The Thursday Report – Issue 326

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, June 9th, 2022Issue #326

Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Starting next month, Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Florida Adopts 1,000 Year Trust LawWritten By: Alan Gassman, JD, LL.M., Samuel Craig, Stetson Law Student Article 2New SLAT Legislation Opens New Asset Protection Opportunities for Florida ResidentsWritten By: Alan Gassman, JD, LL.M., Christopher Denicolo, JD, LL.M. & Brock Exline, Stetson Law Student Article 3Green Book Proposals That Impact High-Earners and Estate Tax PlanningWritten By: Alan Gassman, JD, LL.M. & Kristen Sweeney Article 4Recent Letter to Co-Owners of a Company – How to Save a FriendshipWritten By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) Article 5PCF Social Justice Fund: What Trust Based Philanthropy Means To UsWritten By: Pinellas Community Foundation For Finkel’s Followers4 Mentality Shifts That Will Make You More ProductiveWritten By: David Finkel Free Saturday WebinarTOOLS AND STRATEGIES TO AVOID ESTATE PLANNING TRAGEDIES – PART IIPresented By: Alan Gassman More Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Florida Adopts 1,000 Year Trust Law

Written By: Alan Gassman, JD, LL.M, AEP (Distinguished), Samuel Craig, Stetson Law Student The Florida legislature has passed legislation that will become effective on July 1, 2022, allowing trusts established after that date to have a lifetime of up to 1,000 years[1]. The 1,000 year countdown starts when a trust becomes irrevocable. As trusts later divide into other trusts, they will have 1,000 years from when the first trust became irrevocable. The law extends the perpetuities limit on the life of a trust from 360 years to 1,000 years for trusts created on or after July 1, 2022, and (2) extends the allowable life of a noncharitable trust to 1,000 years. This does not apply to trusts that have already been established. Additionally, an authorized trustee may not decant a trust in a way that violates the rule against perpetuities. Any exercise of the decanting power under Section 736.04117, F.S., will be subject to the provisions of Section 689.225, F.S., as to the beginning date and termination of the permissible period that applies to the first trust. We are setting our calendars for June 30, 3022, to check on trust clients to make sure that they know to distribute any trust assets from trusts that began on or after July 1, 2022. If you would like to be put on our list to receive a reminder next millennium, please send us an email and we will send your reminder free of charge. Please remember to notify us of change of address information for the next 1,000 years. It is noteworthy that 1,000 years ago, in the year of 1,022, the rule against perpetuities had yet to be established. Instead, Emperor Henry II was making his way down the Adriatic coast through Rome onto Capua. Meanwhile, the Song Dynasty achieved one million registered soldiers for the Chinese military. As a brief background to the new Florida law, and a far too condensed history lesson, the rule against perpetuities (“RAP”) requires that future trust interests (that is, interests that do not take effect immediately) must be certain to vest within a defined period of time known as the perpetuity period. The standard RAP statute has a 21-year perpetuity period, stemming from Harvard Law Professor, John Chipman Gray’s 1986 treatise[2], which has given law students, professors, and plenty others a headache for decades, “No interest is good unless it must vest, if at all, not later than twenty-one years after some life in being at the creation of the interest.” _______________________________________________ [1] See Florida Senate Bill 1368 [2] J. Gray, The Rule Against Perpetuities (1st ed. 1886)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2New SLAT Legislation Opens New Asset Protection Opportunities for Florida Residents

Written By: Alan Gassman, JD, LL.M., Christopher Denicolo, JD, LL.M. & Brock Exline, Stetson Law Student This article was originally distributed by Leimberg Information Services. LISI Estate Planning Newsletter #2963 (May 24, 2022) at http://www.leimbergservices.com. Copyright 2022 Leimberg Information Services, Inc. (LISI). POEM: “Behold the Florida SLAT, Which can now provide that, If your spouse dies first, The contributor spouse can be a beneficiary, to make the death less worse. But will the contributor spouse with a heartfelt shrug, Be more inclined to pull the beneficiary’s plug? This and more, We below explore.” EXECUTIVE SUMMARY: On May 10th, Governor Ron DeSantis approved a new law limiting claims by creditors against the settlors of certain trusts under special circumstances. The legislation includes a provision amending Florida Statute 736.0505(3) which will make certain Spousal Limited Access Trusts (“SLATs”) more attractive to Florida residents who form them after June 30, 2022, by allowing the contributing spouse to be a beneficiary of the trust following the death of the beneficiary spouse.[i] This modification to the law effectively allows for a Florida SLAT to convert to a domestic asset protection trust for the benefit of the contributing spouse following the death of the beneficiary spouse.[ii] Florida does not currently have a statute providing for self-settled domestic asset protection trusts, so this legislation will be welcomed with open arms by planners. The spouse who contributes to a SLAT is hereafter referred to as the “contributing spouse” and the spouse who is the beneficiary of the SLAT is hereafter referred to as the “beneficiary spouse.” Additionally, “asset protection trust jurisdictions” refers to states which permit the formation of self-settled asset protection trusts and is abbreviated throughout the article as “APT jurisdictions.” Special Thanks to the Tax Section of the Florida Bar, and Donna Longhouse, H. French Brown IV, Mark Brown, Brian Malec, Bill Lane Jr., Gerard “JJ” Wehle Jr., Drew Lagrande, and Matthew Schmitzlein for all of their dedication and hard work in bringing this impactful change to Florida law. FACTS: A SLAT is a trust that is created and capitalized by one spouse for the benefit of the other. The SLAT can be used to protect the trust assets from claims by creditors of both spouses and from federal estate tax. Two considerable benefits of the SLAT are that: (1) creditors of the contributing spouse cannot access the trust assets to satisfy their claims because the contributing spouse is not a beneficiary and, (2) creditors of the beneficiary spouse cannot access the trust assets if there is either: (a) a trustee that is independent from the beneficiary spouse who has complete discretion as to if and when distributions will be made to the spouse, or (b) if the beneficiary spouse serves as trustee, such spouse’s ability to receive distributions is restricted to what is reasonably needed for health, education, maintenance, and support. The primary features of a SLAT are that the trust can be used to pay one-half of the living expenses of the married couple on behalf of the beneficiary spouse, the beneficiary spouse can have the power to direct how the trust assets will pass upon their subsequent death, and trust assets generally can be held in a creditor-protected manner and outside of the federal estate tax system. In spite of the benefits a SLAT can provide, many contributing spouses want to have the right to become beneficiaries of the trust in the event of divorce, if the beneficiary spouse dies, or under other circumstances. Florida law allows the creditors of a trust settlor to access trust assets that the settlor is a beneficiary of to the extent that a trustee has the discretion to make distributions to the settlor, even if those distributions are limited to what is needed for the settlor’s health education, maintenance, and support. As a result of this, many Floridians have been using the laws of APT jurisdictions, such as Nevada, South Dakota, Alaska, and Delaware to form SLATs in order to allow the contributing spouse to be eligible to receive benefits without having the trust assets be reachable by creditors.[iii] This is not only significant for creditor protection purposes, but also for purposes of estate tax planning. If a creditor of the contributing spouse can reach into a trust, then the trust assets will be considered as owned by the contributing spouse for estate tax purposes under the rationale that if a person sets up an irrevocable trust thereby enabling them to accumulate debt and benefit from having the trust pay that debt, then the assets of the trust will be considered as includible in that person’s gross estate. This recently passed Florida law, which will only affect trusts that are created and funded after June 30, 2022, does little to level the playing field between Florida and the APT jurisdictions, but is designed to implement one important benefit that has not been available until now, namely, allowing the contributing spouse of a SLAT to be added as a beneficiary following the death of the beneficiary spouse. To take advantage of this new opportunity, Florida Statute 736.0505(3), as amended, provides that the trust must be one of the following: 1. A trust described in Section 2523(e) of the Internal Revenue Code (a marital deduction trust providing the donee spouse with a life estate and a general power of appointment); 2. A trust for which the election described in Section 2523(f) of the Internal Revenue Code has been made (a lifetime QTIP trust); or 3. An irrevocable trust not otherwise described in subparagraph 1 or 2 in which all 3 of the requirements are met: (a) the settlor’s spouse is a qualified beneficiary for the lifetime of the settlor’s spouse (i.e. the settlor’s spouse must be a distributee or permissible distributee of trust income or principal during his or her lifetime); (b) at no time during the lifetime of the settlor’s spouse is the settlor a qualified beneficiary (i.e. the contributing spouse cannot be a distributee or permissible distributee of trust income or principal during the lifetime of the beneficiary spouse), and (c) transfers to the trust by the settlor are completed gifts under Section 2511 of the Internal Revenue Code As an example, assume that a wealthy individual places $5,000,000 into a SLAT for the benefit of his spouse and descendants in order to protect the assets from creditors and federal estate tax. The trust is drafted to provide that the contributing spouse will be individually responsible for paying the income of the trust, therefore making the trust “disregarded” for income tax purposes. This occurs automatically when the beneficiary spouse is a trustee of the trust and has powers to make distributions, or if the grantor retains the right to replace trust assets with assets of equal value.[iv] Most contributing spouses would like to be able to become beneficiaries of the trust after the beneficiary spouse dies. Florida Statute 736.0505(3), as amended, satisfies this concern and Florida case law and federal estate tax law appear to allow this result. However, the contributing spouse from our example may wish to be “addable” back to the trust as a discretionary beneficiary in other situations, such as if: (a) a divorce occurs (in which case if the trust was funded from the separate assets of the contributing spouse the entire trust might be held to benefit the contributing spouse if it is properly formed in an APT jurisdiction, or if the trust is funded with assets that would be divided between the spouses as “marital assets” because they were acquired from earnings during the marriage or otherwise, then a trust properly formed in an APT jurisdiction could allow for division into two separate trusts, one for the beneficiary spouse and the other that might benefit the contributing spouse.)[v] (b) the contributing spouse encounters significant economic hardships The new Florida statute only solves the issue of what happens if the beneficiary spouse predeceases the contributing spouse, but does not allow for the contributing spouse to be added back to the trust under the circumstances described in (a) or (b) above. The authors typically use the language “in the highly unlikely event of divorce” in our firm documents, and “in the almost impossible to imagine event of divorce” in our personal documents. An additional consideration when determining whether to use Florida or an APT jurisdiction is the possibility of having a “floating spouse clause.” While the original spouse that is the beneficiary of the trust may not be deleted by reason of divorce, a new spouse could be added, so that both spouses (the settlor ex-spouse and the settlors new spouse) could be discretionary beneficiaries. A Florida trust (and also an APT) can include a provision that reduces, but does not eliminate, the original beneficiary spouse’s ability to receive distributions or to have control over the trust in the event of divorce, and adds the future spouse of the contributing spouse as an additional beneficiary of the trust. This helps to level the playing field for Florida where the contributing spouse knows that he or she can remarry in the event of divorce or having substantial financial need and the trust can benefit his or her next spouse (and the spouse after that and the spouse after that) to reduce the overall family living expenditures.[vi] Nevertheless, if the contributing spouse wants to have his or her ex-spouse eliminated as a beneficiary upon divorce, then it seems that Florida would not be an appropriate situs for the trust and that an APT jurisdiction instead might be preferable. Florida’s Trust Code and pertinent case law generally provide that assets attributable to contributions to a trust made by a beneficiary of the trust can be seized by creditors insofar as the trustee has the power to make distributions to such contributor. When the beneficiary has not contributed assets to the trusts, then a trustee may typically only attach the maximum amount that the beneficiary has the individual right to compel the trustee to pay to him or her. To give an example, in the Eleventh Circuit Court of Appeal decision of In re Brown (303 F.3d 1261) on August 28, 2002, Mrs. Brown contributed assets from an inheritance into a Charitable Remainder Unitrust that paid her 7% of the value of the trust assets each year for life, with the remainder interest to pass to charity. Mrs. Brown subsequently filed for bankruptcy and the court held that her creditors could access the 7% annual payment, but not the remainder interest therein. The court also observed that because Mrs. Brown failed to assert that the 7% payment right could be exempted as an annuity payment under Florida Statute Section 222.14, she procedurally lost the ability to make that argument.[vii] Had Mrs. Brown not been the contributor to this trust and instead had the trustee had the discretion to pay the 7% unitrust amount to the trustee’s choice of Mrs. Brown or any other trust established for the benefit of Mrs. Brown, then the creditor would probably not have been able to access the assets in the trust, and the trustee could have made the payments to a separate trust that could have been designed to not be reachable by Mrs. Brown’s creditors. The Florida Trust Code indicates that a trust established by a “settlor” will be accessible to creditors of the settlor to the extent that the settlor may receive benefits, but the statute is clearly intended to only apply to the extent that the settlor has made a contribution to the trust. Some lawyers erroneously assume that when a person sets up a trust that will be funded by his or her parents or others, he is nevertheless the “settlor” and will be treated as having contributed the assets. Somewhat Thrilling Commentary: As with any recently passed legislation in a complicated area, there will certainly be mistakes made in trying to qualify for the new SLAT benefit. The biggest mistakes that we are likely to see are as follows: 1. Florida sitused SLATs inadvertently will have terms which specify that the contributing spouse will be added back in the event of divorce instead of only upon the death of the initial beneficiary spouse. A SLAT with terms that specify situations where the settlor/contributing spouse will become a beneficiary before the death of the initial beneficiary spouse will forfeit the availability of the new SLAT benefit under Florida law. 2. Conversely, a mistake is likely to occur where the contributor’s spouse will no longer be a beneficiary in the event of divorce or certain other events. Florida Statute 736.0505(3), as amended, requires that the contributor’s spouse must be a beneficiary “for the lifetime of the settlor’s spouse.” 3. A SLAT that provides the trustee with the power to reimburse the contributing spouse for taxes paid on the income of the trust may expose all of the trust assets to federal estate tax and the amount that could be reimbursed, but is not, to creditor claims. The reason for this is that the grantor/contributor cannot be a beneficiary until after the death of the beneficiary spouse – the IRS may consider the grantor/contributor to be a beneficiary if he or she may receive reimbursement of taxes paid before the death of the beneficiary spouse. 4. Will the existence of Trust Protectors also spoil the sought after result? Assume a Florida SLAT signed and funded after June 30, 2022 complies with the rules above but also provides the Trust Protectors with the authority to do many things, such as excluding the beneficiary spouse from being able to receive distributions from the trust. If the IRS can prove that the Trust Protectors have a fiduciary duty to remove the beneficiary spouse, then the requirement set forth in 736.0505(3)3.(b) (that at no time during the lifetime of the settlor’s spouse is the settlor a beneficiary) may not be satisfied due to the fact that the contributing spouse would benefit from the trust after the removal of the beneficiary spouse which would cause inclusion of the trust assets in the estate of the contributing spouse. This will alienate many contributors from wishing to establish a Florida SLAT. 5. Relationship issues – “He unplugs me, he unplugs me not” With the requirement that the beneficiary spouse must be deceased in order for the contributing spouse to become a beneficiary, beneficiary spouses may wonder whether their plugs will be pulled sooner rather than later so that the contributing spouse can become beneficiary of the trust and shack up with their new significant other. It remains to be seen what other intricacies and confusions may develop or be found to apply with respect to this new statute, which will undoubtedly help many Floridians. Contrary to the Florida Community Property Trust Act, which makes clear that a Florida Community Property Trust need only have a Florida resident as trustee to qualify as a Florida Community Property Trust, the new SLAT legislation does not include such language. It is therefore safest to have the grantor/contributing spouse be a resident of Florida, have at least one trustee in Florida and for the trust to be administered in Florida to qualify for this new Florida SLAT benefit. 6. Failure to address the exception creditor risk COMMENT: Individuals who are married to spouses who have a short life expectancy may wish to establish these trusts in order to have the equivalent of an asset protection trust without having to go to an APT jurisdiction. Florida SLATs that would otherwise be protected under Florida Statute 736.0505 have a better chance of holding up than an APT jurisdiction sitused trust for Floridians, given that Florida law now expressly condones this and may not condone an APT jurisdiction sitused trust if the circumstances would be such that protecting the trust from creditors would be against the public policy of Florida. Now we’ve told you about it, What should your clients or parents do? Well what would you do, If your client or mother asked you? It may depend, On if their spouse is a true friend, And how they think things will come out in the end, If the marriage is a ruse, Contact Dr. Suess (Esquire).[viii] [i]FL LEGIS 2022-101, 2022 Fla. Sess. Law Serv. Ch. 2022-101 (C.S.S.B. 1502) [ii]736.0505(3), as amended, now reads as follows: (3) Subject to the provisions of s. 726.105, for purposes of this section, the assets in: (a) 1. A trust described in s. 2523(e) of the Internal Revenue Code of 1986, as amended;, or 2. A trust for which the election described in s. 2523(f) of the Internal Revenue Code of 1986, as amended, has been made; or 3. An irrevocable trust not otherwise described in subparagraph 1. or subparagraph 2. in which: a. The settlor’s spouse is a beneficiary as described in s. 736.0103(19)(a) for the lifetime of the settlor’s spouse; b. At no time during the lifetime of the settlor’s spouse is the settlor a beneficiary as described in s. 736.0103(19)(a); and c. Transfers to the trust by the settlor are completed gifts under s. 2511 of the Internal Revenue Code of 1986, as amended; and (b) Another trust, to the extent that the assets in the other trust are attributable to a trust described in paragraph (a), shall, after the death of the settlor’s spouse, be deemed to have been contributed by the settlor’s spouse and not by the settlor. [iii]Readers should know that when a Florida resident establishes an asset protection trust in an APT Jurisdiction it is not clear whether Florida law or the law of the other jurisdiction will apply, so additional safeguards normally include not having the contributor/settlor included as a beneficiary of the trust unless certain events occur which have “independent significance,” like a divorce, the settlor/contributor having significant financial problems, or allowing third parties (such as Trust Protectors) to add the settlor/contributor as a beneficiary of the trust even though they do not have the duty to do so. [iv]There are other ways to make a trust “disregarded” for federal income tax purposes and it is unknown at the present time whether disregarded status can be “toggled off” upon divorce so that the trust would pay its own income taxes due to what is known as the “repeal of IRC Section 682 under the Tax Reform Act of 2017″ as explained at https://www.irs.gov/pub/irs-drop/n-18-37.pdf “Guidance in Connection with Repeal of Section 682.” [v]“To get the full value of joy you must have someone to divide it with” – Mark Twain [vi]In order to save the environment and preserve proper social equities the authors condemn Tom Waits for having said that “She has been married so many times that she has rice marks on her face” and those who find this statement to be humorous. [vii]In the Florida Bankruptcy Court case of In Re Mart (88 B.R. 436, S.D. Fla. 1988) the Bankruptcy Court found that an annual annuity payment owed by a trust to its grantor was exempt from creditor claims under Florida Statute 222.14 [viii] The Cat in the Hat was published in 1957 and ends as follows: Should we tell her about it? Now, what SHOULD we do? Well… What would YOU do If your mother asked you? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3Green Book Proposals That Impact High-Earners and Estate Tax Planning

Written By: Alan Gassman, JD, LL.M. & Kristen Sweeney On March 28, 2022, the Biden Administration released its Fiscal Year 2023 Revenue Proposals, known as the “Green Book.” Certain proposals could significantly affect high-earners and estate tax planning. It remains to be seen whether these proposals will be passed into law, but now is the time to begin thinking about their potential impact. Summary of Fiscal Year 2023 Revenue Proposals Here are 19 proposals from the Fiscal Year 2023 Green Book that impact high-earners and estate tax planning: 1. Corporate income tax rate will increase to 28% effective January 1, 2023. The new proposed rate effectively splits the difference between the current rate, 21%, set by the Tax Cuts and Jobs Act of 2017, and the previous rate, which was 35%. 2. New business tax credit equal to 10% of certain eligible expenses incurred with bringing a business back to the United States. This proposal provides a nice incentive for bringing businesses that are currently offshore in foreign jurisdictions back to the U.S. 3. New rules aimed at preventing basis shifting in partnerships. This proposal takes aim at the concept of “basis shifting” amongst related parties through the use of partnerships. It states that it “would prohibit any partner in the distributing partnership that is related to the distribute/partner from benefitting from the partnership’s basis step-up until the distribute/partner disposes of the distributed property in a fully taxable transaction.” 4. Elimination of fossil fuel tax preferences. Aimed at oil and other fossil fuel industries, the most notable aspect of this proposal is the inability to expense intangible drilling costs. 5. Increase the top marginal rate to 39.6% for taxpayers with income exceeding $450,000 ($400,000 if single filer) effective January 1, 2023. Under this proposal, high-income individuals will not only be taxed at a higher tax rate, but the top tax bracket will also be more compressed compared to today. The current rate of 37% for the highest earners is currently scheduled to revert to 39.6% at the end of 2026. 6. Long-term capital gains and qualified dividends would be taxed at 37% for taxpayers with taxable income exceeding $1,000,000, effective on the date of enactment. My colleagues and I don’t read this proposal as a tax cliff, which would suggest that if an individual has over $1,000,000, all of their capital gains and qualified dividends would be subject to a 37% tax. Instead, we’re inferring that it pertains only to income exceeding $1,000,000. For instance, if an individual has $1,100,000 in long-term capital gains, only $100,000 would be subject to this higher rate. However, much depends on how the statute clarifies this provision if the proposal passes into law. 7. Transfers of appreciated property by gift or on death would be treated as realization events with a $5,000,000 per donor exclusion (exceptions also apply for transfers to spouses and charity) effective January 1, 2023. Under this proposal, if an individual has an asset worth $1,000,000 and their basis is only $100,000, they’ll have $900,000 of gain that will be assessed, and they will pay capital gains tax on death or if they transfer that asset by gift. There are certain exceptions for spouses and charities, and there’s an exclusion of up to $5,000,000, so this proposal won’t affect low-income individuals or those with a low net worth. However, high-earners will be impacted by this new rule. 8. Valuation discounts for determining whether a person or couple have more than $100,000,000 in assets, and possibly for other purposes, would be limited to only apply to transfers of an active trade or business and only to the extent that assets are used in the active conduct of that trade or business. It’s clear that this proposal applies for the deemed sale on death, as far as valuing the assets. There will be no valuation discounts unless it is an interest in an active trade or business, and then only to the extent that the assets are used in the active conduct of that trade or business. What is less certain is whether this proposal also applies for gift and estate tax purposes—whether the proposal would eliminate valuation discounts for everything or just for the purposes of assessing this new deemed realization income tax on a gift or upon death. 9. 20% minimum tax on total income (including unrealized capital gains) for taxpayers with a net worth of $100,000,000 or more, effective January 1, 2023. Under this proposal, taxpayers with a net worth of over $100,000,000 will be taxed instantly as of January 1, 2023. Individuals will owe annual payments for the next 10 years in an amount totaling the taxes they would pay if they sold their business on January 1, 2023. They will be measured every year for the rest of their life, and as long as their net worth is over $100,0000,000, their assets will be treated as if they all were sold. If this proposal passes, many families may set up private foundations and charities. If you have a net worth of $120,000,000 or $130,000,000, you’ll likely want to get your planning done and your asset values compressed before next year. 10. Grantor Retained Annuity Trusts (GRATS) would be required to have a minimum term of ten years and a remainder interest of at least 25% of the value of the assets transferred effective for GRATs established on or after the date of enactment. This proposal is essentially copied and pasted from the For the 99.5 Percent Act introduced by Senator Bernie Sanders and Senator Sheldon Whitehouse in 2021. Most individuals don’t need a Grantor Retained Annuity Trust, but for those who do, this proposal will limit its utility. 11. Transfers to grantor trusts would be considered taxable transfers for income tax purposes effective on or after the date of enactment. Currently, an individual can establish a trust that is irrevocable and out of their estate for estate tax purposes, but they can trade assets with it. They can pay the income tax attributable to the trust’s income without it being considered a gift to them, and they can sell assets to the trust for a low-interest promissory note. Under this proposal, if an individual transfers assets to the trust in exchange for a note—even if it’s a grandfathered trust—they’ll be treated as if they sold those assets at fair market value and will owe income tax on the proceeds of the sale. 12. The payment of income taxes by the grantor of a grantor trust would be considered a gift to the trust effective for trusts established on or after the date of enactment. In addition to considering transfers to grantor trusts as taxable transfers, if an individual forms a new grantor trust and pays the income tax on the trust’s behalf, that payment would be considered a gift to the trust. An individual who is grandfathered in and continues paying the income tax on the grantor trust’s behalf would not be affected. 13. New rules to require the consistent valuation of promissory notes, effective on or after the date of enactment. Currently, if an individual sells assets to a trust for a $100,000,000 note bearing interest at 3.0% for loans made in June of 2022, for 25 years, they can have that note appraised at about $7,000,000. That has been a loophole in the estate and gift tax arena, and under this proposal it will be gone. Instead, when an individual values one of these low-interest notes, they have to assume that it’s a short-term note due within three years, meaning that any discount is going to be much smaller. 14. The proposal would require annual information reporting for trusts whose estimated value exceeds $300,000 or with income in excess of $10,000. This requirement would create more paperwork involved with maintaining trusts and would give the government greater visibility into the assets inside of them. Defective grantor trusts, a popular estate planning vehicle, do not currently require any reporting because they are disregarded for tax purposes, but this proposal would impose new reporting requirements. 15. Modify the tax exemption for generation skipping trusts (GSTs) to only last as long as the life of any trust beneficiary who either is no younger than the transferor’s grandchild or is a member of a younger generation but who was alive at the creation of the trust, effective on or after the date of enactment regardless of the trust’s inclusion ratio. Current generation-skipping laws vary by state and allow a GST to endure for an extended term (up to 1,000 years in some states, and in perpetuity in South Dakota) without being included for purposes of estate taxation. Under this proposal, the trust would be taxed every third generation. A trust established with $10,000,000 tomorrow would only be estate tax-free as to the grantor’s children, grandchildren, and any great-grandchild who was living at the time the trust was created. 16. Carried interest would be taxed at ordinary income rate. Hedge fund managers normally receive a fixed annual fee of 2% of the value of hedge fund assets and an additional “kicker” based upon 20% of the profits for the hedge funds they manage, with the kicker being tax-deductible by the hedge fund but includable in the income of the managers at a 20% rate. Many wealthy families set up their own management companies in order to deduct a 20% fee from their personal income taxes and to have their management company receive the fee and pay only 20% in income taxes. Under this proposal, they would pay ordinary income tax on those assets instead. 17. Section 1031 like-kind exchanges for real estate would only allow deferral of up to $500,000 per taxpayer per year. 18. 100% depreciation recapture for Section 1250 property (real estate) at ordinary income rate. Under this proposal, if an individual sells real estate that they had depreciated, they have to recapture the depreciation as ordinary income as opposed to recapturing it at a capital gains rate that applies in most situations. This proposal will have a significant impact on the real estate industry. 19. Distributions to a donor-advised fund from a private foundation would not satisfy private foundation distribution requirements. Under this proposal, if an individual has a private foundation and wants to make their 5% per year minimum distribution, they must give those funds to charities other than a donor-advised fund (DAF). Funds placed in DAFs are immediately tax-deductible but do not have to be distributed to charities right away; in the meantime, they earn interest. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 4Recent Letter to Co-Owners of a Company – How to Save a Friendship

Written By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) This is a sample letter to describe the design of an Operating Agreement for a company owned 1/3 each by three owners, who are now friends and might hopefully be friends many years up the road. Dear Client: This is to follow the LLC packages that we sent you on Friday. I am enumerating a number of concerns that can be addressed in operating agreements having multiple members, but there will always be the possibility of having disputes, notwithstanding how many hundreds of pages of agreements may be customized and provided. Nevertheless, the process of thinking through what the rules of governance and rights and responsibilities of each member, and potential future and successor members can help assure that the relationship and expectations will be as synergistic and mutually agreeable as possible. We have provided you with a “majority rule” operating agreement which basically provides that any two of you can make decisions without the approval of the third person. Notwithstanding that the agreement provides that each member and each manager has a fiduciary duty to act reasonably and in the best interests of the company, common examples of disputes that we see in these kinds of situations are as follows: 2. Two of the members may change the business the company is in, or cause the company to engage in activities that the third member objects to. 3. Two of the members may decide to bring in a fourth member or subsequent members over the objection of the third member. 4. Two of the members may decide to sell the business of the company to a third party or a related party at a price the third shareholder objects to. 5. Two of the members may wish to sell their shares to a third party who will then mistreat the third member. If you like, we can add a provision to the agreement that will permit the third member to “tag along” and sell his or her shares at the same time as the majority of members can sell their shares. One solution to the above issues is to require unanimous consent for any decision, or to give any one member a veto power over any decision or change from an initial business plan. A variation of this to agree upon the specific business of the company, how much will be invested, how much each member will be compensated, if anything, and to require that nothing else can occur or be changed without unanimous consent, which will not be withheld, except upon extraordinary circumstances. Some clients go with the unanimous consent requirement, and name a neutral third party that will have the power to resolve any material issues. I am enclosing a sample operating agreement that we recently provided for a client who owns less than fifty percent of a real estate LLC. I am sending this in redline form so that you can see the provisions that we added in order to attempt to protect the client. I can provide you with further information and other sample forms, or we can set up a call to discuss this if you like. Best personal regards, Alan S. Gassman |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 5PCF Social Justice Fund: What Trust Based Philanthropy Means To Us

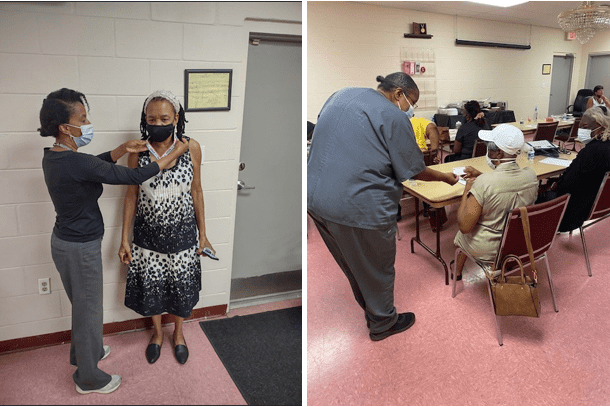

Written By: Pinellas Community Foundation The Pinellas Community Foundation Social Justice Fund was formed with the belief that the charitable world needs to make room for small, emerging, and grassroots organizations that are deeply embedded in the community. With the help of donors, Pinellas Community Foundation established the Social Justice Fund (f/k/a Venture Philanthropy Fund) with the goal of reducing risk aversion in giving by taking the traditional model for nonprofit support and replacing it with the practices of trust-based philanthropy. Often, donors shy away from supporting grassroots organizations with reasoning like, “I haven’t heard of them before,” “they haven’t been around very long,” “the financials aren’t strong,” or “let’s wait and see.” But through trust-based philanthropy, fear and hesitancy are replaced by strong relationships. Through the PCF Social Justice Fund, the foundation aims to support organizations by doing the following: • Providing unrestricted funding for programs • Forming relationships with organizations so we can “do the homework” on them, rather than making organizations jump through hoops to get to know the foundation • Simplifying paperwork to short-circuit traditional application processes and instead focus on building trust and understanding • Creating lines of communication that are rooted in transparency and responsiveness • Asking for feedback and input, and providing space for organizations to honestly express their needs and opinions • Offering more than funding to help organizations build their capacity for marketing/communications, program design, board development, and financial accountability Adopting the practices of trust-based philanthropy has afforded PCF the opportunity to better understand the needs of organizations and our community. Our work with grantees from the PCF Social Justice Fund has also helped us improve other grant programs at the foundation and assisted us in helping other donors more effectively support great organizations. Kimberly Crawford-Nunn of The Willa Carson Center for Health and Wellness shared, “PCF Social Justice Fund funding allowed to the clinic to hire a Medical Assistant. The clinic needed a medical assistant to provide dedicated clinical support to physicians who volunteer at the clinic.”

Funding also provided clinical support for a monthly programming geared toward seniors, retirees, and disabled residents who are interested in improving their health through education and solution-focused behavioral changes. Crawford-Nunn noted that programs are extremely important because of the empowering approach. “The most recent presentation on diabetes assisted participants with understanding they have the power to change their health track. The certified diabetes educator spoke of prediabetes (Metabolic syndrome) and broke down the steps to avoid falling into full-fledged diagnosis of diabetes.” The PCF Social Justice Fund has awarded over 40 nonprofit organizations like The Willa Carson Center servicing low-income and low-resource populations in Tampa Bay, Florida with over $700,000.00. We invite you to maximize the power of your charitable giving by supporting the PCF Social Justice Fund. If you are interested in donating to the Social Justice Fund, please contact Leigh Davis, Director of Donor and Advisor Relations, ldavis@pinellascf.org, 727-306-3142. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers4 Mentality Shifts That Will Make You More Productive

Written By: David Finkel; Author, CEO, and Business Coach As a business owner, your plate is already really full. Your to-do list is several pages long and your calendar is full of meetings and phone calls. Throw in a few fire drills throughout the day, and it’s a wonder that you get anything accomplished. It’s no surprise that when I bring up productivity with my business coaching clients, they often get visibly agitated by the sheer idea of adding on another “thing” to their list in the hopes of being more productive in the long run. So, today I wanted to share with you four mentality shifts that will make you more productive without adding anything extra to your to-do list. Get Comfortable With Leaving Things On the Table The first thing I teach our clients is to get really comfortable with the idea of leaving things undone on their to-do list. Some things are just not worth doing. The small thrill you get out of checking off a box, oftentimes isn’t worth the time and mental energy that it requires to get it done. So,one of the best ways to be more productive is to get used to the idea that some things aren’t worth doing at all. Know What To Cut Once you come to terms with the idea that you shouldn’t be doing it all. Then comes the mentality shift of deciding what is your “Fewer, Better.” This is the idea that everything on your to-do list has a value to it and some are worth far more than the others. Your job is to learn how to recognize the high level tasks that you should be doing and focusing your attention, and which ones should be left alone. It is far easier to do two or three things really well, then it is to do ten or fifteen things sub par. And that mentality shift will often save you money, as you won’t have to pay someone to fix your mistakes down the road. Be Mindful of Time Blindness Another mentality shift has to do with time blindness. This is the idea that you don’t really have a good grasp on the flow of time. Do you often think a task or project will take thirty minutes to an hour tops, and find yourself still working two or three hours later? Time blindness can make it really difficult to plan out your day and decide how much you can tackle in a certain time period. To overcome this, start by setting a timer for thirty minutes while you work on a task or project. When the timer goes off, take note of what you were able to do during that time period. After a few tries, you will get better about learning just how long it takes you to do certain tasks and you can then plan accordingly. Stop Being Fearful The last mentality shift has to do with your emotions. Instead of putt ing off tasks on your list that you find “fearful” or “scary,” make the shift to tackle them head on first thing in the morning. Not only will you get it off your plate and open yourself up to more enjoyable projects, but it will also free up a large amount of mental energy that was spent worrying about the thing that you were putting off. With a few mentality shifts, you can make a huge difference in the amount of high value work that you get done in a day. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Saturday WebinarTOOLS AND STRATEGIES TO AVOID ESTATE PLANNING TRAGEDIES – PART IIClick This Link To Watch Part 1 Now Date: Saturday, June 11, 2022 Time: 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished)

We are collaborating with CPAacademy.org to offer 1.0 CPE credit to CPAs who watch this webinar through their system. If you are a CPA and would like to earn this credit, then feel free to register below. If you are not already a CPAacademy.org member, you will be prompted to first set up a free member profile. REGISTER BELOW:

Course Description: You do not need to watch Part 1 to attend this presentation. Click This Link To Watch Part 1 Now. Learning Objective: Identify primary and effective strategies for estate tax avoidance. Please Note: This is a complimentary webinar program. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPA Academy. Please email registration questions to info@gassmanpa.com. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Humor

POEM: THE SIMPLER DAYS OF THE LAW

Written By: Ron Ross In the nineteenth century, Oh, for the simpler times when, The only reason they hated a lynch mob, Best of all, the law was a kind of fight, *Younger readers would be interested to know Abraham Lincoln was a former president of the United States. He was also a lawyer and invented Lincoln logs and the internet.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||