The Thursday Report – 12.8.16 – Live From the Magical Mystery Maui Mastermind Tour

Re: Live From the Magical Mystery Maui Mastermind Tour

Representing Clients in Investments and “Deal Making”

11 Mistakes That Business Owners Make (Besides Not Reading Every Thursday Report)

Rising Sun: Updates to the SunBiz.org Website

The New Requirements for Captive Insurance

Three Simple Steps to Take Back Control of Your Business Day by David Finkel

Richard Connolly’s World – Trump’s Tax Code Changes and His Apparent Ability to Do So

Webinar Spotlight: What to Expect After the Unexpected – Planning for the Probable and Possible Trump Tax Law Changes

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

On this day in a year long, long ago . . .

The Beatles released their double EP in the UK for the often maligned Magical Mystery Tour film in 1967. While the film itself was regarded in many respects as a flop, the resulting soundtrack and other accompanying singles on the double EP has been rightly viewed as one of The Beatles finest ever albums.

One of the primary contributors to that album, and one of five credited directors of the film, was none other than John Lennon, who was granted his green card to reside in the United States in 1976 after getting a haircut and being investigated by the FBI. Information from the FBI files that were made public under the Freedom of Information Act in November 2011 can be viewed by clicking here. With respect to the film, Lennon quipped that it was “the most expensive home movie ever filmed.”

In a sad but true turn of events, John Lennon died on the 13th anniversary of the Magical Mystery Tour’s release on December 8, 1980.

Let’s all enjoy our personal tour in helping others.

Quote of the Week

“Imagine all the people living life in peace. You may say I’m a dreamer, but I’m not the only one. I hope someday you’ll join us, and the world will learn to live as one.”

Representing Clients in Investments and “Deal Making”

by Alan Gassman

The New Lawyers Guide

Lawyers giving advice on transactional matters have many challenges. If the deal goes well, the client might be somewhat appreciative, but if the deal goes badly the lawyer may be completely to blame. Before I became a lawyer, I swore that I would never be one of those “deal killer lawyers.” However, upon becoming a lawyer, I found that clients often do not want to be the heavy, and that “pulling the plug if we don’t get our way” is just one of my many jobs.

Other duties associated with the more intensive jobs include: helping to size up both business and legal risks, working with the psychology of all concerned, and attempting to handle all of the details and “what if’s” to hopefully spot whatever may go wrong, well before it actually happens.

Legal Advice

A competent lawyer representing a client in a business transaction or structuring must ask a number of questions:

- What needs to be done from a legal standpoint?

- What legal issues apply as to the transaction and the chain of events that may occur after the transaction?

- Is the business or subject of the arrangement legal, and what registrations, licensing and other governmental and contractual requirements will apply?

- What proposed or possible new laws or concerns may arise in the future?

- What is the true motivation of the other parties involved, and how do we assure that our client is not harmed by lack of disclosure, dishonesty or post transaction wrongdoings, which are not uncommon.

Additional business considerations

- Many lawyers will not give business advice because they do not think they have the ability to do so, or that it is not their job.

- More than 30 years of experience in watching business transactions both succeed and fail, and having heard and watched clients ignore or not receive practical business advice, I think I have something valuable to offer, as do most good experienced transaction lawyers.

- Conversely, I must be careful not to substitute personal judgment for the opinions for those clients. Generally, those with experience in a profession have good gut intuition, but some people have better business sense than others.

- The most successful lawyers in a given field usually have as much or more business sense as they do legal knowledge, and are commonly available to help the rest of us.

Many clients have ignored advice and done risky things, making millions, but those are the lucky few. It is always better to head on the side of caution. The urge to say “I told you so” must be suppressed.

Group Think and Human Nature

It is sometimes easy to miss the big picture in negotiations and fail to warn clients about practical and technical considerations. It is important to make sure that as a competent lawyer, your representation is based both on fact and intuition. It is a lawyer’s fiduciary duty to bring up all important and material issues, whether or not it is what your client wants to hear, and it is always good to put concerns in writing.

In addition, it is human nature to blame others for problems that happen. Keep in mind that sometimes, clients will blame lawyers who helped them with a transaction to save face, and this will certainly happen to you during your career a number of times if you are busy and successful.

Approaching clients to let them know the “error in their thinking” and how they could improve that path they have put themselves on must be done tactfully and succinctly, as we work with the human ego and emotion. By the same token, there may be “bad actors,” or naive individuals in positions of influence who must be dealt with. These can include: business brokers and others who profit from a transaction, spouses, in-laws, “the other guys at the club,” and other advisors who may not see things the same way you do.

Oftentimes, bankers will make the loan, but then later become adversaries when things do not go as planned because the bank needs to recover its losses. Many clients will come to the lawyer with the bank loan details already in place, when they could have negotiated much better financing terms if they has started earlier and shopped between banks, as opposed to having limited time and choices between signing an acquisition agreement and closing.

Common Sense and Clients

It is one thing to say, “I recommended that you have an environmental review but you elected not to,” versus, “I explained to you that last year a client spent $1,000,000 on a property that he paid $50,000 for because he did not have an environmental review.”

Some people may have or learn “common sense,” or will trust yours, but it may take a lot of time and patience both in years and hours spent. Others will never understand what they do not grasp.

Being allied with the client’s CPA and other advisors can make a very big difference. Taking some time to get to know the CPA of the client, the client’s spouse and other advisors, key officers, or those involved in a given transaction can be very helpful for all concerned.

It may take an army of advisors to talk a client out of a bad decision or assumption, along with patience, the courage to communicate your views, and tactful skills. We should all factor in on the situation where we know that the deal is not right or imbalanced, but the client may still want to move forward regardless of the advice presented to them. Some lawyers strongly recommend that the lawyer involved should resign in those situations, before helping a client complete an unwise transaction. At a minimum, however, the lawyer here should make sure to document that there was a discussion of the issues, and that the primary concerns were expressed in writing and reviewed by the client.

How Much Risk Can the Client Afford?

Another big question is what is the risk involved, and can your client afford to take it? A multi-millionaire can afford a $200,000 loss, but someone with just a $200,000 net worth cannot afford a $400,000 loss unless they are willing to go bankrupt. The full extent of downside risk needs to be clearly explained. For example, many tenants don’t realize that their real obligation is the number of years on the lease multiplied by the annual rent, not just the monthly payment amount.

Due diligence is another common area of disagreement between lawyers and their clients. Clients may hope for the best and spend as little as possible on due diligence and verification, or assume that they can do this themselves and do not need to have experts who can provide insight and warnings that most people would not recognize. This may work well most of the time, but can the client risk being the poor son of a gun who everything falls apart on because due diligence did not spot big issues that become catastrophes after the deal is done?

Teamwork Between Parties

While the lawyers are typically playing the role of the “stick” thereby allowing the client or another advisor to be the carrot in negotiations, we will do best if we consider the other party’s team to be part of our team for cooperation and mutual respect purposes. When there are minor issues after a closing, we want to be able to work these out by having strong personal relationships and mutual respect when we can. Clients who do not allow us to take the high road in negotiations and closing, or who choose to deal with “not so nice” people, put themselves in peril of not being able to have cooperation on unforeseen fronts afterwards.

Also, if the lawyer on the other side is making a mistake that may benefit your client in the transaction, it is commonly best to give them a courteous call so that they can correct their error. Otherwise you may find yourself in a fray that could have been avoided.

11 Mistakes That Business Owners Make (Besides Not Reading Every Thursday Report)

by Alan Gassman

This article was written for the benefit of business clients large and small in the hopes that it will help other advisors guide their business clients to success and safety.

- Failure to recognize legal threats caused by lack of compliance with the law.

Over and over again we see clients who are near death’s door from a business or financial standpoint because they “did the right thing” but did not follow the clear requirements of government rules or contractual obligations for lack of having a “compliance component” of their business.

Most successful entrepreneurships got to where they are because they ignored traditional business conventions. Unfortunately, however, they then confuse “bucking the system” with “following the law or contract.” Steep fines, largest payments, bankruptcy, and even jail are not uncommon results.

- Failure to sever ties with the dishonest people.

Those who lie with dogs shall rise with fleas. If you conduct business with the wrong people the potential is there for you to lose everything, including your personal freedom. When/if it becomes time to cope with these situations that arise when corners are cut or laws broken, bad people will eventually do whatever is necessary to take advantage of any leverage they can. An example of this are the many otherwise innocent business people who have been lead to “cheat on their taxes” by dishonest accountants, who then turn in all of their clients for shorter jail sentences.

- Failure to fix or flee from bad relationships.

When relatives in the business, trusted employees, or difficult suppliers or customers are out of alignment there can be a tendency to try to ignore or procrastinate the inevitable. Cutting to the chase with the person or organization to quickly decide whether to fix the relationship or sever it, is essential to avoiding the calamities that we often see as a result of not taking action.

- Failure to adhere to high quality standards of conduct, products, and following through.

People and businesses get sued when they make mistakes, don’t follow agreements, or cause harm to people or businesses. While it is faster, cheaper and often easier to be “a little sloppy,” this almost always backfires and can cause great harm to any business or organization.

- Failure to monitor and assure honesty in others.

It only takes 1/10th of 1% of the population to be dishonest and dislodge 30% of the rest of the population. Do not expect honesty, and do not provide temptation by not making everyone in your organization accountable. Accounting firms, lawyers, and quality control specialists have ways of verifying and enhancing the honesty of people and organizations. Have those safeguards in place, and verify responsibly.

- Failure to have planned for Murphy’s Law.

Highly leveraged businesses, one product companies, and even organizations with “only one key person” regularly go under because most of the time something unexpected happens, but there is also too much centralized power that allows someone to take unfettered risks.

An outside advisory board or consultant can help business owners understand risks that can cause loss of major resources or an entire business. Terrible things do happen, and more often they occur to those who had rose colored glasses on and have ignored rational warnings. Sometimes risks are much more prominent than they seem.

- Failure to find and follow sound legal or accounting advice.

A great many times the story behind the business or financial disaster is that sound legal advice was given and ignored for whatever reason. And the adage is true that “anyone who does their own legal work has a fool for a client.” The legal system is said to be rigged against those who do not follow the rules. Better to be safe than sorry, or worse, devastated. Using lawyers who are familiar with the specific area of law involved is essential.

- Failure to have proper liability and casualty insurance to cover prominent risks.

We live in the most sophisticated society in history with respect to the ability to insure a great many risks, and to avoid those risks that cannot be insured for. Quite often, business disasters result in litigation that was not insured against, or is actually over whether insurance is properly in place.

An annual insurance review and periodic second opinion from an independent consultant who is familiar with the industry are both essential. Why not ask a lawyer who regularly defends claims in the industry to look over the policies to ensure the right insurances and procedures are in place. It is advisable to outsource those functions that cannot be insured whenever possible.

- Failure to have employees and contractors in sync with objectives and operations.

Many successful businesses have been brought down by short sighted or irresponsible employer practices. These can include: not listening to other peoples concerns regarding the business; not protecting employees from harassment and being hurt; not following wage, hour, and safety laws; and harboring dissatisfied workers who look forward to ratting on the business and try to make money from being whistle blowers, instead of being a loyal team player who has the business’s back. This takes time, money and energy that should be part of the business plan, budget, and culture.

- Failure to have a team approach to avoid the above failures.

Good and great leaders understand their drive and talents, and make sure that they have team and business structures inside and outside of the business to help monitor and improve situations that open them up to the potential for failure. Making sure that there are systems and people in place to monitor and improve compliance is essential to any successful business.

- Failure to Implement and Maintain Proper Legal Structures.

A good many business owners come to us after clear threats to their survival have occurred, making it too late to put legal entities and structures into place that would safeguard assets and business operating rights from creditors, taxes, divorce and other doomsday scenarios. Others have not thought through what assets to own, what to lease, how to invest or how to own the selected investments. The difference in result between a well planned business and estate structure and a poorly or unplanned arrangement can be dramatic.

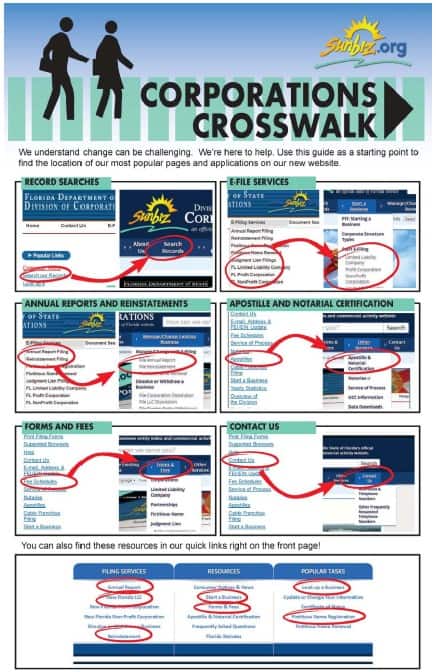

Rising Sun: Updates to the SunBiz.org Website

by Tina Arvin

The Secretary of State has updated their site,

And so far we’re filled with nothing but delight!

The site is still located at www.sunbiz.org,

Give it a try for your corporate re-org.

The headings and toolbars are easy to navigate,

The changes are minimal, with little to hate.

The e-file services work just like before,

You may find you like them even more!

With commonly used tasks so easily accessible,

Our excitement over the change is irrepressible!

If you do not like change, or anything strange,

You’ll find that this one is an easy exchange.

If you find that you need a cheat sheet or guide,

Try the Corporations Crosswalk to help you abide.

The Crosswalk shows you before and after links,

You’ll find that there really are very few kinks.

If you need assistance, they welcome your questions,

Just scroll down to Contact, and give your suggestions!

The New Requirements for Captive Insurance

by Jay Adkisson and Chris Riser

When Sean Connery was captured and was a captive, IRC Section 831(b) did not apply, and he was able to escape. This may not be the case for many captured captives now, or at least captive carriers that are not carefully following the rules and making sure there is substantial economic substance behind the insurance arrangement.

Master storyteller and captive carrier experts Jay Adkisson and Chris Riser were kind enough to share their knowledge and candor in a recent LISI newsletter. We thank Steve Leimberg and his amazing team for allowing us to reprint the following introduction. You can read the entire newsletter by clicking here.

Here is their commentary:

EXECUTIVE SUMMARY:

On November 1, 2016, the IRS released Notice 2016-66, designating certain captive insurance companies that have made the 831(b) election as a “Transaction of Interest.” The Notice imposes significant reporting requirements on the certain owners of 831(b) captives, the insured businesses paying premiums to the captive, and the business owners themselves if those insured businesses are treated as passthrough entities for tax purposes. The Notice also imposes significant reporting and list-keeping requirements for certain material advisors.

Three Simple Steps to Take Back Control of Your Business Day

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Debbie owned a $12 million/year marketing firm that worked with fortune 500 clients. She had so much opportunity to grow, but because she was totally overwhelmed she left each day feeling drained and disempowered to continue to scale.

When I first met her at an EO event in Texas (I was giving a keynote there), I could feel the frustration that dripped into her description of her company.

This is a common pattern for an owner-reliant or rapid growth stage company – the key people are stretched so thin and pulled in so many directions that they don’t even know how to get out of that cycle.

Here is my best coaching for you on how to get started with this process of building a business you love owning again, even in the face of all the conflicting demands on your time and attention.

Step 1: Start your day by asking what ONE thing could you do today that in 30 minutes or less would have the biggest impact on your business?

I caution you to be ruthlessly realistic about what you can get done in 30 minutes. Chunk down a larger project into the one piece you could bite off and get done in just 30 minutes of focused time.

Over time you can grow that 30 minutes into an hour or more, but start off with something you know you’ll follow through on and build on these small, daily victories.

Please click here to continue reading this article on the Maui Mastermind website. You can also follow David on Twitter: @DavidFinkel https://twitter.com/davidfinkel.

Webinar Spotlight:

What to Expect After the Unexpected – Planning for the Probable and Possible Trump Tax Law Changes

James Barrett is the chair of the Miami office tax department and is a senior editor in Baker & McKenzie North America Tax Practice Group’s Tax News & Developments. He is the immediate past chair of the Florida Bar Tax Section. He has extensive experience in: (i) structuring offshore investments and transactions by U.S. multinationals; (ii) tax planning associated with cross-border mergers & acquisitions; (iii) advising clients with regard to tax issues arising in the formation, operation and liquidation of partnerships, and (iv) addressing issues relating to debt and equity investments in the U.S.

Mr. Barrett is recognized in Chambers USA tax in the Band 1 category, the highest ranking available. Mr. Barrett is the co-founder and legal counsel to CasaBlanca Academy, Inc., which provides a comprehensive program to address the unique sensory, perceptual and motor planning difficulties that many children with autism and developmental challenges have. Mr. Barrett is an adjunct professor at the University of Miami School of Law.

For more information about this webinar presentation, please email Alan Gassman at agassman@gassmanpa.com.

Abrahm Smith is a partner with Baker & McKenzie LLP in the Firm’s Tax Practice Group, and practices mainly in the area of general tax planning. He is a recipient of the Chair’s Special Merit Award from The Tax Section of the Florida Bar.

Michael Bruno is an associate in Baker & McKenzie’s Tax Practice Group in the firm’s Miami office. Mr. Bruno focuses his practice on international tax planning, wealth management, and general corporate and partnership taxation, advising clients on mergers, acquisitions, restructurings and divestitures in a variety of business contexts, including with respect to investments in US real estate.

Sean Tevel is a member of Baker and McKenzie’s Tax Practice Group and an associate in their Miami office. Mr. Tevel primarily focuses on general international tax planning, subpart F planning, treaty issues, as well as general partnership and corporate taxation.

For more information about this webinar presentation, please email Alan Gassman at agassman@gassmanpa.com.

Just Announced!

What Physicians and Advisors Can Expect Under the Trump Administration Webinar Series

Richard Connolly’s World

Trump’s Tax Code Changes and His Apparent Ability to Do So

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the articles of interest are “Trump’s Changes to the Tax Codes May Encourage Dynastic Wealth” by Paul Sullivan; and “Estate Tax Repeal No ‘Slam Dunk’ Under Trump and Repliblican-Held Congress” by Greg Iacurci. These articles were featured in The New York Times on November 11, 2016, and Investment News on November 9, 2016, respectively.

Richard’s descriptions are as follows:

If Donald J. Trump follows through on his campaign promises, a host of taxes that affect only the very richest Americans may be eliminated, along with almost all tax incentives to be philanthropic. As a result, wealthy families may find it much easier to amass dynastic levels of wealth.

At the top of the list is the estate tax. Currently, the rules are straightforward: A married couple is exempt for the first $10.9 million in their estate, and they pay a 40 percent tax on the amount above that.

Mr. Trump’s campaign proposal seems straightforward: Repeal the estate tax — the death tax, in his words.

As for deductions for charitable contributions, Mr. Trump addressed that in two areas of his platform. As part of his proposal on the estate tax, he said, “To prevent abuse, contributions of appreciated assets into a private charity established by the decedent or the decedent’s relatives will be disallowed.” In the section on the income tax, he said all itemized deductions would be capped at $200,000 for a couple.

In addition, Richard provided:

The following article from Investment News discusses the difficulty the Trump administration may encounter in trying to repeal the estate tax.

Most notably:

“Although the Senate was able to keep control of the Senate with 51 Republicans, that tally isn’t enough of a majority to invoke cloture, or the closure of a debate on a particular question. To do so, Republicans would need to achieve a three-fifths vote in the Senate, or 60 total votes.

“Yes, he has the White House, the House and the Senate, but the big wild card is you need the 60-vote supermajority in the Senate,” Mr. Behrendt said.”

Please click here & here.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

Alan is in Maui this week with David Finkel and several other business advisors for the annual Maui Mastermind Wealth Summit at the beautiful Fairmont Resort in Maui.

Alan’s away message this week is as follows:

Zing-zang-zowee!

We’re far away in Maui.

At a conference where I am speaking,

Then off the to the bar I am sneaking.

In between talking about wills and trusts,

We’ll take sunset walks on the beach – it’s a must.

And boy oh boy, will it fill me with joy,

When we’re guests at a luau and sampling some poi.

What will be worse- my purple Hawaiian shirt?

Or coming to dinner in a lei and grass skirt?

We’re enjoying that ocean-y, island-y breeze,

And eating as much pineapple as we darn well please.

I’ll be wishing I was back with you,

While talking to attendees about just what to do.

Marcia’s here with me, so downtime occurs,

But I will read your email, and his, also hers.

Our able crew at the office, although without a boat,

Is guarding the fort, and making sure the office stays afloat.

And when I come back, I’ll get you what I owe,

All the while humming the songs of Don Hoe.

So aloha, my friend, goodbye and hello,

I’ll return before long, and be ready to go!

**********************************************************

In the News

by Ron Ross

NASA releases photo of a black hole eating a galaxy. Samsung’s exploding Galaxy Note 7 vows revenge.

Upcoming Seminars and Webinars

Calendar of Events

LIVE LORMAN EDUCATION SERVICES WEBINAR:

Alan Gassman, Ken Crotty, Christopher Denicolo, and Brandon Ketron will present a Lorman Education Services Webinar entitled THE MATHEMATICS OF ESTATE PLANNING.

Date: Thursday, December 15, 2016 | 1:30 PM (Eastern)

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LARGO PRESENTATION:

Alan Gassman will present a talk to Largo Medical Center Residents & Fellows on What New Doctors Need to Know about Money, Savings, Creditor Protection and Everything Else that Matters

Date: Thursday, December 29, 2016 | 12:00 PM (Eastern)

Location: Bilgore Conference Center | Largo Medical Center | 201 14th St. SW, Largo, FL, 33770

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SAN DIEGO PRESENTATION:

Alan Gassman will ASSET PROTECTION AND ESTATE PLANNING FOR SAVVY BUSINESS OWNERS AND PROFESSIONALS at the 2017 Maui Mastermind Freedom Formula Workshop. You’ll get a “charge” out of this, whether you are a San Diego fan or not.

Date: Friday, January 27, 2017 – Sunday, January 29th, 2017 | Time TBD

Location: Hilton San Diego Mission Valley | 901 Camino del Rio South, San Diego, CA, 92108

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan Gassman will speak on a panel discussion at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

51ST ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING EVENTS

Alan will speak at InterActive Legal’s display area on the topic of SHOWING CLIENTS HOW ESTATE TAXES WORK AND THEIR UNIQUE SITUATIONS – THE ESTATEVIEW SOLUTION on Tuesday, January 10 at 8:40 AM.

The Alan Gassman Channel and EstateView Software will be profiled and demonstrated at the InterActive Legal station Monday through Thursday during conference hours. Please feel free to contact Alan at agassman@gassmanpa.com for an appointment and personal tour of how EstateView works.

Alan’s Bloomberg BNA moderated webinar series will present live questions and answer opportunities at the Bloomberg BNA booth. Stay tuned for more details!

Date: January 9th – January 13th, 2017

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan Gassman and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

To download the complete schedule, please click here.

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please email Stephanie at alan@gassmanpa.com. For more information, please contact Alan Gassman at alan@gassmanpa.com.

**********************************************************

LIVE STETSON LAW SCHOOL PRESENTATION:

Do you need a positive jump start for 2017? Think about making a date with Srikumar Rao’s book Are You Ready to Succeed? followed by participation in one or more InterActive workshops that Professor Rao will lead in St. Petersburg, Florida, which are as follows:

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan Gassman for a 6-hour interactive, very interesting workshop to enable recent law school graduates and others to reach new levels of enjoyment and achievement in your business or professions.

This is based on Alan’s workshop materials that have been presented on many occasions at the University of Florida, Ave Maria School of Law, State and City Bar conferences, and elsewhere. This workshop will be free of charge for law and MBA students; a donation will be determined for all other interested participants. This workshop includes free course materials and a subscription to The Thursday Report.

Sunday, February 12, 2017

The Anxiety Solution: How to Replace Worry and Stress with Clear Direction, Confidence, and Joyous Life Experience at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan Gassman and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

The official invitations for these events can be viewed by clicking here: [INVITES IN FILE]

Date: Saturday, February 11, 2017 and Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Cost: Free for second and third year law students. $50 for lawyers in their first three years of practice and members of the Solo Member Section of the Clearwater Bar Association and the St. Petersburg Bar Association. $100 for all others. Includes free lunch.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan Gassman will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. This will be Alan’s third visit to Pensacola, and a welcome treat. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan Gassman will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined; Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

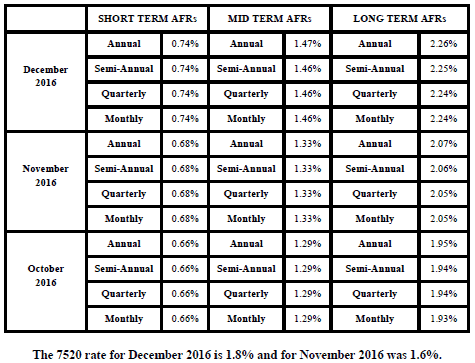

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.