The Thursday Report – 1.29.15 – BP Mistakes and the June 8, 2015 Deadline

Florida Matters: Alan Gassman’s Interview with WUSF (not to be confused with UNICEF!) on Same-Sex Marriage

June 8, 2015 BP Claim Filing Deadline – An Important Issue for Advisors Involved in BP Claims

Seminar Spotlight – How to Handle Stressful Matters in an Ethical Way with Dr. Srikumar Rao and Alan S. Gassman

Avoiding Disaster on Highway 709 – The Confusion Regarding the Gift Tax and GST Annual Exclusions

Richard Connolly’s World – Beware Crazy Clauses in Condo Contracts

Thoughtful Corner – Is Your Need for Sleep Illusory?

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Florida Matters: Alan Gassman’s Interview with WUSF (not to be confused with UNICEF!) on Same-Sex Marriage

Last week, Alan Gassman was interviewed by world-renown radio talk host and commentator Carson Cooper and Mike Reedy of Equality Florida on the legal aspects of same sex marriage. Lottie Watts, of WUSF Public Media, emailed us the links to the interview earlier this week.

The description for the radio show reads as follows:

Florida Matters: Same Sex Marriage in Florida

Same-sex marriage has been legal in Florida since January 6, 2015, and to mark the occasion, Hillsborough County Clerk Pat Frank held a group wedding at a park across the street from the courthouse. The issue is heading to the US Supreme Court this summer, but in the meantime, marriage licenses are being issued to same-sex couples across the state. Mike Reedy of Equality Florida and attorney Alan Gassman with Gassman, Crotty & Denicolo, P.A. in Clearwater discuss many of the questions facing same-sex couples as they consider tying the knot.

To listen to the interview in its entirety and for more information on the subject, please click here.

An excerpt of this interview is as follows:

Carson Cooper: Now you specialize in things like estate planning, and you wrote a book called The Florida Legal Guide to Same Sex Couples

Alan Gassman: Yes. Yes, and I felt that this book needed to be written because there are so many different laws, so many different tax rules, so many different qualification areas that change when somebody becomes married.

Carson Cooper: Now you wrote this book, and it was published back in June. Now there is no way that you could have seen this coming back then. Right?

Alan Gassman: I was thinking this was going to be a three to four year process. I was so delighted that the federal court did what it did and that the train is rolling faster here.

Carson Cooper: Now are you, as an attorney, getting a lot of questions now from same-sex couples who have yet to tie the knot? And what are they asking?

Alan Gassman: They are asking what happens to their legal rights when they get married? What happens to their homestead rights when they get married? What happens to their ability to leave assets to their children? What happens to their social security? What happens to their income taxes? What happens with their place of employment and their employment rights and benefits? They are asking a lot of questions; there is a lot of areas that have to be understood to avoid a haphazard situation.

****************************************************

Carson Cooper: The US Supreme Court has agreed to hear cases from Ohio, Tennessee, Michigan, and Kentucky, combined into one case known as Obergefell v. Hodges. The court will consider two questions. Number One – does the 14th Amendment to the US Constitution require a state to license a marriage between two people of the same sex, and Number Two – does the 14th Amendment require a state to recognize lawful out-of-state same-sex marriages? So Alan Gassman, let’s take this one at a time. Does the 14th Amendment, which guarantees equal protection and due process of law, forbid folks from treating gay couples differently than heterosexual couples?

Alan Gassman: The overwhelming majority of court decisions by both federal courts, state courts, and appellate courts have said yes, you cannot discriminate from a basis of sex. You have to treat the same sex couple the same as you would treat a cross-gender couple. So hopefully the US Supreme Court will go along with that and agree. Public sentiment is certainly that way, and you now have tens of thousands of marriages that have taken place based upon all of these decisions.

Carson Cooper: Well let me ask you this about equal protection. What exactly does that mean?

Alan Gassman: No one is sure exactly what the planners of the Constitution meant when they passed the Legal Protection Act. At the time, there were same sex couples in prison because it was a felony punishable by death to have a same sex relationship back then. But what they said was, as you have heard, that all men and women were created equal, and it took our system until the 1950s and 60s to realize that black people would be treated the same as white people. And now it is taking our system this long to ask the Supreme Court, can same sex couples be treated the same way as traditional couples?

Carson Cooper: And, in fact, wasn’t the 14th Amendment cited in a case? I believe it was in the 1960s in Virginia v. Loving or Loving v. Virginia, which banned interracial marriages, and that was overturned.

Alan Gassman: Right.

Carson Cooper: Based on the 14th.

Alan Gassman: Right. And, you know, the way history goes is that you do not ask the Supreme Court something that you are going to get a “no” answer to; you wait until society is ready for the “yes” answer.

To hear and read another excerpt of the Florida Matters interview with Alan Gassman and Mike Reedy, please click here.

To listen to the interview in its entirety and for more information on the subject, please click here.

To purchase The Florida Legal Guide for Same Sex Couples, please click here.

And if you don’t want to click here, click here!

Thanks to Lonnie Watts of WUSF Public Media for making this content available to our Thursday Report readers!

June 8, 2015 BP Claim Filing Deadline – An Important Issue for Advisors Involved in BP Claims

Don’t let your clients who were told they had no claim (by you and others) go without rechecking if they are in the medical, legal, or accounting industries!

The BP Claim Class Action Right of those whose businesses and professions had a presence in Counties that have water exposure to the Gulf of Mexico will reportedly expire this coming June 8, and thousands of businesses and individuals with potential claims will doubtlessly not file by then because they are not aware of the changed accounting rules.

A great many law firms, CPAs, and consulting firms have run numbers for many companies and individuals and concluded that a number of them do not qualify under the automatic damages assumption rules due to the monthly revenue earnings patterns prescribed by the complex Class Action rules. These rules, however, have changed to provide that the cash amounts received each month will not be controlling in many situations where the income was actually earned as opposed to received under what many are referring to as a “modified accrual method of accounting,” which will apply to several industries, including medical, legal, and accounting.

As a result, many who have filed claims actually have bigger claims than they thought, many have smaller claims than they thought, and many who were told they had no claims at all actually do. Those who fall into the last category should get working fast to file their claims as soon as possible.

More information on this very important, opportune, and treacherous situation will be provided in detail by John D. Goldsmith and Alan S. Gassman in a webinar on February 17, 2015. To register for this 12:30 pm webinar, please click here.

To see a webinar on BP Oil Spill Claims: Avoid Mistakes and Maximize Claims – 170 Calculation Errors and Why Everyone is So Excited to Help Pursue Claims with John Goldsmith and Alan Gassman, please click here.

Seminar Spotlight

How to Handle Stressful Matters in an Ethical Way

with Dr. Srikumar Rao and Alan S. Gassman

On February 19, 2015, Dr. Srikumar Rao and Alan S. Gassman will present a free, 50-minute webinar entitled “How to Handle Stressful Matters in an Ethical Way.”

This webinar is classified as Advanced and will qualify for 1 hour of CLE Ethics Credit. If you’re on the fence about signing up, see Professor Rao’s Ted Talk YouTube video, which can be viewed by clicking here, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed?, which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

For more information, please email agassman@gassmanpa.com or click here to sign up for the webinar.

Avoiding Disaster on Highway 709

The Confusion Regarding the Gift Tax and GST Annual Exclusions

by Kenneth J. Crotty

If a gift qualifies for the Gift Tax Annual Exclusion, then some or all of the gift will not utilize the donor’s applicable exclusion amount for lifetime gifts, depending on the size of the gift. For 2014, the gift tax annual exclusion is $14,000 per donor per donee. This amount is indexed for inflation. I.R.C § 2503(b)(1). If a donor makes a gift to a donee in excess of the gift tax annual exclusion, assuming the gift qualifies for the gift tax annual exclusion, then the reportable value of the gift will be reduced to $14,000.

Only gifts “of present interests” qualify for the gift tax annual exclusion. A gift is a present interest if the donee has an immediate right to use, possess, or enjoy the property. Treas. Reg. § 25.2503-3.

When gifts are made to a trust, the terms of the trust will often provide beneficiaries with a Crummey right of withdrawal, which gives the beneficiary an absolute right to withdraw the gift or a certain portion of the gift during a stated time. Frequently, this right of withdrawal is for 60 days. This right of withdrawal helps to qualify the gift as a present interest.

Gifts of future interests do not qualify for the gift tax annual exclusion. Examples of future interests include remainders, reversions, and any other interest that commences in use, possession, or enjoyment at some future time. Treas. Reg. § 25.2503-2. A gift of a future interest must be reported at its full value and uses an amount of the donor’s lifetime gift tax exemption equal to the fair market value of the gift.

The GST Annual Exclusion

The GST annual exclusion and the gift tax annual exclusion are not identical. The GST annual exclusion is much more limited, and a transfer that qualifies for the annual gift tax exclusion may not qualify for the annual GST exclusion.

An outright transfer to a skip person (such as a grandchild) qualifies for the GST annual exclusion.

For a transfer in trust to qualify for the GST annual exclusion, the trust must be a “qualified trust” as described in I.R.C § 2642(c)(2). To satisfy this requirement, the trust must be held for the benefit of an individual and

- During the life of such individual, no portion of the corpus or income of the trust may be distributed to any other person, and

- If the trust does not terminate when the individual dies, the assets of the trust must be included in the gross estate of such individual. I.R.C § 2642(c)(2).

Crummey Gifts Often Use Up GST Exemption

Most often a trust with a Crummey right of withdrawal which meets the requirements for the gift tax annual exclusion will not meet the requirements for the GST annual exclusion. Therefore, the donor will need to allocate GST exemption to the trust if the transferor wants the trust to have an inclusion ratio of zero.

Direct Skips (GST Transfers)

A direct skip is a transfer made to a skip person, which is subject to gift or estate tax. A skip person is a person who is two or more generations below the generation of the transferor, unless the predeceased ancestor exception applies. A skip person also includes a “non-relative” who is more than 37.5 years younger than the donor. A non-relative is an individual who is not a lineal descendant of a grandparent of the donor or the donor’s spouse (which includes individuals who have been legally adopted or individuals who are married to such a descendant.)

A non-skip person is any person who is not a skip person.

A trust may also be considered a Skip Person if:

- All of the interests of the trust are held by skip persons, or

- The likelihood that a non-skip person would receive a distribution from the trust is less than 5%. I.R.C § 2613(a)(2).

Indirect Skips and GST Trusts

An indirect skip is a gift subject to gift tax that is not a direct skip and is made to a GST Trust. I.R.C §2632(c)(3)(A). Most trusts are GST Trusts. If the children of the donor are beneficiaries of the trust, then the Trust will almost always be a GST Trust. Therefore, transfers to these trusts are indirect skips.

Where are Direct and Indirect Skips Reported?

We often see mistakes made with respect to which Schedule on the Gift Tax Return is appropriate for reporting these gifts. Direct skips are to be reported on Schedule 2, and indirect skips on Schedule 3. Therefore, gifts to GST trusts, which include most (if not all) trusts where the children of the donor are beneficiaries, should be reported on Schedule 3 and not on Schedule 2. To see a Sample Form 709, please click here.

Richard Connolly’s World

Beware Crazy Clauses in Condo Contracts

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “Beware Crazy Clauses in Condo Contracts” by Robert Milburn. It was featured in Barron’s on November 29, 2014.

Richard’s description is as follows:

It’s a seller’s market for new condos in cities like San Francisco, Miami, and New York. If, for example, a buyer in a recently erected New York building unloads his condo for a profit within a year of purchase, a new standard line in contracts states that the condo owner must hand the developer half of his windfall. Meanwhile, buyers in Florida are putting down deposits of as much as 50 percent on condos, which developers can draw down to 10 percent to help pay for their construction costs. If the Florida real estate market tumbles or the developer goes bankrupt, chances are good that buyers are never going to get their money back.

So how’s a buyer to protect himself?

After you get all of the key documents to your attorney – including a few years of the building’s financials, the offering plan, and the house bylaws – review the building’s rules and regulations for easy-to-spot conflicts, like a building that won’t accept your 70-pound golden retriever.

In short, buying a condo in a fashionable city has become a brutal contact sport – so you should have a top-rated real estate lawyer close by your side.

With clients now heading to warmer climates, attorneys may get requests for help with condo purchases, which may include unusual terms like those identified in the article.

Please click here to read the article in its entirety.

Thoughtful Corner

Is Your Need for Sleep Illusory?

Most Americans reportedly need between 7 and 7.5 hours of sound sleep to function optimally, and it is easy to believe that if you do not have sufficient sleep, you will not feel good, function well, or be healthy.

The truth is that different people need different amounts of sleep, and many people are led to believe that if they do not get enough of it, they will be cranky, tired, forgetful, or feel like they have the flu.

In many cases, this is absolutely wrong. Due to this belief, people end up rolling around in bed, wishing they could get sleep and becoming frustrated, restless, and irritable when sleep doesn’t come. Instead, they could be up and about doing what they would like to do and having more hours for enjoyment or productivity while feeling well and vibrant.

Many successful, healthy adults have reported that they function very well on 5 hours of sleep or less three to four days a week and catch up on sleep later.

This might be you, and you might not know it because you have not given this theory a chance. Instead, millions of Americans medicate themselves with sleeping pill prescriptions, which can negatively affect brain wave functions, short term and long term memory, and health in general.

Try waking up earlier or staying up later if your body tells you to, while holding steadfastly to your need to wake up at the same time each day when the alarm rings. If you end up sleep deprived for the day because you were up too late, you can go to bed earlier that day or even take a nap.

Stop caffeine in the afternoon or at least four hours before bedtime. Exercise anywhere from two to twenty minutes approximately four hours before bedtime. Get some relaxing reading done, and give your body and mind the chance to tell you how much sleep you need and not the other way around.

If you are addicted to sleeping pills, you might try to get off of them. One positive effect of Benadryl, which is a 4 or 8 hour antihistamine, is that it induces sleep while not impacting memory or being considered addictive.

Many people (and only with doctor supervision, of course) will gradually reduce their sleeping pill prescription use while taking Benadryl. They then find that they sleep better, with better memory, no grogginess in the morning, and with better control of allergies.

Another thing that will throw sleep off is the jet lag that you get if you stay up extra late Friday and Saturday night and then expect to get right back into a normal sleep rhythm Monday and Tuesday. The older you get, the more difficult that becomes.

If you do choose to stay up until 4:00 AM when the bars close, consider waking up earlier than you normally would the next morning and taking a power nap in the afternoon or going to bed earlier in the evening to get back into the right rhythm. Melatonin is reported to reset the biological clock if you take it at your normal bedtime, but it makes some people groggy the next morning.

Let’s face it – our bodies and minds were designed or evolved to be based upon a 24 hour clock. We’re programmed to go to bed when it gets dark and wake up when it is light in the morning. When your modern brain is telling you to move the time you go to bed and the time you wake up all around from day-to-day, you can expect some resistance from the reptile brain and the body.

Please do not take the above to mean that you should deprive yourself of sleep to do better things. If and when your body is telling you you need sleep, then you usually will be able to sleep. If not, then a doctor or other counselor can be of help. A great many people have reported that using meditation, self-hypnosis, or tapes that you can listen to at night that will “put you to sleep” can help immensely.

The art and science and falling asleep is something that you will want to master if you can. People who have been in the military or have otherwise taken transcendental meditation, self-hypnosis, or other training will often report that they can go to sleep at will within two to three minutes. Reading old Thursday Reports has been rated as one of the top six ways of falling asleep by the National Boredom Foundation. Others report that drinking warm milk before bedtime or an herbal tea can be helpful. Meditation coaches can also help someone learn how to reach a relaxed and sleep-like state of consciousness quickly and efficiently.

If you think about the above and listen to your body, you can be more productive and enjoy deeper sleep.

One more tip – one well-known business advisor points out that when you have not gotten enough sleep, people get “stupider.” Lack of sleep can cause anxiety, loss of patience with other people in situations, and otherwise.

When you are short on sleep, remind yourself every hour or so that you might be seeing the world through a harsher filter. That realization, along with the ability to step back before reacting, may help you get used to those days when you have been sleep deprived as the result of whatever may have occurred.

The above article has not been approved by the Attorney General, any medical doctor, or Colonel Sanders. Take it with a grain of salt and a Benadryl, and enjoy some great dreams tonight.

Humor! (or Lack Thereof!)

THIS ACTUALLY HAPPENED:

A child at Disneyland spread measles to other children and guests in the park. Could this happen here in Florida?

NEW WALT MEASLEY WORLD THEME SONG

(to the tune of “It’s a Small World”)

by Ron Ross aka “Uncle Winkie”

A kid with measles arrives from Spain

Passes it on to a kid from Ukraine

It’s the germs that we share that make us aware

It’s a small world after all.

Tourists arrive with bacteria

Spreading flu and mumps and diphtheria

Then the kids can’t be cleaned till they’re all quarantined

It’s a small world after all.

A trip to Disney is a kid’s greatest wish

But the park itself is a big petri dish.

Diseases will spread right to Mickey’s head,

And they’ll close this small, small world.*

*For a while. Remember, never smile at Mr. Crocodile.

Upcoming Seminars and Webinars

LIVE WEBINAR:

John D. Goldsmith and Alan S. Gassman will present a webinar on BP OIL SPILL CLAIMS – IMPORTANT ISSUES FOR ADVISORS.

Date: February 17, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar, please click here or email agassman@gassmanpa.com for more information.

******************************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Please note the below announcements for subsequent installments of this series:

March 4, 2015 – Premium Financing in 22.5 Minutes

March 17, 2015 – Split-Dollar in 22.5 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

*******************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on PREMIUM FINANCING IN 22.5 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 22.5 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

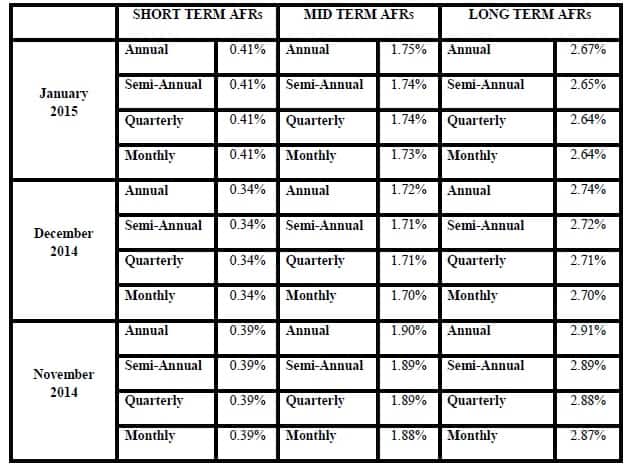

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.