The Thursday Report – 11.19.15 – Instant Thursday Report: Just Add Water!

What to Do When Clients Want to Change the Trusteeship of an Irrevocable Trust that Prevents Them from Appointing Themselves, Relatives, or Employees

Can I Get a Witness?: A Grantee as Witness to a Deed

IRA Loses its Bankruptcy Exemption Due to Loan Transaction by Chuck Rubin

Richard Connolly’s World – All About Trusts

Thoughtful Corner – Three Acts to a More Powerful Presentation by John Graden

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Don’t let the good things crowd out the best things – Make sure that the best things are pursued fully before spending any time or energy on the good things.”

– David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

What to Do When Clients Want to Change the Trusteeship

of an Irrevocable Trust that Prevents Them from

Appointing Themselves, Relatives, or Employees

by Alan Gassman

You can’t get what you don’t ask for.

Oftentimes, we will review an Irrevocable Trust with clients who would like to have their children or other relatives or an employee become Trustee or Co-Trustee at some point in time.

We have to explain to the client that the language of the Trust prevents them from appointing relatives and employees, but that they can request that a court order be obtained upon certain events and also provide that if everyone does not cooperate to get the court order, then they can designate that “Attila the Hun” will be pointed to serve as Trustee.

Language that may be used for this would be as follows:

The undersigned, JOHN SMITH and MARY SMITH, as Grantors of the Smith Gifting Trust do hereby request that after neither of us is living or competent with respect to our ability to replace the Trustee or Trustees of the Trust, that all Beneficiaries of the Trust and involved individuals shall agree by binding contract, or by court action if necessary, to make the Trusteeship of such Trust our daughter, SHERRY SMITH, with MIKE JONES, CPA as First Alternate and PAUL BROWN as Second Alternate, provided that in such event, such Agreement or Court Order shall also provide that by unanimous consent of our children, the Trusteeship shall be equivalent to the Trusteeship set forth under Section 6.03 of our Revocable Living Trust.

We recognize that under Section 6.04 of the Smith Gifting Trust, we are not able to appoint Successor Trustees, other than individuals or institutions not related to us or employed by us, and therefore make this non-binding request and this binding designation to the extent applicable, provided that if such request is not effectuated by cooperation to facilitate a court order as requested above, then Attila the Hun shall be appointed to serve as Co-Trustee with his choice of Hagar the Horrible or Donald Trump, and we encourage that no distributions whatsoever be made to any beneficiary who has been disrespectful to our memory and values.

Can I Get a Witness?: A Grantee as Witness to a Deed

by Dena Daniels and Alan Gassman

Grand Funk were not the only individuals who needed a witness to attest to how their baby was Some Kind of Wonderful. Florida requires that a plethora of documents be witnessed, with one of those documents being a deed. As you know, a deed is a document that transfers the ownership of real estate. Under Florida Statute §689.01, the deed, or instrument reflecting a conveyance, must be signed by the grantor (the individual conveying the property) in the presence of two witnesses.

The statute requires that the witness be subscribing witnesses[1], and it is important to note that a deed that is not properly witnessed may cause a defective deed and invalidate the conveyance.[2]

Now that it’s clear that two subscribing witnesses are required for a valid transfer, let’s take a look at who can, in fact, be a witness to a deed. The first prerequisite for a witness is that he or she be competent, meaning that he/she must be legally competent to testify. A person who lacks competency is a disqualified witness and is therefore not able to be a subscribing witness to a deed.

Another disqualifying factor for a witness to a deed is whether or not the witness has an interest in the conveyance. Dating back to 1886, in Linddon v. Honett, 22 Fla. 442 (1886), the Florida Supreme Court held that a grantee cannot witness a deed. However, a deed that is defective because of a lack of proper witnesses may still be validated by the curative statutes. In regards to curative statutes, §21 of Florida Jurisprudence provides that:

Such statutes may validate a recorded deed in regular form that shows upon its face a clear purpose and intent to convey land notwithstanding the fact that it was not under seal, was not attested by subscribing witnesses, and was not separately acknowledged by the grantor’s spouse as required by law.[3]

Under Florida Statute §95.231(1), a defective deed is cured five (5) years after the recording if the deed is executed in accordance with Florida Statute §689.01 and if it appears that:

The person owning the property attempted to convey, affect, or devise it, the instrument, power of attorney, or will shall be held to have its purported effect to convey, affect, or devise, the title to the real property of the person signing the instrument, as if there had been no lack of seal or seals, witness or witnesses, defect in acknowledgment or relinquishment of dower, in the absence of fraud, adverse possession, or pending litigation.[4]

Although there is a possibility that a deed that is defective as a result of the grantee being a witness may be held valid, this is a risk that both the grantor and the grantee should not gamble on.

*******************************************

[1] “A subscribing witness is one who witnesses or attests the signature of a party to an instrument, and in testimony thereof subscribes his own name to the documents, or who sees a writing executed, or hears it acknowledged, and at the request of the party thereupon, signs his names as a witness.” American General Home Equity, Inc. v. Countrywide Home Loans, Inc., 769 So. 2d 508, 509 (Fla. 2000).

[2] In American General Home Equity, Inc. v. Countrywide Home Loans, Inc., 769 So. 2d 508, 509 (Fla. 2000), it was held that, “a deed which lacks two subscribing witnesses is insufficient to convey title.”

[3] 319 Fla. Jur. 2d Deeds § 21.

[4] Florida Statute §95.231(1)

IRA Loses its Bankruptcy Exemption

Due to Loan Transaction

by Chuck Rubin

Charles (Chuck) Rubin is a board certified tax attorney and a managing partner of Gutter Chaves Josepher Rubin Forman Fleisher Miller, P.A., a tax, trusts, and estates boutique law firm in Boca Raton, Florida. Chuck has published numerous treatises, manuals, and articles, including two BNA Tax Management portfolios. He also authors a popular tax blog at www.rubinontax.blogspot.com. He was also named the 2015 Attorney of the Year by Best Lawyers in Tax Law for the Miami metropolitan region.

This article originally appeared as Steve Leimberg’s Employee Benefits and Retirement Planning Email Newsletter Issue #650

Executive Summary:

The Internal Revenue Code bars loan transactions between an IRA and a disqualified person. A recent Bankruptcy Court case illustrates that these tax prohibitions may be of more interest to bankruptcy trustees than the IRS.

Facts:

An IRA was an investor in a partnership. The IRA participant declared bankruptcy. The bankruptcy trustee desired to void the bankruptcy exemption usually available to IRA accounts so as to be able to reach the IRA assets.

Code § 4975(c)(1)(B) prohibits loan transactions between an IRA and a disqualified person. If an IRA engages in a prohibited transaction with the beneficiary or creator of the account, the IRA will lose its exempt status under Code § 408(e)(2).

Generally, IRAs are exempt assets in bankruptcy proceedings and are thus, beyond the reach of the bankrupt’s individual creditors. This exemption in the Bankruptcy Code is tied to the tax-exempt status of the IRA. 11 USC § 522(d)(12) provides an exemption to “[r]etirement funds to the extent that those funds are in a fund or account that is exempt from taxation under section…408…of the Internal Revenue Code of 1986.” Thus, if a bankruptcy trustee can prove the IRA engaged in a prohibited transaction, such as a loan with a disqualified person, the IRA is no longer exempt from income tax and thus, ceases to also be exempt from the reach of bankruptcy creditors.

In Kellerman v. Rice, a bankruptcy trustee was able to successfully show that funds transferred by the IRA to the partnership (a disqualified person) were transferred via loan and not a capital contribution. This characterization as a loan is a question of fact. The trustee was able to prevail since the partnership itself went into bankruptcy and on one of the schedules submitted to the court it showed the IRA as an unsecured creditor. This disclosure tipped the balance to the trustee, and the trustee was able to prove the advanced funds were a loan.

Comment:

Kellerman demonstrates that while the IRS may seek to find a prohibited transaction on audit to collect penalties and terminate the income tax deferral of an IRA, bankruptcy trustees often (and perhaps more often than the IRS) seek to find prohibited transactions for the purpose of voiding the bankruptcy exemption of the IRA.

Bankruptcy trustees have even sought to characterize 60 day rollover transactions as prohibited loans to the participant. Code § 408(d)(3)(A)(ii) allows a participant to receive a distribution from an IRA without including it in gross income if such distribution is rolled over to an IRA within 60 days. Interestingly, the rollover can be made back to the same IRA that the distribution came from. See e.g., PLR 9010007. In In re Willis, a trustee was able to convince the bankruptcy court that distributions out to a participant that were paid back to the IRA within the 60 day rollover period were nonetheless prohibited loans. This is a questionable result since the bankruptcy court effectively voided the statutory 60 day rollover period granted in Code § 408 by converting that transaction into a prohibited loan transaction that voided the IRA’s exempt status. Notably, the bankruptcy court cited to no cases, regulations, or rulings in support of its decision – it relied solely on the prohibited transaction definitions of the Code.

Thereafter, In re Rudd took on the same issue as Willis and rejected the loan treatment of a 60-day rollover back to the same IRA. It expressly noted the above Code argument that to “read 26 U.S.C. § 4975(c)(1)(D) as broadly as the trustee does effectively do away with the 60-day rollover rule, rendering 26 U.S.C. § 408(d)(3) and 11 U.S.C. § 522(b)(4)(D)(ii) inoperative.” The Court in Rudd also noted guidance in Publication 590 and in private letter rulings that such withdrawals and recontributions are permissible. In attempting to reconcile Willis with Rudd, that the participant in Willis was also engaged in check-kiting arrangements with the IRA may serve to place Willis as an outlier that should be applied only when under egregious facts there are transactions likely to injure the plan (an absence of likely injury was noted in Rudd.) Some guidance by the IRS on such rollovers would be helpful to taxpayers engaged in rollover transactions to avoid the risk of a bankruptcy trustee seeking to rely on Willis. As Kellerman and Willis demonstrate, bankruptcy trustees are not shy in aggressively seeking to use the prohibited transaction rules to void the bankruptcy exemptions of IRA accounts.

Richard Connolly’s World

All About Trusts

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “The Ins and Outs of Trusts that Last Forever” by Paul Sullivan. This article was featured in The New York Times on December 5, 2014.

Richard’s description is as follows:

In the last several decades, states have begun competing with one another for the business of perpetual trusts, which are designed to last forever, or at least 1,000 years, in the case of Wyoming.

People have been putting their millions and billions into them, eschewing traditional trusts, which typically end after 100 years.

But now a Harvard Law School professor, Robert H. Sitkoff, has written an academic paper making the case that perpetual trusts are unconstitutional in some of the very states that have tried hardest to persuade people to establish them.

Even people who set up perpetual trusts in states where they are legal could find themselves in trouble. Lawsuits brought in a state where the trusts are prohibited could result in those out-of-state assets being counted in any settlement.

Please click here to read this article in its entirety.

The second article of interest this week is “Interest in Irrevocable Trust is a Martial Asset” by Jillian Hirsch, Leiha Macauley, and Darian Butcher. This article was featured on WealthManagement.com on September 9, 2015.

Richard’s description is as follows:

On August 27, 2015, the Massachusetts Appeals Court held in Pfannenstiehl v. Pfannenstiehl, Nos. 13-P-906, 13-P-686, & 13-P-1385, 2015 Mass App. LEXIS 123, that a husband’s interest in an irrevocable trust with an ascertainable standard is a “vested beneficial interest subject to inclusion in the marital estate.” This is a significant decision that could impact the way in which estate planning practitioners in Massachusetts draft estate plans for clients concerned about divorce protection.

At issue in the case is an irrevocable trust established by the husband’s father for the benefit of the husband and his siblings, as well as their children. The trust contains an ascertainable standard, which obligates the trustees to make distributions of income and principal “to provide for the comfortable support, health, maintenance, welfare, and education of [the beneficiaries.]” The trust also contains a spendthrift clause, which prohibits the assignment or attachment of trust assets to creditors of any beneficiary.

The trial court ordered the husband to pay 60 percent of the value of his 1/11th share to the wife in 24 monthly payments totaling $1,133,047.79.

Please click here to read this article in its entirety.

Thoughtful Corner

Three Acts to a More Powerful Presentation

by John Graden

As I entered his office in St. Petersburg, my attorney started waving some pages in the air. He smiled and said, “This is the best brief I’ve ever read. It reads like a novel.” He was referring to a brief written by my other attorney, who was based in Oklahoma.

Over the following three years, we received many equally compelling and, dare I say, entertaining briefs. He authored his briefs in a style that was easy to understand, and it worked.

When I finally met with him, I asked him point blank, “Why don’t other attorneys write that way?” His response was, “They probably never thought of it.”

While my discussion with him that day was about his writing style, the lesson applies to all levels of communication.

It turns out that my Oklahoma attorney was a movie buff and took some creative writing classes in college. He always looked for the story within the case and attempted to make his brief follow the traditional three-act structure commonly used in film scripts, plays, or books.

Psychology 101 tells us that humans respond best to stories. Here is how he made his stories more effective and persuasive:

Act One was the introduction to set up the story. This describes what the situation was for his client prior to the incident that led to the hearing. In writing, this is known as establishing “normal life.” The normal life is best described in a manner that your audience can relate to. It’s also where you start to make a ninja-like emotional connection in a fact-based legal brief.

Act Two is the incident or change in situation that has brought the court action. This is the “confrontation.” It’s when things changed. This is the meat of the story. Here is where he presented his arguments both in fact and real talk. Without going overboard, he simply explained the case in legal and human terms. Rather than recite law, he painted a vista.

He then finished with a strong Act Three, where he argued for the outcome he sought in a manner most sympathetic to his client and least sympathetic to the other side. In writing, Act Three is the “resolution” or, in a court case, an argument for resolution.

His three-act presentation style worked in writing and his verbal presentations. His structure of storytelling helped him break down resistance and made it much harder to simply “tune him out.”

Where in your communications can you tell a stronger story? How can you help a judge or jury to understand your argument beyond the legal one? What can you do to make a more powerful, human connection in your presentations?

The three-act story has worked from the days of Aristotle to modern-day Hollywood. It’s a powerful tool that will work for you as well.

John Graden is the author of The Art of Marketing Without Marketing, which can be viewed by clicking here. He will be teaching presentation skills at the Professional Acceleration Workshop in Clearwater. He can be contacted at john@generatemoreleads.com, 727-664-3384, or via his website, http://www.generatemoreleads.com/.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***************************************************

***************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Keith Hodgdon, John McDonald, and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES BUSINESS OWNERS MAKE THAT REDUCE OR DAMAGE THE ABILITY TO SELL THEIR BUSINESS OR PRACTICE.

There will be two opportunities to attend this presentation.

Date: Wednesday, December 2, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5 PM webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of PLANNING TO PROTECT MEDICAL PRACTICE ENTITIES AND INCOME.

There will be two opportunities to attend this presentation.

Date: Tuesday, December 15, 2015

Location: Online webinar:

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 16, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

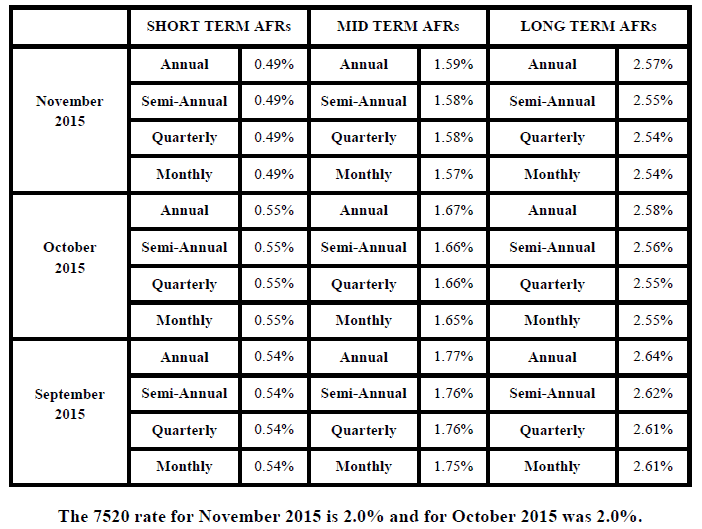

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.