The Thursday Report – 9.29.16 – Celebrating Our 200th Edition and 1976

Celebrating the 200th Edition of “The Thursday Report”

A Doctor Speaks Out

A Call to Congress for Action on 2704 Proposed Regulations

by Keith Schiller

Revenue Procedure 2016-49: The IRS Finally Puts Planners at Ease on the Validity of “Unnecessary” QTIP Elections

A Look at Economic Citizenship

Richard Connolly’s World – Creating an Effective Digital Estate Plan

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“It is good to know that in our own lifetime we have taken part in the growth of freedom and in the expansion of equality which began here so long ago. This union of corrected wrongs and expanded rights has brought the blessings of liberty to the 215 million Americans, but the struggle for life, liberty, and the pursuit of happiness is never truly won. Each generation of Americans, indeed of all humanity, must strive to achieve these aspirations anew. Liberty is a living flame to be fed, not dead ashes to be revered, even in a Bicentennial Year.”

– Gerald R. Ford

Gerald Rudolph Ford, Jr. was the 38th President of the United States, serving from 1974 to 1977. Prior to his presidency, he was the 40th Vice President of the United States, serving from 1973 until Richard Nixon’s resignation in 1974. Ford was President during the United States Bicentennial celebration in 1976, and the above quote is taken from his remarks in Philadelphia, Pennsylvania on July 4, 1976. Gerald Ford currently holds the distinction for living longer than any other United States president, having lived 93 years and 165 days upon his death in 2006.

Celebrating the 200th Edition of “The Thursday Report”

On July 26, 2012, the very first Thursday Report was released, making history for our law firm, our estate planning and medical practice-related communities, Kentucky Fried Chicken, and mediocre humor. Our reader base expanded dramatically in the first year to over 17 people and has roughly doubled every three years since.

Many readers identify with the character that Woody Allen describes in the movie Annie Hall, where a gentleman is explaining that his brother thinks he is a chicken. The psychiatrist he is speaking to asks why he does not tell his brother that he is not a chicken. The gentleman then says, “I would, but I need the eggs.”

We thank all Thursday Report readers for “needing the eggs” and for the extremely warm, vibrant, and expecting nature of the vast majority of our readers. We will strive to continue the Thursday Report tradition and to make the opening of the Report a worthwhile action.

Please continue to give us questions, comments, submissions, and please forward copies of our Reports to anyone you like and anyone you don’t like.

This 200th Thursday Report is dedicated to our amazing country and the 200 year bicentennial that many of us were around to celebrate in 1976.

The United States celebrated its 200th anniversary in 1976 with a series of celebrations and observances during the mid-1970s that paid tribute to the events that lead to the creation of the United States of America as an independent republic. Special celebratory currency was created, and the official logo of the Bicentennial was created by Bruce N. Blackburn, who also co-designed the NASA insignia used from 1975 to 1992. Special events included elaborate firework displays, nautical parades, and a 21-month tour of the 48 contiguous states by the American Freedom Train. The Bicentennial concluded on July 4, 1976 at the site of the signing of the Declaration of Independence.

We have a lot to be thankful for, and we wish you the best for a fantastic Thursday (or Saturday, if you are viewing our Report Replay). Thanks to the many lawyers, legal assistants, and others who have contributed to the Thursday Report over the past 199 issues.

We hope you, the reader, find this Report to be a good one. While we have been approached by both Fox News and CNBC for a potential merger, neither organization would tolerate Kentucky Fried Chicken jokes or in-depth tax and legal analysis. C-SPAN has not returned our calls.

But what were our current presidential candidates, Donald Trump and Hillary Clinton, doing during the 200th birthday of the United States of America? The Bicentennial Year of 1976 proved to be a big year for both of them.

In 1976, The New York Times launched Donald Trump into the public eye with the publication of the first standalone profile of the New York businessman. This profile can be viewed by clicking here. Though Trump, at this time, hadn’t yet developed any Manhattan properties, the inclusion of a quote from Trump’s father, Fred Trump that “everything [Donald] touches turns to gold” effectively crafted the beginning of Trump’s celebrity.

Also in 1976, Hillary Clinton’s husband (and former President of the United States) Bill Clinton won his first election to public office as Arkansas Attorney General. Having married only one year before, the Clintons moved to Little Rock, the capital of Arkansas. Shortly after Bill’s election, Hillary became the first female associate at the Rose Law Firm, the third oldest law firm in the United States and the oldest company in Arkansas. At the Rose Law Firm, Secretary Clinton specialized in patent infringement and intellectual property law while also working pro bono in the area of child advocacy. She would go on to be named the Rose Law Firm’s first female partner in 1979.

Thank you to the readers of the past 199 edition of the The Thursday Report and the readers of today’s 200th edition. We hope you’ll continue to join us for the next 200!

Don’t miss our very special Bicentennial Thursday Report game! Please see our Humor section below for your chance to win a bucket of Kentucky Fried Chicken.

A Doctor Speaks Out

In the September 15, 2016 Thursday Report, we published an article by Charles G. Kels entitled “5 Myths About Patient Privacy.” You may view this article by clicking here. Thursday Report reader and professional writer Stanley Sack, M.D. had the following to say about this article:

“Thank you for your report on the HIPAA fiasco. Nothing gets me fired up like HIPAA, which I think is one of the worst things to happen to medicine.

As a physician, I find that it is used a lot as an excuse not to tell anything to people who actually need to know patient information. My favorite story in this regard was a test that I ordered – yes, I ordered the test – that had to be done in Miami. The facility would not release the result to me due to “HIPAA concerns.” We had to drag the patient in and sign a consent to eventually, and still with some difficulty, get it.

That’s actually pretty dangerous – a potentially abnormal result sitting in a file room with no one having access to it. To me, HIPAA represents Here I Project Additional Attitude. With all of the silliness that these accrediting and credentialing bodies make us go through – apparently JCAH goes nuts if there’s a paper on the floor, for example – it’s always mystified me why non-communication is not seen as an egregious transgression. The only thing I can figure out is, unlike HIPAA, no non-health-care provider has figured out a way to make a buck out of amping up a requirement, which is certainly not the case with the HIPAA circus.”

Dr. Stanley Sack graduated from the Hahnemann University School of Medicine and completed his residency in Pediatrics at Tulane University. He currently works in Key West, Florida, and specializes in Pediatrics and Adolescent Medicine. Dr. Sack is Board Certified by the American Board of Pediatrics and the Neonatal Resuscitation Program.

Thanks, Stanley, for sharing this opinion with us!

A Call to Congress for Action on 2704 Proposed Regulations

by Keith Schiller

Lawyer and writer Keith Schiller recently published an excellent appeal to members of Congress and others to describe how discriminatory the new Section 2704 Regulations would be. The article points out that the owners of family owned businesses will be treated much less favorably than businesses not controlled by one or two families, given the higher taxes and other associated disparities that would result from the new regulations.

A recent New York Times editorial called for elimination of the estate tax and indicated that affluent American families pay more to professionals and for life insurance to avoid estate tax than what the government receives in estate tax revenues. We find that statement to be completely untrue based upon our own experience, but there is no doubt that the federal estate tax will be an item of discussion in the next Congress, although it is quite likely that things will only change for the worse from the point of view of clients who have worked decades, if not generations, to put together businesses and productive investments that are at risk of substantial loss or diminution because of the federal estate tax.

Competent estate planners do have tools that can alleviate, and in some circumstances eliminate, the federal estate tax. While many are hopeful that the federal estate tax will someday be eliminated, the chances of this occurring in the next twenty to thirty years seem remote at best. The estate tax is probably the most profitable tax for the U.S. Government, collecting $19.232 billion per year, and requiring only about 7% of estate tax revenues per year for expenditures.

With the present low interest rates and discounts available, well advised and responsible individuals and families with estate tax exposure will spend significantly less than what their family will save to make sure that key mechanisms and structures are in place for the protection of the next and subsequent generations.

Keith Schiller, Esquire, Schiller Law Group, Alamo, California. Keith is the author of The Art of the Estate Tax Return published by Bloomberg BNA Books, a member of the Advisory Board for the Estates, Gifts, and Trusts Journal and Consulting Group for LISI, and an estate planning and tax attorney with 42 years of experience.

This article original appeared as Steve Leimberg’s Estate Planning Email Newsletter #2455, which can be viewed on the LISI service by clicking here.

Mr. Schiller would like to thank the following co-authors and endorsers of this editorial for their contributions and support: Harris “Trip” H. Barnes, III, James G. Blase, Jonathan G. Blattmachr, Len Cason, Mary Kay Foss, David B. Gaw, Michael M. Gordon, John A. Hartog, Linda Hirschson, L. Paul Hood, Michael Jones, Matthew F. Kadish, Stephen E. Kantor, Jonathan C. Lurie, Alan L. Montgomery, Charles Morris, Edwin P. Morrow, Charles A. Redd, Jacqueline Patterson, Steven Siegel, and Alan T. Yoshitake

A Call to Congress for Action:

Potentially Harmful Impact of 2704 Proposed Regulations on Succession of

Family Businesses and Farms and Why it Must Be Stopped!

Plans to Pass Family Businesses to Next Generation Face Crisis

To see the footnotes for the article below, please click here.

Separate and Unequal Tax Injustice1

The proposed regulations could create for the valuation of family controlled businesses a harsher, more expensive and arguably unjust version of a “family penalty” similar to the “marriage penalty” which generated controversy and unfairness to married couples. Identical businesses, one controlled by family members and one owned among non-family will be valued under different standards, which could relegate family businesses to a substantial competitive disadvantage. Just as Congress took action to create fairness between the married and unmarried with income tax rules, Congress should take action to prevent the family business penalty from taking hold in the first place.2 If adopted as final regulations, these proposed rules could impair business capital formation among family members, force more family-owned businesses to sell (and in some instances to foreign investors) and force the enterprise into risky leveraging to pay this family business penalty.3

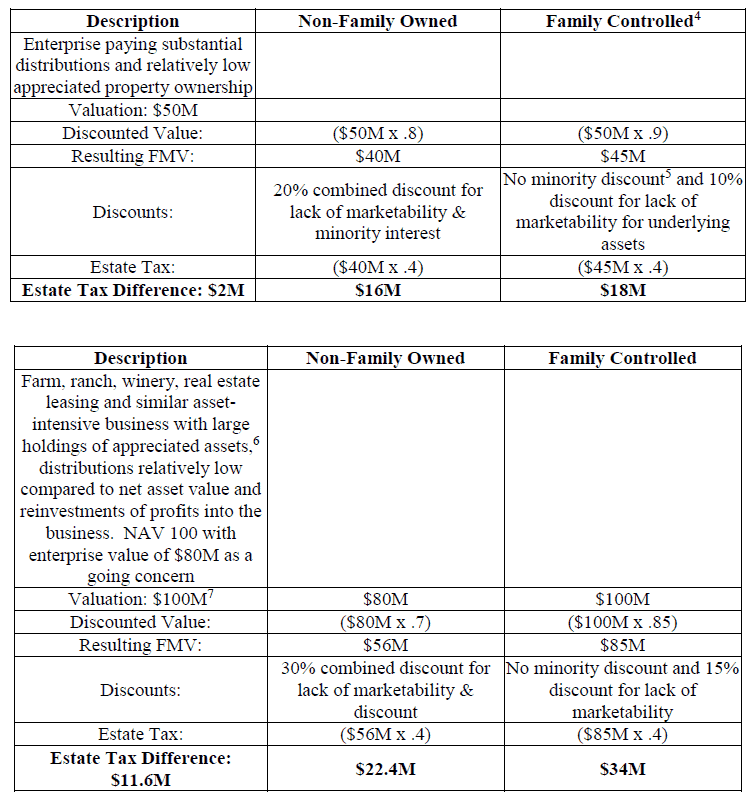

The next two charts summarize the impact arising from the interpretation of the proposed regulations.

The extent of the damage to family business succession arising from the proposed regulations in their current form currently is in dispute.8 In any event, the adverse impact on family business would be substantial in many situations. From a fairness point of view, the Treasury may have disregarded decades of fundamental valuation principles and effectively has overstepped its authority with the terms of the proposed regulations.

Published articles from leading national experts reflect a lack of consensus on the extent of adverse consequences to family-controlled businesses that would occur if the regulations are finalized in their current form.9 Construed by its most onerous terms to business owners, the proposed regime establishes a minimum value assumed equal to its net asset value.10 Informal input from the IRS/Treasury indicates that this harshest of results is not intended.

If a deemed net asset value based put is not intended, the regulations should make that clear. Indeed, to get meaningful comments about the proposed regulations, Treasury should issue a public announcement stating what it intended and provide examples to eliminate confusion. In any event, minimum value applies as part of the four-part test of generally required conditions if ownership by a non-family member is to be respected for the purpose of respecting the terms of a business deal.11

The family business penalty falls most harshly upon operating companies, land-rich/cash poor enterprises, and finally, on decades-old family businesses with no intent to liquidate. Even the most benign application of the minimum value test imposes artificially high and prejudicial estate taxes against family-controlled enterprise in its varied forms.12

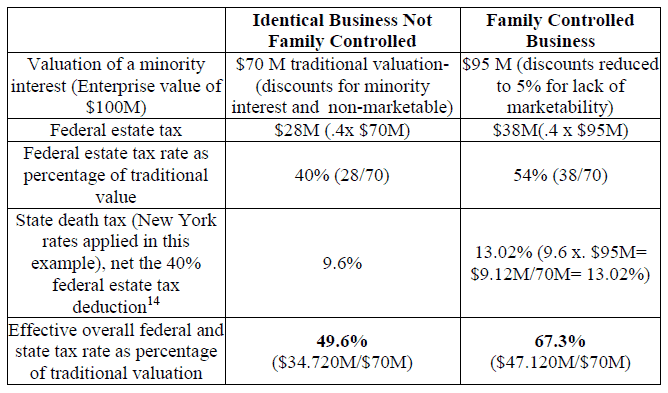

Confiscatory Combined Federal and State Death Tax Rates Fall Upon Family Controlled Businesses13

State estate taxes that follow federal estate tax valuation will compound the injustice. Effective combined wealth transfer rate increases of 67% or more will arise when comparing the artificially inflated value for family enterprise to traditional valuation law:

The remainder of Mr. Schiller’s Leimberg article can be viewed by clicking here.

For a sample client letter, please click here. For a letter that can be sent to members of Congress, please click here.

Revenue Procedure 2016-49: The IRS Finally Puts Planners at Ease

on the Validity of “Unnecessary” QTIP Elections

by Christopher Denicolo

In 2001, the IRS released Revenue Procedure 2001-38, which was then regarded as a taxpayer-friendly ruling. Under this Ruling, the IRS stated that it would nullify a QTIP election made in cases where the election was not necessary to reduce federal estate tax liability to zero.

The reason for this Ruling was to assist taxpayers who had inadvertently or unadvisedly made a QTIP election for a trust which was not necessary to eliminate federal estate tax liability. The IRS was essentially attempting to protect taxpayers from themselves.

However, when the concept of portability of unused federal estate tax exclusion between spouses was introduced in 2010 along with the $5,000,000 (plus inflation) federal estate tax exclusion, planners had a reason to make a QTIP election for a trust where such election is not necessary to reduce or eliminate federal estate tax liability. The portability rules allow the surviving spouse to utilize any portion of the first dying spouse’s unused federal estate tax exclusion. As a result, some clients would benefit from having a QTIP election apply to a trust or a portion of a trust which would otherwise be classified as a “credit shelter trust” that would have used the first dying spouse’s federal estate tax exclusion, in order to receive a step-up in basis on the assets held under the trust at the deaths of both spouses.

This planning technique was viewed by some commentators as possibly being disallowed by the IRS because of Revenue Procedure 2001-38 because the IRS would disregard a QTIP election made in cases where the election was not necessary to reduce federal estate tax liability to zero. While much of the estate planning community felt that Revenue Procedure 2001-38 could or would not be used by the IRS to adversely affect taxpayers who are taking advantage of portability rules that were promulgated more than ten (10) years after such Revenue Procedure was released, Revenue Procedure 2016-49 puts to rest any debate on this issue.

This past week, Revenue Procedure 2016-49 was released, and provides that the IRS will not disregard QTIP elections made by executors of a decedent’s estate where the executor has made a portability election in accordance with the applicable Treasury Regulations under Internal Revenue Code §2010(c)(5)(A). Specifically, this new revenue procedure does not treat as void QTIP elections made for property where:

(1) A partial QTIP election was required with respect to the trust to reduce estate tax liability, and the executor made the election with respect to more trust property than was necessary to reduce the federal estate tax liability to zero;

(2) A QTIP election was stated in terms of a formula designed to reduce the estate tax to zero;

(3) The QTIP was a protective election under Treasury Regulation 20.2056(b)-7(c);

(4) The executor of the estate made a portability election in accordance with Internal Revenue Code §2010(c)(5)(A) the regulations thereunder, even if the decedent’s deceased spousal unused exclusion (DSUE) amount was zero based upon values as finally determined for federal estate tax purposes; or

(5) The taxpayer timely files the federal estate tax return for the first dying spouse, and does not otherwise attempt to have the QTIP election treated as void.

Additionally, Revenue Procedure 2016-49 also allows relief for taxpayers who have inadvertently or unadvisedly made QTIP elections and did not intend for such QTIP election to apply. Section 4 of the Revenue Procedure provides that the IRS will disregard the QTIP election and treat it as null and void if the taxpayer’s satisfies the following requirements:

(1) The taxpayer submits the information required under the Revenue Procedure with a supplemental estate tax return for the first dying spouse, a gift tax return filed by the surviving spouse, or a federal estate tax return filed by the estate of the surviving spouse;

(2) The taxpayer notifies the IRS that a QTIP election is to be determined void and disregarded by entering at the top of the applicable tax return “Filed Pursuant to Revenue Procedure 2016-49″;

(3) The taxpayer identifies the QTIP election that should be treated void and provides an explanation of why this election should be treated in this manner; and

(4) The taxpayer provides sufficient evidence of the QTIP election was not necessary to reduce the federal estate tax liability to zero with respect to the first dying spouse’s estate.

Revenue Procedure 2016-49 is a welcomed sign that the IRS is aware of the potential confusion brought about by Revenue Procedure 2001-38, and that they have disavowed any sinister or malicious intent in turning Revenue Procedure 2001-38 on its head and enforcing it against taxpayers. We are thankful that this confusion has been cleared up, and that planners can make “unnecessary” QTIP elections in order to achieve other planning goals.

A Look at Economic Citizenship

by Alan Gassman and Seaver Brown

Thinking of leaving the country? Maybe you can share a house with Ruth Bader Ginsburg.

In any event, and in every presidential election, one or more clients will exclaim they are thinking about leaving the country. It looks like St. Kitts and Nevis would be the prime option for most, but a summary of residency requirements and passport rights for Dominica, St. Kitts and Nevis, Belize, and Portugal are as follows.

There are two ways countries typically offer citizenship for the economic investments of foreign individuals. Countries such as Dominica and St. Kitts and Nevis offer a direct citizenship by investment route without any residency requirements.

Other countries, such as Portugal, Belgium, Spain and the UK offer “residence permits” to high net worth individuals that can eventually lead to citizenship. In these instances, the investor must establish residency through any number of means before they may apply for citizenship.

Dominica

Under current regulations, to qualify for citizenship in Dominica under the Citizenship by Investment Program, the government requires either:A contribution made into the Government Fund of $100,000 depending on the number of dependents included in the application; or

- An investment in designated Real Estate with a value of at least $200,000. Additional payments for any dependents included in an application, due diligence fees, government fees and other fees are also payable.

St. Kitts and Nevis

There are two options available to qualify for citizenship and a passport of St. Kitts and Nevis under its Citizenship by Investment Program:

- A non-refundable (once the passport is issued) minimum charity donation of $250,000 to the Sugar Industry Diversification Foundation plus payment of processing fees. Additional fees apply for accompanying family members are as follows:

- $250,000 for a single applicant

- $300,000 for applicant with up to three dependents

- $350,000 for applicant with up to five dependents

- $450,000 for applicant with up to seven dependents

- $50,000 for additional contribution for each dependent above seven

- A designated real estate investment of at least $400,000, plus payment of various registration and other fees. Additional fees apply for any accompanying family members.

- $50,000 for the main applicant

- $25,000 for the spouse of the main applicant

- $25,000 for each child of the main applicant under 18

- $50,000 for each qualified dependent of the main applicant over 18, other than his or her spouse

Additional fees include $7,500 for due diligence and processing fees for the main applicant, and $4,000 for due diligence background checks and processing fees for each dependent over 16 years.

The Government of St. Kitts and Nevis website provides the following, “The St. Kitts and Nevis passport is very well regarded…As a result, St. Kitts and Nevis passport holders enjoy a passport with an excellent reputation and very good visa-free travel, including to all of the EU, Canada, Hong Kong, Switzerland, and other countries.

Belize

Belize ended its economic citizenship program in 2002. Currently, to become a citizen of Belize, you must live in the country for a year, during which time you cannot leave for more than fourteen consecutive days. After a year, you must apply for a permanent residency. If approved, you must spend five years as a permanent resident to apply for citizenship. The application process for citizenship can take another year in addition to all other waiting periods.

Portugal

Portugal offers three types of investments under their “Golden Visa” program. Through this program a foreign investor will have permanent residency status after 5 years, and citizenship after 6 years. The three ways in which a foreign investor can take advantage of the Golden Visa program include:

- Property Investments

- Acquire one or multiple properties above €500,000; or

- All types of property qualify

- Possibility of co-ownership

- Freedom of use, rent or lease

- If the investment is made in low density population areas the amount is reduced by 20% to €400,000

- Acquire property above €350,000 that is more than 30 years old or located in areas of urban renovation

- Includes the property and the investment in refurbishing it

- Possibility of co-ownership

- Freedom to use, rent for commercial or agricultural purposes

- If the investment is made in low density population areas the amount is reduced by 20% to €280,000

- Acquire one or multiple properties above €500,000; or

- Capital Investments – must be transferred from abroad into a bank in Portugal

- Transfer of funds above €1,000,000

- Total freedom to invest the funds

- Possible to use the funds to invest in shares of companies

- Transfer of funds above €350,000 for research activities

- To be used in research activities conducted by public or private scientific research institutions involved in the national scientific or technological system

- Transfer of funds above €250,000 for artistic or cultural activities

- Investing in artistic output or supporting the arts, for reconstruction or refurbishment of the national heritage

- Transfer of funds above €500,000 for capitalization of small and medium sized companies

- Investment is used to purchase shares in investment funds or in venture capital

- Transfer of funds above €1,000,000

- Job Creation

- Create at least 10 jobs

- No minimum investment value

- No limitation on areas/activities

- Must comply with social security obligations

- Possibility of grants, incentives, or benefits

- If investment is made in low density population areas the amount of jobs to be created may be reduced by 20% to 8.

- Create at least 10 jobs

Richard Connolly’s World

Creating an Effective Digital Estate Plan

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Creating an Effective Digital Estate Plan” by Christopher Steele. This article was featured on WealthManagement.com on July 20, 2016.

Richard’s description is as follows:

Because access to digital accounts following the death of a family member can be daunting, it is important that clients implement an effective digital estate plan. The principles which guide traditional estate planning are also applicable to digital estate planning. Keeping important documents updated and in a place where family members and/or an executor can access the information is especially important with digital accounts. Most people have a myriad of email addresses, passwords, pin numbers, reset questions, thumbprints, secret knocks, and code phrases that grant us access to our accounts. However, how many of those access keys are accessible by a family member and/or executor?

There are currently four methods to transfer access upon death: written instructions, access through specific digital providers, password managers, and digital legacy services.

Please click here to learn about the four methods listed above and read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Saying of the Week

**********************************************************

The Thursday Report Bicentennial Trivia Quiz

For our celebration of the 200th Thursday Report and the Bicentennial of 1976, some of the most famous quotes in American history are listed below.

Tell us who said each quote, and you could win a bucket of Kentucky Fried Chicken!

- “Ask not what your Thursday Report can do for you, but what you can do for your Thursday Report.”

- “The reports of the death of the Thursday Report are greatly exaggerated.”

- “Four score and seven Thursday Reports ago…”

- “I regret that I have but one Thursday Report to lose for my country.”

- “You won’t have the Thursday Report to kick around anymore.”

- “A Thursday Report in every pot, and a car in every garage!”

- “First in war, first in peace, and first in the heart of the Thursday Report”

- “Give me the Thursday Report, or give me [the] death [tax]!”

- “…conceived in liberty and dedicated to the proposition that all Thursday Reports are created equal”

- “Mr. Gorbachev, tear down this Thursday Report!”

- “We cannot solve our problems with the same thinking we used when we created the Thursday Report.”

- “And that’s the way the Thursday Report is.”

Send your answers to agassman@gassmanpa.com or stephanie@gassmanpa.com.

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Thursday, October 20, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sean Healy and Alan Gassman will present a free, 30-minute webinar on the topic of GUN TRUST UPDATE – NEW RULES AND REGULATIONS YOU NEED TO KNOW ABOUT.

Sean Healy currently operates Healy Law Offices, P.C. in Tyler, Texas, where he has been practicing law for over 20 years. He represents a number of business and nonprofit organizations and focuses on litigation, including jury trials and various types of court cases, including family law cases of divorce, child custody, and others. He is a Life Member of the National Rifle Association and the Texas State Rifle Association and has competed in over 150 pistol competitions.

The second edition of The Legal Guide to NFA Firearms and Gun Trusts by Sean Healy, Jonathan Blattmachr, Alan Gassman, and others will soon be available at the Amazon web store in your neighborhood. We aim to please!

There will be two opportunities to attend this presentation.

Date: Tuesday, October 25, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan.

During this week-long event, Alan will be speaking on the following topics:

- Getting Out of Bad Financial Partnerships, Joint Ventures, or Strategic Relationships

- Asset Protection and Estate Planning for Business Owners

- The Estate Planning and Asset Protecting “Choose Your Own Ending” Game

- The Language of Investing

- Engineering a Better Investment Deal

Thursday Report attendees will receive a free Mai-Tai with call brand liquor and their choice of a hula hoop or Hawaiian lei. Watch Don Juan sing the greatest hits of Conway Twitty on December 7th at 7:00 PM Hawaiian Time.

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute. To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, Jerry Hesch, and Curly, Larry, and Moe.

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: Speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

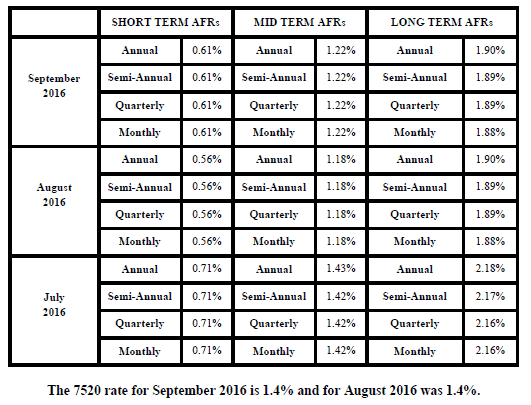

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.