The Thursday Report – Heckerling, TBE, Important Conferences and the Sea

The fate of modern society is in your hands. Or would you rather have a beer? Decide tonight, after reading the Thursday Report (after drinking a beer). Substitute a glass of Silver Oak 2008 Cabernet if you must! No ice please unless you add whiskey.

The Stepped-Up Basis Conversation

Imposing Punitive Damages on Fraudulent Transfers: Where Will Florida Fall? With a State-by-State Chart

Everything You Always Wanted to Know About Motor Vehicle Ownership Planning* and Did Not Think To Ask – Part 2 of a 4 part Series

Frank Jakes is Not Afraid of Virginia Woolf

Seminar Announcement – Same Sex Marriage and Associated Laws We Should All Know About Anyway, Thursday, January 30, 2014 at 5:30 p.m. at Stetson Law School

Downton Abbey and the Dreaded Fee Tail – A Far Worse Fate Than Not Having Air Conditioning, Microwaves or Hair Dryers

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

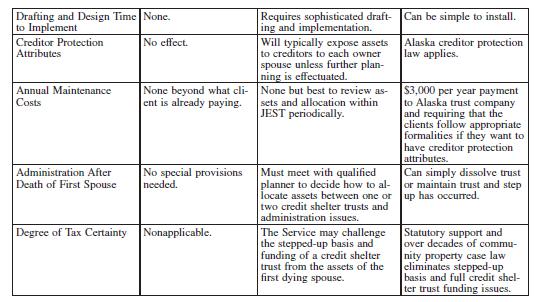

The Stepped-Up Basis Conversation

Our article with Jonathan Blattmachr entitled “The Stepped-Up Basis Conversation” has been published by Bloomberg BNA Tax Management Estates Gifts and Trusts Journal. The first page and our chart are reproduced with permission below. Click here to read the rest of the article.. We thank Tom Waits for providing the inspiration for this article and for the album Small Change. If you have not heard Small Change download it and listen to it, even before finishing this Thursday Report.

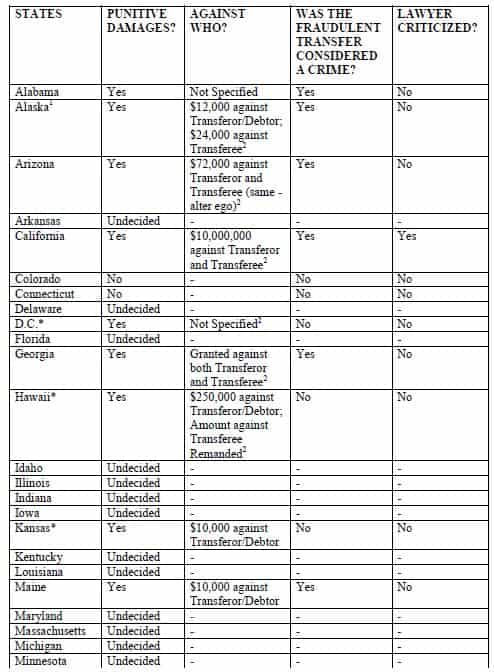

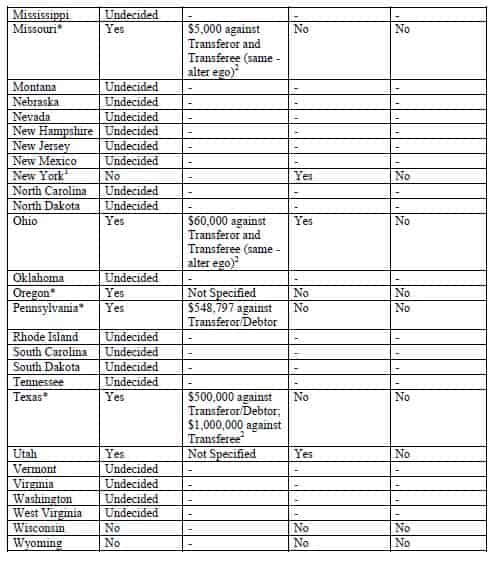

Imposing Punitive Damages on Fraudulent Transfers: Where Will Florida (and Other States) Fall? With an Informative Chart

By Alan S. Gassman and Charlie Lawrence

When asset protection goes painfully wrong, can your client and transferees be held liable for punitive damages due to fraudulent transfers? Courts in several jurisdictions have imposed punitive damages on transferors and transferees, however, no Florida court has taken a stand on this issue.

The first punitive damages award for a fraudulent transfer that we are aware of was the Ohio case of Locafrance United States Corp. v. Interstate Distribution Servs., Inc which was decided in 1983.

More recently, the California case of Elie v. Smith established that a judge may impose punitive damages on the perpetrators of a fraudulent transfer.1 The recent Pennsylvania case of Klein v. Weidner also imposed punitive damages on what was found to be an “outrageous and intolerable” situation.2

The Pennsylvania statute contains the same exact language as the Florida statute, with reference to enumerating the following language as being included in the remedies that a court can impose in a fraudulent transfer action:

“1) In an action for relief against a transfer or obligation under ss. 726.101-726.112, a creditor, subject to the limitations in s. 726.109 may obtain:

(c) Subject to applicable principles of equity and in accordance with applicable rules of civil procedure:

3. Any other relief the circumstances may require.”3

In Klein, the punitive damages were imposed on the debtor, who willfully defied a court order and used unlawful and threatening means to impede the judicial process.”4 However, in the Elie case, punitive damages were imposed on both the transferee and the transferor because the debtor’s behavior was “despicable and subjected Elie to cruel and unjust hardship” that each defendant’s behavior was “vile, base, and contemptible.”5

In the Elie case, a wife owing money to a third party signed an amendment to her prenuptial agreement with her spouse, which required her to transfer all of her assets to him in exchange for consideration, if any, that was not discussed in the case. To apparently attempt to make this look at arm’s-length, the husband sued Mrs. Smith without giving notice to the creditor. The creditor intervened in the suit, and the husband and Mrs. Smith moved to Florida and filed for a Chapter 7 bankruptcy.

The California court and bankruptcy courts found that the husband and Mrs. Smith engaged in clearly egregious conduct, which included, but was not limited to, what was found to be a deceptive and entirely fraudulent transfer motivated conduct, but also concealing assets with the assistance of a lawyer and severely impeded the court.

The court did not comment on the lawyer’s behavior, but it did describe his involvement. The debtor used the lawyer’s services to transfer funds and held funds in the lawyer’s client-trust account.6 Jay Adkisson was not so kind. In his Asset Protection Planning Email Newsletter Archive Message 229, Mr. Adkisson expressed his view that “there will come a time in every planner’s career when a financially-distressed client will walk through the door seeking asset protection. … It is this point in time which separates the smart planners from the foolhardy ones. The smart planners might voice sympathy for the client’s plight, but will refuse to take the case… The foolhardy planners will give in to their urges, do planning where it lawfully shouldn’t be done, and thereby expose their clients, their own assets, and even their careers to potentially dire consequences.” However, Mr. Adkisson does note that Florida law is different. He explains that “in some jurisdictions, such as Florida, the courts have held that an attorney cannot be liable either under a conspiracy or aiding and abetting theory for a client’s fraudulent transfer.” In other jurisdictions, like California and Pennsylvania, the same act is considered a tort and, in some circumstances, a crime.

However, the lawyer in Elie has not seen the end of this battle. The Bankruptcy Trustee sued him on a number of claims, including unlawful and unfair business practice, injunctive relief, racketeering, negligence, fraudulent transfers, deceptive acts and practices, breach of fiduciary duty, conspiracy, accounting, and constructive trust. The case against the lawyer is set for trial for July 28, 2014. In the Trustee’s complaint to the court, he argued:

“The unlawful business practices of [lawyer] are likely to continue and therefore will continue to mislead the public because [lawyer] holds himself out as a professional who renders sound legal advice yet instead he performs the above-referenced unfair and unlawful activities under the guise of providing legitimate business services, which presents a continuing threat to the public.

As a direct and proximate result of [lawyer’s] conduct, [lawyer] has received and will continue to receive fees for his unethical and unlawful services that rightfully belong to members of the general public who have been adversely affected by [lawyer’s] conduct as well as to Plaintiff by virtue of the money and assets lost due to [lawyer’s] actions.”7

This is much different than a situation where a client who may have a litigation or contingent liability situation goes to a lawyer and determines it appropriate to engage in conventional estate and/or business planning actions that incidentally cause insulation of assets from creditors.

Several states have found that the Uniform Act’s “Remedies of Creditors” Section allows for punitive damages, including Maine, Ohio, and Utah. However, Colorado, Connecticut, and Wisconsin courts have found that punitive damages are not allowed under their respective Uniform Acts, regardless of how egregious the behavior is. All of the states relied on pre-existing state law and common law when interpreting the remedies available under the Act. See the table below for a look at where states have fallen on this issue.

What is the result of a judgment for punitive damages against the debtors besides the fact that the debtor owes more money to the creditor? If the debtor is already insolvent and has no other assets it may make no difference, but transferees will not want to have judgments against them! If the transferee receives money and can give it to the creditor this may not be a problem, but if the transferee receives an asset of questionable value and the judge finds it to be more valuable than it really was then the transferee can suffer an extreme loss, not to mention having to pay attorneys, fees and punitive damages.

For example, a client with a $500,000 IRA and a $200,000 bank account might transfer the $200,000 bank account into a variable annuity contract the day after a judgment is entered into by the debtor. Typically a court can award the creditor the right to set aside the transfer into a variable annuity, plus attorneys’ fees and costs.

Can the judge also order that punitive damages are owed, and will this cause loss of the IRA? Under Florida law, punitive damages are no more or less collectible than any other debt obligation, but, in bankruptcy, punitive damages for willful and malicious injury are not dischargeable.11

In re Fabian is one example of the bankruptcy court holding, and the district court affirming, that damages for willful and malicious injury are not dischargeable.12 In Fabian, the debtor, through a corporation in which he was the sole officer and shareholder, entered into several agreements with a leasing broker. The agreements allowed the leasing broker to purchase equipment and software from the debtor’s corporation, and then lease the same equipment and software back to the corporation. In many cases, the equipment and software did not exist or were of substantially less value than the “purchase price.” As a result of the agreements, the debtor’s corporation obtained approximately $32 million from the leasing broker.

After he defaulted on 11 leases, the debtor transferred money to a for-profit entity that was controlled by the debtor. In addition, he purchased beach property, donated to a private school, and indulged in private jet travel. The debtor’s corporation was forced into bankruptcy by two creditors. The bankruptcy court held, and the district court affirmed, that the transfers were fraudulent. Further, because the debtor acted intentionally, his actions met the willful and malicious injury requirement of Section 523(a)(6) of the Bankruptcy Code. The judgment regarding the willful and malicious injury caused by the debtor was not dischargeable.

*Awarded punitive damages when conduct was not a crime

1Does not follow the Uniform Fraudulent Transfer Act.

2Transferee was found to have acted with intent to defraud.

Will Florida courts follow these decisions for similar egregious situations? It is possible. Our original expectation was that only states that consider a fraudulent transfer to be a crime would allow punitive damages. However, this is not the case.

California has a criminal statute that caused the subject transfers to constitute clearly illegal conduct.8 Florida has no statute making a fraudulent transfer a crime. In fact, the Florida Supreme Court has confirmed that an intentional fraudulent transfer into a homestead is immune from being subject to the Florida fraudulent transfer statute.9 Debtors who have any concern whatsoever about having a punitive damage claim brought against them and/or their transferee may prefer to make transfers to pay off mortgages on homesteads, to purchase new homesteads, or even adjoining homesteads to increase the property that they live on. Florida appellate courts have held that lawyers who intentionally represent and advise clients on transfers intended to avoid creditors are not liable to the creditor, because there is no cause of action against the lawyer.10

St. Petersburg lawyer, Joel Bronstein, has indicated as follows in an outline that will be presented for the Florida Bar Tax Section/Health Law Section Representing the Physician program on January 17, 2014 in Orlando:

However, another cause of action may exist. In Freeman, the court in dicta stated that “we caution that our answer to the certified question in this case is confined to the context of the Florida Uniform Fraudulent Transfer Act. We do not address whether relief is available under any other theory of liability or cause of action.” … Clients have the right to know their rights and advising them of their rights should not result in liability to the client’s creditors. However, if an attorney crosses the line and knowingly and intentionally participates in a client’s unlawful conduct to hinder, delay and/or fraudulently obstruct a creditor, the creditor is likely to bring an action upon a theory of law such as creditor fraud or as a co-conspirator in a fraudulent transfer.

However, Pennsylvania, like Florida, does not have a statute making fraudulent transfers to judgment creditors illegal and it still found punitive damages proper under the circumstances of Klein. Other states, including D.C., Hawaii, Kansas, Missouri, and Texas, have allowed punitive damages for fraudulent transfers when the fraudulent transfer was not considered a crime.

In conclusion, we do not know where Florida will fall on this issue. The majority of states that have considered the issue have jumped on the bandwagon to allow punitive damages for fraudulent transfers, regardless of whether the transfer is considered a crime. Only time will tell what the Florida courts decide to do in this area.

Everything You Always Wanted to Know About Motor Vehicle Ownership Planning* and Did Not Think To Ask

Part 1 which appeared in the January 2, 2014 Thursday Report discussed strict liability for owners under the dangerous instrumentality rule, negligent entrustment and liability of two people who jointly own a car. Click here to read last week’s report.

Part 3 on 1.16.2014 will discuss special planning for children and ownership issues.

Part 4 on 1.23.2014 will discuss survivorship planning and why boats and airplanes are different.

AUTO INSURANCE ISSUES

Most of the exposures to liability for owning and operating a vehicle in Florida can be transferred to an insurance company by purchasing a Personal Automobile Policy (also called PAP). The Personal Automobile Policy gives “insured” status to the person named on the policy, the resident spouse, and any “family members” who must be related to the person named and must also be resident in the household.

“Adequate limits” are based upon personal preference and premium tolerance. The best way to increase your protection is through a “Personal Umbrella” policy that provides excess liability limits over automobile and homeowner’s policies. In fact the umbrella can be endorsed to cover most personal exposures, including boats and recreational vehicles (RVs) as well. It is critical to let the umbrella policy insurer know of all other coverages.

There are circumstances that require special care in structuring your insurance policy.

1. Corporate-Owned Automobile. Where an automobile is provided by a company that does not have a Personal Automobile Policy, a coverage gap can exist when the vehicle is not insured on the corporate policy for personal use. Two endorsements need to be added to the corporate policy, Drive Other Car and Named Individual Broadened Personal Injury Protection. Each family member will need to be named on these endorsements.

2. Non-Married Partners. Since the Personal Automobile Policy considers resident spouses and related family members as insureds, non-married partners should have a separate policy in their own name. It would be advisable to have the same limits and insurance companies to avoid claim issues.

3. Children. A common question is how to insure a child’s car while that child is at home. The safe answer is on the parent’s policy. Often this is the most expensive option since the child is then provided with the same liability limits as the parents. Under Florida law, the parent is liable for the minor child’s operation of a vehicle. Even when the child turns eighteen, they can still be held liable if the child is operating under the direction of the adult (running errands). For example, Susan and Bill have an eighteen-year-old child, Dave, who still lives at home. The vehicle is titled in Dave’s name, and Dave has his own policy. When Dave drives that car, his policy will respond to claims against Dave and his parents, but only up to the limit that Dave’s policy provides. Susan and Bill’s policy will not respond. If Dave’s policy has low limits, then Susan and Bill could have a large gap in coverage.

4. Rental Cars. The Personal Automobile Policy normally covers the named insured and family members for liability from any vehicles except those with less than four wheels. If the rental is for business purposes coverage only applies to private passenger vehicles, vans, or pickups. Coverage for damage to the rented vehicle is afforded based on the vehicle insured on the policy with the broadest coverage. The rental company may provide a physical damage waiver that would also pay for the rental company’s administrative costs and loss of use of a damaged vehicle.

USING SUBSIDIARY ENTITIES

Businesses and individuals who own their motor vehicles through a business entity may expose other assets and operations of the entity to judgments emanating from the driver=s negligence. Therefore, the company should consider establishing a subsidiary limited liability company (LLC) as an operating business to own one or more vehicles. If the driver of the automobile is an employee of the company, liability may accrue to the owner (employer) under the doctrine of Respondent Superior for negligent driving resulting in injuries to another that occurs in the scope of business. After-hours driving, however, which would include most DUI events, may not subject the operating company to liability when the car is driven for personal, non-business purposes after hours. Also, the company may not be responsible for obligations incurred outside of the normal scope of employment, which could include drunk driving. Thus, it is often recommended that the subsidiary LLC owning the vehicles meticulously draft its corporate documents and define its business purpose so as to limit its liability even further.

Clients with significant automobile and trucking operations may employ drivers through a separate company to limit liability that would otherwise accrue under Respondent Superior. It is generally recommended that such a company should be responsible for ownership, maintenance, operation, and all personnel practices relating to automobile and trucking operations. Alternatively, an independent employee-leasing company might handle personnel issues for both the primary operating company and the subsidiary, but it should be clear in all paperwork that the drivers are not identified as employees of the primary parent company.

Some companies with large vehicle operations have attempted to limit liability by creating a number of subsidiaries, each owning a small number of vehicles. In 2005, however, Florida Statute Section 324.021, which excludes rental companies from the limited liability rules, was amended so that “rental company” now includes a related rental or leasing company acting as a subsidiary of the same parent. Under this new statute, the famous case of Walkovszky v. Carlton would have a different outcome. In that case, a personal-injury plaintiff sued a taxi company. The parent owned a large number of small subsidiaries, each owning just two cabs. That court held that the plaintiff could not reach the assets of the parent or the other subsidiary companies. Under this new statute, the other subsidiaries could be liable.

For a parent company to be reached through the negligent acts of a subsidiary, the subsidiary company will have to be “pierced.” Florida courts regard veil piercing as an extraordinary remedy to be exercised with caution. Therefore, parties who seek to pierce the corporate veil carry a very heavy burden. The Florida Supreme Court held in Dania Jai-Alai Palace, Inc. v. Sykes that, before the general rule of limited shareholder liability can be disregarded, the party seeking to pierce the corporate veil must establish by a preponderance of the evidence that (1) the shareholder dominated and controlled the corporation to such an extent that the corporation had no independent existence; (2) the corporate form was used fraudulently or for an improper purpose; and (3) the fraudulent or improper use of the corporate form caused injury to the claimant.

Under the first prong, it must be shown that the corporation had no independent existence. The courts will review the administration of the corporation to determine whether (1) the stockholder controlled the corporation’s administration through centralized legal, accounting, and other support services; and (2) the stockholder eliminated many of the corporation’s own administrative services or the corporation depended on the stockholder for, among other things, its physical premises, data processing facilities, insurance, purchasing, employee benefit programs, employee relations and personnel services, public affairs, property management, internal auditing, legal services, telecommunications, cash management systems, and marketing research.

The existence of certain controls over areas of management and administration does not conclusively result in a finding that the stockholder dominated and controlled the corporation. Courts have recognized the value of centralized services in the holding company structure.

Under the second prong—improper conduct—the corporate veil will be pierced when (1) the corporation was organized, or after organization was used by the stockholders for fraudulent or misleading purposes; (2) “corporate property was converted or corporate assets depleted for the personal benefit of the individual stockholders”; (3) “the corporate structure was not bona fidely established”; or (4) “property belonging to the corporation can be traced into the hands of the stockholders.”

The Florida Supreme Court in Dania Jai-Alai Palace, Inc. v. Sykes held that improper conduct was proved when (1) the parent wholly owned the subsidiary; (2) the two corporations shared common officers; (3) the parent controlled the hiring and firing of the subsidiary’s employees; (4) the subsidiary “existed only to serve the needs of” the parent; (5) the subsidiary’s offices were in the parent’s premises, and gave all outward appearances of being an integrated operation; and (6) the two corporations filed joint tax returns and were jointly insured.17

After Dania, Florida courts have pierced the corporate veil only in extreme cases of abuse of the corporate form. Absent proof of intentionally fraudulent conduct, courts simply do not pierce the corporate veil under Florida law. For instance, in Hilton Oil Transportation v. Oil Transportation Co., the court did not find proof of fraudulent conduct and therefore refused to pierce the corporate veil even though the wholly owned corporation did not observe corporate formalities, had no capitalization and owned only one asset, and the sole shareholder exercised complete control over the corporation’s board of directors.

Further, the corporate veil will not be pierced solely because a subsidiary corporation is thinly capitalized. The claimant must also prove that a shareholder intentionally concealed the corporation’s thin capitalization or defrauded or misled investors as to this fact. The Supreme Court in Dania stated that if allowing corporate veil piercing whenever a corporation is loosely capitalized were the rule, “it would completely destroy the corporate entity as a method of doing business and it would ignore the historical justification for the corporate enterprise system.”

Frank Jakes is Not Afraid of Virginia Woolf

Intellectual property litigation lawyer, Frank Jakes, of the Johnson Pope Tampa office is more than just a phenomenal intellectual property law lawyer and litigator. He is playing the part of George in The Cornerstone Theatre Company’s production of Who’s Afraid of Virginia Woolf? by Edward Albee. The shows run Thursdays at 7pm, Fridays and Saturdays at 8pm and 2pm on Sundays from January 9 through January 26 at the Lowndes Shakespeare Center, 812 E. Rollins St. in Orlando.

Angel Allen plays Martha in this 1966 film adaptation and Chaz Krivan and Janae Riha also star in this 4 person cast. For more information please visit http://www.cornerstonetheatrecompany.com/.

Seminar Announcement

Same Sex Marriage and Associated Laws We Should All Know About Anyway

On Thursday, January 30th, 2014 at 5:30 p.m. at Stetson Law School, Alan Gassman will be speaking at the Pinellas County Chapter of the Florida Association for Women Lawyers’ CLE Program. Professor Jason Palmer, Professor Rebecca C. Morgan, and Charles F. Robinson, will also be speaking. Discussions will include various issues facing America after the Supreme Court decisions in U.S. v. Windsor and Hollingsworth v. Perry.

For registration please click here. Please come out and join us at this fantastic event!

The following are the profiles of 3 of the fantastic speakers:

Charles F. Robinson, P.A.: Elder Law asset protection planning (Medicaid); fiduciary services

AA Degree, St. Petersburg Junior College

BA and JD degrees, University of Florida

Professional Accreditations:

Florida Bar Board Certified Elder Law Attorney

Accredited Attorney for Veterans Benefits

Certified Court Appointed Arbitrator

Certified as a Civil Circuit Court Mediator by the Florida Supreme Court.

Association of Professional Futurists

Professor Jason Palmer

Professor of Law, Stetson University College of Law

B.A., University of Virginia

J.D., George Washington University Law School

Professor Palmer joined Stetson after teaching legal writing and oral advocacy for six years as a professorial lecturer in law at George Washington University Law School. Most recently, he worked for the Department of State as a team leader representing the United States in international arbitration cases before the Iran U.S. Claims Tribunal. He also spent four years in Switzerland working as a claims judge for the Claims Resolution Tribunal for Dormant Accounts, adjudicating claims of victims of Nazi persecution; for the United Nations Compensation Commission, coordinating review of Palestinian claims against Iraq as a result of its invasion and occupation of Kuwait; and for the Europa Institute at the University of Zurich, creating and teaching a course for Swiss lawyers on U.S. legal writing. Before working in Switzerland and at the Department of State, Professor Palmer spent several years in private practice in Washington, D.C., focusing on commercial litigation and international arbitration.

Professor Palmer is the co author, along with Professor Arturo Carrillo, of the article “Transnational Mass Claims Processes in International Law and Practice,” published in 28 Berkeley J. Int’l L. 343 (2010). He is also the author of the book chapter “Remedying Mistakes in Mass Claims without Compounding Errors Lessons from the Palestinian Late Claims Program” in Designing Compensation After Upheaval: Insights From the Experience of the United Nations Compensation Commission (Oxford University Press). This two volume treatise is scheduled for publication in fall of 2010.

Professor Palmer was a judge for the 2010 Michael Greenberg Writing Competition for the National Lesbian, Gay, Bisexual, and Transgender (LGBT) Bar Association. He was also a deputy editor of the “International Year in Review” published in The International Lawyer in spring of 2010 and was an assistant editor for Volume 16 of the Legal Writing Institute’s Journal of Legal Writing. He is a corresponding editor for International Legal Materials, which is published quarterly by the American Society of International Law.

Professor Rebecca C. Morgan

Professor of Law, Stetson University College of Law

Boston Asset Management Chair in Elder Law and Director, Center for Excellence in Elder Law

B.S.B.A., Central Missouri State University

J.D., Stetson University

Professor Morgan teaches a variety of elder law courses in the J.D. and LL.M. programs and oversees the elder law concentration program for J.D. students. She is the successor co author of Matthew Bender’s Tax, Estate and Financial Planning for the Elderly, and its companion forms book (Lexis), a co author of Representing the Elderly in Florida, (Lexis), The Fundamentals of Special Needs Trusts (Lexis), Ethics in an Elder Law Practice (ABA) and Planning for Disability (Bloomberg BNA Portfolio). She is a member of the elder law editorial board for Matthew Bender. Professor Morgan has authored a number of articles on a variety of elder law issues and has spoken a number of times on subjects of elder law. She is the co editor of the Elder Law Prof Blog, http://lawprofessors.typepad.com/elder_law/ (with Kim Dayton (William Mitchell) and Katherine Pearson (Penn State).

Professor Morgan is a past president of the National Academy of Elder Law Attorneys, past president of the board of directors of the National Senior Citizens Law Center, past chair of the American Association of Law Schools Section on Aging and the Law and of the Florida Bar Elder Law Section, and on the faculty of the National Judicial College. She is a member of the American Law Institute (ALI), academic advisory board for the Borchard Center for Law and Aging, an academic fellow of the American College of Trusts & Estates Counsel (ACTEC), a NAELA fellow, and a member of NAELA’s Council of Advanced Practitioners (chair 2012 2014). After a term on the Board of the ABA Commission on Law and Aging, she is a special advisor to the ABA Commission on Law and Aging. She is a member of the board of directors for the Center for Medicare Advocacy.

Downton Abbey and the Dreaded Fee Tail – A Far Worse Fate Than Not Having Air Conditioning, Microwaves or Hair Dryers

“People are trapped in history and history is trapped in them.”

– James A. Baldwin

The Masterpiece Theatre hit series Downton Abbey is more than a 1900-1920s era English aristocracy and servant class study showcasing lush manors and decadent gowns. The series illustrates a thankfully now outdated concept in property law: the dreaded fee tail. The show centers on a wealthy family in the turn of the century England. Robert Crawley is the Earl of Grantham and head of the luscious estate Downton Abbey, which has been in the family for centuries. Crawley is married to a wealthy American and they have three daughters that live on the estate. As occurred on dozens of occasions after the turn of the century, daughters of wealthy US industrialists inherited large amounts and then found a shortage of well healed men in the US to marry. These wealthy daughters turned to England, where there was a welcomed shortage of women for aristocratic English men to marry, but there was one major catch—England was in a depression and the men needed cash to maintain their estates. In the case of Downton Abbey, Mr. Crawly married a wealthy American, who put her inheritance into Downton Abbey and was not able to get it back or direct how it would pass.

There is much ado about the future possession of the estate, because only a male could inherit title or ownership of Downton Abbey. The Earl’s cousin and son, his two closest male relatives, die on board the Titanic in an early episode of the show. The Earl’s eldest daughter, Mary, will not be eligible to inherit the estate because the estate can only pass to a male heir. As a result, the Earl was forced to reach out to his third cousin, Matthew Crawley, who is (ironically) a solicitor in Manchester, to inform him that he was due to inherit the massive estate. Further intrigue follows, but central to the plotting and scheming is the pestering fee tail.

The time period of the show is essential to understanding the importance that the estate holds to the family. In the early 1900s, land was more than just the soil built upon; land was the key to the aristocracy, a sacred status symbol, and gave the family the right to basically enslave individuals who had the need to work on farms or to extract minerals from the significant properties that were not available to common people in those times.

The property interest at the center of the controversy is a fee tail or entail. This type of property interest is all but abolished today, with only a watered down presence in four U.S. states. An owner of a fee tail cannot devise the property by will or alienate it, but rather, the property passes by law to the owner’s heirs upon his death. The fee tail was employed to keep the land in the family. This often caused confusion about the proper succession of the title of land, especially in a case of a gender specific fee tail, such as a “fee tail male” (seen in the show) which only sons could inherit. An owner of a fee tail could grant, at maximum, a life estate for the period of years of the grantee’s life. After the life estate expired the property would revert back.

In Downton Abbey, the women were excluded from the fee tail, as described above. Women were able to control property not subject to the fee tail estates at the time they were unmarried or widowed, but only after passage of the Married Women’s Property Act in 1882. Without a will, the property passed via the English law of primogeniture, which gave the oldest son the right to inherit real property in the absence of a will, and this was in effect until the Administration of Estates Act 1925. The most recent change in English succession law has been this year: the Succession to the Crown Act 2013, which allows the oldest child, female or male, to take precedence in line to the throne. Before the Act, the oldest male would take precedence over any older female.

Further commentary on the specifics of how this law applies to the characters in Downton Abbey, as published from an interview with an English Barrister, can be viewed by clicking here.

Potter Steward was an attorney who graduated from Yale Law School. He was a member of the U.S. Naval Reserve and served in World War II. In 1954, at the age of 39, Potter was appointed to the United States Court of Appeals for the Sixth Circuit, and in 1959, he was nominated to the Supreme Court.

Stewart was a member of the Supreme Court for landmark court decisions, including Griswold v. Connecticut, Miranda v. Arizona, Sierra Club v. Morton, Ginzburg v. United States, and Roe v. Wade. Stewart retired in 1981, and was succeeded by Sandra Day O’Connor. He is known for both his statement on censorship from the Ginzburg v. United States dissent, “censorship reflects a society’s lack of confidence in itself. It is a hallmark of an authoritarian regime,” and his statement in the obscenity case of Jacobellis v. Ohio. He died in 1985.

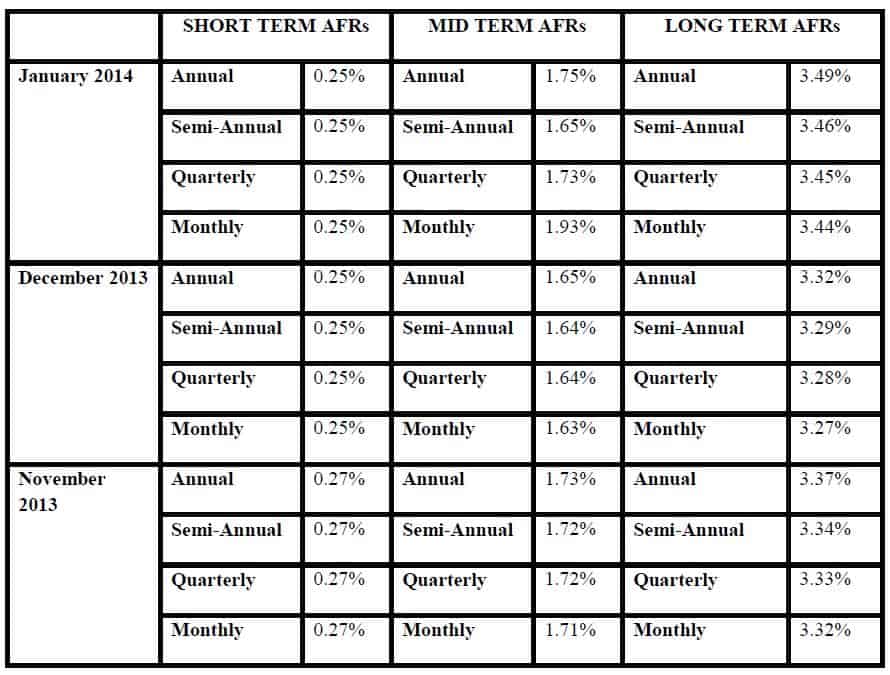

Applicable Federal Rates

The 7520 Rate for January is 2.2% and for December was 2.00%.

Seminars and Webinars

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Hyatt Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Hyatt Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland, can include a room at the fantastic Hyatt Hotel for a discounted rate per night, single occupancy.

PINELLAS COUNTY CHAPTER OF THE FLORIDA ASSOCIATION OF WOMEN LAWYERS SEMINAR

Alan Gassman will be speaking on Same Sex Marriage and Associated Laws We Should All Know About Anyway.

Date: January 30, 2014 | 5:30 p.m.

Location: Stetson Law School, Gulfport, Florida

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications.

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

HILLSBOROUGH COUNTY BAR ASSOCIATION HEALTH LAW SECTION LUNCHEON

Alan Gassman and Christopher Denicolo will be speaking at the Hillsborough County Bar Association’s Health Law Section Luncheon on the topic of Tax and Asset Protection Basics for Those Who Represent Physicians and Medical Practices

Date: March 12, 2014

Location: Chester H. Ferguson Law Center in Tampa, FL

Additional Information: For additional information please contact Co-Chairs Sara Younger (sara.younger@baycare.org) or Thomas Ferrante (tferrante@carltonfields.com).

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2013

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live

interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”