking in the Federal Register aimed at banning employers’ imposition of non-compete clauses, in workers’ employment agreements, which the FTC estimated to impact 18% of the U.S. labor force (approximately 30 million people) in 2021. Noncompete clauses typically prohibit employees from working for competing businesses, within a specified geographic area, for a specified period after the employment relationship ends. In a press release, the Director of the Office of Policy Planning indicated that research showed noncompetes not only restricted workers’ mobility and suppressed wages, but also “hinder[ed] innovation and business dynamism … preventing would-be entrepreneurs from forming competing businesses … harm[ing] consumers; in markets with fewer new entrants and greater concentration, consumers can face higher prices — as seen in the health care sector.”[2] An example case cited an ophthalmologist who was constrained from practicing medicine in two Idaho counties, for two years after leaving the medical firm, unless the ophthalmologist paid the former employer a “practice fee” – ranging between $250,000 and $500,000, depending on the length of employment. [3] In another example, a security firm inhibited its security guards from accepting employment in a competing business within a 100-mile radius, for a period of two years after employment, subject to a $100,000 “liquidated damages” clause, for breach of contract.[4] Despite egregiously oppressive restrictions on workers’ rights, generally lacking enforceability, lower-wage workers without legal counsel may feel stuck in a job they would prefer to leave. The FTC Director hopes the proposed rule “would ensure that employers can’t exploit their outsized bargaining power to limit workers’ opportunities and stifle competition.”[5]

The details of the proposed rule: The agency’s proposed rule would make it illegal for an employer to enter into, attempt to enter into, or maintain an existing noncompete agreement with a worker — whether they are an employee, independent contractor, extern, intern, volunteer, or apprentice — and whether they are paid or unpaid. That means, if enacted, the rule would apply retroactively, requiring employers to rescind existing agreements and actively inform workers that such existing agreements would be extinguished. If a final rule is promulgated, the agency intends to provide model language for notifying applicable workers of their nullified agreements. Potentially, other agreements or contract clauses could also be impacted. Although other types of agreements do not specifically prevent a former employee from obtaining other employment, or starting a competing business, the FTC indicated that other restrictive covenant clauses may be impacted by the ban – if they are broad enough in scope to function as de-facto noncompete clauses.[6]

NDAs prohibit workers from disclosing or using certain confidential information obtained in the service of their employment.

TRAs require workers to reimburse the employer for training expenses, incurred when the worker leaves the job, within a specified timeframe. Narrowly defined exception to the proposed ban: A limited exception for non-compete clauses may apply, between a buyer and seller of a business, where the restricted party owns at least 25% of the business, although antitrust laws may still apply.[7] Questions of authority: The FTC claims its authority under § 5 of the Federal Trade Commission Act, which delineates the power of the agency to regulate “unfair methods of competition.” From that proclamation, the agency points to unequal bargaining power between employers and workers and the agency further asserts that restrictions on workers’ mobility and employment opportunities constitute unfair methods of competition, affecting labor and service markets in the aggregated national commerce. Some opponents of the ban claim the agency is exceeding its rulemaking authority with this proposed rule. This assertion mirrors last year’s Supreme Court reasoning in West Virginia v. EPA where the Court invoked the “Major Questions Doctrine” to prohibit an administrative agency’s rulemaking overreach when the agency lacked clear Congressional delegation of broad-scope authority to promulgate rules significantly impacting fundamental sectors of the economy.[8] Opponents also assert that the FTC’s proposed rule unnecessarily usurps authority from states that have regulated non-compete contracts for over two centuries.[9] In fact, all 50 states have addressed non-compete agreements. Forty-seven states’ statutes stipulate the scope of workers’ restrictions, carved-out exceptions, and enforceability of non-compete contract terms, determined on a case-by-case basis. Hawaii prohibits noncompete clauses only within the technology sector, other states prohibit non-compete clauses for low-wage-earners; while still, other states only allow noncompetes for key employees and contractors who have access to confidential information. The three remaining states (California, North Dakota, and Oklahoma) prohibit noncompetes altogether. [10] Massachusetts and Oregon have enacted “garden leave” provisions, which require employers to compensate workers for the entire period they are bound by the noncompete clause.[11] Florida tends to enforce non-compete agreements which advance legitimate business purposes, and the state presumes irreparable injury to employers where employees breach for non-public-policy reasons. Those legitimate business interests include trade secrets and other confidential information, substantial relationships with specific prospective or existing customers, patients, or clients, and goodwill associated with an ongoing business or professional practice, as well as specifically protected geographic locations or trade areas, and extraordinary or specialized training.[12] However, Florida statutes limit the use of noncompete agreements restricting the mobility of medical professionals, in particular. The statutes specifically refer to a Florida physician practicing a medical specialty, in an affiliated group with other physicians practicing the same specialty, could not be constrained by a non-compete agreement that would otherwise restrict patients’ access, and where the employer’s business interest was not harmed by the physician’s departure.[13]

Arguments in favor of the ban include:

Arguments against the ban include:

The Federal Trade Commission is seeking public comments, through March 20, 2023, to express support or opposition to the proposed rule. All related feedback is welcomed, including opinions on whether senior executives or franchisees should be covered by the rule, whether any specific industry should be excluded by the rule, and whether low- and high-wage workers should be treated differently under the proposed rule, or whether regulation should remain with the states. If you have strong feelings about this issue, you are encouraged to post your comments at this link: https://www.regulations.gov/docket/FTC-2023-0007/document. You can abbreviate your name, or even post anonymously, if you prefer. The agency must consider and respond to each issue collectively raised among all pertinent comments and may make changes to a final rule based on feedback received, or discard the proposal entirely.

[1] Employers’ Associations, Worker Mobility, and Training, Pedro S. Martins and Jonathan P. Thomas, January 2, 2023. [2] Elizabeth Wilkins, Director of the Office of Policy Planning. quoted in Federal Trade Commission press release, January 5, 2023. [3] Intermountain Eye & Laser Ctrs. P.L.L.C. v. Miller, 127 P.3d 121, 123 (Idaho 2005). [4] Federal Register, vol. 88, No. 12, January 19, 2023, 16 CFR Part 910 at 3483. [5] Id. [6] Federal Register, vol. 88, No. 12, January 19, 2023, 16 CFR Part 910 at 3509. [7] Federal Trade Commission, 16 CFR, Part 910, §910.3 Exception, January 19, 2023. [8] West Virginia v. EPA, 142 S. Ct. 2587 (2022). [9] The Changing Public Policy and Legal Landscape Affecting Noncompete, Paul J. Schneider, JD, LLM, Journal of Financial Service Professionals, January, 2023. [10] Id. [12] West’s F.S.A. § 542.335 (2022). [13] West’s F.S.A. § 542.336 (2019). [14] The Changing Public Policy and Legal Landscape Affecting Noncompetes, Paul J. Schneider, JD, LLM, Journal of Financial Service Professionals, January, 2023. [15] After 200+ Years Under State Law, FTC Proposes to Ban Noncompetes in Unauthorized Power Grab, Erik w. Weibust, Peter Steinmeyer, and Stuart Gerson, Washington Legal Foundation, Legal Backgrounder, January 12, 2023.

|

||

Forbes Corner

8 Lessons For George Harrison’s 80th BirthdayWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

George Harrison’s 80th birthday was February 25 of this year, and in preparing for a live webinar with his first wife, Pattie Boyd, I have been struck by the following lessons that can be learned from his life and experience… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

For Finkel’s FollowersFive Destructive Management Behaviors That You May Be Doing |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

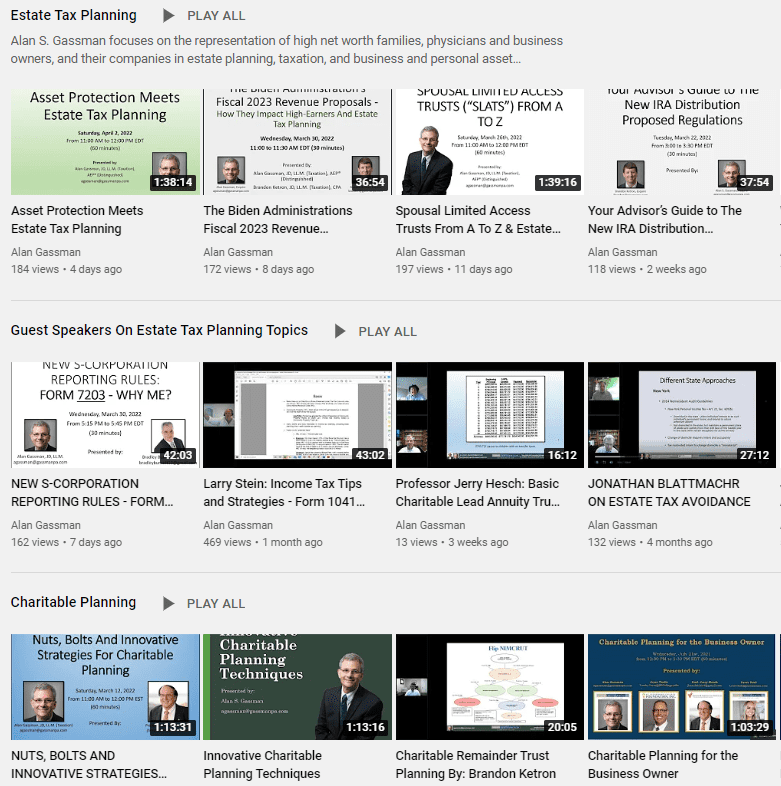

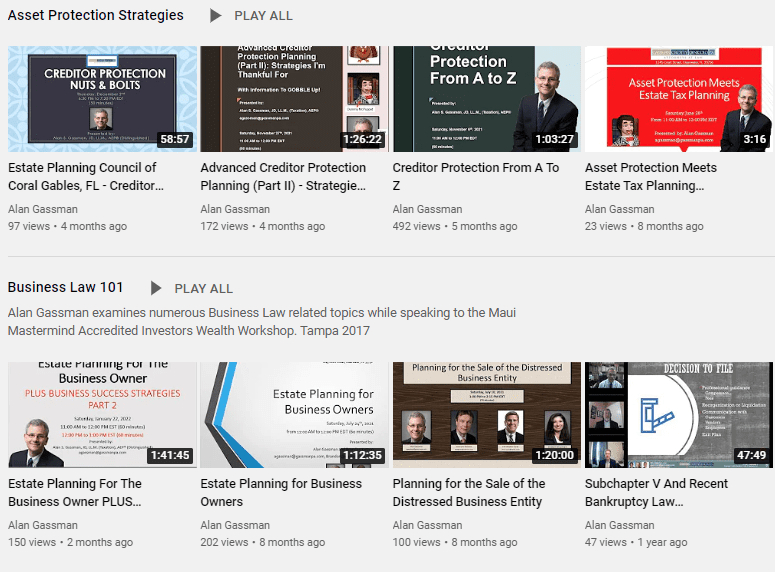

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

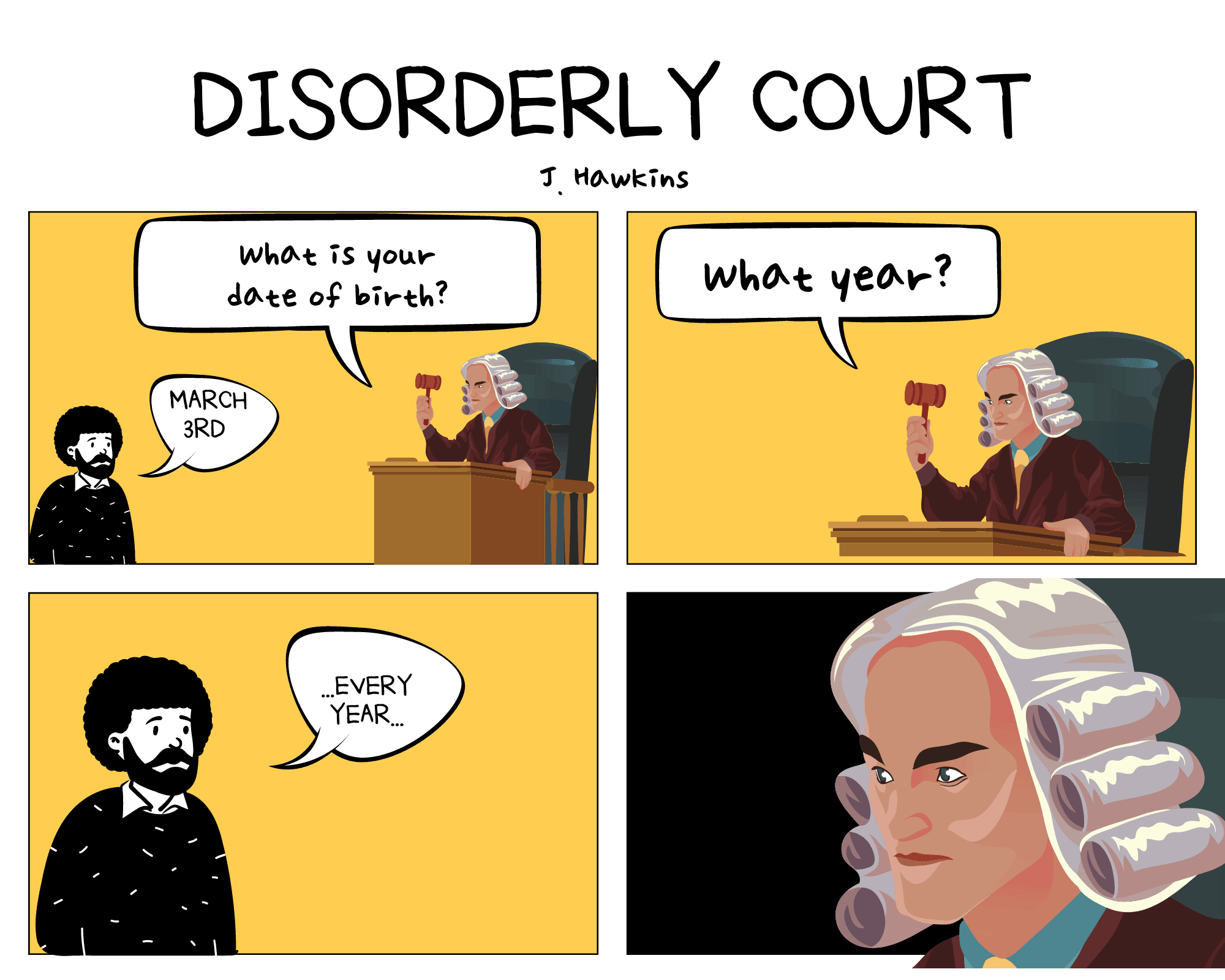

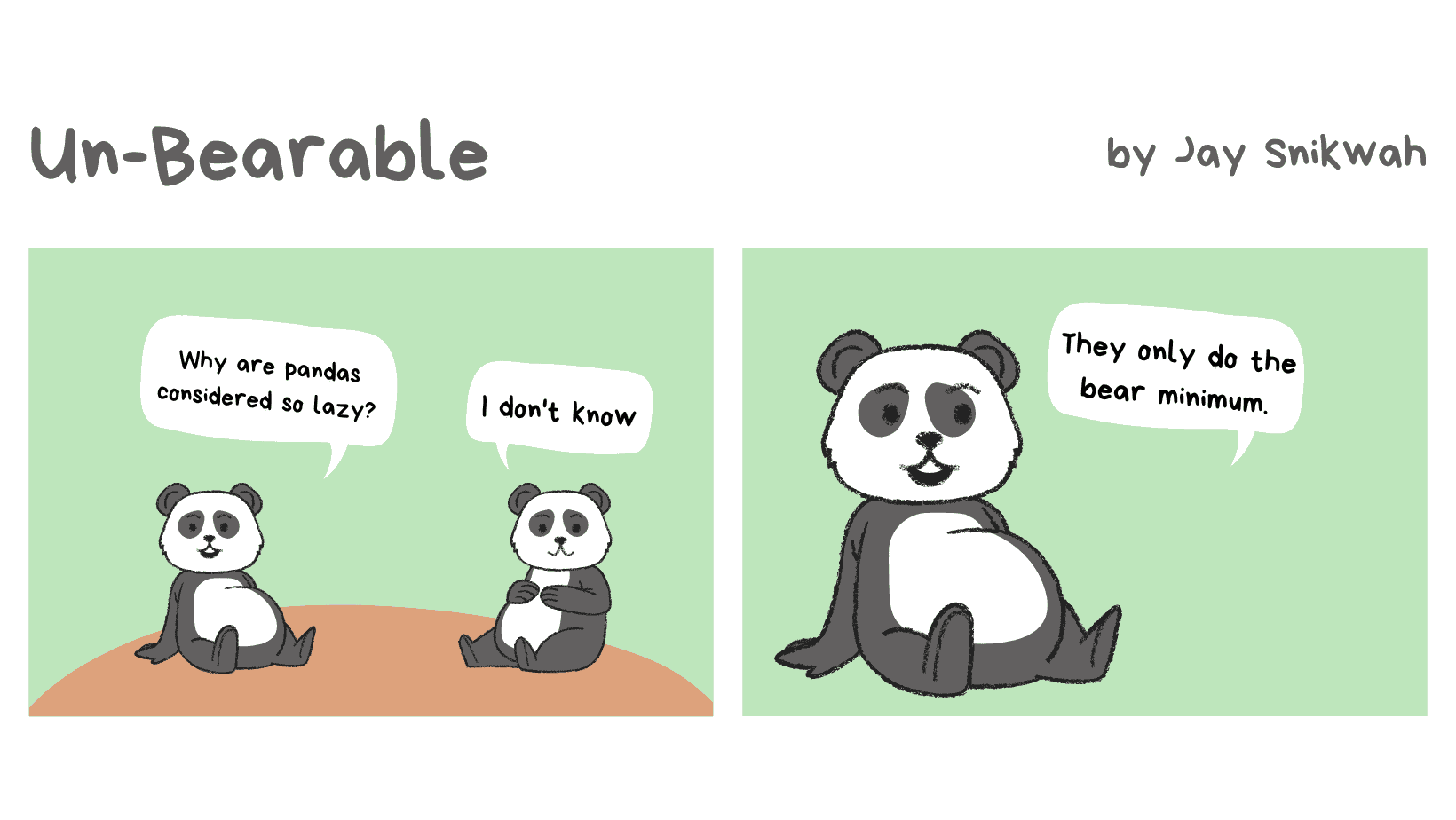

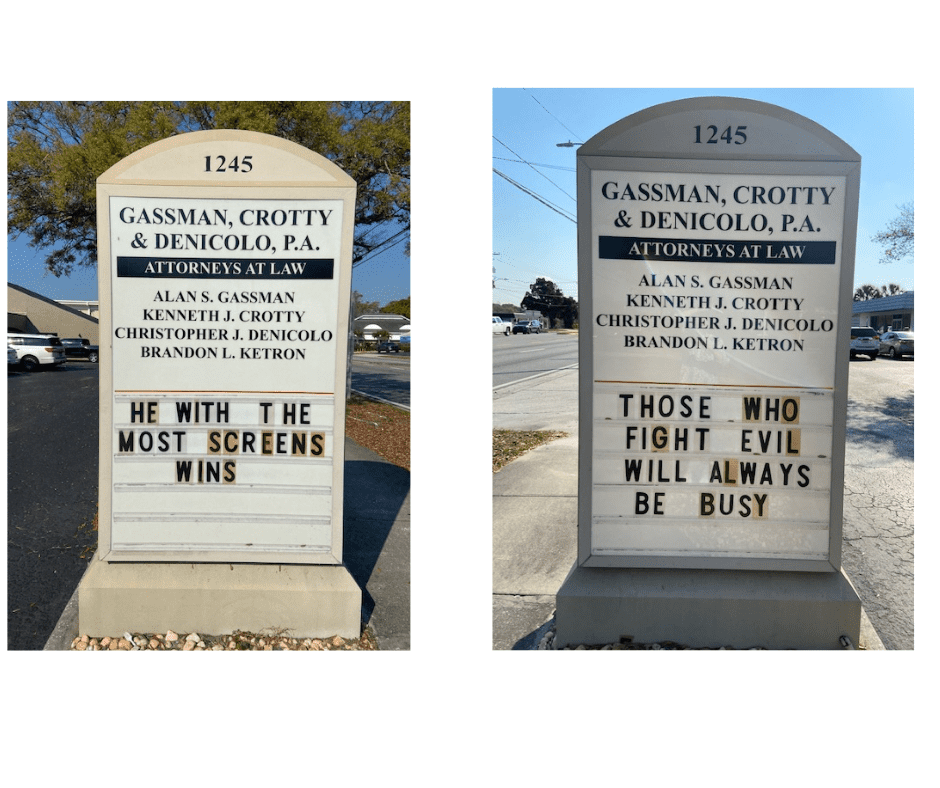

HUMOR

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|