The Pattie Boyd Report – Issue 334

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, February 16, 2023The Pattie Boyd Report – Issue #334

REGISTER HERE FOR NON-CPE CREDIT Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Alan Gassman Having trouble viewing this? Use this link |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Qualified Longevity Annuity Contracts Under the Secure Act 2.0Written By: Jason McCosby & Brandon Galvao Article 2Unique Tax Saving Strategy For Net Unrealized Appreciation on Company StockWritten By: Jill Ashley, CPA, Law Degree Candidate Article 3Proposed Ban on Non-Compete AgreementsWritten By: Jill Ashley, CPA, Law Degree Candidate Forbes CornerNew Tax Law Rewards Charitable IRA Retirees With A $50,000 Income Tax Deferral OpportunityWritten By: Alan Gassman For Finkel’s Followers3 Signs You Have Control IssuesWritten By: David Finkel Free Saturday WebinarEstate Tax Planning From Basic to BeyondPresented By: Alan Gassman More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Increasing Diversity in the Estate-Planning Field

Alan Gassman details the concrete steps he’s taking toward inclusion. I’ve heard many discussions and presentations on the importance of increasing diversity in the estate-planning field. But putting these thoughts into practice isn’t always easy. As I was networking with my colleagues at the Heckerling Institute on Estate Planning, I spoke with one attorney, Alan Gassman of Gassman, Crotty, and Denicolo, P.A., who’s created a program to increase diversity by partnering with Stetson University College of Law in Gulfport, Fla., to create an Estate Planning Council Diversity Fellowship and Award. The goal of the program is to introduce estate planning and elder law as a viable career opportunity for students of color by enabling two students to be selected for a two-semester fellowship beginning in fall 2023. Each fellow will receive an award of $1,500 per semester. They will join an estate-planning council and be mentored by two members of that group. I asked Alan what motivated him to create the program and to explain the details. Here’s his response: Motivation Given that when I started to practice law in Clearwater, Fla., in 1985, I wasn’t able to join certain clubs or to be involved with certain law firms or events that, quite frankly, gave other professionals opportunities that I didn’t have. My thought was to provide the opportunities that I found by being able to join and be active in the Pinellas County Estate Planning Council to others who wouldn’t have these available to them. I therefore joined NAEPC’s Diversity Committee but found no clear path of conduct that I could engage in to cause “diversity to happen.” Last summer, I taught a course on Law Office Management and Professional Achievement at Stetson Law School and met several students who didn’t come from wealthy or well-educated families and felt they could use interaction with a local estate-planning council while in law school. After a few months of attending diversity committee meetings, I realized that there was a natural need for students of color in law school to be involved in estate-planning councils and for them to mentor and nourish these students. CLICK HERE TO CONTINUE READING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Internal Revenue Service has released the Applicable Federal Rates (AFRs) for January 2023 and February 2023 Here are the rates for January 2023:

Here are the rates for February 2023:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Qualified Longevity Annuity Contracts Under the Secure Act 2.0

Written By: Jason McCosby & Brandon Galvao A Qualified Longevity Annuity Contract (QLAC) is a special type of deferred annuity contract generally purchased after age 55[1] from a life insurance company, using funds held in a traditional IRA, 401(k), or other qualified retirement account. Like many traditional deferred annuity contracts, the insurer guarantees equal annual lifetime payments to annuitants to help ensure they do not outlive their savings. Annual payouts begin at a predetermined date and extend over an annuitant’s lifetime or for a specified term of years. Payments under a QLAC may begin as early as age 72 or as late as age 85. What makes the QLAC special is that the Secure Act 2.0, effective December 29, 2022[2], removed several restrictions related to QLACs. Under the revised rules:

Thus, the Secure Act 2.0 helped resolve a predicament for individuals who owned a deferred annuity in their IRA and reached the age requiring minimum distributions when the annuity did not yet permit payouts.

For example, an individual with qualified retirement accounts valued at $300,000 could invest up to $200,000 in a QLAC in 2023, while RMDs would be required only on $100,000 non-QLAC assets until age 85 or when the QLAC distributions begin, if earlier. Under Internal Revenue Code (IRC) Section 401(a)(9), an IRA, as defined in 408(a) or (b), is subject to the required minimum distribution rules, as laid out in IRC Section 401(a)(9). Per Treasury Tax Regulation Section 1.401(a)(9)-5[4] the value of a QLAC will not be included in the IRA balance for determining the annual minimum distribution requirement for said IRA. The regulations, issued in 2014, state that the balance invested in the QLAC will not be included in the calculation of the Required Minimum Distribution (RMD) until the QLAC begins issuing the income or the owner turns age 85, whichever occurs first. Inflation Factors and Cost of Living Adjustments to Consider Before Investing in a QLAC:

However, rather than requiring strictly equal annual payouts, there are now occasions where QLAC payments are permitted to increase annually. Some insurance companies have stepped up to offer QLACs that permit annual Cost of Living Adjustments (COLAs) to help reduce the impact of inflation. Under U.S. Treasury Regulations, QLAC payments may increase:[6]

The “Short Free Look Period” for QLAC Purchases: QLACs are permitted to include a provision under which the purchaser has the option to rescind the purchase of the contract, within a period not exceeding 90 days from the date of the purchase, known as the “Short Free Look Period.” QLACs Are Intended to Supplement Other Sources of Retirement Income: It is important to note that QLACs are not intended to be an individual’s sole-source of retirement income, but instead, are intended to supplement other sources. However, to get the benefits of this supplement, individuals are subject to some additional requirements to qualify the annuity as a QLAC. To qualify as a QLAC, a contract is not permitted to allow for any commutation benefit, cash surrender value, or any other similar feature. During the issuance, the contract must state its intended purpose as a QLAC. Further, distributions under a QLAC must satisfy the generally applicable requirements under 26 U.S.C. § 401(a)(9). These requirements, namely the RMD requirements, are supplemented by Treasury Tax Regulation Section 1.401(a)(9)-5, giving QLACs preferential treatment. Planning For Financial Uncertainty: Given the current $200,000 maximum allowed for funding QLACs and given that funds are tied up until the payout begins at the age you chose when you purchased the contract and that payout age cannot be changed after your 90-day “short free look period,” you might consider purchasing smaller QLAC contracts over several years. Owning separate QLACs provides as opportunity to ladder the future payouts to begin at different ages up until age 85 when annual payouts become mandatory. Joint and Survivor Benefits of a QLAC in the Event of Divorce: The Secure Act 2.0 clarified confusion in circumstances when individuals purchased QLACs choosing joint and survivor annuity benefits, and later divorced. Under the clarified rules, a divorce or legal separation occurring before annuity payments begin under the joint and survivor annuity contract will not affect permissibility of joint and survivor benefits, if the divorce or separation instrument specifically provides for the spouse remaining as the survivor beneficiary.[7] For example, if you intend to maintain that spouse as the beneficiary after the divorce/separation, you should make sure that the separation instrument provides for this, with language indicating that the former spouse is entitled to the survivor benefits under the contract, or that the former spouse is treated as a surviving spouse for purposes of the contract. QLAC Payout Options to Choose From: There are four standard payout options for QLACs: a single life annuity, a joint and survivor annuity, a period certain annuity, and a return of premium annuity. Under a single life annuity, the individual will receive a guaranteed income for the remainder of his/her life. The joint and survivor annuity option is similar, but following the individual’s death, a reduced amount of income flows to the surviving beneficiary. Under a period certain annuity, the individual receives guaranteed income, for a number of years specified in the contract, regardless of whether or not they are alive – the post-death payments will follow the estate plan of the deceased. Lastly, under a return of premium annuity, the individual receives a guaranteed income stream for life, but after their death, any remaining annuity funds are paid to the individual’s beneficiaries – passing by operation of law, in contrast to the period certain annuity. These subtle differences may be important when choosing an annuity that outlives the original beneficiary. It is also important to note that annual payment amounts are typically reduced for joint and survivor annuities and return of premium annuities, to account for the after-death payments. Below are three tables, outlining sample QLAC payouts currently posted on the websites of various insurers. Before purchasing a QLAC, prudence requires comparing the contract options and features in addition to the monetary payouts offered by several insurers as well as the financial stability of the insurer guaranteeing the payouts.[8] All three samples are based on the following scenario: A Florida man (primary annuitant), born 07/29/1959, and his wife (secondary annuitant), born 05/14/1958. The man purchases a QLAC with a $100,000 premium with payments beginning on the date the primary annuitant reaches age 85, i.e. 07/29/2044. All three QLACs offer a refund upon death, each has a 100% continuation level, and all have a qualified tax status. The QLAC offered by Insurer #1 pays $3,444.38/month, the QLAC offered by Insurer #2 pays $2,750.57/month, and the QLAC offered by Insurer #3 pays $2,419.53/month. It is important to note that despite the charts ending at age 100, payments would continue for the entire lifespan of the annuitant; there is no cited “cut-off” age within these contracts.

Table 1: Insurance Company #1

Table 2: Insurance Company #2

Table 3: Insurance Company #3

[1] Kiplinger’s Personal Finance, Jerry Golden, January 31, 2023, “What is a QLAC and How Does It Work?” [2] Secure 2.0 Act became effective 12/29/22, but the Treasury Regulations are not required to be updated until 2024. Full details regarding the changes are included within the Act, itself, but may not be apparent if only searching the Treasury Regulations, alone. [3] Supra, Kiplinger’s Personal Finance, Jerry Golden. [4] 26 CFR 1.401(a)(9)-5(A3)(d); The account balance does not include the value of any qualifying longevity annuity contract (QLAC), defined in A-17 of § 1.401(a)(9)-6, that is held under the plan. This para |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thursday, February 16, 2023 |

LISI (Not So Free) |

Alan Gassman Presents: DESIGNING YOUR MEAL AT THE SLAT-O-TERIA – DIFFERENT KINDS OF SLATS AND HOW THEY CAN BE DESIGNED, DRAFTED & IMPLEMENTED – WITH SAMPLE CLAUSES AND CLIENT EXPLANATION LETTERS 3:00 PM to 4:15 PM EST (75 minutes) |

REGISTER HERE |

| Saturday, February 18 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman presents: ESTATE TAX PLANNING FROM BASIC TO BEYOND 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT |

|

Thursday, February 23, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Kettering Health Foundation Alan Gassman Presents: 4 HOT TOPICS WITH SOLID ACTION ITEMS 12:00 PM to 12:30 PM EDT (30 minutes) |

|

| Friday, February 24, 2023 | Stetson Business Law Review Tax Symposium |

Alan Gassman, Jonathan Blattmachr, Marty Shenkman & Brock Exline Present: ESTATE AND TAX PLANNING FOR COMMUNITY PROPERTY IN NON-COMMUNITY PROPERTY STATES: OPPORTUNITIES, STRATEGIES AND PITFALLS Time: 12:00 PM to 12:30 PM EST (30 minutes) |

Coming Soon! |

| Saturday, February 25, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman & Marty Shenkman Present: PRACTICAL PLANNER QUARTERLY 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE |

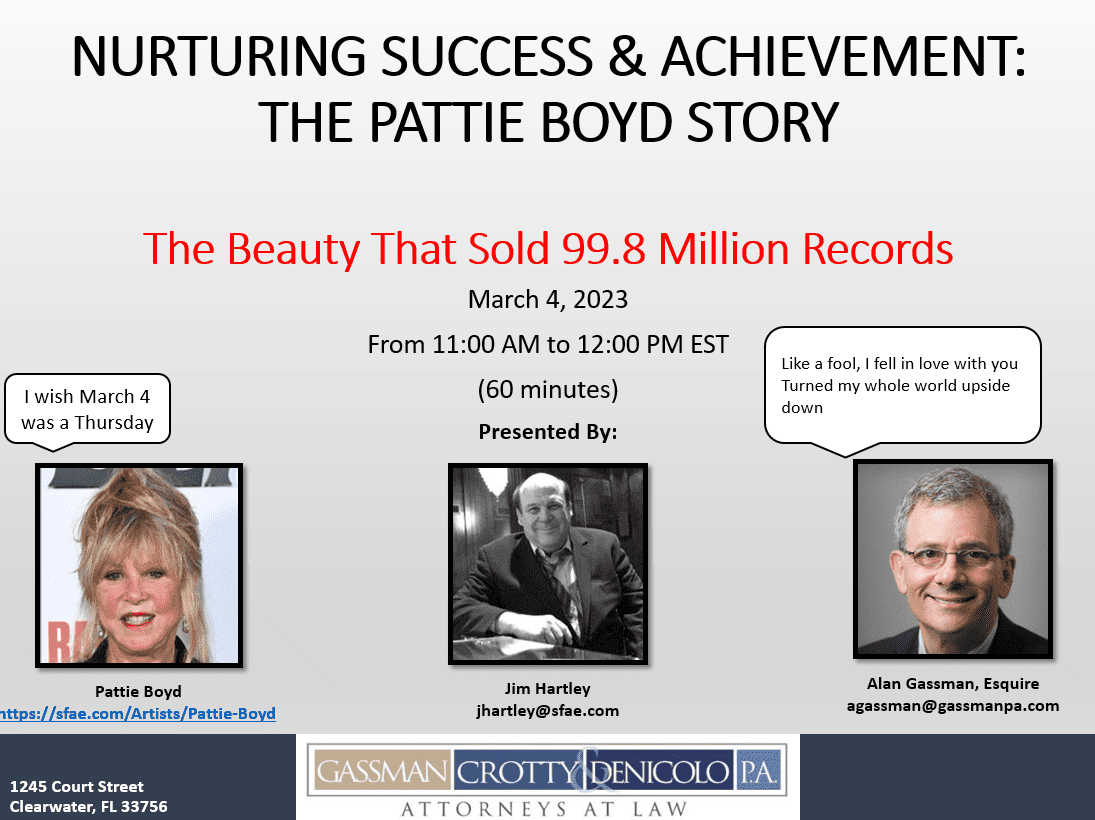

| Saturday, March 4, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

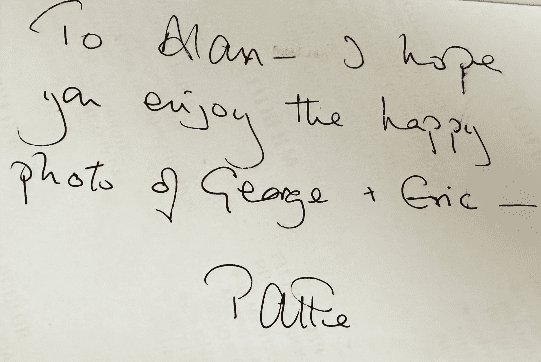

Alan Gassman, Jim Hartley & Pattie Boyd Present: NURTURING SUCCESS & ACHIEVEMENT: THE PATTIE BOYD STORY 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT

|

|

Tuesday, March 7, 2023 |

New Jersey Estate Planning Council (Not So Free)

|

Alan Gassman Presents: WHAT NEW JERSEY ESTATE PLANNERS NEED TO KNOW ABOUT FLORIDA LAW 8:05 AM to 9:05 AM EST (60 minutes) |

REGISTER HERE |

| Friday, March 17, 2023 |

LISI (Not So Free) |

Alan Gassman Presents: ESTATE AND BASIS PLANNING WITH JOINT TRUSTS INCLUDING THE JEST (JOINT EXEMPT STEP-UP TRUST) 2:00 PM to 3:00 PM EST (60 minutes) |

REGISTER HERE |

|

Tuesday, April 18, 2023 |

Boca Raton Estate Planning Council (Not So Free) |

Alan Gassman Presents: ESTATE AND ESTATE TAX PLANNING FOR FLORIDIANS: INCLUDING SLATs, COMMUNITY PROPERTY TRUSTS, AND CREDITOR PROTECTION IMPLICATIONS 6:50 PM to 7:40 PM EST (50 minutes) |

Coming Soon! |

|

Thursday, April 20, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Kettering Health Foundation Alan Gassman Presents: PUTTING ASSET PROTECTION INTO AN ESTATE PLAN 12:00 PM to 12:30 PM EST (30 minutes) |

|

| Thursday, April 27, 2023 |

LISI (Not So Free) |

Alan Gassman Presents: CREATIVE AND DYNAMIC CHARITABLE PLANNING TECHNIQUES – WHAT YOU DO NOT KNOW CAN HURT YOUR CLIENT 1:00 PM to 2:00 PM EST (60 minutes) |

REGISTER HERE |

| Thursday, April 27, 2023 |

Financial Experts Network (Free) |

Alan Gassman Presents: MATHEMATICS TO ESTATE TAX PLANNING 1:00 PM to 2:00 PM EST (60 minutes) |

Coming Soon! |

|

Thursday, May 18, 2023 |

Kettering Health Foundation (Not So Free) |

Kettering Health Foundation Half or Full Day Event Please Support this Important Program 3535 Southern Blvd. Kettering, OH 45429 |

Coming Soon! |

| Thursday, June 1, 2023 |

Financial Experts Network (Free) |

Alan Gassman Presents: ALPHABET SOUP: PLANNING WITH LLCS, IDGTS, GRATS, AND OTHER ACRONYMS 1:00 PM to 2:00 PM EST (60 minutes) |

Coming Soon! |

|

Wednesday, October 11, 2023 |

National Association of Estate Planners & Councils (Not So Free) |

Alan Gassman Presents: DESIGNING AND IMPLEMENTING ESTATE PLANNING STRUCTURES WITH THE IRS IN MIND: AUDIT TRIGGERS & CONSIDERATIONS ASSOCIATED THEREWITH 3:00 PM to 4:00 PM EST (60 minutes) |

REGISTER HERE |

|

November, 2023 |

Birmingham, AL Estate Planning Council |

Alan Gassman and Brandon Ketron Present: ESTATE TAX STRATEGIES, HOT TOPICS AND YEAR-END PLANNING — BETTER THAN BBQ, HOTTER THAN SUMMER (100 minutes) |

Coming Soon! |

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more!

The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording.

Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library.

HUMOR

“What I find most disturbing about Valentine’s Day is, look, I get that you have to have a holiday of love, but in the height of flu season, it makes no sense.” – Lewis Black

THE BALCONY SCENE, IF ROMEO AND JULIET WERE ATTORNEYS

Written By: Ron Ross

JULIET: Deny thy father, and refuse thy name, and petition in chancery court for a name change, and file before the office of vital statistics.

ROMEO: My name, dear saint, is hateful to myself, because it is an enemy to thee. I will therefore show that my petition is filed for no ulterior or illegal purpose and granting it will not in any manner invade the property rights of others, according to Title VI, Chapter 68.07 (j).

JULIET: How camest thou hither, tell me, and wherefore? The orchard walls are high and hard to climb, and a person who, without being authorized, licensed or invited, willfully enters upon or remains in any property violates Title XLVI, Chapter 810.09 and the place death, if any of my kinsmen find thee here. Does thou love me? I know thou wilt say ‘Aye’, thou may prove false, at lover’s perjuries, they say, ‘Jove Laughs’.

ROMEO: Lady, by the blessed moon, I swear

JULIET: O, swear not by the moon, the inconstant moon.

ROMEO: Then I call the judge from “Merchant of Venice” and a stenographer.

JUDGE AND STENOGRAPHER: Hello.

ROMEO: Who will now depose me, under rule 1.310 of the rules of civil procedure, recording my oath or affirmation taken or administered before an officer authorized under s. 92.50, knowing that the penalty for perjury, under s775.082, s775.083 or s775.084 may result in imprisonment for up to one year, a fine of $1,000 dollars, or both, since this is not a legal proceeding for a capital felony.

JUDGE: Ready, my lady?

(JULIET HAS FALLEN ASLEEP)

Gassman, Denicolo & Ketron, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200

Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|

|

|

|

|

|