The Thursday Report 8.7.2014 – Tax Law Heaven Edition

Demystifying the RPM Trust; A Dynamic Estate Tax Planning Technique for Married Couples with Assets Exceeding $11,000,000, an article by Ken Crotty

Barry Nelson and Michael Sneeringer Review Barry Engel’s Amazing Asset Protection Planning Guide 3d Edition, a Leimberg Information Services Article

Seminar Announcement – Jonathan Blattmachr and Brandon Centula of Alaska Trust join Alan Gassman for a Double Header Free Webinar on Tuesday, August 12, 2014 at 12:00 p.m.

Is Estate Tax Repeal a Shakedown?, an article by Denis Kleinfeld

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 4

Thoughtful Corner – If Your Life is a Treadmill This Will Fit You Perfectly

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Demystifying the RPM Trust; A Dynamic Estate Tax Planning Technique for Married Couples with Assets Exceeding $11,000,000, an article by Ken Crotty

Some estate planning techniques are underutilized because they are difficult for practitioners to understand, and therefore difficult for practitioners to explain to clients. One such technique is the Remainder Purchase Marital Trust (“RPM Trust”), which has been developed and discussed by David Handler and Stacy Eastland, among others.

The following was derived from a Bloomberg BNA Webinar presented by Stacy Eastland and Alan Gassman on March 27, 2012. If you would like to receive the PowerPoint presentation from that webinar please let us know. If you would like to view the webinar please contact Mark Carrington at mcarrington@bna.com and request a promotional code (discount).

Estate tax planners need to make sure that the RPM is one of the arrows in their arsenal.

The use of the RPM Trust is a great planning technique for clients who (1) are married; (2) want to establish a trust for the benefit of their spouse; (3) have already established a trust for the benefit of their descendants with significant assets (the “Descendants Trust”); (4) have little of their lifetime gift tax exclusion remaining or do not want to use what is left of their lifetime gift tax exclusion; and (5) have significant assets in their individual name which could generate potential estate tax liability.

For these clients, the use of the RPM Trust would allow them to establish a trust that would provide benefits for their spouse, the assets of which may not be included in the spouse’s estate on his or her death. Further, when the trust is funded there is no gift by the client, and the Descendants Trust will receive the assets remaining in the RPM Trust after the spouse’s beneficial interest terminates.

Clients who want to use the RPM Trust technique should have an existing Descendants Trust which has significant assets. It is best if this trust is “old and cold” to prevent the IRS from using the step transaction to recharacterize what occurs when the RPM Trust technique is used. Many clients established trusts for the benefit of their descendants and funded these trusts with large gifts to take advantage of the increased lifetime gift tax exclusion which was available in 2012, and was scheduled to disappear in 2013. These trusts would be potential trusts that could be involved in the RPM technique.

A slide show demonstrating the steps involved in using the RPM technique can be viewed by click here.

The first step is for the client and the Descendants Trust to establish a family limited partnership or limited liability company (the “FLP”). In the attached example, the client contributes $10,000,000 for a 1% general partner interest and a 79% limited partner interest. The Descendants Trust contributes $2,500,000 in exchange for a 20% limited partner interest.

After the FLP is funded, the client establishes the RPM Trust. The RPM Trust will initially be for the benefit of the client’s spouse. The spouse can either have an interest for a term of years or an interest for life. If the spouse has an interest for a term of years and dies during that period, then some of the value of the RPM Trust will be included in the spouse’s estate, similar to a GRAT. If the RPM Trust is drafted so that the spouse has the right to receive either the income of the trust or an annuity for life, then, none of the assets would be included in the spouse’s gross estate for estate tax purposes on the spouse’s death.

Clients with spouses who are in excellent health may wish to have the RPM Trust provide that the payments would only be made to the spouse for a term of years, so that the value of the remaining assets in the trust is greater at the end of the set period than it would be when the spouse dies if the spouse outlived his or her life expectancy. For clients with spouses whose health is a potential concern, such clients probably should structure the RPM Trust to provide benefits for the spouse’s lifetime, and then on the spouse’s death, none of the assets in the trust would be included in the spouse’s gross estate, and the remaining assets would pass to the Descendants Trust.

The portion of the RPM Trust held for the benefit of the spouse will qualify for the gift tax marital deduction if it provides that a set annuity or that the income of the trust will be paid to the spouse. To qualify this portion of the trust for the gift tax marital deduction, it is important that only the spouse be a beneficiary of the trust and that no distributions may be made from the trust except for the benefit of the spouse. Further, to be able to quantify the interest that the spouse has in the trust, distributions should not be limited to the health, education, maintenance and support standard. Instead, the trust should provide that the spouse has the right to receive all of the income from the trust or an annuity from the trust.

The next step in using this technique is for the grantor to fund the RPM Trust with discounted limited partner interests. In the attached example, the grantor transfers $5,000,000 worth of limited partner interests. Assuming a 30% discount, this is equal to a 57.14% limited partner interest.

At the time that the grantor funds the RPM Trust, the Descendants Trust purchases the remainder interest in the RPM Trust from the Grantor. Because the grantor receives the full fair market value for the value of the remainder interest, no gift is made with respect to the remainder interest either when the RPM Trust is funded or when the assets remaining in the RPM Trust pass to the Descendants Trust after the spouse’s interest in the RPM Trust ceases.

To be certain that the grantor receives the full fair market value of the remainder interest of the RPM Trust when it is purchased by the Descendants Trust, it is important that the remainder interest be purchased by the Descendants Trust using discounted limited partner interests in the same FLP. The reason for this is because of the possibility of the IRS challenging the planning and reducing the value of the discount taken on the limited partner interests that were gifted to the RPM Trust.

If the discount is reduced, then the value of the remainder interest would be increased. If the Descendants Trust had purchased the remainder interest with cash or securities equal to a set dollar amount and the value of the remainder interest was increased, then the grantor no longer would have received the full fair market value of the remainder interest. As a result, the grantor would have made a taxable gift on the funding of the trust. For clients who have already utilized most or all of their lifetime gift tax exclusion, this would result in the client paying gift tax.

To avoid this risk, the remainder interest should be purchased with discounted limited partner interests. Then, if the IRS on audit changes the discount associated with the value of the limited partner interests transferred to the RPM Trust, this same change in value would occur to the limited partner interests used by the Descendants Trust to purchase the remainder interest. Because the value of the assets used to purchase the remainder interest would be adjusted by the same factor as the value of the remainder interest in the RPM Trust, the grantor still would have received the full fair market value of the remainder interest when it was purchased by the Descendants Trust.

When the RPM Trust is funded, software such as Number Cruncher or Tiger Tables can be used to determine the value of the spouse’s interest in the trust. During periods when interest rates are low, it often makes sense to provide the spouse with an annuity interest so that the spouse’s interest in the trust is larger, and the value of the remainder in the RPM Trust purchased by the Descendants Trust is less.

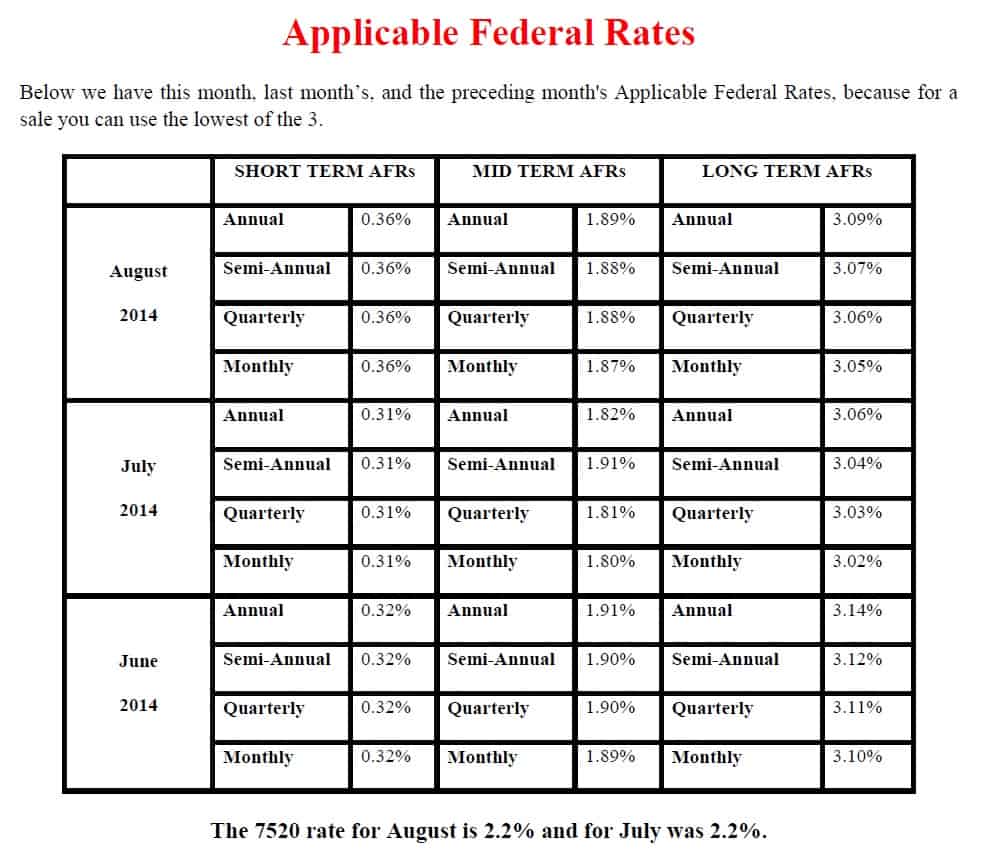

The attached spreadsheet shows the potential wealth that could be transferred using this technique. The spreadsheet is based on the assumptions stated above and further assumes that the client’s spouse was age 82 when the RPM Trust was funded, that the 7520 rate was 2.4%, and that the surviving spouse received an annuity interest for life, with the annuity payments being equal to $500,000 per year. Based on the IRS tables, the client’s spouse had a 7.48 year life expectancy. The example further assumes a 40% estate tax rate.

Assuming 5% growth, if the client’s spouse dies during the third year after the RPM Trust was established, $2,231,018 of wealth would have been transferred to the Descendants Trust, resulting in $892,407 of estate tax being saved. Even if the client’s spouse died during the ninth year after the RPM Trust was established, which would be beyond her life expectancy, the technique would still transfer $1,110,769 of wealth, resulting in $444,308 of estate tax being saved.

Although the RPM Trust technique is not a planning technique that would be suitable for every client, for certain clients the technique can be a very effective way to transfer wealth to the client’s children or other descendants without utilizing any of the client’s lifetime gift tax exclusion. It is a more sophisticated technique which may be more difficult to explain to clients. Hopefully the discussion above and the attached slides will make the technique more understandable, so that you will then be more likely to utilize this technique with some of your clients.

Barry Nelson and Michael Sneeringer Review Barry Engel’s Amazing Asset Protection Planning Guide 3d Edition, a Leimberg Information Services Article

“Barry Engel’s Asset Protection Planning Guide is a comprehensive treatise that provides examples, citations and resources for estate planning and asset protection practitioners. The 800 plus pages of information serve as a quick desk reference for the experienced practitioner, as well as introduction for the novice practitioner seeking to learn the complex concepts of domestic and international asset protection planning.”

In their commentary, Barry Nelson and Michael Sneeringer review the 3rd Edition of Barry S. Engel’s asset protection treatise, titled Asset Protection Planning Guide.

Barry A. Nelson, a Florida Bar Board Certified Tax and Wills, Trusts and Estates Attorney, is a shareholder in the North Miami Beach law firm of Nelson & Nelson, P.A. He practices in the areas of tax, estate planning, asset protection planning, probate, partnerships and business law. As the father of a child with autism, Mr. Nelson combines his legal skills with compassion and understanding in the preparation of Special Needs Trusts for children with disabilities. He is a co-founder and current Board Member of the Victory Center for Autism and Behavioral Challenges (a not-for profit corporation) and served as Board Chairman from 2000-2008. A Fellow of the American College of Trust and Estate Counsel, he served as Chairman of its Asset Protection Committee from 2009 to 2012. As the Founding Chairman of the Asset Preservation Committee of the Real Property, Probate and Trust Law Section of the Florida Bar, he introduced and coordinated a project to write a treatise authored by committee members entitled Asset Protection in Florida (Florida Bar CLE 2008, 3rd Edition 2013) and wrote Chapter 5 entitled “Homestead: Creditor Issues.” Barry is a past President of the Greater Miami Tax Institute.

Michael A. Sneeringer is an associate in the North Miami Beach law firm of Nelson & Nelson, P.A. He practices in the areas of estate planning, probate administration, tax and asset protection planning. He was recently awarded a fellowship by the Real Property, Probate and Trust Law Section of the Florida Bar.

Here is their commentary:

EXECUTIVE SUMMARY:

Barry Engel’s “Asset Protection Planning Guide” (the “Guide”) is a comprehensive treatise that provides examples, citations and resources for estate planning and asset protection practitioners. The 800 plus pages of information serve as a quick desk reference for the experienced practitioner, as well as an introduction for the novice practitioner seeking to learn the complex concepts of domestic and foreign asset protection planning.

FACTS:

Denver, Colorado attorney Barry S. Engel, founding principal of the law firm of Engel & Reiman pc, released the 3rd Edition of his asset protection treatise titled “Asset Protection Planning Guide”. Published in November 2013 by Wolters Kluwer (CCH), the Guide’s contributing authors are also attorneys at Engel & Reiman pc: John R. Garland (a principal); Edward D. Brown (a principal) and Eric R. Kaplan (a senior associate). Over the Guide’s 800 plus pages, Engel explains the “integrated estate planning process” (“IEP”) with a focus on the asset protection component of IEP. The Guide is divided between Planning Materials (approximately 550 pages) and Practice Tools (approximately 200 pages).

The Guide begins with a general overview: frequently asked questions about what asset protection is and how it works. The rest of the Guide explains in depth, with examples, numerous asset protection techniques. Among the topics covered are the following:

·Fraudulent transfers;

·Gifting;

·Joint or concurrent ownership;

·Exemptions;

·Foreign insurance and annuities;

·Domestic insurance;

·Family limited partnerships and LLCs;

·Domestic trusts;

·Foreign trusts;

·A comparison of state law and foreign law on trusts;

·Choice of law and conflict of law issues;

·Other foreign-based planning tools;

·Expatriation;

·Protection of retirement benefits;

·Ethical, civil and criminal considerations;

·Contempt of court principals;

·Trust litigation; and

·Asset protection for an operating business

COMMENT:

The Guide’s audience is both experienced and novice asset protection planning attorneys. Anybody currently practicing related areas such as “estate planning,” “business planning” or “planning for professionals” should consider the Guide. For ordering and other information, click here.

For the novice asset protection planning attorney, the key is that the text itself is 556 pages while the “Practice Tools” is 246 pages. What Engel is able to do is concisely form a basis for what asset protection planning tools are out there, what tools Engel favors the most, and what cases and statutes are out there that will affect the planning described in the Guide.

The novice could essentially read the Guide over a long weekend or a vacation and instantly learn a whole host of issues and ideas that he or she can integrate into a solo practice or bring to the table at a large firm. What Engel also generously does is provide sample planning materials in the “Practice Tools” section. For example, the Guide includes: (i) solvency; (ii) testamentary powers of appointment; (iii) fee agreements; and (iv) Alaska Perpetual Family Trusts, among others. Attorneys often struggle to find “sample forms” and the Guide includes a variety of documents common to an asset protection practice.

The Guide has many resources for the experienced asset protection planning attorney, especially in a field where laws change frequently. The Guide addresses planning with assets exempt from creditors’ claims, use of LLCs and partnerships to provide charging lien protection, homestead and use of spendthrift and discretionary trusts, domestic and foreign.

Engel provides case summaries throughout the Guide through 2013. The case summaries provide an experienced asset protection attorney with issues he or she may have missed over the years, and the novice asset protection attorney with examples of effective planning and planning that was ineffective.

Engel provides examples of how his clients fared where his asset protection planning was challenged. Engel’s experiences serve as a reminder that asset protection attorneys should plan as if one day planning may be challenged, and if so, describe an example of what a client may expect if asset protection is challenged.

Engel’s unique approach is exemplified by his “Ladder of Asset Protection Tools” (the “Ladder”) and his “Maxims of Asset Protection Planning” (the “Maxims”). The Ladder is unique in that it serves as Engel’s opinion as to a rank of the planning techniques discussed in the Guide. The Ladder, which is introduced in the first Chapter, provides a roadmap for the reader to locate the chapters most relevant to the matter under consideration and then integrate the techniques into the client’s comprehensive estate and asset protection planning.

While the Ladder may be an effective aid for the novice, the experienced asset protection attorney can compare his or her techniques with Engel’s suggestions to potentially enhance even an experienced planner’s repertoire. The Maxims are also geared more toward the novice asset protection attorney. However, for an experienced asset protection attorney, they provide what would look to be an excellent guide for discussion with new clients in that they summarize what the attorney (and client) should hope to get out of embarking on asset protection planning.

Among the unique areas covered in the first portion of the Guide are expatriation as an estate planning tool and trust litigation issues. The Practice Tools include uniform acts, flowcharts of domestic and foreign possible structures, sample clauses, relevant tax forms, and more. The Guide also includes a number of charts comparing state exemptions (such as charging orders by state, homestead exemptions with reference to state laws and life insurance exemption amounts).

Asset protection planning is driven by applicable state statutes and we reviewed with interest the author’s review of Florida homestead provisions. The Guide provided a rather thorough analysis of Florida law and addressed some of the finer points that are difficult with a multi-jurisdictional resource reviewing applicable state laws. In addition, the Guide cited a recently filed lawsuit in South Florida that has yet to be decided, but is an excellent example of making large gifts to a spouse as part of an asset protection plan.

Engel’s Guide is an effective resource for the seasoned and novice estate and asset protection planner. It covers a wide variety of existing techniques and is likely to be a helpful resource at a reasonable price.

We thank Steve Leimberg of Leimberg Information Services for allowing us to reprint this article for Thursday Report readers. Click here to visit Leimberg Information Services.

Seminar Announcement – Jonathan Blattmachr and Brandon Centula of Alaska Trust join Alan Gassman for a Double Header Free Webinar on Tuesday, August 12, 2014 at 12:00 p.m.

While almost every estate and tax lawyer knows who Jonathan Blattmachr is and has benefited from his ideas and guidance, Brandon Cintula is a very well-kept secret known only to those of us who have had the opportunity to work with him at Alaska Trust Company. Brandon has more knowledge and hands-on trust drafting assistance experience than any other trust officer we have ever worked with.

Please do not miss this lively and interactive discussion.

To register for the webinar please click here.

Is Estate Tax Repeal a Shakedown?, an article by Denis Kleinfeld

While Denis Kleinfeld is well known as a Miami based estate planning and international tax lawyer, many people are not aware that Denis is a co-author of the two volume treatise “Practical International Tax Planning”, and a Professor at Thomas Jefferson School of Law in San Diego, California.

Many people think that the latest Republican attempt to repeal the estate tax is merely a political ploy. After all, there is an up-coming election to be won.

If there is one thing politicians of all persuasions know is that they need money to win elections. Playing well-heeled competing interests off each other is a sure-fire way to generate lots of campaign contributions.

Let’s all understand this. Congress created the estate tax game and set the rules. Keeping the game alive, pitting one side against the other, changing the rules as needed to keep things at a fervor pitch is crass, but it keeps the money rolling in.

On one side of the field are the taxpayers who realize that a life time of hard-work can be expropriated by the government and there is little they can do about it. Essentially, during life you are married to the government and like a dutiful spouse pay over half your earnings. At death, the government treats it like a divorce and you pay over half of what’s left as a property settlement.

On the other side is the entire estate tax planning industry that finds their work highly financially rewarding even if not exactly personally fulfilling. It’s a vast array of professional service providers who depend on the complexity and indecipherability of the tax law to maintain their necessity.

It is a lot of brainpower and talent which could be more useful doing something far more constructive for society. Something like focusing on the real human and financial problems that occur to families and businesses when someone dies, without being distorted by tax considerations, would exceed useful and desirable.

Is the estate tax of any real benefit to the government? Not really. It raised just $13.7 billion last year. It is such a tiny fraction of the federal tax revenues it is virtually statistically insignificant.

The Congressional Joint Committee on Tax has issued numerous reports over the years that state that the estate tax is actually a net revenue loser for the government. Because all estates, taxable or not, step the basis of the estate assets up to fair market value, the loss in income tax is far greater than the estate tax received.

Supporters of estate tax claim it is necessary because it keeps wealth from accumulating in too few hands. This is the class warfare school of logic.

The opposite happens because there is an estate tax.

Larger taxable estates use tax-exempt foundations, controlled in perpetuity by a select few, to not only hold wealth but also avoid both the estate tax and the income tax to keep on accumulating more wealth.

A typical estate planning technique is for a business or appreciated investments to be gifted to a charitable remainder trust. That generates an income tax deduction. The income tax savings then are used to fund a wealth replacement trust which buys life insurance. In the meantime, assets gifted to the trust can be sold without incurring a capital gains tax.

At death, the insurance usually pays off in an amount which is a multiple of the amount which eventually goes to the charity. The charity getting the remainder of the trust is many times the family’s own private tax-exempt foundation run by the heirs.

Will all these intricate and complicated estate tax planning schemes continue to be necessary? The answer to that question will only be revealed after the coming election.

In the meantime, those running for Congress will expect the estate tax adversaries to keep the campaign contributions coming.

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 4

The July 24 edition of the Thursday Report discussed cases and situations where courts have allowed planning actions finalized shortly before a bankruptcy to stand and not be considered “fraudulent transfers” when clearly performed for business or planning purposes, notwithstanding prejudice to creditors. To view the July 24 Thursday Report please click here.

This week we continue with our discussion on limiting risk and deciding if and when to ever file a bankruptcy, limiting risk, and fraudulent transfers.

LIMITING RISK:

For many clients, there is no need to file a voluntary petition: Their asset protection plan provides enough creditor protection and the non-bankruptcy forum appears to be more debtor-friendly since there are no “strong arm” powers such as the ones provided to a bankruptcy trustee. Outside of bankruptcy, there is no trustee and no strong-arm powers with which to contend.

When an estate planning strategy is put into place; the estate tax, income tax, and financial and family advantages of the arrangement should be emphasized. While important, creditor protection should not be the primary reason of an estate-planning strategy. Rather, estate tax, income tax and other financial considerations should be the motivating factors. For example, if a family were to choose between having an offshore protection trust or a domestic FLP to hold significant long-term assets, the FLP may be more desirable, if discounts for tax purposes, greater control, and expense are important considerations.

On the other hand, offshore asset protection trust arrangements may be more advantageous when there are significant business reasons for their use. For example, if there are family marital agreements in place in which each spouse agrees to allow premarital assets to be held in offshore trusts. Such agreements may provide to hold such assets in jurisdictions that clearly uphold separate non-marital asset rights, and to resolve any dispute under the law of a jurisdiction that protects such premarital assets. Other examples are longer or eliminated perpetuity statutes, and the ability to use in terrorem clauses.

Also, it is common for non-U.S. clients to want their assets held in a jurisdiction that allows free movement between the country where many of their relatives reside, and the jurisdiction where some portion of their wealth is held. An example would be clients who have relatives that they support or may need to support in the future.

One author has also recently found that many spouses holding significant tenancy by the entireties assets want “contractual assurances” from a surviving spouse that the assets will not be mishandled or lost to a creditor of the surviving spouse. Married couples may choose to execute agreements whereby the surviving spouse agrees to immediately fund and become co-trustee of a trust established in a “creditor protection trust” jurisdiction.

Clients who have offshore asset protection trust motivation factors, and particularly those who live in states that provide protection for the “cash value” of life insurance policies, also should consider offshore life insurance arrangements that can facilitate holding the underlying policy investments in favorable jurisdictions while offering income tax avoidance under the life insurance provisions of the Internal Revenue Code. Annuity contracts with offshore life insurance companies are also a popular way of attempting to defer income tax on investments that cannot be held under U.S.-sponsored annuities because of insurance commissioner limitations that do not apply in offshore jurisdictions.

The age of the client, tax issues, current stage in life or business and family support factors are all important in fashioning and defending a legitimate plan. At every opportunity, the documents relating to the plan should contain “recitals” or specifically mention the non-creditor protection factors which result in the creation of the plan.

PAPER TRAIL

In defending any estate or asset protection plan, it is important to have a paper trail that justifies the estate-planning purposes behind the transfers. Again, assuming that the timing is in favor of the debtor, documentation that proves adequate and reasonable non-creditor planning purposes for the transfers may provide a bankruptcy judge with sufficient ammunition to defeat efforts by a bankruptcy trustee to enforce a claim against the protected assets. For instance, if a debtor’s medical condition is one factor that supports an estate or asset protection plan, it is wise to document the debtor’s health and include letters from treating physicians.

LLCS AND FLPS

Limited liability companies (LLCs) and FLPs―integral parts of many estate plans―are popular vehicles to hold valuable family assets. Indeed, typical estate and gift tax planning recognize the advantage of discounting that can occur for gift tax purposes, and transfer partial interests in an LLC to family members and or trusts for their benefit.

There are some state statutes that limit creditors of a debtor-limited partner. For example, Florida Statute Section 608.433(4) safeguards the membership interest of an LLC owner or member by limiting creditors of a debtor-limited partner to a “charging order.” A charging order provides the creditor with the right to receive any distributions that may be paid to the debtor-limited partner, but does not allow the creditor to exercise any rights otherwise held by the limited partner.

A charging order may turn the creditor into a partner for federal tax purposes, although the tax law is not clear on this. The one Revenue Ruling reaching this result involved a situation where the debtor-limited partner voluntarily gave the creditor an assignment of the limited partnership interest. Many authorities believe that a creditor will not be subject to federal income tax by reason of merely holding a charging order.[1] If income is allocated but not distributed, then the creditor has the risk of being taxed on income that is never received.

One suggestion is to make an LLC or limited partnership agreement impose affirmative obligations on members and partners to make future capital calls and to be involved in partnership management.[2] This conclusion is based upon the Bankruptcy Court decision in Ehmann,[3] where a bankruptcy judge concluded that charging order protection does not apply once a limited partnership interest is subjected to the Bankruptcy Court’s jurisdiction when the debtor-limited partner has filed or has been forced into bankruptcy if the partnership arrangement is non-executory. If executory, a trustee is bound by the operating agreement. LLC and FLP agreements should state that they are intended to be executory contracts, that is to say, a contract in which obligations exist on both sides that are unperformed.

There is very little case law addressing the question of whether a limited liability company’s operating agreements are an executory contract . . . although the Bankruptcy Code does not define the term “executory contract,” legislative history and case law cite with approval Professor Vern Countryman’s definition: “a contract under which the obligations of both the bankrupt and the other party to the contract are so far unperformed that the failure of either to complete performance would constitute a material breach excusing performance of the other.” Vern Countryman, Executory Contracts in Bankruptcy: Part 1, 57 Minn.L.Rev. 439, 460 (1973). However, in In re Warner, the Bankruptcy Court held that operating agreements do not qualify as an executory contract.[4]

Where a debtor is a limited partner in a limited partnership with no affirmative duties to the partnership, the contract may be considered non-executory, and thus not binding upon the trustee in bankruptcy. On the other hand, if a debtor, as limited partner, has affirmative duties to contribute money and to perform services for the partnership, then the partnership agreement may be considered executory, and may, therefore, receive charging order protection in bankruptcy.

Moreover, LLC members and FLP partners should assume an active role in the management of the entity. Changes to the limited partnership statutes in many states permit participation of limited partners in the management of the entity with loss of limited liability.[5]

Another suggestion made in the article is to include contractual provisions which are authorized by state statute to require the consent of the remaining members when one member seeks to transfer a membership interest.

Another example of bankruptcy court “interjection” in this area is the case of In re Ashley Albright,[6] where a Colorado bankruptcy court held that the trustee in bankruptcy, as the successor of the LLC that had been owned by a debtor, had the ability to provide consent to the transfer of member interest in a single-member LLC, and could therefore exercise management control over the LLC and liquidate the assets of the LLC to realize the value as the sole member. The bankruptcy judge concluded that the purpose of the Colorado charging order statute was to protect other members, even though the language of the statute itself had no mention of the charging order protection only applying in a multiple member situation.

We suggest that an LLC have multiple members, so that if one member ends up in bankruptcy, the presence of other members (hopefully) could strengthen the possibility of applying charging order protection.

Finally, given the discounting that can occur for gift tax measurement purposes, it will often be inconsistent with normal estate and gift tax planning not to transfer partial interests in an LLC to family members and/or trusts for their benefit.

FRAUDULENT TRANSFERS

A fraudulent transfer is defined under the Bankruptcy Code as a transfer that can be avoided by a trustee if the transfer was made with (1) the intent to actually defraud, hinder and delay creditors or (2) in exchange for less than reasonably equivalent value while the debtor was insolvent.[7]

A fraudulent transfer also can be found to have occurred when a debtor has assumed a creditor’s obligation instead of making a transfer. If a debtor makes a transfer to a creditor and does not receive equivalent value,[8] a fraudulent transfer exists if

- the debtor’s business (or impending business) held assets unreasonably low in value;

- the debtor incurred or believed it would incur debts beyond what the debtor could repay; or

- at the time of the transfer, the debtor was either already insolvent or became insolvent as a result of the transfer.

There is a popular misconception that a “fraudulent transfer” is a transfer that involved defrauding one or more creditors in the bankruptcy court. Under debtor-creditor law, the term “fraudulent transfer” means a transfer made for the purpose of avoiding creditors, or in a situation where the transferor is undercapitalized when business operations and potential risk relating thereto is taken into account. This is certainly different than “committing fraud,” which occurs when one party actively misleads another party.

Committing a “fraudulent transfer” in the debtor-creditor law context is generally not a crime, although some states have passed bar rules that prevent lawyers from being integrally involved in helping or advising clients to effectuate fraudulent transfers,[9] even though it may be unconstitutional, and seems at least distasteful by many to prohibit lawyers from advising their clients to take actions that are in the client’s best interests. At the least, a client has the right to know all potential actions and potential implications thereof.

A recent case involved an attorney having to pay for the transfer he made on behalf of a client. Harwell establishes that a lawyer may be held liable for disbursing funds in the way a client wishes, if they are being disbursed with the intent to defraud creditors.[10] The bankruptcy trustee tried to recover the funds under 11 U.S.C. § 550(a)(1) claiming the attorney was the initial transferee.[11] Eventually, the bankruptcy court held the attorney was the initial transferee and was liable to the trustee for the funds.

Some transfers that are intended to defeat creditors may be illegal, such as transfers intended to evade collection of taxes by the Internal Revenue Service, under Internal Revenue Code Sections 7206(4) and 7201.[12]

Any person who 1) conceals a debtor’s assets, 2) receives the debtor’s assets fraudulently, or 3) transfers or conceals assets on behalf of a corporation intending to defeat the Bankruptcy Code will find himself, and possibly his lawyer, in prison for up to five years.[13] Take for instance U.S. v. Smithson,[14] in which the debtor and his lawyer were both convicted and served jail time for a transfer made two days before filing bankruptcy.

Prosecutors also apply 18 U.S.C. Section 371, which prohibits individuals from committing fraud on the United States. The government must prove

1) an agreement between two people,

2) a scheme to defraud the United States, and

3) an overt act committed in furtherance of the agreement.[15]

An attorney was convicted of conspiring to transfer the assets of one corporation to another in contemplation of bankruptcy under both 18 U.S.C. Section 371 and Section 152.[16] There, the attorney counseled the client to transfer some of the corporation’s inventory to another company and then auction off the rest of the company’s assets. The attorney, Switzer, set up the transactions and prepared confessions of judgment for some favored creditors. The transaction took place prior to the judicial sale for the trustee in bankruptcy’s benefit. The Switzer’s conviction was upheld on appeal because he was found to have attempted, through his advice and participation in the transactions, to defeat the bankruptcy statutes, and thereby defraud the United States of the client’s assets in bankruptcy.

_________________________________

[1]812-2nd Tax Mgmt. Est., Gifts & Tr. J. IX.D.2 (2006).

[2]See Thomas O. Wells & Jordi Guso, Business Law: Asset Protection Proofing Your Limited Partnership or LLC for the Bankruptcy of a Partner or Member, 81 Fla. Bar J. 34 (2007).

[3]This decision was subsequently vacated when the parties settled and the Court approved same. See Movitz v. Fiesta Investments, LLC, 337 B.R. 228 (Bank. D. Ariz. 2005).

[4]480 B.R. 641 (Bankr. N.D.W. Va. 2012). An article about this case can be found here: http://www.llclawmonitor.com/tags/executory-contract/

[5]See, Thomas O. Wells & Jordi Guso, Business Law: Asset Protection Proofing Your Limited Partnership or LLC for the Bankruptcy of a Partner or Member, 81 Fla. Bar J. 34 (2007).

[6]291 B.R. 538 (Bankr. D. Co. 2003).

[7]11 U.S.C. Section 548(a)(1) (2007).

[8]Value is defined in 11 U.S.C. Section 548(d)(2)(a) as property, or satisfaction or securing of a present or antecedent debt of the debtor. Thus, a promise to remain employed does not satisfy this definition and is not enough to prevent a fraudulent transfer.

[9]See, for example,Connecticut Informal Opinion 91-23-: “A lawyer may not counsel or assist a client to engage in a fraudulent transfer that the lawyer knows is either intended to deceive creditors or that has no substantial purpose other than to delay or burden creditors.” The opinion went on to say that the determining factor of impropriety was whether the lawyer knew that the transfer was intended to deceive, embarrass, delay or burden a creditor. But see South Carolina Bar Ethics Advisory Opinion 85-02, which specifically held that it was ethical for an attorney to transfer a client’s assets to protect against the potential claims of future creditors. There, the Committee held that if there was no immediate reasonable prospect of judgment against the client, to transfers to avoid future creditors was not a violation of the ethics code.

The Florida Supreme Court in the case of Freeman v. First Union Nat’l Bank, 329 F.3d 1231 (2003), held that Florida’s fraudulent conveyance statute is only a creditor collection tool and is not a basis for damage claims against nontransferees such as third-party financialconsultants or legal advisors.

[10]Harwell Trans. at 24:23-25:4 (M.D. Fla. Nov. 20, 2012). The attorney in question was representing his client in two separate matters, a shareholder dispute and a judgment entered in Colorado. The first matter resulted in the client receiving a substantial settlement from a shareholder dispute action that was to be deposited into an escrow account held by the attorney’s firm. The second matter was a judgment entered against the client for over one million dollars. Neither the client nor the attorney revealed to the party which held the million dollar judgment that the client was receiving settlement payments. Instead of satisfying the existing million dollar judgment, the client instructed the lawyer to disburse the funds to third parties which included the client’s wife, father, and other various people. The attorney followed the client’s instructions with the knowledge that there was this substantial judgment in place.

[11]Section 550(a)(1) states: (a) Except as otherwise provided in this section, to the extent that a transfer is avoided under section 544, 545, 547, 548, 549, 553(b), or 724(a) of this title, the trustee may recover, for the benefit of the estate, the property transferred, or, if the court so orders, the value of such property, from– (1) the initial transferee of such transfer or the entity for whose benefit such transfer was made; (2) any immediate or mediate transferee of such initial transferee

[12]Fines in the amounts of not more than $100,000 ($500,000 for corporations) and not more than 3 years in prison or both. See U.S. v. Hook, 781 F.2d 1166 (6th Cir. 1986), in which the court affirmed appellant’s conviction under IRC Section 7201 for concealing assets from the IRS, by forming a corporation to hold stock and automobiles with his wife and daughter as the sole shareholders. He also conducted other transactions not in compliance with the tax code. In dicta, the court also discussed the effect of Section 7206(4) providing that any attempt to conceal assets after a tax assessment, notice and demand of payment, and refusal to pay is a felony under that statute. This case effectively states that some transfers and transactions intended to conceal assets for tax purposes prior to a tax deficiency assessment will be illegal under IRC Section 7201, and that any transfer or concealment of assets after an assessment will be illegal.

[13]18 U.S.C. Section 152. Punishment includes fines and/or up to 5 years in prison.

[14]49 F.3d 138 (5th Cir. 1995). The case was remanded for re-sentencing.

[15]18 U.S.C. Section 371 (2007).

[16]U.S. v. Switzer, 252 F.2d 139 (2nd Cir. 1958).

Thoughtful Corner – If Your Life is a Treadmill This Will Fit You Perfectly

We purchased a Lifespan TR 5000 DT Treadmill. It has a 3-1/2 by 6 foot table that is very stable and also rises up or goes down by switch so that you can put your elbows on it to have a firm hold.

The maximum speed is 4 mph, which is 15 minute miles and requires a jog.

It is comfortable to walk at 3 miles an hour while reviewing documents, marking them and dictating changes.

The ability to walk 3 miles a day while also having uninterrupted time to review documents and draft revisions has been fantastic.

6 of our employees have been on the treadmill so far, and we anticipate purchasing a second one as others try and become quite happy with the reduction in stress, increase in burned calories, and enhanced concentration that being at a higher than stationary heart rate provides.

One team member walked 6.2 miles while doing routine paperwork last Thursday and felt that his powers of concentration and stress levels were greatly enhanced. Try it, you’ll like it!

Upcoming Seminars and Webinars

FREE LIVE WEBINAR:

A POWERFUL 40 MINUTE DOUBLE HEADER WITH JONATHAN BLATTMACHR AND BRANDON CINTULA

Topics:

- Foreign vs. Domestic Asset Protection Trusts: More Than Just Creditor Protection Considerations

- Empowering Your Powers of Appointment: Don’t Leave Out Important Tax and Practical Provisions or Ignore Important Considerations. With Sample Provisions

Date: Tuesday, August 12, 2014 | 12:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE ISLE OF MAN PRESENTATION:

Alan S. Gassman will be speaking on US TRUST AND TAX LAWS FOR INTERNATIONAL INVESTORS at Cayman National Bank and Trust Company on the Isle of Man

Sign up now and you will receive a free lunch! Transportation not included.

“Half-way between England

And Ireland in the Irish Sea.”

Is a great place to discuss trusts with glee.”

Date: Wednesday, September 3, 2014

Additional Information: If you would like to receive a copy of the materials that will be presented please email Janine Gunyan at janine@gassmanpa.com and we will send them to you once they are ready.

********************************************************

FREE LIVE WEBINAR:

Ken Crotty will be presenting a free live webinar entitled AVOIDING DISASTER ON HIGHWAY 709. The 50 minute guide to disaster avoidance with respect to gift tax returns. This webinar will qualify for 1 hour of CLE and CPE credit.

Date: Wednesday, September 3, 2014 | 12:30 p.m. (50 minutes)

Location:Onlinewebinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of TRUST PLANNING FROM A TO Z for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAS.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

FREE LIVE WEBINAR:

Attorney Leslie A. Share (not related to Sonny and Cher) will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES

Date: Thursday, October 23, 2014 | 8:00 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifing the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Seven Springs Gold and Country Club, 3535 Trophy Blvd, Port Richey, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information:For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

Notable Seminars by Others (We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.