The Thursday Report – 4.13.17 – Sponsored by United Airlines – Extra Seats Now Available

Re: Sponsored by United Airlines – Extra Seats Now Available

Creditor Protection Meets Divorce – What Works and What Doesn’t

Avoiding Disaster on Highway 709 – The 10 Biggest Mistakes Made on Gift Tax Returns and How to Avoid Them

Colorado Aid in Dying Law

Using Strategic Expenses to Enhance Your Cash Flow by David Finkel

Richard Connolly’s World – 6 Money Myths About Marrying After 50

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Alan at agassman@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

United, We Stand?

Commensurate with American entrepreneurialism, and out of respect for the CEO of United Airlines, Oscar Muñoz, who may be looking for a job soon, we have named today’s report The United Report. To book a flight on United click here.

To speak to investor relations of United click here.

To learn what the “11 original herbs and spices” of Colonel Sander’s famous fried chicken click here.

Quote of the Week

Speaking of United, allow us to re-accommodate this week’s Quote of Week.

Doctors can get in the habit of wearing habits and cornettes like Sally Field wore in the television show Flying Nun which debuted on ABC in 1967.

Well before she met Burt Reynolds, Sally Field was a high flyer, and as Sister Bertrille in the television show she could always take off with a good headwind. However, she and Burt no longer fly united. Sally has starred in notable films such as: Smokey and the Bandit, Steel Magnolias, Mrs. Doubtfire, and Forrest Gump. She has no notable quotes.

Creditor Protection Meets Divorce – What Works and What Doesn’t

by Alan Gassman

Quite often a new client will come in, sit down, and inform me that the reason for the visit is to help assure that I can protect assets from what a family law judge would otherwise determine.

At that point, I have to disappoint the client by letting them know that making “asset protection moves” on the eve of a divorce could be the very worst thing they could ever consider doing – no one wants to face an angry family court judge, and a court of equity can order people to take actions and in some cases put them in jail if they don’t obey orders (sounds like a marriage, doesn’t it?).

Further, the majority of asset categories that are exempt from the claims of normal creditors will be within the grasp of a family law judge, and the client can end up paying the attorney’s fees and costs of his or her beloved soon-to-be ex-spouse’s lawyer and professional fees incurred for tracking down and recovering the assets.

On the other hand, well before the eve of divorce, and hopefully while the client is making best efforts to save the marriage, there may be things that can be done that would be helpful in the event of an unexpected divorce.

These might include the following:

- Pre-fund college and other expenses that the higher earning spouse might end up paying from post-marital income as opposed to sharing from marital assets.

- Shift wealth into trusts for the descendants that can be preserved to own family investments that would not be taken by a spouse who might be a spendthrift or might put the assets to unwise uses if he or she would receive them in a divorce.

- To help be assured that a judge’s order would not lock up funds or resources needed to have reasonable liquidity it could be wise to have funds under an account in a jurisdiction that does not respond to judicial orders, but it would be important to disclose the funding of the account to the other spouse and on tax returns so that the other spouse and the family court judge does not think that the client is being manipulative or dishonest.

- Have long-term financing as opposed to lines of credit that might be pulled more easily by banks that may feel insecure in the event of a contentious divorce.

- Understand that once the divorce is final, the family court judge can seize almost all categories of assets to enforce post-divorce obligations, except for the following:

- The homestead where someone other than the obligee spouse is an owner and lives there, such as a future significant other, or a close friend / roommate.

- A tenancy by the entireties account between the obligee spouse and his or her subsequent spouse, which would hopefully be funded at least one-half (1/2) by the subsequent spouse’s assets so as not to be lost upon divorce from the subsequent spouse, according to case law.

- Assets held in trusts where the client is not a beneficiary, or was not the contributor to the trust, or which are properly established in creditor protection jurisdictions that do not allow access to family support creditors.

Notwithstanding the above, a judge may still conclude that the client should work harder and earn more money to pay his or her obligations, or be put in jail on contempt.

Clients who have enjoyed time away in jail on contempt have reported that it was good to have quiet time and rest, but have not recommended it for others.

Avoiding Disaster on Highway 709 – The 10 Biggest Mistakes Made on Gift Tax Returns and How to Avoid Them

by Ken Crotty

We have had the opportunity to review many gift tax returns, and enjoy doing so. See Ken’s webinar on YouTube by clicking here.

The Top 10 Mistakes we see with respect to filing gift tax returns are as follows:

- The gift tax return does not contain sufficient information to provide “adequate disclosure” to the IRS. This prevents the statute of limitations on the ability of the IRS to audit the gift from starting to run. As a result, the IRS will have an unlimited time to audit the gift.

- The return is filed and does not utilize the client’s annual exclusion to reduce the value of the reportable gifts that are made. When the preparer does not reduce the value of the reported gifts by the donor’s applicable annual exclusions, then a portion of the donor’s gift and estate tax exemption is wasted, which could cause the family to owe unnecessary gift or estate tax.

- The gift tax return does not exclude from the reportable gifts the gifts which qualify for the educational or medical exclusion. This oversight will also unnecessarily use the donor’s lifetime gift and estate tax exemption, which could cause the family to owe additional gift or estate tax.

- The return misreports gifts to 529 plans that exceed the annual exclusion. Gifts to 529 plans can be spread out over a period of 5 years, but this election must be affirmatively made on a gift tax return. If a gift to a 529 plan in excess of the annual exclusion is not split, then the gift will use some of the donor’s gift tax exemption, which could cause the family to owe unnecessary gift or estate tax.

- The return is prepared assuming that annual exclusion gifts also qualify for the GST tax annual exclusion. Most gifts that qualify for the gift tax annual exclusion that are made to trusts do not qualify for the GST tax annual exclusion, and utilize some of the client’s GST tax exemption. If these are misreported, then the client may have less GST tax exemption remaining than what is stated on the return, which could significantly impact future planning.

- When a gift is made to a trust, the gift tax return is filed without attaching either a copy of the trust or a brief description of the trust’s terms to the return. Pursuant to Treasury Regulations, if a reportable gift is made to a trust and the gift tax return is filed without attaching either a copy of the trust or a brief description of the trust’s terms, then adequate disclosure has not been provided to the IRS. Per Mistake #1 above, the statute of limitations on the ability of the IRS to audit the gift does not start to run.

- Gifts made to trusts which are not direct skips for GST tax purposes are reported on Schedule A Part 2 and not on Schedule A Part 3. Returns prepared this way are incorrect and might be considered to not provide adequate disclosure.

- A joint tax return is filed. Spouses may not file a joint gift tax return. If a joint gift tax return is filed, more than likely the statute of limitations will not begin to run for any of the gifts that are reported on the return.

- Mistakes related to gift splitting. Married spouses may split the gifts they make so that the gifts are treated as having been made one-half by each spouse. There are numerous traps related to gift splitting which may prevent the gift from actually being split.

- The possibility of opting out of the automatic allocation of GST Exemption is not considered. If the value of property that was an indirect skip has decreased when the gift tax return is filed, the return preparer should consider opting out of the automatic allocation of GST Exemption. In this case, a second return could be filed allocating GST exemption equal to the reduced value of the property, thereby saving the client’s GST exemption. It is important to note that this should only be considered for indirect skips and not direct skips, otherwise GST tax would be payable.

Colorado Aid in Dying Law

by Seaver Brown & Alan Gassman

Colorado has joined the other five states that permit “legal suicide” medication prescriptions for terminally ill individuals—must have less than a six month life expectancy and multiple physician interactions as a Colorado resident. Flying United might help reduce the life expectancy, especially with physicians.

On December 16, 2016, John Hickenlooper as governor of Colorado, signed into effect the Colorado End of Life Options Act after it was approved by 65% of the state’s voters. The Act allows “individuals with a terminal illness to request from their physician and then self-administer, medical aid-in-dying medication.”

In order to be eligible to request aid-in-dying medication, the individual must:

- Be a Colorado resident age 18 or older;

- Be able to make and communicate an informed decision to health care providers;

- Have a terminal illness with a prognosis of six months or less to live (terminally ill) that has been confirmed by two physicians, including the individual’s primary physician and a second, consulting physician;

- Be determined mentally capable by two physicians, who have concluded that the individual understands the consequences of his or her decision; and

- Voluntarily express his or her wish to receive the medication.

Upon establishing eligibility, the individual must make two oral requests, at least fifteen days apart, and one written request in a specific form to his or her primary physician. The written request must also be witnessed by at least two other persons who meet certain requirements.

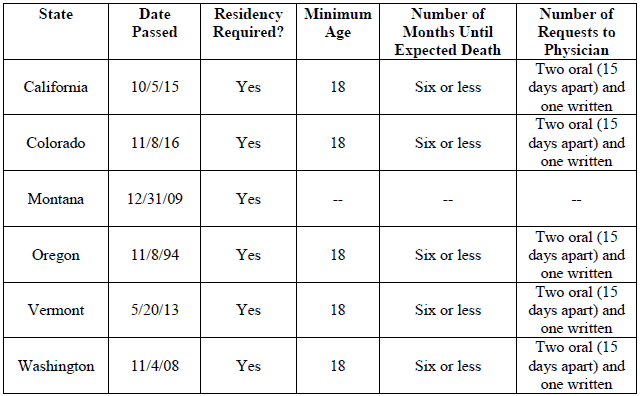

The other states that currently allow physicians to aid an individual in voluntarily ending their life, being: California, Oregon, Vermont, and Washington. Unlike the aforementioned states, Montana does not have a statute that codifies the right to assisted suicide. In 2009, Montana’s Supreme Court ruled that there is nothing prohibiting a physician from prescribing medication to hasten the patient’s death.

A table of the requirements for physician assisted suicide in each state is as follows:

Using Strategic Expenses to Enhance Your Cash Flow

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ businesses coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

If you’re looking to run a lean, efficient business, where are the places you should and should not spend money?

Here is a simple distinction that will help you make smarter strategic choices for yourself.

The distinction is between “strategic expenses” and “non-strategic expenses.”

Essentially, strategic expenses, are expenses for things that concretely help you improve the current and future health of the company. They help the company reach its core goals of growth, profitability, and long term sustainability.

Non-strategic expenses are everything else.

Here are some examples of strategic expenses:

- Sales people who sell

- Marketing that works

- Sales systems that are effective

- IP barriers that give you sustainable advantages

- Research and development breakthroughs that are salable or that are profitable products and services

- Practical outside expertise that positively impacts your bottom line (long and short term)

- Production efficiencies that lower your real costs or allow you to increase your pricing and hence yield a high return on investment

Click here to read the full article.

Follow David on Twitter: @DavidFinkel.

Richard Connolly’s World

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “6 Money Myths About Marrying After 50” by Lisa Rabasca Roepe. This article was featured on Forbes.com on February 13, 2017.

Richard’s description is as follows:

Marriage after 50 is a wonderful thing, but it has some financial challenges, too. There is plenty to take into account, and plenty of money myths, if you plan to tie the knot in midlife—especially if your spouse-to-be has children from a first marriage.

Please click here to read this article in its entirety.

Seminar Spotlight

Marty Shenkman is well known to most estate planning and tax professionals. He practices in New Jersey and New York City, and has published over 40 books on estate planning, tax and related topics. His abilities are beyond legendary, including the Heckerling Reports that he issues daily during the Heckerling Estate Planning Institute, and the Notre Dame Tax and Estate Planning Institute Report that he issues as well.

Please come out to meet Marty on Monday, August 21, 2017 at Johns Hopkins All Children’s Foundation from 4 to 6 p.m. located in the Conference Center for a two hour continuing education program.

Tentative topics are as follows: Planning for Chronic Illness for Lawyers and Family Care Managers.

Please note that Marty will bring his dog, Elvis, who will answer questions and be part of the panel discussion.

Marty and Alan recently presented a webinar on the Asset Protection Continuum, which concentrates on bread and butter creditor protection measures that can be taken for clients without the need for complicated or expensive “asset protection trust systems” and other arrangements.

Marty and Alan will also be presenting this topic at no charge on June 22, 2017 for the AAA-CPA group.

Humor! (Or Lack Thereof!)

**********************************************************

Twitter the Twain Shall Meet

The following jokes were some of the author’s favorite from Twitter.

- United Airlines—arrive as a doctor . . . leave as a patient.

- United Airlines—if we can’t seat you, we will beat you.

- United Airlines—we have an offer you can’t refuse . . . no really.

- United Airlines—we put the hospital in hospitability.

**********************************************************

The Chamber of Commerce is asking the country to change our name from United States to American States.

United Cab is changing their name to “NRTAAC” Cab – Nothing Related To An Airline Cab.

Ex-football player Johnny Unitas is changing his name to Johnny Deltas.

American and Continental have announced that they are glad to be together, but are not United.

Riunite on Ice is changing their name to Southwestern on Ice.

United Arab Emirates is changing their name to Untitled Arab Emirates.

In summary, flying United can be a real drag.

**********************************************************

Upcoming Seminars and Webinars

Calendar of Events

**********************************************************

Just Announced!

LIVE GUN TRUST WEBINAR

Alan and national gun law expert, Sean Healy will unite get together to present a live one hour webinar on how to properly and safely draft Gun Trusts.

Date: Thursday, May 18, 2017 | 12:00 – 1:00 p.m. (Eastern)

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

Alan will be speaking at the STEP Chapter Meeting in Naples, Florida. His topic for this event is FLORIDA CREDITOR EXEMPTION LAW PLANNING UPDATE. He will speak on April 19 from 12:00 to 12:45 p.m.

STEP is a global professional association for practitioners who specialize in family inheritance and succession planning. STEP members help families plan for their futures, from drafting a will to advising on issues concerning international families, protection of the vulnerable, family businesses and philanthropic giving.

Date: Wednesday, April 19, 2017 | 12:00 – 12:45 p.m. (Eastern)

Location: McCormick & Schmick’s Restaurant in Naples, Florida

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Alan will also appear on a panel of speakers with Jerry Hesch and Lester Law on the topic of TAX PLANNING WITH LIFE INSURANCE PRODUCTS, RECENT LITIGATIONS, AND OTHER HOT TOPICS.

Other speakers and topics include the following:

- Stacy Eastland – Comparing Freeze Techniques

- Jonathan Gopman – Asset Protection Trusts: An Update and Discussion of Planning

- Joan Crain – Challenges for Trustees in Dealing with Millennial Beneficiaries

- Jerry Hesch – Passing a closely-held business on to junior family members or key employees or co-owners: An analysis of the income tax, estate tax and financial impact of business succession planning techniques.

- Jerry Hesch & Alan Gassman – Life Insurance Planning Panel – Techniques, Tax Planning and The Good, the Bad, and the Ugly

- Tae Kelley Bronner – Homestead Planning and Update

- Lester Law – Basis Consistency for Estate and Income Tax Planning Purposes, and Multiple Implications Thereof.

- Marve Ann Alaimo & Dixon Miller – International Estate Planning Rules and Planning Opportunities

- Susan Cassidy, M.D. – What You Need to Know for Your Client’s Medical Issues: Competency, Great Care Versus the Mainstream, What Medicare Recipients Should Seek Outside of the Medicare System, End of Life Communications and Planning and How Will the Above be

- Alan Gassman – Ethical Considerations to Avoid Estate and Trust Litigation and Family Disputes, and the 10 or so Avoidance Techniques You Should Be Actively Using

- Suzy Walsh – Special Needs Trusts Essentials and Well Beyond

Date: Friday, April 28, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION HOSTED BY: MAUI MASTERMIND & GASSMAN, CROTTY & DENICOLO, P.A.

Why do more and more physicians seem to no longer have the passion for their practices and the business of medicine, while a smaller but growing group is expanding, becoming more profitable, and enjoying what they do? Don’t get stuck at the wrong end or in the growing middle grounds. Life is too short, and opportunities are too plentiful.

Spend a day with colleagues and industry leaders to see what your opportunities are to restore or simply enhance the profitability and passion that you and your practice deserve to experience. We know from experience that physicians who are entrepreneurial, open-minded, deliberate, and dedicated have better professional, financial, and personal life results. Explore why and how this happens and how it can apply to you.

Join David Finkel, Alan and Dr. Singh for what could be the first step in a very positive journey for your practice and career on how to Scale Your Medical Practice.

Date: Sunday, June 4, 2017 | Check In 7:45 a.m. | Starts 8:30 a.m. | Ends ~5 p.m. | Hosted cocktail social with appetizers to follow.

Location: Tampa Westshore Marriott 1001 N Westshore Blvd, Tampa, FL 33607

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

Special Business Panel: Practice Management Secrets from 4 Exceptionally Successful Medical Leaders. With Special Guests: Dr. Patel; Dr. Singh; Chuck Wasson; Fred Simmons; Denise Gaulin.

Alan will be speaking on 12 Asset Protection Strategies Every Doctor Must Know.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL. He will speak on June 14 from 10:50 to 11:40 a.m.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s speaks on June 14 from 10:50 to 11:40 a.m.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan at agassman@gassmanpa.com or click here.

**********************************************************

FREE LIVE WEBINAR FOR THE AAA-CPA STUDY GROUP

Alan and Marty Shenkman will present a free one and one-half hour webinar concerning a practical model for rendering asset protection planning services to more clients, more efficiently and more effectively using a construct called the “Asset Protection Planning Continuum.”

The program is intended for practitioners with moderate asset protection planning knowledge so that they can expand that knowledge in a practical way that will assist them to better help their clients, whatever the nature and focus of their practice may be.

Not related to the AAA Auto Club so do not lock your keys in the car during this presentation.

Date: Thursday, June 22, 2017 | 2:00 – 3:30 p.m. (Eastern)

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PROFESSIONAL ACCELERATION WORKSHOP

Alan will present a Professional Acceleration Workshop at Ave Maria School of Law for students, young alumni, and old professionals. Register early to get an aisle seat.

Date: Friday, August 25, 2017 | 9:00 a.m. Eastern, to be SPacific

Location: Ave Maria School of Law, Naples, FL.

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com. More details will be provided in the future, but please plan to attend.

**********************************************************

LIVE LINCOLN NEBRASKA PRESENTATION

Alan will speak at the Nebraska Medical Association’s Annual Meeting in Lincoln, Nebraska. His topics include: Top 10 Mistakes Physicians Make with Investments/Business & Lawsuits 101.

Florida attendees will receive a complimentary picture of Abraham Lincoln eating Kentucky Fried Chicken with Colonel Sanders on a United flight.

Date: Friday, September 8, 2017 | 1:30 p.m. & 4:30 p.m.

Location: TBA

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan will present AN ESTATE PLANNER’S UPDATE AND HOT TOPICS for the Charitable Consortium.

Special thanks to Gregory Gay for helping to arrange this. Check out Gregory’s book entitled Florida Senior Legal Guide by mail order or at the book store of your choice. The 2017 11th Edition is now available.

Date: Thursday, September 14, 2017 | 12:00 p.m. Eastern

Location: Spartan Manor 6121 Massachusetts Avenue, New Port Richey, FL 34653

Additional Information: For more information, please contact Alan at agassman@gassmanpa.com.

**********************************************************

LIVE JACKSONVILLE PRESENTATION:

ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA

Please put Tuesday, September 19, 2017 on your calendar to enjoy a dinner conference for the Estate Planning Council of Northeast Florida.

Date: Tuesday, September 19, 2017 | Cocktails are at 5:30 p.m.; Alan speaks from 7:00 – 8:00 p.m. (Eastern)

Location: Epping Forest Yacht and Country Club | 1830 Epping Forest Drive, Jacksonville, FL 32217

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017Nassau: November 30th – December 3rd, 2017

Location: New York: Marriott Marquis | 1535 Broadway, New York, 10036

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT.

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan at agassman@gassmanpa.com.

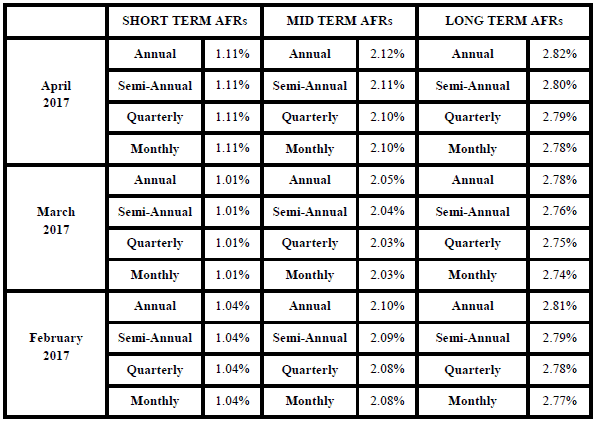

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.