The Thursday Report – 1.22.15 – Is Obama the Taxman?

Is Obama the Taxman?

Bruce Steiner & the President’s Proposals for a Simpler, Fairer Tax Code that Responsibly Invests in Middle Class Families

Florida Department of State Consumer Alerts

Special Seminar Announcement – An Update to How to Read Life Insurance Illustrations

Gassman Law Associates in the News – Listen for us on WUSF 89.7!

Florida Law Trivia, Part II

Gregory Gay’s Corner – Selling a Residence and Homestead Exemptions, Part II

Richard Connolly’s World – A New Tool to Make Your Money Last

Thoughtful Corner – How to Get the Most from Those Who Work With You or For You

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Is Obama the Taxman?

Does anyone remember the song “The Taxman”? Try this on for size!

We thank Kristen Sweeney, Bernie Taupin, and Tom Waits for their assistance with the lyrics of this song. We thank George Harrison for writing the music to the original lyrics, which you can see by clicking here.

The state of this Union will be,

No estate in this world goes tax-free,

Cause he’s the taxman,

Yeah, Obama is the taxman.

Dividends up to 28,

But two-earner couples get a break,

Cause he’s the taxman,

Yeah, Obama is the taxman.

Since 2009,

Capital gains I’ve doubled.

IRAs aren’t safe,

Hate to burst your bubble.

We will tax billions (320!),

In just 10 short years.

But it’s for a good cause (education!),

So wipe away your tears.

If your millions number 3.4,

You can’t contribute any more.

Cause he’s the taxman,

Yeah, Obama is the taxman.

Beware to those of you who’ve died,

Declare each dime, let nothing slide.

Cause he’s the taxman,

Yeah, Obama is the taxman.

The state of this Union will be,

No estate in this world goes tax-free,

Cause he’s the taxman,

Yeah, Obama is the taxman.

Bruce Steiner & the President’s Proposals for a Simpler, Fairer Tax Code that Responsibly Invests in Middle Class Families

Bruce Steiner, of the New York City firm of Kleinberg, Kaplan, Wolff & Cohen, P.C., is a long-time LISI commentator and has provided LISI members with a first look at the Administration’s Revenue Proposals for several years. This year, on the day of the 2015 State of the Union address, Bruce provided a first look at President Obama’s 2015 Tax Code proposals.

On January 17, 2015, the White House released the details of the President’s proposal for a Simpler, Fairer Tax Code that Responsibly Invests in Middle Class Families (no need for additional humor after that title!). You may view this proposal by clicking here.

Some of the proposed changes that will affect individual taxpayers are as follows:

- The President proposes to increase the top tax rate on qualified dividends and long-term capital gains to 28% for couples with income over $500,000.

- The President proposes to treat bequests and gifts other than to charitable organizations as realization events.

- The President proposes a second-earner credit equal to 5% of the first $10,000 of earnings of the lower-earning spouse.

- The President proposes to make permanent the additional earned income credit and child credit benefits that are scheduled to expire at the end of 2017.

- The President proposes to increase the maximum child and dependent care credit for families with children under age 5 to $3,000 per child.

- The President proposes to exempt Pell grants from taxation and the American Opportunity Tax Credit (AOTC) calculation.

- The President proposes to roll back the expanded tax cuts for 529 plans that were enacted in 2001 for new contributions.

- The President proposes to give a tax credit of up to $3,000 to any employer with 100 or fewer employees that offers an auto-IRA.

Bruce goes on to provide commentary on the proposed changes, the introduction to which is re-printed below:

The President’s proposals are not law, nor even a bill. Given the 2010 and 2012 tax legislation, attempting to predict tax legislation is difficult. However, these proposals are worth watching. Some of them are similar to recent Republican proposals. Some of them may be enacted soon. Some of them may be enacted eventually. Some of them may never be enacted.

To see the complete list of proposed changes, and to read Bruce Steiner’s full commentary, please click here.

Our thanks to Bruce Steiner, Steve Leimberg, and Leimberg Informational Services for making this available to our readers.

Florida Department of State Consumer Alerts

Rip-off companies that send letters to newly incorporated entities selling “certificate of status,” “annual minutes,” and “annual corporate record forms” are recognized by the Secretary of State as being confusing and inappropriate, but otherwise, the government is not doing anything about these.

If you are active in incorporating clients, then you already know about this, but if not, the Consumer Alerts posted on the Secretary of State website are shown below. Pay particular attention to the last two alerts listed on the page.

Examples of the deceptive letters that go to the newly incorporated companies can be viewed by clicking here.

It is a shame that crime pays, and it is a bigger shame that the government does nothing to try to stop it.

Special Seminar Announcement

An Update to How to Read Life Insurance Illustrations

Jerry Hesch to join How to Read Life Insurance Illustrations webinar on Monday, January 26 at 5:00 PM

Barry Flagg and Alan Gassman were pleased when Jerry Hesch accepted our invitation to join as a co-presenter next Monday for our 5:00 PM webinar on How to Read Life Insurance Illustrations.

The discussion will be led by Barry Flagg, and this will be an important experience for those of us who look at life insurance illustrations and help clients determine how life insurance vehicles will best fit into their estate and family planning.

Please do not miss this webinar! Click here to register.

This webinar is just the first in a series of presentations we are planning with Barry Flagg. Please also note the below announcements for subsequent installments of this webinar series:

February 18, 2015 – Criticism of Hybrid Index Life Insurance Products – What the Heck are These, and Why are They Becoming So Popular?

March 4, 2015 – Premium Financing in 15 Minutes

March 17, 2015 – Split-Dollar in 15 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

You can find the links to register for each of the four webinars listed above in our Seminars & Webinars section.

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program, and we thank Jerry Hesch for agreeing to co-present our first installment!

Gassman Law Associates in the News

Listen for us on WUSF 89.7!

This morning, Alan Gassman was interviewed by world-renown radio talk host and commentator Carson Cooper and Mike Reedy on legal aspects of same sex marriage. Mike Reedy is a statewide organizer with Equality Florida, the largest civil rights organization committed to obtaining equality for Florida’s growing LGBT community, and we were very impressed with his remarks. Alan’s remarks were not that great, but you can listen to them anyway. Alan’s interview will be broadcast on WUSF 89.7 on Tuesday, January 27 at 6:30 PM and Sunday, February 1 at 7:30 AM. They will air again on the classical station WSMR 103.9 FM on Monday, February 2 at 10:00 PM. Hopefully you have something better to do, but if not, tune in!

Alan was invited to discuss his recent book, The Florida Legal Guide for Same Sex Couples, but the conversation took a path of its own. To purchase the Kindle edition of our book for only $0.99, please click here so that you can help others (and both of their mothers!)

Florida Law Trivia, Part II

We had many successful participants in Part I of our Florida Law trivia contest, which you can see by clicking here. We thank both of them.

Here is Round II, with questions 7 through 12 and two questions for extra credit.

7. A debtor must generally have lived in Florida for __________ consecutive days in order for Florida law to apply in Bankruptcy Court.

A. 1, 215

B. 730

C. 365

D. 25

ANSWER: (B) Under the Seven Hundred and Thirty (730) Day Rules, a debtor will usually be required to have lived in Florida for the seven hundred and thirty (730) consecutive days before filing bankruptcy in order to have Florida law apply.

8. 36 states permit married couples to own assets jointly as tenants by the entireties.

TRUE or FALSE

ANSWER: FALSE. Florida and twenty-four (24) other states permit married couples to own assets jointly as tenants by the entireties and do not allow creditors with a judgment against one (1) spouse to lien or seize any part of tenancy by the entireties assets.

9. The ______________ has the power to waive beneficiaries’ rights to annual trust accountings, to receive information regarding the trust and the trustee, and to represent and bind the applicable beneficiaries with respect to any notices, accountings, information, or reports related to the trust.

A. Power of Attorney

B. Grantor

C. Designated Representative

D. Personal Trainer

ANSWER: (C) The Designated Representative has the power to waive beneficiaries’ rights to annual trust accountings, to receive information regarding the trust and the trustee, and to represent and bind the applicable beneficiaries with respect to any notices, accountings, information, or reports related to the trust. Any such action taken by a Designated Representative, or any notices, accountings, information, or reports given to a Designated Representative on behalf of a specific beneficiary or beneficiaries, have the same effect as if the action was taken or the items were given directly to the applicable beneficiary or beneficiaries. The Designated Representative is not liable to the beneficiaries that he or she represents, or to anyone claiming through such beneficiary, for any actions or omissions to act that are made in good faith.

10. A(n) _________________ indicates that there can be no transfer or encumbrance without the written consent of a specified individual or company.

A. Statement of Authority

B. Order to Stop

C. Notification saying, “You can’t do that.”

D. Statement of Authorization

ANSWER: (A) A Statement of Authority can be filed with the Secretary of State and recorded in the county where real estate is held, indicating that there can be no transfer or encumbrance without written consent of a specified individual or company. The Statement can specify that consent is needed before any transfer or mortgage of real estate occurs and will expire five years after being filed.

11. The surviving spouse can elect to become a one-half undivided owner of the homestead with the descendants equally sharing ownership of the other one-half undivided interest effective upon the decedent’s death.

TRUE or FALSE

ANSWER: TRUE. By recent law change, the surviving spouse can elect to become a one-half (½) undivided owner, with the descendants equally sharing ownership of the other one-half (½) undivided interest, effective upon the decedent’s death. This can be avoided by placing the homestead into joint ownership with right of survivorship with the spouse so that the surviving spouse would become the sole owner upon death, but this could leave the children of the dying spouse out in the cold.

12. There are ________ exceptions that permit a creditor to invade a third party spendthrift trust providing for health, education, and maintenance of one or more beneficiaries.

A. 5

B. 1

C. 0

D. 3

ANSWER: (D) A third party settled spendthrift trust providing for the health, education, and maintenance of one or more beneficiaries can generally not be invaded by their creditors, divorce or child support claimants, or parties who provide services associated with the trust itself, except in the following situations:

- A beneficiary’s child, spouse, or former spouse who has a judgment or court order against the beneficiary for support or maintenance;

- A judgment creditor who has provided services for the protection of a beneficiary’s interest in the trust;

- A claim of the state of the US to the extent a law of Florida or federal law so provides.

These exceptions only apply when there are no other resources and/or assets available.

BONUS ROUND:

- If a WAVE is a Florida girl in the Navy, and a WAC is a Florida girl in the Army, then what is a WHOCK?

ANSWER: A WHOCK is what you throw at a Wabbit.

- What did the sea say to the shore?

ANSWER: Nothing; it just waved.

Gregory Gay’s Corner

Selling a Residence and Homestead Exemptions, Part II

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

In Part I of this article, which you can see by clicking here, we discussed reverse mortgages and capital gain exclusions on the sale of a residence. This week, we turn our focus to the Florida Documentary Stamp Tax, title insurance, and property tax exemptions.

Florida Documentary Stamp Tax

A documentary stamp tax must be paid to the clerk of the circuit court in the county where a parcel of real property is located before a deed transferring the ownership of that real property can be recorded in the official records of the clerk of that court. This tax is presently $.70 for each $100 of the amount paid for the real property. Thus, the sale of a home for $70,000 will give rise to a transfer tax of $490 payable to the state of Florida.

Although the contract for purchase and sale of this real property can provide otherwise, it is customary for the contract to require the seller of the real property to pay for the documentary stamps. The seller normally pays the documentary stamp tax because the seller is expected to deliver a deed that is marketable.

It is customary for the contract for purchase and sale of real property to provide that the buyer will pay the documentary stamp tax relating to the issuance of a promissory note given to borrow the money necessary to pay a portion of the purchase price. This documentary stamp tax for the privilege to issue a promissory note is $.35 for each $100. This means that if the seller accepts a promissory note from the buyer for $50,000 of the purchase price, the documentary stamp tax that the buyer will pay to the clerk of the circuit court will be $175. Likewise, if the buyer borrows some of the purchase price from a third party such as a bank, the buyer will pay this documentary stamp tax to the clerk of the court for the promissory note he or she gives to the bank.

Since the seller or the lender will want the repayment of the promissory note to be secured by a mortgage constituting a lien on the real property, there is also an intangible tax that must be paid for the privilege of giving a mortgage. The intangible tax on a mortgage is paid to the clerk of the circuit court when the mortgage is recorded in the official records. The intangible tax is presently two mills per dollar, or $2 per $1,000, on the exact dollar amount of the new mortgage. So if the buyer gives a mortgage to secure the repayment of a $50,000 promissory note, the intangible tax will be $100.

LIFE SITUATION #8

Paul and Carol wish to sell their home for $100,000. In addition to possibly paying a real estate commission, they will also be responsible for the transfer tax for the privilege of selling the real property which will amount to $700 ($.70 x $100,000). The buyer will probably be responsible for the cost to record the deed. The buyer will also be responsible for the transfer tax for the promissory note signed to finance the purchase and for the intangible tax.

Title Insurance

The seller of real property or a person offering real property to secure the repayment of a loan may also be required to pay for title insurance. The purpose of title insurance is to reimburse the buyer of the real property or the owner of a mortgage against a loss in case the owner’s or mortgagor’s title to the real property is later determined to be defective or invalid. A new title insurance policy is issued when the present owner sells or refinances the real property even if that owner received a title insurance policy from the previous owner. This is because the coverage provided in a title insurance policy extends only to the owner who is being insured at the time of that particular closing. Thus, an owner’s title insurance policy cannot be assigned to the next buyer of a parcel of real property.

Property Tax Exemptions

An Amendment to Florida’s Constitution was approved by its voters on January 29, 2008. One of the provisions of this Amendment increases the current $25,000 homestead exemption to $50,000. However, the additional $25,000 exemption applies to the assessed value of the homestead between $50,000 and $75,000, but does not apply to the school tax levy.

Presently, a person entitled to a homestead exemption has his or her homestead assessed at just value as of January 1 of each year. However, the change in the assessment cannot exceed the lower of 3% of the assessment for the prior year or the percentage of change in the Consumer Price Index for all urban consumers, U.S. City Average. Thus, homesteads often have a just value assessment and a lower taxable value assessment. The new Constitutional Amendment provides the taxpayer with the opportunity to transfer this accumulated Save-Our-Homes benefit to a new homestead within one year but not more than two years after relinquishing the previous homestead. If the owner moves to a home with an equal or greater value, the owner may transfer to the new home’s valuation the lesser of 100% of the current Save-Our-Homes benefit or up to $500,000 of the benefit. If the owner moves to a home with a lesser value, the owner may transfer to the new home’s valuation the lesser of the percentage of the current Save-Our-Homes benefit or up to $500,000 of the benefit. If two or more people own multiple homesteads (one each) and are moving into one new homestead, they may transfer the largest of the benefits to the newly established homestead up to $500,000. If two or more persons jointly own a homestead and are moving into more than one new homestead, they must divide the value of their benefit among the new homesteads based on the number of owners.

This Constitutional Amendment also limits the amount of the increase in the assessed value for non-homestead property to 10% per year, and at no time may the assessed value exceed the market value. The base year for assessing the 10% cap is 2008, which means the protection from the assessment increases began in 2009. The assessment limitation does not apply to school tax levies. This portion will expire after 2018, at which time the voters will decide whether it should be reauthorized.

Next time, Gregory Gay’s series will continue with a brief conversation on health care surrogate designations, including what this means, what role the surrogate plays, and how a surrogate can be established. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

A New Tool to Make Your Money Last

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “A New Tool to Make Your Money Last” by Glenn Ruffenach. It was featured in The Wall Street Journal on January 12, 2015.

Richard’s description is as follows:

Get ready to hear a lot more in 2015 about “longevity insurance,” an increasingly popular product among would-be retirees and a potentially important tool for financial advisors.

Longevity insurance is more properly known as a deferred income annuity (DIA). “Deferred” is the key word. An immediate annuity begins making payments soon after you buy it; a deferred annuity payout typically begins 10 or 20 years into the future.

That delay means a buyer can get large payments in later life with a relatively small payment upfront.

Fifteen insurers now sell deferred annuity products, up from three insurers just three years ago.

Deferred Income Annuity (DIA) Example:

A male age 65 paying a $100,000 premium to New York Life is guaranteed $59,300 per year for life, $4,941.65, beginning at age 85.

Please click here to read the article in its entirety.

Thoughtful Corner

How to Get the Most from Those Who Work With You or For You

Well-trained professionals are always told to make the client happy first. THE CLIENT IS KING!

Team members are told this also, but what causes us to treat team members like second or third class citizens in the process of doing what we do for clients?

It is certainly human nature to put all of the effort “front stage” to the best of our abilities while remaining less cordial, more informal, and sometimes or oftentimes blowing steam and treating team members and the colleagues we work with without reference to the “golden rule” or appropriate civility.

What if, for one week, you treated your team like A-plus clients by doing the following things, which might be almost unheard of in your present office environment?

- Smile, make eye contact, and thank your team members for coming in every morning to help their day start out on a friendly, positive, and grounded footing.

- Find something to compliment each person you interact with on at least once a day.

- Do not complain, criticize, or speak negatively about anything in the office. When mistakes are made or frustrations occur, approach them very, very gently but professionally without “pulling rank” or making the situation any more unpleasant than it has to be.

- At the end of the day, say goodbye and thank each team member for what they have done, particularly for any projects they have done a great job on or that have been frustrating.

- Say please before each request, or phrase it as a question instead of a command (“Would you mind showing Mrs. Peterson how the copier works?”) and say thank you for anything you receive.

How much time would it take from your busy day to facilitate the above? Three minutes a day? Seven minutes a day? Twenty-five minutes a week?

What will you get in return?

- A better office environment, as positivity bounces back to you

- More loyalty and productivity from your staff

- Less chance of errors occurring or team members being leery of making suggestions or calling problems to your attention

- Genuine friendships with people you work with

Yes, there are people that we have to work with who are less than perfect and who do not always have a good attitude or work ethic, but if you treat someone like a failure, it is almost guaranteed that they will be a failure. On the other hand, if you treat a C+ student like an A student, they may well turn out to be an A student with proper encouragement and polite but firm remedial action.

If you have been a terrible grouch, you might start out with the one person on your team who you think would be most accepting of this type of change in you, and do not be surprised if you do not get an immediate reaction. They will at first be very cautious and wonder what is happening. When they figure out that you have not left your spouse and are not trying to move in with them, you may see a whole new attitude.

When was the last time you paid for someone’s lunch when they did a good job on something or sent an email to five or six staff members telling them how fortunate you were to have them achieve something specific or stay late to get something done right?

By the same token, when someone makes a mistake unintentionally, how often have you thanked them the next day for correcting the error and reducing the damage to the extent possible?

There are some great books available to help you on your path to making your clients happier because your staff treats them like they have never been treated before. A fantastic book for long-term offenders is What Got You Here Won’t Get You There by Marshall Goldsmith. The One Minute Manager by Kenneth Blanchard is an essential, quick read on how to take corrective action while giving a compliment and deliberate instruction.

How to Win Friends and Influence People by Dale Carnegie is a “must read every five years” book for anyone successful in this area.

While thinking through how to best treat your team so that they produce at their best and treat your clients well, take a look at our write-up on the Gallop organization’s 12 Elements of Great Managing. This will give you more ideas about how to have a fantastic and synergistic workplace.

If you find this Thoughtful Corner piece to be of interest and would like to see more like it, please let us know, and feel free to share.

This is one of the many things that we will be covering at the Ave Maria School of Law on Saturday, February 21 on Lawyer Success and Professional Acceleration in the Real World.

As always, we welcome your questions, comments, and suggestions.

Upcoming Seminars and Webinars

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Learn how to plan, structure, and protect wealth using revocable and irrevocable trusts and trust systems to effectuate wealth preservation and inheritance planning in a tax-efficient manner.

This course is designed for both new and experienced accountants and includes valuable materials, free use of estate tax projection software, client explanation letters, and a number of useful Excel spreadsheets that can be used on client matters.

Many past attendees have expressed significant praise for this presentation, indicating that it is both dynamic and interesting, while providing a fresh new look at both time tested and new strategies and planning considerations with an emphasis on the numbers, practical application and an accountant’s role in planning and implementation.

Part Two of this presentation will be offered on May 21, 2015 at 10 AM and is entitled “A Practical Trust Planning Checklist and Practitioner Compliance Guide for Florida CPAs.” Please view the seminar announcement below for more details.

Date: January 26, 2015 | 10:30 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

*******************************************

FREE LIVE WEBINAR SERIES ON LIFE INSURANCE FOR TAX ADVISORS:

Alan Gassman, Jerry Hesch, and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on HOW TO READ LIFE INSURANCE ILLUSTRATIONS in the first of a series of webinars intended to help tax lawyers and CPAs understand how life insurance and life insurance structuring works from a technical and mechanical standpoint.

Bring your wrench and screwdriver as we look under the hood to see how we can do our clients some good!

Date: January 26, 2015 | 5:00 p.m.

Location: Online webinar

Please note the below announcements for subsequent installments of this series:

February 18, 2015 – Criticism of Hybrid Index Life Insurance Products – What the Heck are These, and Why are They Becoming So Popular?

March 4, 2015 – Premium Financing in 15 Minutes

March 17, 2015 – Split-Dollar in 15 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Additional Information: To register for the January 26th webinar, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

*******************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 15-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

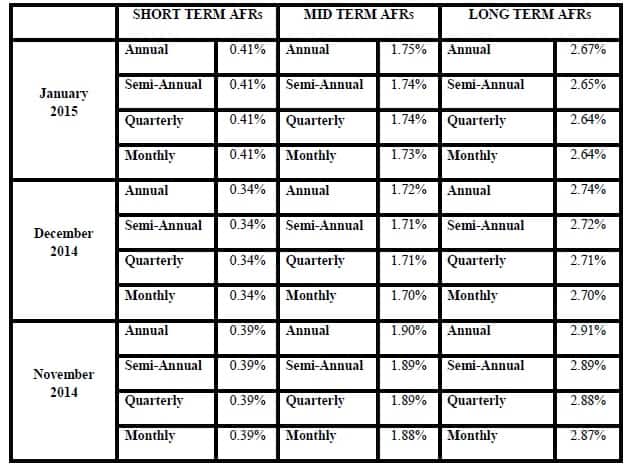

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for January is 2.2% and for December was 2.0%.