The Thursday Report – 7.3.2014 – 4th of July Edition

Try Our Safety Latch Clause to Protect Your Clients and Their Inheritances

“Explaining the Surviving Spouse’s Disclaimer, Portability, and Clayton Q-TIP Choices in 577 Words or Loss”

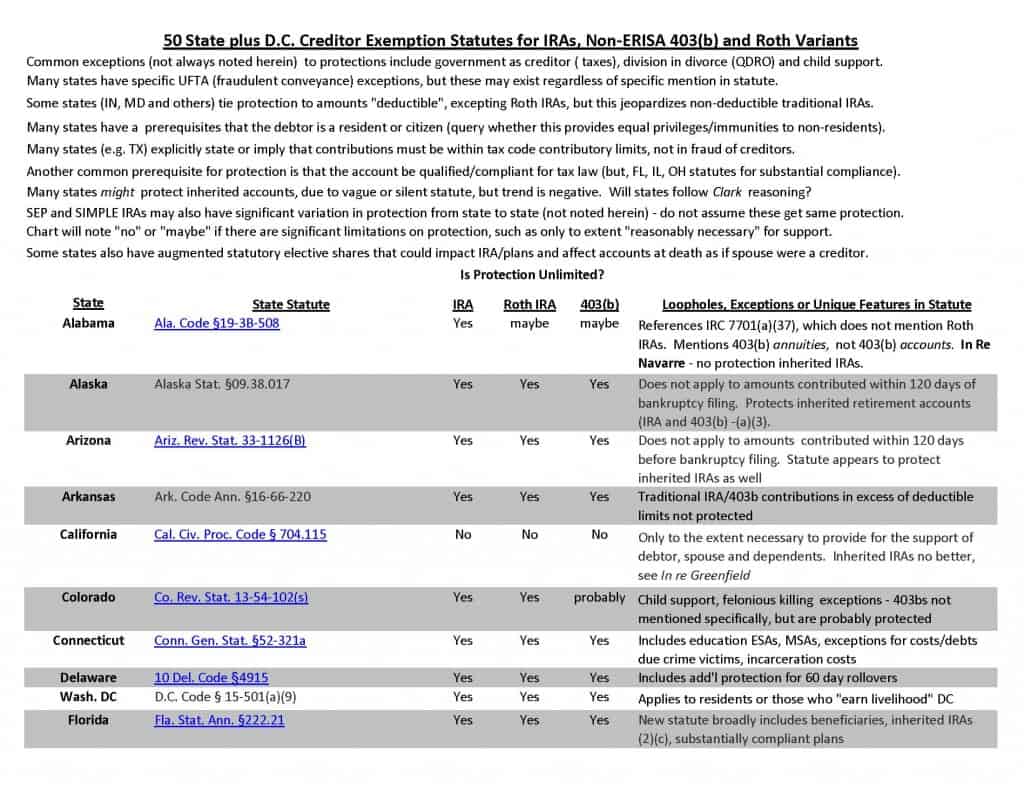

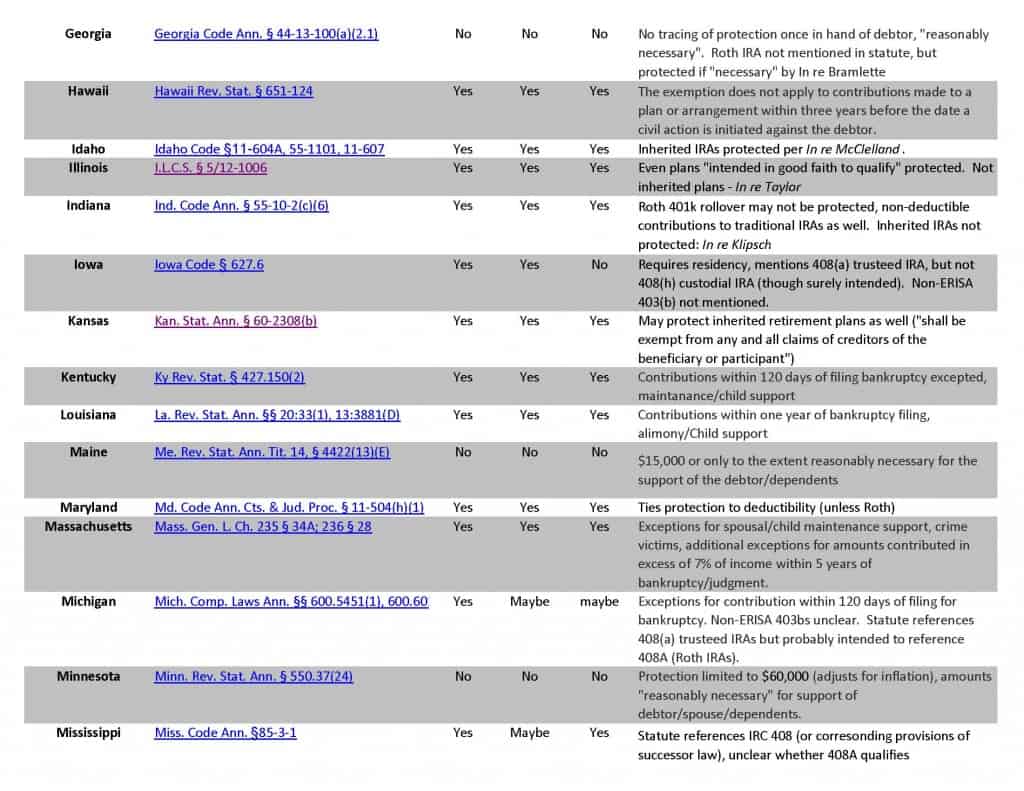

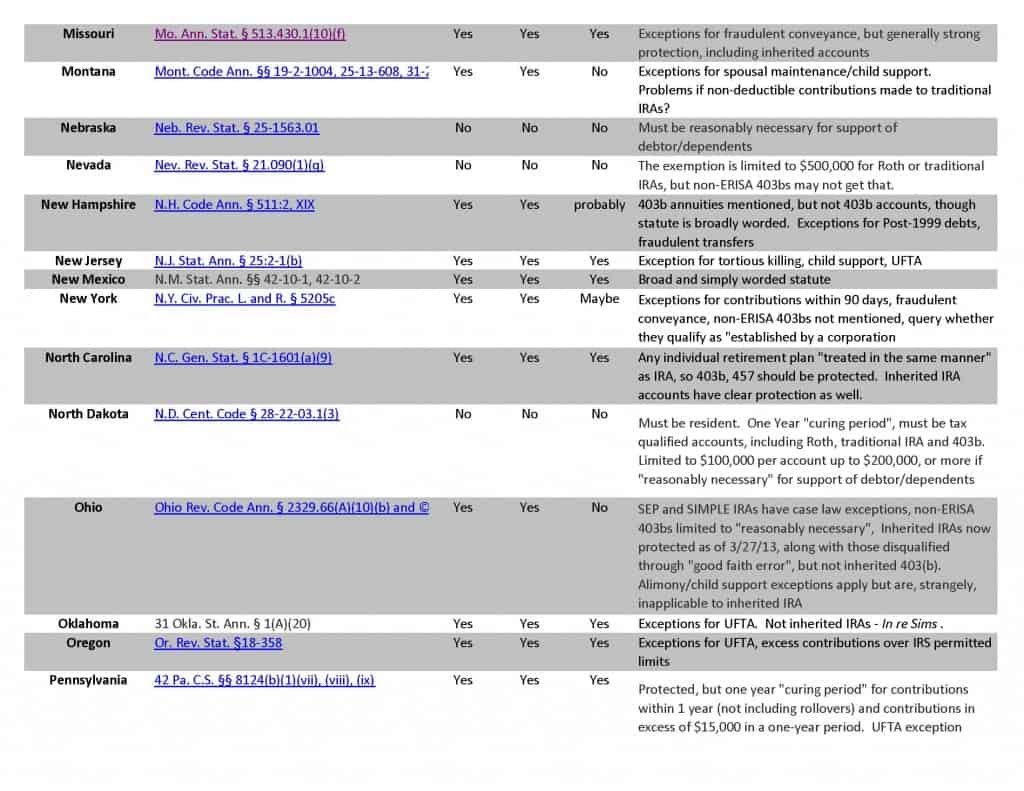

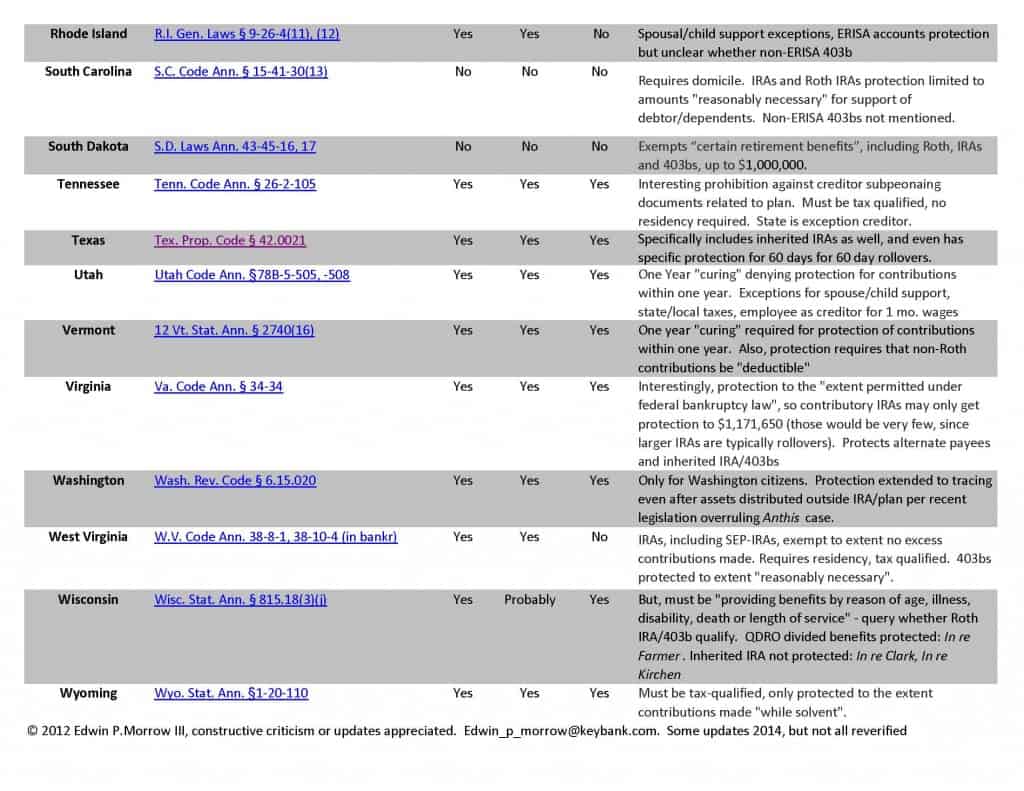

State-by-State Summary of Inherited IRA Protection Statutes, by Edwin P. Morrow, III, J.D., LL.M., MBA, CFP, RFC

Seminar Announcement – Step-Up Your Efforts to Step-Up Clients’ Basis – Strategic Estate Planning and Stepped-Up Basis Considerations

Tea for Two Liked by Bloomberg BNA Too

Annuity Concepts and Terminology Review for Tax Advisors, an article by Alan S. Gassman, Christopher H. Price and Christopher J. Denicolo

Thoughtful Corner – What is the Helper’s High, and How Can I Get Some?

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Try Our Safety Latch Clause to Protect Your Clients and Their Inheritances

Many times we have used the following clause to assist a client who might be infirm, of high age, or subject to undue influence.

The clause prevents amendment of a revocable trust without confirmation of good mental status, and understanding of the change, and absence of undue influence by one or more listed individuals and/or neurology or psychiatry doctors.

We have used this provision dozens of times, and it has facilitated avoidance of undue influence or trust litigation on a number of occasions.

Try it, you’ll like it!

I recognize that I have had mental challenges and want to assure that any future changes to this Trust Agreement or my estate plan are verified to have been carefully and completely considered and understood by me, and therefore wish to have a medical or psychologist verification of any change made and to have any two of __________________, _________________, _________________ and/or a board certified psychiatrist or neurologist verify my mental capacity.

2.01 Reservation of Power/Safety Latch Provision. Except as provided below I expressly reserve the right, at any time and from time to time, during my lifetime, by instrument in writing delivered to the Trustee, to alter, amend, or revoke this trust instrument, either in whole or in part.

Notwithstanding the above, or any provision herein to the contrary, no amendment or revocation of this Trust, no change of trusteeship, and no withdrawal by me or any other person of more than $100,000 of principal in cash or other assets (unless such withdrawal is authorized by a Trustee not related to me) in a calendar month may be made unless it is documented that such amendment, revocation, or withdrawal is made by me at a time and under circumstances as to which I am of sound mind and full mental capacity and am acting as the result of undue influence, by means of such action being: (1) approved in writing as to such mental condition by a then serving Trustee or Co-Trustee who is not related to me or a beneficiary of this Trust; or (2) such sound mind and full mental condition is confirmed in writing by (a) my ______________, ______________________, (b) any two (2) of the following individuals: ____________________________, ______________________________, or ____________________________, or (c) by two (2) Specialist Physicians selected as described below in this paragraph. In the event of a dispute or uncertainty between me and an acting Trustee or Trustees with respect to my competency to make a change in trusteeship, to make a Trust Amendment, or to require payment of principal or income under this Trust Agreement, then such dispute shall be resolved by two (2) Specialist Physicians. For the purposes of this provision Specialist Physicians shall mean licensed physicians specializing and board certified in areas relating to mental competency (psychiatrists or neurologists) who are on full-time staff at a well-respected hospital near where I reside, and are selected by the Trustee(s). If there is a dispute as to the selection of such Physicians, then the party with the power to designate successor trusteeship in the event of vacancy under Section 6.05(d) of this Agreement shall select such Physicians. Further, the exercise of any power of appointment by me set forth under this Agreement shall require the above confirmation as well.

“Explaining Credit Shelter Trusts, Clayton Q-TIP Trusts, Q-TIP Trusts and GST Exemption to Clients in 577 Words or Less”

Most but not all estate tax planners have become fluent with disclaimers, portability and Clayton Q-Tip choices.

Others are not so sure.

We welcome reader comments on whether the following is understood or enlightening by estate planners.

Enjoy!

A husband dies in 2014 and leaves everything to his wife. At the time of death, the couple has $20,000,000 worth of assets, which will be worth $40,000,000 when the wife dies. If the wife does not disclaim any of the assets left to her, then all of the couple’s assets will be subject to federal estate taxation on her death. The wife, however, by disclaimer can allow up to $5,340,000 worth of assets to pass into a “by-pass trust,” which will benefit her for her lifetime without being subject to federal estate tax. When the wife makes a valid disclaimer within 9 months of the husband’s death, she will be deemed to not have received the disclaimed property, but will also have to disclaim any right that she would otherwise hold to direct how the property would pass during her lifetime or upon her death.

The wife’s estate tax exemption on her death will be based upon her $5,340,000 present exemption, plus increases in the Consumer Price Index taking place after 2014, plus the husband’s unused $5,340,000 portability allowance, which does not grow with inflation. If she receives the portability allowance but remarries and her successor spouse dies before her and does not leave her a portability allowance, then the portability allowance left by the husband in our example above completely disappears! We are using $5,340,000 under the assumption that 2014 amounts will apply, and that the couple has not made gifts exceeding $14,000 per year to any individuals that would reduce the allowance.

Let’s assume that the wife disclaims $3,000,000 worth of assets that will be held for her benefit without being subject to federal estate tax at her death, and those $3,000,000 worth of assets grow to $7,000,000 in value before she dies, so that the wife will have $33,000,000 of individually owned assets when she dies. That whole $7,000,000 in value passes without being subject to federal estate tax, and she still has $2,430,000 from her husband’s portability allowance, so assuming that she does not remarry, upon her death the amount that passes estate tax free for the assets outside of the $7,000,000 in the trust that is already estate tax free will be based upon $2,340,000, plus whatever the $5,340,000 allowance has grown to.

The wife, however, may decide to rely on portability completely but would like to maximize the amount that will be held in a protective trust for her children and for her descendants, so as to never be subject to estate tax at the children’s level. In such scenario, she can disclaim up to $5,340,000 worth of the assets that would have been coming over from the husband into the special trust. The trustees of the special trust then would make a “Clayton Q-TIP election” so that those assets will be subject to federal estate tax as if they belong to the wife when she dies, and the wife will have the entire $5,340,000 portability allowance from the husband. The Clayton Q-TIP election allows the executor to determine how much of the Q-TIP trust should qualify for the marital deduction. The amount not qualifying for the deduction may pass to another trust or to other beneficiaries without jeopardizing the entire marital deduction.

The advantage here is that the husband has a $5,340,000 generation skipping tax exemption that enables that amount in assets to be placed into the Clayton Q-TIP trust on the husband’s death (after the disclaimer and the Clayton Q-TIP trust election have been made) and if that $5,340,000 grows to $12,000,000 before the wife dies it will nevertheless be able to pass to a trust that can benefit the children without being subject to federal estate tax at the children’s level.

So in a situation similar to this one, upon the death of the first spouse, the surviving spouse has the disclaimer option, the using portability option, and the Clayton Q-TIP option.

State-by-State Summary of Inherited IRA Protection Statutes, by Edwin P. Morrow, III, J.D., LL.M., MBA, CFP, RFC

Our friend and writing idol, Edwin P. Morrow, III, J.D., LL.M., MBA, CFP, RFC was kind enough to updated the attached chart which shows a state-by-state summary of inherited IRA protection statutes. To view the chart please click here.

If you have not read Ed’s materials on obtaining a step-up in basis by trust and power of appointment planning please let us know and we will be glad to send them, or you can contact Ed directly by emailing him at Edwin_p_morrow@keybank.com.

Ed’s picture and short biography are as follows:

Ed Morrow is currently the Manager for Wealth Strategies Communications for Key Private Bank’s Wealth Advisory Services and is involved in the marketing of advanced wealth strategies and training of local teams of credentialed financial planners, trust officers, investment specialists and private bankers. In addition, Mr. Morrow is a Wealth Specialist analyzing tax, trust and estate planning needs of high net worth and ultra-high net worth clients nationwide. He is a Board Certified Specialist (Ohio State Bar Assn.) in Estate Planning, Trust and Probate Law, a Certified Financial Planner (CFP) and Registered Financial Consultant (RFC). He is also a Non-Public Arbitrator for the Financial Industry Regulatory Authority (FINRA). Mr. Morrow is a frequent speaker at CLE/CPE courses on asset protection, tax, and various financial and estate planning topics.

Seminar Announcement – Step-Up Your Efforts to Step-Up Clients’ Basis – Strategic Estate Planning and Stepped-Up Basis Considerations

To register for the webinar, please click here.

Tea for Two Liked by Bloomberg BNA Too

Our recent article entitled Tea for Two, and Two for TBE has been featured in the July edition of the Bloomberg BNA Tax Management Estates, Gifts and Trusts Journal, with the following introductory poem:

Tea for Two,

And two for TBE,

Many clients want to own assets jointly,

If not sure, why not try and see………..

The article explains that same gender couples residing in Florida and other states that do not recognize their marriages may still nevertheless attempt to use tenancy by the entireties in anticipation of court decisions that will quite likely provide that state law must recognize these marriages.

The first ten requesters will receive a complimentary copy of the entire Journal, which includes our article.

For a copy of the article itself please click here.

What about situations where the individuals are married and one dies owning a homestead and Florida does not recognize the marriage? Will there be a cause of action later to the effect that the surviving spouse had homestead inheritance rights? Time will tell, but on some days it is better to be a lawyer than a title insurance company.

Annuity Concepts and Terminology Review for Tax Advisors, an article by Alan S. Gassman, Christopher H. Price and Christopher J. Denicolo

Our article entitled Annuity Concepts and Terminology Review for Tax Advisors was published in the July 2014 edition of Estate Planning Magazine.

To read the article please click here.

Thoughtful Corner – What is Helper’s High, and How Can I Get Some?

Wikipedia defines helper’s high as “a euphoric feeling, followed by a longer period of calm, experienced after performing a kind act.”

The encyclopedia goes on to indicate that the sensation results from the release of endorphins, followed by a longer lasting period of improved emotional well being and sense of self-worth, which will reduce stress and improve health.

When you help someone make sure to enjoy your “helper’s high.”

It is better than shopping, gambling, and many other things that cause release of endorphins.

So it’s okay to get high, as long as it is the “helper’s high”, and especially if it is billable or charitable.

Humor! (Or Lack Thereof!)

The Legal Problems of Cartoon Characters

by Ronald H. Ross

Bullwinkle the Moose

Was jailed for substance abuse

His partner shouldn’t be so cocky,

He turned state’s witness against Rocky

When he couldn’t pay his debts to thugs,

It was broken bunny legs for Buggs

Popeye accidentally squeezed Olive Oil

So hard she shuffled off her mortal coil

Caught with a bone, and someone else’s shoe,

Was seasoned crime-fighter Scooby Doo

Charged with treason is Betty Boop,

Giving info and “entertaining” enemy troops

And there’s a reason they call him Speed Racer

(amphetamines with a whiskey chaser)

They almost caught Mr. Magoo,

The FBI wired one of his criminal crew

But the nearsighted guy smelled trouble because the snitch was Pepe Le Pew

Upcoming Seminars and Webinars

NEW PORT RICHEY SEMINAR:

Alan S. Gassman and Kenneth J. Crotty will be speaking at the North FICPA Monthly meeting on two topics:

- Planning for Same Gender Couples and Laws that Apply to All Couples

- A CPAs Guide to Trust, Tax Law and Compliance

Date: Wednesday, July 16, 2014 | 4:30 p.m.

Location: TBD

Additional Information: If you would like to attend this seminar please contact Ron Cohen at 352-257-9518 or email agassman@gassmanpa.com

********************************************************

FREE LIVE WEBINAR:

STEP-UP YOUR EFFORTS TO STEP-UP CLIENTS’ BASIS – STRATEGIC ESTATE PLANNING AND STEPPED-UP BASIS CONSIDERATIONS

Date: Wednesday, July 23, 2014 |12:30 p.m. (30 Minute Webinar)

Speakers: Edwin P. Morrow, III, Alan S. Gassman

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE LIVE WEBINAR:

GAUGING AND HANDLING ENTITLEMENT TENDENCIES OF BENEFICIARIES, EMPLOYEES AND OTHERS – A FASCINATING AND EXTREMELY PRACTICAL GUIDE ON SOCIETY’S NEWEST ISSUE

Date: Tuesday, July 29, 2014 | 12:30 p.m. (30 Minute Webinar)

Speakers: Stephanie Thomason, Ph.D. and Alan S. Gassman, Esq.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE LIVE WEBINAR:

A POWERFUL 40 MINUTE DOUBLE HEADER WITH JONATHAN BLATTMACHR

Topics:

- Foreign vs. Domestic Asset Protection Trusts: More Than Just Creditor Protection Considerations

- Empowering Your Powers of Appointment: Don’t Leave Out Important Tax and Practical Provisions or Ignore Important Considerations. With Sample Provisions

Date: Tuesday, August 12, 2014 | 12:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE ISLE OF MAN PRESENTATION:

Alan S. Gassman will be speaking on US TRUST AND TAX LAWS FOR INTERNATIONAL INVESTORS at Cayman National Bank and Trust Company on the Isle of Man

Sign up now and you will receive a free lunch! Transportation not included.

“Half-way between England

And Ireland in the Irish Sea.”

Is a great place to discuss trusts with glee.”

Date: Wednesday, September 3, 2014

Additional Information: If you would like to receive a copy of the materials that will be presented please email Janine Gunyan at janine@gassmanpa.com and we will send them to you once they are ready.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014 at 5:00 p.m.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it=s our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifing the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(WE WERE NOT INVITED, BUT WILL ATTEND AND ARE STILL EXCITED)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

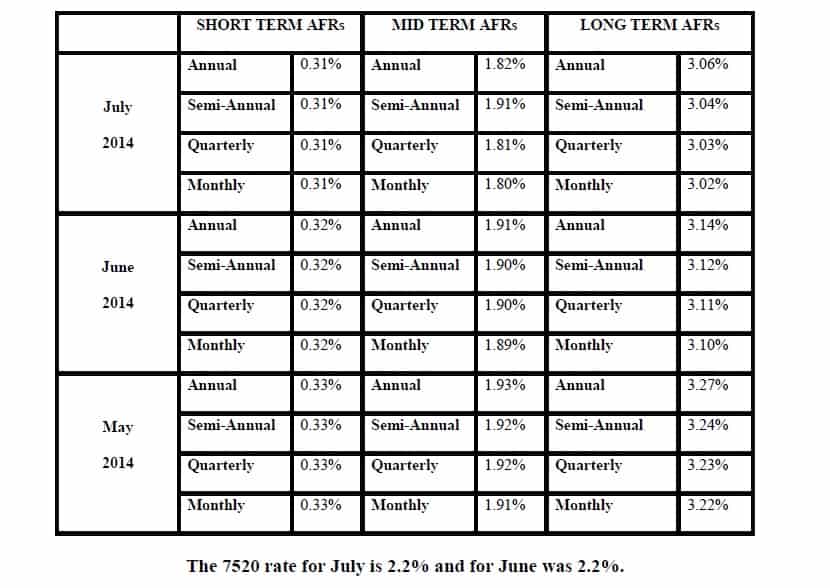

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.