The Thursday Report – Issue 329

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, September 15th, 2022September – Issue #329

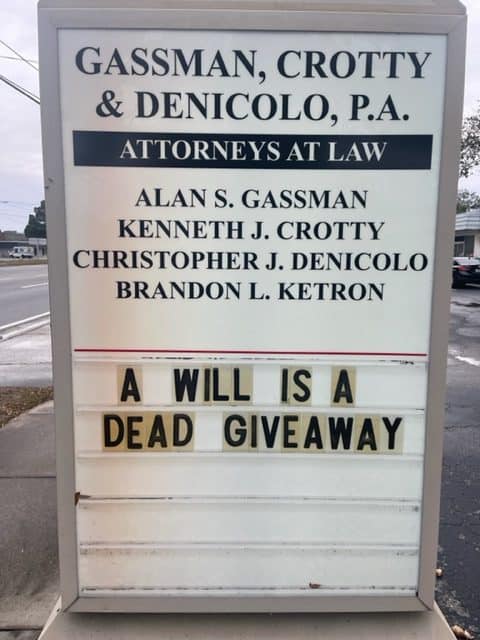

The world pays tribute to Her Majesty the Queen, as she reigned queen for 70 years. We know her for her heroic role in joining the Women’s Auxiliary Territory Service (ATS), her guidance in the transformation to commonwealth, making succession more equitable, her charity work, supporting racial justice and much more. We give our condolences to the royal family in their time of mourning. Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Edited By: Brandon Ketron Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1COVID-19: Updated CDC and EEOC Guidance – September 2022Written By: Joan M. Vecchioli, Colleen M. Flynn, & Rachael L. Wood Article 2Designated and Disregarded Beneficiaries Under the New IRA Proposed RegulationsWritten By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished), Brandon Ketron, JD, LL.M. (Taxation), CPA & Christopher Denicolo, J.D., LL.M. Article 3IRS Issues Proposed Regulations for the Present Value of

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1COVID-19: Updated CDC and EEOC Guidance

Written By: Joan M. Vecchioli (joanv@jpfirm.com), Colleen M. Flynn (colleenf@jpfirm.com) & Rachael L. Wood (rachaelw@jpfirm.com) Although it has been over two years since our first article concerning COVID-19, it is still making the news with updates from both the Centers for Disease Control and Prevention (“CDC”) and the Equal Employment Opportunity Commission. REVISED ISOLATION GUIDANCE Recently, the CDC revised its COVID-19 guidance concerning what do to if an individual is exposed to COVID-19 or has COVID-19. Notably, the CDC no longer requires individuals who have not been vaccinated or are not up to date on their vaccinations to isolate after exposure. Rather, the CDC now recommends that individuals (regardless of vaccination status) who have been exposed to COVID-19 wear a high-quality mask, such as an N95, for ten full days after exposure and test after five days. If an individual tests negative, the individual should still continue to wear a high-quality mask until the expiration of the ten-day period. If the individual tests positive, then the individual should isolate immediately. Individuals may end isolation after five days from the date of a positive test (or symptom onset if they develop after the positive test) if the individual either 1) had no symptoms or 2) had symptoms and the symptoms are improving and the individual is fever free for 24 hours without fever reducing medication. Individuals should still wear a mask through day ten, unless the individual receives two negative antigen tests at least 48 hours apart prior to the expiration of the ten-day period. Employers should review their policies concerning returning to work after a known exposure or positive test result to make sure that they are consistent with this new CDC guidance. COVID-19 AND THE ADA Over the summer, the Equal Employment Opportunity Commission (“EEOC”) updated its guidance titled “What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws” to reflect the changing landscape of COVID-19. These updates include guidance on mandatory screening tests, returning to work, pre-employment screening and job offers, reasonable accommodations and confidentiality of test results, among other topics. MANDATORY SCREENING TESTS Of particular importance, the EEOC has clarified that an employer may only implement mandatory screening tests for COVID-19 if the employer can show that the screening testing is job-related and consistent with business necessity in accordance with the Americans with Disabilities Act (“ADA”). In determining whether screening testing meets the “business necessity” standard, employers should consider:

The EEOC cautions that in making these assessments employers should review the latest CDC guidance and other relevant sources to determine whether a screening test is appropriate for employees. The EEOC also clarifies that in accordance with CDC guidance, an antibody test does not meet the ADA’s business necessity standard for medical examinations or inquiries for employees and cannot be required before allowing employees to re-enter the workplace. RETURNING TO WORK The EEOC points out that the ADA does allow an employer to require a note from a qualified professional explaining that it is safe for an employee to return to work and that the employee is able to perform the job duties after an employee is out of work due to COVID-19. The EEOC also states, however, that employers may follow CDC guidance to determine whether it is safe to allow an employee to return to the workplace without confirmation from a medical professional. PRE-EMPLOYMENT SCREENING AND JOB OFFERS Under the updated EEOC guidance, an employer may screen an applicant for symptoms of COVID-19 after making a conditional job offer, as long as the employer does so for all entering employees in the same type of job. An employer may screen an applicant in the pre-offer stage only if the employer screens everyone (i.e., applicants, employees, contractors, visitors, etc.) before permitting entry to the workplace and if the screening is limited to the same screening that everyone else undergoes. If an applicant tests positive for COVID-19, has symptoms of COVID-19, or has been exposed recently to COVID-19, an employer should consult with CDC guidance to determine when the individual may enter the workplace. The EEOC explains that an employer may withdraw a job offer if 1) the job requires an immediate start date, 2) the CDC guidance recommends the person not be in proximity to others, and 3) the job requires such proximity to others, whether at the workplace or elsewhere. Employers should be careful to consider a revised start date or temporary telework given that for some individuals there may be only a short period of time required for isolation. While an employer may withdraw a job offer under the above conditions, an employer may not postpone the start date or withdraw a job offer because of the employer’s concern that the individual is older, pregnant or has an underlying medical condition that puts the individual at risk from COVID-19. If the individual has an underlying medical condition that is a disability, the employer must determine whether the individual’s disability poses a “direct threat” by starting immediately and, if so, what reasonable accommodations can be made. REASONABLE ACCOMMODATIONS The updated EEOC guidance makes clear that an employee or a third-party, such as the employee’s physician, must let the employer know that the employee needs a reasonable accommodation because the employee has one of the medical conditions that the CDC says may put a person at higher risk for severe illness from COVID-19. After receiving a request for accommodation, the employer may ask questions or seek medical documentation to help decide if the individual has a disability under the ADA and if there is a reasonable accommodation, barring undue hardship, that can be provided. When the employer knows that an employee has one of these conditions and is concerned about the employee’s health, but the employee has not requested a reasonable accommodation, the employer is generally not required to take action in this situation. As a reminder, the ADA requires that an employee’s disability pose a direct threat to the employee’s health or safety that cannot be eliminated or reduced by reasonable accommodation before an employee may be excluded from the workplace. If an employee does need a reasonable accommodation, the EEOC provides examples that these accommodations might include additional or enhanced protective gear, air filtration measures, increasing space between the employee and others, the elimination or substitution of “marginal” functions, telework, modifications of work schedules, or moving the location where the individual performs work. CONFIDENTIAL MEDICAL INFORMATION An employee’s COVID-19 test results and vaccine status are confidential medical information under the ADA. This information may be shared with employees who need it to perform their job duties, but those employees must also keep the information confidential. Employers should also be aware that the EEOC recently resolved a claim under the Genetic Information Non-Discrimination Act (“GINA”) where the employer was collecting employees’ family members’ COVID-19 testing results. In the press release, the EEOC explained that GINA prohibits employers from requesting or requiring genetic information about applicants’ or employees’ family members and that “genetic information” includes the manifestation of a disease or disorder in an employee’s family members. WHAT TO DO NOW Now is a good time for employers to review their COVID-19 policies and procedures to make sure that they are in compliance with state and federal law and regulatory guidance. Policies written during the early stages of the pandemic may not reflect the changes in what we know now about COVID-19 and may not be in compliance with current laws, such as Florida Statute § 381.00317, which prohibits a private employer from imposing a COVID-19 vaccination mandate without providing certain individual exemptions. Employers can review the full, updated EEOC guidance at What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws. Joan M. Vecchioli is a partner in the Clearwater office and is Board Certified in Labor and Employment Law by the Florida Bar. THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL ADVICE. LEGAL ADVICE CANNOT BE GIVEN WITHOUT INFORMATION ABOUT YOUR SPECIFIC SITUATION |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2Designated and Disregarded Beneficiaries Under the New IRA Proposed Regulations

Written By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished), Brandon Ketron, JD, LL.M. (Taxation), CPA & Christopher Denicolo, J.D., LL.M. The Proposed Regulations identify two tiers of Designated Beneficiaries.[1] Tier I includes any beneficiaries of the trust whose benefits “are neither contingent upon nor delayed until the death of another trust beneficiary” who did not predecease the Plan Participant. Tier II includes “any beneficiaries of the trust who could receive amounts in the trust . . . that were not distributed to the [Tier I] beneficiaries, [but only if they cannot benefit until after the death of the Tier I beneficiary or beneficiaries].” If the beneficiary of the See-Through Trust is another trust, the beneficiaries of the second trust are treated as being beneficiaries of the first trust and thus they are considered Designated Beneficiaries. There are multiple situations under the Proposed Regulations in which a beneficiary can be “disregarded” for purposes of determining which payout method applies: 1. If one of the following events occur prior to September 30th of the calendar year following the year of the Plan Participant’s death: A. A beneficiary predeceases the Plan Participant. B. A beneficiary is treated as having predeceased the Plan Participant by reason of a simultaneous death provision under applicable state law or via a qualified disclaimer. C. A beneficiary receives the entire benefit that the beneficiary is entitled to. D. If a power of appointment is exercised in favor of one or more beneficiaries, then the other permissible appointees are disregarded. 1. An Accumulation Trust Beneficiary Who Can Only Benefit After the Death of Tier I and Tier II Beneficiaries. For Accumulation Trusts only, when entitlement of such beneficiary is conditioned upon the death of any and all Tier I Beneficiaries and at least one Tier II Beneficiary, this type of beneficiary sometimes is referred to as a “Tier III Beneficiary.” The Preamble to the Proposed Regulations provides the following example to illustrate this rule: [A]ssume that an IRA names a see-through accumulation trust that requires the trustee to pay specified amounts from the trust to the employee’s surviving spouse. Upon the spouse’s death, the see-through trust is to terminate and the amounts remaining in the trust are to be paid to the employee’s brother (who is not more than 10 years younger than the employee, and thus is an Eligible Designated Beneficiary). Further if the employee’s brother survives the employee but predeceases the surviving spouse, then the amounts remaining in the trust after the death of the surviving spouse are to be paid to a charity. In that case, the charity is disregarded as a beneficiary of the employee because the charity could receive only amounts in the trust that are contingent upon the death of the employee’s brother, whose only interest was a residual interest (that is, an interest in the amounts remaining in the trust after the death of the surviving spouse). In contrast, the charity would be treated as a beneficiary of the employee if the brother could receive amounts in the trust not subject to any contingencies or contingent upon an event other than the death of the surviving spouse (such as the surviving spouse’s remarriage). 2. A Beneficiary Who Can Only Inherit by Surviving a Minor Under a Trust That Pays Out Entirely On or Before the Minor’s 31st Birthday (The “Age 31 Outright Distribution Accumulation Trust”). A beneficiary of a See-Through Trust may also be disregarded when entitlement is conditioned upon the death of a minor (not necessarily a minor child of the Plan Participant) who has not reached the age of majority (21) if the terms of the trust requires full distribution to such minor by the later of (1) the 10th calendar year following the calendar year of the Plan Participant’s death, or (2) the end of the 10th calendar year following the calendar year in which that minor attains age 21.[2] The following example from the Preamble illustrates this rule: Assume an employee names an [Accumulation] trust as the sole beneficiary, the trust permits specified amounts to be paid to the employee’s niece until the niece reaches age 31 (age of majority plus 10 years). The trust is scheduled to terminate with a full distribution of all trust assets to the niece when the niece reaches age 31, but if the niece dies before this scheduled termination, then the amounts remaining in the trust will be paid to the employee’s sibling. In that case, the only beneficiary designated under the plan for purposes of section 401(a)(9) and these regulations is the employee’s niece because the employee’s sibling is disregarded under the exception described in the preceding paragraph. However, if the see-through trust terms do not require a full distribution of amounts in the trust representing the employee’s interest in the plan until the niece reaches age 35, then this exception does not apply, and both the employee’s niece and sibling are treated as beneficiaries designated under the plan for purposes of section 401(a)(9) and these regulations. 3. Remainder Beneficiaries of Conduit Trusts Continue to Be Disregarded. Remainder beneficiaries of Conduit Trusts continue to be disregarded. In other words, only beneficiaries that could receive amounts in trust that are neither contingent upon, nor delayed until, the death of another trust beneficiary (Tier I Beneficiaries) must be taken into account. The following example derived from the Proposed Regulations illustrate this rule: [3] Cathy dies at the age of 30 leaving her retirement plan payable to a trust for the benefit of her 35 year old sibling Doug. If and when Doug dies, the trust will pass to Edward, who is 50. Doug is an Eligible Designated Beneficiary because he is not less than ten years younger than Cathy. Since the trust is a Conduit Trust, Edward’s interest can be disregarded and distributions can be paid out over Doug’s life expectancy as an Eligible Designated Beneficiary; however if the Trust was an Accumulation Trust, Edward would be considered a designated beneficiary and, since all trust beneficiaries are not Eligible Designated Beneficiaries, the 10-Year Rule would apply. If the Accumulation Trust instead provided that it was for the benefit of Doug, and that after the death of Doug the trust would be held for the sole benefit of Cathy’s 36 year old half-sibling Frank, and then would only benefit Edward if both Doug and Frank were deceased, then Edward would be disregarded and the lifetime payment rules could apply since all beneficiaries are Eligible Designated Beneficiaries. ______________________________________________________ [1] § 401(a)(9) did not categorize designated beneficiaries, however §1.401(a)(9)-(4)(f)(3)(I) provides that “[a]ny beneficiary who could receive amounts in the trust representing the employee’s interest in the plan that are neither contingent upon, nor delayed until, the death of another trust beneficiary who did not predecease (and is not treated as having predeceased) the employee; and any beneficiary of an accumulation trust that could receive amounts in the trust representing the employee’s interest in the plan that were not distributed to beneficiaries.” [2] § 1.401(a)(9)-4(f)(3)(ii). [3] Adaptation from Example 1 in the Proposed Regulations under § 1.401(a)(9)-4(f)(6)§§. (A) Facts. Employer L maintains a defined contribution plan, Plan W. Unmarried Employee C died in 2022 at age 30. Prior to C’s death, C named a testamentary trust (Trust T) that satisfies the requirements of paragraph (f)(2) of this section, as the beneficiary of C’s interest in Plan W. The terms of Trust T require that all distributions received from Plan W, upon receipt by the trustee, be paid directly to D, C’s sibling, who is 5 years older than C. The terms of Trust T also provide that, if D dies before C’s entire account balance has been distributed to D, E, will be the beneficiary of C’s remaining account balance. (B) Analysis. Pursuant to paragraph (f)(1)(ii)(A) of this section, Trust T is a conduit trust. Because Trust T is a conduit trust (meaning the residual beneficiary rule in paragraph (f)(3)(i)(B) of this section does not apply) and because E is only entitled to any portion of C’s account if D dies before the entire account has been distributed, E is disregarded in determining C’s designated beneficiary. Because D is an eligible designated beneficiary, D may use the life expectancy rule of § 1.401(a)(9)-3(c)(4). Accordingly, even if D dies before C’s entire interest in Plan W is distributed to trust T, D’s life expectancy continues to be used to determine the applicable denominator. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3IRS Issues Proposed Regulations for the Present Value of

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 4Excerpt from 50 Ways to Leave Your Legacy – Charitable Planning Strategies You Forgot or Didn’t Know about – Charitable Planning for Real Estate Investors, Developers, and Others

Written By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) CHAPTER 1:INTRODUCTION The Internal Revenue Code and Regulations encourage and influence charitable giving and activities by providing tax incentives and strict rules with respect to contributions and uses of monies and assets transferred to or for the use of charitable organizations and activities. This book is intended provide an intermediary and advanced summary of these rules, as they apply to affluent donors and those who have involvement with what can occur on the charitable playing field. This book is intended to be a practical and readable resource for professional advisors and dedicated charitable entity officers and employees, but does not cover many basic items, such as all of the nooks and crannies that exist for income tax purposes when an individual or business entity makes a charitable contribution, or all of the different types of charitable entities that may be used for tax and general charitable purposes. A. Charitable Tools and Primary Rules By very brief summary of the primary income tax rules relating to charitable giving, each U.S. taxpayer can deduct up to $300 in contributions made to entities that qualify as Public Charities or Private Operating Foundations, but not Private Non-Operating Foundations. Married couples filing jointly can take a total deduction of $600. For the 2021 tax year, those married and filing jointly can take a total deduction of $600. Further, individuals who itemize their deductions and therefore have more than $12,950 for 2022 in itemized deductions, if single, or $25,900 for 2022 in itemized deductions, if married, for 2022 can deduct charitable contributions. The itemized deductions include deductions permitted for real estate taxes (not exceeding $10,000 per taxpayer or jointly filing married couple), certain types and amounts of interest paid on a home and second home, medical and dental expenses exceeding 7.5% of the taxpayer’s adjusted gross income, charitable contributions, long-term care insurance premiums, certain casualty and theft losses, job expenses, and the miscellaneous deductions (limited to 2% of adjusted gross income). Many affluent taxpayers “bunch their deductions” by donating to charity every 2, 3, or 4 years instead of annually to be well over the standard deduction amount in the years they make transfers to charities. For example, a single individual who would normally give $10,000 per year to charity and has only $11,000 in itemized deductions other than charity could give $30,000 in 2022 to a donor-advised fund or other charity and have total deductions of $41,000 ($28,050 more than the individual itemized deduction amount) of $12,950 to save $15,170 in federal income taxes if he or she is in the 37% bracket. The donor advised fund may transfer $10,000 per year to Public Charities selected by the individual, and the individual may give another $30,000 to the donor advised fund in year 4. In addition to income tax savings there can be significant income tax savings or deferral if and when an IRA or pension or ordinary income vehicle is made payable to a 501(c)(3) organization or a charitable remainder trust. Additionally, a “complex trust” can pay all of its income to a charity and receive the equivalent of a 100% income tax deduction without regard to its adjusted gross income or the adjusted gross income of the grantor of the trust or its non-charitable beneficiaries. The $100,000 per year per donor “Qualified Charitable Distribution IRA Transfer Exception” allows charitable transfers to count towards the minimum distribution requirements and a tax-free transfer of IRA monies or assets from an IRA to a Public Charity or Private Operating Foundation (but not to a donor-advised fund) by an IRA holder who is at least 70½ years old. Many affluent charitable IRA owners therefore make transfers from the IRA to a Public Charity or Private Operating Foundation. While many donors give cash to charitable organizations, it is normally advantageous to give appreciated assets that would otherwise be subject to capital gains tax if they were sold. In general, the gift of an appreciated asset to a charitable organization will result in an income tax deduction based upon the tax basis, and not the fair market value, of the asset given, unless one of several exceptions apply. These rules sometimes work differently when the donation is to a particular kind of charitable organization. The discussion of the various kinds of charitable organizations is set forth below, but in general, Public Charities and Private Operating Foundations enjoy the best and same treatment when it comes to the donation of appreciated assets, with Private (Non-Operating) Foundations not being treated as well in many situations. A simplified explanation with respect to this is as follows: 1. Appreciated securities that qualify as appreciated long-term capital gain property can be donated to a Private Foundation, Private Operating Foundation, or a Public Charity for a fair market value income tax deduction of up to 20% of the adjusted gross income of the donor if the donation is to a Private Non-Operating Foundation, or up to 30% if the donation is to a Private Operating Foundation or a Public Charity. The donation of appreciated assets to a Private Operating Foundation or Public Charity will normally qualify for a tax deduction of up to 30% of adjusted gross income, as opposed to the 20% threshold that applies when appreciated securities are transferred to a Private Foundation, with the same 5-year carryover rule to applying. 2. If the donation exceeds the 20% or 30% threshold then it can be carried over for up to 5 subsequent calendar years. 3. No other appreciated assets besides appreciated marketable securities can yield a fair market value donation if given to a Private Foundation. Donations of long term capital gain assets other than marketable securities to a Private Foundation are valued at basis and can only offset a maximum of 20% of adjusted gross income. 4. Appreciated jewelry, physical artwork, and other tangible non-real-estate assets can be donated and deducted at fair market value, whether to a Private Foundation, a Private Operating Foundation, or a Public Charity as long as the asset or assets are donated for a use by the charity that is related “to the purpose or function constituting the basis for its exemption.” A few taxpayers will take advantage of the ability to give up to 60% of adjusted gross income if it is all given in cash. 5. This is why jewelry given to universities and other charities is often displayed, so as to be considered as used by the charitable organization, and why collections of cars, airplanes, or other valuable tangible assets are commonly given to museums that will display them or foundations that will loan them out to museums that are open to the general public. 6. Appreciated real estate and other assets not constituting marketable securities can be donated to a Private Operating Foundation or Public Charity for a fair market value deduction, but not to the extent that ordinary income would be recognized on the sale of the property such as to the extent that an IRC § 179 deduction was taken as “component depreciation” when the property was acquired or improved, or accelerated depreciation was taken. 7. Notwithstanding that a fair market value deduction may be permitted under the rules above, a taxpayer can elect to deduct the basis of the property instead of its fair market value in order to not be subject to the 20% or 30% limitation above and instead have a 50% limitation apply, as discussed below. 8. Cash donations to a Private Operating Foundation can be used to offset up to 60% of the donor’s adjusted gross income. 9. For example, donations of long term capital gain assets are valued at fair market value and can be deducted to the extent of 30% of adjusted gross income when made to a Private Operating Foundation.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

What the IRS Can Learn from The Florida Bar Tax Section: Comments To Clawback Proposed RegulationsWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

On July 26, 2022, the Tax Section of the Florida Bar (the “Tax Section”) submitted “Comments on Proposed Treasury Regulations Relating to the Basic Exclusion Amount Applicable to the Computation of Federal Estate and Gift Taxes.”… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s FollowersWhy “Staying On Top Of Everything” Can Be Bad For Business |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Saturday Webinar

Date: Saturday, September 17, 2022 Time: 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) Please Note: This is a complimentary webinar program. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. GUEST SPEAKER TRAVIS FINCHUM PRESENTS:

Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Humor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||