The Thursday Report – 10.23.14 – Pre H-ween, Issue 118, Don’t Screan

The “Don’t Contact My Client the Debtor” Trap by Kenneth J. Crotty and Alan S. Gassman

Surviving Spouses of Veterans May Qualify for Benefits You Were Not Aware Of – Pension, Home Health Care/Skilled Nursing Facility Benefit Rules

Gregory Gay’s Corner – Social Security, Part One

Reverse Side of Reverse Mortgages – One Congressman’s Harsh Criticism

Seminar Spotlight – Ave Maria Professional Acceleration Workshop

Halloween Trivia Contest!

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The “Don’t Contact My Client the Debtor” Trap

By Kenneth J. Crotty and Alan S. Gassman

Florida Statute Sections 559.55 through 559.785 provide that a business entity owed money by a customer or patient cannot contact the customer or patient if they are represented by legal counsel and it has been requested that they contact only the legal counsel.

If this rule is violated and the professional practice or business did not have a protocol in place requiring its personnel and systems to follow this rule, then the debtor will be entitled to a statutory penalty amount of $1,000 plus reasonable attorney’s fees and costs incurred by the debtor.

Many plaintiffs and debtor-friendly law firms are sending letters to businesses, waiting for the business to slip up and send a past-due notice to the patient or client, and then sending demand letters which will typically request $1,000 in statutory damages and $1,500 in legal fees.

Businesses that have a written protocol in place are more likely to not violate this law and to be able to negotiate or litigate so that there will be no statutory fee or legal fee paid.

It is equally important to specifically confirm that all faxes and letters coming into the practice which ask that a patient or client not be contacted about billing matters are handled appropriately and that the billing contact information for the patient or client is updated. Receipt of such a notice needs to cause a change in the billing contact information so that if a bill is past due and a notice or other correspondence relating to the patient or client is sent, it will automatically go care of the lawyer or of the third party.

If you would like to have a copy of a prototype policy and a memorandum to billing and collection personnel with respect thereto, please let us know, and we will be happy to send it to you.

Surviving Spouses of Veterans May Qualify for Benefits You Were Not Aware Of – Pension, Home Health Care/Skilled Nursing Facility Benefit Rules

MANY WIDOWS AND WIDOWERS ARE UNAWARE OF VALUABLE BENEFITS THAT THEY CAN RECEIVE FROM THE VETERANS ADMINISTRATION.

Intro

The surviving spouse of a U.S. veteran may be surprised to find that he or she is eligible for both pension and nursing home or home health care benefits that many senior citizens and their advisors are not aware of.

In particular, the assisted living facility or home care benefits are provided under the Veteran Administration’s (“VA”) Aid & Attendance and Housebound Pension.

The VA offers a variety of benefits and services to spouses, children, and parents of Service members and Veterans who are deceased or totally and permanently disabled by a service-connected disability. The benefit categories to be considered are as follows:

- Dependency and Indemnity Compensation

- Survivors’ Pension

Dependency and Indemnity Compensation

When a veteran dies from a service-connected injury or disability, the veteran’s surviving spouse is entitled to dependency and indemnity compensation. The monthly payment is based upon the deceased veteran’s pay grade. A copy of the applicable pay rates can be found by clicking here. This rate is increased by $246 for each child of the deceased veteran and surviving spouse who is under the age of 18.

A surviving spouse of a deceased veteran with a service connected disability may be eligible to receive Dependency and Indemnity Compensation by meeting any one of the following criteria:

- Married to a Service member who died on active duty, active duty for training, or inactive duty training, OR

- Validly married the Veteran before January 1, 1957, OR

- Married the Veteran within 15 years of discharge from the period of military service in which the disease or injury that caused the Veteran’s death began or was aggravated, OR

- Was married to the Veteran for at least one year, OR

- Had a child with the Veteran, AND

- Cohabited with the Veteran continuously until the Veteran’s death or, if separated, was not at fault for the separation, AND

- Is not currently remarried

If eligible, the surviving spouse must also provide evidence that:

- The Service member died while on active duty, active duty for training, or inactive duty training, OR

- The Veteran died from an injury or disease deemed to be related to military service, OR

- The Veteran died from a non-service-related injury or disease, but was receiving, OR was entitled to receive, VA Compensation for service-connected disability that was rated as totally disabling for at least 10 years immediately before death, OR

- Since the Veteran’s release from active duty and for at least five years immediately preceding death, OR

- For at least one year before death if the Veteran was a former prisoner of war who died after September 30, 1999

Survivor’s Pension

The Survivor’s Pension is a need based program for surviving spouses of deceased veterans with wartime service. There is no service connected injury or disability requirement, only that the deceased veteran completed his or her service and was discharged under other than dishonorable conditions. The surviving spouse’s family income must be less than the amount set by Congress to qualify for the Survivors Pension Benefit. This annual limit is called the Maximum Annual Pension Rate (MAPR). A surviving spouse’s pension is an amount equal to the difference between your countable family income and the Maximum Annual Pension Rate.

The Maximum Annual Pension Rates can be found by clicking here. The rate for a surviving spouse with no dependents is $8,485, and the rate for a surviving spouse with one dependent child is $11,107.

An example would be if an eligible surviving spouse had one dependent child the Maximum Annual Pension Rate would be $11,107. If the surviving spouse’s income was above $11,107, then the surviving spouse would not receive anything from the Survivor’s Pension. If her income was $10,000, which is below the Maximum Annual Pension Rate her annual income from the Survivor’s Pension would be $1,107 (11,107 – 10,000).

In order to be eligible to receive a Survivor’s Pension, a surviving spouse must meet the following requirements:

- Surviving Spouse of a deceased Veteran AND

- Un-remarried AND

- The deceased Veteran must have met the following service requirements

- For service on or before September 7, 1980, the Veteran must have served at least 90 days of active military service, with at least one day during a war time period.

- If he or she entered active duty after September 7, 1980, generally he or she must have served at least 24 months or the full period for which called or ordered to active duty with at least one day during a war time period

- Was discharged from service under other than dishonorable conditions.

Aid & Attendance and Housebound Pension

The Aid & Attendance and Housebound Pension will increase the monthly pension amount that a surviving spouse is currently receiving if the spouse meets the eligibility requirements.

In the above example, the Maximum Annual Pension Rate limitation for a surviving spouse with one dependent was $11,107. If the surviving spouse is eligible for the Aid & Attendance Pension, this amount will increase to $14, 113.

In order to be eligible for additional VA benefits through the Aid & Attendance Pension a surviving spouse must meet the following requirements:

- Eligible for a VA pension AND

- Require the aid of another person to perform functions of everyday living (bathing, feeding, dressing, attending to the wants of nature, adjusting prosthetic devices, or protecting yourself from the hazards of your daily environment) OR

- Bedridden OR

- Patient in a nursing home OR

- Have eyesight limited limited to a corrected 5/200 or less in both eyes

In order to be eligible for additional VA benefits through the Housebound Pension a surviving spouse must be substantially confined to his or her immediate premises because of permanent disability.

It is important to note that since the Aid & Attendance and Housebound Pension allowances increase the pension amount, people who are not eligible for a basic survivor’s pension due to excessive income may be eligible for pension at these increased rates.

How to Apply

There are numerous ways a Surviving Spouse may apply for a VA pension. The options include:

1.) Complete the VA Form 21-534, “Application for Dependency and Indemnity Compensation, Death Benefits and Accrued Benefits by a Surviving Spouse or Child” and mail the form to your VA regional office.

2.) Work with an accredited VA representative or agent.

3.) Go to a VA regional office and have a VA employee assist you.

4.) If the death was in service, the surviving spouse’s Military Casualty Assistance Officer will most likely assist you in completing the process.

In order to apply for increased benefits under the Aid & Attendance and Housebound Pension, a surviving spouse may apply by writing to the VA regional office where he or she filed a claim for pension benefits. The surviving spouse should include written copies of any evidence validating the need for Aid & Attendance type care.

The report should include sufficient details to determine whether there is a disease or injury producing physical or mental impairment, loss or coordination, or conditions affecting the ability to perform daily functions of living. The report is preferred to come from an attending physician.

The report should also indicate how well the applicant gets around, where the applicant goes, and what he or she is able to do during a typical day.

The Reverse Side of Reverse Mortgages – One Congressman’s Harsh Criticism

Last week, we featured a great article from Michael Kitces on appropriate uses of reverse mortgages. This week, our reverse mortgage coverage continues with a report from Congressman Mark Takano’s report and a discussion of Fred Thompson’s commercial regarding reverse mortgages.

Congressman Mark Takano’s April 24, 2014 Report

On April 24, 2014, California Representative Mark Takano released a report titled “Reverse Mortgages: Senior Housing Bubble Held Together by Glue and Tax Dollars”. The Congressman stressed extreme concern and provided specific recommendations regarding the flaws in the reverse mortgage industry, and sent a letter to the Federal Housing Administration recommending reforms stating that, “It’s time for the federal government to reconsider its involvement with reverse mortgages and make crucial changes to the program to protect seniors and taxpayers.” The very well-written report presented several key findings, which include:

- 1 out of every 10 reverse mortgages are in default and could face foreclosure;

- Reverse mortgages are indeed expensive, adding a significant amount to a lump sum option as a result of interest and ongoing fees;

- Seniors are using reverse mortgages as an alternative way to supplement their retirement income because of the decrease in pensions, the drastic cost-of-living adjustments, the rising cost of health care, and because they are living longer lives;

- Over the past 20 years, the number of reverse mortgages issued increased over 1,000%; and

- Misleading advertising presented by “trusted celebrities” suggest that a reverse mortgage is a government benefit (i.e. SSI, Medicaid, Medicare, etc.) and not a loan, therefore, the risks associated with reverse mortgages are not emphasized.

Representative Takano’s recommended solutions to FHA are to:

(1) Improve Counseling and Consumer Protections;

(2) Require Brokers and Originators to act in the best interest of seniors;

(3) Introduce protections to limit defaults and hold lenders accountable; and

(4) Strengthen protections for spouses and family members.

We believe that the Congressman is spot on with his analysis of the reverse mortgage industry, the flaws and manipulations associated therewith, and his recommended solutions can lead to a protection of our seniors rather than the current detriment reverse mortgages are causing.

Fred Thompson Commercial:

Senator Mark Takano’s April 24, 2014 report has the following to say about Mr. Thompson’s commercial:

Reverse mortgage lenders use trusted celebrity spokespeople to encourage seniors to take out these types of loans. Take these examples from actors and even a former U.S. Senator:

Fred Thompson for American Advisors Group (AAG): “A government insured reverse mortgage allows seniors to stay in their own home and to turn their equity into tax-free cash.”

What Senator Thompson fails to mention is that reverse mortgages can cause loss of eligibility for Medicaid or Supplemental Security Income (SSI). The ad includes disclaimers in small, almost illegible font that only the keenest eyes can spot. He doesn’t mention that homeowners must continue to pay insurance, taxes, maintain the property, and comply with loan terms. Testimonials from customers in the same ad claim “It doesn’t cost anything. You won’t lose anything, and at the end of the day you might be pleasantly surprised.” These downplay the risks that seniors face when taking out reverse mortgages.

Here is the exact small print found, but not readable, on the Fred Thompson television commercial:

- Reverse mortgages are first and second mortgage loans.

- A reverse mortgage increases the principal mortgage loan amount and decreases home equity (it is a negative amortization loan).

- Borrowers are responsible for paying taxes and insurance, which is substantial.

- We do not establish an escrow account for disbursement of these payments.

- We arrange loans with third‑party providers but do not make mortgage loans in New York.

- Fred Thompson is a paid AAG spokesperson.

- AAG also works with other lenders and financial institutions that offer reverse mortgages.

- With your consent, AAG may forward your contact information to other lenders and financial institutions that offer reverse mortgages for your consideration of reverse mortgage programs that they offer.

- These materials are not from HUD or FHA and were not approved by HUD or a government agency.

If you enjoyed this presentation half as much as we enjoyed giving it, then we enjoyed giving the presentation twice as much as you enjoyed reading it.

The above line was stolen from Monty Python, and we are not giving it back!

Gregory Gay’s Corner – Social Security, Part One

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

We begin this series with a discussion of the national Social Security program, Social Security taxes, limits on Social Security earnings, and how these benefits can be influenced by a regular, early, or late retirement.

An Overview of the National Social Security Program

Presently, about 64 million people collect some form of Social Security benefit. Fifty-six million people receive retirement benefits. An additional eight million people receive Social Security Income known as SSI. Social Security originated as a retirement program. However, today’s Social Security system provides much more. Persons other than retirees receiving benefits are the disabled, spouses and dependents of persons who receive Social Security, widows, widowers and children of deceased workers. Thus, depending on the circumstances, a person may be eligible for Social Security at any age.

The contributions from the Social Security tax presently paid by in excess of 164 million employees is sufficient at this time to pay the benefits received by the retired and disabled workers and still create a reserve. However, several years ago, Congress recognized that the pay-as-you-go Social Security system will be insufficient in future years to fund the increased demand for benefits brought about by the increasing number of retired workers.

In 1950, the ratio of workers to beneficiaries was 16 to 1. Presently, there are 2.9 workers for every Social Security beneficiary. By the time the Boomer generation attains full retirement age, this ratio will be 2.1 workers for every 1 beneficiary. By 2030, the Baby Boomer generation will double the number of retirees receiving Social Security benefits. In recognition of these demographic changes, Congress passed legislation a few years ago intended to respond to this increasing demand for retirement benefits.

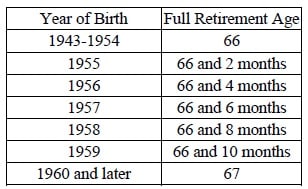

The legislation increases “full retirement age” for workers born in 1943 or later. Full retirement age now caps at age 67 for workers born after 1959. Thus, baby boomers will have to wait longer to receive their regular old-age Social Security benefits.

Social Security Taxes and Limits on Earnings

The percentage of Social Security tax that will be deducted from a worker’s pay in 2013 is 6.2 percent of earnings. It is estimated that the social security tax will be paid by 163 million workers in 2013. The maximum amount on which this tax is imposed for the year 2013 will be $113,700. The maximum that can be withheld from a worker for the social security tax in 2013 will be $7,049.40. The percentage of Social Security tax and the maximum amount of earnings on which this tax is imposed may increase each year. Employers will also pay an additional 6.2% of their employees’ covered wages in 2013 for their share of social security taxes. Self-employed individuals will pay 12.4% of their income in social security taxes up to the $113,700 wage base. A Medicare tax is also deducted from a worker’s paycheck. Presently, this is an additional 1.45% of earnings for employees earning less than $200,000. An additional Medicare Tax became effective for individual workers earning more than $200,000 for taxable years beginning January 1, 2013. Married couples filing a joint return who earn more than $250,000 will have to pay the additional Medicare Tax. The rate of the additional Medicare Tax is 0.9%. The new statute requires an employer to withhold the additional Medicare Tax on wages or compensation the employer pays to an employee in excess of $200,000 in a calendar year. An employer has this withholding obligation even though an employee may not be liable for the Additional Medicare Tax because, for example, the employee’s wages or other compensation together with that of his or her spouse (when filing a joint return) does not exceed the $250,000 liability threshold. Any withheld but unused Additional Medicare Tax will be credited against the total tax liability shown on the individual’s income tax return (Form 1040).The employer is not required to notify an employee when it begins withholding the Additional Medicare Tax. There is no employer match for the Additional Medicare Tax. An example for a single tax payer with wages of $245,000 is as follows. In 2013, a single individual with wages of $245,000 will owe the Medicare tax rate of 1.45% on the first $200,000 of wages. The Medicare higher rate of 2.35% will be applied to the remaining $45,000 of wages for 2013. Employers will be responsible for collecting and remitting the additional Medicare payroll tax on wages that exceed $200,000. There is no maximum amount of earnings on which this tax is imposed.

Starting in 2013, the new Health Care legislation imposes an additional Unearned Income Medicare Contribution Tax (UIMCT) equal to 3.8% of the lesser of net investment income or the excess of the modified adjusted gross income over the applicable threshold amount. The threshold amount will be $200,000 in a year for an individual and $250,000 in a year for a married couple. Net investment income includes interest, dividends, annuities, royalties, rents, net gain from property held for investment and income from passive activities. It does not include the gain on the sale of real estate if the property was held in an active business and the gain on the sale of a personal residence to the extent the gain is not taxable income.

The Senior Citizens Freedom to Work Act eliminated the Social Security retirement earnings test in and after the month in which a person reaches regular retirement age. However, the Senior Citizens Freedom to Work Act does not repeal the present maximum that can be earned without a reduction in Social Security benefits between ages 62 and 66. The maximum amount that a worker under age 66 can earn without a reduction in Social Security benefits in the year 2013 will be $15,120. The maximum that can be earned without a reduction in Social Security benefits may be adjusted by Congress each year. For every $2 earned over the limit, $1 is withheld from Social Security benefits. However, during the calendar year in which a worker born in 1947 attains age 66, the amount that can be earned prior to his or her birth month without reduction in Social Security benefits in the year 2013 is $40,080. A person can earn an unlimited amount of income without a penalty after attaining age 66. Only wages and net self-employment income count toward the Social Security earnings limit. Income from savings, investments, interest, pensions, annuities, capital gains or insurance will not affect a retired worker’s benefits. Failure to inform the Social Security Administration of any excess earnings by April 15th of the year following the excess earnings may result in the imposition of an additional penalty.

Regular Retirement

A wage earner today may take normal retirement and begin receiving monthly Social Security checks at age 66 if born between 1943 and 1954 (see chart below). At least 40 quarters of credit for contributing to Social Security (ten years of work) are needed to qualify for Social Security benefits. The amount of earnings upon which Social Security is paid in order to earn a quarter of coverage from wages or net income in the year 2013 is $1,160. A credit is earned by reporting at least $1,160 in 2013 of wages or net income from self- employment at any time in a year. Thus, a worker can receive credit for four quarters in a year by earning the $4,640 ($1,160 x 4= $4,640) at any time during a year. This minimum amount of earnings for credit for a quarter of coverage increases each year.

Early Retirement

A person may still elect to start receiving Social Security benefits as early as age 62 at a reduced rate. Since the minimum retirement age remains at 62 but the regular retirement age has increased, a person retiring early must understand that there will be a reduced monthly benefit. For example, a person who has a full retirement age of 67 and retires at age 62 will have his or her benefit reduced 5/9 of 1 percent for each of the 36 months between age 64 and age 67 plus 5/12 of 1 percent for each month in excess of 36 months before normal retirement age. Thus, if this person whose normal retirement would have been age 67 retires early at age 62, he or she will only receive 70 percent of his or her full retirement benefit.

The disadvantage to taking early retirement is that it will permanently reduce a worker’s monthly benefit. Thus, if a worker eligible for regular retirement at age 66 chooses early retirement at age 62 and lives beyond age 77, the worker may ultimately receive less in total benefits.

In addition, a surviving spouse may receive less social security benefits for the rest of his or her lifetime due to early retirement. This is because the survivor can receive his or her own benefit or the deceased spouse’s benefit, whichever is more. If the deceased spouse had a larger benefit than the surviving spouse, the surviving spouse will be limited to his or her smaller benefit or the reduced benefit paid to the deceased spouse who took early retirement.

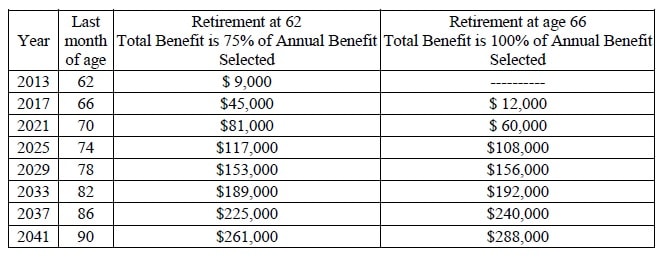

LIFE SITUATION #1

John, who was 62 in January of 2013, is considering early retirement. John would receive $1,000 per month at normal retirement. John wants to know how much he would lose in Social Security benefits over his lifetime if he retires at age 62, rather than the normal retirement age of 66. John is in good health and both of his parents lived until age 85. John will only receive 75 percent of his normal retirement benefit if he retires at age 62. This is because his benefit will be reduced 5/9 of 1 percent for each of the 36 months between age 63 and age 66 plus 5/12 of 1 percent for each month in excess of 36 months before normal retirement age. The following chart shows the total Social Security benefits John will receive at various points following retirement, depending on whether John retires at the normal retirement age of 66 or takes early retirement at age 62.

The break-even point is during the 16th year after early retirement at age 62. At this point, the total benefit for the person who selected normal retirement exceeds the total benefit for the person who selected early retirement. Since it is assumed for the purpose of this illustration that the monthly benefit will be used for living expenses, no projections have been made to determine how much the early retirement benefits might earn if they were invested for the entire period. In addition, the person who elects early retirement must not earn more than $15,120 per year between ages 62 and 65 without having to repay some of the social security received during the early retirement years.

Until 2011, persons turning age 62, could take an early Social Security retirement and then invest these funds until age 66. Then, the funds could be paid back to the Social Security Administration and a benefit at the normal retirement amount could be taken. This loophole has been eliminated as of 2011. Now, a person taking early retirement cannot pay back the previously withdrawn funds and begin receiving regular retirement benefits.

Late Retirement

A worker may find it advantageous to delay normal retirement in two ways. First, the extra income earned after full retirement age usually increases average earnings because the earnings in later years may be higher and will replace a previous lower year of earnings. The higher the earnings, the higher the monthly Social Security benefits. Secondly, a special credit is given to a worker who delays retirement. This credit is a percentage added on to the worker’s Social Security benefit that varies depending on his or her full retirement age.

A delayed retirement credit of 8% per year is given for retirement after the normal retirement age. To receive this credit, a person must be working at his or her normal retirement age. No additional credit is given after age 70.

A person born in 1947 who intends to retire at age 70 would first determine his or her normal retirement age from the table on page 4. This person’s normal retirement age is 66. The delayed retirement percentage for a person born in 1947 which is 8% per year would be multiplied by 4 for the additional years to be worked beyond normal retirement. Thus, the worker’s benefit at age 70 would be 32% higher than his or her primary insurance amount at age 66.

A married worker who intends to take advantage of the late-retirement benefit may wish to consider filing for social security benefits at the full retirement age of 66, and then immediately suspend the receipt of his or her social security benefit until age 70 if the spouse’s lifetime earnings are lower. If the spouse with the higher earnings record files for regular social security benefits at age 66 and then suspends his or her benefit, the spouse with the lower lifetime earnings may receive a higher normal retirement benefit based on the non-retiring spouse’s record. This is because the spousal benefit is 50% of what his or her spouse is to receive at regular retirement. By example, John has reached full retirement age of 66, but intends to not receive Social Security benefits until age 70. His regular retirement monthly benefit is $1,800. By waiting until age 70 to begin receiving benefits, his monthly delayed retirement benefit will be 32% more or $2,376. If his wife, Mary, who is also age 66, has lower life-time earnings that will entitle her to only receive $750 per month from Social Security, she could instead request to receive at age 66 an amount equal to $900 per month, which is 50% of John’s regular retirement benefit. However, John must first file for benefits at age 66 and then immediately suspend the receipt of the benefits. In addition, if John dies first after attaining age 70, Mary’s benefit will increase to $2,376 per month. This is because her retirement benefit is based on the worker’s benefit or his or her spouse’s benefit, whichever is greater.

Next week, our examination of the Social Security program will continue with a look at spousal benefits and family benefits of a retired or deceased worker, as well as a discussion of disability benefits and eligibility.

Gregory Gay can be reached at gregg@willtrust.com.

Seminar Spotlight – Naples Ave Maria Professional Acceleration Workshop

Saturday, January 31st Ave Maria Professional Acceleration Workshop

By Jerald E. Slutzky, J.D., CFP and Janine M. Gunyan

Ave Maria School of Law and Gassman, Crotty & Denicolo, P.A. are pleased to announce that Alan Gassman will be presenting a full day interactive workshop for 3rd year law students, alumni and interested professionals at Ave Maria School of Law for individuals who wish to enhance their present and future professional practices and personal lives. This workshop will consist of 8 interesting and thought provoking sessions that will enable participants to think through their own situations, formulate solutions and goals, and engage in thought provoking small group breakout sessions.

Bring your goals, problems and decisions to be made to this stimulating environment and be prepared to walk out with enthusiasm, solid action steps, and a great passion for the practice and business of law and helping others.

This workshop offers planning, goal setting, road block elimination and many innovative and useful strategies for both established professionals and beginner lawyers, and is based on prior workshops that have received very high praise from a number of successful lawyers and law students. Many have said that this allows for turbo-charging a normal practice to take it to the next level by breaking the practice-building process into bite-sized, useful and effective action steps to avoid wasting time, money and important opportunities in a myriad of ways.

The program helps beginning lawyers hit the ground running by covering the most important and not always obvious principles for building a successful law practice, including choosing the proper first practice experience, hiring and working with staff, when to use outsourcing opportunities, how to keep costs under control, how to choose an appropriate fee or hourly rate, how to build an efficient office, how to attract and keep good clients, and much, much more.

This workshop will provide the established attorney with several timesaving tools that will enhance your already successful practice, and provide you with strategies to restore your passion for the practice of law while improving your bottom line, enjoyment of daily activities and maximizing efficiency and the quality of work performed.

This workshop will provide real life useful ways to reduce stress, maintain and increase the quality of important relationships, and interact with others effectively.

This program will be presented on Saturday, January 31, 2015 from 8:30 a.m. to 5:00 p.m. at Ave Maria School of Law in Naples, Florida.

Professionals who did not graduate from Ave Maria School of Law can attend this program by making a small donation to the school.

Comments from past workshop participants include the following:

“I want to personally thank you again for providing me with the unbelievable opportunity to attend your professional acceleration workshop. I came away from your workshop with renewed excitement in improving my practice. While I had long let go of the notion that doing things the old way was the only way, I found myself mentally making changes in nearly every area of my practice.

There were added bonuses that are intangible and difficult to articulate. I love what I do, but to be able to do it better, more efficiently, add to my bottom line and, all the while, allow me to have more personal time available in a 60-plus hour week, was truly unexpected. Simply implementing half a dozen of the changes I developed throughout the day as a result of your program will not only enhance the bottom line, but make my days innumerably easier.

Thank you so much for giving your time to help other professionals with personal and professional growth.”

– Hamden H. Baskin, III, J.D., LL.M. (Taxation)

Estates and Trust Litigation Lawyer with Over 30 Years of Experience

Baskin Fleece Attorneys At Law

“I thoroughly enjoyed the workshop presented by Alan Gassman and am looking forward to adopting new routines and habits. I appreciate Alan’s time and commitment to sharing his achievements with others. I am looking forward to being part of the 2015 Professional Acceleration Workshop program.”

– Linda Chamberlain, Esq.

Linda R. Chamberlain, P.A.

Board Certified Elder Lawyer with Over 30 Years of Experience

“Alan Gassman’s Professional Acceleration Workshop was a fast-paced, information-packed, and highly instructional event. Through interactive discussions of time-tested professional and personal growth strategies ranging from goal setting and problem solving to office efficiency and effective team building, Alan provides a thoughtful and measured approach to becoming a highly effective professional. I left the workshop feeling invigorated and excited to implement the insights into my practice management and continued self-study. The course materials and Alan’s compilation of trusted additional resources will be an invaluable resource for years to come. Thank you for the opportunity to participate.”

– Christina Rankin, J.D., LL.M.

Trust and Estates Lawyer with Over 10 Years of Experience

Law Offices of Richard D. Green

“By having the opportunity to discuss my goals and the obstacles keeping me from achieving those goals with other professionals I was able to define my path to achieve those goals like never before.

Not only was I able to improve myself personally, but I also had the unexpected opportunity of being able to have very candid discussions about law practice management and what actually works and doesn’t work with experienced lawyers who provided great advice for me as a new lawyer entering the field.

The entire experience was invaluable and far more than what I thought it may be. I am very much looking forward to our next session to continue to develop as a young lawyer both personally and professionally.”

– Brandon Ketron, CPA and 3rd Year Stetson Law Student

“I am super charged from the workshop. I have already started to work towards my written goals and my subconscious has me waking up almost 2 hours earlier ready to start my day – one of my goals! It really works. I am very grateful to be a part of this program and your professional community.”

– Debbie Faulkner, J.D., LL.M. (Taxation)

The Faulkner Firm, P.A.

To register for this exciting and informative program, please email Alan Gassman at agassman@gassmanpa.com or Karen Grebing at kgrebing@avemarialaw.edu.

2015 Clearwater Professional Acceleration Workshop

By Invitation Only – Please Invite Yourself!

Alan Gassman will be starting a one year program for attorneys and professionals based off of the one-day seminar mentioned above.

The year-long program features five 6 hour sessions on the last Friday of each month, with a make-up session provided 7 days later.

The dates for the workshop are as follows:

- Friday, January 30, 2015

- Friday, March 20, 2015

- Friday, June 26, 2015

- Friday, September 25, 2015

- Friday, December 4, 2015

There will be other associated support and interactive activities that can be discussed with interested participants.

The number of spots in the 2015 year-long program are limited and several very successful and positive lawyers have already registered. For more information email agassman@gassmanpa.com or call 727-442-1200. (Sorry not free. Admission is limited to positive forward thinking professionals who are sincerely interested in helping others—others need not apply)

Halloween Trivia Contest!

Halloween is just one short week away! To get the celebration started early for our Thursday Report readers, we are holding a Halloween Trivia contest. Please email your answers to the below questions to agassman@gassmanpa.com. Winners will receive an empty bucket of Kentucky Fried Chicken to go trick-or-treating with!

1.) What were the first Jack-o-Lanterns traditionally made from?

- Melons

- Turnips

- Pumpkins

- Coconuts

2.) What does the Halloween color orange represent?

- The twilight

- The burning of spirits

- Jack-o-Lanterns

- The harvest

3.) What does the Halloween color black represent?

- Midnight

- Uncertainty

- Death

- Trick-or-treating

4.) After Candy Corn, which is the most popular Halloween candy?

- Reese Cups

- Starburst

- Snickers

- M&Ms

5.) Halloween is the 2nd highest grossing commercial holiday after what?

- Christmas

- Thanksgiving

- Easter

- Valentine’s Day

6.) What is the fear of Halloween called?

- Samhainophobia

- Phasmophobia

- Wiccaphobia

- Coimetrophobia

7.) Halloween is the 3rd largest party day of the year in the United States. Which days are ranked 1st and 2nd?

- The 4th of July and Christmas

- New Year’s Eve and Super Bowl Sunday

- New Year’s Eve and Christmas

- Super Bowl Sunday and the 4th of July

8.) What percentage of parents admit to sneaking candy from their children’s trick-or-treat bags?

- 30%

- 55%

- 75%

- 90%

9.) How much does the United States, as a country, spend annually on celebrating Halloween?

- $1 billion

- $2 billion

- $5 billion

- $7 billion

10.) What year was the Halloween classic “It’s the Great Pumpkin, Charlie Brown” first aired?

- 1957

- 1966

- 1982

- 1993

BONUS ROUND: Which famous magician died on Halloween Day?

Don’t forget to email your answers to agassman@gassmanpa.com, and stay tuned next week for the Halloween Trivia Contest answers, more Halloween humor, and some legal aspects of Halloween you might want to consider.

Upcoming Seminars and Webinars

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” IRA and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

INTERNATIONAL TAX LAW DOUBLE HEADER WEBINARS:

Alan Gassman and Leslie A Share will be presenting a double header webinar on two topics:

- US Tax and Compliance Issues Affecting Americans Abroad – You Can Run, But You Can’t Hide (5:00 p.m.)

- Door #7 – Planning Techniques for Non-Resident Aliens Who Invest in Florida Real Estate – The Irrevocable Trust Structure Explained (5:30 p.m.)

Date: Monday, October 27, 2015 | 5:00 p.m. and 5:30 p.m.

Additional Information: To register for the 5pm webinar please click here. To register for the 5:30 pm webinar please click here.

*********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by reverse mortgage specialist Elena Katsulos for a webinar on REVERSE MORTGAGES, A DEEPER DIVE

Date: Wednesday, November 5, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar please click here.

*************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: To see the complete schedule, please click here. For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan S. Gassman will be presenting Dick and Jane’s Legal Adventure at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting. This program will cover the basics of Wills, trusts, LLCs and coordination thereof for paralegals. The presentation includes a 4 color slide show called “THE LEGAL STORY OF DICK AND JANE”, and all attendees will receive one copy of the Thursday Report, whether they want it or not. Dinner is included, but mashed potatoes are extra.

Date: November 11, 2014 | 6:00 p.m. – 8:00 p.m. (Alan Gassman speaks at 7pm)

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATIONS:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING.

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar please click here. To register for the 5:00 p.m. webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information:To register for the webinar please click here.

********************************************************

LIVE 2015 CLEARWATER PROFESSIONAL ACCELERATION WORKSHOPS:

Alan Gassman will be presenting a year-long Professional Acceleration Workshop that will enable participants to look down from 30,000 feet to supercharge their practices and professional lives.

5-6 hour sessions will be held on the following dates:

- Friday, January 30, 2015

- Friday, March 20, 2015

- Friday, June 26, 2015

- Friday, September 25, 2015

- Friday, December 4, 2015

Location: A Clearwater, Florida hotel to be determined.

Additional Information: For more information or to register for the program please contact Alan Gassman at agassman@gassmanpa.com or at 727-442-1200.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

*************************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

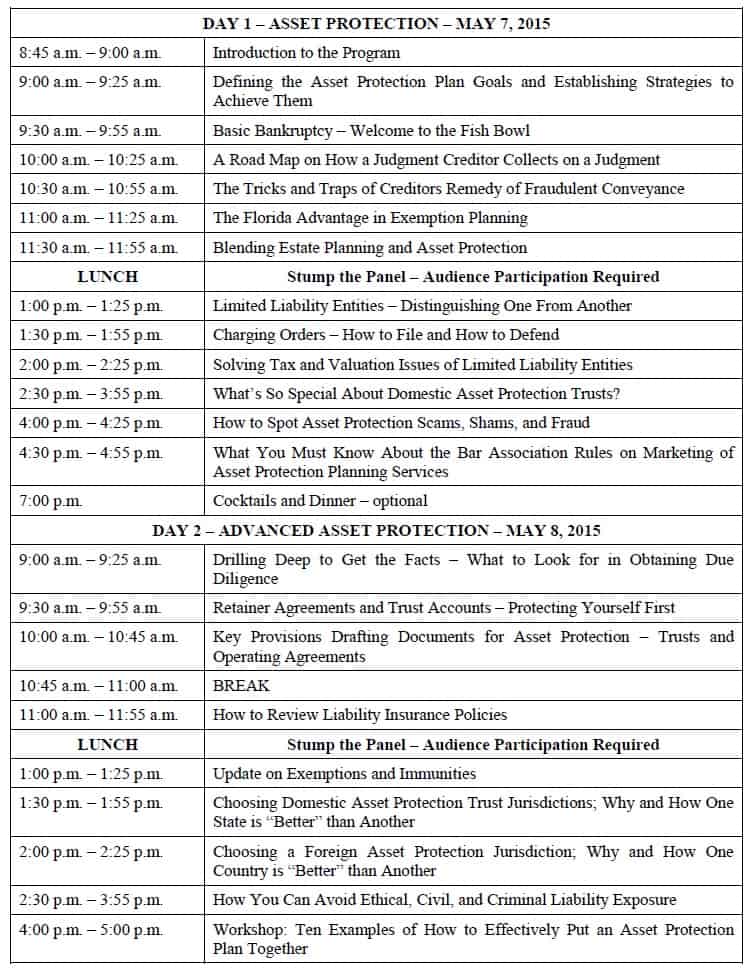

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Topics and Times are as follows:

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here . For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

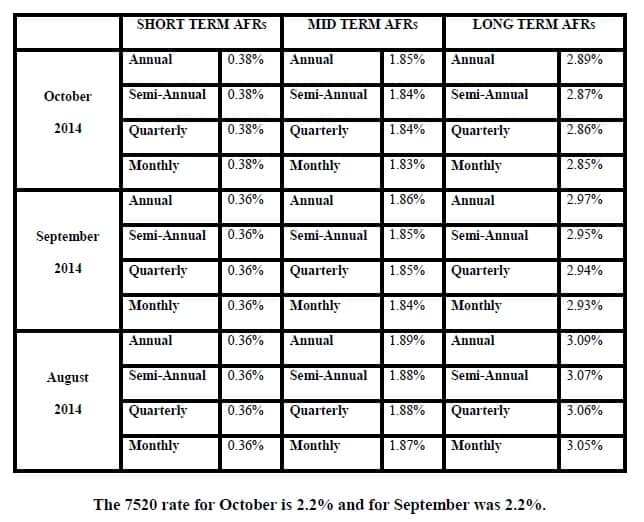

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.