The Thursday Report – 8.20.15 – New Florida Laws and More

Seminar Spotlight – Ave Maria Professional Acceleration Workshop with Alan S. Gassman

Florida Statute Updates: Changes You Need to Know About

An Introduction to Succession Planning and Possibly All You Need to Know, Part I

Gregory Gay’s Corner – Medicaid Nursing Home Assistance, Part I

Richard Connolly’s World – All About GRATs

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“If you’re not confused, you’re not paying attention.” – Tom Peters

Tom Peters is a business management author best known for his 1982 book In Search of Excellence, which discussed solving business problems with as little business-process overhead as possible. The book also served to empower decision makers at all levels within a company. The quote above can be found in the book Thriving on Chaos: Handbook for a Management Revolution, which can be purchased by clicking here.

Seminar Spotlight

Ave Maria Professional Acceleration Workshop

For 3rd Year Law Students, Alumni, and Experienced Professionals

Please join us for an 8 hour, CLE approved, interactive workshop that will completely engage all participants in personal goal setting, one-on-one conversations about how to handle practical challenges and obstacles, important strategies for business and personal relationships, and one-on-one client interaction guidelines and techniques that are commonly used by the most successful professionals.

The workshop consists of eight sessions. In the first, we will talk about goals and all of the things each of us has to be thankful for. During the second session, we will discuss eliminating frustrations and obstacles that often arise when striving to reach the goals we identified in the first session.

The third session will be spent reviewing exercises that can be used to solve problems, develop strategies, and enable participants to think out of the box about unique and effective ways to achieve objectives and handle issues that everyone faces.

During the fourth session, we will talk about clients. We will discuss how they think and how we can most effectively attract, serve, and retain them. In the fifth session, we will talk about techniques and strategies to have appropriate work-life balance, maximize efficiency, and enhance overall life enjoyment.

In the sixth session, we will discuss techniques that can be used to implement the objectives that each of us adopt, and we will select 2 professional action items and 2 personal action items and schedule events to take the first steps forward on each of them.

In the seventh session, we will discuss the tools and strategies to develop a great team, and during the final session, we will pull everything together to have solid action steps for the future.

This workshop will be held from 9:00 AM to 5:00 PM at the Thomas More Commons at the Ave Maria School of Law in Naples, Florida. Cost of attendance is $20.00 for students or alumni of Ave Maria School of Law and $35.00 for other professionals. Lunch and snacks are included in the cost of attendance.

LIMITED SPACES REMAIN! Please click here to register and RSVP.

See you there!

Florida Statute Updates: Changes You Need to Know About

by Alan Gassman and Travis Arango

This year, the Florida Legislature has made some changes to Florida’s health care surrogate statutes, to the Florida tax apportionment statute, to the Florida Uniform Transfers to Minors Act, and to Florida guardianship law. Some changes were minor or simple, small additions to make things work more smoothly, but some changes were pretty severe. We briefly examine these changes below:

Florida’s Health Care Surrogate Statutes

Certain additions have been made to the Florida Health Care Surrogate rules. After October 1st, a person will be able to assign the power to a surrogate to make health care decisions for that person even if the person is not incapacitated. If there is ever a conflict between the surrogate and the principal, the principal’s decision is controlling as long as the principal has capacity. A principal may also amend or revoke the durable health care surrogate as long as the principal is not incapacitated. A principal can do this through a variety of different ways including written amendments or written revocation. Physicians still must discuss treatment and other important information with a person who is not incapacitated regardless of whether or not there is a surrogate.

Parents now have an option to name a health care surrogate for minors under 765.2035(6). This will be useful if a parent is unavailable to provide consent for treatment for their child. This could come up in a variety of situations, such as when the parents are traveling without their minor children.

Click here for a compare of the 2014 statute and the updated 2015 statute.

Tax Apportionment Statute

This statute has effectively been re-written. When you look at a compare between the 2014 version of Florida statute 733.817 and the new 2015 version of 733.817, you can see just how many changes were made. Some of the changes will only apply to decedents who pass away after July 1, 2015, while some changes will apply to proceedings that are pending or started after July 1, 2015. We will have more on this provision in future Thursday Reports.

Click here for a compare of the 2014 statute and the updated 2015 statute.

Florida Uniform Transfers to Minors Act

As of July 1, 2015, Florida allows custodianships to last until the age of 25. Florida statute 710.123 now allows for an age of 25 to be set as the termination date when the UTMA account is created. A Florida custodianship can be created if the custodian, minor, or transferor lives in Florida or if the property protected by the custodian is in Florida.

Florida Statute 710.123(2) was added, which grants minor beneficiaries of UTMAs with a termination age of 25 the ability to withdraw the funds at 21. However, there is also the ability to limit the right to withdraw to a certain duration so that if the beneficiary does not use their right within the specified time, then the assets cannot be withdrawn until the age of 25 when the UTMA terminates. This time period is generally 30 days. The reason for this addition is so the gifts are not treated as future interests under the Internal Revenue Code and, thus, will qualify for the gift tax annual exclusion. Stay tuned for tinkering and examples of the use and mistakes that will be made under this statute, and please keep in mind that creditors of a minor can reach these accounts, so they should generally be discouraged for any large amounts.

Click here for a compare of the 2014 statute and the updated 2015 statute.

Florida Guardianship Law

Previously, durable powers of attorney were suspended when anyone initiated judicial proceedings to determine incapacity of an individual or to have a guardian advocate appointed. This suspension lasted until the petition was dismissed or withdrawn. Now, if certain family members will not be automatically removed from being agents upon the incapacity of the principal, the powers provided in the document will continue. The legislature basically added an exception to the existing rule for the principal’s child, parent, spouse, or grandchild. The new statute also has a process to suspend a power of attorney that is held by a family member in case that family member is abusing their power.

New regulations require that professional guardians must have fiduciary bonds and liability insurance. Also, if a professional guardian was appointed as an emergency temporary guardian, then they are prohibited from becoming a permanent guardian with some limited exceptions. There is also a provision that expressly prohibits abuse by the guardian, and that provision has a mandatory reporting requirement.

Settlements involving minors are now confidential. This means that settlements that require court approval, petitions for approval of settlements, reports of ad litems, and the orders approving them are all confidential under Florida Statute 744.3701.

Click here for a compare of the 2014 statute and the updated 2015 statute.

Stay tuned for more information on other law changes, which include health care laws and rules with respect to allowing minors to read Thursday Reports without parental guidance.

An Introduction to Succession Planning and

Possibly All You Need to Know, Part I

by Alan Gassman

Welcome to a new work in process – defining succession planning with reference to passing family businesses to succeeding (and hopefully succeeding!) generations. This is a multiple choice exam, not an essay:

PART I – TERMINOLOGY

While there are many legal and tax concepts that even experienced professionals struggle with when designing succession plans, some basic terminology and concepts that can be understood are as follows:

Company or Corporation – An entity formed by filing with a Secretary of State, which limits the liability of its shareholders/members, unless they have personal liability by reason of having signed guarantees or engaged in personal conduct.

The liability limitation feature of a corporation is often called the firewall liability protection.

Limited Liability Company (“LLC”) – A more modern type of corporation that provides firewall protection and has the following two additional features:

- In most states, the creditors of a limited liability company owner (“member”) cannot seize the ownership interest, but may instead only put a “charging order” in place to receive whatever distributions the member would have received. Oftentimes, creditors will sell their position for nickels or dimes on the dollar because they cannot require that the LLC make a distribution.

- A regular corporation (often referred to as an “Inc.”) must be taxed as either an S corporation or a C corporation.

- An S corporation normally pays no tax and instead files a tax return called an 1120S and reports the net income or loss by K-1 form that causes each shareholder to pay the tax, or have use of the losses, on their personal tax returns.

- A C corporation is a separate taxable entity and pays tax on its net income, usually at lower than the highest tax brackets on its first $100,000 of net taxable income.

Many other differences exist between S corporations and C corporations. S corporations can only be owned by individuals, charities, and certain trusts that only benefit individuals. Foreigners are not allowed to be S corporation shareholders, and S corporation distributions must be strictly pro-rata to ownership. There cannot be a “second class of stock,” meaning that, essentially, shareholders must be treated equally, except that there can be voting and non-voting shares.

LLCs can elect to be taxed as S corporations, C corporations, or partnerships. Partnership tax is similar to S corporation tax because income and deductions flow through to the partners, and the partnership itself does not pay tax. Partnership tax is much more flexible than S corporation tax. When appreciated assets are distributed to the owner of an S corporation, a tax is triggered as if the assets were sold. With a partnership, assets can be distributed tax-free to the partners.

An LLC owned by only one owner can also be disregarded for income tax purposes, meaning that all of its income and deductions are simply incorporated into the tax return of the owner.

Recently, the “drop and swap” partnership flexibility technique has become publicized among tax professionals. For example, assume that the father has a building worth $1,000,000 that he wishes to sell in the next few years, and that building has a $100,000 tax basis. The son has a stock portfolio worth $1,000,000 with a $1,000,000 tax basis that will not be sold. Father and son both put these assets into an LLC taxed as a partnership. Seven years later (or possibly just two years later), the partnership dissolves, the father receives the stock, and the son receives the building.

The son’s basis in the building will be $1,000,000, and the father’s basis in the stock will be $100,000. The son will sell the building and can pay no capital gains tax. The father will die owning the stocks, so they will get a stepped up basis.

Respondeat Superior and Structuring – Under the legal doctrine of Respondeat Superior, a company is responsible for the actions of its employees. However, a company is not responsible for the actions of its independent contractors.

An independent contractor is considered to be a separate business (even though it may be one person) that is not controlled as to activity or provided with all of the tools or a guaranteed wage or profit from the work it performs.

In the Florida Supreme Court case of Kane Furniture Corp. v. Miranda, a truck driver driving a furniture truck who killed Mrs. Miranda in an accident (after he had been drinking) was found not to be an employee of Kane Furniture Corporation, but instead, to be an employee of an independent contractor company that provided delivery services for Kane’s Furniture Corporation, even though the same family owned both companies.

The same result occurred in the Florida Supreme Court case of Dania Jai-Alai Palace, Inc. v. Sykes, where the valet parking operation of the Miami Jai Alai Fronton was found to be independent from the fronton itself, even though the valet company was owned by the fronton company.

Trust – A trust is an agreement between a grantor/contributor and the Trustee or Trustees for the benefit of one or more beneficiaries who have some degree of legal right to assure that the trust is properly managed for their eventual benefit.

Irrevocable Trusts – Irrevocable trusts can also be designed to be considered as separate taxable entities (complex trusts), whereby income not distributed is taxed at the highest bracket once it reaches $12,055 in a year.

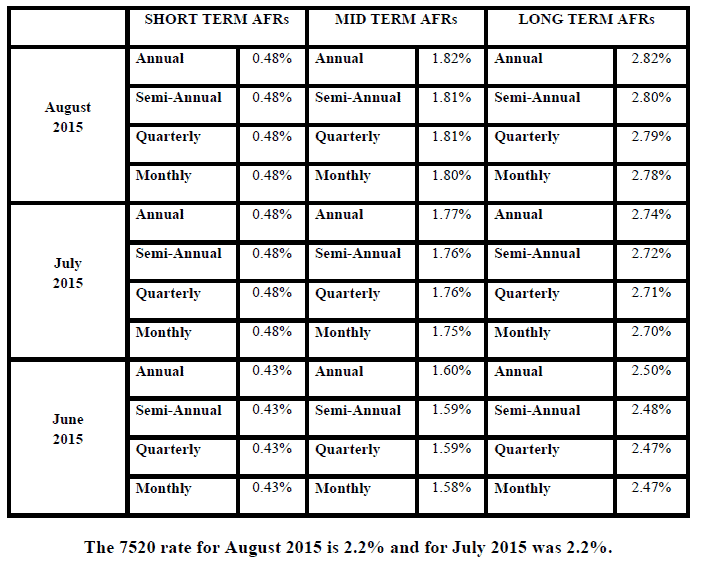

Irrevocable trusts can also be designed to be “disregarded” whereby all income and deductions of the trust would be reported on the tax return of the grantor. A “disregarded” irrevocable trust can still be fully effective for creditor protection and estate and gift tax purposes and can buy assets from the grantor without tax in exchange for low interest promissory notes. The August 2015 rates that can be used are 0.48% on a note from 0 to 3 years, 1.82% for a note over 3 years and up to 9 years, and 2.82% for a note over 9 years.

A great many wealthy taxpayers set up irrevocable trusts that are disregarded for income tax purposes and make a seed capital gift, which is usually approximately 10% of the value of an asset or entity ownership interest that they then sell to the trust. This is called an “installment sale to defective grantor trust.”

An irrevocable trust that can benefit the grantor/contributor will generally be accessible to the creditors of the grantor/contributor unless it is properly formed and funded in one of the asset protection trust jurisdictions, which have specific laws that provide that creditors cannot reach into these trusts. The United States asset protection statutes have not yet been tested in federal court under the Full Faith and Credit Clause, which may allow a judge in Florida to rule that a Nevada trust is a sham or that Florida law would somehow apply to a Nevada trust if a Floridian sets up a Nevada trust and has significant direct or indirect control over it. The primary asset protection trust states are Nevada, Delaware, Alaska, and North Dakota.

Hybrid Asset Protection Trust – A “hybrid asset protection trust” will not include the grantor/contributor as a beneficiary but will have provisions that may permit the grantor to be added as a beneficiary if and when certain circumstances exist such as an adverse financial setback if and when there is approval by named Trust Protectors.

Crummey Trust – A crummey trust is a trust that allows for contributions to qualify for the $14,000 per year annual gift exemption as to each beneficiary holding a “crummey withdrawal power” which entitles such beneficiary to withdraw up to $14,000 worth of what is placed in the trust each year.

In the recent Tax Court case of Mikel v. Commissioner, there were 60 beneficiaries holding withdrawal powers, and the Tax Court held that this qualified the husband and wife donors for $1,440,000 of gift tax exempt gifts. The IRS continues to litigate with taxpayers who do not inform beneficiaries of each contribution, even though this is the third case that they have lost in Tax Court over the issue.

Grantor Retained Annuity Trust (“GRAT”) – A grantor retained annuity trust is a special trust that can receive a transfer and will have the obligation to make payments of money or assets back to the grantor over two or more years. The actuarial value of the payments to be made can equal the value of what is contributed to the trust, and if the assets grow in value, or if certain discounts are used, significant value can remain in the grantor retained annuity trust to benefit family members without being subject to federal estate tax upon the death of the grantor.

Charitable Lead Annuity Trust (“CLAT”) – A charitable lead annuity trust is a special trust that can receive a transfer and will have the obligation to make payments of money or assets back to the grantor over two or more years. The actuarial value of the payments to be made can equal the value of what is contributed to the trust, and if the assets grow in value, or certain discounts are used, significant value can remain in the grantor retained annuity trust to benefit family members without being subject to federal estate tax upon the death of the grantor.

An example would be to place $15,000,000 in investments into a limited partnership and to gift or leave the 99% limited partnership interest to the CLAT, which would then be valued at $10,000,000. There could be a 100% charitable deduction if the CLAT makes payments of $111,000 per year to charity for 11 years, and the CLAT may have significant assets remaining in year 12 for descendants.

Confidentiality Planning – Confidentiality planning refers to the use of entities and property ownership structuring so that someone looking in the public records cannot find out who owns or even has control over certain properties or businesses.

Some states, including Colorado, Wyoming, and Delaware, do not require disclosure of members or managers to the public. Commonly, we will establish a company in one of those states which will be the manager of a Florida entity. Florida only requires public posting of the name of the manager. Someone who sees that the manager is a Delaware company is then unable to find out who owns the Delaware company or who manages it.

In Florida, we are able to file a Statement of Authority in the public records of each county that such a company owns real estate in to require that our law firm or another third party must give written consent before real estate can be mortgaged or transferred. This prevents someone from fraudulently asserting that they manage the Delaware management company that owns Florida real estate. We commonly use this technique for clients who do not want their name to be in the public record with respect to ownership of their primary home. This is common with high profile physicians, professional athletes, and people involved with law enforcement.

This concludes Part I. Stay tuned for Part II of An Introduction to Succession Planning and Possibly All You Need to Know!

Gregory Gay’s Corner

Medicaid Nursing Home Assistance, Part I

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week, we begin the conclusion of Gregory Gay’s series with a look at Medicaid Nursing Home Assistance.

Eligibility

A nursing home patient may be eligible for assistance in paying a portion of his or her skilled or custodial nursing home cost through the state of Florida’s institutional care program. However, there is a maximum amount of countable assets that a person applying for assistance and his or her spouse can own and still receive assistance. The institutionalized spouse entering a nursing home cannot own more than $2,000 in countable assets. In the year 2013, the community spouse who is not residing in the nursing home cannot own more than $115,920 in countable assets. A person who has no spouse can only retain $2,000 in countable assets if his or her income exceeds $828 per month in the year 2013. A person who has no spouse can only retain $5,000 in countable assets if his or her income is $828 or less per month in the year 2013.

There is also a maximum amount of monthly income that the institutionalized spouse can receive and still be eligible for nursing home assistance. The monthly gross income available to the institutionalized spouse cannot exceed the state monthly income cap of $2,130 in 2013. However, a nursing home patient with a gross monthly income in excess of $2,130 for 2013 can still qualify for the institutional care program by establishing an irrevocable qualified income trust. This trust if often referred to as a Miller Trust, after the name of the Colorado case that originally approved this concept. The nursing home patient’s income in excess of $2,130 is irrevocably assigned to the irrevocable qualified income trust that is used to pay the patient’s medical and nursing home expenses.

In determining the institutionalized spouse’s income available to pay the cost of the nursing home, a community spouse is first permitted to retain a minimum monthly maintenance income needs allowance that is sometimes referred to as a MMMNIA. This means that the community spouse may retain his or her income plus the portion of the institutionalized spouse’s income necessary to allow the community spouse $1,891.25 in income per month. There may be an additional amount of income diverted from the institutionalized spouse if the community spouse can demonstrate excess shelter expenses. However, the maximum monthly maintenance income needs allowance is $2,898 per month in 2013.

Non-Countable Assets

All assets owned by the institutionalized spouse or by the non-institutionalized spouse are considered countable assets unless exempted by state regulation. An individual with an equity interest in his or her home in excess of $536,000 is not eligible for long-term care. Home equity is calculated using the current market value of the home minus any debt. The current market value is the amount for which is can be reasonably expected to sell on the open market in the geographic area. If the home is held in any form of shared ownership, only the fractional interest of the person requesting long-term care assistance should be considered. The home equity policy does not apply if the residence is being occupied by the nursing home resident’s spouse, a child under age 21, or a blind or disabled child. The home equity must be revalued each year that the applicant remains on Medicaid nursing home assistance. This home equity limitation may be waived when a denial of long-term care eligibility will result in a demonstrated hardship to the individual.

One vehicle is excluded in computing countable assets, regardless of its age or value. A second vehicle is generally excluded if it is more than seven years old. If the total face value of the patient’s whole life insurance policies is $2,500 or less, the cash value of the policies is excluded as an asset. The full value of an irrevocable burial contract is excluded as an asset. Likewise, there is a $2,500 exclusion for bank accounts that have been designated for burial expenses.

It is also important to consider the exemptions and maximum allowances for tangible personal property such as clothing, jewelry, tools of a trade, pets, and household goods such as furniture and appliances. A community spouse is entitled to exclude all personal property, if his or her spouse is in a nursing home. A single person may exclude a wedding ring, one engagement ring, and any items required because of the individual’s medical or physical condition. A single person may also exclude household goods and personal effects up to a value of $2,000. It will be assumed that the household goods and personal effects are less than $2,000, unless the individual applying for personal assistance indicates he or she owns items of unusual value.

The total value of an individual retirement account (IRA) owned by an institutionalized spouse is not counted as an available asset if it is placed into payment status over the life expectancy of the institutionalized spouse. Likewise, the total value of an individual retirement account (IRA) owned by a community spouse is not counted as an available asset if it is placed into payment status over the life expectancy of the community spouse. Most districts of the Department of Children and Families require the IRA payments to be paid over Social Security’s life expectancy tables.

Life Situation #1

George has been in a nursing home for over twenty days. He will need to remain there because a massive stroke has disabled him to the degree that he will no longer be able to perform his daily living activities. George and his wife, Helen, own a residence having a fair market value of $250,000. They also have $138,980 in savings and a 1995 car with over 100,000 miles.

George’s monthly income is $1,000 from Social Security and $1,230 from a pension. Helen receives $700 each month from Social Security. Since a community spouse (the spouse living outside the nursing home) can only own $115,920 and a nursing home spouse can only own $2,000 in countable assets in 2013, George is presently not eligible for Medicaid nursing assistance.

One way to obtain eligibility is for Helen to replace the 1995 automobile with a new one that will cost about $20,000. This purchase will not disqualify George from Medicaid assistance since something of value was received by Helen, and the new automobile is a non-countable asset. Since George’s income exceeds the 2013 monthly income cap of $2,130, he will need to establish a Qualified Income Trust (QIT). The trust will need to state that any monthly income over the monthly income cap of $2,130 is assigned to the trustee of the trust. The excess income of $100 per month that is paid to the QIT will be used for George’s care.

Helen is entitled to a minimum monthly maintenance income needs allowance in 2013 of at least $1,891.25 each month and can divert $1,191.25 of George’s income ($1,891.25 minus Helen’s $700 Social Security) to meet her living needs. George will be able to retain $35 each month for his personal needs allowance. George’s remaining income of $1,003.75, after Helen receives her minimum monthly maintenance income needs allowance and George receives his $35 personal needs allowance, becomes George’s patient pay responsibility to the nursing home. The additional monthly cost of the nursing home will be paid to the nursing home facility by the State of Florida’s Department of Children and Families.

Transferring Assets

A gift to someone other than a spouse may cause the donor and his or her spouse to be ineligible for nursing home assistance for a period of time. Transfers made before November 1, 2007 to someone other than a spouse for no consideration caused the nursing home patient to be ineligible for Medicaid assistance for a certain period determined by dividing the amount of the uncompensated transfer by the state determined average cost of nursing home care. Thus, a gift by the nursing home patient to someone other than a spouse in October of 2007 results in an eligibility period lasting for 10 months, beginning with the month in which the gift was made.

Transfers made on or after November 1, 2007 to someone other than a spouse for no consideration will cause the nursing home patient to be ineligible for Medicaid assistance on the later of the following dates:

- The first day the individual would be eligible for long-term care Medicaid were it not for the imposition of the transfer period (this includes the filing of an application and meeting all other program criteria for long-term care Medicaid), or

- The first day of the month in which the individual transfers the assets, or

- The first day following the end of an existing penalty period

Thus, a gift by a person to someone other than a spouse of $73,620 in November of 2010 who then enters the nursing home on April 15, 2013 will result in an ineligibility period lasting for 10 months beginning May 1, 2013, which is the first month after an application is filed and the person meets all other program criteria for long-term care Medicaid. This means that the applicant who made the gift of $73,620 on April 15, 2013 will not be eligible for Medicaid nursing home assistance until February 2014. This is because the average cost of a nursing home is increased to $7,362 on April 15, 2013. The look-back period for gifts was 36 months. Beginning February 2014, the look-back period became 37 months. The look-back period will increase by one month until January 2015, when it will cap at 60 months.

Stay tuned for the next edition of Gregory Gay’s Corner, which will feature a discussion of promissory notes, loans, mortgages, undue hardship, irrevocable annuities, and how they influence Medicaid assistance eligibility. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

All About GRATs

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Grab a GRAT Before It’s Too Late” by Robert Gordon. This article was featured on OnWallStreet.com on August 3, 2015.

Richard’s description is as follows:

If you have a client who is ever going to use a GRAT, now might be the time to act. In every one of his budgets, the president has tried to limit GRATs.

In addition, there is a growing sense in Washington that income inequality may have to be dealt with politically. Between the political environment and the current level of interest rates, one would have to conclude that if you are contemplating the use of a GRAT, the time is now.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Investors Rethink Stocks Given to Family Trusts” by Liz Moyer. This article was featured in The Wall Street Journal on March 27, 2015.

Richard’s description is as follows:

A strong stock market is prompting investors to rethink assets they previously gave away to family members in trusts.

Some individuals who set up grantor retained annuity trusts, or GRATs, in previous years now are swapping out the investments they put into those trusts and replacing them with other holdings, cash, or promissory notes that are of equal value today.

Buying an asset from the trust can lock in tax-sheltered appreciation for the trust beneficiaries.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************************

See if you can bear the following comic by Thursday Report cartoonist Joe Lyons!

Upcoming Seminars and Webinars

Calendar of Events

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law one week from this Saturday. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

**LIMITED SPACES AVAILABLE**

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES. There will be two opportunities to attend this presentation.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Planning for Retirement – This Needs to Be Your #1 Objective

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Please watch this space as details for these two great events are finalized in the upcoming months!

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE CLEARWATER EVENT:

40th ANNIVERSARY SCREENING OF JAWS WITH RICHARD DREYFUSS

The Capitol Theatre ’70s Movies Series will present a special feature 40th anniversary screening of Jaws with a live appearance by Academy Award winter Richard Dreyfuss.

The 1975 thriller, directed by Steven Spielberg, will be followed by a rare, candid, interactive discussion and Q&A with the film’s star Richard Dreyfuss. The event will be hosted by Tampa Bay Times film critic Steve Persall.

A portion of the proceeds from this event will benefit the Clearwater Marine Aquarium.

Date: Thursday, September 10, 2015 | 7:00 PM

Location: The Capitol Theatre, 405 Cleveland Street, Clearwater, FL

Additional Information: For more information, or to purchase tickets for this event, please click here.

**********************************************************

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and have a killer time with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.