The Thursday Report 6.8.17-Eat a Thursday (Peach) Report

Thursday Report

Re: Eat a Thursday (Peach) Report

Helping Successor Trustees Understand Their Obligations, Duties, and Potential Liabilities by Kenneth Crotty

An Interview with Darryl Richards on Non-Competition Covenants

How You Can Help a Wonderful Cause by Martin Shenkman

Fiduciaries and Freakonomics – What Do They have in Common? by Kimberly Sterling

Asset Protection Checklist for Florida Physicians in a Group Practice by Phillip Rarick

Richard Connolly’s World –’Eat What You Kill, ‘ Business Development and Collaborative Culture

Thoughtful Corner

Humor! (Or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com

Quote of the Week

“I’ve come to the conclusion that I’m not supposed to be married”

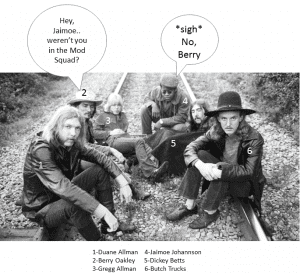

-Gregg Allman

This week’s Thursday Report is dedicated to the Allman Brothers Band, which started as two real brothers being raised in Tennessee then Daytona Beach, Florida in a modest family that allowed for the development of their extremely special musical talents. Duane Allman and Eric Clapton made significant contributions to modern music as Derek and the Dominoes, with Gregg Allman on organ birthing “Layla” and “Other Love Songs” in a Miami studio.

Duane and Gregg are credited with being the fathers of southern rock. Duane died at age 24 in a motorcycle accident. Estate planners will appreciate that Greg was married seven times and had 5 children by 4 wives, including Cher, which we are sure made for very challenging estate planning documents and interesting family events.

“I said, other people can write songs, let’s see if I can. So the first 400 or 500 wound up on the floor somewhere. Then I wrote one called Melissa.”

The rocker had several groups with his brother in the early 1960s before the creation of the Allman Brothers Band in 1969.

President Jimmy Carter credited Allman for drawing support during his campaign, which helped put Carter in the White House. The two became friends and in 2016 Carter presented Allman with an honorary doctorate from Mercer University.

In 1995, Allman was inducted into the Rock and Roll Hall of Fame as part of the Allman Brothers Band and Gregg received a Lifetime Achievement Award at the 2012 Grammys. Allman will be remembered as a pioneer of Southern rock.

Gregg Allman wrote such songs as “I’m No Angel,” “Ain’t Wastin’ Time No More,” and “Ramblin’ Man,” and died on May 27 at age 69.

Our best recommendations for Allman Brothers Music are the Eat a Peach album, and YouTube videos featuring the Allman Brothers with Eric Clapton which are below.

https://www.youtube.com/watch?v=pb22MYqdugE

https://www.youtube.com/watch?v=MfbJ5clkI1k

Helping Successor Trustees Understand Their Obligations, Duties, and Potential Liabilities

by Kenneth Crotty

When a client passes away, the Successor Trustee of the client’s revocable trust will have many duties to perform. In many cases, the Successor Trustee will not be aware of all the responsibilities that he or she will need to perform. Although the items below are not a complete list of the Successor Trustee’s duties and obligations, the following may be helpful for practitioners to share and discuss with the Successor Trustee so that the Trust will be administered correctly and the potential liability of the Successor Trustee will be limited.

The administration of a Trust Estate is accomplished by determining and collecting the assets, determining and paying any debts, filing appropriate tax returns, and distributing the remaining assets to the named beneficiaries. The Successor Trustee’s role in the administration process is a crucial one, and the Successor Trustee will have many duties and responsibilities. Under Florida law, the Successor Trustee is a fiduciary because he or she is technically holding the property of the Trust Estate for the benefit of the creditors and beneficiaries of the Trust. As a fiduciary, the Successor Trustee must adhere to the standards of care applicable to Trustees, which means that the Successor Trustee must use all authority available to act in the best interest of the persons interested in the Trust Estate (the creditors and beneficiaries) and must take all steps necessary to administer and distribute the Trust Estate as quickly and efficiently as is consistent with the best interest of the Trust.

Notice Requirements

Under Florida law, there are a few requirements the Successor Trustee must fulfill. The Successor Trustee is required to file the original Will and a Notice of Trust with the Court. The Successor Trustee should also advise the Internal Revenue Service that he or she is acting as a fiduciary by filing a Form 56, and will need to request an appropriate Tax Identification Number by completing and filing a Form SS-4.

The Successor Trustee also needs to provide notice to the qualified beneficiaries of the Trust. A qualified beneficiary is any beneficiary that could receive income or principal from the Trust, and also any beneficiary who would receive income or principal from the Trust if the interest of a person receiving income or principal from the Trust was terminated.

The Successor Trustee has a duty to alert the qualified beneficiaries that the Successor Trustee has accepted serving as Trustee, provide his or her full name and mailing address, and provide notice that a fiduciary lawyer-client privilege applies with respect to the Successor Trustee and any attorney employed by him or her. Further, the Successor Trustee needs to provide qualified beneficiaries notice of the Trust’s existence, the identity of the Grantor, the right a qualified beneficiary has to request a copy of the Trust instrument, and the right to accountings.

Management of Trust Property

The primary responsibility of a Successor Trustee will be to identify, collect, inventory, and value the assets of the Trust Estate. To obtain access to the Trust accounts and information, the Successor Trustee will need to prove to the banks and entities holding those assets that he or she is entitled to act as a Successor Trustee. In this regard, the Successor Trustee may need to present certified copies of the death certificate as proof of authority to administer the Trust assets. The Successor Trustee may also need to provide a copy of the Trust.

Generally, the Successor Trustee is responsible for taking possession of all property, determining its value as of the date of death by formal appraisal, and arranging for its preservation and safekeeping. The Successor Trustee should confirm or arrange for adequate insurance coverage for tangible personal property or improved real estate. Existing insurances may not be valid because the event of death took place and this should be carefully re-checked with both the agent and the applicable carrier. Most insurance companies will not renew property insurance on vacant buildings.

In marshaling the assets and preparing an inventory, the Successor Trustee will need to determine the title and location of all assets held in the decedent’s name alone (not in Trust), assets which the decedent held jointly with anyone else, and assets to which the decedent may have been entitled, such as the proceeds of life insurance policies.

Estate Tax

Although estate tax will not be payable to the State of Florida, Florida requires that an Affidavit of No Florida Estate Tax Due be filed with the Department of Revenue to advise them that no taxes are due on the estate. The filing of this document with the Department of Revenue is admissible as evidence of non-liability for Florida estate tax and will remove the Department’s estate tax lien. In estates that have a probate, the document is signed by the Personal Representative of the estate.

If the value of the decedent’s gross estate is of a sufficient size to require the filing of a federal Estate Tax Return, additional steps will need to be taken, and this should be confirmed and coordinated with a certified public accountant “CPA” of the Successor Trustee’s choosing. Typically, the CPA employed by the decedent will be the best able to handle filing the required return. The federal Estate Tax Return (IRS Form 706) is generally required to be filed if the decedent’s assets exceed $5,490,000. This return must be filed within 9 months of the date of death unless, an extension is applied for and granted. If the decedent made lifetime gifts in excess of the annual exclusion amount per donee, per year, (which is currently $14,000 per donee, per year) the amounts in excess of these amounts would reduce the filing threshold for the federal Estate Tax Return.

Creditors

The Successor Trustee also has an obligation to identify all potential creditors of the decedent. This will typically include credit card companies, doctors, hospital charges, funeral expenses, and other miscellaneous creditors. Unlike a probate proceeding, there is no formal “process” for identifying valid creditor claims with a Trust administration. Generally, the time period within which creditors may file claims against the Trust is two years from the date of death.

If there is a probate proceeding, the Personal Representative will publish a Notice to Creditors which will reduce the claims period to 3 months after it is published. The Personal Representative will mail the Notice to any ascertainable creditors, who will then only have 30 days after receiving the Notice to file a claim. Any creditor that does not file a claim will be forever barred from later filing a claim or demanding payment from the Trust. This process also gives the Personal Representative a means by which he or she can “object” to any particular claim, which then forces the creditor to prove the claim in a formal Court proceeding within 30 days after receiving the objection, or else their claim will also be barred.

Income Tax Returns and Income Tax Associated with the Trust

If the Trust Estate generates income in excess of $600 during administration, a Fiduciary Income Tax Return (Form 1041) will need to be filed on behalf of the Trust. Additionally, a final individual Income Tax Return (Form 1040) will have to be filed for the decedent. The Successor Trustee may want to call a CPA to schedule an appointment to discuss the tax return requirements. Prior tax returns and other tax matters may need to be reviewed by the Successor Trustee, and the Successor Trustee may have a duty to be sure that prior taxes were timely filed and paid. We generally recommend that the Successor Trustee review the past three years’ returns as they can also reveal assets and income sources of which the Successor Trustee may not be aware.

Administration Expenses

During the administration of the Trust Estate, the Successor Trustee will be required to pay any expenses of the Trust Estate from Trust assets. In this regard, the Successor Trustee should either use the existing Trust account or open a new Trust checking account into which all funds should be deposited and from which all expenses should be paid. The Successor Trustee will want to be certain that any Trust accounts are updated with the new Employer Identification Number for the Trust, because the Trust can no longer use the decedent’s social security number for tax identification purposes. Additionally, if the original Trust Estate has cash available, the Successor Trustee should determine whether and to what extent the cash may be more than will be required and whether some form of prudent investment will be required. Further, the Successor Trustee may be required to sell assets or borrow money on behalf of the Trust Estate to meet the cash requirements, if the cash available is not sufficient to meet the Trust Estate expenses. These Trust Estate expenses may include the payment of creditors, the payment of taxes, and the payment of general administration expenses.

Accountings

To coordinate the inventory, receipts and disbursements the Successor Trustee will be required to make, it is strongly advised that the Successor Trustee maintain proper accountings that meet the standards required under Florida law. This can be done by the Successor Trustee individually. The Successor Trustee must be able at all times to report the activity concerning the Trust Estate property to the beneficiaries of the Trust Estate and the form of an accounting is most efficient to achieve this purpose. As stated above, pursuant to the Florida Trust Code, the Successor Trustee has an obligation to provide qualified beneficiaries with trust accountings annually. This right to receive accountings can be waived by the applicable beneficiaries. If accountings are waived by the beneficiaries, a schedule should nevertheless be prepared showing the manner in which the assets available for distribution were computed and how those amounts will be distributed among the beneficiaries.

An Interview with Darryl Richards on Non-Competition Covenants

Tampa Johnson Pope lawyer, Darryl Richards and Alan Gassman presented a webinar on non-competition covenants, which included the following comments by Darryl:

Alan Gassman: So to get started, can you begin by telling us what exactly a non-competition agreement is, and what it does?

Darryl Richards: Sure, Alan. Non-competition agreements essentially state that an employee or independent contractor cannot compete with you for either business, clients, or referral sources for a specific period of time.

AG: Are these easy to create?

DR: They are easy to create. However, they can be easily found unenforceable if not all of the necessary provisions are included.

AG: And what are all of those necessary provisions?

DR: A proficient non-compete clause includes: (a) a non-waiver provision; (b) a referral sources provision; (c) a liquidated damages provision; and (d) an affidavit waiver provision.

AG: Can you go into more detail on those?

DR: Sure. Although it is intuitive that a non-competition agreement should contain a non-compete clause, many non-competition agreements only contain a non-solicit clause.

AG: What is the difference between a non-compete clause and a non-solicit clause?

DR: Non-solicitation clauses only prohibit employees from actively seeking out clients, patients, or referral sources. They do not prevent the employee from conducting business if they did not solicit it.

AG: What types of terms should be included in the non-compete clause?

DR: Non-compete agreements must include specific terms about when it becomes active. For example, a poorly designed, 2 year non-compete agreement, which does not include a clause about when the agreement becomes enforceable begins when it is signed. After signing the clause, an employee can begin working, then after 2 years, they can leave, and compete freely without violating the agreement because the agreement has already expired.

AG: Can you tell us a little about enforcement clauses?

DR: Enforcement clauses state that the non-compete provision acts independently from other terms in the contract. This allows the non-compete agreement to still be enforceable even if one of the other contract terms is violated, so the entire contract will not be void.

AG: Why else can this be important?

DR: If taken to trial, judges and juries will often find a way to not enforce a non-compete agreement, especially if they believe that the employer wronged an employee. The provision must act independently, so if the employer has “unclean hands,” and violates or does not fully comply with another part of the agreement, the non-compete agreement will still be enforceable.

AG: How do you construct the enforcement clauses?

DR: The non-compete clause should be as broad as possible to include any type of violation the employer may commit.

AG: Can you explain the non-waiver provisions you mentioned earlier?

DR: Non-waiver or merger provisions indicate the agreement cannot be void for oral communications. To create this, the provision must state that for a term to be enforceable, it must be written that the parties entering into this agreement are only relying upon what is written in the contract itself, and be signed by the parties. Additionally, the provision should include language that indicates that the non-compete agreement is still operable, even if it is not absolutely accurate.

AG: Why is this important?

DR: This prevents employees from getting out of a non-compete contract if the representations made to the employee were incorrect. A good example is, “we recognize that the things represented may not be quite correct, but we contractually acknowledge we are not going to use that to set aside the agreement.”

AG: Are there any laws on this?

DR: Yes, in fact recently Florida enacted a law that prohibits a contractual agreement to be waived if the non-compete clause contains a written stipulation. Courts will enforce these.

AG: What else should non-compete agreements contain?

DR: They should indicate which interests are being protected. By requiring the employee to legally acknowledge that the interests are both legitimate and important to the employer, the employee implicitly recognizes that the employer has the legitimate right to protect those interests. If this provision is missing, a judge or jury will only enforce the provision to the extent reasonably necessary to protect the legitimate business interests.

AG: Moving on to the referral sources you mentioned earlier. Can you explain why those are important to include? And how to create the clause?

DR: Referral sources are crucial to businesses, and are often forgotten in non-compete contracts. Employers spend lots of time and money cultivating the relationship between themselves and their referral source. Some Florida courts do not recognize referral sources as legitimate and protectable resources, however, some Florida courts do. It is better to include the provision, and have a court find a referral source not protectable, than to not including the provision, and lose any chance of protection. Within the referral source provision, make sure to require the employee to acknowledge the referral source’s identity is confidential information, potentially trade secrets, which are statutorily protected and not to be disclosed. Additionally, make sure the employee acknowledges that the particular requirements, needs, or preferences of referral sources that are known solely to the employer are to remain confidential and protectable.

AG: What about the liquidated damages provision?

DR: First, you need to understand that although these are rarely (if ever) enforced, they are a powerful tool that can instill fear into the employee, and potentially influence their compliance. The liquidated damages provision should be an estimate of lost damages that the employee would have to reimburse to the employer. The liquidated damages estimate must be a rational estimate of the damages inflicted or the provision will be unenforceable on its face.

AG: Any other last thoughts?

DR: It is very important to include a provision that the employee waives any objection to affidavit use. This is important because professionals do not want to inconvenience their patients or clients by requiring their attendance at depositions or temporary injunction hearings. Affidavits are a convenient tool to take sworn testimony, however, they do not allow the employee to cross-examine the witnesses, and can be considered inadmissable hearsay if litigated to trial.

AG: That’s great Darryl. Thank you so much for all of this great information.

How to Help a Wonderful Cause

By Martin Shenkman

Every spring and summer for the past seven years, my wife Patti and I, accompanied by our adorable therapy dog Elvis, spend 2+ months traveling the country in our Airstream, lecturing to professional advisors on how to better advise clients living with chronic disease and other health challenges. Patti was diagnosed 11 years ago with multiple sclerosis. Our MS journey has taught us first hand many of the challenges those with health issues face. As traditional travel or vacations became too difficult, we sought a way to squeeze lemonade out of the proverbial lemon and found a way to both travel, and help others with health challenges. The list of speeches and other efforts on the front side of this flyer reflects this year’s efforts, almost all to build awareness about cancer and the incredible efforts of the American Cancer Society.

Building awareness among professional advisors (attorneys, CPAs, insurance consultants, wealth advisors and more), about planning for health challenges, makes an important impact. These advisors are in a unique position to help clients struggling with health challenges, and the many wonderful charities serving them. Over the years we have been given the opportunity to address scores of professional groups including many local councils of the National Association of Estate Planners and Councils, Society of Financial Service Professionals, American Bar Association, American Institute of CPAs, state and local bar organizations, state CPA societies, and many more. So many organizations, such as Printing for Less whom assisted with this flyer and others in the past, and people have been so welcoming and helpful in making these efforts possible. Thank you. All honoraria have been donated to many worthy charities helping those with chronic illness and other health challenges including: American Cancer Society, National Multiple Sclerosis Society, Michael J. Fox Foundation for Parkinson’s Research, COPD Foundation, Hole in the Wall Camps, American Brain Foundation, and others. For our eighth year of adventure we have been afforded the opportunity to partner with and help an incredible organization, the American Cancer Society.

Relax, this is not a pitch for money, only for two minutes of your time to do something that could be even more important than writing a check.

Almost everyone has been touched by cancer. A dear and very close friend from law school days had his life cut short at too young an age to pancreatic cancer. My sister is a breast cancer survivor. My wife Patti’s father died from non-Hodgkin’s lymphoma. One of our closest friends is battling inflammatory breast cancer as I write this. My father lost a 10-year battle to cancer a year and a half ago. The list is much too long. While few people are fortunate enough to have six degrees of separation from cancer, the American Cancer Society has made, and will continue to make, incredible efforts to make that happen.

So, here’s the no-cost pitch.drum roll.. Join the American Cancer Society’s National Professional Advisor Network (NPAN). It will take a couple of minutes and doesn’t obligate you to anything more. Why is this so important? Because merely adding your name will add strength to the American Cancer Society’s efforts. Merely adding your name will keep the American Cancer Society name and mission in mind if a client, friend or loved one faces the challenges of cancer. For those advisors who might benefit, NPAN offers services to help support you and your clients in the community. NPAN gives you information and professional materials to enhance your client relationships – especially with those clients who are affected by cancer. For those of you who are don’t need these benefits, adding your name and reputation to the NPAN rolls will lend creditability to NPAN in its outreach efforts to other advisors. This could be the easiest pitch to say “YES” to. If you’re not an advisor, email this flyer (*editor’s note-the flyer Mr. Shenkman is referring to is in the Seminars section of this newletter) to your attorney, CPA, insurance consultant, wealth manager and trust officer. Encourage them to join NPAN.

It’s easy. Visit www.cancer.org/npan to join today. For more information visit www.cancer.org/plannedgiving to locate the Society estate and gift planning professional in your area.

Martin M. Shenkman

**Note from Alan Gassman**

I have joined, myself, and encourage all of my friends and colleagues to do the same. It is a wonderful opportunity to help by simply being available and being a part of an organization who goes above and beyond to help those who truly need it.

Fiduciaries and Freakonomics – What Do They have in Common?

By Kimberly Sterling

This is a story about what the Department of Labor’s (DOL) Fiduciary Rule and the book Freakonomics have in common. As it turns out, it’s quite a lot.

Freakonomics, published in 2005, was both entertaining and surprising because it upended some of our beliefs about how people conduct themselves. The authors, Steven D. Levitt, a Ph.D. economist at University of Chicago and Stephen Dubner, an American journalist, demonstrated that economics is really all about the study of incentives.

Incentives are also at the core of why every investor should prefer an advisor who is a fiduciary. The DOL rule (currently on hold until June 2017 at least) would hold brokers and advisors who work with IRAs, 401(k), and other tax-advantaged retirement savings plans to a fiduciary standard. In other words, advisors must work in the best interest of their clients and generally avoid conflicts of interest; when conflicts exist, they must explicitly be disclosed.

Brokers, insurance agents and fee-based advisors receive significant amounts of their compensation from sources other than their clients’ fees. Could these outside sources of compensation prove to be incentives – consciously or subconsciously?

Freakonomics chronicled the impact that incentives have on many common economic transactions. Here’s an example involving realtors.

You hire a realtor to help you sell your house and you expect them to negotiate for the highest price. But Levitt’s study of the data showed that the realtor’s focus is more on reaching a faster deal than pushing for a higher price. Realtors make more money by selling more homes, not by getting an extra 3% on the price of your home.

The underlying incentive may not be obvious at first. But once you hear it and absorb it, it makes sense. Nevertheless, most of us still hire a realtor expecting them to get us the best price.

Critics claim Levitt and Dubner wander away from economics and into sociology. Daniel Kahneman, a Ph.D. psychologist also wandered outside his field when he won the Nobel Prize in economics. His work in behavioral economics showed the impact that emotions and psychology (and incentives) have on financial and economic decisions.

Sometimes incentives are carrots: Do this and you’ll get free coffee.

Does anyone doubt that Starbucks offers us incentives to join their rewards program because they know they’ll get more business from us?

Free coffee for your birthday! Free coffee when you earn 125 points!

But in the meantime, we are prompted by the app to visit more often than we would have otherwise.

Sometime incentives are sticks: Do this or lose the promotion.

In September 2016, we learned that Wells Fargo employees had opened around 2 million unauthorized accounts on behalf of customers, without their knowledge or permission. It was a routine practice at the bank that employees referred to as “sandbagging.” Those employees who had not met the onerous, bank-imposed sales goals were not considered for promotions. In this case, the incentive didn’t work out for around 5,300 employees who were fired, nor for the bank, which paid a $185 million fine. The consumer banking chief of Wells Fargo left because of the scandal, claiming it was a “personal decision to retire after 27 years with the bank.”

While we are often motivated by the incentives around us, being a fiduciary mitigates their lure. The loudest objections to the DOL Fiduciary Rule came from brokerage firms and the insurance industry that employ professionals who are not fiduciaries and who receive the majority of their compensation from selling products.

Brokers are subject to a suitability standard that falls short of being a fiduciary. It requires a broker to make recommendations that are suitable, based on a client’s personal situation. But the standard does not require the advice to be in the client’s best interest.

Financial advice also comes from a myriad of fee-based advisors, insurance representatives and those with industry-designed titles and credentials. They receive a meaningful amount of their compensation from sources other than the client. Fees, commissions, and compensation might be disclosed, but if so, the disclosure is so obfuscated, it is of no value and provides no transparency.

It is often difficult to tell whether a financial advisor is a fiduciary. Here are two ways to find out:

Ask them if they can provide independent certification that they are fiduciaries. RCG has been certified by the Centre for Fiduciary Excellence (CEFEX) since January 2008.

Ask them if they have a Client Bill of Rights or will sign one stating they will act as a fiduciary. An example would be RCG’s Client Bill of Rights.

The DOL Fiduciary Rule may never become law. The issue has been in the national and political news frequently over the past year, but most investors still do not recognize or appreciate the difference. We encourage you to share this information with family and friends so they’ll be on the lookout for these incentives and minimize the chance that they will accept advice that is not in their best interest.

And, while we’re at it, in addition to being a fiduciary, we think it is just as important that your advisor is fee-ONLY and a Certified Financial Planner® professional. Consider it the trifecta standard for wealth advisors. There are enough uncertainties in reaching financial independence. Why add the uncertainty of having a financial advisor who may be rewarded with incentives that are not in your highest interest.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.

Asset Protection Checklist for Florida Physicians in a Group Practice by Phillip Rarick

The following is an asset protection checklist recently authored by Phillip Rarick

| Action Item | Done |

| 1. No weak links. Each physician in group has personal creditor protection plan. The goal is to have no exposed assets for plaintiff malpractice attorney to attack forcing plaintiff to settle within insurance policy limits. See points 2-5 below. | |

| 2. Each physician has domestic or off-shore asset protection trust to protect non-qualified equities and other liquid investments. If domestic trust, consider top tier state jurisdiction such as Nevada. If off-shore, consider clean jurisdiction with sophisticated, modern laws designed to provide maximum protection against creditor attack, such as Nevis or the Cook Islands. Note: Consider multiple layers, such as Nevis LLC owned by Cook Island Trust. | |

| 3. Each physician has Delaware LLC or other entity to protect wages. A Florida wage account is limited to 6 months and therefore often not the best solution. | |

| 4. Each physician has homestead fully protected. If homestead in municipality exceeds ½ acres it is not protected by Florida homestead law. Consider deeding exposed property to corporate entity with 99 year lease to preserve homestead tax benefits. If homestead is not in municipality then 160 acres are protected. Consider leaving mortgage on property – even if not necessary – as good asset protection option. The mortgage can be paid down to avoid creditor attack. | |

| 5. Confirm investment rental properties and non-homestead real estate are protected by having title in multi-member LLC with operating agreement updated to take advantage of new Florida LLC law. Note: Do not have LLC without asset protection Operating Agreement drafted by an attorney who concentrates in corporate or asset protection law. | |

| 6. Office Space: If group practice owns condo office space or other real estate this property should likely be owned by a separate LLC or LP and leased back to the Group. Exposed real estate is low hanging fruit for creditors. Remember if the practice is to be judgment proof there should be no exposed assets. | |

| 7. Confirm IRA’s, pensions and similar plans are properly managed. Private pension plans must strictly follow complex regulations. You likely need a CPA or investment advisor experienced in pension plan administration. See Item #21. | |

| 8. Have a Plan B in event of death, disability or disagreement with partners. This requires a Shareholder Agreement or you may find you have your partner’s spouse as a partner. Do you have a shareholder agreement? Is it up to date? Is it adequately funded with life insurance? Mark Done only if you can answer yes to all questions. | |

| 9. Conduct annual independent review of patient charts and billing, coding, and collection processes to insure compliance with Medicare/Medicaid/private insurance carriers | |

| 10. Conduct annual review of group corporate records to make sure basic corporate formalities are followed so that corporate veil cannot be pierced using alter ago theory. If professional association check if: (a) annual corporate minutes up to date; (b) separate corporate bank account; (c) stock certificates clearly show each partner’s interest; (d) tax records sync with corporate record. | |

| 11. Make sure individual medical malpractice policy and possible corporate malpractice policy in place. Conduct annual review of policy limits with medical malpractice broker who specializes in med-mal insurance. | |

| 12. Individual checking account you use for monthly expenses: If married, title as Tenants by Entirety (TBE); if single consider placing title in Delaware LLC. | |

| 13. Umbrella policy. This is a good, cost effective insurance product but make sure you check for gaps in policy. All insurance policies have limits and exceptions; make sure the “Umbrella Policy” does not contain gaps. | |

| 14. Insurance coverage to avoid business interruption or threats to profitability of practice: (a) Disability insurance; (b) Overhead insurance to cover practice expenses during period of disability; (c) Workers compensation insurance; (d) general liability insurance to cover slip and falls in office or parking lot; adequate auto insurance. | |

| 15. Theft proof practice monies and accounts receivable. Have strict system for logging in all checks in master log and ensure properly deposited. No one person should control check logging system. In larger practices, have someone from CPA firm periodically review check logging system without notice. | |

| 16. Ensure trust systems in place for children and loved ones. Note: Make sure your estate plan is integrated with your asset protection plan. | |

| 17. Protect vacation home: Consider to title in LLC, Limited Partnership, or Tenancy by Entireties. | |

| 18. Auto and motor vehicles: If married, title in name of person who drives vehicle the most; not in joint name. Make sure all vehicles are adequately insured. | |

| 19. Boats or jet skis: Title in name of LLC with asset protection operating agreement. | |

| 20. Schedule target completion date for your asset protection plan. Write the date down on your office and smart phone calendars. Plan when the waters are quiet – prior to any lawsuit. Waiting too long may limit planning options and enable attack via the Florida Uniform Fraudulent Transfer Act, F.S. 726. | |

| 21. The most important item: Have team of experienced, caring professional advisors consisting of: (a) CPA; (b) estate and asset protection attorney; (c) qualified financial and pension plan advisor; (d) medical malpractice insurance broker; and general liability insurance advisor. |

*With special thanks for ideas from Alan Gassman, Esq., estate & asset protection planning attorney, guru, and friend. Alan is the author of Creditor Protection For Florida Physicians, an excellent and insightful book for physicians, attorneys, and CPA’s. It is available on Amazon.com here

Richard Connolly’s World

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “’Eat What You Kill, ‘ Business Development And Collaborative Culture” by Pete Winstead. This article was featured on June 3, 2017 in Forbes.

Richard’s description is as follows:

In the attached article from Forbes Pete Winstead, founding member of Winstead PC, talks about the motivation behind hanging his own shingle, the values that have brought the firm to where it is today, and some of the business aspects behind his firm’s success, including compensation, governance, culture, and more.

Thoughtful Corner

22 Ways to Motivate Your Team

by David Finkel

Wall Street Journal bestselling author of, Scale:

Seven Proven Principles to Grow Your Business and Get Your Life

Back http://www.amazon.com/Scale-Seven-Proven-Principles-Business/dp/1591847249/ref=cm_cr_pr_product_top

How do you retain your top talent? How do you get the best from your team? Here are 22 simple ways to help you motivate your team.

- Salary: Are you paying your people market rate? While you will never win with money, you need to be in the right neighborhood. If you aren’t paying in the market range, you’ll risk higher turnover with the costs associated with that turnover.

- Benefits: For many of your team, especially those who are more “security” conscious, the benefits you offer are actually worth more than their true cost to your company.

- Bonuses: Recognize that any bonus that is regularly paid quickly becomes part of the “base” in the minds of your team, a strategic bonus plan can be a great motivator and retention tool. Ideas range from setting up a semi-annual bonus for qualifying team members that is paid 90 days after the end date, and for which they must still be employed by your company to earn it at that date (by which time they will have earned half of their next semi-annual bonus, making it painful for them to walk away from); to bonuses for generating new business; to bonuses for innovative ways to lower your structural costs.

- Commissions: For some of your staff, letting them earn “success fees” and “commissions” is a great motivator. The biggest mistake I see with sales compensation plans is to have too high and not enough of the earnings on commission (if in fact that is how you want to structure your sales team comp.) A sales team that earns too much on base is more concerned with selling you on not firing them than they are on selling more of your products and services.

- Contests: Set a goal, have a clear way to measure progress that your team can visually see, and reward the result. The best contests bring a team together, either by setting a team challenge and reward, or by being playful enough that they let any competition be healthy competition, not destructive competition.

- Great work environment: Do people like the feeling and atmosphere of your office? Do they feel good when they are at work? After all, they are spending 8+ hours a day there, give them an work environment that brings out their best.

- Flexibility of schedule: Where possible, can you let your team schedule work around family commitments? Or give them the ability to feel in control of their own calendar? Obviously the job has to get done, and the nature of the work and your business will put some constraints there, but within those constraints you have a lot of room to be flexible. This costs you nothing, and can mean the world to your team. It can also be something they have to earn (as well it should.)

- Work remotely (all or part time): This is one of the highest valued perks my team likes with Maui Mastermind. Not only does it cost you nothing, but likely it will reduce your costs as you have the need for less space in your office. Yes you have to work harder to improve communication and workflow, but this can spark you to increase quality and volume of output by your team.

- Vacation time: Let your team earn more vacation time based on their performance. Whether this be you reward a team that came through on a big project with a 4-day weekend, or you let any team member who is in their 3rd year with you get a 3rd week of paid time off, vacation time is a sweet perk that many small business owners can use to retain top talent.

- Unpaid time away: If you can’t afford to pay them for those extra three weeks of vacation you want them to have, perhaps you can give them weeks 3, 4 and 5 off for that once in a lifetime trip, just without pay. Again, be creative here and keep this in your bag of tricks to use with individual situations of your top people.

- Greater autonomy: This is a huge motivator for your team – letting them earn the ability to self-manage and to do things their way. After all, it’s likely one of the strongest drives that compelled you to start your own business to begin with so why shouldn’t it be as compelling to your team?

- Greater responsibility: Your team will see that when they earn greater responsibility they are growing professionally. It’s a sign that you trust them more, and that they are creating more value for the company. This is a powerful intoxicant for top producers. Of course if you give them greater responsibility you need to give them the authority to meet those responsibilities too.

- Share information: Bringing a team member into the “inside” where you share key information with them is a clear signal that you value and trust them. On a lessor scale, even just sharing more mundane information with your team in an organized and regular way is a motivator as it keeps employees in the “know”. It’s a sign that you respect them. Often this motivator is employed in its opposite—by not sharing information – and the destructive, demotivating message of distrust and disrespect that sends.

- Ask and value their input— honor their voice: When was the last time you asked for a team member’s opinion? Or confided in them asking for their help to solve a thorny issue? Asking your team for input on how to solve problems or to improve the company is a great way to engage your workforce. If you do this, make sure you are serious and not just paying lip service to their ideas. Your staff can smell insincerity a mile away.

- Cool work: Is the work your team does inherently challenging and absorbing? Do you have the ability to hand off cool projects to your key team?

- Feeling of growth: Do you have a plan in place to help your staff learn and grow? This can be as simple as taking time each quarter to give your team feedback and help them map out a plan of action to grow professionally. You do this with your managers and encourage your managers to do this with their teams.

- Let them bring pets into work: From my experience, it is a great reward to bring a pet in to work versus the stress of finding a way to care for them while they are at work.

- Let them bring their kids in to work (or work home to their kids): If you can swing the onsite day care, that can be a huge perk for your people. Obviously most small businesses can’t afford this. But this can also be letting them bring a child in who has an afternoon off at school, or perhaps letting them work from home (mentioned above) if they have a sick kid. It can also having a contract with a local babysitter service and rewarding your core team with x days of sitting for when they need it during the work day.

- Aspirational—a path forward: Help your team map out a career with your company, not just a job. The clearer you paint that future picture with them the more committed they will be to doing great work and enhancing their capabilities to fit in with the future you paint for them.

- A mission to be part of: Does your team move boxes or move the world? Do they feel connected to a higher calling with your business? At Maui Mastermind we “coach business owners” to grow their companies and reduce its reliance on them the owner. But our team all feel part of a company that changes lives – of our clients, of their staffs, of their vendors, of their customers, and of the families of all of these groups. We share stories of client’s success. We start or end many meetings with reminders that we’re not here to coach a business, but to bring the humanity back into building a business. (Yes you can grow your business and get your life back! You can build a company that gives opportunities and security to a growing team of employees.)

- Relationship—a personal connection: Be willing to forge deep personal connections with your team. Take the time to get to know them and their lives. Share about yours. I know that many business owners (myself included) hold ourselves back for fear of drama or awkward moments, but in general, we error too often on isolating ourselves from our teams. So take a team member out to lunch, organize a social event, ask them how their son is doing is school, and truly be open to connecting in an authentic way.

- Identity—how they see themselves: The team at Zappos see themselves in a special way. It’s clear to me every time I order from them over the phone. The more you can get your team to identify with your company, to see their work with you as part of who they are, the more committed they will be and the happier they’ll be working with you. So help shape how your team see themselves.

Humor! (Or lack thereof!)

In The News with Ron Ross.

Tiger Woods tries out Ivanka Trump’s idea and celebrates Memorial Day with champagne popsicles. Tiger denies sleeping behind the wheel, claims he was just imitating TV audiences watching him over the past three years.

…………………………………………………………………………………….

Ryan Seacrest mistakes Jeffrey Tambor for a dead actor. United States mistakes Ryan Seacrest for someone we should care about.

……………………………………………………………………………………………….

Jokes by this writer in Thursday Report seem to reflect our Nation’s lowered expectations.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Where is Montenegro?

It’s shoved between Bosnia and Albania.

Who shoved it?

Someone with tiny Hans.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Because the Republicans are eliminating funding for PBS, the network will be forced to fire everyone at “Sesame Street” and replace it with “Sesame Streep”, a children’s show in which the award winning actress will do all the production work and play all the roles, including beloved Muppets with appropriate voices carefully researched until perfected.

The show will consist of re-occurring segments such as:

SILK AND WOOD: A puppet made of silk and wood works at the nuclear plant, is contaminated by radiation and run off the road in exhilarating, Muppet behind the wheel action.

THE DEVIL WEARS FUZZY CLOTH: A Muppet loosely based on the editor of Vogue body shames Mr. Snuffleufagus and belittles the fashion choices of the Count.

SOFTIE’S CHOICE: Elmo must choose whether Bert or Ernie will die. Elmo’s dilemma causes him to keep changing his mind, leaving both classic characters begging for the sweet release of death.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

WHAT’S THE NEW SUMMER BLOCKBUSTER ALL THE KIDS WANT TO SEE?

“LAWYERMAN”!

Did Spiderman leave silk threads behind?

Lawyerman will make sure you keep what you find!

Did the Batmobile drive across your lawn?

Lawyerman will win that case before dawn!

Did you breathe He-Man’s stinky perspiration?

Lawyerman says you will get compensation!

Did you hit Wonder Woman’s invisible plane?

Lawyerman will turn that crash into your gain!

And if she lassos you and you admit you’re a phony

Lawyerman will have them throw out that testimony!

Don’t take your kids to see movie fantasy

Lawyerman is the hero they are meant to be!

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Upcoming Seminars and Webinars

Calendar of Events

ZPIC Investigations of Medical Practices webinar with Lester Perling

Alan, along with Lester Perling, will update us on the ZPIC investigations

Date: Friday, June 16, 2017 | from 12:30 P.M

To Register, Please go to https://attendee.gotowebinar.com/register/4622958594211084033

LIVE PRESENTATION: FICPA SANDSPUR CHAPTER JUNE MEETING-

Alan will be speaking on “Asset Protection from A to Z” and Ed Hanna will be speaking on “The Kerry Brown Model”.

Date: Monday, June 19, 2017 | 5PM – 7PM

Location: TGI Friday’s – 2501 E Fowler Ave, Tampa, FL 33612

Cost: $35.00

For more information: email Alan at agassman@gassmanpa.com

Use your credit card to quickly and easily register for this event. Click to register online.

******************************************************************************

Monthly Business Law Webinar with Alan Gassman and Friends

Series 4: Coordinating Business Conduct, Contractor Relationships and Insurances with Chuck Wasson.

Date: Tuesday, June 20th, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/4299825319267582211

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

Webinar: Maui Mastermind

Alan will be the guest speaker for a Maui Mastermind webinar moderated by Maui Mastermind CEO, David Finkel

Dates: Tuesday, June 27th from 1 P.M – 2 P.M. (Eastern) Topic: Negotiating Leases for Your Business and Related Relationships

Additional Information: For more information, please email Alan at agassman@gassmanpa.com

******************************************************************************

Health Law Update webinar with Lester Perling

Alan, along with Lester Perling, will update us on the Health Law Update for Florida CMS and ACA.

Date: Thursday, June 29, 2017 | from 12:30 P.M. – 1:00 P.M.

To Register, Please go to https://attendee.gotowebinar.com/register/6845642240213202946

******************************************************************************

Monthly Business Law Webinar with Alan Gassman and Friends

Series 5: Creditor Protection Planning for the Professional Practice or Operating Business

Date: Tuesday, July 25th, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/471874487653868291

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

Marty Shenkman and Alan Gassman on the Asset Protection Continuum.

At All Children’s Hospital

Thanks to Richard Thie & Lydia Bailey for making this presentation possible.

******************************************************************************

Monthly Business Law Webinar with Alan Gassman and Friends

Series 6: The Art and Science of Negotiating Agreements with David Finkel and Steve Maxwell

Date: Tuesday, August 15th, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/1353295785037253635

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

LIVE PRESENTATION: Professional Acceleration Workshop at Ave Maria School of Law

Alan will be conducting a Professional Acceleration Workshop at Ave Maria

Date: Friday, August 25, 2017 | 9AM – 2PM

Location: Ave Maria School of Law – St. Thomas More Commons – 1025 Commons Circle-Vineyards Campus, Naples, FL 34119

For more information: email Alan at agassman@gassmanpa.com

******************************************************************************

LIVE LINCOLN NEBRASKA PRESENTATION

Alan will speak at the Nebraska Medical Association’s Annual Meeting in Lincoln, Nebraska. His topics include: Top 10 Mistakes Physicians Make with Investments/Business & Lawsuits 101.

Date: Friday, September 8, 2017 | 1:30 p.m. & 4:30 p.m.

Location: Lincoln, Nebraska

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

******************************************************************************

LIVE NEW PORT RICHEY PRESENTATION

Alan will be speaking at the New Port Richey Charitable Consortium on new estate planning issues and hot topics.

Date: Thursday, September 14, 2017 | 12:00 p.m. (eastern)

Location: Spartan Manor 6121 Massachusetts Avenue, New Port Richey, FL 34653

Additional Information: For more information, please email Alan at agassman@gassmanpa.com

******************************************************************************

LIVE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA (Jacksonville)

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017

Location: TBA

Additional Information: For more information, please email Alan at agassman@gassmanpa.com

******************************************************************************

Alan on the Hot Seat!:

Alan will be the guest speaker for a “Hot Seat” question and answer session moderated by Maui Mastermind CEO, David Finkel. This series is provided especially for Maui Mastermind clients and their advisors.

Date: Thursday, September 21st from 1 P.M – 2 P.M. (Eastern) Business Law Hot Seat Sessions: A Moderated Q&A Session to Get help on Your Most Pressing Business Law Questions

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

To submit questions for the Hot Seat sessions, please send to lawquestions@mauimastermind.com at least 2-3 days ahead of time.

******************************************************************************

Monthly Business Law Webinar with Alan Gassman and Friends

Series 7: Negotiating the Purchase and Sale of a Business with John McDonald of Hyde Park Capital

Date: Tuesday, September 26th, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/3133928477941465347

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

LIVE PRESENTATIONS: FICPA – FORT LAUDERDALE

Alan will be speaking on the following 2 topics:

- “Tax and Associated Planning for Asset Protection Situations”

Learn about Florida and Federal creditor protection technique and the tax and

practical implications thereof.

- “Dynamic Trust Planning”

This presentation will provide over 20 common and not so common trust planning

structures and techniques that estate and financial planning professionals should

know about.

Date: Wednesday, September 27, 2017 1 – 3 PM

Location: Ft. Lauderdale – Exact Location TBD

For more information: email Alan at agassman@gassmanpa.com

******************************************************************************

LIVE PRESENTATION-Naples Estate Planning Council

Alan will be speaking at the Naples Estate Planning Conference

Subject: IRA Planning with Trusts, Minimum Distributions, and Associated Topics – How to Learn the Rules and Use Them Expeditiously

Date: Friday, October 13th, 2017 – 8 A.M. – 5 P.M.

Location: Naples-Exact Location TBD

LIVE PRESENTATION-The Jewish Federation of Sarasota-Manatee

Alan will be presenting, along with Professor Jerry Hesch at The Jewish Federation.

Subject: Alan will be presenting on Asset Protection Planning

Jerry will be presenting on Charitable Planning

Date: Friday, October 17th, 2017

Location: Sarasota-Exact Location TBD

******************************************************************************

LIVE PRESENTATION:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

October 20th – October 22nd, 2017 in New York, New York

November 30th – December 3rd, 2017 in Nassau, Bahamas

His topics for these events are:

- the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017

Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

******************************************************************************

42nd Annual Notre Dame Tax & Estate Planning Institute

Alan will be presenting on “What Estate Planners Need to Know About Bankruptcy”

Date: Wednesday, October 26th, 2017

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

Monthly Business Law Webinar with Alan Gassman and Friends

Series 8: Choice of Entity and Multiple Entity Structures

Date: Tuesday, October 31st, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/9026149718541918979

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

Monthly Business Law Webinar with Alan Gassman and Friends

Series 9: Uses and Abuses of Independent Contractor Agreements

Date: Tuesday, November 21st, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/8342069867623416835

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

Monthly Business Law Webinar with Alan Gassman and Friends

Series 10: Income Tax Strategies and Compliance Aspects of Business Planning

Date: Tuesday, December 19th, 2017 at 12:30 P.M.

To register go to: https://attendee.gotowebinar.com/register/608938507660895491

Additional Information:

For more information, please email Alan at agassman@gassmanpa.com

To register for this entire series, please email jason@gassmanpa.com

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

LIVE PRESENTATION-5th Annual Estate Planning Symposium-

Alan will be presenting, at the 5th Annual Estate Planning Symposium, Sponsored by The Estate Planning Council of Greater Miami.

Subject: Asset Protection for Business Owners and Their Entities

Date: Tuesday, February 6th, 2018

Location: University of Miami

******************************************************************************

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT.

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

******************************************************************************

LIVE PRESENTATION:

2018 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the Medical Education Resources (MER) event:

Date: May 17 – 20, 2018

Location: Nassau, Bahamas – Atlantis Paradise Island Resort

Additional Information: For more information, please email Alan at agassman@gassmanpa.com

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

| SHORT TERM AFRs | MID TERM AFRs | LONG TERM AFRs | ||||

| June 2017 |

Annual | 1.18% | Annual | 1.96% | Annual | 2.68% |

| Semi-Annual | 1.18% | Semi-Annual | 1.95% | Semi-Annual | 2.66% | |

| Quarterly | 1.18% | Quarterly | 1.95% | Quarterly | 2.65% | |

| Monthly | 1.18% | Monthly | 1.94% | Monthly | 2.65% | |

| May 2017 |

Annual | 1.15% | Annual | 2.04% | Annual | 2.75% |

| Semi-Annual | 1.15% | Semi-Annual | 2.03% | Semi-Annual | 2.73% | |

| Quarterly | 1.15% | Quarterly | 2.02% | Quarterly | 2.72% | |

| Monthly | 1.15% | Monthly | 2.02% | Monthly | 2.71% | |

| April 2017 |

Annual | 1.11% | Annual | 2.12% | Annual | 2.82% |

| Semi-Annual | 1.11% | Semi-Annual | 2.11% | Semi-Annual | 2.80% | |

| Quarterly | 1.11% | Quarterly | 2.10% | Quarterly | 2.79% | |

| Monthly | 1.11% | Monthly | 2.10% | Monthly | 2.78% | |