The Thursday Report – 6.9.16 – Oshins, Ali, Gideon Rothschild, and Me

US v. Alexander – Federal Court Upholds Charging Order Protection – The Creditor was the United States Government

1202 Things to Consider When Setting Up a Related Business Servicing Company – Part 1 by Brandon Ketron, J.D., LL.M., CPA, and Alan S. Gassman, J.D., LL.M.

Remembering Muhammad Ali, a story from Zev Buffman

Event Spotlight: New Federal Medical Laws Webinar with Lester Perling and Alan S. Gassman

Richard Connolly’s World – The Future of Legal Research and Law School Admissions

Clause of the Week: Sponsored by the Alan Gassman Channel at InterActive Legal

Thoughtful Corner – Summer Reading List: Best Books for Financial Advisors by Michael Kitces

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Impossible is just a big word thrown around by small men who find it easier to live in the world they’ve been given than to explore the power they have to change it. Impossible is not a fact. It’s an opinion. Impossible is not a declaration. It’s a dare. Impossible is potential. Impossible is temporary. Impossible is nothing.”

-Muhammad Ali

I think that we will never again see,

An athlete like Muhammad Ali.

With a profound effect upon young and old,

For centuries, his stories will be told.

Without hesitation to make his own rules,

He surprised countless and exposed many fools

For his bravery in going out on a limb,

This Thursday Report is dedicated to him.

Last weekend, the world lost Muhammad Ali, the legendary boxer who was among the most beloved athletes and the most recognizable people on the planet. He was a three-time Heavyweight Champion boxer who proclaimed himself “The Greatest” and wanted to be remembered, as told in his book The Soul of a Butterfly: Reflections on Life’s Journey, as “a man who won the heavyweight title three times, who was humorous, and who treated everyone right…as a man who tried to unite all humankind through faith and love.”

US v. Alexander – Federal Court Upholds Charging Order Protection –

The Creditor was the United States Government

The United States government is often considered to be a “super creditor” that can override normal creditor exemption statutes and rights, like the Homestead Exemption, IRA exemptions, 529 Plans owned by the debtor, and others. Bankruptcy court decisions have determined, however, that charging order protection will still apply in the face of the super creditor challenges. This was confirmed in the recent Arizona federal court case of US v. Alexander, which is well-described by a June 1, 2016 Leimberg Asset Protection Planning Newsletter by our heroes Jay Adkisson and Steve Oshins, who wrote the following:

Why is this decision such a potential game-changer? The reason goes to a very simple question that creditors ask debtors at a debtor’s examination: ‘Where are you getting the money to live on?’ Far too often, this question has resulted in the deer-in-the-headlights look from the debtor, followed by the debtor telling porkies that later are used to the advantage of creditors in attacking the debtor’s veracity as to other matters. Now, a client who is receiving distributions from an LLC can answer quite truthfully and without benefiting the creditor, ‘From the 75% of my distributions that you can’t garnish!’

The holding in this Order was a welcome addition to asset protection planners in that it rationally interpreted the law. It is our opinion that Judge Campbell got this decision exactly right. Instead of looking at a wholly superficial distinction of such things as ‘distribution’ or ‘salary’ or ‘wages’, etc., Judge Campbell looked beyond the superficial legal characterization of ‘distributions’ to find that Alexander’s compensation (however defined) arose from the fruits of his labors, and were thus earnings for purposes of Arizona’s collection exemptions, and, by implication, the Federal Wage Garnishment Law.

You can read the entire newsletter by clicking here, and if you don’t subscribe to the LISI system, please consider a membership, which can be accessed by clicking here. We thank Steve Leimberg and his amazing team for everything they do to help those of us who practice in this area.

1202 Things to Consider When Setting Up a

Related Business Servicing Company – Part 1

by Brandon Ketron, J.D., LL.M., CPA,

and Alan S. Gassman, J.D., LL.M.

Some advisors are using or considering C corporation management companies, which are separate and apart from a medical, legal, CPA, or other practice, and can receive tax-deductible management fees that are then taxed at the level of the management company, which may be in a lower bracket. Under Internal Revenue Code Section 1202, such a company may be taxed as a C corporation and may liquidate later on a tax-advantaged basis.

What rules have to be followed in order to achieve this result or similar results that can apply anytime that a client or family’s business and investment arrangement can entail arm’s-length payments per services, leasing furniture, equipment, and otherwise?

This is not a widely addressed issue, and our newest lawyer, Brandon Ketron, J.D., LL.M., CPA, has worked extensively on the following explanation, which is Part 1 of a multi-part series called 1202 Things to Consider When Setting Up a Related Business Servicing Company.

We hope you enjoy it!

Part 1 – Requirements Under Section 1202

Section 1202 currently allows for a non-corporate stockholder to exclude either all or a significant portion of capital gain realized from the sale of stock in a qualified small business, so long as the stock is stock of a corporation with 80% or more of its assets being used in an active trade or business, and has been held for more than five years.[1]

An example of a Section 1202 arrangement would be a company independent from an existing business that would furnish legitimate services for that business on an arm’s-length basis and would receive net income and generate income of $50,000 a year, which would be taxed at the 15% bracket if the company is a C corporation in a state that does not tax C Corporations. Years later, this Section 1202 company might liquidate, and the shareholders would not pay capital gains tax.

General Requirements to Qualify for Section 1202 Gain Exclusion

In order to be eligible to exclude gain under § 1202, the taxpayer must meet the following requirements, each of which will be discussed in more detail below:

- Must be stock of a C-Corporation acquired after 1993.[2]

- Stock must have been acquired at original issue in exchange for money or other property, or as compensation for services performed for the corporation.[3]

- The Corporation must be a “qualified small business” immediately before and immediately after the issuance of stock.[4]

- During substantially all of the taxpayer’s holding period, the Corporation meets the active trade or business requirements of 1202(e).[5]

- The qualifying stock must be held for more than five years.[6]

A. Stock of a C-Corporation Requirement

In order to qualify for the exclusion, the stock must be stock of a C-Corporation.[7] Interests in S-Corporations, Partnerships, or LLCs will not qualify for this exclusion. Also, in order to qualify, the C-Corporation must be an eligible corporation defined in Section 1202(e)(4). An eligible corporation is any domestic corporation except for:

- A DISC (“domestic international sales corporation”) or former DISC;[8]

- A corporation with respect to which an election under Section 936 is in effect or which has a direct or indirect subsidiary with respect to which an election is in effect;[9]

- A regulated investment company (RIC), real estate invest trust (REIT), or a real estate mortgage investment conduit (REMIC);[10] and

- A cooperative.[11]

B. Original Issuance Requirement

In order to be eligible for gain exclusion, the stock of the C-Corporation must have been acquired at “original issue” (directly or through an underwriter) in exchange for money or other property, or as compensation for services performed for such corporation (other than services performed as an underwriter of such stock.)[12] If the stock is acquired through the exercise of options or warrants, or through the conversion of convertible debt, it is also treated as acquired at original issue according to legislative history reports.[13] Additionally, the stock must have been acquired after 1993, which is the date of the enactment of this provision under the Revenue Reconciliation Act of 1993.[14] The exclusion is not limited to the C-Corporation’s initial stock offering, but it can also apply to any subsequent issuance of stock so long as the requirements of § 1202 are met.

The C-Corporation also may not redeem its stock within a specified time period, which was enacted to prevent manipulation of the above rules.[15] Section 1202(c)(3) provides that stock acquired by the taxpayer is not treated as qualified small business stock (QSB) if the issuer purchased stock from the taxpayer or a person related to the taxpayer (within the meaning of § 267(b) or 707(b)), at any time during the four-year period beginning two years before the issuance of the stock. Additionally, stock issued by the C-Corporation will not be QSB stock if, during the two-year period beginning on the date one year before the issuance of such stock, such corporation made one or more purchases of its stock with an aggregate value exceeding 5% of the aggregate value of all of its stock as of the beginning of such two-year period.[16]

If QSB stock in one corporation is exchanged for stock in another corporation through a § 368 reorganization, or a § 351 transaction, and the new/acquiring corporation is also a QSB, the stock will continue to be treated as QSB stock.[17] However, if the new/acquiring corporation is not a QSB, then the new stock is treated as QSB stock only to the extent of the gain that would have been recognized at the time of the Section 368 or Section 351 transaction if the original QSB stock had been sold in a taxable transaction.[18]

The QSB stock may also be held by a partnership, LLC, S Corp, regulated investment company, or any common trust fund and satisfy the original issue requirement.[19] The gain is passed through the entity to the individuals of the partnership. In order to be eligible to exclude gain from the sale of QSB by a partnership:

- The gain must be attributable to the partnership’s sale or exchange of stock, which is QSB stock in the hands of the partnership.[20]

- Held by the partnership for five or more years.[21]

- The individual taxpayer must have held an interest in the partnership on the date the partnership acquired the QSB stock and at all times thereafter until the partnership disposed of its QSB stock interest.[22]

If the above conditions are met, the taxpayer must treat the gain as a disposition of stock in the corporation issuing the stock disposed of the partnership, and the taxpayer’s basis in the corporation’s stock includes the taxpayer’s proportionate share of the partnership’s adjusted basis in the corporation’s stock.[23]

Stay tuned for Part 2 of this series, where we will discuss the Qualified Small Business Requirement, the Active Business Requirement and the Five Year Holding Period Requirement under Section 1202.

*******************************************

[1] See generally IRC § 1202.

[2] IRC § 1202(c)(1).

[3] IRC § 1202(c)(1)(B).

[4] IRC § 1202(c)(1).

[5] IRC § 1202(c)(2)(A).

[6] IRC § 1202(b)(2).

[7] IRC § 1202(c)(1).

[8] IRC § 1202(e)(4)(A); See IRC § 992(a) for the definition of a DISC

[9] IRC § 1202(e)(e)(B).

[10] IRC § 1202(e)(4)(C).

[11] IRC § 1202(e)(4)(D).

[12] IRC § 1202(c)(1).

[13] David B. Strong, Section 1202: Qualified Small Business Stock available at http://www.mofo.com/files/Uploads/Images/110811-Section-1202-Qualified-Small-Business-Stock.pdf (August 11, 2011) citing House of Representatives Report of the Committee on the Budget to Accompany H.R. 2246, Report No. 103-111, 1993-3 C.B. 163 (July 1993), accompany the Omnibus Budget Reconciliation Act of 1993, which ultimately added Section 1202 to the Code.

[14] IRC § 1202(c)(1).

[15] Supra note 13.

[16] IRC § 1202(c)(3)(B).

[17] IRC § 1202(h)(4).

[18] Id.

[19] See generally IRC § 1202(g).

[20] IRC § 1202(g)(2)(A).

[21] Id.

[22] IRC § 1202(g)(2)(B).

[23] IRC § 1202(g)(1)(B).

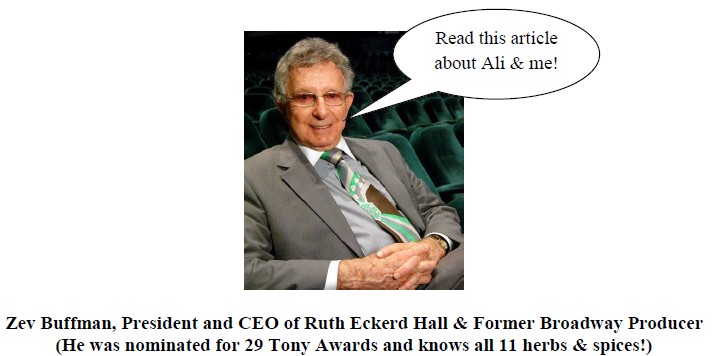

Remembering Muhammad Ali, a story from Zev Buffman

Muhammad Ali died last weekend after a 32-year fight with Parkinson’s disease, and, after his passing, our friend Zev Buffman shared the following article with us about his experience with the boxing great. To read the Thursday Report’s Wikipedia write-up of Zev Buffman, please click here.

When Muhammad Ali Made His Broadway Musical Debut

by Patrick Pacheco

When “Buck White,” a musical by Oscar Brown, Jr. and produced by Zev Buffman, opened on Broadway in December of 1969, there were picketers protesting outside the theater while the mood inside was tense and uncertain.

The reason: the show marked the stage debut of Muhammad Ali, in the title role of a political black activist and messiah who’d come to free his people of their slave legacy.

The run of “Buck White” on Broadway was brief, only seven performances, and served as little but a theatrical footnote in the colorful and heroic life of Ali, who died on June 3 at the age of 74. The effusive tributes and remembrances that poured in from around the world marked the passing of an American original who brought a distinctively theatrical passion to everything that he did inside and outside the ring. Indeed, it was what had made the sports legend such a beloved figure.

Ali, however, was far from beloved when, in early 1969, Buffman suggested the idea of the athlete starring in a Broadway musical. Two years earlier, the heavyweight champion, then a follower of the Nation of Islam, had taken a principled religious stand not to be inducted into the military and was not only stripped of his boxing titles, but also convicted for his pacifist refusal. His anti-war stance alienated a large segment of the American public, then in the midst of the punishing conflict in Vietnam.

Buffman, reached at his home in Florida, recalled, “We all knew that Ali’s participation in ‘Buck White’ could lead to some backlash, but for the first time in my life, I received death threats, we had to rehearse the show at a secret location, and I had to engage a security detail.”

The very idea of a boxer making a musical Broadway debut might have struck anyone else as somewhat outlandish. But Buffman was then a bold and maverick producer who’d presented Dustin Hoffman in “Jimmy Shine” and had a hit with the rock musical, “Your Own Thing.” In late 1968, he also produced an off-Broadway drama, “Big Time Buck White” by Joseph Dolan Tuotti, which had been inspired by the Los Angeles Watts riots in 1965. During its run at the 99-seat theater, the cast had a frequent visitor: Muhammad Ali.

To read this article in its entirety, please click here, and thank you to Zev Buffman for sharing this story with us.

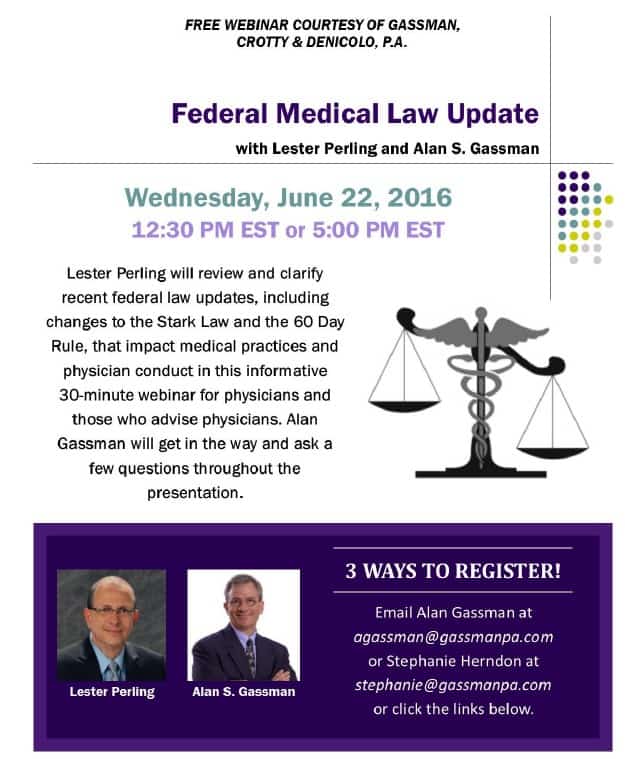

Event Spotlight:

New Federal Medical Laws Webinar

with Lester Perling and Alan S. Gassman

To register for the 12:30 PM presentation, please click here.

To register for the 5:00 PM presentation, please click here.

.

Richard Connolly’s World

The Future of Legal Research and Law School Admissions

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Law Firm BakerHostetler Hires a ‘Digital Attorney’ Named ROSS” by Amit Chowdhry. This article was featured on Forbes.com on May 17, 2016.

Richard’s description is as follows:

Lawyers at the larger firms usually have to deal with long work hours, few vacations, and difficulties in achieving a fair work-life balance. And the entry level workers at law firms typically spend hundreds of hours sifting through thousands of precedents and articles to prepare for cases. BakerHostetler, an Ohio-based law firm founded in 1916, is taking an innovative approach to make life easier for its employees by hiring a robotic legal researcher called ROSS.

ROSS was built on IBM Watson, a cognitive system that can answer questions in natural language. ROSS will be able to quickly respond to questions after searching through billions of documents. Lawyers can ask ROSS questions in plain English such as ‘what is the Freedom of Information Act?’ and ROSS will show users what the citations are for its responses. The more ROSS is used by lawyers, the more it improves its responses. If the laws change, then ROSS will be able to track whether it affects the case. Essentially, lawyers will be able to avoid some of the mundane tasks in favor of being able to focus on the nitty gritty aspects of each case.

Please click here to read this article in its entirety and see some screenshot photographs of the results ROSS produces.

The second article of interest this week is “Arizona Law Faces Fight Over LSAT Policy” by Jacob Gershman. This article was featured in The Wall Street Journal on April 30, 2016.

Richard’s description is as follows:

A top-tier law school’s decision to make the Law School Admission Test (LSAT) optional has put it on a collision course with the powerful national non-profit group that administers the exam and controls much of the law-school application process nationwide.

University of Arizona College of Law has started allowing applicants to take the Graduate Record Examination (GRE) test in lieu of the LSAT, a move the school hopes will expand and diversify the pool of students considering enrolling.

LSAC’s general counsel in April notified Arizona Law that the school’s new policy may violate its bylaws, which require that “substantially all of” a law school’s applicants take the LSAT.

The group is considering expelling Arizona Law from its membership, which would effectively cut off the school’s access to a crucial student admissions pipeline.

Please click here to read this article in its entirety.

Clause[s] of the Week:

Sponsored by The Alan Gassman Channel at InterActive Legal

Today’s featured clauses come from the “Revocable Trust Provisions You Should Be Using (or at least Considering)” section of the Legal Provisions Collection on The Alan Gassman Channel at InterActive Legal. For more information about The Alan Gassman Channel at InterActive Legal, please click here and visit https://legalexpertchannels.com/ to register.

1. Trustee to Not Permit Beneficiaries to Become “Trust Dependent”:

Except, and to the extent that, a Trust beneficiary other than the Grantor’s spouse has a bona fide physical or mental disability preventing the Trust beneficiary from being a productive member of society, it is my desire that no Trust beneficiary who is a descendant shall become “trust dependent” or otherwise induced or encouraged by the availability of “easy money,” to not have a work ethic, to not contribute appropriately to society, to not work, to not raise their family, to not teach appropriate ethical and economic values to their descendants and loved ones, to not be rewarded for inactivity, to not be habitually dishonest, and to not lead a non-productive life in regard to society or the Trust beneficiary’s family. Each of the aforementioned negative characteristics shall be considered as signs that a beneficiary is “Trust dependent.” If a beneficiary becomes “Trust dependent,” the Trustee is encouraged to withhold distributions to such Trust beneficiary on a permanent or temporary basis at the discretion of the Trustee until the Trustee determines that such Trust beneficiary is no longer “Trust dependent.”

2. Trustee to Require Beneficiaries to “Live Like Students” Until They Complete Their Education:

It is my intention that any beneficiary with reasonable aptitude and ability should obtain a reasonable education, including college and graduate school, and have a career or productive child-raising or full-time vocational or professional job or occupation before receiving substantial benefits, and therefore request that trust benefits be limited to those amounts as are reasonably necessary to provide educational expenses and support until the beneficiary has become educated and is productively applying himself or herself, as opposed to having access to “easy money” during his or her teenage years, 20s, 30s, or thereafter. It is also my intention that my Trustee shall reward beneficiaries who attain college and graduate school degrees, professional designations, and similar achievements by providing them with funding for housing, automobiles, and similar luxuries as and when they have proven themselves with reference to their personal self-development and productive and respected stature in society.

Thoughtful Corner

Summer Reading List: Best Books for Financial Advisors

by Michael Kitces

Michael E. Kitces, MSFS, MTAX, CFP®, CLU, ChFC, RHU, REBC, CASL, is a nationally recognized speaker and sought-after commentator on financial planning issues. He also writes extensively on a broad range of advanced financial planning topics. He is the co-author of books such as The Advisor’s Guide to Annuities and Tools & Techniques of Retirement Income Planning. He is currently a Director of Planning Research and a Partner at Pinnacle Advisory Group, Inc.

The following article was originally published on the blog Nerd’s Eye View: Commentary on Financial Planning News and Developments by Michael E. Kitces on May 30, 2016. Excerpts from the article are re-produced below.

To see the article in its entirety, please click here.

As clients begin to go on summer vacations, and it’s harder to schedule them for meetings, advisors have some time to relax with family themselves and catch up on their reading lists.

As an avid reader myself, I’m always eager to hear suggestions of great books to read, whether it’s something new that’s just come out or an “old classic” that I should go back and read (again or for the first time!) So I’m now excited to share my latest 2016 Summer Reading list for financial advisors, with suggestions on books about everything from how to improve your personal and business focus, several books on advisor marketing and practice management, and a few more to challenge your thinking about the business world of the future. As you might guess from the common theme of the books, I’m spending a lot of time thinking about the future of financial advisory and where the best opportunities may be going forward from here!

So as we head into the summer season, I hope that you find this suggested list of the latest books to read to be helpful.

Essentialism by Greg McKeown

As author Greg McKeown defines it, “Essentialism” is about being more successful through the disciplined pursuit of doing less. The fundamental principle of Essentialism is that most of us exert energy in lots of different directions simultaneously, which limits our ability to make progress on any one thing in particular; by contrast, if we’re more selective about where we direct our focus, we can really get the ball rolling and achieve exponentially more. In other words, when it comes to personal success, “diversification” of focus is not good risk management, it just spreads you too thin and causes you to accomplish less. In the context of financial advisors, this dynamic helps to explain why building in a niche has a long-term compounding effect, while those who build broad-based generalist advisory firms often hit a growth wall. And even those who initially start out focused may struggle with the “Paradox of Success” – that the focus which brings them early success can bring so many opportunities that they spread themselves too thin, and lose their momentum. Of course, the caveat is that in practice, the focus of Essentialism requires you to say “no” a lot – in order to focus on the things that really matter in your business (and life) – which is very difficult for anyone to do, and especially those in a helping profession like financial planning. Fortunately, McKeown’s book provides a lot of helpful tips and suggestions to figure out how to start saying “no” and do the essential cutting, recognizing that we can’t really making our highest contribution towards the things that really matter until we give ourselves permission to stop trying to do everything ourselves.

The Sustainable Edge by Ron Carson and Scott Ford

While Essentialism is a “general” business book relevant for anyone trying to regain focus in their life and advance their career, The Sustainable Edge is written specifically by owners of financial advisor businesses, and is best suited for those who own their own financial advisory firm. Authored by mega-advisory-firm owner Ron Carson (and co-authored by Scott Ford, a member of Carson’s Institutional Alliance platform), the core message of the book is quite similar to Essentialism – that maximizing your success and the growth of your business is about focusing on the core strengths that you do best, and that energize you to get out of bed and go to work every morning. The book also has some helpful guidance about how as an advisory firm owner, you can raise your “IQ” – your Implementation Quotient, or the proportion of all the great business ideas you have in your head that actually get implemented at the end of the day. Advisors who are too unfocused will tend to struggle with lots of great ideas, but no time to implement them and get them done; the business tools in The Sustainable Edge are meant to help an advisory firm owner find the focus they need to get growth going again.

Platform: Get Noticed in a Noisy World by Michael Hyatt

Arguably the biggest challenge today for most financial advisors who want to grow their business is figuring out how to differentiate your business, and then building a platform to communicate that differentiated message to your target clientele. And while ultimately it’s up to you to figure out how you would like to differentiate and into what niche you would like to focus, Hyatt’s book “Platform: Get Noticed In A Noisy World” is a fantastic guide in how to take the next step of building a digital platform to reach your target clientele. The starting point is to build your financial advisor website – the digital stage upon which the advisor will stand. From there, it’s possible to “narrowcast” to the niche clientele the advisor is trying to reach. And throughout the book, Hyatt provides practical tips and guidance about how to create a compelling “About [You]” page, to creating client case studies that showcase your expertise, establishing your financial advisor blog, and why and how to get involved in social media. Ultimately, the book was not written specifically for financial advisors in particular, but the reality is that principles of establishing and building your digital platform that Hyatt articulates in the book are entirely relevant anyway.

To see the complete list of Michael Kitces reading recommendations, please click here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************

What is Truth?

by Ron Ross

They say, ‘It is what it is,’

But it isn’t, you know?

The truth is fine as it is,

But it can be played like a cello.

And what if ‘what is’

Is insurmountable odds

Do we lay down and surrender

And pray to Greek gods?

Our Ancestors would build,

They would create and invent

What was needed, even if

It required aggressive intent.

But now, great difficulties

Bring no action, only words.

Saying ‘it is what it is,’

We go back to playing Angry Birds.

*************************************

Upcoming Seminars and Webinars

FEATURED EVENT OF THE WEEK

FREE LIVE BLOOMBERG BNA WEBINAR:

Gideon Rothschild and Alan Gassman will discuss BASIC AND INTERMEDIARY CONSIDERATIONS FOR TRUSTS ESTABLISHED IN ASSET PROTECTION JURISDICTIONS in a one-hour webinar as part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

They may also discuss a great recipe for mashed potatoes.

This presentation will have nothing to do with Gideon’s Trumpet, which is both a book by Anthony Lewis describing the story behind Gideon v. Wainwright, in which the Supreme Court ruled that criminal defendants have the right to an attorney, and a 1980, made-for-TV movie starring Henry Fonda, José Ferrer, and John Houseman.

Date: Wednesday, June 15, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Calendar of Events

LIVE BLOOMBERG BNA WEBINAR:

Martin Shenkman will present a one-hour webinar on the topic of ESTATE PLANNING NUGGETS: FAVORITE BUT LITTLE KNOWN ESTATE AND INCOME TAX PLANNING STRATEGIES FOR THE WELL-VERSED PLANNER.

This webinar is part of the (not so free) Bloomberg BNA Practical & Creative Planning series moderated by Alan Gassman.

Date: Tuesday, June 21, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, 30-minute webinar on the topic of FEDERAL MEDICAL LAW UPDATE.

There will be two opportunities to attend this presentation.

Date: Wednesday, June 22, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, 30-minute webinar on the topic of JAY ADKISSON’S MUSINGS ON THE UVTA.

There will be two opportunities to attend this presentation on the new Uniform Voidable Transfers Act.

Date: Tuesday, June 28, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Dr. Srikumar Rao and Alan Gassman will present a free, 30-minute webinar on the topic of ETHICAL FRAMEWORK FOR DEALING WITH CHALLENGING SITUATIONS.

There will be two opportunities to attend this presentation.

Date: Wednesday, June 29, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, one-hour webinar on the topic of FRAUD AND ABUSE LAWS AS APPLIED TO DRUG TREATMENT CENTERS.

There will be two opportunities to attend this presentation.

Date: Wednesday, July 13, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

John Porter will present a one-hour webinar on the topic of BASIC BUT EFFECTIVE ESTATE TAX PLANNING TECHNIQUES AND HOW THE IRS MAY LOOK AT THESE.

This webinar is part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

Date: Thursday, July 14th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

DAVID FINKEL CONFERENCE FOR PHYSICIANS – SCALE YOUR MEDICAL PRACTICE

This free event for physician clients and friends of Gassman, Crotty & Denicolo, P.A. (including those who claim to be friends) will feature nationally-recognized business advisor and author David Finkel’s unique presentation on growth and lifestyle improvement opportunities for physicians and medical practices. The conference will be entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM.

Spouses, office managers, and other practice advisors will also be welcome to attend this interesting and useful one-day conference.

Date: Saturday, July 23, 2016

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

FLORIDA’S PREMIER BEHAVIORAL HEALTH ANNUAL CONFERENCE

Alan Gassman will be speaking at Florida’s Premier Behavioral Health Annual Conference, sponsored by The Florida Alcohol and Drug Abuse Association and The Florida Council for Community Mental Health. The 2016 conference theme is Providing Value in Challenging Times and examines the latest advances in the fields of substance use disorders and mental health.

Alan will be speaking on the topic of CRIMINAL AND CIVIL LAW IMPLICATIONS OF MARKETING, WAIVING DEDUCTIBLES AND CO-PAYS, RELATIONSHIPS WITH REFERRAL SOURCES, AND OTHER WAYS TO END UP IN JAIL: A COMPLIANCE WORKSHOP.

Date: August 10th – 12th, 2016 | Alan’s date and time is to be determined.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information or to register for this conference, please visit http://www.bhcon.org/. You may also email Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

Edwin Morrow and Christopher Denicolo will present a one-hour webinar on the topic of ESTATE & TRUST PLANNING FOR IRA & PENSION ACCOUNT ASSETS.

This webinar is part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

Date: Thursday, August 11th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

The Ameriprise Clearwater branch office, in conjunction with The Tampa Bay Gay and Lesbian Chamber of Commerce, will be hosting an event centered on LGBT estate planning, featuring Alan Gassman’s presentation on PRACTICAL PLANNING FOR MARRIED AND UNMARRIED COUPLES.

The Florida Advisor’s Guide to Counseling Same Sex Couples, which was last updated in 2015, is now available on Amazon for only $39.17. It can be viewed by clicking here. Please note that this edition was last revised before the US Supreme Court decision of Obergefell v. Hodges, but the book still has extensive, useful information.

Date: August 18th, 2016 | Time To Be Determined

Location: Safety Harbor Resort & Spa | 105 N Bayshore Drive, Safety Harbor, FL, 34695

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Philip Nelson at philip.nelson@ampf.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates for 2017!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar. Watch this space for more details to be announced!

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

Applicable Federal Rates

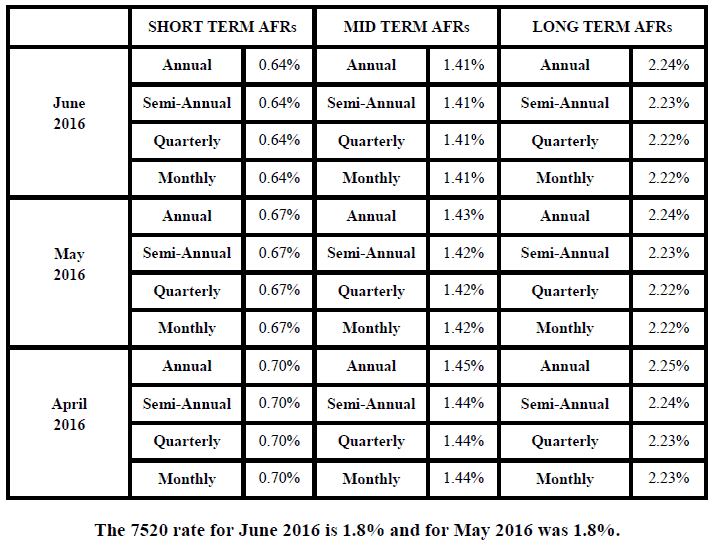

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.