The Thursday Report – 2.5.15 – The Leonardo da Thursday Report

Leonardo da Thursday Trivia Test

Avoiding Disaster on Highway 709 – Gift Tax Return Filing Checklist with a Hypothetical Fat Pattern and Sample Form 709 Completed Pages

Don’t Inadvertently Lose S Corp Losses When Terminating an Irrevocable Trust Holding S Corp Stock – Not All Unused Losses are Treated Equally by Logan Baker

Richard Connolly’s World Double Header – PA First State to Restrict Lawyers as Financial Advisors and A Peek at the Highest Earners’ Tax Returns

Thoughtful Corner – Public Listening or When Silence Speaks by Matthew Stillman

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Leonardo da Thursday Trivia Test

This week, we here at the Thursday Report are coming to you live from Italy. Not the Italy at Epcot, but the real Italy, where they invented Pizza Hut and Olive Garden! Take our Leonardo da Thursday Trivia Test and win a free last supper for you and eleven friends.

1.) What was Leonardo da Vinci’s father’s profession?

- Legal Notary

- Painter

- Barber

- It was never identified.

ANSWER: (A) Leonardo da Vinci’s father was a legal notary in the Republic of Florence.

2.) What was unique about how Leonardo painted The Last Supper on the wall of the Santa Maria delle Grazie monastery dining hall in Milan?

ANSWER: Leonardo painted The Last Supper on a dry wall rather than employing the traditional fresco style of painting on wet plaster. He wanted the painting to have a greater level of detail and luminosity than could be achieved with a fresco style painting, so he sealed the stone first, painted the wall with a white lead undercoat, and then applied his work on top. Additionally, rather than isolating Judas, the disciple who would eventually betray Jesus, to the opposite side of the table from the other disciples, da Vinci chose to seat him among the others leaning back into the shadows.

3.) Which of the following was a function that da Vinci told the Duke of Milan he could perform if hired in a letter written in 1482?

- Construct bridges

- Construct subterranean passages

- Supply infinite means of attack and defense in times of war

- All of the above

ANSWER: (D) In an effort to secure a job with the Duke of Milan, Leonardo da Vinci wrote what we would refer to today as a cover letter, detailing 10 functions he could perform that would prove invaluable during times of war. Surprisingly, his artistic abilities (painting and sculpting) did not make his list of 10 talents and were, instead, mentioned as an afterthought at the bottom of the letter. Click here to look at the letter and click here to see a translation of the letter. Leonardo da Vinci got the job, which he held until the French captured his employer.

4.) Leonardo da Vinci was accused of sodomy, but charges against him were dismissed.

TRUE or FALSE

ANSWER: TRUE. Leonardo da Vinci and 4 others were arrested upon accusations of sodomy in 1476, but charges were eventually dismissed because the accusations against him were not signed. Legally, for sodomy charges to end in prosecution, the initial accusations could be made secretly, but they could not be made anonymously, and no witnesses against da Vinci ever came forward. Additionally, sodomy charges seldom ended in punishment in Florence, Italy, where homosexuality was common and generally tolerated.

5.) Which US city is currently displaying Leonardo da Vinci’s Codex Leicester, a 72-page manuscript containing da Vinci’s observations on the arts, science, and engineering?

- Los Angeles, CA

- Austin, TX

- Phoenix, AZ

- New York City, NY

ANSWER: (C) The Codex Leicester was purchased by Bill Gates in 1994 for $31 million. It is currently on loan to the Phoenix Art Museum in Phoenix, Arizona, where it can be viewed by the general public until April 12, 2015. For more information, click here.

Avoiding Disaster on Highway 709

Gift Tax Return Filing Checklist with a Hypothetical Fact Pattern and Sample Form 709 Completed Pages

by Kenneth J. Crotty

The following checklist could help a practitioner obtain the necessary information to complete a gift tax return and provide adequate disclosure to the IRS.

- Donor Information

- Donor’s name, address, and social security number

- Does the donor have a deceased spousal unused exemption amount?

- Copies of past gift tax returns that were filed

- Confirmation regarding any consideration received by the donor for a gift

- Is the donor opting out of automatic allocation of generation skipping tax?

- Citizenship of donor

- Spouse’s Information

- Confirmation that the donor’s spouse is a United States citizen or resident

- Will the gifts be split? If so, the consenting spouse’s name and social security number

- If gift splitting is desired, confirmation that the clients were married when the gifts were made

- If gift splitting is desired and the donor and the donor’s spouse have divorced, confirmation whether either the donor or the donor’s spouse have remarried during the taxable year

- Reportable Gifts

- List of all gifts made, including gifts to spouses and charitable donations

- Were gifts made to 529 Plans?

- If so, were these intended to be split ratably over a five-year period?

- Inquire about life insurance premiums paid for life insurance policies owned by Irrevocable Trusts

- Did the donor establish a lifetime QTIP Trust?

- Information Required for Particular Gifts

- The donee’s name and address and relationship to the donor

- Description of the gift

- Donor’s adjusted basis of the gift

- The date of the gift

- The value as of the date of the gift

- Appraisals or explanations of valuation discounts

- Obtain Form 712 for transfers of life insurance policies

- For stock sold on an established exchange, determine the number of shares gifted, whether the shares are common or preferred, obtain the CUSIP number, and determine the mean between the highest and lowest quoted selling prices on the valuation date

- For transfers of closely held corporations, obtain the balance sheet, earning statements, and dividends received for the five years prior to the gift.

- If bonds are transferred, obtain the number of bonds transferred, the principal amount of each bond, the name of the obligor, the date of maturity, the rate of interest, the date or dates when interest is payable, the series number, exchanges where listed, or if unlisted, the principal business office of the issuer, the CUSIP number, and determine the mean between the highest and lowest quoted selling prices on the valuation date.

- Information Required for Trusts

- Copies of all of the Trusts which received gifts during the year (or a brief description of the terms of each trust)

- Taxpayer identification number for the Trust

- Name and address of Trustee of Trust

- Check Trust documents for Crummey right of withdrawals

- If the Trust does not provide for Crummey rights of withdrawal but the Trust allows the grantor to designate withdrawal powers, a copy of the designation should be attached.

Hypothetical Fact Pattern

John and Mary Doe are married to each other and have been married to each other for all of 2013. John was widowed in 2011, prior to marrying Mary.

John and Mary have two children: Henry Doe and Ruth Anderson.

John and Mary have five grandchildren: Jean Anderson, Lily Anderson, Kate Anderson, Stella Doe, and Buddy Doe.

Mary is the grantor of the Ruth Anderson Irrevocable Trust. Each of Ruth, Jean, Kate, and Lily have Crummey rights of withdrawal.

During the 2013 tax year, John and Mary made the following gifts:

- 1-1-2013; John gifted $28,000 to Henry;

- 3-31-2013; John made a $40,000 donation to Community Foundation;

- 8-1-2013; Mary made an $18,000 tuition payment to College University for Stella;

- 9-1-2013; Mary gave Stella $18,000;

- 9-1-2013; Mary funded a 529 Plan for Buddy with $140,000;

- 12-1-2013; Mary contributed $210,000 to the Ruth Anderson Irrevocable Trust; and

- 12-30-2013; John contributes $6,000,000 to the Doe Descendants Trust

Find a completed Form 709 using the above stated hypothetical fact pattern by clicking here.

This concludes Ken Crotty’s series on Avoiding Disaster on Highway 709. To view the article in its entirety, please click here.

Don’t Inadvertently Lose S Corp Losses When Terminating an Irrevocable Trust Holding S Corp Stock – Not All Unused Losses are Treated Equally

by Logan Baker

Logan Baker is a Trust Advisor with Regions Private Wealth Management in Clearwater. Prior to joining Regions, Logan practiced law in Vermont, Montana, and Florida, primarily in the areas of estate planning, taxation, and insurance regulation. Logan received his J.D. from the University of Montana School of Law, his LL.M. from the New York University School of Law, and his M.B.A. from Florida State University.

It is often beneficial to place ownership of S corporation shares into a trust for tax, estate, succession, and other planning purposes. However, not all trusts are permissible S corporation shareholders. Check with an advisor before transferring ownership of S corporation shares, since placing ownership of the shares into a non-permissible trust may jeopardize the corporation’s Subchapter S election. Assuming the shares are owned by a trust that is permitted to hold S corporation shares under IRS rules, the S corporation’s income, loss, and other tax attributes will “pass through” to the trust. While this “pass through” treatment is relatively simple when an individual owns the S corporation shares, an additional layer of complexity arises when the shareholder is a trust. This additional complexity is due in part to the fact that the trust lies between the income and loss-generating S corporation and trust beneficiary.

In many cases, the trust will eventually terminate and distribute the S corporation shares and/or any other trust property to the beneficiary. In addition to the distribution of property, IRS rules also allow the trust to, in effect, “distribute” certain tax attributes to the beneficiary. Code Section 642(h) provides that unused net operating loss carry forwards and unused capital loss carry forwards are allowed as deductions to the beneficiary of a trust to the extent existing and unused at the time of termination of the trust. This provision is quite helpful, since important non-tax considerations regarding trust termination can be addressed without worrying that these unused losses will be wasted upon trust termination.

However, not all unused losses are treated equally under the IRS rules. While Code Section 642(h) allows the trust beneficiaries to utilize a terminated trust’s unused net operating losses, the same cannot be said for another common type of loss that looks very similar to a net operating loss. S corporations and their shareholders frequently encounter the loss limitation of Code Section 1366(d)(1), which prevents an S corporation shareholder from taking a “pass through” loss that exceeds the shareholder’s basis in the S corporation stock. For example, if a shareholder has a basis of $100,000 in the stock of an S corporation, and that corporation incurs a $150,000 loss in a given year, the shareholder would be limited to a “pass through” loss of $100,000 in that year. The remaining $50,000 of the loss is suspended until a future year in which the shareholder has sufficient basis to utilize it.

S corporation stock basis, for purposes of this limitation, is generally based upon past contributions plus undistributed income that has been recognized by the company, less distributions, and plus loans from shareholders. Section 1366(d)(1) provides that basis for this purpose is determined with regard to paragraphs (1) and (2)(A) of Section 1367(a), in addition to shareholder’s basis in S corporation debt.

A loss that is suspended under Code Section 1366(d)(1) is similar in several respects to a net operating loss that has been carried forward in that both arise from an excess loss limitation, and (with certain limitations) both may be carried forward until they can be used. However, upon termination of a trust that holds S corporation stock, only the net operating loss can be used by the trust beneficiaries. This is because the suspended loss under Code Section 1366(d)(1) is not actually “occurred” for federal income tax purposes until the trust has sufficient basis to absorb it. If the loss is still suspended in the year the trust terminates, it follows that the trust has insufficient basis in that year and that the loss has not yet “occurred.” Therefore, there is no loss to which the trust beneficiaries could succeed. Support for this interpretation is found in Treasury Regulation Section 1.1366-2(a)(5)(i), which provides that the suspended loss “is personal to the shareholder and cannot in any manner be transferred to another person.” That section also provides that: “If a shareholder transfers all of the shareholder’s stock in the corporation, any disallowed loss or deduction is permanently disallowed.”

In the case of a trust with a suspended loss with respect to its S corporation stock, these provisions mean that the suspended loss is personal to the trust and cannot “in any manner be transferred to” the trust beneficiaries. The conclusion to be drawn is that the provisions of Code Section 642(h), which allow the trust beneficiaries to utilize the trust’s unused net operating loss carryovers, will not apply to the trust’s Section 1366 (d) suspended losses. If the trust terminates, those suspended losses would be wasted.

Trustees and their advisors should consider adding basis to S corporations held under trusts to release otherwise limited losses before the trust terminates and distributes the S corporation stock.

Richard Connolly’s World Double Header

PA First State to Restrict Lawyers as Financial Advisors

and

A Peek at the Highest Earners’ Tax Returns

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the first article of interest is “Pennsylvania First State to Restrict Lawyers as Financial Advisors” by Ted Knutson. It was featured in Financial Advisor magazine on January 13, 2015.

Richard’s description is as follows:

Pennsylvania is becoming the first state to restrict the ability of lawyers to give financial advice. As of January 30, Keystone State lawyers who are state or federally licensed financial advisors or insurance agents will be barred from recommending or making an investment for clients if they or their family members have financial stakes in the transactions.

Beyond the ban against profiting from a financial transaction, the board will prohibit lawyers from giving financial advice unless they have specific registrations with the state or the SEC.

Please click here to read this article in its entirety.

Our second article of interest this week is “A Peek at the Highest Earners’ Tax Returns” by Laura Saunders. It was featured in The Wall Street Journal on November 24, 2014.

Richard’s description is as follows:

The 400 individuals and couples reporting the highest adjusted gross income for 2010 – the latest data available – earned an average of $265 million per return, according to new statistics from the Internal Revenue Service.

To make the list, taxpayers had to have at least $99 million of income, well below the 2007 cutoff of $138.8 million.

The IRS’s tables show that the top 400 taxpayers had an average tax rate of 18%. But more than half, or 221, had average effective tax rates between 10% and 20%, while 37 had an average rate of less than 10%.

Please click here to read this article in its entirety.

Thoughtful Corner

Public Listening or When Silence Speaks

by Matthew Stillman

Photo Credit: @stillmansays/Twitter

Matthew Stillman is, in his words, a professional Problem-Re-Imaginer. He identifies unseen connections, uses creative techniques to find new solutions, and helps move his clients towards new opportunities. He also helps to teach the Creativity and Personal Mastery course developed by Dr. Srikumar Rao. Prior to this career, Matt was a program development executive at the Food Network and a student at the Upright Citizens Brigade Theater in New York City, where he studied with Amy Poehler. His film, The End of Poverty, was featured at the Cannes Film Festival and has been shown in over 40 festivals around the world.

In April of 2009, Matt started an experiment in Union Square. He would sit in Union Square in New York City with two chairs, a table, and a sign that reads “Creative Approaches to What You Have Been Thinking About.” He publishes stories about his experiences at this table on his website, which can be viewed by clicking here.

The following article has been reprinted with permission. Thanks to Matt for bringing this story to Thursday Report readers!

Public Listening or When Silence Speaks

I am always grateful when someone as lovely as K comes to the table. She exuded a simple joyous quality coupled with a fine air of stillness that radiated from her in equal measure. Soft spoken, but clear and easy to talk to. The sort that you just start talking, assuming that you have already been friends for some time.

In her admiration of my project, she revealed what she needed a creative approach to.

“I love your table and have been thinking about doing something similar called ‘public listening.’ What do you think of it, and what could I do with it?”

Hearing a woman of this depth say those two words – public listener – I could just see her out there being an amazing resource. My experience of putting myself out there with chairs and a table interacting with the public as a service/experiment/art project/exploration of something I am good at has been a total joy. Profoundly rewarding and deeply nourishing for me and others.

As my mind telescoped into the future, I could see moments of the same for K. But as I looked into the sweet face of K, the one twist to the project popped into mind that somehow fit with K.

“This is brilliant. What if you actually just listen only? You don’t speak. You just have a pad of paper to say anything if you need to say anything. Just receive. That could be a service unlike any other particularly because of the depth of your presence and attention.”

As I said this, K broke into tears of relief.

“Yes! Thank you for saying that. I’m a professional singer. I love singing but need to do it all day. Sing songs. Sing commercials. At night, I sing at bars and shows. I am almost at a point where I need a break from hearing myself. I didn’t realize that this project could save me and give me space, too. How could you have known this about me?”

I understood why she was crying. The realizing that our own ideas often have the keys to our own freedom. To what we need most. I saw the unspoken silence in K and called it out. Her silence spoke back. We lovingly embraced goodbye like new old friends.

Sometimes it is just that simple out here in Union Square.

Humor! (or Lack Thereof!)

If you try to email Alan Gassman while he is away on his tour of Italy, you might receive one of the following messages in return, written by Alan and Kristen Sweeney.

Milan

I’ve left for Milan,

And am not putting you on.

We’ve crossed the Atlantic by plane.

For great art, food, and fashion,

To quench Marcia’s strong shopping passion.

In this place conquered by Charlemagne.

The history’s a muddle

Of political struggle

Will the Guelphs or Ghibellines reign?

The big family is Visconti,

Did they invent biscotti?

A question not exactly germane.

If you need help while I’m in Lombardy,

Maribeth and Tina feel free to bombard-y.

They’re great at keeping me sane.

In the meantime I’m fine,

Sampling kegs of red wine,

Can’t wait to see you stateside again.

***************************************************

Florence

Thank you much for writing,

I report it’s quite exciting

To be in Florence writing articles for LISI,

In the home of Machiavelli,

And delicious cavatelli,

I’ll tour the palace of the Medici.

I’m pleased that there is ample

Time for a gnocchi sample.

And we absolutely love veal bolognese.

Firenze’s simply grand,

Next to David I did stand.

Chianti gives the Duomo a lovely haze.

On Thursday, February 12th, I will return,

With lots of new things I’ve learned,

Such as: Did Italy really invent the pizza?

But for now this lucky fella

Is with Marcia and Brent dancing tarantella,

With an appetite and of course- the office Visa.

*******************************************************

Naples

I am reporting happily

That I’m out of town in Napoli,

The third stop on my European tour.

In Greek it means “new city,”

And it sure is awfully pretty,

Down here on the bright Italian shore.

Way back when in World War II,

They were heavily bombed, it’s sad but true,

And were reconstructed under Mussolini.

High speed rail’s now a staple,

Of the big port town of Naples,

And my favorite dish is clam sauce with linguine.

If your legal matters need motion

While I’m across the ocean,

(I’m learning how to play the mandolin)

Maribeth or Tina can assist,

They’re keeping a detailed list,

For my return so I can dive right in.

**************************************************

We received the following from Char Pfaelzer in response to the Florence poem:

Nothing could be neater,

Enjoy La Dolce Vita.

Family [no fights!],

Pasta, vino, and sights…

Enjoy special time

In Firenze sublime

Safe travels home.

Stay tuned for more Italy-inspired poems from Kristen Sweeney and Alan Gassman in next week’s Thursday Report!

Upcoming Seminars and Webinars

LIVE WEBINAR:

John D. Goldsmith and Alan S. Gassman will present a webinar on BP OIL SPILL CLAIMS – IMPORTANT ISSUES FOR ADVISORS.

Date: February 17, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar, please click here or email agassman@gassmanpa.com for more information.

******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Please note the below announcements for subsequent installments of this series:

March 4, 2015 – Premium Financing in 22.5 Minutes

March 17, 2015 – Split-Dollar in 22.5 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here. To register for this program please email agassman@gassmanpa.com.

*******************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

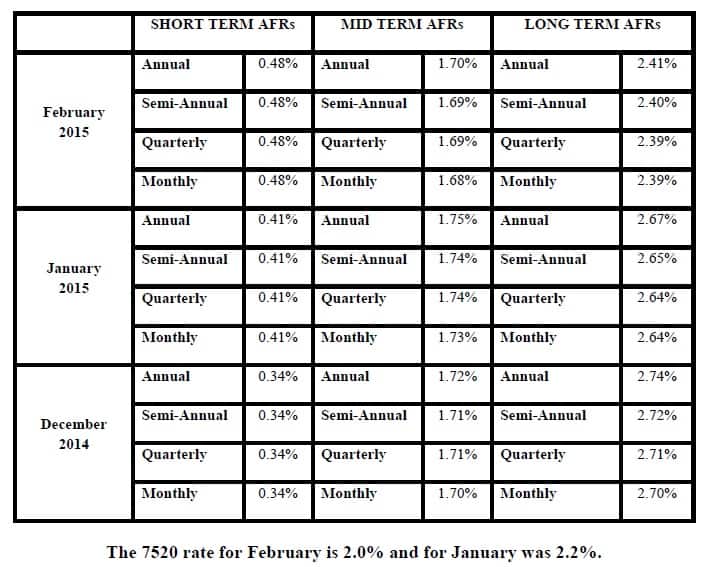

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.