The Thursday Report – 1.30.2014 – Velveeta, Portability and What’s My Line

Superbowl Edition

IRS Rev. Proc. Liberates Taxpayers Who Did Not File Timely Portability Elections, by Christopher J. Denicolo, J.D., LL.M.

Velveeta Cheese and the Superbowl

Heckerling Pearls of Wisdom – Part 2

Marty Shenkman’s JEST Review from Heckerling 2014

Colonel Sanders on What’s My Line?

Seminar and Webinar Announcements:

• See Our University of Florida Tax Institute Webinar

• Attend our Private Placement Life Insurance Webinar with Jerry Hesch, Thursday, February 6 at 12:30 p.m.

• The Annual Florida Bar Wealth Protection Conference, May 8, 2014 in Miami, Florida

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

IRS Rev. Proc. Liberates Taxpayers Who Did Not File Timely Portability Elections

By Christopher J. Denicolo, J.D., LL.M.

Since estate tax exclusion portability became available to taxpayers in 2011, the personal representative of the first dying spouse’s estate needed to file a Form 706 (the estate tax return) after the death of the first dying spouse in order to appropriately make the portability election for the surviving spouse. This Form 706 needed to be filed within nine (9) months following the date of death of the first dying spouse, unless the personal representative filed for and was granted an automatic six (6) month extension to this deadline.

However, a great number of personal representatives and surviving spouses were not aware of this deadline or otherwise did not file the Form 706 in order to take advantage of any unused estate tax exclusion amount that remained at the death of the first dying spouse.

The IRS recently issued Revenue Procedure 2014-18, which provides for an extension of time for the personal representative of the first dying spouse to file a Form 706 with respect to the first dying spouse’s estate for the sole purpose of electing portability. This Rev. Proc. generally allows the personal representative until December 31, 2014 to file a Form 706 for the first dying spouse’s estate if the first dying spouse died after December 31, 2010 and on or before December 31, 2013, and if no estate tax return was required to be filed for the first dying spouse because the first dying spouse died with assets with a value less than their estate tax exclusion amount.

Under Rev. Proc. 2014-18, the taxpayer is entitled to relief under Treasury Regulation §301.9100-3, which allows the personal representative to file a Form 706 for the first dying spouse in order to take advantage of such spouse’s unused estate tax exclusion amount. This Rev. Proc. only applies if the taxpayer is the personal representative of the estate of a decedent who (1) has a surviving spouse; (2) died after December 31, 2010 and on or before December 31, 2013; and (3) was a citizen or resident of the United States on the date of death. Further, this Rev. Proc. only applies if the personal representative is not required to file an estate tax return because the first dying spouse’s assets were less than his or her estate tax exclusion amount upon his or her death or if the taxpayer did not timely file an estate tax return to elect portability.

When filing Forms 706 pursuant to this Rev. Proc., the Form 706 must be complete and properly prepared in accordance with Treasury Regulation §20.2010-2T(a)(7) (i.e., it must be prepared in accordance with the instructions to the Form 706), and it must be filed on or before December 31, 2014. Additionally, the following language must be included at the top of the Form 706 in capital letters: “FILED PURSUANT TO REV. PROC. 2014-18 TO ELECT PORTABILITY UNDER §2010(c)(5)(A)”.

If the above requirements are satisfied, then the personal representative will be considered to have timely filed the Form 706 to elect for portability to apply, and the personal representative will receive an estate tax closing letter acknowledging receipt of the decedent’s Form 706.

The impetus for this Rev. Proc. is the recent Supreme Court case of United States v. Windsor, in which the Supreme Court struck down Section 3 of the Defense of Marriage Act to provide that a law defining “marriage” as a legal union between one man and one woman as unconstitutional. After the Windsor decision, the IRS released Revenue Ruling 2013-17 to provide the IRS’ interpretation of the Internal Revenue Code vis-a-vis taxpayers’ marital status in light of the Windsor decision. This Revenue Ruling held that for federal tax purposes the terms “spouse,” “husband and wife,” “husband,” and “wife,” include an individual married to a person of the same sex if the individuals were lawfully married under state law, and the term “marriage” includes such a marriage between individuals of the same sex.

Rev. Proc. 2014-18 provides a good analysis of the legal effect of Windsor and Revenue Ruling 2013-17 on the tax law, and indicates that this Rev. Proc. is significantly based upon the outcome in the Windsor decision and the IRS’ interpretation of the Internal Revenue Code as a result thereof.

Nevertheless, the benefits afforded by this Rev. Proc. are available to provide relief for late portability elections for opposite sex surviving spouses, as well as same sex surviving spouses.

This Rev. Proc. did not address the situation where a surviving spouse has previously filed a Form 706 late, and the Form 706 was not accepted for the purposes of electing portability due to the late filing. It seems that in this case the surviving spouse would simply need to re-file the Form 706 (assuming that it was properly completed and appropriately prepared) with the magic capitalized words on top of the first page in order to take advantage of this other relief provided by this Rev. Proc.

Therefore, for some personal representatives and surviving spouses who neglected to timely file a Form 706 to take advantage of portability, Rev. Proc. 2014-18 provides a second chance.

Velveeta Cheese and the Superbowl

The press has recently written about an expected shortage of Velveeta cheese this weekend. If you cannot find Velveeta try Spam. It is equally delicious or undelicious depending on the way you look at it.

Are they eating this or are they throwing it at cars?

The following should be pertinent:

Watch out for Velveeta Rita,

She will come to your party to de-cheese-ya,

And eat your crackers to defease ya,

Sticking with KFC is much less worse,

Because it is too slick to be put in Rita’s purse.

So when you stock up on picante and chips,

Visit the Colonel, or use Cool Whips,

Don’t have Velveeta, without a plan,

And you also can’t trust Sue, or John or Stan.

Velveeta cheese is not the best

But if you don’t care about your friends

It’s less expensive than the rest.

Heckerling Pearls of Wisdom – Part 2

Ken Crotty, Chris Denicolo and Alan Gassman attended the University of Miami Heckerling Institute on Estate Planning the week of January 13 – 17, 2014 and this is part 2 of their summary of a few of the outlines and presentations:

Robert B. Fleming -Representing Clients with Diminishing Capacity: What to Know and How to Bridge the Gap

This presentation provided several practical items to incorporate into the advisor’s practice:

• Never sit in front of the window. The bright light behind you makes it harder for your clients to see you.

• Speak loudly, clearly, and do not cover your mouth or place your hands on your face when speaking. Clients who are not able to hear you will almost never ask you to speak louder. If they do not have an issue hearing they will ask you to speak more softly. Clients who have issues hearing frequently read your lips to supplement their comprehension of what you are saying.

• Mr. Flemming never allows the child who brought the client to the meeting to come into the conference room before first discussing this with the client. His engagement letters state that they will not be able to come into the conference room.

• Be certain that the discussion in your conference room cannot be heard in the waiting room. Purchase a white noise machine if necessary.

Stephanie Loomis-Price and David Pratt – Wrapping Up Your Gift Tax Return with a Tidy Bow: Reporting Gifts with an Eye Toward Audit

• Make your gift tax return as boring as possible. The statement that you attach describing the valuation discount should provide a snapshot of the entire gift detailing what was given, who received the gift, and also the discounts taken. Consider reporting a sale to an irrevocable trust on the gift tax return to get the statute running on the sale instead of just reporting the seed gift made to the irrevocable trust.

• Remember to disclose charitable gifts. If there is an audit and the charitable gifts are not disclosed on the gift tax return, then the auditor may ask what other gifts were not reported. It is a matter of credibility.

Lee-Ford Tritt – Planning for Same-Sex Couples

• Advisors will need to redefine how their documents define a spouse. They will need different alternatives for different clients and this is something that you will need to discuss with the clients.

• Public policy arguments may prevent the definition of a spouse which excludes same-sex couples from being effective.

• Recognize that all same sex couples may not want to be married, either because of personal reasons or for economic reasons, such as avoiding the income tax marriage penalty and causing taxation of Social Security benefits.

Tourney Berry – Recent Developments for Fiduciaries 2014

Clients who have the desire to help charities and also save taxes have a number of opportunities that are not well-known to financial advisors. The tax benefits will almost never outweigh what goes to charity, so any client who starts off by saying that they want to give to charity to save taxes should be further questioned on whether they are willing to have less money after the transaction in order to help the charity. If the real motive is to save more taxes than what the contribution will cost the donor, end the conversation.

Besides an ordinary income tax deduction and reduction of the 3.8% Medicare tax, there are income savings techniques that can be used if the donor is comfortable making a 501(c)(3) organization a partner or shareholder in a family entity.

For example, a client with a $10,000,000 investment portfolio that has a very low tax basis might place the portfolio assets into a limited partnership, and retain the 1% General Partner interest while gifting the 99% Limited Partner interest to a charity.

The charitable gift might be valued at $6,000,000, and if the partnership thereafter sells the investments, there would be no capital gains tax recognized by the charity. This would save almost $2,380,000 of taxes, not counting state or city income taxes.

At a later time, and not based upon any pre-existing understanding, the client’s children might buy the 99% Limited Partnership interest from the charity for $600,000 in cash. It would be safest if this occurred more than three years after the donation in order to make it as clear as possible that this is not a “step transaction.”

The end result is the same as if the client had sold a discounted Limited Partnership interest to his or her children, but with the savings of almost $2,380,000 of capital gains taxes.

Another example involves the use of a charitable shareholder to avoid the tax on the reduction of stock.

If the same donor also owns 49% of a closely held corporation that can afford to redeem her, why not donate the 49% ownership interest to a charity. At a later time, the charity could be redeemed, and pay no income tax on the redemption.

Thanks to book purchasers at the 2014 Heckerling Seminar

We donated $5 for each book purchaser at the Heckerling Institute and thus wrote checks to several Universities, Colleges and Law Schools around the country. Most of the money went to the University of Florida and the University of Miami came in second (as usual!).

Thank you to everyone who supports higher education and estate and tax conferences.

Professor Jerry Hesch and Danielle Creech, Esq. at the Gassman Law Associates booth waiting for an order of Kentucky Fried Chicken with Velveeta cheese to arrive.

Marty Shenkman’s Heckerling 2014 Review

We were very proud that estate tax lawyer and author Marty Shenkman included mention of our JEST Trust (Joint Exempt Step-Up Trust) in his 47 page Heckerling review, which was provided in Leimberg Information Services Estate Planning Email Newsletter – Archive Message #2188 on January 24, 2014.

Marty’s summary of our JEST technique can be viewed by clicking here.

Our 2 part Estate Planning Magazine article from October and November of 2013 on the JEST Trust can be viewed by clicking here.

Don’t forget that married couples may be able to receive a stepped-up basis on all joint assets on the first death by using the JEST Trust or other techniques.

Colonel Sanders on What’s My Line

It is hard to imagine that such a recognizable figure as Colonel Sanders could have been so unknown. In 1963, when panelists on the popular TV show “What’s My Line” were asked to try to identify the occupation of Colonel Harland Sanders, not only were they stumped, but Colonel Sanders walked away with an extra $50. Maybe the panelists ate too much fried chicken and the grease went to their brains prior to the show which led to them not being able to correctly identify him.

Could this have been a set up? In 1963 there were already 900 Kentucky Fried Chicken restaurants throughout the United States which made it the largest fast food operation at the time in the U.S. Maybe he was disguised as Edward Snowden since there is no mention of Edward Snowden in the 1963 show and where was Mr. Ed? Doubtlessly making the hay somewhere.

So how does the game work? A group of panelists interview contestants with unusual occupations. The panelists are only allowed to answer “yes” or “no” to the questions, with the contestant winning $5 per “no” answer. The game ends with either 10 “no” answers (which was the case for Col. Sanders) or a panelist correctly guessing the contestant’s occupation.

Click here to view a clip of the show.

Seminar and Webinar Announcements:

See Our University of Florida Tax Institute Webinar

On Tuesday, January 27, 2014 we hosted a 15 minute webinar with Professors Friel and Calfee from the University of Florida and Bruce Bokor. You can view this informative webinar about the tax conference that will be in Tampa, Florida on Wednesday, February 19 – Friday, February 21, 2014 (1 day passes are available) by clicking here. For more information about the Institute and to register please click here.

Attend Our Private Placement Life Insurance Webinar with Jerry Hesch

On Thursday, February 6, 2014 at 12:30 p.m. Jerry Hesch and Alan Gassman will present a free live webinar to facilitate discussion of private placement life insurance and this year’s Notre Dame Tax Institute.

The Notre Dame Tax & Estate Planning Institute will be held on November 13 and 14, 2014 in South Bend, Indiana, and features two presentations being given simultaneously most of the time so that attendees can choose the presentation and speaker that best suits them. The focus this year will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis”. To register for the webinar please click here.

The Florida Bar Annual Wealth Protection Conference, May 8, 2014 in Miami, Florida

Please note that the annual Wealth Protection conference will be held in Miami, Florida on May 8 at the Hyatt Regency Downtown, and will feature nationally known speakers and authors Barry Engle, Jay Adkisson and Howard Fisher along with well respected and practical Florida based speakers.

We are particularly looking forward to an ethics and practice development panel discussion entitled ” What are the Ethical, Legal and Administrative Liability Exposures in Wealth Protection Planning and How Do We Protect Ourselves” that will feature Barry Engle, Professor Jerome Hesch, Denis Kleinfeld and Alan Gassman.

Jerry Hesch will be presenting his ever improving materials on Income and Estate Tax Issues for 2014.

Please give this conference a try if you have never attended. The interaction, synergism and information derived from the lectures and from other attendees is always dynamic.

For more information on this seminar please contact Alan Gassman at agassman@gassmanpa.com.

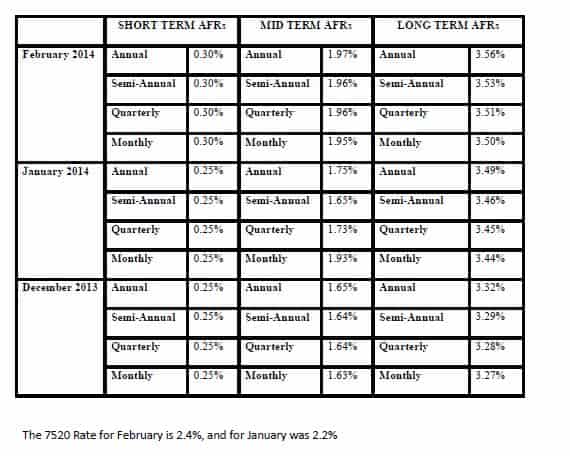

Applicable Federal Rates

Seminars and Webinars

PINELLAS COUNTY CHAPTER OF THE FLORIDA ASSOCIATION OF WOMEN LAWYERS SEMINAR

Alan Gassman will be speaking on Same Sex Marriage and Associated Laws We Should All Know About Anyway.

Date: January 30, 2014 | 5:30 p.m.

Location: Stetson Law School, Gulfport, Florida

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

LUNCH TALK – SOCIAL MEDIA

Date: Monday, February 3, 2014 | 12:30 p.m.

Location: Online webinar

Speaker: Aparna Tutak

Additional Information: To register for this webinar please visit www.clearwaterbar.org

PRIVATE PLACEMENT LIFE INSURANCE

Jerry Hesch will be joining Alan Gassman for a free 30 minute webinar to discuss private placement life insurance and this year’s Notre Dame Tax and Estate Planning Institute.

Date: Thursday, February 6, 2014 | 12:30 p.m.

Location: Online webinar

Speakers: Professor Jerry Hesch and Alan Gassman

Additional Information: To register for the webinar please click here.

INDIVIDUAL AND GROUP MEDICAL PRACTICES BLOOMBERG BNA WEBINAR

Health care attorney Lester Perling, Pension Actuary Jim Feutz and Alan Gassman will be presenting a 90 minute webinar for Bloomberg BNA Tax and Accounting on Individual and Group Medical Practices.

Date: February 13, 2014 | 12:00 – 1:30 p.m. (90 Minutes)

Location: Online webinar

Additional Information: Please contact agassman@gassmanpa.com for more information.

THE 444 SHOW – CREDITOR PROTECTION UPDATE

Date: Thursday, February 27, 2014 | 4:00 p.m.

Location: Online webinar.

Speaker: Alan Gassman

Additional Information: To register for the webinar please visit www.clearwaterbar.org

LUNCH TALK – LAWYER REFERRAL SERVICE

Date: Monday, March 3, 2014 | 12:30 p.m.

Location: Online webinar

Speaker: David Robert Ellis, Esq.

Additional Information:To register for the webinar please visit www.clearwaterbar.org

THE JEST, THE SCGRAT AND THE E STREET SOFTWARE

Please join Alan Gassman, Ken Crotty and Chris Denicolo for a 30 minute webinar describing 2 new planning techniques and also free beta testing of the EstateView software that was developed by Gassman, Crotty & Denicolo, P.A.

Date: Tuesday, March 4, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

FLORIDA BAR HEALTH LAW REVIEW 2014

Alan Gassman will be speaking on What Healthcare Lawyers Need to Know About Tax Law and Business Entities at this excellent annual Florida Bar conference that is attended not only by those who are taking the Board Certification exam but also healthcare lawyers and other advisors.

Other speakers will include Lester Perling who is the co-author of A Practical Guide to Kickback and Self-Referral Laws for Florida Physicians and a number of other books and publications, and Mickey Mouse, Donald Duck and the “dwarf planet” formerly known as Pluto!

Date: March 7 – 8, 2014

Location: Hyatt, Orlando, Florida

Additional Information: We thank Jodi Laurence and Sandra Greenblatt for all of their hard work in making this conference as successful as it is. For more information please contact Jodi at jl@flhealthlaw.com or Sandra at sg@flhealthlawyer.com.

HILLSBOROUGH COUNTY BAR ASSOCIATION HEALTH LAW SECTION LUNCHEON

Alan Gassman and Christopher Denicolo will be speaking at the Hillsborough County Bar Association’s Health Law Section Luncheon on the topic of Tax and Asset Protection Basics for Those Who Represent Physicians and Medical Practices.

Date: March 12, 2014

Location: Chester H. Ferguson Law Center in Tampa, FL

Additional Information: For additional information please contact Co-Chairs Sara Younger (sara.younger@baycare.org) or Thomas Ferrante (tferrante@carltonfields.com).

LUNCH TALK – LAW PRACTICE EFFICIENCY TIPS

Date: Monday, April 7, 2014 | 12:30 p.m.

Location: Online webinar

Speaker: Alan S. Gassman

Additional Information: To register for this webinar please visit www.clearwaterbar.org

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on the topic of THE FLORIDA CPA’S GUIDE TO PLANNING WITH PHYSICIANS AND MEDICAL PRACTICES

Date: Thursday, April 17, 2014 | 4:00 p.m.

Location: TBD

Additional Information: For more information on this event please email agassman@gassmanpa.com or mary@clawsonasplus.com

DONOR LUNCHEON AT RUTH ECKERD HALL WITH PROFESSOR JERRY HESCH IN CLEARWATER, FLORIDA

Professor Jerry Hesch will be speaking at a Donor Luncheon on the topic of CHARITABLE TAX SAVINGS: HOW TO MAKE SURE THAT UNCLE SAM CONTRIBUTES HIS SHARE TO MAXIMIZE RESULTS

Date: Tuesday, April 22, 2014 | TIME TO BE DETERMINED

Location: TBD

Additional Information: For additional information please contact Suzanne Ruley at sruley@rutheckerd.net or Alan Gassman at agassman@gassmanpa.com

RUTH ECKERD HALL PLANNED GIVING MEETING

Professor Jerry Hesch will be speaking at the Ruth Eckerd Hall Planned Giving Meeting in Clearwater, Florida on the topic of INNOVATIVE CHARITABLE GIVING TECHNIQUES FOR THE WELL TUNED ESTATE PLANNER

Date: Tuesday, April 22, 2014 | 4:00 p.m.

Location: TBD

Additional Information: This session qualifies for 1 hour of continuing education creditor for lawyers and CPA’s. To attend please email Suzanne Ruley at sruley@rutheckerd.net or Alan Gassman at agassman@gassmanpa.com

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

THE FLORIDA BAR ANNUAL WEALTH PROTECTION SEMINAR

Date: Thursday, May 8, 2014

Speakers: Speakers will include Barry Engel on Offshore Trust Planning and Developments Over the Past 2 Years in Asset Protection, Howard Fisher and Alex Fisher on “Designer Entities – The Cutting Edge in Asset Protection”, Denis Kleinfeld on The Roadmap to Wealth Protection Planning and Alan Gassman on Structuring Business and Investment Assets and Entities – Wealth Protection 401 for the Dedicated Planner.

Location: Hyatt Regency Downtown, Miami, Florida

Additional Information: For more information please contact agassman@gassmanpa.com

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate their limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

NOTABLE SEMINARS PRESENTED BY OTHERS:

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Presenters: Martin McMahon, Jr., C. Wells Hall, III, Abraham N.M. Shashy, Karen L. Hawkins, Lawrence Lokken, Stephen F. Gertzman, James B. Sowell, John J. Rooney, Louis Weller, Ronald Aucutt, Karen Gilbreath Sowell, Herbert N. Beller, Peter J. Genz, Stephan R. Leimberg, John J. Scroggin, Lauren Y. Detzel, David Pratt and Samuel A. Donaldson

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: For more information and to register for the program please visit www.floridataxinstitute.org. There will be cocktail parties at the Grand Hyatt as part of the programs on Wednesday, February 19 at 5:00 p.m. and then again on Thursday, February 20 at 5:00 p.m. Please plan to attend these receptions. See how your classmates are doing and say hello to your favorite professors. (If they didn’t teach at Florida then you can call them on your cell phone during the cocktail hour). Help us strengthen and improve a UF LLM community, the school, and the synergism that results from these types of activities. Students will be in attendance and will greatly value conversations with advice from alumni. Do you remember how you felt when you were in the LL.M. program and were able to interact with successful lawyers who gave you valuable feedback? There is also a reception for all attendees and the guests on February 19, 2014 at 5:00 p.m. for attendees and their spouses along with a reception on February 20, 2014 at 5:00 p.m. to thank the supports of the University of Florida, the law school and the LL.M. program.