The Thursday Report – 1.8.2015 – Margaritaville and Heckle and Jeckle Part I

A Message From The Thursday Report

Avoiding Disaster on Highway 709: The Ten Biggest Mistakes Made on Gift Tax Returns and How to Avoid Them

Gregory Gay’s Corner – Selling a Residence and Homestead Exemptions, Part I

Richard Connolly’s World – The Way Early ‘529’ Gift

Seminar Spotlight – Tampa Bay Estate Planning Council Dinner Program

Thoughtful Corner – Using Personality Test Results to Improve Your Team Performance, Synergism, and Satisfaction

Humor Lite!

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

A Message From The Thursday Report

Lite Edition Notice – The National Thursday Report Advisory Council (NTRAC) has placed the Thursday Report on probation for excess humor and is requiring us to issue a lite version every other Thursday in order to enhance the quality of our even numbered Thursday Reports. We find this to be odd, but will comply for the foreseeable future. On opposite weeks we will still bring you full Thursday Reports packed with all of the information and humor you or a bucket of Kentucky Fried Chicken can hold! We hope that you will continue to join us each week!

— The Management

“The above is untrue and being investigated.”

— The National Thursday Report Advisory Council

Avoiding Disaster on Highway 709: The Ten Biggest Mistakes Made on Gift Tax Returns and How to Avoid Them

by Kenneth J. Crotty

The Top 10 Mistakes we see with respect to filing gift tax returns are as follows:

- The gift tax return does not contain sufficient information to provide “adequate disclosure” to the IRS. This prevents the statute of limitations on the ability of the IRS to audit the gift from starting to run. As a result, the IRS will have an unlimited time to audit the gift.

- The return is filed and does not utilize the client’s annual exclusion to reduce the value of the reportable gifts that are made. When the preparer does not reduce the value of the reported gifts by the donor’s applicable annual exclusions, then a portion of the donor’s gift and estate tax exemption is wasted, which could cause the family to owe unnecessary gift or estate tax.

- The gift tax return does not exclude from the reportable gifts the gifts which qualify for the educational or medical exclusion. This oversight will also unnecessarily use the donor’s lifetime gift and estate tax exemption, which could cause the family to owe additional gift or estate tax.

- The return misreports gifts to 529 plans that exceed the annual exclusion. Gifts to 529 plans can be spread out over a period of 5 years, but this election must be affirmatively made on a gift tax return. If a gift to a 529 plan in excess of the annual exclusion is not split, then the gift will use some of the donor’s gift tax exemption, which could cause the family to owe unnecessary gift or estate tax.

- The return is prepared assuming that annual exclusion gifts also qualify for the GST tax annual exclusion. Most gifts that qualify for the gift tax annual exclusion that are made to trusts do not qualify for the GST tax annual exclusion, and utilize some of the client’s GST tax exemption. If these are misreported, then the client may have less GST tax exemption remaining than what is stated on the return, which could significantly impact future planning.

- When a gift is made to a trust, the gift tax return is filed without attaching either a copy of the trust or a brief description of the trust’s terms to the return. Pursuant to Treasury Regulations, if a reportable gift is made to a trust and the gift tax return is filed without attaching either a copy of the trust or a brief description of the trust’s terms, then adequate disclosure has not been provided to the IRS. Per Mistake #1 above, the statute of limitations on the ability of the IRS to audit the gift does not start to run.

- Gifts made to trusts which are not direct skips for GST tax purposes are reported on Schedule A Part 2 and not on Schedule A Part 3. Returns prepared this way are incorrect and might be considered to not provide adequate disclosure.

- A joint tax return is filed. Spouses may not file a joint gift tax return. If a joint gift tax return is filed, more than likely the statute of limitations will not begin to run for any of the gifts that are reported on the return.

- Mistakes related to gift splitting. Married spouses may split the gifts they make so that the gifts are treated as having been made one-half by each spouse. There are numerous traps related to gift splitting which may prevent the gift from actually being split.

- The possibility of opting out of the automatic allocation of GST Exemption is not considered. If the value of property that was an indirect skip has decreased when the gift tax return is filed, the return preparer should consider opting out of the automatic allocation of GST Exemption. In this case, a second return could be filed allocating GST exemption equal to the reduced value of the property, thereby saving the client’s GST exemption. It is important to note that this should only be considered for indirect skips and not direct skips, otherwise GST tax would be payable.

Next, the Disaster on Highway 709 series continues with a look at 9 Common Mistakes Related to Spousal Gift Splitting.

Gregory Gay’s Corner

Selling a Residence and Homestead Exemptions, Part I

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week, we turn our focus to real estate with an examination of reverse mortgages and capital gain exclusions on the sale of a residence.

Capital Gain Exclusion on the Sale of a Residence

A single taxpayer can exclude up to $250,000 of the gain received on the sale of a principal residence, provided that the taxpayer has owned and occupied the residence as a principal residence for at least two of the past five years prior to the date of sale. This exclusion increases to $500,000 for married couples who meet this requirement.

A taxpayer who cannot meet these new requirements because of a change of employment or a disability is able to exclude a portion of the taxpayer’s capital gain earned on the sale of a residence.

LIFE SITUATION #6

Paul and Carol purchased a residence in New York in 1960, for $30,000. They retired to Florida on January 1, 2012 to a new residence for which they then began claiming a homestead exemption. Paul and Carol would like to sell their New York residence, which now has a fair market value of $300,000. Since Paul and Carol have resided in the New York residence for two of the last five years, they can exclude the entire $270,000 capital gain realized for federal income taxation purposes if they sell their New York residence by December 31, 2014. This is because they resided in their New York residence in 2010 and 2011.

If Paul and Carol continue to reside in Florida and do not sell the New York residence by December 31, 2014, they cannot claim they lived in the New York residence for two of the past five years. If they wait to sell the residence after the year 2014, they will have to pay income tax on a capital gain of $270,000 if they sell it for appraised value unless they return to New York and reside in their New York residence for two years before selling it. They will need to abandon their claim for the Florida homestead exemption in the years they subsequently reside in New York. Florida has no state income tax. However, Paul and Carol should be aware that there is a state income tax in New York. Thus, any capital gain may also be subject to taxation at both the federal and New York rates.

LIFE SITUATION #7

Sally, a widow, purchased a residence in 2010 but in 2012 entered a nursing home where she has continued to reside. If Sally sells her residence, she will be able to exclude the entire capital gain on the sale of her residence. There is an exception to the two-year residency requirement if the owner is physically incapable of residing in his or her residence.

Until now, if a spouse died late in the year, the surviving spouse had to quickly sell the family residence before the end of the year if the surviving spouse wanted to preserve the $500,000 exclusion on the sale of a residence. The law now gives the surviving spouse a $500,000 exclusion if the sale of the residence occurs not more than two years after the year of the death of the first spouse and all of the other conditions apply. If the surviving spouse remarries before the residence is sold or exchanged, this new two year exclusion will not apply.

Reverse Mortgage

A reverse mortgage is a home loan that provides cash advances to a homeowner, but does not require any certain repayment until the home is sold or the surviving homeowner dies or relocates. The funds received from a reverse mortgage can be used for any purpose a homeowner deems appropriate including the additional expense related to a homeowner’s assisted living or nursing home cost. The proceeds from a reverse mortgage can also be used to pay for unexpected repairs to the home due to storm damage.

A reverse mortgage is different from a traditional mortgage, or a home equity line of credit, in that a homeowner must have sufficient income and little or no debt to qualify for these types of loans. In addition, the homeowner is required to make monthly mortgage payments. By contrast, a reverse mortgage is available regardless of the homeowner’s current income. In addition, the homeowner creating a reverse mortgage cannot be foreclosed or forced to vacate the home because he or she does not make a mortgage payment.

The amount a homeowner can borrow on a reverse mortgage depends on the age of the youngest borrower, the current interest rate, and the appraised value of the home or the Federal Housing Administrations mortgage limits for the homeowners county, whichever is less. Generally, the more valuable the home, the older the homeowner, and the lower the interest rate, the greater the amount that can be borrowed.

While the homeowner is not required to make payments as long as the house remains his or her principal residence, the homeowner is still required to pay the real estate taxes, assessments and property insurance. When the home is sold or is no longer used as the borrower’s primary residence, the borrower must repay to the lender the cash received from the reverse mortgage, plus the accrued interest and closing costs. The remaining equity in the home, if any, belongs to the borrower. None of the borrower’s other assets will be affected by a reverse mortgage loan.

The most common reverse mortgage is the Home Equity Conversion Mortgage. This is the only reverse mortgage that is insured by the Federal Housing Administration (FHA). Over 493,815 senior citizens have taken advantage of FHA’s Home Equity Conversion Mortgage as of May, 2010. All of the homeowners must be age 62 and older in order to receive a Home Equity Conversion Mortgage. By contrast, a “proprietary” reverse mortgage is lent by a private company that owns the mortgage. Loan costs can vary from one type of reverse mortgage to another.

Not all reverse mortgages include the same type of loan costs. As a result, the true total cost of reverse mortgages can be difficult to understand and compare. That is why federal Truth-in-Lending law requires lenders to disclose a “Total Annual Loan Cost” for these loans. This is the same comparison used for a traditional “forward mortgage”.

If funds actually drawn from a reverse mortgage are not spent in the same month as received, these funds will be counted as available assets to the community spouse or the nursing home patient. These excess assets could disqualify the nursing home spouse’s Medicaid eligibility for subsequent months if the community spouse or the nursing home spouse has too many countable assets. Medicare and Social Security benefits are not affected by monies received from the reverse mortgage.

On October 4, 2010, the U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) introduced a new program called the HECM Saver. The HECM Saver is an option to the existing HECM program that will now be referred to as the HECM Standard. While the HECM Standard will continue to charge an initial mortgage insurance premium of 2 percent of the maximum amount of the mortgage, the HECM Saver will only charge .01 percent of the loan amount. Thus, the MIP for a $200,000 HECM Standard will be $4,000 while the MIP for a $200,000 HECM Saver will be $20. The trade-off will be that the amount the borrower can finance will be reduced between 10 to 18 percent. This will reduce the risk to the FHA insurance fund by reducing the principal limit or the amount of money available to the borrower.

Further information regarding reverse mortgages can be obtained from the Internet at www.aarp.org. The Department of Housing and Urban Development also provides information regarding its approved lenders without cost. Approved housing counseling agencies are available for free, or at minimal cost, to provide information, counseling, and referrals to HUD’s approved lenders.

Next time, Gregory Gay’s series will continue with commentary on Florida Documentary Stamp Tax, title insurance, and property tax exemptions. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World – The Way Early ‘529’ Gift

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “The Way-Early ‘529’ Gift: Grandparents Can Start a College-Savings Plan Before a Baby is Born.” It was featured in The Wall Street Journal on November 3, 2014.

Richard’s description is as follows:

So you just threw your daughter a big wedding. Now comes the not-so-obvious next step: setting up “529” plans for the future grandchildren.

If that seems like rushing things, think again. With the average four-year price of a private college nearing $165,000 and rising 3.7% a year, anxious families are looking at lots of strategies for helping future grandchildren get a college education. One strategy is to open a 529 college-savings plan and have it start growing years before the future student is even born.

Please click here to read the article in its entirety.

Seminar Spotlight

Tampa Bay Estate Planning Council Dinner Program

Wednesday, January 21, 2015, 6:45 p.m. at the Tampa Club,

101 E. Kennedy Blvd, Tampa, FL

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits, the Handbook and Charts You Have Always Wanted

By Alan S. Gassman, J.D., LL.M. and Christopher J. Denicolo, J.D., LL.M.

This presentation will provide attendees with clear directions for understanding and applying the rules with reference to minimum distributions, transfers and rollovers, trust beneficiaries, and how to otherwise handle pension and IRA accounts. The discussion and handbook will also cover creditor protection aspects of pension and IRA planning, non-qualified variable annuity distribution planning, annuitized IRA planning, qualified longevity annuity contracts (QLACs) and more.

The presentation will also discuss:

- Understanding the rollover, aggregation/non-aggregation, creditor protection, borrowing, and first-time homeowner rules as they apply to living participants

- Understanding the four different methods of calculating minimum distributions and when each of them applies

- Understanding what post-death decisions can be made and what flexibilities can be programmed into an estate and trust plan so that the best possible decisions can be made during the 9 months after the death of the IRA/Plan Participant

- Being able to determine how to best integrate Roth and regular IRA and plan distribution planning with Q-TIP marital deduction trusts, generation skipping trusts, and non-generation skipping trusts

- Understanding the differences in the payout rules that apply based upon whether the deceased IRA owner/plan beneficiary was receiving minimum distributions by reason of having reached age 70.5

- Understanding annuitized IRA contracts, qualified longevity contracts (QLACs) and beneficiary designation planning under non-qualified variable annuity contracts

Alan Gassman will present this talk at the Tampa Bay Estate Planning Council Dinner Program on January 21, 2015. This dinner program will take place at The Tampa Club on 101 E Kennedy Boulevard, 41st Floor in Tampa, Florida.

The event runs from 5:30 p.m. to 7:30 p.m. The presentation described above will run 30 minutes, from 6:45 p.m. to 7:15 p.m.

If you are interested in attending or for more information, please email Alan Gassman at agassman@gassmanpa.com.

Thoughtful Corner

Using Personality Test Results to Improve Your Team Performance, Synergism, and Satisfaction

It amazes us that many companies and law firms are able to put together an effective team without using traditional and effective psychological test results. These results can help make sure that jobs are appropriately tailored to the prospective employee’s personality and talent characteristics. They can also help coach supervisors on how to best handle each employee’s specific traits.

We have been using the Omnia Profile system for over 25 years, and we will not leave home without it!

If the Omnia Profile report says that something is likely to go wrong with a prospective employee, then we simply stay on watch for that, and it will almost always happen.

We have learned the hard way that hiring against Omnia’s advice is almost always a very bad idea.

Why don’t other offices use these techniques?

Usually we find that this is either inexperience with use or a desire to save $150 at the risk of spending a few thousand dollars.

Humor Lite!

Upcoming Seminars and Webinars

LIVE FLORIDA BAR FORT LAUDERDALE REPRESENTING THE PHYSICIAN LAW CONFERENCE:

Alan Gassman will speak at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. We thank chair Lester Perling for doing most of the work on this annual conference.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will speak at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS. We have put a great many hours of time into a comprehensive, easy-to-understand outline that we plan to have become a book on this topic. Satisfaction guaranteed!

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

FREE LIVE WEBINAR SERIES ON LIFE INSURANCE FOR TAX ADVISORS:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on HOW TO READ LIFE INSURANCE ILLUSTRATIONS in the first of a series of webinars intended to help tax lawyers and CPAs understand how life insurance and life insurance structuring works from a technical and mechanical standpoint.

Bring your wrench and screwdriver as we look under the hood to see how we can do our clients some good!

Date: January 26, 2015 | 5:00 p.m.

Location: Online webinar

Please note the below announcements for subsequent installments of this series:

February 18, 2015 – Criticism of Hybrid Index Life Insurance Products – What the Heck are These, and Why are They Becoming So Popular?

March 4, 2015 – Premium Financing in 15 Minutes

March 17, 2015 – Split-Dollar in 15 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Additional Information: To register for the January 26th webinar, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

When browsing the tables, be sure to stop by Management Planning, Inc. or Veralytic for a chance to purchase one of our books or check out our EstateView software! Phil’s Ultimate Estate Planner will also be featuring our JEST forms and instructional webinar.

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE CLEARWATER PRESENTATION:

RUTH ECKERD HALL PLANNED GIVING ADVISORY COUNCIL MEETING

Ruth Eckerd Hall’s next Planned Giving Council Meeting will be a spectacular two-part event, featuring an educational presentation at 4:30 p.m. and a networking session at 5:30 p.m.

“Improve with Improv: Using Humor and Immediate Responses to Enhance Client, Professional, and Social Interaction” will be led by Jack Halloway, a well-known improvisational coach and actor. This workshop will cover the basic and effective methods of improvisation in order to increase participants’ ability to think quickly, listen closely, and feel more comfortable responding to situations.

The presentation will be followed by a social networking and information session led by Ruth Eckerd Hall’s President and CEO Zev Buffman.

Call Ruth Eckerd Hall, learn improvisation, get an hour of credit, a glass of wine, and a great time!

Date: Tuesday, January 20, 2015 ǀ 4:30 p.m.

Location: Ruth Eckerd Hall’s Margarete Heye Great Room

Additional Information: For more information, or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com or Suzanne Ruley at sruley@rutheckerdhall.net.

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

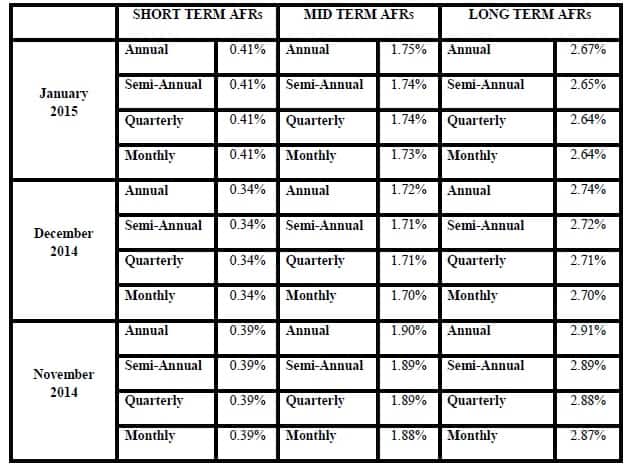

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for January is 2.2% and for December was 2.0%.