The Thursday Report – 10.30.14 – So Bad, It’s Scary!

‘Twas the Night Before Halloween, a poem by Colonel Sanders

Same Sex Marriage Update

Richard Connolly’s World – Talking to Heirs About Inheritance

Gregory Gay’s Corner – Social Security, Part Two

When a Good Casualty and Liability Insurance Agent Gets Involved with Estate Planning and Life Insurance

St. Petersburg College 6th Circuit Pro Bono Newsletter

Thoughtful Corner – The Daily Task List

Halloween Trivia Contest Answers

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

‘Twas the Night Before Halloween…

by Colonel Sanders

‘Twas the night before Halloween

And all through the office,

Not a creature was stirring

Except for Old Lawfuss.

The dentures of Rufus

Had been left on the shelf,

Next to his cane and his hat

And a picture he took of himself.

The probate crew was off

Celebrating another Thursday Report,

While the janitor was cleaning up

And drinking too much port.

When all of the sudden

The Cat in the Hat

Came down the chimney

And encountered a rat.

Terrified of rodents,

He high-tailed it out.

He would cause havoc elsewhere,

And left with a shout.

Because the Monster of Dr. Seuss

Was no longer at large,

The bills had gone out

Billable time must be charged!

And many were sent

Without any discount

The month end was near

Time to add to the bank account.

It was time to refill on staples and beer,

The sign needed a new saying,

And scary Old Lawfuss

Was ready for a slaying.

So down he went on the snowy hill

Yelling “Dash away, Donner!”

The office is closed,

And to heck with “Your Honor”.

And then someone exclaimed,

“He is napping again!”

And the picture of Colonel Sanders

Refrained with a grin (not a gin).

Another Halloween

Scaring children with candy

Without asking their guardians

Is, on this night, just dandy.

But please be safe

And take care of yourself,

Because old Rufus’s dentures

Are missing from the shelf.

And Old Lawfuss exclaimed,

As he flew out of sight,

“Happy Halloween to all!

Isn’t real life enough of a fright?”

Same Sex Marriage Update

Attorney General Eric Holder announced Saturday that the federal government will now recognize the marriages of same sex couples in six new states: Alaska, Arizona, Idaho, North Carolina, West Virginia, and Wyoming.

To see the press release in its entirety, please click here.

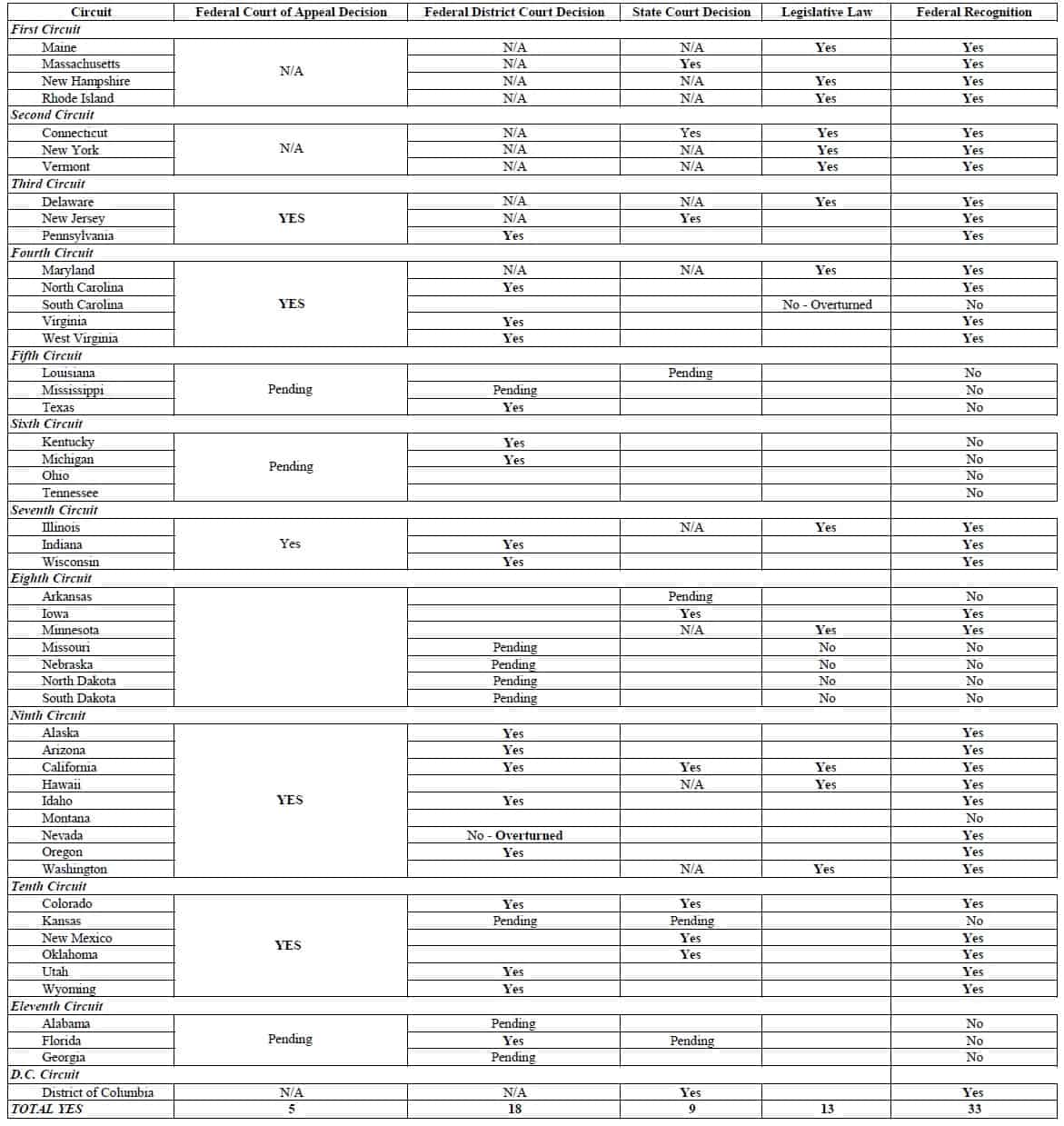

The chart below features a summary of current same sex marriage laws in the United States by the following categories: Federal Court of Appeal decisions, Federal District Court decisions not appealed, State Court decisions, legislative action, and whether federal agencies that rely upon the “state of recognition” consider the state law to recognize marriage.

Alabama, Florida, and Georgia are the only states in the 11th Circuit Court of Appeal, and none of the three are considered to be “recognition states” by the federal government.

To see a full-size version of this chart, please click here.

Richard Connolly’s World

Talking to Heirs About Inheritance

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is entitled “Begin Before the End: Why Families Need to Have Inheritance Conversations Now” and was featured in the Third Quarter 2014 issue of UBS Investor Watch.

Richard’s description is as follows:

It’s easier to have a will (83 percent of respondents have one) than discuss the will with your children (about half have) and harder still to tell them what the assets are (34 percent of respondents have). Martin Halbfinger, a private wealth manager at UBS Wealth Management, said clients typically didn’t talk about inheritance with their children for four reasons: they don’t want to confront dying, they are uncomfortable disclosing financial matters to their children, they don’t want their children to know how much they’re actually going to receive, lest it curb their motivation, and they are concerned about their heirs’ financial acumen.

This is a good article to use with clients to encourage them to have the “inheritance” discussion.

Click here to view the full report.

Gregory Gay’s Corner – Social Security, Part Two

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

We continue the discussion of the nation’s Social Security program with some words on the taxation of benefits, spousal and family benefits of a retired or deceased worker, and disability benefits and eligibility. To read part one of the Social Security chapter from the Florida Senior Legal Guide, please click here.

Taxation of Social Security Benefits

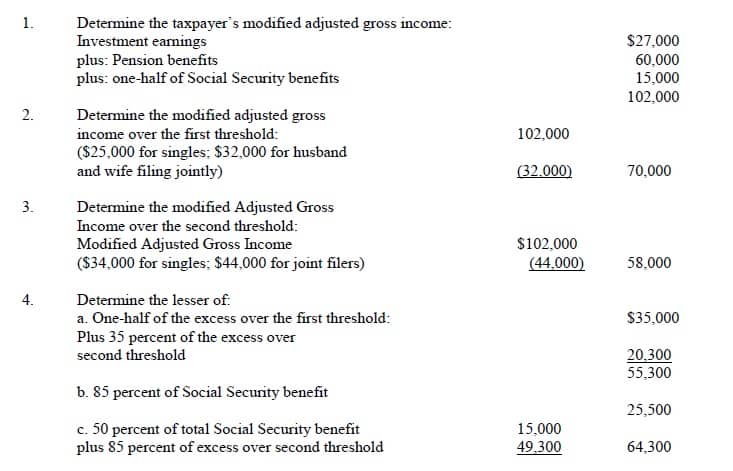

Presently, up to 85 percent of Social Security benefits may be included in taxable income if a taxpayer’s income exceeds a certain amount. If an individual’s gross income (including social security, taxable and tax exempt income) exceeds $25,000, he or she may be taxed on up to 85% of his or her Social Security benefits. A married couple, filing jointly, may be taxed on up to 85% of their Social Security benefit if their total gross income exceeds $32,000. There is no higher exclusion amount for a married person filing separately. Instead, the threshold will be $25,000. The calculation of the income tax on Social Security Benefits is explained in the following chart.

LIFE SITUATION #2

Gregory and Julia are age 66, and are married and retired. In the year 2013, they will receive $27,000 in investment earnings, $60,000 from Gregory and Julia’s combined pension plan retirement benefits, and $30,000 in combined Social Security retirement benefits. The amount of their Social Security that is subject to federal income tax is computed as follows:

Since the smallest of these three figures is $25,500, this is the amount of Social Security benefits that will be subject to income taxation.

Benefits for a Married Spouse of a Retired Worker

A spouse may receive up to a maximum of one-half of a retired or disabled worker’s primary insurance amount subject to the family maximum. At age 62, the spouse’s benefit would be 38.35 percent of the primary insurance amount. The spouse must have been married to the worker for at least one year and be at least 62 years of age. The spouse cannot be entitled to a higher old-age or disability benefit from his or her own record. Medicare benefits begin for a spouse at age 65.

Benefits for a Divorced Spouse of a Retired Worker

A divorced spouse is entitled to a monthly benefit equal to one-half of an insured’s unreduced retirement amount. The divorced spouse must be at least 62 years of age, have been married to the worker for at least ten years, and the couple must have been divorced for at least two years. This two-year wait is intended to discourage couples from divorcing in order for one member to receive benefits while the other continues to work. In addition, the divorced spouse cannot be remarried and cannot be entitled to a larger benefit on his or her account. An eligible divorced spouse will receive a further reduction if he or she retires before his or her full retirement age. The difference between the current spouse and a divorced spouse is that the current spouse cannot receive benefits on the worker’s record until the worker actually files for Social Security benefits, whereas the divorced spouse may file for benefits once he or she meets the eligibility requirements and the worker is of retirement age (at least age 62). Medicare benefits begin for a divorced spouse at age 65.

Surviving Spouse’s Benefits

A surviving spouse of a deceased worker who remains unmarried and has no dependent children under age 18 may retire and begin receiving a widow(er)’s benefits at 60, or 50 if disabled. The surviving spouse must have been married to the deceased wage earner for at least nine months. If the marriage was less than nine months, it must be proven that the deceased was reasonably expected to have lived nine months and that the insured’s death was not expected. Medicare benefits begin for a widowed spouse at age 65. A subsequent marriage after age 60 will not affect the right to receive social security as the widow or widower of a deceased spouse. If a widow or widower remarries before age 60, there is no right to social security due to the death of the previous spouse. However, entitlement may again be considered if the current marriage ends in divorce or the current spouse dies.

The surviving spouse will also receive a lump sum death benefit of $255. This is a small stipend in relation to the actual cost of burial, which Florida’s legislature has recognized as being on the average of $6,000.

Family Benefits for a Deceased Worker

If a spouse dies fully insured, the surviving spouse and the minor children are entitled to survivor’s benefits. The surviving mother or father will receive Social Security benefits as a parent of a minor child until that child reaches the age of 16, or is over 16 and disabled and in the care of this parent. A child of the deceased worker will receive Social Security benefits until 18 as long as he or she remains unmarried. A child’s benefits can continue to age 19 if he or she is attending a full-time secondary school. A child cannot be married and continue to receive benefits unless he or she is an adult disabled child who marries another dependent or survivor beneficiary.

These family benefits are subject to a family maximum. This means that although the surviving spouse and the minor children of a deceased worker may all be entitled to social security, there is a limit on how much a family may receive. The family maximum is never large enough to pay full benefits to more than two persons. The surviving mother or father and each child receive a proportionate share of this benefit. For example, if the family maximum due to the death of the father is $1,500 per month, then the mother and the three minor children would receive $375 each per month. It is also important to remember that the widow or widower and the minor children are not entitled to Medicare unless they are disabled. Thus, it may be necessary to use a portion of this monthly Social Security family benefit for the family’s health insurance premiums.

Parent’s Benefits

A parent may be dependent on a worker at the time of the worker’s death. This occurs if the parent is at least 62 years of age, receiving at least one-half of his or her support from the worker at the time of the worker’s death, and is not entitled to his or her own Social Security benefit that exceeds the benefit to be received as a parent. The parent cannot be married when he or she applies for the benefit. However, the parent can subsequently marry another survivor or dependent after the benefit begins to be paid.

Disability Benefits and Eligibility

In order to receive Social Security Disability Insurance (SSDI), a worker must be under age 65 and have obtained a status of disability insured or specially insured. A worker meets the definition of disability-insured if he or she has enough credits of coverage during a certain period of time before becoming disabled. A credit is earned when a worker receives at least a minimum amount of earnings (presently $1,160 in 2013) during a quarter of a calendar year. However, a worker can earn 4 credits for a year by earning the minimum amount for the year at any time during the year. The worker must have credits for at least 20 quarters during the past 40-quarter period that ends with the quarter in which the disability occurred. This is referred to as the 20/40 rule. A person who is disabled due to blindness is not required to meet this 20/40 rule.

LIFE SITUATION #3:

A married mother with children 5 and 7 years old becomes disabled. She had worked the first five years of marriage and then stayed home the next seven years to raise the children. To receive any kind of benefit from the Social Security Administration, a wage earner must have worked at least five of the last ten years. In this case, the mother is not entitled to Social Security disability benefits. Had she worked part-time and earned enough to gain four quarters of coverage each year, she would be eligible. Example: for the year 2013, $1,160 in earnings equals one quarter of coverage. Therefore, $4,640 earned equals four quarters of coverage for 2013.

The exception to this disability-insured status rule relates to younger workers. For instance, a younger worker who has not worked long enough to meet the disability insured status may still be specially insured and entitled to disability benefits if he or she becomes disabled after age 21 and before age 31 and has credit for one-half the quarters from the time he or she attained age 21 until becoming disabled, with a minimum of 6 credits. If a worker becomes disabled before age 24, the worker is specially insured for disability benefits if he or she has 6 quarters of credit in the 12 quarter period immediately prior to becoming disabled.

Determining Disability

The Social Security Administration will only determine an eligible worker to be disabled when he or she lacks the ability to do any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or which has lasted (or can be expected to last) for a continuous period of not less than twelve months. The impairment must be so severe that the worker must be unable to do his or her previous work or any other substantial gainful activity which exists in the national economy. The Social Security Disability Insurance monthly payment is based on the worker’s past earnings. There is usually a five-month waiting period before these payments begin.

Working While Receiving Disability Benefits

“Substantial gainful activity” (SGA) is the ability to perform work that produces earnings. Beginning in 2013, earnings of $1,040 per month or more is considered substantial. If a worker’s earnings average less than $1,040 per month, the worker’s disability benefits should continue. For a blind person, earnings of $1,740 or more will be considered substantial in the year 2013.

Disabled Widow’s / Widower’s Benefits

A disabled widow or widower of a deceased worker is entitled to receive Social Security if he or she is between the ages of 50 and 60. A subsequent marriage after age 50 will not affect the right to receive social security as the disabled widow or widower of a deceased spouse. Should the disabled widow or widower who remarried before age 50 divorce the new spouse or should the new spouse die, the death or divorce would re-establish the disabled widow’s or widower’s eligibility to benefits. If a disabled spouse is eligible for multiple benefits as a widow or widower of several spouses, he or she has the option of taking the highest monthly benefit.

Family Benefits for a Disabled Worker

A spouse and each dependent child of a disabled worker will also be eligible for a monthly Social Security benefit. When combined, these family benefits cannot exceed 150 percent of the disabled worker’s retirement benefit.

Next week, Gregory Gay’s series will continue with a look at the Medicare system in the United States. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

When a Good Casualty and Liability Insurance Agent Gets Involved with Estate Planning and Life Insurance

Diana DeVito, who operates a State Farm Agency in Clearwater, recently met with some clients and sent the following email so that they and everyone on the team were aware of what Diana was doing and not doing with respect to their estate and financial planning.

The email reads as follows:

Hello John and Jane,

I feel good about the progress we made this week. Here is an outline of where we are on pending items:

See BELOW for the note from Alan Gassman for things for you to think about regarding the legal work that needs to be done. Please feel free to contact me or Alan if you have any questions. Once you have made decisions, please respond to Alan if you wish to proceed with your legal documents.

We added Uninsured Motorist coverage for $1MM on your Personal Liability Umbrella with State Farm.

We reviewed your investment Risk Tolerances and reviewed your Client Portfolio Report with the recommended changes to your asset allocation mix. Pursuing that balance, we initiated paperwork to transfer both of Jane’s accounts to State Farm and started a new ROTH IRA for John with a monthly contribution of $100 per month. This also leverages the reduced sales charges by having accounts with one fund family. John is still determining if he wants to transfer his accounts from Ameriprise.

We discussed the need for life insurance for Jane. As discussed, we began the underwriting process on $3.5MM of coverage with the intent to use the leverage of having the coverage all with State Farm to obtain a better rate, as well as better management of the plans. The $3.5 figure includes the $1,040,000 needed for the Bank, $1MM for Jamie Smith to fund an option to purchase the business if needed, as well as additional coverage for John and the kids.

We reviewed the disability insurance that Jane now has in force, including the specific coverage provisions. After our discussion, I will run rates to see what is the most cost-effective way to get the amount of coverage that you want provided.

We will review your health insurance with BCBS, as open enrollment starts November 15th, to see if we can assist you there in better coverage/premiums due to the Affordable Health Care Act.

Once Jane’s investment accounts are set up, we will need to set up her automatic deduction for monthly contributions to her retirement plan.

We will review options on John’s life insurance with Phoenix.

Once the dust settles, we will run our Retirement Calculator to provide a picture of your retirement expectation projections as we move forward.

I know this is a lot to absorb, and we are definitely making progress!

Thank you again for your trust and confidence.

Diana

****************************************************

Dear Diana:

Thank you for putting me on the phone with John and Jane.

The questions that come to mind are as follows:

- First choice guardian if the father cannot serve – it sounds like it is Jeff.

- Individual Trustee or Trustees to hold monies for the children

- Individual Trustee or Trustees to hold monies for Jeff and/or the children and ground rules as to access to monies by Jeff and/or the children after Jane’s death

- Agent to serve to make financial decisions if one spouse cannot serve for the other

- Same as above for health care decisions

We typically talk through the above once the client has had a chance to think about who is trustworthy and able to help in these situations; commonly, it is a trusted individual who is required to serve as Co-Trustee with a licensed trust company and/or a professional.

I hope this is helpful.

If you need anything further, please let me know.

Best personal regards,

Alan S. Gassman

Are you being a good neighbor and a good advisor by letting everyone else on the team know what you believe they need to do?

Hats off to Diana for many years of great service to her clients and the community!

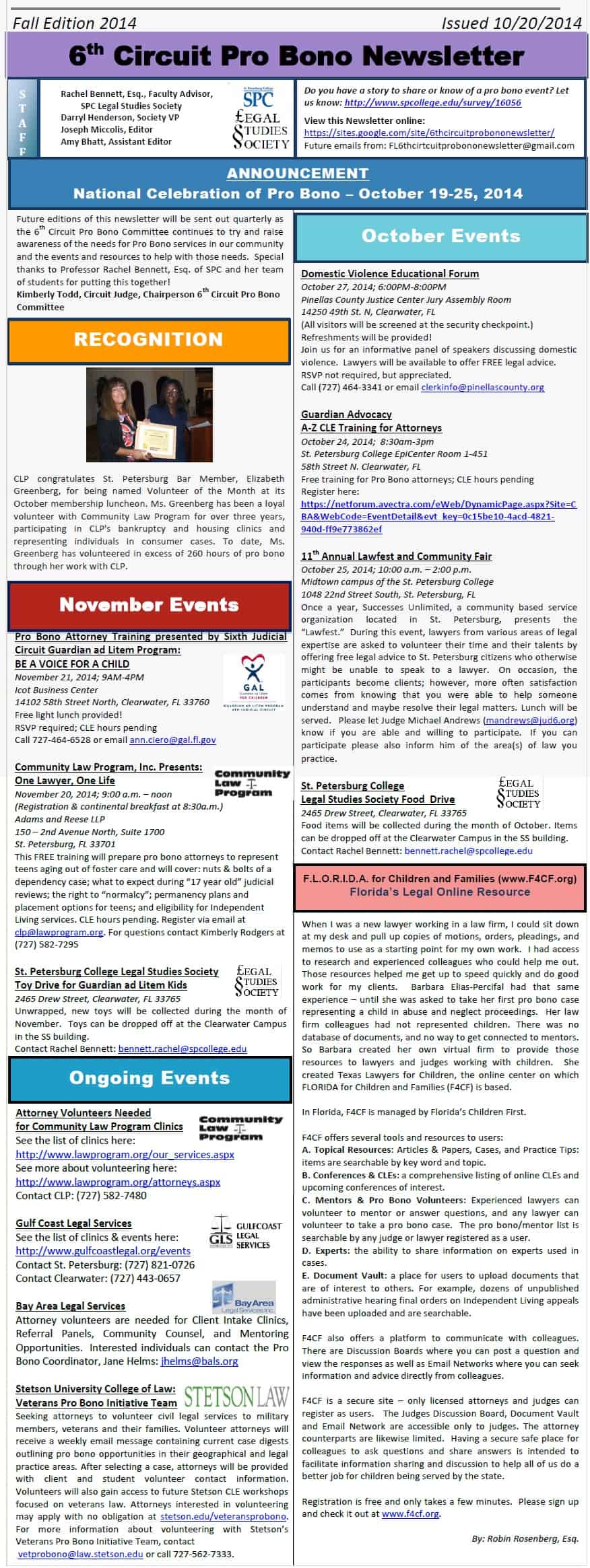

St. Petersburg College 6th Circuit Pro Bono Newsletter

Amy Bhatt, one of our assistants at Gassman Law Associates, is a student majoring in Paralegal Studies at St. Petersburg College. She also serves as the Assistant Editor for the SPC Legal Studies Society’s 6th Circuit Pro Bono Newsletter. Thanks to Amy and Faculty Advisor Dr. Rachel Bennett, Esquire for making this newsletter available to Thursday Report readers!

To download a copy of this newsletter, please click here. For more information, or to join the 6th Circuit Pro Bono Newsletter mailing list, please email Dr. Rachel Bennett at rachel.bennett@spcollege.edu.

Thoughtful Corner – The Daily Task List

Benjamin Franklin carried a day book. He was always working on improving himself and found that writing things down and journaling had a significant impact on his life.

We now have over a thousand things available to us that he never even thought possible, yet armed with intellect, good habits, and a dedication to improving himself, his business, and his community, he was able to achieve much more in each year of his life than most of us will achieve in a lifetime today.

We recommend the day book idea. Handwriting each item to be achieved makes your brain stop and think about the item for a few seconds. Ideas will result. Give it a try – we guarantee that you will like it!

Your Daily Task List Procedure

- Physically write down everything on your to-do list for the next day.

- Do so in uninterrupted silence so that you are concentrating on what you write down and what your thoughts are during this process.

- Generally, write the most important things at the top and less important things at the bottom.

- Rank the items on a letter scale – “A” for very important, “B” for important, “C” for less important

- Once the items are categorized by letter, rank them. Label each item A-1, A-2, A-3, B-1, B-2, etc.

- If the item can be delegated, write down who can handle it for you to the right of the item.

- If the item can be handled by a simple email, put an E in a circle to the right of the item.

- Use other codes like the one described in Step 7 to determine how to best handle each item.

Your Weekly Task List Procedure

- Physically write down each item to be achieved for the week.

- Use a delegation column to list what can be delegated and to whom.

- Use a separate column for items that can be done while doing other tasks, such as exercising or while walking the dog (the dog won’t care and might even have helpful comments!)

- The Weekly Task List can be used for personal tasks as well. For instance, if you want to lose weight, use a separate column to write down what you eat each day.

Review both task lists in your morning meetings and delegate from there.

Do the best you can for the day you are in without being distracted, anguished, or overly attentive to future events that are not relevant today. This all worked very well for Benjamin Franklin and many before (and after!) him.

Now go forth and conquer the day!

Halloween Trivia Contest Answers

Last week, we held a special Thursday Report Halloween Trivia Contest. If our questions had you spooked, look below to find the answers.

1.) What were the first Jack-o-Lanterns traditionally made from?

- Melons

- Turnips

- Pumpkins

- Coconuts

2.) What does the Halloween color orange represent?

- The twilight

- The burning of spirits

- Jack-o-Lanterns

- The harvest

3.) What does the Halloween color black represent?

- Midnight

- Uncertainty

- Death

- Trick-or-treating

4.) After Candy Corn, which is the most popular Halloween candy?

- Reese Cups

- Starburst

- Snickers

- M&Ms

5.) Halloween is the 2nd highest grossing commercial holiday after what?

- Christmas

- Thanksgiving

- Easter

- Valentine’s Day

6.) What is the fear of Halloween called?

- Samhainophobia

- Phasmophobia

- Wiccaphobia

- Coimetrophobia

7.) Halloween is the 3rd largest party day of the year in the United States. Which days are ranked 1st and 2nd?

- The 4th of July and Christmas

- New Year’s Eve and Super Bowl Sunday

- New Year’s Eve and Christmas

- Super Bowl Sunday and the 4th of July

8.) What percentage of parents admit to sneaking candy from their children’s trick-or-treat bags?

- 30%

- 55%

- 75%

- 90%

9.) How much does the United States, as a country, spend annually on celebrating Halloween?

- $1 billion

- $2 billion

- $5 billion

- $7 billion

10.) What year was the Halloween classic “It’s the Great Pumpkin, Charlie Brown” first aired?

- 1957

- 1966

- 1982

- 1993

BONUS ROUND: Which famous magician died on Halloween Day? Harry Houdini

Humor! (Or Lack Thereof!)

It’s never too early to plan your estate!

Dr. Frankenstein’s monster is enjoying his first birthday, but who knows when the torches and pitchforks are coming? Monster needs to plan who will get his giant boots if he dies (again!) Also, who will get the various attached body parts? The families of the original owner? These are all complicated questions that must be addressed by a competent estate planner. Monster doesn’t want to leave it so his estate defaults to the Transylvanian government…estate tax bad!

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman will be joined by reverse mortgage specialist Elena Katsulos for a webinar on REVERSE MORTGAGES, A DEEPER DIVE

Date: Wednesday, November 5, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar please click here.

*************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: To see the complete schedule, please click here. For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan S. Gassman will be presenting Dick and Jane’s Legal Adventure at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting. This program will cover the basics of Wills, trusts, LLCs and coordination thereof for paralegals. The presentation includes a 4 color slide show called “THE LEGAL STORY OF DICK AND JANE”, and all attendees will receive one copy of the Thursday Report, whether they want it or not. Dinner is included, but mashed potatoes are extra.

Date: November 11, 2014 | 6:00 p.m. – 8:00 p.m. (Alan Gassman speaks at 7pm)

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATIONS:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING.

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar, please click here. To register for the 5:00 p.m. webinar, please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE 2015 CLEARWATER PROFESSIONAL ACCELERATION WORKSHOPS:

Alan Gassman will be presenting a year-long Professional Acceleration Workshop that will enable participants to look down from 30,000 feet to supercharge their practices and professional lives.

5-6 hour sessions will be held on the following dates:

- Friday, January 30, 2015

- Friday, March 20, 2015

- Friday, June 26, 2015

- Friday, September 25, 2015

- Friday, December 4, 2015

Location: A Clearwater, Florida hotel to be determined.

Additional Information: For more information or to register for the program please contact Alan Gassman at agassman@gassmanpa.com or at 727-442-1200.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

*************************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

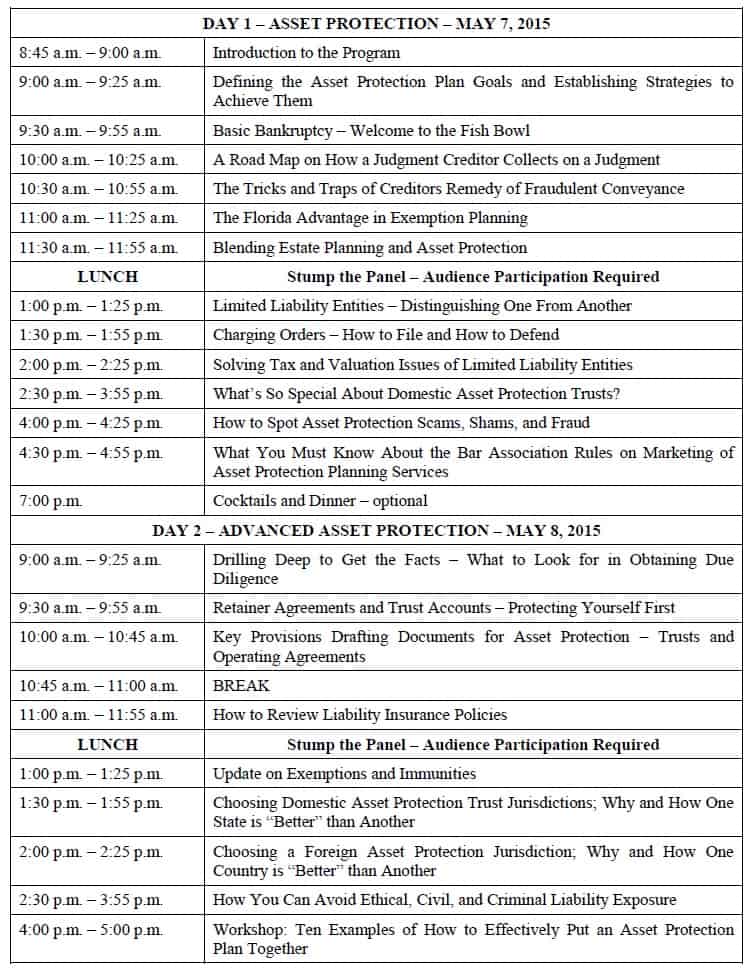

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Topics and Times are as follows:

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

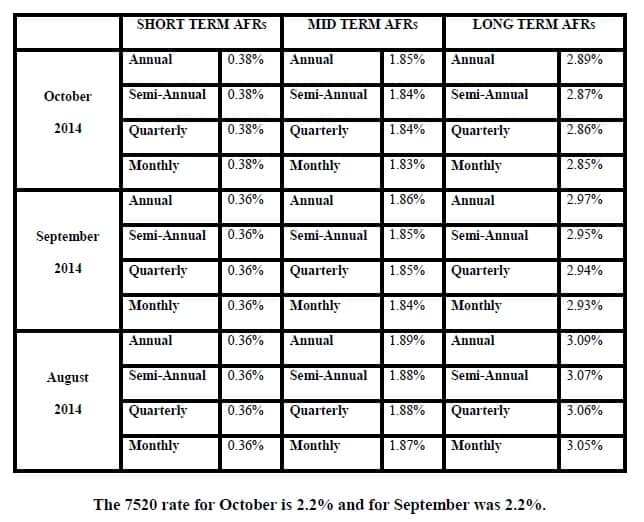

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.