The Thursday Report – 3.10.16 – Zero-Basis, UF Tax, Avvo’s Haircut & Something Lax

Beware the Zero-Basis Rule: The IRS and Treasury Department Release Proposed Regulations on Form 8971 and “Basis Consistency”

Will Avvo Now Harm Floridians and the Legal Community by Setting Low Legal Fees for Services that Cannot be Competently Performed for the Amounts Allowed?

New Code Section 7345: Tax Policy Trumps Freedom of Movement by Chuck Rubin

Seven Reasons to Attend the University of Florida Tax Institute March 30th – April 1st in Tampa

Richard Connolly’s World – Law School on Trial, Plus The End of the LSAT?

George Martin Trivia

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“It wasn’t a question of what they could do [as] they hadn’t written anything great at that time, but what impressed me most was their personalities. I just thought they were interesting and had something slightly different, and I’d like to know more about them. Sparks flew off them when you talked to them. There was an inexplicable presence when all four were together in a room.”

– George Martin, on The Beatles

Sir George Henry Martin was an English record producer, arranger, composer, conductor, audio engineer, and musician, best known for his extensive involvement on each of the Beatles’ original albums. Throughout his six-decade career, Martin held a number of senior executive roles at media companies and produced 30 number-one hits in the United Kingdom and 23 number-one hits in the United States. He was made a Knight Bachelor in 1996 in recognition of his services to the music industry and popular culture. Martin, also known as “The Fifth Beatle,” died in Wiltshire, England on March 8, 2016.

For more on Sir George Henry Martin, see our trivia section below.

Beware the Zero-Basis Rule: The IRS and Treasury Department Release Proposed Regulations on Form 8971 and “Basis Consistency”

by Christopher Denicolo

Can $1 Too Many Cost $5,450,000 of Income Tax Basis?

In 2015, the Internal Revenue Service unveiled the Form 8971, which is designed to facilitate taxpayers’ compliance with the requirement that certain estates report assets that have been included in a decedent’s estate for the purposes of determining income tax basis. The Form 8971 was released to implement the new basis consistency rules provided under Internal Revenue Code Sections 1014(f) and 6035, which were enacted on July 31, 2015 by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015.

Sections 1014(f) and 6035 establish “basis consistency” rules in order to cause congruity between the finally determined value of assets for federal estate tax purposes, and the income tax basis of assets that were received from a decedent on death to which Internal Revenue Section 1014 applies (i.e., a step-up in basis occurs on the decedent’s death). The ostensible purpose of these rules is to assure that estate beneficiaries are not claiming an initial income tax basis in an asset that is valued lower on the decedent’s federal estate tax return.

Sections 1014(f) and 6035 also require the executor of any large estate that is required to file a federal estate tax return (a “large estate”) that is due or actually filed after July 31, 2015 to file with the IRS and furnish to the estate beneficiaries receiving property from the decedent a statement (the Form 8971 and the Schedule A thereto) identifying the value of each interest in such property as reported on such return. Since the last Thursday Report, the IRS has issued Proposed Regulations under Sections 1014(f) and 6035 to provide for greater detail and guidance on the basis consistency rules and the filing of the Form 8971.

It is important to note that these basis consistency rules apply only where: (a) assets are includable in the decedent’s gross estate for federal estate tax purposes; (b) assets’ income tax basis are affected by the decedent’s death (such as where the asset receives a step-up in basis on the decedent’s death); and (c) such assets generate an estate tax liability on the decedent’s estate in excess of allowable credits (i.e., the estate is over the estate tax return filing threshold). Thus, the basis consistency requirements do not apply with respect to estates that are under the estate tax filing threshold due to the value of the estate being less than the decedent’s applicable exclusion amount (a “small estate”). Also, these rules do not apply to property that qualifies for the federal estate tax charitable or marital deductions, cash, assets that are income in respect of a decedent, tangible personal property with a total artistic or intrinsic value of $3,000 or less, or property that is sold, exchanged, or otherwise disposed of by the estate in which capital gain or loss is recognized.

However, under the Proposed Regulations, if a federal estate tax return is filed which indicates that the estate is below the filing threshold (i.e., the return was filed only for portability or GST exemption allocation purposes), and assets are omitted or unknown and later discovered which would have generated a federal estate tax liability, then until such assets are reported on a supplemental estate tax return before the expiration of the applicable statute of limitations, the basis of such omitted or later-discovered assets will be zero for federal income tax purposes. If no supplemental federal estate tax return is filed before the expiration of the applicable statute of limitations, then the basis of such omitted or later-discovered assets is zero.

Further, the Proposed Regulations provide that, if no federal estate tax return was filed for an estate which was required to file such a return (including a situation where an estate believes that it is under the filing threshold, but property is later discovered that would push the estate over the filing threshold), then the basis of all property subject to the above referenced basis consistency rules is zero until a federal estate tax return is filed.

This will give a great many planners pause with regard to whether estates near the filing threshold should be filing protective federal estate tax returns to cover a situation where the estate might have unknown property that could generate a federal estate tax liability. Because the income tax basis of any assets not disclosed on a required federal estate tax return will be zero, this could cause a taxpayer who sells or exchanges such property before it is discovered to possibly be subject to income tax deficiencies and underpayment penalties. The IRS likely espoused this draconian rule in order to cause estates near the filing threshold to file federal estate tax returns if the value of the decedent’s gross estate is close to the filing threshold, as opposed to not filing a return based upon the theory that valuation discounts and other limitations on value actually cause the estate to be under the filing threshold.

It remains to be seen how successful the IRS will be in combating taxpayers who attempt to take artificially large discounts to drive the value of the gross estate below the filing threshold, but this new “zero-basis” rule certainly raises the stakes for those who are aggressive with respect to the decision on whether to file a federal estate return for an estate that is close to the threshold. Nevertheless, practitioners may want to consider getting into the habit of advising clients whose estates are close to the filing threshold to file estate tax returns to avoid this harsh trap, even if the Regulations are currently in “proposed.” form.

The Proposed Regulations also contain much guidance on the filing of the Form 8971 and Schedule A thereto. The new rules can be cumbersome and tedious, but provide for severe penalties for noncompliance.

Per Code Section 6035 and the Proposed Regulation 1.6035-1, the Form 8971 must be filed by the executor of a large estate, and a Schedule A to the Form 8971 must be given to each beneficiary showing the appropriate information (as described in the previous paragraph) within the earlier of: (a) thirty (30) days after the due date that the estate tax return was required to be filed; or (b) thirty (30) days after the date on which the return was actually filed. As described above, the Form 8971 initially was required to be filed only for large estates for which the federal estate tax return is due or actually filed after July 31, 2015. However, the IRS has delayed this filing deadline through the issuance of Notice 2015-57 and Notice 2016-19, which state that the Form 8971 and Schedule A for applicable estates must be filed with the IRS and furnished to beneficiaries by March 31, 2016, even if the Form 8971 would have otherwise been required to be filed and furnished sooner. The Proposed Regulations clarified that a Form 8971 is not required to be filed by a small estate, or by an estate which files a federal estate tax return solely for portability purposes or to make allocations of GST exemption, but is not otherwise required to do so.

Per the Proposed Regulations, the Form 8971 and Schedule A must report all property that is reported or required to be reported on a federal estate tax return that is required to be filed, but need not include cash, assets that are income in respect of a decedent, tangible personal property with a total artistic or intrinsic value of $3,000 or less, or property that is sold, exchanged, or otherwise disposed of by the estate in which capital gain or loss is recognized. However, the Form 8971 and Schedule A must include property that qualifies for the federal charitable deduction or marital deduction, notwithstanding the fact that such property is not subject to the basis consistency rules as described above.

The executor of a large estate must give to each beneficiary the applicable Schedule A which contains the required information regarding the property received by such beneficiary. In the event that the beneficiary is not determined by the due date for the Form 8971, or the property that will satisfy the beneficiary’s interest in the estate has not been determined yet, then the executor must report all of the possible property that could be used to satisfy such beneficiary interest.

The Proposed Regulations also require a beneficiary who receives property which is reported on the Form 8971 and Schedule A to provide such Schedule A to any party who receives the applicable property in a non-recognition event (such as gifts or 1031 exchanges of the applicable property that occur after the beneficiary receives such property). The purpose of this requirement seems to be to create a mechanism to document and trace the income tax basis of property received from a decedent that is later transmitted to a third party in a non-recognition transaction. The beneficiary who transfers such property must file a supplemental Schedule A with the IRS, and provide a copy of such supplemental Schedule A to the transferee.

The penalties for non-compliance with the filing of the Form 8971 can be draconian. For example, the Instructions to Form 8971 and Schedule A provide for a penalty of $50 per each Form 8971 and Schedule A that is filed with the IRS within 30 days following the due date of the Form, with the maximum penalty being $532,000 per year (or $186,000 if the taxpayer qualifies for lower maximum penalties), and a penalty of $260 per Form 8971 that is filed with the IRS more than 30 days after the due date, or if it not filed, with the maximum penalty being $3,192,000 per year ($1,064,000 if the taxpayer qualifies for lower maximum penalties). Separate penalties based upon the above amounts and due dates also apply with respect to the failure to furnish a correct Schedule A to each beneficiary of the estate.

The Proposed Regulations permit the waiver of such penalties for certain failures due to reasonable cause, and the Instructions to Form 8971 and Schedule A provide for no penalties where there is an inconsequential error or omission, although errors and omissions related to the value of the property that the beneficiary is receiving from the estate, the beneficiary’s surname and taxpayer ID number, and a significant item in the beneficiary’s address are never considered as inconsequential errors or omissions. An intentional disregard of the requirement to file and furnish a correct Form 8971 and Schedule A can result in a penalty of $530 per non-compliant Form 8971 and Schedule A that is not filed with the IRS, and a penalty of $530 per non-compliant Schedule A that is not furnished to the beneficiaries, with no maximum penalty.

Given the size of the potential penalties, and the amount at stake if a beneficiary or the estate is stung by the zero-basis rule, practitioners will want to assure that they are aware of these new requirements, and that they adhere to these tedious but significant rules with respect to filing the Form 8971, and the basis consistency rules if and when they are ever finalized.

The new Proposed Regulations can be found here, and the Instructions to Form 8971 and Schedule A can be found here.

Will Avvo Now Harm Floridians and the Legal Community by Setting Low Legal Fees for Services that Cannot be Competently Performed for the Amounts Allowed?

by Alan Gassman and Seaver Brown

Since when can lawyers pay “marketing fees” for direct referrals?

What is going on politically here?

Recently, Avvo Legal Services began offering fixed-fee estate planning and real estate services to prospective clients on Avvo.com. Many Florida attorneys have already begun receiving offers to be among the first in the State to provide these services. The rates that they propose to charge are horrendously low, with the result being that many Floridians will be harmed when lawyers who are willing to undertake this work at such low rates do less than the right job.

Here is how Avvo describes the process:

“Avvo sets the services to be provided and the prices. Attorneys who sign up for the service can choose which services they want to offer. When a client buys the service, Avvo sends the client’s information to the attorney. The attorney then contacts the client directly and completes the service.

Clients will be within the attorney’s geographic area and are able to choose the attorney they want to work with. They pay the full price for the service up front.

After the service is completed, Avvo sends the attorney the full legal fee (paid once a month). As a separate transaction, the attorney pays Avvo a per-service marketing fee. This is done as a separate transaction to avoid fee-splitting.”

Examples of the types of services attorneys can offer through Avvo and their costs include:

- Living trust document review: $199 client payment/$50 marketing fee

- Commercial lease agreement review: $495 client payment/$150 marketing fee

- Create a living trust (couple): $1,095 client payment/$300 marketing fee

- Setup commercial lease agreement: $1,295 client payment/$225 marketing fee

The Florida Rules of Professional Conduct §4-7.22 provide that “a lawyer may not accept referrals from a lawyer referrals service…unless the [referral] service receives no fee or charge that constitutes a division or sharing of fees…”

We contacted the Florida Bar Ethics Hotline to see what their stance on this arrangement is and whether the so-called “marketing fee” would be considered a disguised referral fee. The individual we spoke to noted that this practice would have been considered fee-splitting in the past, however, the question has been posed to a committee for review that is now sending it to the Florida Supreme Court for further review. We should expect a definitive answer in May.

Several commentators on this issue make a point to note that the attitude surrounding referral fees are beginning to change. We have yet to see any formal complaints from State Bar Associations against Avvo and other referrals services with respect to the services they provide attorneys. As one author believes, given the present difficulty of cultivating a client base for both new and established lawyers, the last thing a Bar Association wants to do is take money directly out of their pockets for something of this nature. We hope that the result here is to tell Avvo to take their program to other states besides Florida to prevent harm to Floridians.

This article is the opinion of The Thursday Report and of many others we have discussed this with. What we have not considered is whether it will be illegal fee-splitting for competing lawyers to sign on to this type of program.

Stay tuned for more analysis, and we invite all input on this situation.

New Code Section 7345: Tax Policy Trumps Freedom of Movement

by Chuck Rubin

This article was originally featured in Steve Leimberg’s International Tax Planning Email Newsletter. To see the article in its entirety, please click here.

Executive Summary:

A provision in the FAST Act grants authority to the Secretary of State to restrict the international travel of U.S. persons who are delinquent in their federal tax obligations.

Facts:

On December 4, 2015, President Obama signed into law the “Fixing America’s Surface Transportation Act” (officially labeled the “FAST Act.”) A little discussed provision of the FAST Act is the enactment of Code Section 7345. This new Code Section allows the Commissioner to certify to the Secretary of State that an individual has a seriously delinquent tax debt over $50,000. The Secretary of State has authority to deny, revoke, or limit the passport of the delinquent individual.

This $50,000 amount will be adjusted for inflation. A taxpayer will be seriously delinquent if a notice of lien or a notice of levy has been filed. However, if the taxpayer is current under an installment payment agreement with the Service or collection is suspended due to a pending due process hearing or request for innocent spouse relief, then he or she will fall outside of the seriously delinquent characterization.

While the language of Code Section 7345 makes it look like the Secretary of State has discretion on how to act or not act after receiving a certification from the Commissioner, Section 32101(e) of the FAST Act expressly prohibits the Secretary from issuing a passport to a taxpayer who comes within the seriously delinquent definition (except for emergency circumstances or for humanitarian reasons) if the Secretary receives the certification. If the taxpayer already has a passport, the authority of the Secretary to revoke the passport appears to be discretionary, not mandatory.

Once the taxpayer ceases to have a seriously delinquent tax debt and the Commissioner notifies the Secretary of State, the Secretary of State is directed by Section 32101(g) to remove the certification from the Department’s records. Presumably, this means that the taxpayer is then entitled to an unrestricted passport, although the statute does not expressly say that.

Comment:

The new provision continues a line of laws that impinges on the freedom of movement of persons and capital for the policy goal of tax collection and enforcement. In 2008, an exit tax was established for US citizens and long-term green card holders expatriating from the US. A few years later, FATCA was promulgated, which has made it extremely difficult for US persons to hold bank and brokerage accounts outside of the US regardless of whether they are delinquent in paying taxes.

Now, besides the panoply of civil and criminal enforcement mechanisms that have existed through or were enacted during the 100+ years of the federal income tax, Congress found it necessary to limit the travel rights of its tax delinquents. This restriction on freedom of movement should not be taken lightly. Freedom of movement is a human rights concept, embodied in the constitutions of numerous states and in documents reflecting norms of international law, including Article 13 of the Universal Declaration of Human Rights. Yet, if one searches the Internet for a discussion of this new restriction, there are very few comments or articles.

It is also worth noting that the $50,000 threshold is not limited to tax, but also includes interest and penalties.

Seven Reasons to Attend the University of Florida Tax Institute

March 30th – April 1st in Tampa

- Charles Egerton’s presentation on “Tax Planning for Disposition of Real Estate”

Wednesday: March 30, 2016, 10:45 AM – 11:45 AM

Charles Egerton of Dean Mead will present TAX PLANNING FOR DISPOSITION OF REAL ESTATE, a case study for a sale of undeveloped real estate that is ripe for development. The presentation will focus on alternative sale structures including an installment sale with the payoff or assumption of existing mortgages; an installment sale with a wrap-around mortgage; an installment sale with a partial contingent purchase price feature; and a rolling option sale, with an emphasis on the tax advantages and disadvantages of each structure.

- Terence F. Cuff’s presentation on “How to Foul Up Partnership Agreements”

Wednesday: March 30, 2016, 3:00 PM – 4:00 PM

Terence F. Cuff of Loeb & Loeb will present HOW TO FOUL UP PARTNERSHIP AGREEMENTS, which will discuss ways in which partnership and LLC agreement drafters have managed to foul up economic and tax provisions in their agreements and ways to avoid those problems.

- Samuel A. Donaldson’s presentation on “Current Developments in the Transfer Tax Arena”

Thursday, March 31, 2016, 1:15 PM – 2:30 PM

Professor Samuel A. Donaldson of Georgia State University College of Law will present CURRENT DEVELOPMENTS IN THE TRANSFER TAX ARENA, an informative and entertaining session that will recap important recent federal income, estate, and gift tax cases, rulings, regulations, and legislation of interest to estate planning professionals.

- Stacy Eastland’s presentation on “Putting it All Together: Some of the Best Estate Planning Strategies We See in the New Frontier that Reduce Both Income and Estate Taxes©”

Thursday, March 31, 2016, 3:00 PM – 4:00 PM

Stacy Eastland of Goldman Sachs will present PUTTING IT ALL TOGETHER: SOME OF THE BEST ESTATE PLANNING STRATEGIES WE SEE IN THE NEW FRONTIER THAT REDUCE BOTH INCOME AND ESTATE TAXES©. This presentation will focus on planning strategies that lower the taxpayer’s potential transfer taxes and also reduce the net tax effect a sale of any assets subject to estate planning may have, including: various borrowing, location, disregarded entity, grantor trust, QSST, DSUE, mixing bowl, and charitable planning strategies. This presentation will also explore various strategies that reduce a complex trust’s income taxes, indirectly benefit grantor GST trusts with a Roth IRA conversion, and enhance the basis of a surviving spouse’s assets.

- Steven B. Gorin and Thomas J. Pauloski’s presentation on “Putting ‘Success’ Into Business Succession Planning”

Friday, April 1, 2016, 1:15 PM – 2:45 PM

Steven B. Gorin of Thompson Coburn and Thomas J. Pauloski of AB Bernstein will present PUTTING “SUCCESS” INTO BUSINESS SUCCESSION PLANNING, which will explore legal, tax, and financial implications for a potpourri of topics, including income tax exit strategies, life insurance issues, planning for businesses that produce minimal current cash flow, and financing the payment of estate tax.

- Jeffrey Pennell’s presentation on “Income Taxation of Estates and Trusts”

Friday, April 1, 2016, 3:45 PM – 4:45 PM

Professor Jeffrey Pennell of Emory University School of Law will present INCOME TAXATION OF ESTATES AND TRUSTS. The income taxation of trusts, estates, grantors, and beneficiaries (Subchapter J) is an odd backwater for estate planners because it is at once the tax that affects most estate plans, the one the government seems to ignore in the main, and (perhaps, therefore), the one that we hardly ever teach or study. This session will focus first on a few basics of Subchapter J and then delve a bit more into specifics of planning with intentionally defective grantor trusts, especially including the myths and hype surrounding them.

- Visiting the InterActive Legal table

March 30th – April 1st, 2016

InterActive Legal and Alan Gassman will be at all three days of the event. Be sure to stop by the InterActive Legal table and the Gassman, Crotty & Denicolo table to check out the new Alan Gassman Channel!

To see the complete, 3-day conference agenda, please click here. We’ll see you there!

Richard Connolly’s World

Law School on Trial, Plus The End of the LSAT?

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “LSAT’s Grip on Law School Admissions Loosens” by Sara Randazzo. This article was featured in The Wall Street Journal on February 21, 2016.

Richard’s description is as follows:

Law schools are toying with a new way to boost shrinking applicant pools: dropping the Law School Admission Test requirement. The University of Arizona College of Law began accepting Graduate Record Examination (GRE) scores in lieu of the LSAT as an option for applicants this month, and other schools say they are weighing the same move. Arizona Law will continue accepting LSAT scores as well.

Please click here to read this article in its entirety.

The second article of interest this week is “Law Graduate Gets Her Day in Court, Suing Law School” by Elizabeth Olson. This article was featured in The New York Times on March 6, 2016.

Richard’s description is as follows:

Nearly a decade has passed since an aspiring young lawyer in California, Anna Alaburda, graduated in the top tier of her class, passed the state bar exam, and set out to use the law degree she had spent about $150,000 to acquire.

But on Monday, in a San Diego courtroom, she will tell a story that has become all too familiar among law students in the United States: Since graduating from the Thomas Jefferson School of Law in 2008, she has yet to find a full-time salaried job as a lawyer.

From there, though, her story has taken an unusual twist. Ms. Alaburda, 37, is the first former law student whose case against a law school, charging that it inflated the employment data for its graduates as a way to lure students to enroll, will go to trial.

Please click here to read this article in its entirety.

George Martin Trivia

Born in England in 1926, George Martin’s legacy is one that will have an impact on the music world for eternity. As the man credited with taking the Beatles from a regional platform to an international sensation, George Martin’s ingenuity, skill, and impeccable ear made him one of the best music producers the world has and will ever encounter. In his honor and memory, enjoy this trivia and see just how well you know the Fifth Beatle himself, George Martin.

- George Martin took which sad song and made it better, even if it had 60 less musicians than Paul McCartney originally requested?

- What was the first Beatles song recorded after 1962 to feature an outside musician other than George Martin?

- What is the name of George’s autobiography, published in 1994?

- George was fielded with the difficult task of blending two different versions of which 1967 Beatles song?

- What was one of the first songs George Martin recorded with the Beatles?

- Although an altercation between his mother and teacher put a screeching halt to his lessons after only 8 sessions, what was the first instrument George Martin learned to play?

- Although he was not present, where did the Beatles audition for Martin?

- In 2006, George and his son remixed 80 minutes of Beatles music (which eventually won a Grammy) for what Las Vegas stage performance?

- George contributed to the main themes for what film series?

- Which Beatles member named George “The Fifth Beatle”?

- What is one of Alan Gassman’s favorite albums?

- Whose autographed picture has been in Alan’s office for 8 years?

George Martin Trivia Answers

- “Hey Jude”

- “You’ve Got to Hide Your Love Away” (featuring Johnie Scott on the flute)

- All You Need is Ears

- “Strawberry Fields Forever”

- “How Do You Do It?”, “Love Me Do,” or “Please Please Me”

- Piano

- Abbey Road Studios

- Cirque du Soleil’s Love

- James Bond

- Paul McCartney

- In My Life, by George Martin, featuring John Lennon, Paul McCartney, Robin Williams, Jim Carrey, Sean Connery, and others.

- Sir George Martin’s

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************

In the News

by Ron Ross (Martin)

The struggling Bush dynasty has called in J.J. Abrams to re-boot their franchise. The designated heir, George P. Bush, says they hired Abrams because they like Star Trek and Star Wars, not because Abrams’s production company is called “Bad Robot.”

********

There was a minor diplomatic breakthrough in foreign relations this week. Turkey still refuses to apologize to Armenia, but Armenia is finally willing to apologize to the world for the Kardashians.

********

After a poor showing from Marco Rubio in recent Republican primaries, the Republican establishment has been spotted crying from balconies, “Rubio, oh Rubio, wherefore art thou, Rubio?”

********

How many Supreme Court justices does it take to change a light bulb? At least five. In the case of a tie, the light bulb stays unchanged, based on the ruling of the lower court.

********

In the new movie Planet of the Apps, astronauts from Earth break the speed of light to travel to another planet. Instead, they find they have traveled into the future, to an Earth where humans are ruled by apps. All around them, humans have their noses down, punching buttons on their devices, oblivious to the computers that are ruling the world around them. The astronauts try to raise a rebellion, but no one pays any attention because of that cool new game “Angry Goslings,” in which you throw Angry Birds at Ryan Gosling.

Spoiler Alert: The astronauts eventually punch the Uber button and get a ride back home.

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. Clients, advisors, and colleagues of Gassman, Crotty & Denicolo are welcome to attend.

Date: Wednesday, March 16, 2016 | 12:30 PM – 1:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Martin Shenkman on the topic of THE ESSENTIALS OF PLANNING BEFORE AND AFTER THE DEATH OF A CLIENT.

This is a free Essential Elements webinar presented by Bloomberg BNA.

Date: Thursday, March 17, 2016 | 12:30 PM to 1:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE UNIVERSITY OF FLORIDA PRESENTATION:

Saturday, March 19, Alan Gassman will be speaking to Professor Dennis Calfee’s University of Florida Tax LL.M. program on PROFESSIONAL ACCELERATION FOR ESTATE PLANNING LAWYERS.

Alan’s six-hour, interactive workshop will include breakout discussions on goals, time management, enjoyment of what we do, and time-tested tools and techniques for making the best of the opportunity to help others and our communities in a fascinating profession.

We welcome your input, and, if you know any UF law students who would like to attend, please email agassman@gassmanpa.com.

Date: Saturday, March 19, 2016 | 9:00 AM – 3:00 PM

Location: University of Florida | Gainesville, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PROTECTION CONFERENCE

The Annual Florida Bar Wealth Protection Conference in Miami on Thursday, April 14th and Friday, April 15th will definitely be our best program ever! You can attend one or both days.

Speakers will include Barry Engle, Howard Fisher, Denis Kleinfeld, Jonathan Gopman, Alan Gassman, and many others! The two-book course materials will be available to all attendees.

A Thursday evening dinner with the speakers and a post-dinner small group discussion and workshop on Practice Acceleration will be available only to those who attend the live sessions.

The official brochure for this program can be viewed by clicking here.

Date: Thursday, April 14th, 2016 and Friday, April 15th, 2016

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Wall Street Journal and Business Week bestselling author David Finkel will present a free, one-hour webinar on the topic of MORE WITH LESS: 5 SIMPLE STEPS TO ENJOY MORE BUSINESS GROWTH AND GREATER PERSONAL FREEDOM BY DOING LESS.

Date: Thursday, April 28, 2016 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Date: Friday, May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. Clients, advisors, and colleagues of Gassman, Crotty & Denicolo are welcome to attend.

Date: Wednesday, May 11, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

MAUI MASTERMIND ACCREDITED INVESTOR WEALTH WORKSHOP

Maui Mastermind will present their three-day ACCREDITED INVESTOR WEALTH WORKSHOP on July 21st – 23rd.

The first two days of this event will feature three speakers: David Finkel, Kevin Bassett, and Alan Gassman, on a variety of topics including advanced asset protection topics, reducing your tax drag, creating more with less, and how to create and sustain rapid growth of your business or company.

Saturday, July 23rd will feature a bonus add-on to the program entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM. This event will feature David Finkel’s presentation on scaling a medical practice.

Watch this space as more details will be forthcoming!

Date: Thursday, July 21st – Saturday, July 23rd

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE TAMPA PRESENTATION:

2016 FLORIDA TAX INSTITUTE

The 2016 Florida Tax Institute, organized by the University of Florida Levin College of Law, will feature top speakers in the United States on tax, business, and estate planning issue. This program is designed to be informative, engaging, and state of the art!

For a full conference agenda, please click here. Up to 24 hours of continuing education legal credit will be available in several states, while Accounting, Certified Financial Planner, Certified Trusts and Financial Advisor, and Enrolled Agents PACE credit will be available nationwide.

Date: Wednesday, March 30, 2016 – Friday, April 1, 2016

Location: Tampa Marriott Waterside | 700 S. Florida Avenue, Tampa, FL 33602

Additional Information: To register for this event, please click here. For more information, please email admin@floridataxinstitute.org.

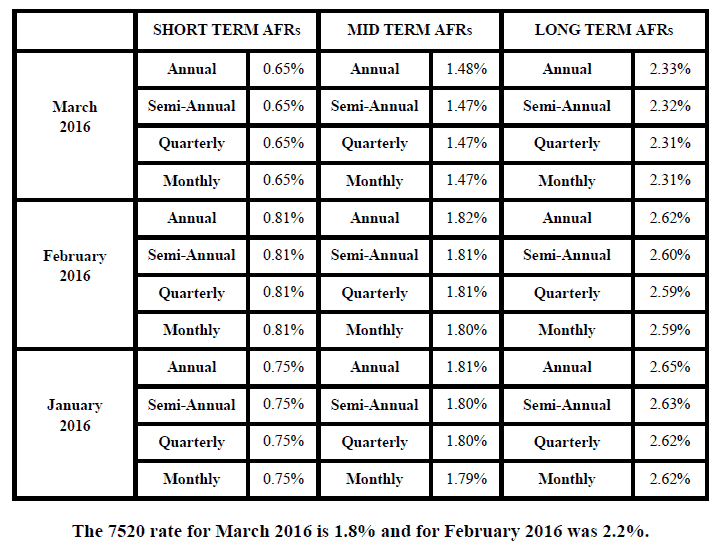

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.