The Thursday Report – 11.5.15 – Deep Thought for the Self-Taught

A Reminder of What Needs to Happen When Wholly-Owned Subsidiaries are Referring to One Another Under a Medical Practice

A Life Insurance Interview with Barry Flagg and Alan Gassman, Part II

You’ve Prepared Your Assets for Your Heirs. Have You Prepared Your Heirs for Your Assets? By Jeffrey M. Verdon

Richard Connolly’s World – Protecting Clients Before and After Death

Thoughtful Corner – Agreements Between Inheritors

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“If you want something new, you have to stop doing something old.”

– Peter Drucker

Peter Drucker was a writer, professor, management consultant, and self-described “social ecologist” who explored the way people organize themselves and interact in a manner similar to how an ecologist would observe and analyze the biological world. Drucker was called “the man who invented management” by Business Week and is best known for his book The Effective Executive: The Definitive Guide to Getting the Right Things Done, which can be viewed by clicking here.

A Reminder of What Needs to Happen When Wholly-Owned Subsidiaries are Referring to One Another Under a Medical Practice

A client recently asked us about the issue of self-referral between two medical practices. We consulted with Lester Perling, who sent us the following email:

Alan,

The client needs to be aware of disclosure requirements when referring patients between entities. Here is the primary requirement that applies to an owner, violations of which subject practitioners (any sort, including MD, DO, ARNP, PA, etc.) to misdemeanor prosecution and license disciplinary actions:

- A health care provider shall not refer a patient to an entity in which such provider is an investor unless, prior to the referral, the provider furnishes the patient with a written disclosure form, informing the patient of:

- The existence of the investment interest.

- The name and address of each applicable entity in which the referring health care provider is an investor.

- The patient’s right to obtain the items or services for which the patient has been referred at the location or from the provider or supplier of the patient’s choice, including the entity in which the referring provider is an investor.

- The names and addresses of at least two alternative sources of such items or services available to the patient.

- The physician or health care provider shall post a copy of the disclosure forms in a conspicuous public place in his or her office.

Additionally, MDs and DOs who are employees are subject to the following, as are owners, violations of which subject the physician to felony prosecution and licensure discipline:

Referring any patient, for health care goods or services, to a partnership, firm, corporation, or other business entity in which the physician or the physician’s employer has an equity interest of 10 percent or more unless, prior to such referral, the physician notifies the patient of his or her financial interest and of the patient’s right to obtain such goods or services at the location of the patient’s choice. This requirement does not apply to referrals within a physician’s own practice, whether he or she is a sole practitioner or part of a group, when the health care good or service is prescribed or provided solely for the physician’s own patients and is provided or performed by the physician or under the physician’s supervision.

Not that referrals between entities would not constitute the physician’s own practice, in my opinion.

I recommend putting a signed copy of any disclosure in the patient’s medical record.

Please let me know if you have any questions.

Lester J. Perling

lperling@broadandcassel.com

A Life Insurance Interview with Barry Flagg and Alan Gassman, Part II

Barry Flagg and Alan Gassman recently appeared on a podcast interview on the subject of their article, “Ten Questions to Ask About a Client’s Life Insurance and Planning: What Every Estate Planning or Tax Planning Advisor Should Know.” The interview was conducted by experienced life insurance executive Randy Zipse. Part I of the transcript can be viewed by clicking here. Part II is as follows:

Randy Zipse: Can you talk a little bit about if, in your views, there is anything besides term that is appropriate, and if so, what are some of the other product choices that are out there, and how should you look at this when you’re considering term versus permanent?

Alan Gassman: Well, one thing I’m going to add just from a practical standpoint as an estate planning advisor is when clients come in and they need more life insurance, I know that they need more death benefit. Therefore, I strongly encourage them to look at the term policy rates in my office and make a commitment to at least buy a certain amount and call their agent and get the physical ordered. I don’t want them in a debate for a year over what kind to buy in case they’re not insurable by the time they make their decision.

It’s worked well for me, and I think it’s worked well for the insurance advisors that I work with, to have the client be able to say that they tentatively decided to at least buy this much death coverage. They know they can afford this much in premiums, and then the agent can work with them to show them the differences while they’re waiting for their carrier quotes.

Randy Zipse: Can we talk about the conversion deadline issue with term policies?

Alan Gassman: Whenever I sit down with clients, we talk about what their conversion deadline is on their term policies. I always ask them, and they never know. Every once in a while, a client will come in and say, “Boy, since I bought that insurance, I can’t get a new policy because I had a little heart attack four years ago,” and then I’ll say, “Okay, well, what’s your conversion deadline?” The client’s response is usually, “Oh, I don’t know.”

Well, for that particular client, the conversion deadline was a year before he came to see me but three years after the heart attack because no one ever told him he had a conversion. Everybody thinks that you can convert up to the last year, but, as you guys know, quite often, depending on the carrier, you can’t.

Randy Zipse: Term is an interesting product. I mean, certainly, there are a lot of purposes for term, and to be perfectly honest, I own term. I’ve got young kids at home, and I have a lot of term insurance on my life, but you know, there’s just a specific need.

One of the things I don’t think most people even think about, and I haven’t seen any new study done on this in some time, but at one point in time, it was about 2% to 3% of term policies actually paid claim, which is, of course, why term insurance can be priced much less expensively than a permanent contract.

The extra cost that you have to pay to get the conversion right on a term contract, in my mind, is one of the best bargains that’s out there in a life insurance contract, so if you’re going to start out with term, make sure you know the quality of the carrier that issues the policy, how many products in the portfolio they allow the conversion to, and how long that conversion right runs.

All those things, I think, are really significant when you’re looking at a term contract, and opting to buy conversion rights should certainly be a big part of the thought process.

Alan, when and where is this article going to be featured?

Alan Gassman: It’s going to be in the Bloomberg Estate and Gift Tax Quarterly in November.

Randy Zipse: Great, and as we said earlier, there are a lot of ways to split life insurance contracts up. You can look at it as permanent versus term. Once you get into the permanent environment, you can look at it as index universal life versus variable universal life versus whole life versus – there’s just a lot of ways to split this up.

At the end of the day, I think one of the things that isn’t always understood by consumers and by advisors – and when I say advisors, I am really referring to the insurance agents as well as the attorneys and accountants who work with the clients and the agents – is under what circumstances can the premiums change and by how much? There’s so much spreadsheeting that is done on life insurance. Life insurance agents constantly spreadsheet, and I understand that you have to compare products against each other, and costs are one way to do that and, probably, the most understandable way from a client’s standpoint, so spreadsheeting is a popular way to look at products.

Understanding where that premium could go over the years – I don’t know how often that is done, and when it’s done, how well it’s done. Can you talk a little bit about the circumstances that can cause premiums to change and how much that impacts the decision making that fiduciaries should do when they’re buying a life insurance contract?

I think that certainly there’s, from a fiduciary standpoint, a lot of agents out there that are simply looking at spreadsheets and determining which have the most hypothetical cash value and/or the most hypothetical cost-efficient premium structure, and that isn’t going to meet any kind of fiduciary test.

Alan Gassman: I can agree that a spreadsheet is not going to directly correlate to the fiduciary test, but I have been accused by many of being one of the geekiest people who ever saw life insurance, and I do find that showing a client a column-by-column spreadsheet, which provides rates of return for each year and shows what goes in, what comes out, and what the performance is expected to be as illustrated and as guaranteed, is a very good educational tool for the client.

The client really doesn’t understand what the policy is. All they see are these columns that come with the illustration, and those don’t really mean a lot to the client. The agents who go the extra mile and put this on a spreadsheet and show the rate of return following FINRA and state insurance commissioner guidelines, I think, are doing a good service for their clients and a good service for the advisors. It certainly teaches you more about what’s going on mathematically, but we also, of course, have to stress to the clients that numbers are only as good as their source and their prediction. It’s certainly not a way to compare two different policies from two different carriers, but it might be a good way to help the client understand how these policies work.

Randy Zipse: When we were talking about this, and I had used the term ‘spreadsheeting,’ in my mind, I was thinking about the spreadsheets I saw insurance agents use, which simply have a list of carriers and premium amounts for carriers and cash values or carriers and internal rates of return (IRR) that are simply showing which one of that list is the best, depending on what they’re trying to show, whether it’s cash value or whether it’s IRR at death or whether it’s the amount out-of-pocket for fixed, but that’s the spreadsheeting that I had in mind.

What Alan is talking about is actually sitting down and looking at charges and how the products work inside. It’s really breaking the product down and understanding how that product works, so I guess, to kind of circle back where I started from, fiduciaries who are merely looking at a spreadsheet in the context of what I said, which is just showing the least expensive product, that doesn’t mean much, but breaking the product down the way Alan talked about – that’s the type of exercise I’m assuming that a fiduciary should be doing and needs to be doing in order to be meeting their standards under the prudent investor rules.

Alan Gassman: I agree completely.

Stay tuned next week for the conclusion of Alan Gassman’s interview with Randy Zipse. We will also have more information regarding the “Ten Questions to Ask About a Client’s Life Insurance and Planning: What Every Estate Planning or Tax Planning Advisor Should Know” article in future Thursday Reports.

You’ve Prepared Your Assets for Your Heirs.

Have You Prepared Your Heirs for Your Assets?

by Jeffrey M. Verdon, Esquire

Jeffrey Verdon is Managing Partner of Jeffrey M. Verdon Law Group, LLP. He has an LL.M. in Taxation from Boston University and practices law in the areas of taxation and comprehensive estate planning. He specializes in estate, trust and income tax planning, and asset and lifestyle protection planning for high net-worth clients across the US. He is also a highly sought-after speaker in the areas of taxation and estate planning, lecturing aboard cruise ships and at top Investment Conferences internationally.

To see this article in its original form, please click here. Thanks, Jeff, for sharing this Client Alert with Thursday Report readers!

The Loaded Question

“Dad, are we rich?”

Ethan’s father drops his fork mid-bite. “That’s an unusual question,” Roger carefully responds.

Ethan, who just turned 16 and still fears his father’s disapproval, hesitates before continuing. He knows there is an unspoken rule in his family to never speak about money. Despite his nerve, he plows on, determined to get to the bottom of the wild claims his classmates made.

“So the guys said I didn’t need to get a summer job, and I was like, ‘yeah, right,’ and then they asked if I had ever Googled you – I mean, us, as a family – which I hadn’t. So I did.”

“Ah,” responds Roger. “So you want to know if it’s true.”

Ethan shrugs, embarrassed. “I guess,” he mumbles, eyes locked onto his plate.

Roger sets down his fork, gently folds his large hands, and looks Ethan in the eyes. “Yes, it’s true, son. But that changes nothing. You are to work, you are to study hard, and you are to go to college. You are to find a career – any career – and you are to live a productive life. An inheritance changes nothing. I know from experience. Understand?”

Ethan nods.

“Now that this nonsense is cleared up, we will never speak of it again,” Roger says, and true to Roger’s word, he didn’t.

The Fallout

Unfortunately, just eleven short years later, Roger and his newest wife die in an airplane accident on their honeymoon, and Ethan suddenly inherits the responsibility of his late father’s estate.

What Ethan quickly learns is that an inheritance does, in fact, change everything.

Ill-prepared, Ethan must suddenly shoulder a nearly half-billion-dollar empire consisting of several closely held businesses, a myriad of trust funds for his multiple half-siblings, step-siblings and cousins, and properties around the world about which he wasn’t even aware. He fails to fend off vultures purporting to give advice and guidance under the guise of feigned concern, which he realizes too late are really efforts at grabbing as much cash from his family as possible. His family’s businesses slide downhill as key personnel jump ship without the consistent vision of a well-prepared leader, and, because money is a magnifier of all things, family infighting leads to mistrust, lack of communication, and eventual lawsuits.

Feeling that his father threw him like a screaming lobster into a pot of boiling water, Ethan drops out of veterinary school to try to manage the estate. He’s not dumb, so he should be able to learn on the go. But as lawsuits mount and his family falls apart, Ethan becomes clinically depressed. Furious at being forced to change his life for the unexpected, stressful burden, Ethan blows through money like water, supporting a lavish lifestyle with several marriages and overly-entitled children. In defiance of everything his father wished, Ethan, who knows nothing about his family’s history, lets the estate’s businesses fail and real estate investments depreciate. At this rate, the next generation will be lucky to inherit anything.

Think something like this can’t happen to you or your loved ones? Think again.

Wealth Transfer Today

The United States is currently experiencing the largest wealth transfer in history. According to the Boston College Center for Retirement Research, two-thirds of baby boomers will inherit family money over their lifetime to the collective tune of $7.6 trillion, and over the next 46 years, the Boston College Center on Wealth and Philanthropy (CWP) estimates that over $59 trillion will change hands. Yes, that’s trillion with a “T.”

So affluent families should expect to inherit huge estates that will keep generations rolling in it for years to come, right?

Wrong. Worldwide, including the United States, 70% of all wealth transitions fail. Used in this context, “wealth transition failure” means that financial “reversals” remove the estate’s assets – involuntarily – from the control of the beneficiaries. These reversals can occur due to poor financial or legal planning, taxes, economic downturns, litigation, mismanagement, inattention, incompetence, family feuding, and simple financial loss. Furthermore, 70% of heir families lose family cohesion after receiving an inheritance, and only one-third of family businesses successfully make the transition from one generation to the next. This consistent failure rate gives rise to the phrase “shirtsleeves to shirtsleeves in three generations.”

Ethan’s story doesn’t sound so unique after all, does it?

Researchers at the family-wealth consultancy firm The Williams Group in San Clemente, California, conducted a study of over 3,250 affluent families and asked why the 70% failure rate was so consistent around the world. Their results are eye-opening.

The reasons for wealth transfer failure most often cited by lawyers and financial planners – high taxes and poor investments – surprisingly only account for 5% of all failures. In fact, the single biggest factor of wealth transfer failure in 60% of all cases is poor trust and communication among family members. Additionally, the failure of parents to prepare their heirs for their wealth resulted in 25% of wealth transfer failures, and the failure to have a “family mission” resulted in an additional 10% of failures. Doing the math, a full 95% of wealth transfer failures are due to family dynamics rather than poor legal and financial planning.

So it’s not enough to prepare your assets for your heirs. You must also prepare your heirs for your assets.

Talking about wealth transfer means talking about death and money, which are, admittedly, two of the most highly sensitive and uncomfortable subjects for families, but not talking about it risks your entire estate. Don’t let Ethan’s story become your own.

Richard Connolly’s World

Protecting Clients Before & After Death

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Protecting Deceased Clients from Identity Theft” by David H. Lenok. This article was featured on WealthManagement.com on August 19, 2015.

Richard’s description is as follows:

Even though potential identity theft is likely the last thing on a family’s mind when trying to process the death of a loved one, there are, nonetheless, some simple steps advisors, in concert with a client’s relatives, can take to discourage any unscrupulous individuals.

Many identity thieves start by gleaning personal information from funeral homes and obituaries. Make sure your client’s family pays special attention not to reveal too much information in publicly available materials. General age of the deceased, for instance, is fine, but spelling out his birthday isn’t. Innocuous seeming items, like the deceased’s mother’s maiden name, can also do a great deal of damage (just think of how many password recovery “secret questions” you have set up currently that ask for that information!)

Please click here to read this article in its entirety.

The second article of interest this week is “Estate Planning Tips: Before & After a Client’s Death” by Martin Shenkman. This article was featured on Financial-Planning.com on March 17, 2015.

Richard’s description is as follows:

There has been a fundamental shift in advisors’ main estate planning concerns in recent years. With estate tax exemptions considerably higher, there’s less need to worry about estate tax minimization. Instead, there is a greater emphasis on income tax considerations and an opportunity to offer a different array of valuable planning ideas.

This article contains a few key ways advisors can add value for elderly clients, as well as for their heirs.

Please click here to read this article in its entirety.

Thoughtful Corner

Agreements Between Inheritors

Oftentimes, an elderly person with assets will exhibit symptoms of dementia, which can include favoring certain children over other children, thinking that one or more children are doing them harm or have done them harm in the past, promising inheritances beyond what is possible, such as promising the same piece of jewelry to three different people at three different times, and refusing to pay for expenses that are in the best interest of the elderly person, such as nursing assistants, monitoring and alarm systems, drivers, and housekeepers.

By the following Agreement, two or more children of the same person can agree that all inheritances will be shared equally, that any gifts given to the parent will come back to the child who gave the parent that gift, and that one or more of the children can pay expenses for the parent as a gift that will increase that child’s inheritance as a kind of repayment.

Many adult children do not realize what their parents are doing, or how to handle this. Also, adult children are often, for many reasons, the last people to realize that a parent has dementia.

The following Agreement may be helpful in such situations:

We agree that with respect to any inheritance any one or more of us who have gifted items of value such as jewelry, iPhones, iPads, health devices, and other items to Mom, will receive those items back as our inheritance, above and beyond one-half (1/2) of remaining assets.

We also confirm that one or more of us have told Mom that we will pay for certain expenses that we think assist her, such as part-time helpers, transportation, a monitoring system, and possible other benefits like a concierge doctor, expenses for travel, and otherwise. We will keep each other posted on amounts gifted, and unless there is a written objection, each of us who has gifted amounts from this time going forward will receive the amount gifted back as his or her inheritance, before the remaining assets are divided equally as described below.

We further agree that Mom’s intent has always been that we would inherit equally, and to the best of our knowledge, all Will, Trust, and any pay on death and beneficiary designation accounts and arrangements provide for equal inheritance between us, and that if one of us dies before Mom, our descendants would receive our share.

We hereby agree between ourselves that if for any reason the equal inheritance arrangements assumed above do not exist, or for any reason Mom intentionally or unintentionally makes changes to how our shares are to be divided, such as if she were to become angry at one of us for telling her not to drive and disinherit that person, then we will nevertheless make appropriate adjustment so that each of us inherits equally, to the extent that this is feasible.

We further agree that our respective inheritances will be reduced to the extent that our respective descendants receive inheritances in greater proportion as between us. For example, if the children of one child receive $20,000 more in the aggregate, than the children of another child, then that other child would receive $20,000 more, to keep or to distribute among his or her descendants.

We further agree that if there is ever a dispute with respect to our inheritance that ________________, CPA, or alternatively _________________, Esquire, will serve first as a mediator to attempt to enable us to agree and resolve any disagreement, and if that is not successful, then such person shall serve as an arbitrator, or upon request of any of us will appoint an arbitrator and designate the rules of arbitration to apply. We will equally bear the expense of any such mediation and/or arbitration process.

We will also keep each other posted on communications with Mom, Mom’s whereabouts, and expenses incurred for Mom, by e-mail or otherwise.

This Agreement shall be construed under Florida law and the situs of any mediation or arbitration will be in Pinellas County, Florida, and will be binding upon your successors and assigns.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free webinar on the topic of ASSET PROTECTION CHECKLIST ITEMS YOU HAVE NOT THOUGHT ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, November 17, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, November 18, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of WHY OUR GOVERNMENT REJECTS PUBLIC IDEAS AND KEEPS PEOPLE IN THE DARK ABOUT SERIOUS ISSUES.

In the area of rejecting ideas, consider this country has won more Nobel prizes than any other country, yet getting new ideas into the government from the general public is almost impossible. Yes, pulling the gems from the pile and evaluating them can be a problem. Unfortunately, it really doesn’t matter whether the potential ideas save lives, money, or time. The government generally ignores them.

Questions to be answered during this presentation include:

- Why are ideas often ignored by politicians and government agencies?

- What drives the motivations of politicians and government agencies?

- Why does the government try to keep the public in the dark about certain subjects?

- Does the government classify things that shouldn’t be marked as classified? Is that against the law?

There will be two opportunities to attend this presentation.

Date: Wednesday, January 6, 2016

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

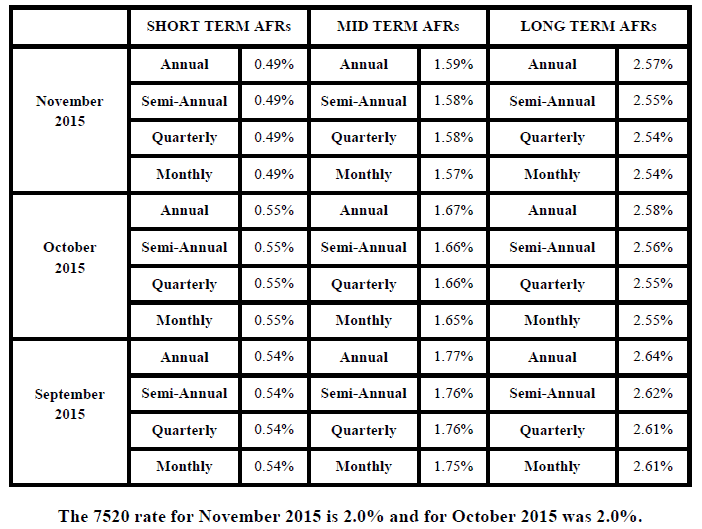

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.