The Thursday Report – Issue 322

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, March 24th, 2022Issue #322Coming from the Law Offices of Gassman, Denicolo & Ketron, P.A. in Clearwater, FL. Having trouble viewing this? Use this link

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Florida Law Change Makes Spousal Limited Access Trusts More Appealing – Fewer Floridians Will Use Asset Protection Trust (“APT”) Jurisdictions As A Result Of ThisWritten By: Alan Gassman, Esq. and Christopher Denicolo, Esq.Article 2CHOATE’S NOTES: March 2022Written By: Natalie Choate, Esq.Article 3Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits in Trust or Otherwise After the SECURE Act – The Estate Planner’s IRA/Pension Planning GuideWritten By: Alan Gassman, Esq. and Brandon Ketron, Esq., CPAArticle 4Planning For Medicaid Eligibility: The Income Trust That Will Pay Income And Still Qualify For Medicaid Five Years LaterWritten By: Samuel Craig, Law ClerkSaturday WebinarMore Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1Florida Law Change Makes Spousal Limited Access Trusts More Appealing – Fewer Floridians Will Use Asset Protection Trust (“APT”) Jurisdictions As A Result Of This

Written By: Alan Gassman, Esq. and Christopher Denicolo, Esq. The Governor is expected to sign a bill that will change Florida Statute Section 736.0505. The Tax Section of the Florida Bar (notably led by Donna Longhouse, H. French Brown IV, Mark Brown, Brian Malec, Bill Lane, Gerard “JJ” Wehle, Drew Lagrande and Matthew Schnitzlein) organized the effort to revise Florida Statute Section 736.0505 to provide that the grantor of a Spousal Limited Access Trust (SLAT) is not considered to be a “settlor” of an irrevocable trust under Florida Law that: (1) Benefits the grantor/spouse only after the beneficiary/spouse’s death; (2) Does not benefit the grantor/spouse at any point during the beneficiary/spouse’s death lifetime; and (3) Is a “completed gift trust” (i.e., transfers to the trust are considered to be completed gifts for federal gift tax purposes). These prospective changes to the Statute is similar to what has been codified under Florida Statute Section 736.0505(3) since 2010 (which now will become 736.0505(3)(a)1. and 736.0505(3)(a)2., as a result of the new Statute) with respect to a Lifetime QTIP Trust or Marital Deduction General Power of Appointment Trust established for the benefit of the beneficiary/spouse, in that after the beneficiary/spouse’s death, the beneficiary/spouse is considered to be the “settlor” for Florida state law purposes and the grantor/spouse is not considered to be the “settlor”. This potential change in legislation means that the grantor/spouse can be named as a remainder beneficiary after the death of the beneficiary/spouse and the trust will not be considered as a “self-settled spendthrift trust” that would cause the assets thereof to otherwise be subject to the creditors of the grantor/spouse under Florida law or subject to federal estate tax in the grantor’s/spouse gross estate for federal estate tax purposes. As a consequence of this, a grantor/spouse can fund a SLAT for the benefit of the beneficiary/spouse, and provide for the assets to “boomerang” back to benefit the grantor/spouse after the beneficiary/spouse’s death without creditors being able to reach into the trust, as long as the grantor/spouse’s ability to receive benefits is limited to what he or she reasonably needs for health, education, maintenance and support. This may make Florida a more attractive jurisdiction for irrevocable trusts and can give married couples comfort that assets contributed to a SLAT can be held as a safety net for either of them in many situations. This could also help Florida to compete with states like Delaware, Alaska, Nevada and South Dakota, which have laws that say that the creditors of the grantor of an irrevocable trust cannot reach into the trust if the grantor’s right to distributions are appropriately limited. The proposed update to Florida Statute Section 736.0505 only provides protection if the grantor/spouse is not a beneficiary of the SLAT until after the beneficiary/spouse has died, whereas the Nevada and other asset protection trust statutes provide protection in certain situations where the grantor/spouse is a beneficiary of an irrevocable trust during the beneficiary/spouse’s lifetime. So while these potential changes to the Florida Statute certainly help Florida be competitive with those states, that do not permit the grantor/contributor of a SLAT to benefit during the lifetime of the initial spouse/beneficiary, or to benefit in the event of a divorce, so a great many SLATs will still be formed in asset protection jurisdictions, but should be carefully structured to require that certain events beyond the control of the grantor should occur before the grantor can become a beneficiary, if a conservative approach is to be taken. As with many state law changes that are intended to enhance tax treatment, mistakes will be made by well-meaning practitioners. For example, this new statute does not abrogate or impact the effect of the Reciprocal Trust Doctrine, or at least that is our impression. Therefore, if the Grantor’s spouse funds a trust for the grantor, then the SLAT may be considered to be “reciprocal” and subject to federal estate tax even if the grantor has not benefitted from it as predeceases the spouse/beneficiary. Nevertheless, the proposed revision to Florida Statute Section 736.0505 is a solid step in the right direction, and makes Florida SLATs an appropriate vehicle, especially for those grantors who have plenty of assets and would not expect to need to receive benefits except after the death of a spouse/beneficiary.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2CHOATE’S NOTES: March 2022Proposed RMD regulations were FINALLY released! “A Note from Natalie”

To sign up for the LISI seminar or learn more, visit: March 25, 2022 – https://new.leimbergservices.com/wdev/register.cfm?id=1697. The Thursday Report is pleased to share the following note from Natalie Choate, whose amazing book, “Life and Death Planning for Retirement Benefits“, is the best selling and probably the best written one-subject treatise in estate planning history. If you have never seen Natalie speak, then waste no time signing up for one of her webinars, especially now. The following explains that Natalie is modest enough to say that “I got it wrong,” when quite possibly the IRS got it wrong, on what happens after the death of an Eligible Designated Beneficiary under the 10-year rule, and that minimum annual distributions have to be taken after the death of a Plan Participant who has reached his or her Required Beginning Date, even if the 10-year rule will apply. Natalie’s notes are below, followed by our attempt to summarize the new rules that now apply, to the extent that taxpayers wish to follow them, with respect to IRA and pension accounts payable to irrevocable trusts for spouses, descendants, and others. Special thanks to Brandon Ketron, McKenzie McAdams, and Christopher Denicolo for their assistance and leadership in writing our article, and working to update our book entitled “Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits in Trust or Otherwise After the SECURE Act – The Estate Planner’s IRA/Pension Planning Guide“. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits in Trust or Otherwise After the SECURE Act – The Estate Planner’s IRA/Pension Planning Guide

Written By: Alan Gassman, Esq. and Brandon Ketron, Esq., CPA Steve Leimberg’s Employee Benefits and Retirement Planning Email Newsletter – Archive Message #781 From: Steve Leimberg’s Employee Benefits and Retirement Planning Newsletter Subject: Alan Gassman & Brandon Ketron – Seeing Through the Proposed Regulations on IRA and Pension Distributions, Good News (Mostly) for See-Through Trusts Special thanks to our law clerks, McKenzie McAdams and Samuel Craig for their assistance in writing this article and to Natalie Choate for her recent writings and analysis. McKenzie is currently a 3L at Stetson University College of Law and will be pursuing an LL.M. in Taxation at the Georgetown University Law Center starting this Fall. Executive Summary: The SECURE Act became law effective January 1, 2020, and eliminated the “stretch” IRA for most trust situations by requiring that all benefits must be paid out of the IRA or Plan on or before December 31st of the tenth calendar year following the death of the Plan Participant under the “10-Year Rule” unless the IRA/Plan was left to an Eligible Designated Beneficiary or in certain trusts benefitting one or more Eligible Designated Beneficiaries. The SECURE Act, together with the predecessor Treasury Regulations and IRS Rulings in place (which did not take into account the changes made by the Act), left us with a seamless web of inconsistent rules that are riddled with gaps requiring many intelligent guesses as to how to design and implement trusts that are funded with IRA, Pension and other qualified retirement plan based accounts. On February 23, 2022, the IRS issued very extensive Proposed Regulations which contain a good many logical and taxpayer-friendly provisions, that seem sure to become permanent regulations in 2022 or early 2023, and which provide drafters with new language they can begin using in trust agreements and wills that will establish testamentary trusts and provide for flexibility that is permitted under the Proposed Regulations, as described below. The Preamble provides that in 2022 “taxpayers must apply the existing regulations” in addition to considering “a reasonable, good faith interpretation of the amendments made by sections 114 and 401 of the SECURE Act.” By complying with the Proposed Regulations, taxpayers can satisfy this requirement. A public hearing is slated for June 15, 2022 to address the comments that the IRS will have received and many estate planning and tax professionals are examining the over 200 pages of Preamble, Proposed Regulations and examples therein to attempt to understand what is intended. Natalie Choate has pointed out the existence of rules expressed in the Preamble that are not in the Proposed Regulations themselves, so there are sure to be many twists and turns between now and when final regulations are issued, but we can cover what seems clear and logical and begin explaining these rules to clients who have short life expectancies or urgent family situations, such as when an IRA is the largest asset of a family that has one or more chronically ill or disabled family members who are in the lower tax brackets. Facts: The New RMD System The Required Minimum Distribution (“RMD”) rules in the Proposed Regulations cover various types of individual beneficiaries and the participant’s estate. Commentator, Natalie B. Choate will present a Webinar for LISI on Wednesday March 23rd at 3:00 p.m. EDT that will cover the minimum payment rules that will apply to various categories of beneficiaries in great detail, and how to use her excellent footnoted charts on this. Natalie’s recent writings on this topic include the following: The new RMD ‘system’ has two parts: First, there is an annual distributions track. What annual distributions are required after the participant’s death, if any? Second, there is an ‘Outer Limit Year’ in which 100% of the account becomes the RMD, regardless of what the ‘annual distributions track’ says. To advise a beneficiary, you’ll need to explain both the annual distributions requirement and the Outer Limit Year requirement. The post-death payout must be completed in the Outer Limit Year if the account was not previously exhausted by the annual distributions. To better understand the RMD for one individual beneficiary of a decedent, there are three questions that must be answered: 1. Did the decedent die before or after her Required Beginning Date (“RBD”)? You can NOT figure out any beneficiary’s RMDs without knowing whether the decedent died before or on/after her RBD. 2. What category is the beneficiary? 3. What is the beneficiary’s life expectancy, and the decedent’s life expectancy (the “ghost” rule)? Tune in for Natalie’s talk to understand when to use life expectancy payouts, whose life to use, and what the payout will be after the death of the Eligible Designated Beneficiary whose life may be used for a lifetime payment purposes. This Article will now concentrate on what trust structures will work best for various situations, what rules have to be followed to qualify trusts for “stretching” and other associated topics. Some of what we cover has to be speculation by necessity, and the final rules are sure to be somewhat different than what we now have, but the basic structure of what we describe should be sound for present planning. To begin, let’s review some of the basics. The Basics First of all, if the deceased IRA or Plan owner has reached his or her Required Beginning Date (“RBD”) before dying, then we have good news, and we have bad news (other than the fact that someone has died). The good news is that a life expectancy annual payout can be used by any Trust, even if it only has charities and creditors as possible recipients, under the at least as rapidly rule, or “ghost” life expectancy rule, which thankfully provide that distributions be made over the life expectancy of the deceased plan participant. Additionally, the life expectancy payout can be based upon the longer of the deceased participant’s life expectancy or the life expectancy of a properly identified Designated Beneficiary or Eligible Designated Beneficiary who was born after the deceased participant. The bad news, however, is that after the death of the beneficiary there may be less than 10 years to take out what remains in the IRA or Plan out, based upon complicated rules. The other “bad news” is that if the Plan Participant dies after his or her RBD, the IRS believes that minimum annual distributions (based on the life expectancy of the identified beneficiary) must begin in the year after the death of the Plan Participant, even if the 10-Year Rule applies. This will probably be the most controversial aspect of the Proposed Regulations, and a prominent point of discussion in the June 15 public hearing. These rules, and others, are discussed in further detail below. Eligible Designated Beneficiaries May Qualify for Lifetime Payouts Before the SECURE Act, almost any person who was the beneficiary of the trust would qualify the trust for either (a) a lifetime payout (as opposed to the 5-Year Rule), or (b) or the “at least as rapidly rule,” but the ability to “stretch” IRA distributions out over the life expectancy of a designated beneficiary was limited by the Act to only apply when the applicable beneficiary of the Plan or of the trust that the Plan is payable to is an Eligible Designated Beneficiary. The five categories of Eligible Designated Beneficiaries that can utilize the lifetime payments under the SECURE Act are as follows: (1) The Surviving Spouse;[1] (2) A minor child[2] of the Plan Participant (defined in the Proposed Regulations as any person under age 21);[3] (3) A disabled beneficiary;[4] (4) A chronically ill beneficiary;[5] or (5) An individual not more than ten years younger than the deceased Plan Participant.[6] A trust for the sole benefit of one or more Eligible Designated Beneficiaries can receive payments over the life expectancy thereof, but what about other possible beneficiaries who may benefit at a later time? This question is more favorably answered under the Proposed Regulations as discussed below. The New and “Unimproved” Ten Year Rule As discussed above, the most unpleasant surprise from the Proposed Regulations concerns the RMDs following the death of a Plan Participant who dies after reaching his or her Required Beginning Date (generally April 1 of the calendar year following the year the Plan Participant reaches the age of 72). Specifically, the Proposed Regulations state that a beneficiary who inherits an IRA or Retirement Plan from such a Plan Participant is required to take distributions beginning on the first calendar year following the year of the Plan Participant’s death, and each year thereafter until the tenth year following the calendar year of the Plan Participant’s death when all assets in the IRA or Retirement Plan must be distributed from the IRA/Plan to such beneficiary. This is a change from the “10-Year Rule” under the statute as understood by many practitioners and commentators, where the beneficiaries of the deceased Plan Participant’s Retirement Plan who are subject to the 10-Year Rule would not be required to take any distributions following the death of the Plan Participant until December 31 of the tenth year following the calendar year of the Plan Participant’s death (regardless of the Plan Participant’s age at death). Many practitioners and commentators find this IRS interpretation to be shocking, since a parallel “5-Year Rule” has been in effect under the Internal Revenue Code and Treasury Regulations regarding Retirement Plans for nearly 40 years, and such 5-Year Rule has never been interpreted or construed to require distributions to be made from the Retirement Plan before December 31 of the fifth year following the Plan Participant’s death. Nevertheless, authorities in this area have expressed concern that taxpayers and trusts may be severely penalized for failure to take distributions under rules that are very difficult to understand. As such, trustees may wish to err on the side of caution and take minimum distributions during the initial ten years if this will not have a significant tax impact. The Proposed Regulations interpret the Ten Year Rule differently if the Plan Participant died prior to his or her Required Beginning Date, in which case the Ten Year Rule operates in a similar manner to the historical Five Year Rule. In other words, no distributions are required to be made from the plan until December 31 of the tenth year following the calendar year of the Plan Participant’s death, if he or she died before the Required Beginning Date. Designated and Disregarded Beneficiaries The Proposed Regulations identify two tiers of Designated Beneficiaries.[7] Tier I includes “any beneficiaries of the trust whose benefits are neither contingent upon, nor delayed until, the death of another trust beneficiary who did not predecease the Plan Participant. Tier II includes “any beneficiaries of the trust who could receive amounts in the trust … that were not distributed to the [Tier I] beneficiaries, [but only if they cannot benefit until after the death of the Tier I beneficiary or beneficiaries].” If the beneficiary of the See-Through Trust is another trust, the beneficiaries of the second trust are treated as being beneficiaries of the first trust and thus they are considered Designated Beneficiaries. There are multiple situations under the Proposed Regulations in which a beneficiary can be “disregarded” for purposes of determining which payout method applies: 1. If one of the following events occur prior to September 30th of the calendar year following the year of the Plan Participant’s death: A. A beneficiary who predeceases the Plan Participant is disregarded. B. A beneficiary who is treated as having predeceased the Plan Participant by reason of a simultaneous death provision under applicable state law or via a qualified disclaimer is disregarded. C. A beneficiary who receives the entire benefit that the beneficiary is entitled to is disregarded. D. If a power of appointment is exercised in favor of one or more beneficiaries, then the other permissible appointees are disregarded. There are also situations under the Proposed Regulations where trust beneficiaries will be disregarded even if their interest is not eliminated prior to the September 30th Designation Date: 1. An Accumulation Trust Beneficiary Who Can Only Benefit After the Death of Tier I and Tier II Beneficiaries. For Accumulation Trusts only, when entitlement of such beneficiary is conditioned upon the death of any and all Tier I beneficiaries and at least one Tier II beneficiary. The Preamble to the Proposed Regulations provides the following example to illustrate this rule: [A]ssume that an IRA names a see-through accumulation trust that requires the trustee to pay specified amounts from the trust to the employee’s surviving spouse. Upon the spouse’s death, the see-through trust is to terminate and the amounts remaining in the trust are to be paid to the employee’s brother (who is not more than 10 years younger than the employee, and thus is an Eligible Designated Beneficiary). Further if the employee’s brother survives the employee but predeceases the surviving spouse, then the amounts remaining in the trust after the death of the surviving spouse are to be paid to a charity. In that case, the charity is disregarded as a beneficiary of the employee because the charity could receive only amounts in the trust that are contingent upon the death of the employee’s brother, whose only interest was a residual interest (that is, an interest in the amounts remaining in the trust after the death of the surviving spouse). In contrast, the charity would be treated as a beneficiary of the employee if the brother could receive amounts in the trust not subject to any contingencies or contingent upon an event other than the death of the surviving spouse (such as the surviving spouse’s remarriage). 2. A Beneficiary Who Can Only Inherit by Surviving a Minor Under a Trust That Pays Out Entirely On or Before the Minor’s 31st Birthday. A beneficiary of a see-through trust may also be disregarded when entitlement is conditioned upon the death of an individual who has not reached the age of majority (21) if the terms of the trust requires full distribution to such individual by the later of (1) the 10th calendar year following the calendar year of the Plan Participant’s death, or (2) the end of the 10th calendar year following the calendar year in which that individual attains the age of majority.[8] The following example from the Preamble illustrates this rule: Assume an employee names an [Accumulation] trust as the sole beneficiary, the trust permits specified amounts to be paid to the employee’s niece until the niece reaches age 31 (age of majority plus 10 years). The trust is scheduled to terminate with a full distribution of all trust assets to the niece when the niece reaches age 31, but if the niece dies before this scheduled termination, then the amounts remaining in the trust will be paid to the employee’s sibling. In that case, the only beneficiary designated under the plan for purposes of section 401(a)(9) and these regulations is the employee’s niece because the employee’s sibling is disregarded under the exception described in the preceding paragraph. However, if the see-through trust terms do not require a full distribution of amounts in the trust representing the employee’s interest in the plan until the niece reaches age 35, then this exception does not apply, and both the employee’s niece and sibling are treated as beneficiaries designated under the plan for purposes of section 401(a)(9) and these regulations. 3. Remainder Beneficiaries of Conduit Trusts Continue to Be Disregarded. Remainder beneficiaries of conduit trusts continue to be disregarded. In other words, only beneficiaries that could receive amounts in trust that are neither contingent upon, nor delayed until the death of another trust beneficiary (Tier I Beneficiaries) must be taken into account. The following example derived from the Proposed Regulations illustrates this rule[9]: Cathy dies at the age of 30 leaving her retirement plan payable to a trust for the benefit of her 35-year-old sibling Doug. If and when Doug dies, the trust will pass to Edward, who is 50. Doug is an Eligible Designated Beneficiary because he is not less than ten years younger than Cathy. Since the trust is a Conduit Trust, Edward’s interest can be disregarded and distributions can be paid out over Doug’s life expectancy as an Eligible Designated Beneficiary; however if the Trust was an Accumulation Trust, Edward would be considered a designated beneficiary and, since all trust beneficiaries are not Eligible Designated Beneficiaries, the 10-year rule would apply. If the Accumulation Trust instead provided that it was for the benefit of Doug and that after the death of Doug the trust would be held for the sole benefit of Cathy’s 36-year-old half-sibling Frank, and then would only benefit Edward if both Doug and Frank were deceased, then Edward would be disregarded and the lifetime payment rules could apply since all beneficiaries are Eligible Designated Beneficiaries. Just a “Minor” Exception for Accumulation Trusts As a general rule, if an accumulation trust has a designated beneficiary that is not an Eligible Designated Beneficiary, then the Plan Participant is treated as NOT having an Eligible Designated Beneficiary, and thus the IRA must be distributed no later than the end of the tenth year following the calendar year of the Plan Participant’s death. The Proposed Regulations introduce a new exception to this rule if there is a designated beneficiary who is the child under age of majority of the Plan Participant. In this case, the Plan Participant is treated as having an Eligible Designated Beneficiary allowing life expectancy payments to be made until ten years after the year in which the child reaches the age of majority. The following examples from the Preamble illustrate this rule: A Plan Participant names a see-through trust as the sole beneficiary of the employee’s interest in the plan, and the trust beneficiaries are the employee’s surviving spouse and the employee’s adult child who is neither disabled nor chronically ill, then the employee is treated as not having an Eligible Designated Beneficiary. As a result, the employee’s entire interest must be distributed no later than 10 years after the employee’s death. However, if there is another designated beneficiary who is the employee’s child and who, as of the date of the employee’s death, has not yet reached the age of majority, then, under the exception described in the preceding paragraph, the employee is treated as having an Eligible Designated Beneficiary. In the situation described in the preceding sentence, if the trust is receiving annual distributions using the life expectancy rule, then a full distribution from the plan would not be required until ten years after the year in which the minor child reaches the age of majority. Changes for Disabled and Chronically Ill Beneficiaries To summarize briefly, a beneficiary is considered to be disable or chronically ill if they satisfy the applicable definition as of the Plan Participant’s date of death and meet certain documentation requirements no later than October 31 of the calendar year following the calendar year of the Plan Participant’s death. The Proposed Regulations do not provide new guidance with respect to defining “chronically ill”, and also do not change the definition of “disabled” for beneficiaries who are 18 years of age or older. The Proposed Regulations do provide a new definition of “disabled” for beneficiaries under the age of 18, and also confirm that if a beneficiary is considered to be disabled as of the date of death by the Commissioner of Social Security under the definition of 42 U.S.C. 1382c (a)(3), then such beneficiary will be considered disabled for purposes of the RMD rules regardless of age. A disabled beneficiary is defined as follows: Age 18 or older – An individual who, as of the date of the employee’s death, is age 18 or older is disabled if, as of that date, the individual is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to be of long-continued and indefinite duration. Younger than Age 18 – An individual who, as of the date of the employee’s death, is not age 18 or older is disabled if, as of that date, that individual has a medically determinable physical or mental impairment that results in marked and severe functional limitations and that can be expected to result in death or to be of long-continued and indefinite duration. Further, the Proposed Regulations delineate a category of See-Through Trusts that have at least one disabled or chronically ill beneficiary, and they are called Applicable Multi-Beneficiary Trusts. An “applicable multi-beneficiary trust” is a see-through trust with more than one beneficiary that will benefit one or more disabled or chronically ill individuals, and with respect to which [both of the following apply]: (1) all of the trust beneficiaries are designated beneficiaries; and (2) at least one of the trust beneficiaries is an eligible beneficiary who is disabled or chronically ill.”[10] There are two types of Applicable Multi-Beneficiary Trusts, Type I and Type II. A Type I Multi-Beneficiary Trust is a trust which provides that the amounts in the trust are to be divided immediately upon the death of the Plan Participant into separate trusts for each beneficiary.[11] A Type II Multi-Beneficiary Trust is a trust that both: (1) identifies one or more individuals who are disabled or chronically ill and entitled to benefits during his/her lifetime, and (2) provides that no individual who is not disabled, chronically ill, or entitled to benefits during their lifetime “has any right to … interest in the plan until the death of all of the Eligible Designated Beneficiaries who are disabled, chronically ill, and entitled to receive benefits during their lifetime.”[12] One of the separate trusts under a Type I Multi-Beneficiary Trust to which the amounts are divided can be a Type II Multi-Beneficiary Trust. The beneficiaries of the receiving Type II Multi-Beneficiary Trust who are not disabled or chronically ill will be disregarded for purposes of these regulations, thus allowing for payments to be made from the IRA over the life expectancy fo the disabled or chronically ill beneficiary. However, if the terms of the trust fail to comply with the requirements of a Type II Multi-Beneficiary Trust then all of the beneficiaries are treated as beneficiaries.[13] The Power of Appointment Safe Harbor The Proposed Regulations confirm that all of the beneficiaries of a See-Through Trusts must be identifiable by September 30th of the calendar year following the calendar year of the plan participant’s death (“Determination Date”). A trust satisfies the identifiability requirement “if it is possible to identify each person eligible to receive a portion of … the plan through the trust.” Previously, the presence of a power of appointment was considered to frustrate such requirement because the failure of the person who holds the power of appointment ( the “Powerholder”) to exercise or restrict such power results in the inability to determine who the beneficiaries are. The Proposed Regulations provide a safe harbor with respect to the exercise or restriction of a power of appointment, which is separate and apart from the ability to reform or modify a trust, as further discussed below. The safe harbor provides that a See-Through Trust will not fail the identifiability requirement due to the presence of an unexercised power of appointment or an exercised power of appointment after the date of death of the Plan Participant. The provision ensures identifiability by clarifying who is deemed to be a beneficiary under the following scenarios: 1. If the Powerholder exercises his/her power of appointment on or before the Determination Date then the parties appointed are considered to be beneficiaries of the trust. 2. If the Powerholder exercises his/her power of appointment after the Determination Date, the Takers in Default and the added individual(s) are considered the beneficiaries of the trust. 3. If the powerholder fails to exercise or limit their power of appointment on or before the Determination Date then the Takers in Default of the power are considered to be the beneficiaries.[14] The following example derived from the Proposed Regulations illustrates this rule: Dad died in 2022 at the age of 60. Dad named a See-Through Trust as a beneficiary of his IRA. Under the terms of the trust, all trust income is payable to Dad’s surviving spouse, Mom, and Mom has a power of appointment to redirect the trust assets upon her death. The power of appointment provides that, if Mom does not exercise the power, then upon Mom’s death, Dad’s descendants are entitled to the remainder interest, per stirpes. As of the date of Dad’s death, Dad has two adult children, Child 1 and Child 2. Before the Determination Date, Mom irrevocably restricts Mom’s power of appointment so that Mom may only exercise the power to appoint in favor of Mom’s siblings (who all are less than 10 years younger than Dad and thus, are Eligible Designated Beneficiaries). Because Mom timely restricted the power of appointment so that Mom may exercise the power only in favor of Mom’s siblings, the only designated beneficiaries are Mom and Mom’s siblings, even though Child 1 and Child 2 are the Takes in Default. Because all of the designated beneficiaries are Eligible Designated Beneficiaries, payments may be made over Mom’s life expectancy. If Mom did not timely restrict the power of appointment, then Mom, Child 1 and Child 2 would all be considered designated beneficiaries and the 10-Year Rule would apply since not all designated beneficiaries are Eligible Designated Beneficiaries. The Ability to Amend, Modify, and Reform The Proposed Regulations are taxpayer-friendly as they permit the amendment, modification, and reformation of trusts on or before September 30th of the calendar year following the calendar year of the Plan Participant’s death so that trust beneficiaries, creditors, charities, and other entities can be added or removed.[15] If a trust beneficiary is added after the applicable September 30th date, however, the addition of the new beneficiary will affect the life expectancy calculation. Additionally, if a beneficiary is added in a calendar year in which a full distribution is not required, and after the addition of such beneficiary full distribution would have been required, the full distribution shall not be required until the end of the calendar year following the calendar year in which the beneficiary was added. Yet Another Special Surviving Spouse Rule: The RMD Delay An often forgotten benefit that is provided to a surviving spouse is the ability of a surviving spouse to delay the commencement of distributions if the surviving spouse is the sole beneficiary, and the Plan Participant did not begin making distributions during their lifetime. As discussed above, in this scenario, the surviving spouse is permitted to delay distributions until the end of the calendar year in which the Plan Participant would have attained the age of 72. If the surviving spouse dies prior to the Required Beginning Date, the applicable distribution rules (5-Year, 10-Year, or Stretch) are to be applied as if the surviving spouse was the Plan Participant. For this purpose, the date of death of the surviving spouse is substituted for that of the Plan Participant. If the surviving spouse remarries and dies prior to the commencement of distributions, the surviving spouse’s new spouse cannot utilize the delay exception. This does not apply to spousal rollovers, but the surviving spouse may roll over the IRA into his or her own IRA and delay the distribution until the surviving spouse reaches their own Required Beginning Date. Protect Yourself By Providing Trust Protectors. The flexibility and traps provided by these Proposed Regulations, call for increased use of Trust Protectors. Trust Protectors are individuals or entities, which may include professional corporations, who are named in a document and provided with the authority to make changes, and may not be considered to be fiduciaries. Before the 2000s, the use of Trust Protectors in will and trust drafting was fairly rare, but a good many planners now offer Trust Protector provisions to their clients to maximize flexibility and convenience for when a trust may need to be changed. Offering Trust Protector provisions that specifically provide that the Protectors are requested to review these rules and finalize arrangements to maximize stretch trust planning before the Determination Date will become more and more common. If Trust Protectors are considered to be fiduciaries and have a duty to add one or more particular individuals as beneficiaries of a trust, then those individuals may be considered to be beneficiaries for purposes of these rules, which could be problematic. On the other hand, giving Trust Protectors the ability to act in a non-fiduciary manner and to reallocate assets and benefits as between different trusts for different beneficiaries can work very well. There will certainly be more written on this topic by the authors and others. Conclusion IF YOU ARE NOT CONFUSED YOU ARE NOT PAYING ATTENTION -Tom Peters- Although most of the SECURE Act provisions became effective on January 1, 2020, the regulations that are proposed to become effective on January 1, 2022 will be crucial for taxpayers who need to arrange their affairs with respect to a qualified plan and IRA benefits going into trusts to safeguard wealth. At this point, thousands of tax, pension and estate planning advisors are combing through the 275 pages that were recently released and we are all awaiting the Final Rule. In the meantime, planners and advisors should comply with the Proposed Regulations, monitor the Proposed Regulations’ development and future implementation, and relay their findings to clients. The time to act is now as far as the documents that are produced in the next few months. Even before we have final regulations we know enough to make sure that taxpayers have the flexibility and planning tools to reflect the stability we now have under these Proposed Regulations. [1] Please note that a surviving spouse can still roll an IRA or pension made payable solely to him or her into a rollover IRA and under the Proposed Regulation can use the life expectancy of the deceased Plan Participant if he or she was younger than the surviving spouse to calculate distributions. [2] An individual under the age of 21 per the Proposed Regulations. [3] The use of the stretch rules can only apply until the end of the year in which the child turns 21. In the calendar year following the year in which the child turns 21, the 10-Year Rule will apply. [4] The individual must be disabled on the date of the Plan Participant’s death. [5] The individual must be chronically ill on the date of the Plan Participant’s death. [6] Most commonly a sibling. [7]§401(a)(9) did not categorize designated beneficiaries, however §1.401(a)(9)-(4)(f)(3)(I) provides that “[a]ny beneficiary who could receive amounts in the trust representing the employee’s interest in the plan that are neither contingent upon, nor delayed until, the death of another trust beneficiary who did not predecease (and is not treated as having predeceased) the employee; and any beneficiary of an accumulation trust that could receive amounts in the trust representing the employee’s interest in the plan that were not distributed to beneficiaries.” [8] § 1.401(a)(9)-4(f)(3)(ii) [9] Adaptation from Example 1 in the Proposed Regulations under § 1.401(a)(9)-4(f)(6). (A) Facts. Employer L maintains a defined contribution plan, Plan W. Unmarried Employee C died in 2022 at age 30. Prior to C’s death, C named a testamentary trust (Trust T) that satisfies the requirements of paragraph (f)(2) of this section, as the beneficiary of C’s interest in Plan W. The terms of Trust T require that all distributions received from Plan W, upon receipt by the trustee, be paid directly to D, C’s sibling, who is 5 years older than C. The terms of Trust T also provide that, if D dies before C’s entire account balance has been distributed to D, E, will be the beneficiary of C’s remaining account balance. (B) Analysis. Pursuant to paragraph (f)(1)(ii)(A) of this section, Trust T is a conduit trust. Because Trust T is a conduit trust (meaning the residual beneficiary rule in paragraph (f)(3)(i)(B) of this section does not apply) and because E is only entitled to any portion of C’s account if D dies before the entire account has been distributed, E is disregarded in determining C’s designated beneficiary. Because D is an eligible designated beneficiary, D may use the life expectancy rule of § 1.401(a)(9)-3(c)(4). Accordingly, even if D dies before C’s entire interest in Plan W is distributed to Trust T, D’s life expectancy continues to be used to determine the applicable denominator. [10] The Proposed Regulations clarify §401(a)(9)(H)(v) and provide that “[a]n applicable multi-beneficiary trust is a see-through trust with more than one beneficiary and with respect to which— (i) All of the trust beneficiaries are designated beneficiaries; and (ii) At least one of the trust beneficiaries is an eligible designated beneficiary who is disabled … or chronically ill.” §1.401(a)(9)-4(g). [11]§1.401(a)(9)-4(g)(2). [12]§1.401(a)(9)-4(g)(3). [13] The special rule concerning Type 2 Multi-Beneficiary Trusts was originally in §401(a)(9)(H)(iii) and §1.401(a)(9)-4(g)(3)(ii) amends such provision to read as follows: “[i]f an employee’s beneficiary is a type II applicable multi-beneficiary trust … then the beneficiaries of the trust [other than the disabled or chronically ill beneficiary] are treated as eligible designated beneficiaries without regard to whether any of the other trust beneficiaries are not eligible designated beneficiaries.” [14] §401(a)(9) did not provide any default rules concerning the existence of a power of appointment in terms of identifiability. However, in §1.401(a)(9)-4(f)(5), a safe harbor was included that provided the following “specificity requirements”: “A trust does not fail to satisfy the identifiability requirements … merely because an individual (powerholder) has the power to appoint a portion of the employee’s interest to one or more beneficiaries that are not identifiable … If the power of appointment is exercised [or restricted] in favor of one or more identifiable beneficiaries by September 30 of the calendar year following the calendar year of the employee’s death, then those identifiable beneficiaries are treated as beneficiaries designated under the plan. … However, if, by that September 30, the power of appointment is not exercised (or restricted) in favor of one or more beneficiaries that are identifiable … then each taker in default (that is, any person that is entitled to the portion that represents the employee’s interest in the plan subject to the power of appointment in the absence of the powerholder exercising the power) is treated as a beneficiary designated under the plan. If an individual has a power of appointment to appoint a portion of the employee’s interest to one or more beneficiaries and the individual exercises the power of appointment after September 30 of the calendar year following the calendar year of the employee’s death, then the rules of paragraph (f)(5)(iv) of this section apply with respect to any trust beneficiary that is added pursuant to the exercise of the power of appointment.” [15] Previously under §401(a)(9), the determination of beneficiaries and the resulting required minimum distribution date were determined at the date of death of the plan participant. However, under 1.401(a)(9)-4(f)(5)(iii)(B) and (C) “A trust beneficiary … may be removed pursuant to a modification of trust terms (such as through a court reformation or a permitted decanting) by September 30 of the calendar year following the calendar year of the employee’s death, in which case that person is disregarded in determining the employee’s designated beneficiary. “A trust beneficiary … may be added through a modification of trust terms (such as through a court reformation or a permitted decanting). If the beneficiary is added on or before September 30 of the calendar year following the calendar year of the employee’s death, paragraph (c) of this section will apply taking into account the beneficiary that was added. If the beneficiary is added after that September 30, then the rules of paragraph (f)(5)(iv) of this section will apply with respect to the beneficiary that is added.”

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

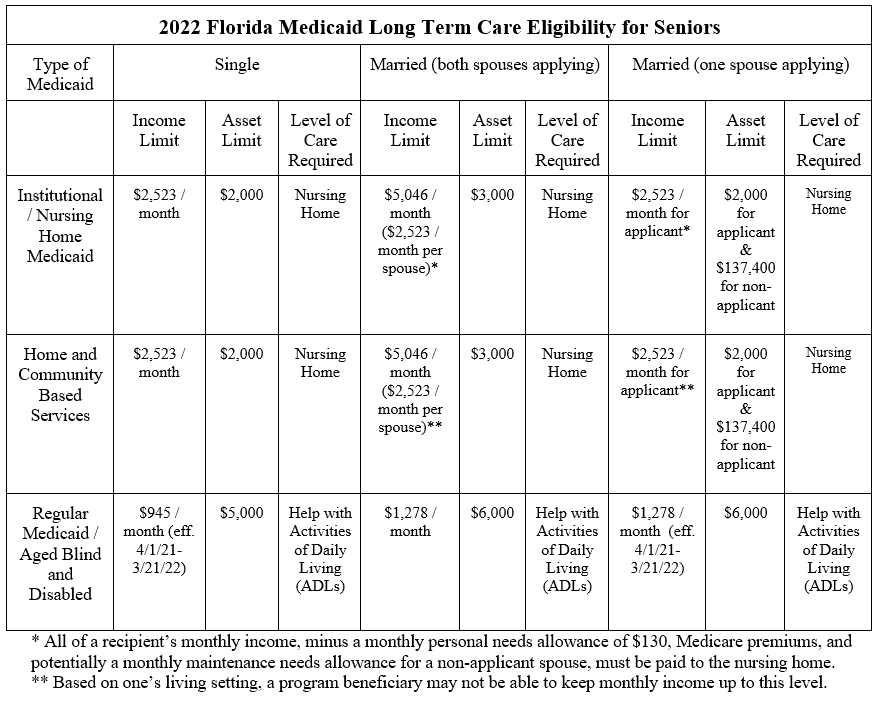

Article 4Planning for Medicaid Eligibility:HomesteadsAutomobilesIncome Trusts & Other Medicaid Planning IdeasThe Income Trust that Will Retain the Income and Still Qualify for Medicaid Five Years Later

Written By: Samuel Craig, Law Clerk Medicaid eligibility can be quite complex. The rules change frequently, and each state has a different way of applying for the Federal Medicaid program. While advanced or even last-minute planning can be very effective, the rules are complicated and any small action or failure to act can result in years of ineligibility and inability to receive care under the Medicaid program. While most estate planners simply refer clients to Medicaid experts, clients often ask what it takes to make sure that loved ones or the clients themselves can qualify for nursing home care, and many erroneously believe that Medicare covers nursing home care1 or that a typical long term care policy will cover this. Long-term care insurance policies are not standardized. Some only provide benefits if the insured resides in a nursing home; others only cover benefits received at home. Not all people qualify for long-term care insurance. Those who wait until the need for care is imminent usually find that it’s too late to purchase a policy because eligibility is based more on health than age. If your loved one is in poor health or already receiving long-term care services, the policy may be cost-prohibitive.2 The Florida Medicaid Program The table below provides a quick reference to allow seniors to determine if they might be immediately eligible for long-term care under the Florida Medicaid program.3 Defining “Income” and “Assets” Income can come from any source, such as, but not limited to, employment wages, Social Security Disability Income, Social Security Income, and IRA withdrawals. Countable assets include, but are not limited to, cash, stocks, bonds, investments, savings, and checking accounts. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable). Florida exemptions include personal belongings, household furnishings, an automobile, and certain irrevocable burial trusts. In addition, the person’s primary home is exempt if he or she either resides in the home or has the “intent” to return to it, which is possible to have even if the person has dementia or other mental disabilities, and his / her equity interest in the home is not greater than $636,000, in 2022. If the applicant has a non-applicant spouse (a spouse who is not on Medicaid) who lives in the home, it is exempt regardless of where the applicant lives or the applicant’s equity interest in it.4 IRAs in payout status are also exempt.5 Trust Choice & Medicaid’s Look-Back Period One should be aware that Florida has a Medicaid “Look-Back Period”, which is a period of 60 months that immediately precedes one’s Medicaid application date. When a senior is applying for long-term care Medicaid, whether that be services in one’s home, an assisted living residence, or a nursing home, there is an asset limit. During this time frame, Medicaid checks to ensure no assets were sold or given away under fair market value. If one is found to be in violation of the look-back period, a penalty period of Medicaid ineligibility will ensue. To be eligible for Medicaid, one cannot have assets greater than the limit. The most common example of a non-exempt transfer is a gift of an asset to a friend or family member within the prior 60 months of applying for Medicaid benefits. While revocable trusts provide the advantages of flexibility and avoidance of probate, they are not ideal when preparing to apply for Medicaid. The primary reason for this is that Medicaid will consider a revocable trust as a countable asset. Instead, a preferred method is through an irrevocable trust, otherwise referred to for Medicaid planning as an irrevocable income-only trust (IIOT). Not only does an IIOT protect family assets from creditors, it also eliminates the countable assets for Medicaid eligibility purposes. It is important to note, that a transfer into an irrevocable trust can be considered a gift for Medicaid eligibility purposes. This gift status works as a significant negative for people applying for Medicaid assistance. In particular, both “penalty period” and 60 months “look-back period” rules apply. If the beneficiary needs nursing home care during the 5-year look-back period and there are no funds available to pay for that care because they have all been placed in the trust, a common tactic is for other family members to finance that interim care. It may be possible to draft the trust deed so as to allow the trust to distribute income to those family beneficiary members to cover for this eventuality. Unfortunately, if the trust was created during the look-back period, it is considered to be a gift, and therefore, a violation of the look-back period. In simple terms, an irrevocable trust (sometimes called a “Medicaid Qualifying Trust”) is a legal arrangement where assets are transferred from an individual, called the grantor, to a third party, called the trustee. The trustee becomes the owner of the assets and holds them for the named beneficiary. A variety of assets can be transferred via a trust and may include a Certificate of Deposit (CD), stocks, property, cash, and annuities. The term, irrevocable, means that the grantor cannot amend or cancel the trust. The Income Only Trust If a grantor wants to protect income-producing assets and is concerned about Medicaid eligibility, he or she can contribute the assets to an income-only trust in which the grantor retains the right to income but no ability whatsoever to receive any distributions of principal. The grantor should not be the Trustee of the trust and the Trustee should have the discretion to distribute income for any purpose as well as the discretion to withhold any distributions of income. Florida planners will often suggest a 5-year income trust, although there is some debate amongst both attorneys and planners regarding the addition of a “trigger” to stop income. This strategy was examined by a Massachusetts court in 2017 in the Daley and Nadeau cases. Lisa Neely covered this, writing the following: Following Daley and Nadeau, elder law practitioners should revisit whether to include the following problematic provisions when drafting IIOTs: 1) the ability to appoint assets to a nonprofit or charitable organization (arising from the issue remanded in Nadeau); 2) a use and occupancy clause (arising from the issue raised by the Supreme Judicial Court in Nadeau concerning the ability of the state Medicaid agency to impute income and include it as part of the patient-paid amount calculation); and 3) the ability of the trust corpus to pay the grantor’s income taxes. If Massachusetts ever decides to enact expanded estate recovery, a retained life estate might cause the entire corpus of an irrevocable trust to be subject to a MassHealth estate recovery lien, as noted by the Daley Court.7 A Medicaid Trust may be a better option in some scenarios because it provides that if assets placed in the trust are suddenly needed, they will be difficult to access by outside creditors, but the assets can be accessed by the beneficiaries if implemented properly. As long as contributions are made to the trust more than five years before the donor applies for Medicaid long-term care benefits, the state Medicaid office will not penalize the donor for transferring assets to the trust, and the existence of the assets will not affect Medicaid eligibility. There are four key points to understand about Medicaid trusts: 1. Your trust will own all of your other assets, including your home, but you can still live in your home; 2. US government Medicaid assistance will pay for your care, including nursing home costs, if required; 3. Your assets need to be in the trust for five years before receiving Medicaid assistance (the 5-year lookback period); 4. Your children can be the trustees of the trust. ___________________________ 1 Medicare covers care in a skilled nursing facility (SNF) up to 100 days in a benefit period. For days 1-20, Medicare pays the full cost for covered services; for days 21-100, Medicare pays all but a daily coinsurance for covered services; after 100 days, Medicare pays nothing. “Medicare Coverage of Skilled Nursing Facility Care,” https://www.medicare.gov/Pubs/pdf/10153-Medicare-Skilled-Nursing-Facility-Care.pdf 2 https://www.myfloridacfo.com/division/consumers/understandingcoverage/longtermcareoverview.htm 3 American Council on Aging, “Florida Medicaid (SMMC-LTC) Income & Assets Limits for Nursing Homes & Long Term Care.” January 10, 2022. https://www.medicaidplanningassistance.org/medicaid-eligibility-florida/ 4 “Equity interest” refers to the amount of the home’s value owned by the applicant 5 Id. 7 Neely, Lisa, “Case Note: Daley v. Executive Office of Health and Human Services and Nadeau v. Director of the Office of Medicaid.” National Academy of Elder Law Attorneys, Volume 14, Number 1, Spring 2018.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Saturday WebinarSPOUSAL LIMITED ACCESS TRUSTS FROM A TO ZESTATE PLANNING FROM THE CUSTOMER FOXHOLE – MUSINGS ON ESTATE PLANNING INDUSTRYBoth programs will be presented on: Saturday, March 26th, 2022From 11:00 AM to 12:30 PM EDTOne link, two presentations. Please feel free to join at any time. REGISTER HEREThis is a free program. This program does not qualify for CLE/CPE Credits. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered. WEBINAR DETAILS:“SPOUSAL LIMITED ACCESS TRUSTS FROM A TO Z”Will be presented from 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) & “ESTATE PLANNING FROM THE CUSTOMER FOXHOLE – MUSINGS ON ESTATE PLANNING INDUSTRY”Will be presented from 12:00 PM to 12:30 PM EDT (30 minutes) Presented By: Noon Guest Speaker Dr. Rahul Razdan SCIENTIST/ENTREPRENEUR

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary informational webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recordings. Click on the playlist below to watch the recordings.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

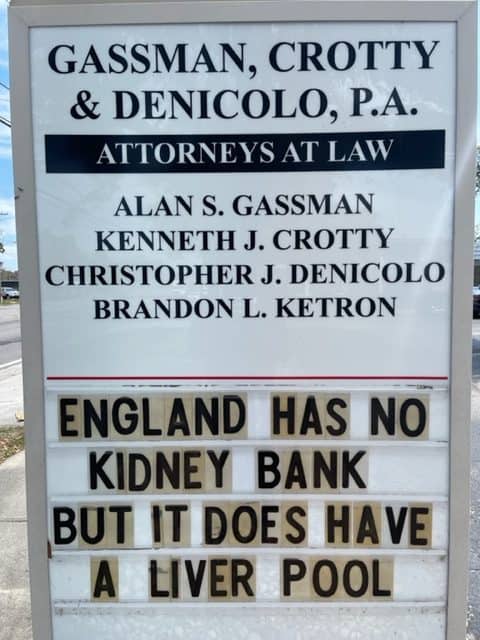

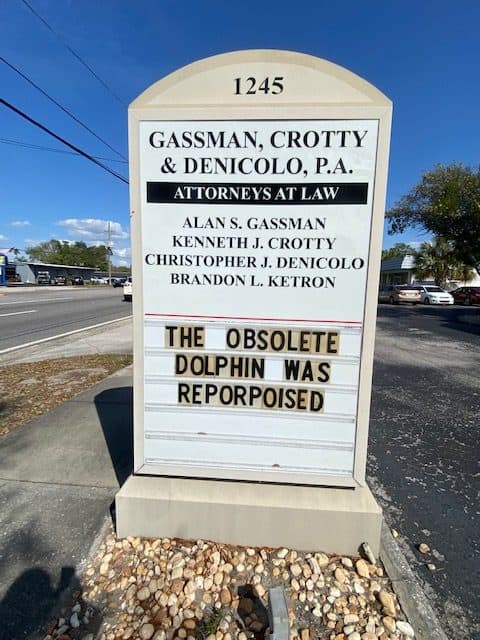

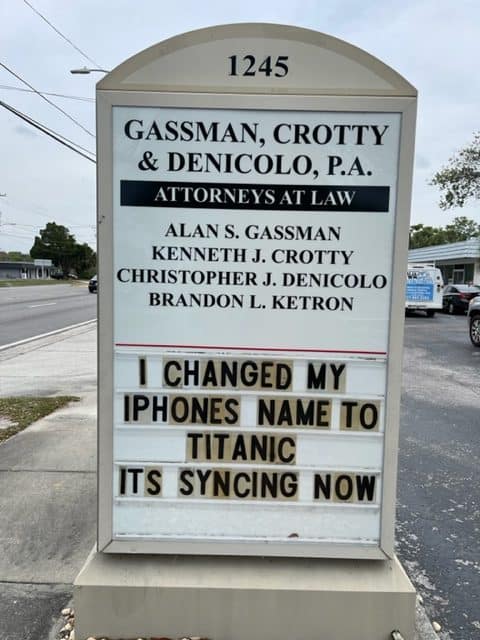

Humor

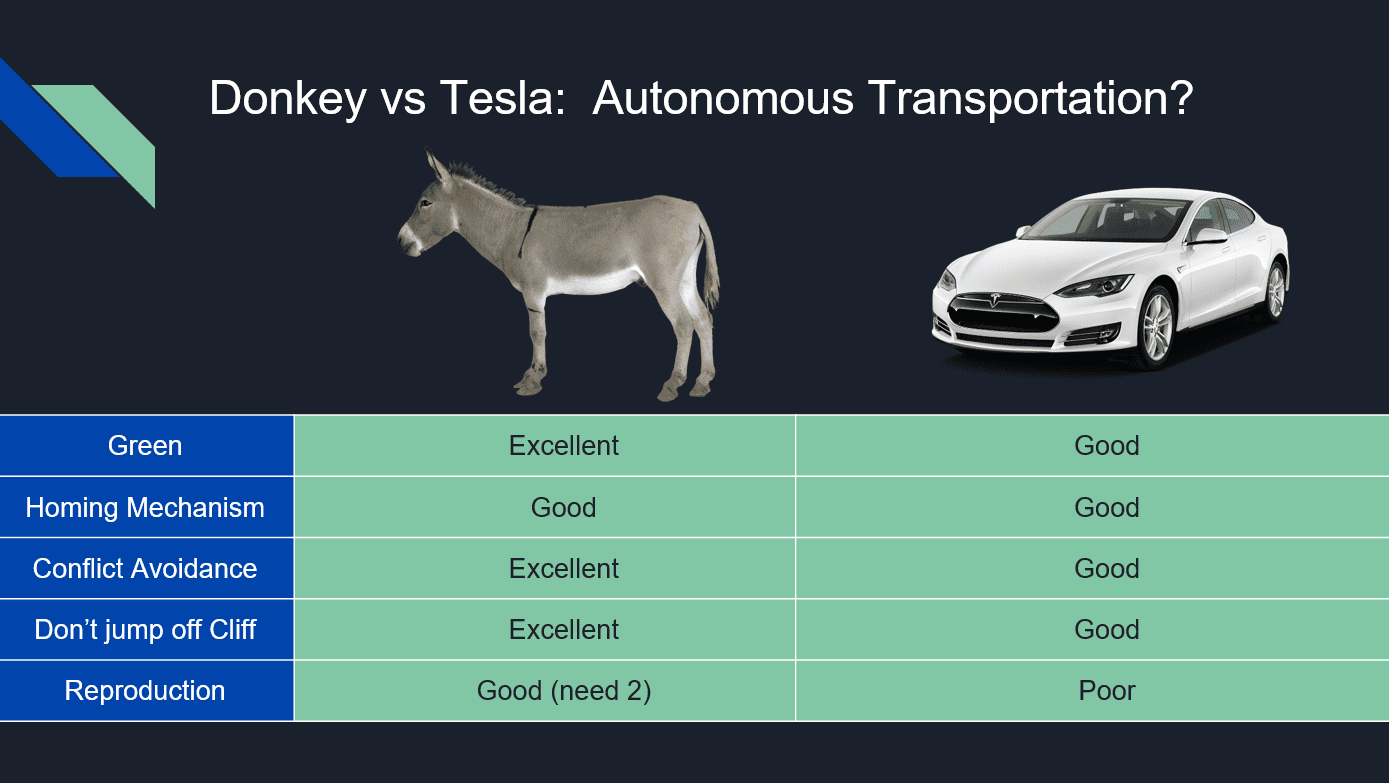

Humor from Dr. Rahul Razdan:

Cqhuote Quotes (Best with Oats)“[I]f you are a plan administrator, I realize we may have some people in the audience today who are actually plan administrators, going to be responsible for this stuff, I do have some advice for you, which is to check in your emails for the last few months and see if your company has made any nice early retirement offers, because this would be the time to consider them.” *** “The IRS used this opportunity to restate the minimum distribution trust rules, and they did a wonderful job of it. They’re so much better. You won’t believe it. You are going to see me genuinely happy with these new rules. When have I been happy?” *** “In preparing the Proposed Regulations the IRS looked ahead and figured out ways that people are going to game some of these rules. I know that you have never heard of anyone doing that, but they figured out that some people, some really bad people, might do this.” ***

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||