The Thursday Report – 9.11.14 – Joke Contest, New Trust Creditor Case, Unclaimed Property, and More!

Illinois Bankruptcy Case on Inherited Trust Should Not Be of Concern to Knowledgeable Planners

How to Detect and Claim Unclaimed Property in Florida

Should a New Doctor Buy a Tail When Moving to Florida?

Seminar Announcement – Pinellas County Estate Planning Council Annual Seminar, Thursday, October 23, 2014

Thoughtful Corner – Enhancing Your Professional Practice

Who Said What Joke Contest!

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

In This Issue of The Thursday Report

Don’t miss our Who Said What Joke Contest, featuring classic jokes and one-liners by Robin Williams, Joan Rivers, and Joey Bishop. Winners will receive recognition in next week’s Thursday Report and, of course, a bucket of Kentucky Fried Chicken!

Illinois Bankruptcy Case on Inherited Trust Should Not Be of Concern to Knowledgeable Planners

On August 6, 2014, a bankruptcy judge in Illinois decided that the daughter of a deceased Grantor committed a fraudulent transfer by declining to receive an outright distribution where the trust stated that if she was insolvent the trust assets would be held based upon a spendthrift trust and a restrictive distribution right.

The trust had stated that the daughter would receive trust benefits solely in the discretion of the Trustee if she was insolvent when the Grantor died.

The judge seems to have been dead-set against her being able to benefit from the trust arrangement, although it is clear that the trust was solely funded by the debtor’s mother, and that the trust language clearly provided that the debtor had no right to receive anything beyond what would be paid in the discretion of the Trustee. The debtor was not the Trustee, and had no control over the Trusteeship.

The Castellano case dealt with a provision in the trust that stated as follows:

If by reason of bankruptcy or insolvency . . . then the interest of that beneficiary shall immediately terminate thereafter, the [Spendthrift] Trustee shall pay to or for the benefit of that beneficiary only those amounts that the [Spendthrift] Trustee, in its sole and absolute discretion, deems advisable . . .

The judge concluded that the transfer was somehow an indirect transfer by the debtor. He apparently thought that games were being played, and noted that:

Rather than accepting direct receipt of [the] assets and then transferring them in to a self-settled trust or the like, she recruited the Spendthrift Trustee to accomplish the equivalent result, schooling him in the Insolvency Letter, in his “obligation to exercise his authority consistent with the provisions of the [Living Trust].”

The judge offered no analysis whatsoever as to whether the debtor was in fact insolvent at the time of her mother’s death, so we must assume that she was, and that the judge made a bad call here.

Florida Statute Section 736.0504 clearly provides that creditors of the beneficiary of a third party settled trust cannot reach trust assets, even if the beneficiary is the Trustee, if the beneficiary’s right to receive distributions is limited to an ascertainable standard (the ability to receive payments only as and when reasonably needed for health, education, and maintenance of the beneficiary and other named individuals and/or family members).

The Castellano case should not change the normal approach to protective trust planning in Florida, or probably in any other state, as it is not mandatory authority.

One lesson from the case is that judges can be very skeptical where trustees are related to beneficiaries, even when this is not relevant. Here is what the judge had to say about that:

Further, the Court cannot ignore the family relationship between the Debtor and the Spendthrift Trustee, as well as the total absence of any court supervision or control over the Spendthrift Trustee’s decisions concerning disposition of the assets of the Spendthrift Trust. Family ties militate against any Trustee exercising completely unfettered, independent discretion in administering a spendthrift trust. Lack of judicial oversight exacerbates the risk that the Spendthrift Trustee’s independent judgment will be compromised by family entanglements. The Debtor had reason to assume that despite the creation of the Spendthrift Trust she would have every opportunity to influence, if not simply instruct, the Spendthrift Trustee to disburse funds according to her own discretion. Whether the Spendthrift Trust was a self-settled trust or similar device, the practical effect is the same–the Debtor can justifiably expect to exercise a significant degree of control over its assets

Two recent articles from the Leimberg information services and the case itself can be obtained by emailing agassman@gassmanpa.com.

In the famous words of Douglas Adams, “Don’t panic” and “Always bring your towel,” there may be a mess.

Notwithstanding the above, do you have a provision in your trust documents which provides that any outright distribution will instead be held only for the health, education, and maintenance of the individual and their descendants if they are insolvent on the death of the Grantor?

The Castellano opinion appears to be plainly mistaken, and will hopefully be overturned by the federal district court that has the right of review, if this is appealed, to reduce the confusion that will doubtlessly be interjected into the creditor protection world by commentary, example, and discussions.

Bad facts often make for bad decisions, but bad decisions should not make for erroneous future planning.

How to Detect and Claim Unclaimed Property in Florida

It is now very easy to check the Florida Bureau of Unlicensed Medicine to determine whether you or a client (or your mother-in-law or Colonel Sanders) have unclaimed property. You can hand this to an assistant with some names and see how you do!

Step 1: Log on to www.fltreasurehunt.org

Step 2: Click “Search Unclaimed Property”

Step 3: Fill in your last name, first name, and the security text then click “search”

Step 4: Depending on the commonness of your name, the search may yield numerous results. Once the search results are there, you then must look through the listed names and find which address is associated with you.

Helpful Hint: When the search results produced numerous names, we found it easier to press Ctrl + F (the “find” function) and type the name of the city in which you currently live or have lived. This usually highlights the search term and you can find your name a lot easier.

Step 5: If your name is found in the search results, click on the hyperlinked “account number” and this will take you to a page titled “Property Detail”

Step 6: After reviewing the property description and verifying that the unclaimed property does in fact belong to you, proceed to mark the circle next to the claim type option that reads, “I am the Original Owner listed on this account.” Then click “Claim It!”

Step 7: The next page will bring up a disclaimer in a yellow box; after reading, click “Continue”

Step 8: Enter the Claimant Information on the next page. The only required entries are the claimant’s last name, full address, and country. Once you have entered the information, click “Save and Continue”

Step 9: If you have more than one account of unclaimed property, now is the time to add those claims. To add additional claims, click “Search Results” and you will be taken back to the list. Follow steps 5 & 6 to add the claims to the account.

Step 10: After you have identified all of your unclaimed properties, on the “Account Summary” page, click the button titled “Get Claim Form.” A pop-up will appear and ask if you are finished adding accounts. If you are, click the “ok” button.

Step 11: The next page will display your “claim number” and you will have the option to immediately print your claim form or to receive the form by mail. If you choose the option to print the form immediately, a yellow disclaimer box will appear on the following page along with a hyperlink that says “Click Here.” Your form will then be downloaded as a PDF, and you are ready to print.

How to File the Claim

To file the claim you must complete the downloaded claim form, provide proof of ownership of the property (utility bills, correspondence, etc.), and a legible copy of a valid driver’s license. Be sure to sign and date the claim form.

The completed claim form and documentation must be sent to:

Department of Financial Services

Bureau of Unclaimed Property

P.O. Box 8599

Tallahassee, FL 32314

You should allow up to 90 days from the date in which the claim is deemed “complete” for the Bureau of Unclaimed Property to make a decision on the claim.

And there you have it! Happy Searching!

Should a New Doctor Buy a Tail When Moving to Florida?

Recently a client asked us the question if buying a tail is necessary when you move to Florida. Our response to the client is below:

Dear Client:

This is a tough call.

Chances are that he/she will save $8,000 (really, about $4,800 after taxes, if you pay it from your PA and settle up with him/her on the side).

I have had doctors sued in these situations without coverage, and then it becomes horrific. In his/her case, I am guessing that he/she could file a bankruptcy and be free of a suit without losing much but his/her credit rating.

A big question is whether the practice he/she left has a corporate policy that would provide coverage and defense costs (at least for the company) in which case, he/she is under a lot of risk.

Another question is whether it is a licensing violation in the state he/she practiced in to not buy a tail and have coverage. If so, then the patient might file a license complaint and this could implicate the Florida license because of cross-state reporting. Florida would not punish a doctor who does buy a tail, last I heard.

Also, is he/she contractually required to pay for the coverage, and if so, will the practice sue him/her, or accept perhaps $4,000 paid to them if they have a corporate policy?

Finally, is there any way to buy less than the offered amount of coverage or to have a large deductible?

Please let me know if I can provide any further information or ideas.

Best personal regards,

Alan S. Gassman

Seminar Announcement – Pinellas County Estate Planning Council Annual Seminar, Thursday, October 23, 2014

See Alan Gassman, Michael Halloran and Sean Casey at the Annual Pinellas County Estate Planning seminar on Thursday, October 23, 2014 from 8:00 am to 11:50 am.

Sean Casey is the Regional Director of Portfolio Management for Fifth Third Bank. He is a successful global portfolio manager for high net-worth individuals and institutions specializing in relative value positioning among equities, fixed income and currencies, commodities, and alternatives. He earned his degree in International Economics and Finance from Fairleigh Dickinson University.

Michael W. Halloran is a Wealth Management Advisor with Northwestern Mutual. Mr. Halloran has been in the financial services industry for over 40 years. Mr. Halloran is a graduate of Florida State University and the American College. Mr. Halloran holds the following designations: CFP®, AEP®, CLU®, ChFC®, LUTC®, RHU®, REBC®. Additionally, he is Series 7, 8, 63, 65, and Life, Health, Long Term Care, and Annuity licensed.

Mr. Halloran guides clients in reaching financial security from every aspect through long-term relationships that are based on value and integrity. His approach to financial planning involves analyzing, planning, and implementing customized strategies. More specifically, Mr. Halloran’s expertise lies in estate and business planning for individuals and businesses.

In recognition of his skills and expertise, Mr. Halloran has received several industry awards, has been featured in publications including National Underwriter, Capital Executive, New York University Review, Money, Life Association News, Life Insurance Selling, USA TODAY, New York Times, Chicago Tribune, Congressional Quarterly, Dow Jones News Wire, and has spoken in numerous states on various financial planning topics.

Mr. Halloran is the immediate Past President of the National Association of Estate Planners and Councils, past National Director of the Society of Financial Services Professionals, past Board of Directors of Florida Association of Insurance and Financial Advisors, past President of Jacksonville Association of Insurance and Financial Advisors, past President of the Estate Planning Council of Northeast Florida, is the Executive Director of Physicians Nationwide, is a Member of the Estate Strategies Group, and other community organization boards.

The topics and schedule are as follows:

7:15 am – 8:00 am – Breakfast/Networking

8:00 am – 8:50 am – Presentation #1 – “Economic Overview”

Sean Casey, Fifth Third Private Bank

8:50 am – 9:00 am – Break

9:00 am – 9:50 am – Presentation #2 – “Planning for Same Sex Couples”

Alan S. Gassman, Esq., Gassman, Crotty & Denicolo, P.A.

9:50 am – 10:00 am – Break

10:00 am – 10:50 am – Presentation #3 – “Charitable Remainder and Charitable Lead Trusts”

Michael Halloran, Estate Strategies Group

10:50 am – 11:00 am – Break

11:00 am – 11:50 am – Presentation #4 – “Combining a Domestic Asset Protection Trust with a Double LLC for Maximum Protection”

Michael Halloran, Estate Strategies Group

This seminar qualifies for 4 hours of continuing education credit.

Cost: $95 per person.

Contact Alan Gassman at agassman@gassmanpa.com or Ellen Mantegna at emantegna@verizon.net to register for this program.

All attendees will receive our latest, 102 page book, The Florida Advisor’s Guide to Counseling Same-Sex Couples. We have had very good reviews from this book so far. It will also be available on Amazon in the coming weeks. If you would like a pre-publication discount, please let us know by contacting Alan Gassman at agassman@gassmanpa.com.

We thank Fifth Third Bank, Pinellas Community Foundation, Ruth Eckerd Hall, and the Clearwater Marine Aquarium for their support of this excellent annual event, which will take place at Ruth Eckerd Hall, 1111 N McMullen Booth Rd, Clearwater, FL 33759.

Thoughtful Corner – Enhancing Your Professional Practice

The Miami Lakes Bar Association presents “ENHANCING YOUR PROFESSIONAL PRACTICE” on Sunday, October 19, 2014 from 1:00 to 5:00 P.M. This program consists of strategies and approaches for making your professional practice more enjoyable and effective while increasing profitability and team member participation. It will also qualify for 4 hours of CLE and CPE credit.

Alan S. Gassman and Phil Rarick will lead a half-day, continuing education workshop for improving the efficiency, effectiveness and profitability of your professional legal practice. This workshop is well suited for both experienced and successful lawyers, as well as new lawyers and those who would like to change their present situations.

WHAT WILL BE COVERED:

Drawing from many years of study and trial and error with a great many tools and techniques that have worked for Mr. Gassman’s firm and others, the exercises and discussion group process has been shown to dramatically help professionals stop wasting time and money, gain control of their priorities, and create a working environment where employees, including lawyers, are excited to show up every morning.

Workshop participants can expect dynamic one-one-one and small group conversations that are right on point to help with decision making and problem solving, and to enable participants to identify and take advantage of opportunities that they have not realized exist. Office managers are also welcome. For the best results bring a list of some goals, trouble spots, and an open mind for brainstorming good decision making.

An optional cocktail and social hour following the workshop is a great opportunity for solidifying thinking and decisions and getting to know the other participants once the day is over. A follow-up event may be scheduled to help assure that promises made are not promises broken!

TIME: 1-5pm

DATE: Sunday, October 19, 2014

LOCATION: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

COST: $35 per person

RSVP: This workshop will be limited to a small number of participants to ensure that everyone receives individualized attention, so please contact Christy at cmedina@raricklaw.com or (305) 556-5209 to secure your spot today!

WHAT OTHERS HAVE SAID:

The following are testimonials from past workshop participants:

I am super charged from the workshop. I have already started to work towards my written goals and my subconscious has me waking up almost 2 hours earlier ready to start my day – one of my goals! It really works. I am very grateful to be a part of this and part of your professional community. All of this came from a New Year’s resolution last year – I was determined to reach out to professionals I admired even if I felt silly. I wrote you an email when you were in the Galapagos with Marcia & you responded! I was amazed. I had no idea how that email would change my life. Thanks for everything you do and all the ways you help me develop professionally and personally.

-Debbie Faulkner, Esquire, The Faulkner Firm, P.A.

By having the opportunity to discuss my goals and the obstacles keeping me from achieving those goals with other professionals I was able to define my path to achieve those goals like never before.

Not only was I able to improve myself personally, but I also had the unexpected opportunity of being able to have very candid discussions about law practice management and what actually works and doesn’t work with experienced lawyers who provided great advice for me as a new lawyer entering the field.

The entire experience was invaluable and far more than what I thought it may be. I am very much looking forward to our next session to continue to develop as a young lawyer both personally and professionally.

– Brandon Ketron, Stetson Law Student

The Workshop was extremely helpful for both my professional and personal development. Alan Gassman made the seminar informative and engaging. I would recommend attending the seminar if you are serious about increasing productivity, meeting goals, and becoming a happier person.

– Travis Arango, Stetson Law Student

ABOUT PHIL RARICK, J.D.:

Phillip B. Rarick, J.D. has over 30 years of experience in both private and public legal work. Mr. Rarick concentrates in the fields of estate planning (wills and trusts), asset protection, probate, and corporate law. Integrated asset protection with an estate plan designed to protect wealth and secure tax advantages are a primary focus of his practice. He is an active member of the Elder Law Section of the Florida Bar, and the Real Property, Probate and Trust Law section of the Florida Bar Association.

Mr. Rarick is the author of a number of popular guides for fellow attorneys and the public, including Florida Probate Quick Reference Guide and Understanding Living Trusts for Florida Residents.

Mr. Rarick is a past President of the Miami Lakes Bar Association, and has served as a board member there for 11 years. Mr. Rarick’s email address is PhilRarick@raricklaw.com

A similar full-day workshop will be held in Clearwater, Florida on Sunday, October 5, 2014, and will also be repeated on a date to be determined in November of this year at the Ave Maria School of Law. Please contact agassman@gassmanpa.com if you are interested in attending.

Who Said What Joke Contest!

Guess who each of the following jokes belong to and win recognition, KFC chicken, and two Haddon Hall Publishing books of your choice. Second place will receive one book. Last place will receive three books.

Each joke listed below is by Robin Williams, Joan Rivers, or Joey Bishop.

Robin Williams was a comedian best known for his stand-up comedy routines and his roles in Mork & Mindy, Mrs. Doubtfire, and Good Will Hunting, for which he won an Academy Award. Robin Williams died on August 11, 2014 at age 63.

Joan Rivers was a comedienne widely known for her red carpet interviews and her comedic style in which she poked fun at celebrities or at herself. She was the first woman to host a late-night network television talk show, winning an Emmy for The Joan Rivers Show. Joan Rivers died on September 4, 2014.

Joey Bishop was an American entertainer who appeared on television as early as 1948, eventually hosting his own late-night talk show. He was also a member of the “Rat Pack” with Frank Sinatra and Dean Martin. Joey Bishop died on October 17, 2007.

- “People say that money is not the key to happiness, but I always figured if you have enough money, you can have a key made.”

- “In England, if you commit a crime, the police don’t have a gun and you don’t have a gun. If you commit a crime, the police will say: ‘Stop, or I’ll say stop again.’”

- “I once called my mother during a hurricane. She got on the phone and said, ‘I can’t talk to you. The lines are down.’”

- “I’ve actually gone to the zoo and had monkeys shout to me from their cages, ‘I’m in here when you’re walking around like that?!’”

- “I was so ugly that they sent my picture to Ripley’s Believe It or Not and he sent it back and said, ‘I don’t believe it.’”

- “My doctor is wonderful; once, when I couldn’t afford an operation, he touched up the X-rays.”

- “My daughter and I are very close, we speak every single day and I call her every day and I say the same thing, ‘Pick up, I know you’re there.’”

- “Do you think God gets stoned? I think so — look at a Platypus.”

- “Today you can go to a gas station and find the cash register open and the toilets locked. They must think toilet paper is worth more than money.”

- “Every so often, Rumsfeld comes out and goes, “I don’t know where. I don’t know when. But something awful’s going to happen. Thank you, that’s all for today, no further questions.” Excuse me, can you give me a clue? What is it, the Central “Intuitive” Agency now?”

- “The other day I drove home filled with pride and a sense of achievement. ‘Mama,’ I said proudly, ‘I have a new Corvette outside.’ Mama looked at me, shook her head and said sadly, ‘Please, don’t bring her in.’”

- “She doesn’t understand the concept of Roman numerals; she thought we fought in World War Eleven.”

- “And what’s George W. Bush doing now? He’s a motivational speaker. It’s kind of cool. It’s kind of like having Lindsay Lohan as a guidance counselor.”

Bonus Round: What famous comedy TV show did Joan Rivers and Robin Williams appear on together in 1977?

Email your answers to agassman@gassmanpa.com!

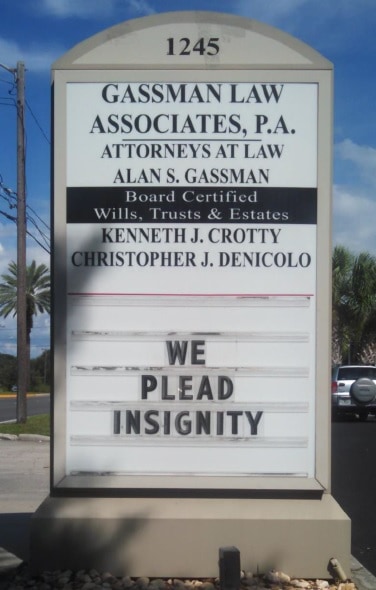

Humor! (Or Lack Thereof!)

For our readers who don’t make it down to Clearwater, Florida often, here’s a look at our latest Gassman Law Associates sign!

Upcoming Seminars and Webinars

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of TRUST PLANNING FROM A TO Z for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program, please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAs.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: DATE TO BE DETERMINED | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************

FREE LIVE WEBINAR:

Attorney Leslie A. Share will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************

LIVE CLEARWATER PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will be joined by several experienced attorneys and other well respected industry experts during a full day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 5, 2014 | 8:30am – 5pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program please email agassman@gassmanpa.com.

********************************************

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Wednesday, October 8, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 11, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a free half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

Cost: $35 per person

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 8:00 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Seven Springs Gold and Country Club, 3535 Trophy Blvd, Port Richey, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

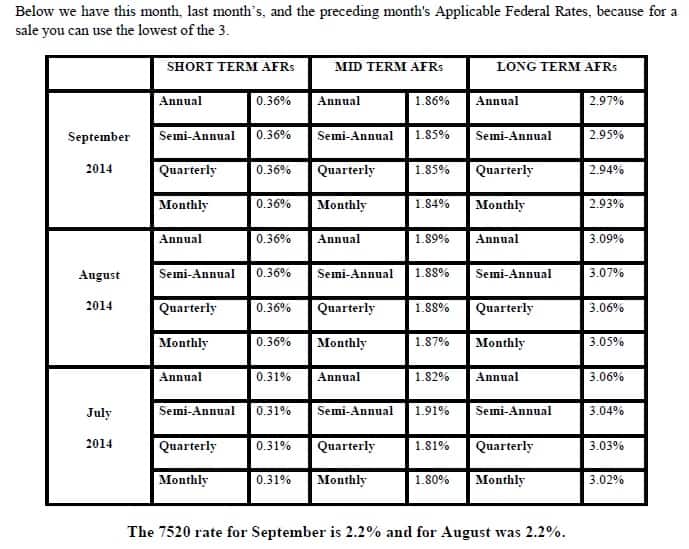

Applicable Federal Rates