The Thursday Report – 5.7.15 – UF Law May 30th PAW Workshop & More!

University of Florida Professional Acceleration Workshop on May 30th, 2015 with Dennis Calfee

“The Affability of Affidavits in Domestic Asset Protection Trust Planning” Published

Voluntary Disclosure of Offshore Assets by Alan Gassman, Leslie Share, and Brandon Ketron, Part II

H.R. 2 Medicare Access and CHIP Reauthorization Act of 2015: The So-Called Medicare “Doc Fix”

Our EstateView Software Featured in the American Bar Association Probate & Property Magazine

Richard Connolly’s World – Estate Planning Before & After Divorce

Seminar Spotlight – Communicating for Positive Results Presentation

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

University of Florida Professional Acceleration Workshop

on May 30th, 2015 with Dennis Calfee

A Professional Acceleration Workshop, moderated by Alan S. Gassman and Professor Dennis Calfee, will be presented for law students and invited professionals at the University of Florida Levin College of Law on Saturday, May 30th, 2015. The presentation will begin at 10:00 AM and run until 3:00 PM. Lunch will be included.

Please join us for a 5-hour, CLE-approved, interactive workshop that will completely engage all participants in personal goal setting, one-on-one conversations about how to handle practical challenges and obstacles, important strategies for business and personal relationships, and one-on-one client interaction techniques that are commonly used by the most successful professionals.

The workshop will consist of five 55-minute sessions and is sponsored by Gassman, Crotty & Denicolo, P.A. Students and employees of the University of Florida may attend for free. Other attending professionals are requested to make a small donation to the Stephen Lind Chair at the University of Florida Tax Program.

A course notebook of over 300 pages of materials will be given to each participant at no extra charge.

For more information, please click here to download our program flyer.

To RSVP or for more information, please contact Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

A splendid time is guaranteed for all!

If you can’t make this workshop, please consider the live Ave Maria School of Law Professional Acceleration Workshop on August 22, 2015 in beautiful Naples, Florida – maybe next year it can be in Naples, Italy!

“The Affability of Affidavits in Domestic Asset

Protection Trust Planning” Published

An article by Alan Gassman and Dena Daniels entitled “The Affability of Affidavits in Domestic Protection Trust Planning” was published on the Leimberg network on April 28, 2015 and Leimberg Newsletter Number 293.

You can view the newsletter by clicking here.

Quotes therein from Jonathan Blattmachr and Steve Oshins were as follows:

Jonathan Blattmachr, who was involved in the drafting of the Alaska DAPT laws, and has active involvement with The Alaska Trust Company, was kind enough to share his thoughts on Affidavits of Solvency:

From my perspective, there are three purposes of the solvency affidavit. First, the requirement shows that Alaska (and other states with Affidavit requirements) is not promoting fraudulent asset protection planning. It is to permit individuals to set aside wealth for future unforeseen events and to allow them to do efficient estate tax planning without permanently parting with all benefits of certain assets. Second, it protects the “honest” client from claims that he or she was trying to hinder, delay or defraud a creditor…signing a false affidavit is, of course, a crime. Third, it protects the trustee and the attorneys. They have verification of the situation. As you know, there was a recent case in Iowa where a lawyer faced possible serious disciplinary action because he unknowingly assisted a client essentially in a fraudulent transfer. The state supreme court let him go because he didn’t know (and perhaps had no real reason to know)–a very scary prospect.

Steve Oshins made the following point to the authors when asked to comment:

It’s a good idea for advisors who use any of the six states that require new Affidavits of Solvency for every new transfer to meet with their clients at least once a year to make sure the clients are complying with this requirement. If they find that they aren’t, then the cure is to move the trust to a DAPT jurisdiction that doesn’t have this requirement. For those clients who, like me personally, add cash or other assets to their DAPT every month, having to prepare a new Affidavit each time would be a huge burden. So I think that those clients who expect to frequently add to their DAPTs are better off selecting a situs that doesn’t have the Affidavit requirement. The clients who are making one big up-front transfer to their DAPT are certainly fine using any of the better DAPT jurisdictions.

We will run this article in its entirety in a future Thursday Report. Stay tuned!

Voluntary Disclosure of Offshore Assets, Part II

by Alan Gassman, Leslie Share, and Brandon Ketron

Leslie A. Share received his J.D. from the University of Florida, where he was the Chief Tax and Research Editor of the University of Florida Law Review. He received his LL.M. in Taxation from New York University and is a member of the Florida Bar. Les has advised clients in numerous and diverse areas, including Broadway theatrical productions, real estate like-kind exchanges, and Internet matters. He speaks at various US and Caribbean seminars on subjects including Florida and offshore trust law, advanced asset protection techniques, and US tax treaties, among others.

We thank Les for his contribution to the following conclusion of our Voluntary Disclosure of Offshore Assets article and his support of The Thursday Report!

Last week, we discussed some of the most common filing requirements for offshore assets and the penalties incurred if the filing of these requirements does not happen or does not happen on time. You can view this report by clicking here. This week, we will discuss options available to correct a failure to file.

Options Available to Correct a Failure to File

A. “Quiet” Disclosure

The “quiet” disclosure option is very rarely recommended due to the significant risk that remains with the taxpayer even after the disclosure. Under this option, a taxpayer files amended tax returns and pays any related tax and possibly interest for previously unreported offshore income without otherwise notifying the IRS.

On May 7, 2009, the IRS had this to say about “quiet” disclosures:

Taxpayers are strongly encouraged to come forward under the Voluntary Disclosure Practice to make timely, accurate, and complete disclosures. Those taxpayers making “quiet” disclosures should be aware of the risk of being examined and potentially criminally prosecuted for all applicable years. The IRS has identified, and will continue to identify, amended tax returns reporting increases in income. The IRS will be closely reviewing these returns to determine whether enforcement action is appropriate.

Therefore, except in rare circumstances, it would generally be unwise to engage in a “quiet” disclosure due to the red flags the amended returns raise with the IRS. While the “quiet” disclosure should not result in penalties after three years of the filing, the taxpayers could be subject to the above penalties (including the 75% fraud penalty) if the “quiet” disclosure was discovered and challenged. The risk does not seem to outweigh the reward.

B. Delinquent International Information Return Submission Procedures

In order to be eligible for the Delinquent International Information Return Submission Procedures, the taxpayer must meet the following requirements:

- Failed to file one or more required international information returns.

- Reasonable cause for not timely filing the information returns.

- Not currently under civil or criminal investigation by the IRS.

- Not already contacted by the IRS about the delinquent information returns.

The biggest limitation on eligibility for the Delinquent International Return Submission Procedures is generally the reasonable cause for the failure to file. The IRS provides that the “longstanding authorities regarding what constitutes reasonable cause continue to apply.”[1]

In order to meet the reasonable cause standard, the taxpayer must exercise ordinary care and prudence in determining his tax obligations. [2] Where tax advisors have been involved, the taxpayer must show that they (1) made a full disclosure to the expert, (2) relied on the advice of the expert, and (3) did not otherwise know that a return was due.[3]

In the recent unpublished case of James v. United States[4], the taxpayer established an irrevocable trust in Nevis, West Indies. The taxpayer provided all the necessary information to his accountant, and the accountant did not file Form 3520. The IRS assessed penalties totaling over $570,000 for the failure to file the appropriate forms. In support for a motion to dismiss, the Government argued that the reliance on a CPA cannot constitute reasonable cause, however, the court denied the motion holding that there was a genuine issue of material fact with respect to whether James’s reliance on the advice of his CPA was reasonable cause.[5] The taxpayer’s victory was short-lived, as he lost in the subsequent jury trial.

If eligible, the taxpayer must follow the procedures set forth below:

- File amended returns, including delinquent returns, along with Form 3520/3520-A, according to the applicable instructions.

- Attach to each delinquent form a statement describing “all facts establishing reasonable cause for the failure to file” signed under penalties of perjury.

If the IRS accepts the reasonable cause explanation, then the taxpayer will not be liable for any penalties. However, acceptance is not automatic and penalties will be imposed if the explanation is not accepted.

C. Streamlined Filing Compliance Procedures

In order to be eligible for the streamlined filing procedures, the taxpayer must meet the following general eligibility requirements:

- Individual taxpayers only (including estates.)

- Certify under penalties of perjury that conduct was non-willful.

- No current civil exam or criminal investigation “for any taxable year.”

- Must have a valid TIN.

The procedures differ for foreign residents and domestic residents. If the taxpayer does not meet the foreign residency requirements, the taxpayer must meet the following additional tests:

- Timely filed a US tax return for each of the most recent three years.

- Failed to report income from a foreign financial asset and pay tax, or may have failed to file a FBAR.

- The failures resulted from non-willful conduct.

Non-willful conduct is defined as “conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.” Factors to consider include (1) willful blindness/recklessness, (2) whether accounts were disclosed to tax return preparer, (3) accounts in jurisdictions known for bank secrecy, (4) frequent movements of accounts or funds, (5) answers to Form 1040 Schedule B questions regarding foreign accounts, and (6) prior year compliant behavior.

Traditionally, the IRS has advised taxpayers to rely on the criminal definition of willfulness in determining willful or non-willful conduct, defining willfulness as “voluntary, intentional violation of a known legal duty.”[6] A recent case analyzing whether or not conduct was willful or non-willful in regards to the failure to file a FBAR presumably aids in interpreting willful conduct for other foreign informational filings.

In United States v. Williams, the court extended the definition to include “willful blindness.”[7] In this case, the taxpayer opened two accounts in Switzerland. The balance of these accounts totaled roughly $7,000,000. Mr. Williams failed to include the income earned on these accounts on his personal tax return and failed to file FBAR forms disclosing his foreign bank accounts. Mr. Williams’s CPA checked no on Form 1040 Line 7a, which asks: “At any time during the [tax year], did you have an interest in or a signature or other authority over a financial account in a foreign country, such as a bank account, securities account, or other financial account? See instructions for exceptions and filing requirements for [FBAR].”[8]

Mr. William’s defense was that he had never read Line 7a, or the instructions of the FBAR; therefore, he had no knowledge of his legal duty. The court declined to agree with Mr. Williams’s holding that he engaged in a conscious effort to avoid learning about the reporting requirements.[9] The court viewed this along with his previous admission in a criminal case that he was aware of the requirement as willful conduct.[10]

A second case, United States v. McBride, in an attempt to avoid tax in the United States, a taxpayer engaged in a risky scheme suggested by a financial management firm involving several offshore entities. Despite initial doubts, the taxpayer failed to seek a formal legal opinion on the proposed plan. The IRS assessed severe penalties on the taxpayer. In holding that the taxpayers conduct was willful, the court stated that willfulness includes recklessness and “willful blindness to the obvious known consequences on one’s actions.”[11] The court did not address if the result would have been the same had the taxpayer received a formal legal opinion.

The Internal Revenue Manual states that “the mere fact that a person checked the wrong box, or no box, on a Schedule B is not sufficient, by itself, to establish that the FBAR violation was attributable to willful blindness.”[12] Some commentators believe that the interpretation of willfulness is beginning to be pushed towards one of strict liability despite the language in the Internal Revenue Manual.[13]

If the taxpayer meets the above requirements, under the Streamlined Domestic Offshore Procedures, the taxpayer must follow the procedures set forth below:

- File amended tax returns, including all information forms (i.e. Form 3520, 3520-A, 8938) for each of the most recent three years.

- File delinquent or amended FBARs for each of the most recent six years.

- Include full payment of all tax and related interest.

- Include payment of a 5% penalty assessed on the highest aggregate balance of the taxpayer’s previously unreported foreign financial assets during the period or relating to such assets that were properly reported, but gross income in respect of the assets was not reported in that year.

- File Form 14654, Certification by US Person Residing in the United States for Streamlined Domestic Offshore Procedures statement, establishing eligibility for the procedure and that the failures were due to non-willful conduct.

- Provide supporting documentation of the 5% penalty calculation.

If the taxpayer follows these procedures, no additional penalties will be assessed. This means that the taxpayer will not be responsible for the failure to file penalties, failure to pay penalties, accuracy penalties, information return penalties, or FBAR penalties. Again, acceptance is not automatic, and the taxpayer could be liable for one or more of the mentioned penalties if the IRS determines that the taxpayer’s non-compliance was fraudulent and/or willful.

D. Offshore Voluntary Disclosure Program

In order to be eligible for the current version of the Offshore Voluntary Disclosure Program, the taxpayer must meet the following eligibility requirements:

- Taxpayer with legal source income invested in undisclosed offshore assets.

- Disclosure was initiated before IRS has received information from a third party regarding the taxpayer’s noncompliance and no civil or criminal investigation is pending against the taxpayer for any reason. In this regard, the IRS may, going forward, receive information from a third party when FATCA reporting has occurred.[14]

- Agree to cooperate with the IRS and DOJ offshore enforcement efforts.

Under the terms of the Offshore Voluntary Disclosure Program, the taxpayer must:

- Submit a letter and power of attorney to the IRS Criminal Investigation Lead Development Center by fax to request preclearance before making an offshore voluntary disclosure. Criminal Investigation will notify taxpayers or their representatives via fax whether or not they are so eligible. Preclearance does not guarantee a taxpayer acceptance into the program.

- Submit the Offshore Voluntary Disclosure Letter and attachment. Criminal Investigation will review the letter and notify taxpayers or representatives by mail or facsimile whether their offshore voluntary disclosures were primarily accepted as timely or declined.

- Submit the OVDP application package, which includes several special IRS OVDP-related statements.[15]

- Include eight years (where applicable) of original or amended federal income tax returns and copies of previously filed original (and, if applicable, previously filed amended) returns.

- Include eight years (where applicable) of FBARs and copies of previously-filed FBARs for each of the tax years in question.

- Include full payment of the tax and related interest.

- Pay a 20% accuracy related penalty.

- In lieu of payment of all other penalties on undisclosed foreign assets, including FBAR and offshore-related information return penalties, a payment of a 27.5% penalty (50% if any of the taxpayer’s undisclosed foreign financial accounts involved one of the “Foreign Financial Institutions or Facilitators” posted on the IRS website[16]) of the highest aggregate value of the offshore assets during the period covered (eight years).

- If applicable, the failure to file and failure to pay penalty for returns required under IRC 6651 (does not include filing of offshore information returns.)

- Include a waiver of the applicable Statute of Limitations.

COMMENT:

The most desirable option where eligible is generally disclosure through the Delinquent International Information Return Submission Procedures, but it can be difficult to establish reasonable cause. The next option would be filing the amended returns through the Streamlined Filing Compliance Procedures, which requires a showing that the failure to file was non-willful – arguably a lesser standard. The final option would be to enter into the Offshore Voluntary Disclosure Program.

A taxpayer is still eligible to enter into the Offshore Voluntary Disclosure Program, even if there was willful non-compliance. Disclosure through the Offshore Voluntary Disclosure Program provides protection from criminal prosecution, and may allow the taxpayer to pay significantly less in penalties than could be otherwise due. In order to begin the process, a taxpayer should submit a preclearance letter to the IRS, which is often fairly simple and can simply be faxed to hopefully “tag” the IRS before the IRS has “information from a third party” relating to the noncompliance.

It is also possible to file under the Offshore Voluntary Disclosure Program and then request removal by “opting-out” therefrom into a regular IRS examination, which should be based upon providing information demonstrating reasonable cause.[17]

The decision to opt out is irrevocable and also results in the forfeiture of criminal immunity offered under the Offshore Voluntary Disclosure Program.[18] Acceptance into one of the other programs is not automatic, and requires that the revenue agent handling the matter be convinced of reasonable cause for the failure to file. Therefore, the taxpayer should weigh the risk versus reward of opting out of the Offshore Voluntary Disclosure Program.

***********************************************

[1] See, for example, Treas. Reg. § 1.6038-2(k)(3), Treas. Reg. § 1.6038 A-4(b), and Treas. Reg. § 301.6679-1(a)(3)

[2] I.R.M. 20.1.1.3.2 (11-25-2011)

[3] Estate of La Meres v. Comm’r 98 T.C. 294, 316-317 (1992)

[4] 2012 WL 3522610 (M.D. Fla. Aug. 14, 2012)

[5] James at *3

[6] Cheek v. United States 498 US 192, 200 (1991)

[7] U.S. v. Williams, 489 Fed. Appx. 655, 659 (4th Cir. 2012) (unpublished)

[8] I.R.M. 4.26.16.1

[9] Williams, at 658

[10] Id, at 660

[11] U.S. v. McBride, 908 F. Supp. 2d 1186, 1213 (D. Utah 2012)

[12] I.R.M. 4.26.16.4.5.3

[13] Government Wins Second Willful FBAR Penalty Case: What McBride Really Means for Taxpayers, 118 JTAX 187, 199; The FBAR Penalty: What Constitutes Willfulness? 46-Jun Md. B.J. 38.

[14] For a list of jurisdictions that have agreed to comply with the FATCA reporting requirements, see: http://www.treasury.gov/resource-center/tax-policy/treaties/pages/fatca-archive.aspx

[15] See, Offshore Voluntary Disclosure Program Frequently Asked Questions and Answers #25

[16] See, Offshore Voluntary Disclosure Program Frequently Asked Questions and Answers #7.2

[17] See, Offshore Voluntary Disclosure Program Frequently Asked Questions and Answers #51

[18] Id.

H.R. 2 Medicare Access and CHIP Reauthorization Act of 2015:

The So-Called Medicare “Doc Fix”

Yes, it’s true! On April 16, 2015, President Obama signed into law the bipartisan bill H.R. 2, the Medicare Access and CHIP Reauthorization Act of 2015, which is also called the Medicare “doc-fix.” We will no longer need to hear about upcoming physician compensation reductions by Medicare. This bill permanently repeals the Sustained Growth rate formula and replaces it with a stable Medicare payment system offering financial incentives to doctors for providing high-quality and value health care and to bill Medicare patients for their overall care, not individual office visits. This new law was signed just in time to head off a 21% cut in doctors’ pay that was due to take effect this month.

It is good to see the political parties working together for an appropriate common cause – physicians! No component of our professional services industry has sacrificed more, given more, or achieved more than the members of the medical profession. The best and the brightest from all over the world aspire nothing short of being practicing physicians here. We are so thankful that they are a part of our country, not to mention being our friends and our protectors.

The “doc fix” bill fixes a 1997 law that aimed to slow down Medicare’s growth through limiting reimbursements to doctors. The formula in the law linked Medicare doctor pay to economic growth while the new formula focuses on quality of care and requires means testing of Medicare beneficiaries. This is so higher income people will pay higher premiums. The old formula used to paying the Medicare doctors has been a long-time problem because health care costs have outpaced economic growth. Congress has fixed this problem in the past by overriding the reductions 17 times, but they were never able to establish a permanent solution. If they had not overridden the reduction, then the formula would have resulted in reduced pay rates.

The new formula will have positive rate increases for the next 4.5 years and incentivizes physicians to participate in Alternative Payment Models.

The deadline for action was actually April 1, 2015, but since Medicare doctors’ claims usually take at least two weeks to be paid by the government, the pay cuts were not expected to be implemented before April 15. The law will take place immediately in order to address payment rates to physicians for their services provided on April 1, 2015. In a written letter from the Centers for Medicare and Medicaid Services, the agency said that “only a small volume of claims” will be processed under the lower levels, but those payments will be reprocessed so that providers get the full amount of fees due.

According to the Congressional Budget Office, H.R. 2 will cost $141 billion over the next 10 years.

For a more detailed summary of what the law contains as well as a breakdown of key provisions of the law, please click here to view an article from Annemarie Wouters from Manatt, Phelps, and Phillips, LLP.

To view the complete H.R. 2 bill, please click here.

Our EstateView Software Featured in the American Bar Association

Probate & Property Magazine

The EstateView Software developed by our firm along with Jerome Hesch, J.D., and David Archer, MBA, was one of only three estate tax illustration and planning software programs chosen for review in the January/February 2015 edition of the American Bar Association’s Probate & Property Magazine. EstateView was highlighted in the Technology Probate section, which provides information on current technology and microcomputer software of interest in the probate and estate planning areas.

Here is what they had to say about EstateView:

EstateView Planning Software is a new entrant into the estate planning and calculation software field. EstateView’s most striking feature is its elegant user interface. The software uses a multi-window design that incorporates a modern feel and strikes the right balance between user-friendliness and advanced customization options. Beginning users can jump right in and start using the software right out of the box. More advanced users have a wide range of customization options, including the ability to undock, hide, or reposition displays to match their personal preferences.

The user experience is further enhanced by simultaneous data updates across multiple screens. As the user enters information and tries out various scenarios, the relevant displays are instantly updated to show the results of the changing assumptions. This makes it easy for the user to make the necessary adjustments to achieve the desired results.

EstateView has preset scenarios to help design and illustrate the most common estate planning options. Baseline scenarios for a married couple include:

- No planning (which can be configured with or without portability),

- Use of a credit shelter trust

- Use of a credit shelter trust with annual gifting

- Use of a credit shelter trust with discounted annual gifting,

- Combination of a credit shelter trust, discounted annual gifting, and one or more irrevocable life insurance trusts, and

- Installment sale to a defective grantor trust using a conventional or self-canceling installment note (with the ability to toggle grantor trust status in a given year).

These scenarios allow the user to illustrate most-often-used estate planning strategies with ease. Changing any of these scenarios will change the current illustration, which remains open throughout the entire process. This provides instant feedback without having to toggle between different screens.

EstateView makes it easy to generate a customized client letter to explain estate planning scenarios to clients. Once all information is entered, the user can generate a client explanation letter that uses color illustrations to explain the estate planning techniques involved. This letter can be saved as a Microsoft Word document and modified as necessary before presentation to the client. If the estate planning assumptions are changed at a later time, a new letter can be easily produced to illustrate the new scenario.

EstateView is still in the beta testing phase and is currently free for use by interested planners. Interested professionals can email estateview@gassmanpa.com and receive a link to download a free 180-day trial version of the software.

To see the complete story from Probate & Property, please click here.

To download the software, you may also email agassman@gassmanpa.com or janine@gassmanpa.com for the link.

Once you download the software, be sure to check out our EstateView tutorial webinar by clicking here. The best thing to do would be to use two screens – have the software open on one screen, and watch the webinar on the second. Do this, and you’ll be good to go!

Thanks to the ABA and Technology – Probate editor Jason E. Havens for featuring EstateView!

Richard Connolly’s World

Estate Planning Before and After Divorce

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “How to Keep Your Inheritance in a Divorce” by Neil Parmar. This article was featured in The Wall Street Journal on November 9, 2014.

Richard’s description is as follows:

For the happily wed, marriage is often about sharing everything – including generous gifts bestowed by parents or grandparents.

But when a relationship ends in divorce, that perspective can change dramatically. At that point, however, it may be too late to keep inherited assets such as vacation homes, rare collections, and other gifts away from a former partner, even if those assets were never intended to go to that person.

What is considered separate versus marital property can vary, depending on the state in which a couple lives.

While the financial outcome of a divorce may boil down to where you live, there are things you can do to help sway the outcome, especially when it comes to inheritances, experts say. This article looks at a few strategies, including negotiating a pre-nup, saving documentation, maintaining separate accounts, relying in trusts, and keeping titles in one name only.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “After Divorce, Separate Your Estate Plans, Too” by Liz Moyer. This article was also featured in The Wall Street Journal on February 20, 2015.

Richard’s description is as follows:

If you have just gotten divorced, you may be focused on getting on with your life, but make sure you also have updated the financial arrangements that kick in at your death.

Failure to do so – or failure to alert all relevant parties to the changes – could result in certain assets and benefits unintentionally going to your former spouse or his or her family upon your death.

Lawyers point to a current court case in New York as an example of how things can go wrong. The family of Robyn Lewis, who died five years ago at the age of 43, is battling her former in-laws, who stand to inherit a $200,000 home in Clayton, NY, even though she and her husband divorced in 2007.

Ms. Lewis executed a will in 1996 that named her then-husband to receive her property after her death. That included the house, which had been in her family for generations. She named her then-father-in-law as the secondary beneficiary.

While under New York law, the divorce automatically cut her ex-husband out of her will, it didn’t automatically cut out her father-in-law, who presented a copy of the 1996 will to the court.

Please click here to read this article in its entirety.

Seminar Spotlight

Communicating for Positive Results Presentation

The Clearwater Bar Association’s Solo & Small Firm Section will be sponsoring the following talk to be presented on May 12, 2015.

Bob Feckner will be presenting Communicating for Positive Results at the Clarion Inn & Suites at 20967 US Highway 19 N in Clearwater. The presentation will take place from 5:30 PM to 7:00 PM.

Bob Feckner is a fantastic teacher and always an inspiration to work with and hear from. He is with the Dale Carnegie program, and we can’t say enough good things about Dale Carnegie or Bob. He is a Senior Performance Consultant and Senior Instructor with Dale Carnegie Training Tampa Bay where he helps individuals and businesses improve performance in terms of Leadership, Communications, Employee Engagement, Sales, Sales Leadership, Customer Service, Teamwork, Human Relations, Productivity, and Presentations.

Join with solo practitioners and lawyers from small firms for networking to build your practice and improve practice management skills. This presentation is given at no charge to members of the Clearwater Bar Association.

To learn more about the type of training you could receive at this presentation, please visit http://tampabay.dalecarnegie.com/

Click here to register for this talk.

Humor! (or Lack Thereof!)

Our Favorite Memorial Day Invitation

We received the following invitation to a Memorial Day party. Names and addresses have been changed or removed to protect the innocent.

Fire in the Grill

(also known as Grills Gone Wild!!!)

Frequently Asked Questions*

- Q: Who Can We Bring?

A: You and your significant other. Kids are okay, but you gotta keep an eye on them yourselves ~ and not the whole Cub Scout troop. - Q: What Can We Bring?

A: About twice as much as you think you’ll drink. Maybe three times ~ you be the judge. A side dish as well since it’s a potluck thing. Please coordinate that with The Mistress of Ceremonies. - Q: Do We Need to Let You Know if We’re Coming?

A: Yeah, that would be super nice. Please let Jane know. If you tell John, he may not remember to tell Jane. - Q: Will the Party Go On Until the Wee Hours?

A: Yes! Probably until 9:30 or 10:00 PM. Then get the hell out. - Q: Will There be Vegan Options?

A: Yes, of course! You always have the option to go hungry (you’re probably used to that) or bring your own tofu and kale.

(*) I was dreaming when I wrote this; forgive me if it goes astray.

Upcoming Seminars and Webinars

**Please note our Bradenton presentation has been moved from May 12th, 2015 to August 13, 2015 so that they could build a new wing to accommodate all of the people who RSVP’d for this important presentation.**

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured headline speaker at the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the following:

- JOINT EXEMPT STEP-UP TRUSTS (JESTs)

- MATHEMATICS FOR ESTATE PLANNERS

- THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE. This luncheon will qualify for 2 CLE credits.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: Italy Today | 6743 Main Street, Miami Lakes, FL 33014

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class. Experienced professionals are also welcome to attend by making a small donation to the Lind Chair.

Date: Saturday, May 30, 2015 | 10:00 AM – 3:00 PM

Location: University of Florida | 2500 SW 2nd AE, Gainesville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Recent Homestead Cases, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

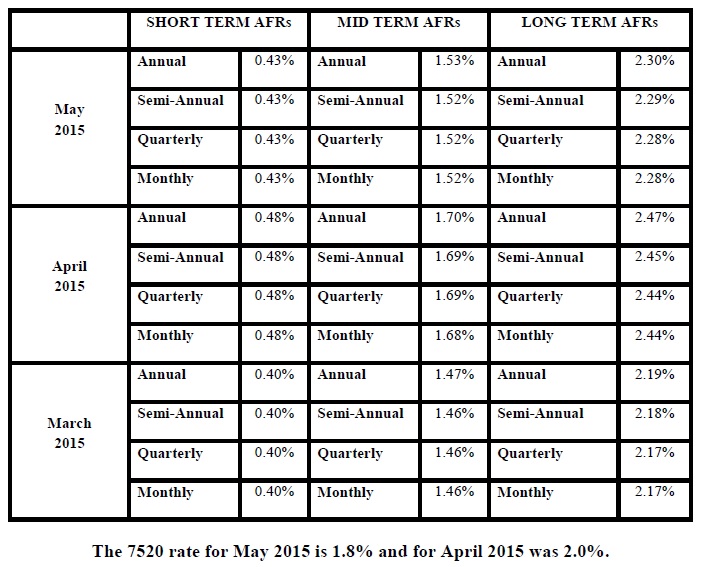

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.