The Thursday Report – 12.25.14 – Merry Creditormas Edition!

Way Down Upon the Bifani River: Setting Aside Fraudulent Transfers into Florida Homestead

Best of The Thursday Report 2014

Richard Connolly’s World 2014 Recap

Visit our Friends and Heckle Us at Heckerling!

Thoughtful Corner – Becoming Bigger Than Your Problem

Humor! (or Lack Thereof!)

This week we especially thank judges who write debtor/creditor opinions that can keep us at the edge of our seats. Last week, we rushed out an article on the Bifani bankruptcy/homestead case, which can be viewed by clicking here.

We have a better write-up on this case this week and welcome all questions, comments, and suggestions as we prepare to publish this in periodicals even more respected than The Thursday Report (by many.)

Way Down Upon the Bifani River: Setting Aside Fraudulent Transfers into Florida Homestead

by Alan S. Gassman, Travis Arango, and Dena Daniels

Debtor’s Transferee Who Received Pre Bankruptcy Fraudulent Transfer Ends Up All Wet

Footnote from Editor–The Suwannee River is a 246 mile blackwater river that can take you much of the way from the Tampa Bankruptcy Court to the 11th Circuit Court of Appeals in Atlanta, which is where this case went before the debtor’s raft sank. Made famous by Stephen Foster’s song, The Old Folks at Home (Foster never saw the river but read about it), Mr. Gassman owns two lots on this river that he bought in 2007 and would gladly sell for half of what he paid, and no extra charge for the alligators who live there. See Way Down Upon The Suwannee River Far Far Away, LLC on the Sunbiz Website, and also Hey Hey Santa Fey (river), LLC and WithLacoochee Coochee-Coo, LLC, which own his other failed river investments.

This article is dedicated to the memory of Joan Rivers, who performed in Tampa Bay shortly before her death at age 81 with great energy and physical strength, like many of us who love what we do and intend to die in the saddle.

The Florida Supreme Court, in Havoco of America, Ltd. v. Hill, 790 So.2 d 1018 (Fla. 2001), held that the homestead protection afforded under the Florida Constitution trumps the Florida Fraudulent Transfer Statute, and therefore a debtor subject to an impending or actual judgment can use monies to purchase or pay down the mortgage on a homestead owned by the transferor, with the creditor having no remedy against the homestead unless or until the debtor files for bankruptcy by reason of the provisions of the 2005 Bankruptcy Reform Act “Mansion Law”.

But what if the debtor, knowing that he or she may be going into bankruptcy, gives the monies to a close friend who puts them into a homestead and then intends to hunker down and remain judgment proof, and outside of bankruptcy, so that the creditor is not able to recover the funds? And the debtor is able to live with the close friend and enjoy the benefit of the home. Will this boat float?

This exact factual pattern has occurred more than once, leading the courts to look for a way to reach the home equity and prevent this type of conduct, as opposed to waiting for Congress to endorse an appropriate remedy by amending the Bankruptcy Code.

Judge Michael Williamson, a very able and well respected bankruptcy judge of the Middle District Bankruptcy Court sitting in Tampa, came to the conclusion in 2013 that a fraudulent transfer, directly or indirectly, into the debtor’s cohabiting and apparent significant other before filing bankruptcy rose (like a river) to the level of being considered as secretion of “ill-gotten gains” under the Florida case law, saying specifically that:

Here, LaMarca’s Sarasota house was acquired with ill-gotten proceeds. LaMarca used the nearly $670,000 from the sale of the Golden Eagle Road property to purchase her Sarasota house. It would be inequitable and unjust to allow the Debtor (Bifani to fraudulently transfer property to LaMarca to keep it from his creditors.[1]

The Federal District Court sitting in Tampa found that the decision did not hold water, and overturned it, but the Eleventh Circuit Court of Appeals agreed with the judge, finding that:

Under Florida law, homestead property purchased with funds obtained by fraud is not exempted from equitable liens. See Havoco, 790 So.2d at 1028. The facts of this case do not fall within Havoco ‘s exception because the funds used to purchase the Sarasota property were obtained through Bifani’s fraudulent transfers…..That the fraud occurred in a bankruptcy proceeding rather than a criminal offense is irrelevant.[2]

It is almost certain that the U.S. Supreme Court will have any interest in hearing this case, and the Florida Supreme Court will not have jurisdiction because bankruptcy court cases pass to the federal system, and not under the state system.

The Eleventh Circuit Court of Appeals could have requested guidance from the Florida Supreme Court by certifying the issue as a question of importance but apparently chose not to do so.

Floridians and their advisors will now most likely need to wait for a number of years before similar factual patterns occur in Circuit Courts and become subject to Circuit Court decisions that are appealed to District Courts of Appeals, and then eventually to the Florida Supreme Court.

A prominent bankruptcy attorney has had this to say about the case:

If you think it through, the whole idea of getting around the Federal Bankruptcy law by doing something through an apparent straw man that you cannot do directly, you can certainly conclude that at least the spirit of the 2005 Bankruptcy Act was violated. That doesn’t really shock me. If you’re going to try to take advantage of the Florida Homestead law, you need to follow the centuries old method of buying your own house, and if this is a fraudulent transfer you also have to stay out of bankruptcy for 10 years thereafter. It’s not escaping taxes or domestic relations liability, it’s not money you stole from somebody else, but a well-respected bankruptcy judge, with affirmation from the highest federal court overseeing Florida Federal Courts have found that it is the equivalent of transferring ill-gotten games into homestead. Debtors and advisors are going to have to stick with the patterns that worked, at least for the foreseeable future. It could be a decade or more before the Florida Supreme Court or the US Supreme Court ever look at this.

While this case may be criticized by some as being judicial legislation, and may add to the longstanding misconception among some courts and advisors that a fraudulent transfer somehow constitutes fraud and is therefore bad or per se illegal, it also shows that conventional knowledge will sometimes be turned on its ear, without warning, and that clients and advisors should not rely upon any one creditor protection technique, or any particularly creative or aggressive one, when multiple techniques are available. Also, as we all know, hogs are often slaughtered.

*********************************************************

[1] In re Bifani, 493 B.R. 866, 871 (Bankr. M.D. Fla. 2013)

[2] In re Bifani, 580 F. App’x 740, 747 (11th Cir. 2014)

Best of The Thursday Report 2014

Never before, since the founding of The Thursday Report, and even before that, when you were a child, has there ever been a Thursday Report Christmas, also known as our Creditormas Edition in honor of the two gifts given by recent court decisions to creditors, one of which fortunately rhymes with the name of a river, released in the same year that Joan Rivers passed away.

Since even some of our best friends are creditors, we can provide you with thoughts and input on these two new cases, which don’t make a great deal of (frankin) sense.

Speaking of Al Franken, he was quoted as follows with reference to his conversion from being a comedian to being a politician:

“At Saturday Night Live, I wrote political stuff, but I never felt the show should have an axe to grind. But when I left in 1995, I could let my own beliefs out.”

“Comedy to the Senate? Well, there certainly hasn’t been a satirist or a political satirist who’s done that. So that really was uncharted territory during the campaign. But I think it’s a good thing. Some people thought it was an odd career arc, but to me, it made absolute sense.”

– Senator Al Franken

Yes, we were as disappointed in these quotes as you were, but this is the best that our writing staff could find on short notice. And remember, if you have a beer stein with Al Franken’s face on it, it’s a Frankenstein!

So we hope that you enjoy a great Christmas, are prepared for a wonderful New Year, and that you print extra copies of this Thursday Report and put it in the stockings of your family and friends (but only the ones hung by the fireplace, please – and don’t damage fishnets!) and enjoy yet another poor excuse for professional and humor literature as we recap some of the best/worst Thursday Report stories from 2014 this week and next.

Best regards,

Colonel Santa Claus

Why Wyoming?

originally published in the January 16, 2014 Thursday Report

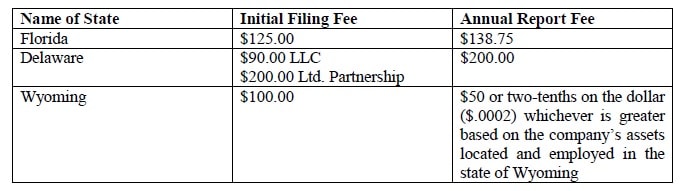

The benefits of limiting liability of owners and shareholders exist under the law of many states and many clients are best served by using a state other than Florida for confidentiality, creditor protection and cost reduction purposes.

While Florida’s limited partnership and LLC laws are among the best in the country, the Florida Supreme Court decision in Olmstead, annual changes in the statutes thereafter, confusion resulting from the above, and the question as to whether there will be further changes leads some planning lawyers to the conclusion that Wyoming secrecy rules and stability help make it the appropriate jurisdiction for many entities.

Many clients are married and want their ownership of an entity to qualify as tenancy by the entireties, which cannot be assured unless the state where the entity is formed or recognition of tenancy by the entireties exists. Delaware and Wyoming are considered to be incorporation havens because they do not impose any income tax and have pro-business laws. In addition, both Delaware and Wyoming recognize tenancy by the entireties, and have good secrecy practices as well, but we have found Delaware to be much more expensive and cumbersome to use than Wyoming, except that Wyoming does not have electronic filing like Delaware does. Colorado and Nevada are also popular, but do not recognize tenancy by the entireties. Wyoming is the only state in the union that is a perfect rectangle with its lines being north and south and east and west. It is more square than Colonel Sanders.

The filing fees and annual report fees for limited partnerships and LLCs in Florida, Delaware, and Wyoming are as follows:

Please note that a Registered Agent will need to be retained in the state of formation.

Marty Shenkman’s JEST Review from Heckerling 2014

originally published in the January 30, 2014 Thursday Report

We were very proud that estate tax lawyer and author Marty Shenkman included mention of our JEST Trust (Joint Exempt Step-Up Trust) in his 47 page Heckerling review, which was provided in Leimberg Information Services Estate Planning Email Newsletter – Archive Message #2188 on January 24, 2014.

Howard Zaritsky will be speaking on the JEST trust in Orlando at the Heckerling Estate Planning Institute on Monday, January 12. We will, of course, report on what he says.

Marty’s summary of our JEST technique can be viewed by visiting https://gassmanlaw.com/wp-content/uploads/2014/01/Shenkman-Leimberg-Article.pdf

Our 2 part Estate Planning Magazine article from October and November of 2013 on the JEST Trust can be viewed by visiting https://gassmanlaw.com/wp-content/uploads/2014/01/Part-1-and-Part-2-Published-Versions.pdf.

Don’t forget that married couples may be able to receive a stepped-up basis on all joint assets on the first death by using the JEST Trust or other techniques.

Everything You Need to Know About IRS Transcripts

originally published in the April 3, 2014 Thursday Report

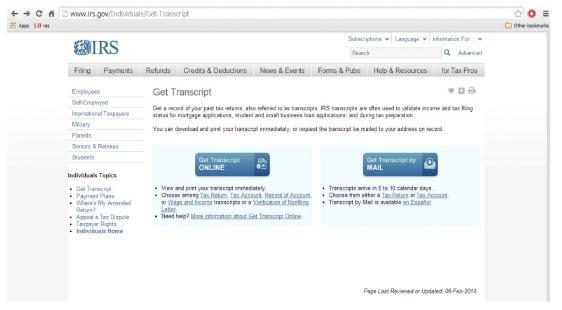

It is now relatively easy to get a comprehensive IRS transcript to show past tax payments, taxes due, and historical tax return history.

What is an IRS Transcript?

These can now be used to help assure that there has not been an identity theft or fraudulent tax refund filed for a client, and can also be used to verify the taxpayer’s income and tax filing status for various purposes. The IRS provides these transcripts free of charge to individuals.

Many individuals may be hesitant to request their tax information due to assuming that it may create a flag on the account and trigger an audit. We do not believe that there is any correlation between the chances of being audited and whether someone has requested their tax information. Taxpayers who request their information are probably more likely to be compliant than the average taxpayer.

Different Types of Transcripts

There are 5 different types of transcripts that an individual can obtain. These are as follows:

- Tax Return Transcript – Displays the majority of the line items from your originally filed tax returns as well as any accompanying forms and/or schedules, however, this transcript does not show any changes made by the taxpayer or the IRS.

- Tax Account Transcript – Shows any adjustments made by the taxpayer or the IRS after the tax return was filed.

- Record of Account Transcript – Combines the information provided in the tax return and tax account transcripts.

- Wage and Income Transcript – Displays information and data from your returns, including, but not limited to, W-2s, 1099s, 1098s, and other forms that were submitted to the IRS.

- Verification of Non-Filing Letter – Proof from the IRS that you did not file a return for the requested year; only available after June 15th.

How to Get Your Transcript?

Transcripts can be received by mail or online. Online is preferred because it allows you to view and print the transcript immediately, and eliminates the chances that someone from the post office or who receives your mail will obtain a copy.

The mail order transcript reportedly arrives between 5 to 7 business days after the IRS receives the request.

A third party or representative can request a transcript on behalf of an individual taxpayer, but in order to do so a Form 4506-T must be filed with the IRS.

When requesting a copy of your transcript online, you may view and print the transcript immediately. The online method allows you to choose among a tax return, tax account, record of account, wage and income transcripts or a Verification of Non-filing letter.

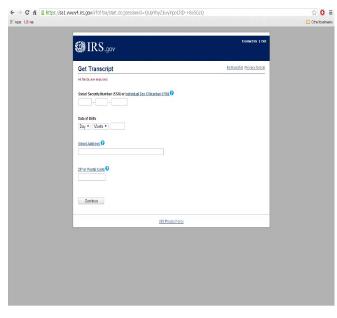

Step-by-Step Instructions for Getting Your IRS Transcript are as follows:

1) Go to www.irs.gov

2) Under Tools, Click “Get Transcript of Your Tax Records

3) Choose whether you want to receive your transcripts via the online method or via mail

4) If you choose the online method, your screen will look as follows. You will need to create an account if this is your first time requesting a transcript online. Proceed to follow the on-screen instructions and enter the proper information.

5) If you choose the mail method, your screen will look as follows and proceed to follow the on-screen instructions and enter the proper information.

Letter Explaining the Use of Life Insurance for a Physician Client as a TBE Substitute in Case the Non-Physician Spouse Dies

originally published in the May 1, 2014 Thursday Report

Recently a client asked us the following question:

Alan,

Mary and I were doing some planning and were looking at life insurance options. You and I had discussed getting a new policy to stagger expiration dates for coverage, specifically, to replace a $2 million dollar policy with two $1 million dollar policies, one for 20 years and one for 30 years.

Can you refresh my memory on the asset protection component of doing this? As I recall, there was an issue with TBE assets becoming exposed if I die and there was a tax issue as well.

Thanks,

John

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Our response to the client is as follows:

Dear John and Mary:

Thank you for your email asking for guidance on the new life insurance.

We favor having multiple policies because once you buy a policy you can never reduce the death benefit. If you buy two $500,000 policies and decide in later years that you only need half of the coverage then you can drop one policy and keep the other.

It does not cost much more to have two $500,000 policies, as compared to one $1,000,000 policy.

On the death of one spouse the life insurance proceeds can be held for the health, education and maintenance of the surviving spouse without being subject to the federal estate tax on the surviving spouse’s estate.

Also, the life insurance proceeds can be held without creditors having access to them.

For example, if Mary dies you are going to lose your tenancy by the entireties protection, but if she dies leaving life insurance in a trust that benefits you for your lifetime without being subject to federal estate tax or creditor claims, this helps to replace the tenancy by the entireties assets and to supplement your future creditor protection and the protection of your children’s inheritance from a potential future spouse and potential future children.

From an estate tax standpoint if we think that there is a good likelihood that the insured spouse will die during the term of the policy, and that the couple will have a net worth exceeding what passes estate tax free (which is presently $5,340,000 per spouse, increased with inflation under the present system), then we can place the life insurance into an irrevocable life insurance trust. This helps to protect the actual ownership of the life insurance policy in case the insured spouse were to ever die, and also avoids federal estate tax on the policy proceeds.

Would you like to set up a ten minute call between the three of us to discuss this?

Best personal regards,

Alan

What Estate Planning and Other Lawyers Need to Know About Bankruptcy

by Alberto F. Gomez and Alan S. Gassman

This year, Al Gomez and Alan Gassman updated their article on bankruptcy. It was originally published in Trusts & Estates in October of 2007 under the title “Avoid Catastrophe – Know the Bankruptcy Code to Ward Off Devastating Surprises to an Estate Plan.”

Al and Alan brought this article to Thursday Report readers in 2014 in an 8-part series published between July 3, 2014 and September 4, 2014, and reader feedback was absolutely amazing. Thousands of advisors sent us cards, letters, flowers, gifts, and candy. One person even offered us a child from Minnesota. Her name was Kelly, and she wanted to be a lawyer when she grew up, so we doubted her judgment and rejected the offer.

Thanks so much to Tampa bankruptcy lawyer and friend Al Gomez and everyone who worked so hard on this article, or at least pretended to.

Executive Summary:

Many estate planners are familiar with asset protection mechanisms, such as state law exemptions, family limited partnerships (FLPs), offshore asset protection trusts (OAPTs), and domestic asset protection trusts (DAPTs). They also are acquainted with some creditor protection rules such as state fraudulent transfer acts as well as ethical considerations that apply to creditor protection planning. Many advisors also have some knowledge of the U.S. Bankruptcy Code.

Unfortunately, though, even those advisors who are familiar with portions of the Bankruptcy Code are unaware of certain provisions—such as those governing preferential transfers—that can have a catastrophic effect upon an estate plan. Indeed, many estate tax- and income tax-oriented planning structures risk being dismantled by a bankruptcy judge, even though the plan’s primary purpose had nothing to do with creditor protection.

That is why it is critical to not only know the basics, but also to recognize certain rules that apply in the bankruptcy forum and the need to consult with a bankruptcy lawyer in certain situations. The following information will provide an update, review, or excellent introduction to this most important segment of financial services.

To view this article in its entirety, please click here.

Richard Connolly’s World 2014 Recap

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

We began this column at the end of October, and it has rapidly become one of our most popular inclusions in The Thursday Report! As the year comes to a close, please enjoy this quick recap of all the best Richard Connolly had to offer us this fall.

The first offering Richard had for us was a great article from UBS about the importance of talking to heirs about their inheritance. As the holiday season reaches its peak and families are once again together, this is a good time to give this article another glance. View the report by clicking here.

Other notable titles shared by Richard this year include:

Using Charitable Remainder Trusts to Turn Bothersome Rentals into Hassle-Free Income by Kelly Kearsley

Court Ruling Sparks Rush to Shield IRAs by Robert Powell

Beyond a Parent’s Reach: When a Child Legally Becomes an Adult by Alina Tugend

An Estate Plan for Your Treasures by Veronica Dagher

Why Everything You Think About Aging May Be Wrong by Anne Tergesen

IRA Rollovers Get New IRS Rules for 2015 by Karen Damato

The 10 Biggest Celebrity Estate Stories of 2014 and What Can You Learn by Danielle and Andy Mayoras

Thanks, Richard, for bringing these articles to Thursday Report readers! We look forward to more of your insightful findings in 2015!

Visit our Friends and Heckle Us at Heckerling!

With the 49th Annual Heckerling Institute on Estate Planning coming up in just a few short weeks, three friends of Gassman, Crotty & Denicolo, P.A. have been kind enough to allow us to display our books and software at their tables.

Management Planning, Inc. (MPI) has graciously agreed to allow our books to be sold at their table, with all profit going to the charity of your choice or to purchase buckets of Kentucky Fried Chicken. Hats off to Joe Gitto for all that he does for the estate planning professional community.

Veralytic, and its brilliant founder and dynamo, Barry Flagg, have also graciously agreed to provide us with space, which is very much appreciated. Veralytic is enables trustees and other professionals to evaluate life insurance policies and historical and comparable product and carrier data. Take a look at a sample report and you will learn a great deal about how insurance products work and what to look for in evaluating products and carriers.

Phil’s Ultimate Estate Planner will also have a booth at Heckerling that will feature our JEST forms and instructional webinar. Howard Zaritsky and Lester Law will be covering JEST trust planning in the Monday morning Fundamentals section. We will be sitting in the front row!

Please plan to stop by these tables and say hello to each of these fine companies. Give them your card for the opportunity to win four buckets of Kentucky Fried Chicken, three copies of an old Thursday Report, four AAA batteries, and a Colonel Sanders Gardening Club membership!

Thoughtful Corner

Becoming Bigger Than the Problem

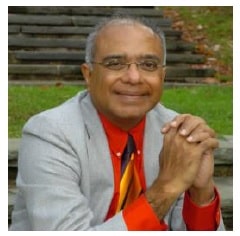

Dr. Srikumar Rao’s widely acclaimed book Are You Ready to Succeed? (now published in over 60 languages!) covers a good many thought exercises. One of his favorite exercises, that does not get discussed nearly as often as it should, is Becoming Bigger Than the Problem.

This can mean a few things, but the most important thing it means is to keep in mind that you, as a thinking and functioning organism, do not need to get bogged down by a problem that may be causing undue distraction or hardship to yourself or others.

The following are a few different, interesting approaches to implementing this school of thought:

1.) “Man Up” – Please excuse the use of the dated and somewhat sexist expression, and think about what this phrase can mean. In short, whether you are a man or a woman, stop letting the little stuff bother you. No matter what the problem is, it is only one of many you will face throughout your life, and chances are, it’s not something that can’t be overcome. You are bigger than the problem. So pay the dues, tolerate the pain, and move on to your next situation.

2.) Is the problem you’re facing one that you can pay to remove? Can you afford, from a financial, psychological, time, or other resource standpoint, what’s necessary to eliminate and remove this problem from your life? If you’ve answered yes to both questions, you have an expense, not a problem.

3.) Problems are one or more perceived obstacles, and solutions will be found by thinking through each obstacle. Everyone gets “analysis paralysis” at times, and an inability to think through situations at other times. There may be an emotional cause or a simple conclusion that the issue cannot be easily resolved. Take some time and step away from your problem. Work through these emotions, and try to think about your problem logically. You may arrive at a solution faster and easier than expected!

4.) Imagine yourself in a situation with a person who represents the problem you’re currently facing. Now imagine yourself to be 18 feet tall, while the person who represents the problem stays at their average human height. The problem probably doesn’t look so threatening anymore.

Manipulate your imagining further. Maybe you are in color, and the person who represents your problem is in black and white. Maybe the “problem person” has an amusing, cartoon-ish voice. All of these things can make the problem seem less challenging. Believe it or not, this can actually work!

5.) Get creative! As Albert Einstein said, “we can’t solve problems by using the same kind of thinking we used when we created them.” Get some help from a creative thinker or from someone who has already been through the experience that you are facing. Gaining a fresh perspective can make the problem dissolve like Alka-Seltzer in water!

Dr. Rao and Alan Gassman will be presenting a webinar entitled How to Handle Stressful Matters in an Ethical Way on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See our Seminars and Webinars section for more information, or click here to register.

Humor! (or Lack Thereof!)

This week, we feature some holiday humor from our frequent comedy contributor Ron Ross.

‘Twas the Night Before Christmas aka The Story of Standra Claus

by Ron Ross

‘Twas the night before Christmas

And all through the house

Sirens were blaring

Because Dad is a louse

Santa lies on the floor

Inside a chalk outline

And Dad will get off

Without even a fine

He got Santa with a bullet

Right square in the jaw

But Dad is not worried

Because “Stand Your Ground” is the law!

THIS WEEK’S MOST IMPORTANT QUESTION: How old should your children be before you tell them there’s no Colonel Sanders?

AND THIS WEEK IN LEGAL NEWS:

Pinocchio pleads the fifth, stating, “I could have just gotten on the stand and lied…well, no, I guess I couldn’t do that,” and Sony cancels a moderately-anticipated film about brave studio executives who stand up for freedom of expression.

And now on to a cartoon by Gassman Law Associates assistant Amy Bhatt:

Upcoming Seminars and Webinars

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Learn how to plan, structure, and protect wealth using revocable and irrevocable trusts and trust systems to effectuate wealth preservation and inheritance planning in a tax-efficient manner.

This course is designed for both new and experienced accountants and includes valuable materials, free use of estate tax projection software, client explanation letters, and a number of useful Excel spreadsheets that can be used on client matters.

Many past attendees have expressed significant praise for this presentation, indicating that it is both dynamic and interesting, while providing a fresh new look at both time tested and new strategies and planning considerations with an emphasis on the numbers, practical application and an accountant’s role in planning and implementation.

Part Two of this presentation will be offered on May 21, 2015 at 10 AM and is entitled “A Practical Trust Planning Checklist and Practitioner Compliance Guide for Florida CPAs.” Please view the seminar announcement below for more details.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

*******************************************************

FREE LIVE WEBINAR SERIES ON LIFE INSURANCE FOR TAX ADVISORS:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on HOW TO READ LIFE INSURANCE ILLUSTRATIONS in the first of a series of webinars intended to help tax lawyers and CPAs understand how life insurance and life insurance structuring works from a technical and mechanical standpoint.

Bring your wrench and screwdriver as we look under the hood to see how we can do our clients some good!

Please note the below announcements for subsequent installments of this series:

February 18, 2015 – Criticism of Hybrid Index Life Insurance Products – What the Heck are These, and Why are They Becoming So Popular?

March 4, 2015 – Premium Financing in 15 Minutes

March 17, 2015 – Split-Dollar in 15 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Date: January 7, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FLORIDA BAR FORT LAUDERDALE REPRESENTING THE PHYSICIAN LAW CONFERENCE:

Alan Gassman will speak at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. We thank chair Lester Perling for doing most of the work on this annual conference.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will speak at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS. We have put a great many hours of time into a comprehensive, easy-to-understand outline that we plan to have become a book on this topic. Satisfaction guaranteed!

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE PRESENTATION:

2015 MOTE VASCULAR SEMINAR

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

When browsing the tables, be sure to stop by Management Planning, Inc. or Veralytic for a chance to purchase one of our books or check out our EstateView software! Phil’s Ultimate Estate Planner will also be featuring our JEST forms and instructional webinar.

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE CLEARWATER PRESENTATION:

RUTH ECKERD HALL PLANNED GIVING ADVISORY COUNCIL MEETING

Ruth Eckerd Hall’s next Planned Giving Council Meeting will be a spectacular two-part event, featuring an educational presentation at 4:30 p.m. and a networking session at 5:30 p.m.

“Improve with Improv: Using Humor and Immediate Responses to Enhance Client, Professional, and Social Interaction” will be led by Jack Halloway, a well-known improvisational coach and actor. This workshop will cover the basic and effective methods of improvisation in order to increase participants’ ability to think quickly, listen closely, and feel more comfortable responding to situations.

The presentation will be followed by a social networking and information session led by Ruth Eckerd Hall’s President and CEO Zev Buffman.

Call Ruth Eckerd Hall, learn improvisation, get an hour of credit, a glass of wine, and a great time!

Date: Tuesday, January 20, 2015 ǀ 4:30 p.m.

Location: Ruth Eckerd Hall’s Margarete Heye Great Room

Additional Information: For more information, or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com or Suzanne Ruley at sruley@rutheckerdhall.net.

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

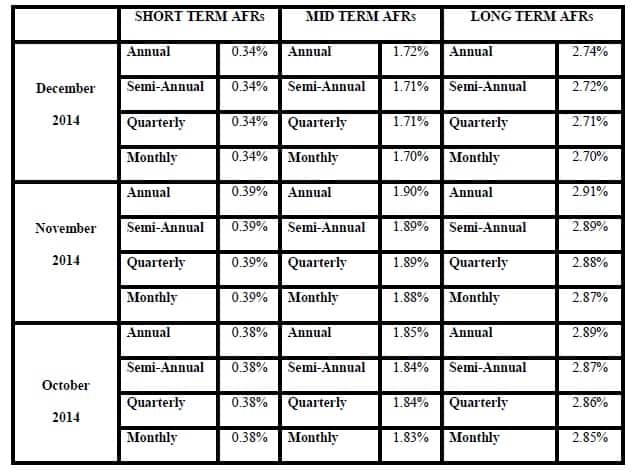

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for December is 2.0% and for November was 2.2%.